#professional bookkeeping services

Text

Experience expert AR services tailored to your needs. Partner with us for professional bookkeeping services and streamline your financial processes effortlessly.

0 notes

Text

Unlock tax efficiency with organized records, optimized deductions, prompt reporting, and audit readiness through proper bookkeeping practices. Simplify tax prep today

Professional Bookkeeping Services

1 note

·

View note

Text

What Are the Key Responsibilities of a Professional Bookkeeping Service?

Bookkeeping is the backbone of any successful business, providing a clear and accurate picture of its financial health. While some businesses may attempt to manage their own books, many turn to professional bookkeeping services to ensure precision, compliance, and efficiency. But what exactly do these services entail? Let's delve into the key responsibilities of a professional bookkeeping service and understand why it's essential for businesses of all sizes.

Maintaining Financial Records: At the core of bookkeeping lies the responsibility of accurately recording all financial transactions. Professional bookkeepers meticulously track income, expenses, assets, liabilities, and equity using accounting software or manual ledgers. By maintaining organized and up-to-date financial records, they provide businesses with a clear overview of their financial standing at any given time.

Tracking Accounts Receivable and Payable: Bookkeeping services manage accounts receivable and payable on behalf of their clients. They track invoices, payments, and outstanding balances owed by customers, ensuring timely collection of receivables. Similarly, they monitor bills, invoices, and payments to vendors, managing cash flow effectively and maintaining positive relationships with suppliers.

Bank Reconciliation: Professional bookkeepers reconcile bank statements with the company's financial records on a regular basis. This process involves comparing transactions recorded in the books with those reflected in bank statements to identify any discrepancies or errors. By reconciling accounts, bookkeepers ensure accuracy and detect fraudulent activities or unauthorized transactions promptly.

Preparing Financial Statements: Bookkeeping services are responsible for preparing accurate financial statements, including income statements, balance sheets, and cash flow statements. These statements provide insights into the financial performance, liquidity, and profitability of the business, guiding strategic decision-making and financial planning efforts.

Budgeting and Forecasting: Professional bookkeepers assist businesses in developing budgets and forecasts based on historical financial data and future projections. By analyzing trends, identifying potential risks, and setting realistic financial goals, they help businesses allocate resources effectively and plan for long-term sustainability and growth.

Compliance with Tax Regulations: Bookkeeping services ensure compliance with tax regulations and reporting requirements imposed by relevant authorities. They accurately calculate and file taxes, including income tax, sales tax, and payroll tax, on behalf of their clients, minimizing the risk of penalties or audits. Additionally, they keep abreast of changes in tax laws and regulations to advise businesses accordingly.

Providing Financial Insights and Advice: Professional bookkeepers offer valuable financial insights and advice to their clients, helping them interpret financial data, identify trends, and make informed decisions. They may analyze key performance indicators (KPIs), conduct financial ratio analysis, and recommend strategies for improving profitability, reducing costs, or optimizing cash flow.

Maintaining Confidentiality and Integrity: Above all, bookkeeping services uphold strict confidentiality and integrity in handling their clients' financial information. They adhere to ethical standards and data protection regulations, safeguarding sensitive data from unauthorized access, disclosure, or misuse.

5 Tips for Choosing the Right Professional Bookkeeping Service?

Choosing the right professional bookkeeping service is crucial for the financial health and success of your business. Here are five essential tips to help you make the best decision:

Assess Your Business Needs: Before selecting a professional bookkeeping service, take the time to assess your business needs and objectives. Determine the scope of services you require, such as basic bookkeeping, payroll processing, tax preparation, or financial reporting. Consider factors like the size of your business, industry-specific requirements, and any regulatory compliance issues that may affect your bookkeeping needs. This understanding will help you narrow down your options and find a service provider that can meet your specific requirements effectively.

Evaluate Experience and Expertise: Look for a professional bookkeeping service with a proven track record and extensive experience in your industry. Assess the qualifications, certifications, and expertise of the bookkeepers or accounting professionals who will be handling your financial records. Consider factors such as their level of education, years of experience, and familiarity with relevant accounting software and technologies. A knowledgeable and experienced team will ensure accuracy, efficiency, and compliance with industry standards and regulations.

