#rebalancing

Text

Something random...

What happens to the middle of a venn diagram when one of the circles disappears?

2 notes

·

View notes

Text

Yes, indeed. TFU/COU is in the middle of a moral disaster. I’m trying to help. 💕🌹💖🪷

#aspergers#moral disaster#new perspective#panic at the disco#unmasking autism#notifications#the lotus#autistic integrity#jeff and shaleia#twin flames universe#rebalancing#let our people go#no more bans#all saints#time for change#pluto in aquarius#revolution#stop#collaborate#listen#divine feminine#divine friendship#truth#truth hurts#seek truth

0 notes

Text

How to Invest Your Money: A 7-Step Investment Plan

Investing your money is a smart way to grow your wealth and achieve financial freedom. However, without a clear plan in place, navigating the world of investments can be overwhelming. That's why we've created a step-by-step investment plan that will help you confidently on How to Invest and also to make good investment decisions. Whether you're a beginner or looking to enhance your investment strategy, this guide is for you. So let's dive in and learn how to invest your money effectively.

Step 1: Define your financial goals

To begin your investment journey, it is crucial to clearly define your financial goals. Consider both short-term and long-term objectives, such as saving for a down payment on a house, funding your child's education, or planning for retirement. By setting specific and measurable goals, you can align your investment strategy accordingly.

Additionally, understanding your risk tolerance and investment horizon are vital factors in creating a successful investment plan. Risk tolerance refers to your comfort level with potential fluctuations in the value of your investments, while investment horizon refers to the length of time you can keep your money invested. Assessing both these aspects allows you to select appropriate investment options that are in line with your comfort levels and time frame.

Lastly, before diving into investing, it's important to establish a solid foundation. Pay off high-interest debts, such as credit card balances or personal loans, which can hinder your financial progress. Building an emergency fund is equally important, as it acts as a safety net to cover unexpected expenses. By addressing these financial priorities first, you can confidently move forward with your investment plan.

Step 2: Educate yourself about investment options

Before making any investment decisions, it is essential to educate yourself about the various investment options available to you. Research different avenues such as stocks, bonds, mutual funds, real estate, and more. Each investment option carries its own set of risks and potential returns, so understanding them thoroughly is crucial.

Learning about investment options can be done through various means. Read books, attend seminars or webinars, follow reputable financial blogs, and subscribe to financial newsletters. Additionally, consider seeking advice from a financial advisor or investment professional who can guide you in selecting the most suitable investment options based on your financial goals and risk tolerance.

While educating yourself, be sure to assess the risks associated with each investment option. A basic understanding of factors such as volatility, historical performance, market trends, and economic indicators can help you make informed investment decisions. The more knowledge you acquire, the better equipped you will be to develop a well-rounded investment plan.

Step 3: Create a diversified investment portfolio

One of the fundamental principles of successful investing is diversification. Diversifying your investment portfolio involves spreading your investments across various asset classes, reducing the potential risk associated with any single investment. This strategy helps cushion your portfolio against fluctuations in a particular sector or asset.

When creating a diversified portfolio, it is crucial to allocate your investments based on your risk tolerance and financial goals. For instance, if you have a higher risk appetite, you may allocate a larger portion of your portfolio to stocks and equity-based investments. On the other hand, if you have a lower risk tolerance, you may lean towards more stable investments like bonds or fixed-income securities.

Consider various factors when diversifying, including stocks, bonds, real estate, and even international investments. Each asset class offers its own benefits and risks, so striking the right balance is crucial. Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals, adjusting your asset allocation as needed.

Remember, diversification does not guarantee profits or protect against losses, but it is an important risk management strategy that can enhance the stability of your investment portfolio.

Step 4: Open an investment account

Once you have educated yourself about investment options and created a diversified investment portfolio, it's time to open an investment account. Here are the steps to follow:

- Research and choose a reputable brokerage firm or investment platform: Look for a brokerage firm or investment platform that aligns with your investment goals, offers the investment options you are interested in, and has a good reputation in the industry. Consider factors such as fees, account types, customer service, and investment product availability.

