#property tax

Text

20 notes

·

View notes

Text

Yellowknife city council has unanimously agreed to a five per cent property tax increase for 2024.

This came after city council met Tuesday and Wednesday to discuss the 2024 draft budget and find ways to cut down the proposed 7.22 per cent increase.

Kavi Pandoo, Yellowknife's director of corporate services, announced in the meeting on Wednesday that the city had managed to reduce that amount to 6.42 per cent.

Coun. Steve Payne made a motion to cut that amount down further to an even five per cent.

Continue Reading

Tagging @politicsofcanada

10 notes

·

View notes

Link

Detroit’s City Council, responding to a clarion call from the community and unsettling findings from a University of Chicago study, has unanimously passed two landmark resolutions aimed at halting foreclosures and correcting property assessments for homes valued under $34,700. This decisive action comes amid the backdrop of opposition from the Duggan administration, highlighting the Council’s commitment to addressing systemic injustices in the city’s property tax system.

The first resolution mandates Detroit City Assessor Alvin Horhn to slash assessments for these homes by 30 percent, a significant step towards rectifying the chronic issue of overvaluation that has burdened many Detroit homeowners. The second resolution urges Wayne County Treasurer Eric Sabree to suspend all foreclosures on owner-occupied homes falling within the same value bracket, offering a lifeline to residents at risk of losing their homes due to inflated tax bills.

The passage of these resolutions, a direct outcome of the relentless advocacy by the Coalition for Property Tax Justice, marks a critical movement in Detroit’s ongoing struggle with property tax fairness. The Coalition for Property Tax Justice is like a powerhouse team, bringing together more than fifteen community-rooted groups all focused on one big goal: putting an end to unfairly high property taxes and the wave of tax foreclosures that have been hitting Detroit hard.

Bernadette Atuahene, a key figure in this movement, lauded the Council’s decision, stating, “The City Council finally acknowledged the continued over assessments and unanimously demanded that the Duggan administration and the County Treasurer take action to correct the ongoing property tax injustice. Now Treasurer Sabree and the Duggan administration must follow these resolutions with action.”

But the resolutions’ success hinges on the actions of County Treasurer Eric Sabree and City Assessor Alvin Horhn. The question now is, will they heed the Council’s directive and address these pressing issues, or will they allow the cycle of illegal foreclosures and assessments to persist? ...

5 notes

·

View notes

Text

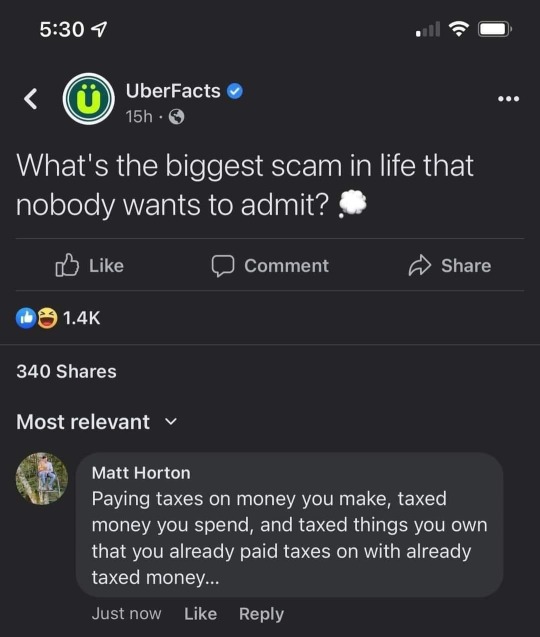

And we don’t even get any say in where our tax money goes.