Check References and Reviews: Before making a decision, seek references and read reviews from past or current clients of the bookkeeping service. Ask for referrals from trusted sources within your industry or professional network. Reach out to these references to inquire about their experience with the service provider, including the quality of their work, reliability, responsiveness, and overall satisfaction. Online reviews and testimonials can also provide valuable insights into the reputation and performance of the bookkeeping service.

Understand Pricing and Billing Structure: It's essential to have a clear understanding of the pricing and billing structure of the professional bookkeeping service before engaging their services. Inquire about their fee structure, whether they charge hourly rates, flat fees, or monthly retainer fees. Clarify what services are included in the pricing and whether there are any additional charges for extra services or unexpected expenses. Ensure that the pricing aligns with your budget and offers value for the services provided.

Communication and Accessibility: Effective communication and accessibility are key factors in establishing a successful partnership with a professional bookkeeping service. Choose a service provider that is responsive, proactive, and accessible when you need assistance or have questions about your financial records. Clarify how communication will be facilitated, whether through phone calls, emails, or in-person meetings, and ensure that you feel comfortable discussing your financial matters with the bookkeeping team. A transparent and collaborative relationship will facilitate smooth communication and ensure that your needs are met effectively.

Faizi Associates offers a top-notch professional bookkeeping service in Dubai, catering to businesses of all sizes and industries. With a team of experienced and skilled bookkeepers, they provide accurate and timely financial records to help clients make informed business decisions. Their services include but are not limited to, maintaining general ledgers, preparing financial statements, managing accounts payable and receivable, and reconciling bank statements.

Professional Bookkeeping Service in Dubai:-

Our bookkeeping service in Dubai is tailored to meet the specific needs of each client, providing customized solutions to streamline your financial processes and improve efficiency. Trust our Professional Bookkeeping Service in Dubai to provide you with accurate and timely financial information, enabling you to make informed decisions and achieve your business goals.

0 notes

Text

Professional Bookkeeping Services

ATS Accounting & Tax Edmonton offers professional bookkeeping services to meet the financial needs of businesses. With a team of experienced professionals, we provide accurate and reliable bookkeeping solutions tailored to your specific requirements. Our services include maintaining financial records, reconciling accounts, managing payroll, and generating financial reports. Trust us to handle your bookkeeping needs efficiently and effectively. Contact us at (780) 484-4006, Please visit: https://atsaccountinginc.com/