- Evaluate fees: Compare the fees charged by different brokerage firms or investment platforms. These may include account maintenance fees, transaction fees, commissions, and expense ratios for mutual funds or exchange-traded funds (ETFs). Choose a provider that offers competitive fees and aligns with your budget.

- Consider account types: Determine the type of investment account that suits your needs. Common types include individual brokerage accounts, individual retirement accounts (IRAs), Roth IRAs, or employer-sponsored retirement accounts such as 401(k)s. Each account type has different tax implications and contribution limits, so choose the one that aligns with your financial goals and tax strategy.

- Check customer service: Consider the level of customer service offered by the brokerage firm or investment platform. Look for a provider that is responsive, provides educational resources, and offers support when needed. Good customer service can make a significant difference, especially if you require assistance with your investments.

- Ensure investment product availability: Ensure that the brokerage firm or investment platform offers the investment products you are interested in. This could include stocks, bonds, mutual funds, ETFs, real estate investment trusts (REITs), or other specific investment vehicles. Having access to a wide range of investment options allows you to diversify your portfolio effectively.

- Open an account: Once you have chosen a brokerage firm or investment platform, follow their account opening process. This typically involves providing personal information, such as your name, address, social security number, and employment details. You may also need to provide funding for your account, which can be done through a bank transfer or other accepted methods.

- Ensure alignment with your investment goals: Before finalizing the account opening, ensure that the account aligns with your investment goals and risk tolerance. Some brokerage firms or platforms offer questionnaires or assessments to help determine your risk profile and suggest suitable investment options.

Step 5: Start investing

After opening your investment account, it's time to start investing. Here's how you can begin:

- Determine the investment amount based on your financial situation: Assess your financial situation, including your income, expenses, and savings. Determine an amount that you can comfortably invest without compromising your essential needs and emergency fund. Consider setting aside a specific portion of your income for investments on a regular basis.

- Begin with a systematic investment plan (SIP) for mutual funds or regular contributions: If you are investing in mutual funds, consider starting with a systematic investment plan (SIP). A SIP allows you to invest a fixed amount regularly (e.g., monthly) in a mutual fund of your choice. This approach helps you take advantage of rupee cost averaging and avoids the need for timing the market.

- Keep investing regularly to benefit from the power of compounding: Consistency is key when it comes to investing. Aim to invest regularly, whether it's through SIPs, automatic contributions, or manually adding funds to your investment account. By investing consistently over time, you can benefit from the power of compounding, which can significantly grow your wealth in the long run.

- Consider dollar-cost averaging: Dollar-cost averaging is an investment strategy where you invest a fixed amount at regular intervals, regardless of the current market price. This approach helps you mitigate the impact of market volatility and reduce the risk of making poor investment decisions based on short-term market fluctuations.

- Rebalance your portfolio: As you continue investing, periodically review your investment portfolio and rebalance it if necessary. Rebalancing involves adjusting the asset allocation to maintain the desired risk-return profile. For example, if certain investments have performed exceptionally well and now form a larger portion of your portfolio, you may need to sell some of those investments and redistribute the funds across other asset classes.

Step 6: Monitor and review your investments

To ensure your investment plan remains on track, it's important to regularly monitor and review your investments. Here's how you can do that:

- Track your portfolio's performance: Use the tools and resources provided by your brokerage firm or investment platform to track the performance of your investments. Monitor the returns, compare them to relevant benchmarks, and assess whether your portfolio is meeting your financial goals.

- Periodically review progress towards your goals: Regularly review how your investments are progressing towards your financial goals. Are you on track to meet your short-term and long-term objectives? If necessary, adjust your investment strategy or contributions to align with any changes in your goals or circumstances.

- Make adjustments as required: Market conditions and personal circumstances can change over time. Stay informed about market news, economic trends, and investment strategies. If needed, make adjustments to your investment portfolio. This could involve rebalancing your asset allocation, diversifying further, or reallocating funds to take advantage of new opportunities or manage risks.

- Seek professional advice when needed: If you are uncertain about certain investment decisions or need guidance, consider seeking advice from a financial advisor or investment professional. They can provide personalized recommendations based on your financial situation, goals, and risk tolerance.