#taxes#tax money#irs#internal revenue service#tax season#sales tax#income tax#property tax#personal property tax#government#state governments#federal government#spending budget#scam#scammers#scamming#robbery#it should be illegal#illegal#highway robbery#united states government#united states of america#USA#United States#America#american government#theft#bullshit#we’re being robbed#reality

97 notes

·

View notes

Photo

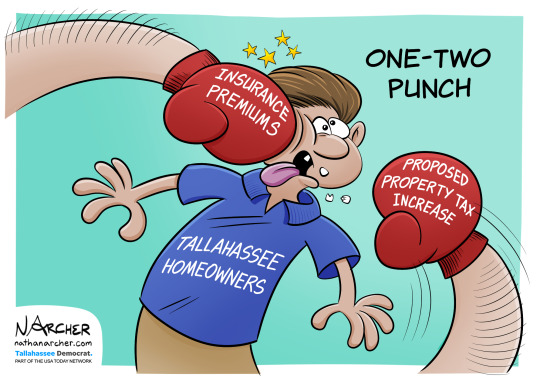

Archer, Nathan. “One-Two Punch.” Tallahassee Democrat, April 30, 2023. https://on.tdo.com/2nUeq7o.

3 notes

·

View notes

Text

"Tax Pinch for India's Middle Class: Can the Upcoming Budget Bring Relief"

#finance#economy#budget#middle class#family#relief#taxpayers#tax credits#property tax#taxation#tax savings#taxes#national taxes#finance minister#nirmala sitharaman#narendra modi#amit shah#anurag thakur#financial markets and investing#investingtips#investmoney#investment#investing#investors#mutual fund#investing stocks#stock news#stock maket news#stock market

2 notes

·

View notes

Text

A Modest Proposal for the Housing Crisis

If you own just one house, you pay the regular property tax on that house.

If you own 2 houses, you pay 2 times the property taxes on those houses. If you own 3 houses, you pay 3 times the property taxes on each.

If you're a Landlord and you own 10 houses, you'll pay 10 times the property taxes on each, and you cannot raise the rates you charge tenants. Or, you could always sell those houses so you don't have to pay as many taxes.

And if you're A BANK that ownes MORE THAN 500 HOUSES...get rekt.

#government#taxation#property tax#housing crisis#housing market#economics#apartments#renting#capitalism

3 notes

·

View notes

Link

After the State made a mistake and kicked the paraplegic, blind women out of her own home, she had to sleep in a parking garage elevator for weeks after they sent her to a psychiatric ward and sold her house, but she is still fighting.

10 notes

·

View notes

Text

Property tax consulting services for both Residential and Commercial properties - O’Connor & Associates O'Connor provides property tax consulting services for both residential and commercial properties in numerous cities throughout Texas.

To know property tax trends and comparison between cities visit: bit.ly/3X2Zu4I

1 note

·

View note

Text

Did you know QuickTaxnBooks.Com provides

$2500 Tax Preparation Guarantee;

$1 Million Tax Audit Defense ™ program; and

Identity Theft Restoration

with every 1040 tax return you file with us?

www.QuickTaxnBooks.Com

#quicktaxnbooks#tax#property tax#tax planning#tax evasion#tax experts#tax exports petrol#irs#irsusa#1040#1040NR#1065#1120#1120S#990#Vikram Angurala

2 notes

·

View notes

Link

Excerpt from this story from Inside Climate News:

Occidental Petroleum is planning to build a series of massive industrial projects in Texas that would be capable of pulling tens of millions of tons of carbon dioxide out of the air, and is seeking substantial state tax breaks to help finance the operations.

The proposals, which the company has not discussed publicly, outline what would be the first commercial-scale operations of a long-shot technology that is gaining increased attention from governments and corporations for its potential to help curb climate change.

In recent months, Occidental has applied for property tax abatements in two Texas counties that could be worth hundreds of millions of dollars if it completes the projects, according to an Inside Climate News analysis of the filings.

The applications include new details about the scale of the company’s planned investments in carbon removal—potentially tens of billions of dollars over the next decade—and fresh insight into how the oil company is trying to finance these plans by assembling a package of federal and state tax breaks, climate incentives, a burgeoning corporate market for carbon offsets and even through the sale of oil.

Some policy experts and scientists say technologies that remove carbon dioxide from the air could one day play a small but important role in helping the world achieve the Paris Agreement’s ambitious climate targets of limiting warming to 1.5 degrees Celsius. These efforts remain prohibitively expensive, however, a fact that is underscored by Occidental’s applications, which say the projects cannot move forward without taxpayer support.