0 notes

Text

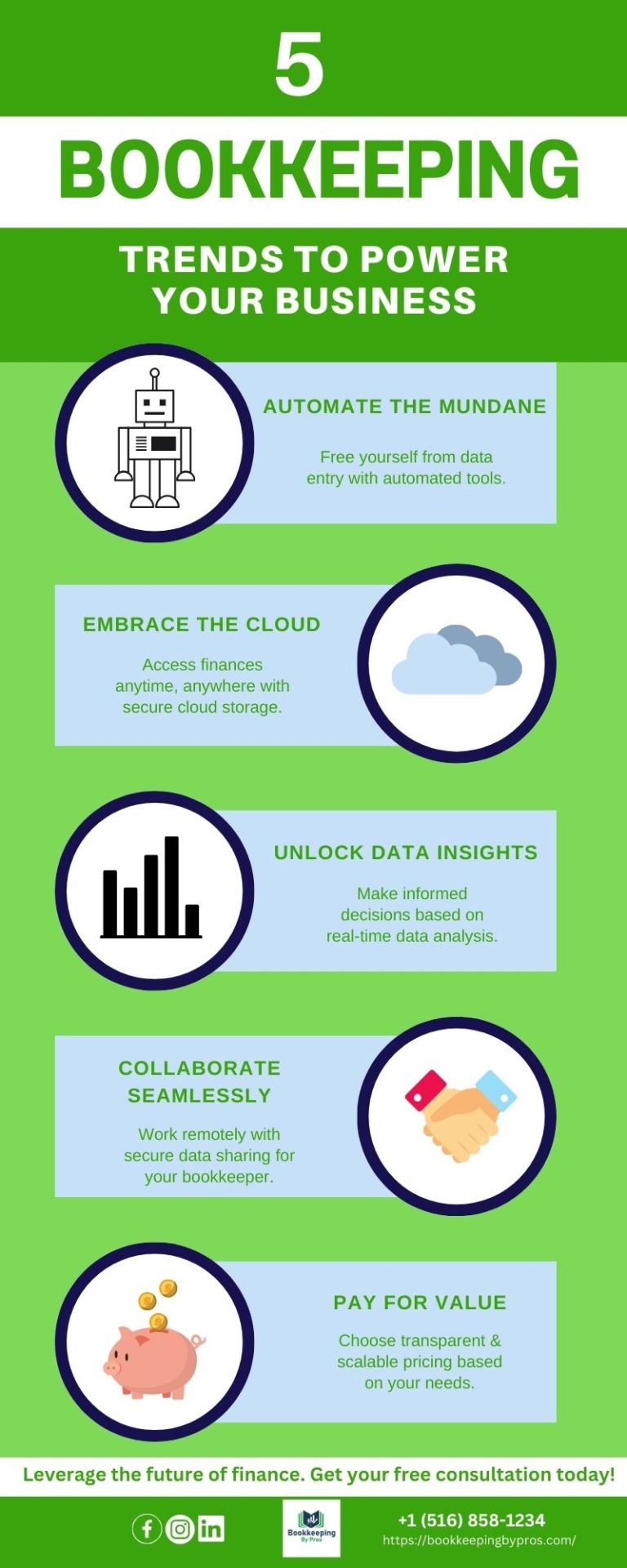

Conquer the future of finance! This infographic by Bookkeeping By Pros unveils 5 key trends to streamline your business: automation, cloud solutions, data-driven insights, seamless collaboration, and value-based pricing. Learn how to leverage these trends and gain a financial edge. Get a free consultation today!

Professional Bookkeeping Services

1 note

·

View note

Text

Mastering Accounting and Bookkeeping: Your Ultimate Guide

In today's fast-paced business world, efficient financial management is crucial for any organization's success. The backbone of this financial management lies in two indispensable pillars: accounting and bookkeeping. Let's dive deep into these essential functions and explore how they can propel your business to new heights.

Understanding the Basics

Before we delve into the intricacies, let's establish a solid foundation by defining these terms:

Accounting

Accounting is the systematic process of recording, summarizing, and analyzing financial transactions. It provides a clear picture of a company's financial health, making it easier to make informed decisions. Key components of accounting include income statements, balance sheets, and cash flow statements.

Bookkeeping

Bookkeeping is the art of recording and organizing financial transactions. It involves the day-to-day task of documenting income and expenses, maintaining ledgers, and ensuring financial records are accurate and up to date. Think of it as the groundwork that enables effective accounting.

The Role of Accounting

Now that we have a basic understanding, let's explore the pivotal roles these functions play in your business:

1. Financial Clarity

Accounting offers a bird's-eye view of your business's financial status. It allows you to track profits, losses, and expenses, providing a clear understanding of where your money is coming from and where it's going.

2. Informed Decision-Making

With accurate financial data at your fingertips, you can make informed decisions. Whether you're considering expanding your product line or cutting costs, accounting helps you assess the feasibility of these choices.

3. Compliance

Accounting ensures your business complies with tax laws and regulations. Accurate records are essential for filing taxes correctly and avoiding potential legal issues.

4. Attracting Investors

Investors are more likely to support a business with a robust accounting system in place. It instils confidence in your financial stability and growth potential.

The Significance of Bookkeeping

Now, let's shift our focus to the indispensable role of bookkeeping:

1. Organization

Bookkeeping keeps your financial records organized. It ensures that all transactions are properly categorized and easily retrievable when needed.

2. Real-Time Tracking

By maintaining up-to-date records, bookkeeping provides a real-time snapshot of your financial situation. This is particularly valuable for identifying cash flow trends and potential issues.