Step 7: Stay disciplined and seek long-term growth

To maximize the benefits of your investment plan, it's important to stay disciplined and maintain a long-term perspective. Here's what you can do:

- Avoid making impulsive investment decisions: Avoid making investment decisions based solely on short-term market fluctuations or emotions. Stay focused on your long-term goals and investment strategy. Making impulsive decisions can lead to poor outcomes and hinder your progress toward financial success.

- Stick to your investment plan: Stay committed to your investment plan even during periods of market volatility or economic uncertainty. Maintain consistency in your investment contributions and asset allocation unless there are legitimate reasons to adjust them. Avoid trying to time the market or chase short-term trends.

- Remain patient: Investing is a long-term journey that requires patience. Keep in mind that investments can experience ups and downs over time. Avoid reacting to short-term market fluctuations and stay focused on your long-term financial goals. Patience can be rewarded with the potential for higher returns and wealth accumulation.

- Continually educate yourself: The investment landscape and market conditions can evolve over time. Continually educate yourself about investments, market trends, and new investment opportunities. Read books, follow financial news, attend webinars or seminars, and engage with reputable financial blogs or newsletters. Enhancing your understanding of investments will empower you to make informed decisions and adapt to changing circumstances.

Conclusion:

By following this step-by-step investment plan, you can confidently navigate the world of investments and work towards achieving your financial goals. Remember to define your goals, educate yourself about investment options, create a diversified portfolio, open an investment account, start investing regularly, monitor your investments, stay disciplined, and seek long-term growth. With patience, perseverance, and the right knowledge, you can set yourself on the path to financial success. Start investing today and secure your financial future.

Looking to take your personal finance journey even further?

Check out "The Mental Time Travel System," an extraordinary program. Drawing upon decades of experience in hypnosis and metaphysics, as well as cutting-edge concepts like Brief Therapy and Narrative Psychology, this system goes beyond anything you've ever encountered before.

Through profound insights and effective methods, "The Mental Time Travel System" unlocks the secrets of the Universe, offering you the tools to manifest anything you desire, including "The Big 3." If you're ready to take your manifestations to new heights and create a life of abundance and fulfillment, this program is a must-have resource.

Please note that by using the affiliate link provided, you support our website at no additional cost to you. Take the next step on your personal development journey and explore "The Mental Time Travel System" today!

Disclaimer: We may receive a commission for purchases made through this affiliate link.

I hope this blog has inspired you to learn more about public speaking and to consider giving it a try

Are you ready to take your life to the next level?

If you’re looking for ways to improve your happiness, productivity, relationships, or overall well-being, then you need to check out our self-help and self-improvement blog.

We’ve got articles on everything from breaking bad habits to setting and achieving your goals. We’ll also help you find your purpose in life and learn how to live a more mindful and intentional life.

So what are you waiting for? Start reading the PERSONAL GROWTH and WEALTH BUILDING categories today and see how you can transform your life!

Read the full article

#assetallocation#brokeragefirm#compounding#diversifiedportfolio#dollar-costaveraging#financialgoals#financialsuccess.#investment#investmentaccount#investmenthorizon#investmentoptions#investmentplan#long-termperspective#patience#portfoliomonitoring#rebalancing#risktolerance#systematicinvestmentplan

0 notes

Text

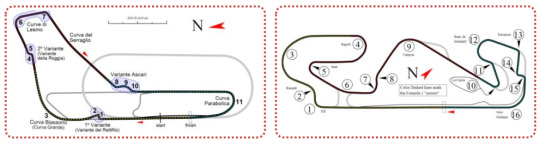

The data analysis procedure of a wind tunnel test for race car design - Part 1

The wind tunnel (WT) tests are carefully scheduled and organized, because the cost of this tool is very high. Hence, a basic flowchart of this tool is composed by Preparation, Testing and Output. Usually, in just one session several runs are made, each of them using as many configurations as possible. When a run is finished, its data is immediately analyzed to decide if this represents an…

View On WordPress

0 notes

Text

How to Build a Diversified Investment Portfolio in Today's Financial Market

Investment Portfolio: A Guide to Mitigating Risk and Achieving Your Financial Goals

By Amir Shayan

Investing in the financial market can be a great way to grow your wealth over time, but it’s important to have a diversified portfolio to mitigate risk. A diversified portfolio is a mixture of different types of investments across various industries, asset classes, and regions. In today's financial market, with so many investment options available, building a diversified portfolio can be challenging. But don't worry, in this article, we will guide you on how to build a diversified investment portfolio that suits your risk appetite and financial goals.

