#bookkeeping services in india

Text

The Advantages of Outsourcing Bookkeeping Services to India

In today's competitive business world, streamlining operations is crucial for success. One way to achieve this is by outsourcing bookkeeping services to India. This blog post will explore the benefits of outsourcing bookkeeping, how to choose the right partner, and why AKM Global is the perfect solution for your needs.

Benefits of Outsourcing Bookkeeping to India

Increased Efficiency and Accuracy: Indian bookkeeping providers are known for their efficiency and accuracy. They leverage cutting-edge accounting software and proven methodologies to ensure your financial records are meticulously maintained and up-to-date.

Reduced Costs: Outsourcing bookkeeping to India can lead to significant cost savings. You can avoid the overhead expenses of hiring and training an in-house bookkeeper, while benefiting from the economies of scale offered by Indian bookkeeping companies.

Freed Up Time and Resources: By outsourcing bookkeeping, you can free up valuable time and resources for your core business activities. Your team can focus on strategic initiatives that drive growth and profitability.

Access to a Wider Talent Pool: India boasts a vast pool of highly skilled and experienced bookkeepers. Outsourcing allows you to tap into this talent pool and secure the expertise you need, regardless of your business size.

Improved Scalability: As your business grows, your bookkeeping needs will evolve as well. A reliable outsourcing partner in India can seamlessly scale their services to accommodate your growing requirements.

Choosing the Right Outsourcing Bookkeeping Partner

Selecting the ideal outsourcing bookkeeping partner requires careful consideration of several factors:

Experience and Qualifications: Ensure the provider has a team of experienced and qualified bookkeepers with a proven track record of success.

Security Measures: Financial data security is paramount. Choose a partner that implements robust security measures to safeguard your sensitive information.

Communication and Time Zone Compatibility: Effective communication is essential. Select a partner with a clear communication style and consider time zone differences to ensure smooth collaboration.

Cost: Obtain quotes from several providers and compare their pricing structures to find a solution that aligns with your budget.

Why AKM Global is Your Ideal Outsourcing Bookkeeping Partner

AKM Global stands out as a leading provider of outsourcing bookkeeping services to India. We offer a multitude of advantages:

Experienced and Qualified Team: Our team comprises highly skilled and experienced bookkeepers who are proficient in handling all your bookkeeping requirements.

Cutting-Edge Technology: We leverage the latest accounting software and technologies to ensure the accuracy and efficiency of your financial records.

Unwavering Security: We prioritize the security of your financial data and implement industry-best security practices to protect your information.

Clear Communication: We maintain a clear and concise communication style, keeping you informed throughout the process. We are always available to address your questions and concerns.

Scalable Solutions: Our bookkeeping services are designed to scale with your business. We can seamlessly adjust our services to accommodate your evolving needs.

Conclusion

Outsourcing bookkeeping services to India offers a compelling solution for businesses seeking to streamline operations, reduce costs, and gain access to a wider talent pool. By partnering with a reputable provider like AKM Global, you can ensure the accuracy and efficiency of your financial records while freeing up valuable time and resources to focus on core business activities.

#Outsourcing Bookkeeping Services in India#Bookkeeping Services in India#AKM Global#Taxation Services

1 note

·

View note

Text

Bookkeeping for Non-Profit Organizations: Key Considerations

Explore vital considerations for effective bookkeeping in non-profits, emphasizing transparency, compliance, and tailored systems. Learn about Indian accounting standards, software choices, managing donor funds, and outsourcing benefits. Read more

#accounting bookkeeping service#bookkeeping services#accounting services#bookkeeping services in india#startupfino

0 notes

Text

AKM Global: Precision Bookkeeping Solutions in India Tailored for USA Businesses

Elevate your financial strategy with AKM Global's premier bookkeeping services in India, crafted for the USA market. Rely on our expertise for precise, compliant, and tailored solutions. Choose AKM Global to optimize your business accounts – your trusted partner for bookkeeping excellence in India, serving the USA clients.

0 notes

Text

Trends in Finance and Accounting Outsourcing for 2023

Outsourcing accounting and finance functions has evolved significantly in recent years, shaping the way businesses manage their financial operations. As we step into 2023, several trends continue to redefine this landscape, influencing how organizations approach outsourcing. Let's delve into some prevailing trends that are anticipated to shape finance and accounting outsourcing in India this year.