3. Business Growth

Accurate bookkeeping is essential for scaling your business. It helps identify areas where you can cut costs and areas that require investment for growth.

4. Auditing and Accountability

In case of an audit, thorough bookkeeping serves as your first line of defense. It provides a transparent record of your financial activities, demonstrating your commitment to accountability.

Conclusion

In conclusion, accounting and bookkeeping are the unsung heroes of business success. They lay the foundation for informed decision-making, financial stability, and long-term growth. By understanding and implementing these practices effectively, you can navigate the complex financial landscape with confidence and take your business to new heights.

Don't overlook the significance of these crucial functions. Embrace them, and you'll be well on your way to financial mastery. Remember, success in business is not just about hard work; it's about working smart. So, invest in your accounting and bookkeeping practices, and watch your business flourish.

#bookkeeping services#virtual bookkeeping services#online bookkeeping services#online bookkeeper#professional bookkeeping services#business

0 notes

Text

#virtual bookkeeping services#virtual bookkeeping service#bookkeeping services#virtual bookkeeping services brisbane#Brisbane#best bookkeeping service#bookkeepingsolutions#professional bookkeeping services#small business bookkeeping#bookkeepingservices#bookkeeping#bookkeeper for business#payroll bookkeeping

0 notes

Text

Why Invest in Professional Bookkeeping Services for Your Growing Small Business

Small business owners often struggle with managing their finances.

They may not have the necessary skills or experience to handle bookkeeping tasks, which can lead to errors and missed opportunities for growth.

In this blog post, we will explore why investing in professional bookkeeping services is essential for your growing small business.

Introduction to the Importance of Bookkeeping for Small…

View On WordPress

#Accounting vs Bookkeeping#Invest in Professional Bookkeeping for Growing Small Businesses#Outsourcing Your Books#Professional Bookkeeping Services#Saving Time and Money with Bookkeeping#Small Business Bookkeeping

0 notes

Text

How to Go From Being a Bookkeeper to an Accounting Business Advisor

As you look at the books of some of your clients, you no doubt see ways they can improve their processes, but you may not have the time needed to, first, restructure your role and then invest your energies in sitting down and advising clients.

Read more on How to Go From Being a Bookkeeper to an Accounting Business Advisor

#bookkeeping services#accounting services#accounting outsourcing company#outsourcing accounting#customized accounting#finance accounting service#account bookkeeping#bookkeeping outsourcing services#accounting and bookkeeping services#bookkeeping for accountants#basic bookkeeping#bookkeeping services for small business#professional bookkeeping services#small and medium business#complete accounting#complete tax service#accounts receivable outsourcing#outsourced tax preparation#outsourcing bookkeeping services#certified bookkeepers#franchise bookkeeping#bookkeeping for franchisee

1 note

·

View note

Text

I set high standards for my bookkeeping work, taking a proactive approach to ensuring the business you’ve established has meticulous, up-to-date, and accurate accounting behind it. As a Quickbooks Online Advanced Proadvisor and Xero Partner, I ensure you maximize the full potential of your cloud accounting software.

1 note

·

View note

Text

Professional bookkeeping services for seamless payroll processing tailored to streamline your payroll management effortlessly.

0 notes

Text

The Power of Bookkeeping in 6 Points

Feeling buried in bills? Conquer chaos with bookkeeping! Less stress, better decisions, & tax relief await. ️Contact Aspire Tax Today

Professional Bookkeeping Services

0 notes

Text

#outsource bookkeeping services#bookkeeping services in india#bookkeeping services#online bookkeeping services#bookkeeping services India#accounting bookkeeping services#professional bookkeeping services#outsourcing bookkeeping

0 notes

Text

Why accounting firms outsource bookkeeping?

Bookkeeping is an essential part of accounting services, providing the foundation for accurate financial reporting and analysis. However, managing bookkeeping tasks in-house can be time-consuming and costly, especially for accounting firms that may not have the resources to hire full-time staff.