- Understand Your Risk

Appetite The first step in building a diversified investment portfolio is to understand your risk appetite. Your risk appetite refers to your ability to tolerate losses in your investments. Generally, the higher the risk, the higher the potential returns. However, higher risk also means higher potential losses. You need to determine how much risk you are willing to take and ensure that your investment portfolio aligns with your risk tolerance.

- Define Your Investment Goals

Before investing, it’s important to define your investment goals. Your investment goals may include saving for retirement, buying a house, or creating a passive income stream. Having clear investment goals can help you determine your investment horizon, which is the time you need to reach your financial goals. The investment horizon will help you choose the types of investments that are appropriate for your portfolio.

- Choose a Mix of Asset Classes

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and cash equivalents. Each asset class has different levels of risk and return. For instance, stocks offer higher potential returns, but come with higher risk, while bonds offer lower potential returns, but come with lower risk. Cash equivalents offer the lowest potential returns, but come with the least amount of risk. A mix of asset classes can help you achieve the right balance of risk and return.

- Invest in Different Sectors

Investing in different sectors can further diversify your portfolio. Sectors are groups of companies that operate in the same industry. By investing in different sectors, you can reduce your exposure to risks that are specific to one sector. For instance, if you invest only in the tech sector, your portfolio is more vulnerable to changes in the tech industry. By investing in different sectors, you can spread your risks and reduce the impact of any negative events in one sector.

- Invest in Different Geographical Regions

Investing in different geographical regions can also diversify your portfolio. Different regions have different economic conditions, political risks, and market trends. By investing in different regions, you can reduce your exposure to risks that are specific to one region. For instance, if you invest only in the U.S., your portfolio is more vulnerable to changes in the U.S. economy. By investing in different regions, you can spread your risks and reduce the impact of any negative events in one region.

- Rebalance Your Portfolio Regularly

Once you have built a diversified investment portfolio, it’s important to rebalance it regularly. Rebalancing involves adjusting your investments to maintain the desired asset allocation. Over time, the value of your investments will change, and some asset classes may perform better than others. Rebalancing ensures that your portfolio stays in line with your risk appetite and investment goals.

- Monitor Your Investments

Lastly, you need to monitor your investments regularly. This involves keeping an eye on your investments, reviewing your portfolio performance, and making adjustments as necessary. Monitoring your investments can help you identify any changes in the market or your portfolio that may require action.

Conclusion

In conclusion, building a diversified investment portfolio in today's financial market requires a strategic approach. By understanding your risk appetite, defining your investment goals, choosing a mix of asset classes, investing in different sectors and regions, rebalancing your portfolio regularly, and monitoring your investments, you can create a portfolio that aligns with your financial goals and risk tolerance. Keep in mind that diversification does not guarantee profits or protect against losses, but it can help reduce risk and increase your chances of achieving your investment goals.

Read the full article

#AssetClasses#diversification#FinancialMarket#GeographicalRegions#investment#Monitoring#portfolio#Rebalancing#Riskappetite#Sectors

0 notes

Text

Bitcoin, a safe haven asset like gold!!!

Nowadays, the price of gold is at an all-time high🔝 and Bitcoin is getting as much attention as gold as a safe haven asset💰. As one US analyst put it, "Not favoring Bitcoin while favoring gold is like not liking a horse that runs faster." Bitcoin's recent stable performance has made it a safe haven asset alongside gold🌟. Even when the economy was suffering from COVID-19, Bitcoin outperformed gold 📈 What do you think?