1. Embrace of Advanced Technologies:

The integration of AI, machine learning, and automation in finance and accounting outsourcing in India has revolutionized operations. AI-driven analysis enhances accuracy, while machine learning refines predictive analytics and risk assessments. Automation streamlines tasks, freeing resources for strategic initiatives. This tech evolution cements India's status as a hub for innovative financial services outsourcing.

2. Focus on Data Security and Compliance:

Outsourcing partners in India prioritize stringent security protocols and compliance standards to combat rising cyber threats. Employing encryption, multi-factor authentication, and compliance audits, they fortify data protection. Regular assessments, employee training, and client collaboration ensure a proactive defense against cyber risks, fostering client trust.

3. Scalable Solutions for Small Businesses:

Accounting Outsourcing in India has evolved, providing small and medium-sized enterprises (SMEs) with customizable solutions. These offerings, specifically designed for SMEs, offer scalability, granting access to specialized expertise. SMEs can optimize resources, focusing on strategic growth while swiftly adapting to market changes, fostering financial resilience and competitive edge in a dynamic landscape.

4. Remote Work Dynamics and Virtual Teams:

In the wake of the pandemic, remote work practices persist, driving a paradigm shift in outsourcing dynamics. Providers adeptly transition to virtual work environments, enabling streamlined collaboration and uninterrupted service delivery. Embracing virtual teams, they ensure seamless operations, leveraging technology to sustain effective client partnerships amidst evolving workplace outlooks.

5. Customized Service Offerings:

Accounting Outsourcing companies in India are pivoting towards bespoke service models, acknowledging the limitations of standardized solutions. They craft tailored approaches addressing unique business needs, ensuring better alignment with client requirements.

This customization drives increased value delivery, allowing providers to deeply integrate with client workflows, offer specialized expertise, and facilitate seamless adaptation to diverse industry nuances, ultimately enhancing client satisfaction and outcomes.

6. Strategic Focus on Analytics and Insights:

Businesses are increasingly prioritizing accounting outsourcing partners in India proficient in advanced analytics. The emphasis on data-driven insights aids in informed decision-making and proactive strategies for long-term expansion. Outsourcing firms harness analytics to offer predictive modeling, trend analysis, and actionable insights, empowering clients to make strategic choices, anticipate market shifts, and steer their businesses toward sustained growth and competitive advantage.

7. Green Accounting and Sustainability:

There's a rising trend in integrating sustainability into financial practices within outsourcing. Providers are partnering with businesses dedicated to eco-conscious accounting. They assist in implementing eco-friendly practices, like carbon accounting and sustainability reporting, aligning financial decisions with environmental responsibility. This alignment fosters transparency, aiding businesses in meeting sustainability goals and addressing stakeholder concerns.

Explore More Such Trends in Accounting Outsourcing in India

The trends outlined above demonstrate the dynamic nature of finance and accounting outsourcing in 2023. To harness the full potential of outsourcing, businesses must strategically align with partners who not only adapt to these trends but also offer innovative solutions aligned with their unique objectives and values.

As the accounting outsourcing services in India evolve, businesses should proactively assess these trends and leverage them to drive efficiencies, enhance financial performance, and achieve strategic objectives in the ever-evolving global marketplace.

#accounting outsourcing in India#accountants in India#outsourced accountants in India#bookkeeping services in India#payroll services in India#accounts#financial freedom#financial analysis#accounting outsourcing services in India#accounting and sustainability reporting#outsourcing partners in India