Carbon removal has also generated controversy within the environmental advocacy community. Some activists are concerned that the technologies could be used as an excuse to weaken efforts to cut emissions from fossil fuels. Many also say that the technologies, which have tremendous energy demands, could have their own damaging environmental impacts.

Virginia Palacios is the executive director of Commission Shift, a Texas advocacy group that has raised concerns about the state’s oversight of oil and gas wells and, potentially, of underground injection of carbon dioxide.

“I think it’s kind of absurd,” she said of the possibility that Occidental could receive the state tax abatements. “Because it’s supposed to be a public benefit, but ultimately it’s a private company that’s going to be making lots of money.”

6 notes

·

View notes

Text

This is a fairly old statistic but DAMN 30% of state and local revenue from property tax? The tax primarily paid by tenants? More than income tax. I think in Germany property tax contributes like an average of less than 2.5% to the budgets of the states, based on this and this; the former shows that the states collected a combined 413 billion euros in taxes in 2019, the latter says that the most money ever collected from Grundsteuer / property tax was 9.5 billion in 2022. Being overly generous and assuming 10 billion as a portion of 413 billion gets you 2.42%.

idk why wikipedia's all from 2007 when it comes to US property taxes but look at this. This is a tax that predominantly affects you if you're in the bottom-fifth of earners! Bc of course landlords make tenants pay for that. They pretty much have to, bc obv if rent doesn't cover the costs of ownership, you don't build places to rent out. Like I'm not sure that the progressive thing to do wouldn't be to abolish property tax (with a legal provision ensuring that rents have to be lowered accordingly) and make up the lost revenue with raises in income taxes at higher tax brackets.

okay now I'm sure.

Like I know @reasonandempathy and the OP of that post were talking about unused land, which is of course not something any tenants would be paying for, and that is why this is a separate post, but just. Wow. It really shows that this country was founded and designed by land lords.

#us politics#taxes#property tax#also I'm still not over the fact that the US has no “zero taxes” income tax bracket for low income people#but that would have to be a separate post I think

0 notes

Text

You can now accelerate depreciation, reduce your tax liability and increase cash flow in your business. Wondering how? Visit https://www.expertcostseg.com/bonus-depreciation/

0 notes

Text

Home Tax Saver: Your Trusted Partner in Property Tax Savings

Say goodbye to property tax overpayments and say hello to great savings with a Home Tax Saver by your side. With Home Tax Saver, you can unlock valuable options to maximize your property tax deduction and save your taxes significantly. Our expert team offers personalized guidance and support tailored to your specific needs, ensuring you get the most out of your deduction.

0 notes

Text

Negotiations continue to happen in secret across the country, all without the public seeing or hearing about it

This is not going to shock anyone. Sports owners hate when their plans are released and looked at intensively by anyone. Have you ever tried to read one of them? Try taking a look at the “Potomac Yard Economic and Fiscal Impact Study” from the failed Capitals/Wizards to Alexandria, Virginia proposal. The agreements are nearly impossible to read and understand unless you read these types of…

View On WordPress

#Alexandria#Atlanta#Atlanta Braves#Baton Rouge#Columbus#Columbus Crew#Columbus Dispatch#Entertainment District#Florida#Florida Politics#Georgia#Impact Study#Jacksonville#Jacksonville Jaguars#JC Bradbury#Judith Grant Long#Louisiana#Louisiana State University#Metro Council#Minor League Baseball#MLS#New Orleans Advocate#NFL#Ohio#Potomac Yard#Potomac Yard Economic and Fiscal Impact Study#Practice Facility#Property Tax#Stadium Authority#Tiger Athletic Foundation

0 notes

Text

Top Essential Terms In Taxation

Taxation is an integral part of our financial lives, influencing everything from business decisions to personal finances. However, navigating the complex world of taxes can be daunting without a solid understanding of key terminology. In this comprehensive guide, we’ll demystify taxation by exploring the top essential terms you need to know.

1. Tax: A compulsory financial charge imposed by the…

View On WordPress

#capital gains tax#estate tax#excise tax#income tax#property tax#sales tax#Tax Audit#tax basics#tax credit#Tax evasion#Tax Liability#Tax Planning#tax refund#tax terminology#taxation#value-added tax (VAT)

0 notes