0 notes

Link

Investment Strategies — A Quick Primer. Money, because of inflation, loses value over time, making investing essential for everyone looking to grow their wealth. For instance, if a stock is trading at $100, but an investor believes the intrinsic value is $120. Read more click on Link

0 notes

Text

7 Tips for Investing in Mutual Funds

Introduction

Investing in mutual funds can be a great way to diversify your portfolio and to get exposure to different asset classes with relatively low levels of risk. Mutual funds are managed by experienced professionals who have the knowledge and expertise to pick the best stocks and bonds for your portfolio. Mutual funds have become increasingly popular over the past few years and have become a great way for investors to diversify their investments and gain exposure to different asset classes.

In this article, we will discuss 7 tips for investing in mutual funds. We’ll give you some basic information about the different types of mutual funds, the fees associated with them, and the different strategies you can use to maximize your returns. We’ll also provide some important tips to help you make the most of your investments.

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors and invests it into a variety of different securities. Mutual funds are professionally managed and can invest in stocks, bonds, money market instruments, and other asset classes. Mutual funds are typically managed by experienced professionals who have the knowledge and expertise to pick the best stocks and bonds for the portfolio.

The primary benefit of investing in a mutual fund is that it allows you to diversify your investments without having to buy individual stocks and bonds. By investing in a mutual fund, you can gain exposure to a variety of different asset classes without having to manage each individual stock or bond. Mutual funds are also relatively low cost compared to other types of investments.

Types of Mutual Funds

There are several different types of mutual funds available to investors. These include stock funds, bond funds, money market funds, and index funds.

Stock funds are mutual funds that invest in stocks. These funds are typically more volatile than other types of funds and have the potential for greater returns.

Bond funds are mutual funds that invest in bonds. These funds are typically less volatile than stock funds and have the potential for lower returns.

Money market funds are mutual funds that invest in short-term debt instruments. These funds are typically less volatile than stock and bond funds and have the potential for lower returns.

Index funds are mutual funds that track a particular index, such as the S&P 500 or Dow Jones Industrial Average. These funds are typically the least volatile of all mutual funds and have the potential for low to moderate returns.

Fees Associated With Mutual Funds

When investing in mutual funds, it’s important to be aware of the fees associated with them. Mutual funds have several different types of fees that can have a significant impact on your returns.

The most common type of fee is the management fee. This is the fee that the mutual fund company charges for managing the fund. This fee can range from 0.25% to 2% of the assets under management.

Another type of fee is the expense ratio. This is the fee that the mutual fund company charges to cover the costs of running the fund. This fee can range from 0.1% to 1.5% of the assets under management.

Finally, there are transaction fees. These are fees that are charged when you buy or sell shares of the mutual fund. These fees can range from $0 to $50 per transaction.

Strategies for Investing in Mutual Funds

When investing in mutual funds, it’s important to have a strategy. Here are 7 tips for investing in mutual funds:

Diversify your investments. Investing in multiple mutual funds can help reduce your risk and can provide greater returns over the long term.

Invest for the long term. Investing in mutual funds is a long-term strategy and it’s important to invest in funds that have the potential to generate returns over the long term.

Invest in different asset classes. Investing in different asset classes such as stocks, bonds, and money market instruments can help diversify your portfolio and reduce your risk.

Research the funds. It’s important to research the mutual funds you’re considering investing in. Make sure you understand the fees associated with the funds, the past performance of the funds, and the strategy used by the fund manager.

Set a budget. It’s important to set a budget for your investments. Make sure you’re only investing an amount that you can afford to lose.

Monitor your investments. It’s important to monitor your investments on a regular basis. Make sure the funds you’re investing in are performing as expected and make adjustments if necessary.

Rebalance your portfolio. Rebalancing your portfolio on a regular basis can help ensure that you’re getting the most out of your investments.

Conclusion

Investing in mutual funds can be a great way to diversify your portfolio and to get exposure to different asset classes with relatively low levels of risk. It’s important to be aware of the fees associated with mutual funds, to research the funds you’re considering investing in, and to have a sound strategy. Following the 7 tips outlined above can help you make the most of your investments in mutual funds.