This is where accounting and bookkeeping services tasks can provide significant benefits for accounting firms. Here are some of the key reasons why accounting firms outsource bookkeeping:

Focus on core activities: Accounting firms may have a range of services to offer, including tax preparation, auditing, financial planning, and more. By outsourcing bookkeeping tasks, they can focus on core activities and provide specialized services to clients, without having to allocate resources to bookkeeping tasks.

Cost savings: Outsourcing bookkeeping tasks can be more cost-effective than hiring full-time staff, as accounting firms only pay for the services they need, without having to provide benefits, training, or equipment.

Improved accuracy and efficiency: Professional bookkeeping service providers are trained to follow best practices and use advanced accounting software and tools, which can help improve accuracy and efficiency in bookkeeping tasks. This, in turn, can lead to more accurate financial reporting and analysis.

Flexibility and scalability: Outsourcing bookkeeping tasks can provide accounting firms with greater flexibility and scalability, as they can easily adjust the level of services based on client needs and business growth.

Access to specialized expertise: Professional bookkeeping service providers have the expertise and experience to handle a range of bookkeeping tasks, including accounts payable and receivable, bank reconciliations, payroll processing, and financial reporting. This can provide accounting firms with access to specialized expertise and improve the quality of services they provide to clients.

In conclusion, outsourcing bookkeeping tasks can provide significant benefits for accounting firms, including cost savings, improved accuracy and efficiency, flexibility and scalability, and access to specialized expertise. By outsourcing bookkeeping tasks, accounting firms can focus on core activities and provide specialized services to clients, while maintaining high standards of accuracy and compliance.

#Accounting outsourcing#bookkeeping services#virtual bookkeeping#virtual accounting#bookkeeping#professional bookkeeping services

0 notes

Link

With bookkeeping service, companies are able to track all the information regarding the key of operating, investing and financing decisions. The bookkeepers are the people who manage all the financial data of the company. We have professional bookkeeping services in which the bookkeepers are highly professional in their work and will make profit in your business.

0 notes

Text

Firstcorr Financial Services LLC - Benefit From Bookkeeping Solutions California

Employees demanding payroll slips, accounts demanding tax statements, and bookkeeping staff demanding invoices, and everything is rapidly falling apart? Well, if that’s your situation, too, then don’t panic. I have the perfect solution for your problem: outsourcing a bookkeeping solutions California company named FirstCorr to handle all your bookkeeping problems.

Small businesses necessarily don’t have enough resources like money and experience to handle financial matters, which makes them lag behind on some matters of growth. Bookkeeping is the practice of organizing, classifying, and maintaining a record of the company’s transactions on a daily basis.

People have had many myths about financial outsourcing services, but the truth is that with Bookkeeping Solutions California, small businesses can easily get bookkeeping services at affordable rates and of high quality without having to hire someone for the job and pay double the amount.

FirstCorr Financial Services LLC - Outsourcing Payroll Service Company

Payroll management and distribution is a headache is itself when you’ve got to pay the people working under you, but you don’t have much to give back. Payroll management is a crucial component part in the successful operations of a small business as it is the task of issuing paychecks and salaries to their employees.

FirstCorr is a well-known payroll service company that provides financial outsourcing services related to payroll like Payroll Processing, Collect & Submit Payroll Tax Payments, Prepare & Submit Payroll Tax Reports, W-2 Reporting, 1099 Reporting, and many more.

Financial outsourcing is often looked down upon when it comes to outsourcing work, but FirstCorr is a payroll service company that excels in payroll management and organization for small businesses by keeping their management and staff working smoothly without a doubt.

Increase Your Chance Of Growth With Certified Tax Professional California

Running a small business means that you only have time to give your attention to a limited number of things at a time. As small businesses lack experience and a solid financial foundation, it is difficult for them to keep up with the ups and downs of tax filings and returns.

We understand how important it is to pay taxes and how most of your profits and investments are given away due to taxes due to which you’re not able to keep proper track of your tax reports, which affects the company’s investments and expenses.

To help small businesses like you out, FirstCorr provides a skilled tax professional California at your service to help you manage your tax reports and keep track of how much you’re spending and investing properly.

0 notes