#MutualFunds#Investing#Diversification#AssetClasses#Risk#Fees#Strategies#Budget#Monitoring#Rebalancing#Portfolio#Returns

0 notes

Photo

Rebalancing Cleansing Treatment promueve el mantenimiento de un cuero cabelludo sano sin el efecto rebote que a menudo se asocia con los tratamientos reguladores del sebo. #davines #davinescostarica #olisaln #davinesheredia #salóndebelleza #cuidadodelcabello #cuerocabelludograso #naturaltech #rebalancing #naturaltechrebalancing #cabellograso 📷@davinesdr (en Oli Salón) https://www.instagram.com/p/Ck3q5A5Oc2H/?igshid=NGJjMDIxMWI=

#davines#davinescostarica#olisaln#davinesheredia#salóndebelleza#cuidadodelcabello#cuerocabelludograso#naturaltech#rebalancing#naturaltechrebalancing#cabellograso

0 notes

Text

Are public company junk bonds a good source of passive income for rebalancing a portfolio?

Are public company junk bonds a good source of passive income for rebalancing a portfolio?

Good question.

Junk bonds typically pay higher rates of interest but the downside is if the company goes bankrupt you may end up losing some principal.

High-yield (also referred to as “non-investment-grade” or “junk” bonds) refers to bonds rated Ba1/BB+ and lower.High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of more financially stable companies.…

View On WordPress

0 notes

Text

Special Guest Liam Naden, Speaker, Teacher, Writer & Researcher Talks Spirituality

#author#brain#coach#creator#for#growing#in#life#love#neuro#overcome#podcaster#rebalance#rebalancing#relationship#researcher#speaker#state#success#writer

0 notes

Photo

Meditation recording of today live is on my YouTube channel @loveauthenticme Links in the bio for my channel and meditation Monday playlist for previous weeks this week we work with #breath and #balancing the right and left brain-hemispheres along with a creative #visualisation for #grounding and seeing your #potential Plant seeds with the #new moon #energy #rebalancing #Libra energy step into your power !! remember who you !! #rebalance #reset #Refocus https://www.instagram.com/p/Ci-2yCTMSuH/?igshid=NGJjMDIxMWI=

#breath#balancing#visualisation#grounding#potential#new#energy#rebalancing#libra#rebalance#reset#refocus

0 notes

Text

UK GDP grows in July but has flatlined in 2022 so far

UK GDP grows in July but has flatlined in 2022 so far

This morning has brought some positive news for the UK economy.

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in July 2022.

Not much but this is a year where any growth us an achievement. It turns out that it was a services effort single-handed. So we are back to our long-standing theme of the UK rebalancing towards services which is exactly the opposite of what…

View On WordPress

#business#Construction#economy#Finance#GDP#health GDP#Production#Rebalancing#Services#Test and Trace#UK

0 notes

Text

#themedifiguy#medifiguy#medical student#medical doctor#south africa#personal finance#investing#volatility#correlation#diversification#rebalancing

0 notes

Text

companion piece for this

For equality.

#with the other one nobody believed me when i said my intentions were pure. i can say that this time they were not :)#i have an imbalance of who's holding who on my blog!! plenty of dazai holding chuuya not enough chuuya holding dazai#i'm starting the rebalancing process with one big swing first#now what do i tag this#suggestive#bsd#bungo stray dogs#bungou stray dogs#bsd fanart#bsd chuuya#bsd nakahara chuuya#bsd dazai#bsd dazai osamu#skk#soukoku#nawy's art#and next time i start drawing a head at a weird angles SOMEBODY STOP ME#i never wanna draw a nose from below again

779 notes

·

View notes

Text

Bad: every kill I got didn't feel like it changed anything.

Slime: Sure didn't stop you though, did it.

#qsmp#liveblogging#LMFAO#the event is over and theyre just chatting after now#foolish got SO fucking mad at bad lmfaooo#slime got killed so much#foolish is gonna get chicken tenders and tina is begging for some too frorm him#they do agree there needs to be some rebalancing#bc this was very intense and slightly miserable#they got frustrated a lot#it would be fine if this wasnt a server and group established a different way#but this is qsmp.#also foolish going ahah yeah i knew bad would IMMEDIATELY check where everyne spawned and kill us#and bad was like :) i did. i noted it immediately

75 notes

·

View notes