1 note

·

View note

Text

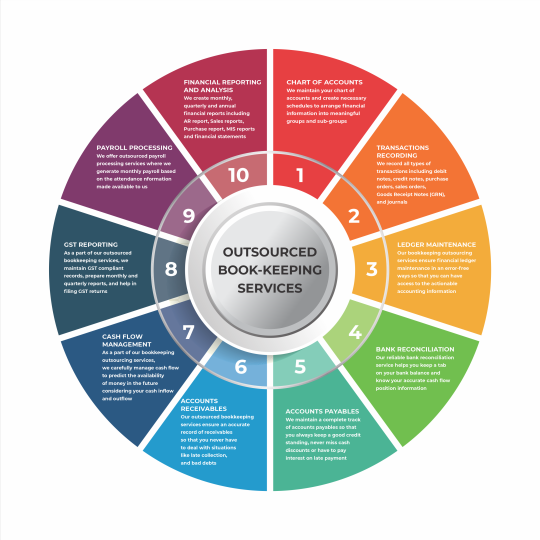

How Outsourcing Bookkeeping Fuels Start-up Growth

Start-ups are at the forefront of innovation and entrepreneurship, but they often face resource constraints and limited bandwidth. In their quest for rapid growth and success, bookkeeping and financial management can become daunting tasks. Outsourcing bookkeeping has emerged as a game-changing solution for start-ups, allowing them to focus on core competencies, maximize efficiency, and fuel accelerated growth. So, here we explore how outsourcing bookkeeping can be a strategic catalyst for start-up growth, providing valuable insights and unleashing the full potential of these budding enterprises.

Cost-effectiveness and Resource Optimization - Start-ups often operate on tight budgets, making it essential to optimize resources for maximum impact. Outsourcing bookkeeping eliminates the need to hire in-house accounting staff, reducing salary expenses, employee benefits, and training costs. Start-ups can allocate these saved resources towards marketing, product development, and customer acquisition, propelling growth and expansion.

Access to Expert Financial Advice - Financial management is a critical aspect of start-up success, and outsourcing bookkeeping provides access to expert financial advice and guidance. Reputable outsourcing firms employ skilled accountants who understand the intricacies of start-up finances. They can analyze financial data, generate insightful reports, and provide recommendations for better budgeting and cash flow management. With expert insights, start-up founders can make informed decisions that drive business growth.

Time Efficiency and Streamlined Processes - Outsourcing bookkeeping allows start-ups to offload time-consuming financial tasks to professionals. This time efficiency enables founders and team members to focus on core business activities, including product development, customer engagement, and market research. Moreover, outsourcing partners use advanced bookkeeping software to streamline processes, making invoicing, payroll, and tax filing more efficient and accurate.

Scalability for Dynamic Growth - Start-ups often experience rapid growth and fluctuating financial demands. Outsourcing bookkeeping offers scalability, allowing businesses to adapt to changing requirements without disruptions. Whether it's managing increased transaction volumes or expanding into new markets, outsourcing partners can seamlessly handle financial tasks while start-ups concentrate on scaling their operations.

Improved Financial Visibility and Decision -Making - Bookkeeping outsourcing in India is essential as it ensures that financial records are well-maintained and up-to-date. This provides start-up founders with real-time financial visibility, enabling them to make data-driven decisions. Well-kept records provide clear insights into revenue streams, expense patterns, and profit margins. So, businesses can identify areas for improvement, capitalize on opportunities, and mitigate financial risks effectively.

Compliance and Risk Management - Start-ups must navigate complex financial regulations and reporting requirements. Non-compliance can result in severe penalties and damage to the company's reputation. Outsourcing bookkeeping to professionals ensures that all financial records are accurate and compliant with relevant laws. Moreover, outsourcing partners stay up to date with regulatory changes, protecting start-ups from potential legal pitfalls.

Outsourcing bookkeeping is a strategic move that can revolutionize the growth trajectory of start-ups. Outsourcing bookkeeping in India empowers businesses and their top management to concentrate on innovation, customer satisfaction, and market expansion while ensuring that financial management is in the hands of qualified professionals. At Infinzi, we understand the significant role bookkeeping services for small business play in achieving business objectives. Our deep understanding of bookkeeping services in India positions us as a strategic partnership that offers solutions that tailored to varying business needs and the nuances of the Indian business landscape.

#"Bookkeeping Outsourcing India#Bookkeeping Services For Small Businesses#Bookkeeping Services In India

0 notes

Text

#outsource bookkeeping services#bookkeeping services in india#bookkeeping services#online bookkeeping services#bookkeeping services India#accounting bookkeeping services#professional bookkeeping services#outsourcing bookkeeping

0 notes

Video

SBS Global offers contract staffing for project-based Accounting & Finance positions. We provide talented candidates to fill your temporary or long-term Outsourced Finance and Accounting Services needs. As a trusted financial accounting staffing organisation SBS Global can provide resources for:

#outsourced accounting and bookkeeping services#accounting service provider#outsourced finance and accounting services#CFO Services in India#Bookkeeping Services in India#staffing services in india#staffing services india

0 notes

Text

Company Formation Experts

Top CA firm in India, facilitating seamless company formation in India with easy processes and successful outcomes, led by experienced professionals. Call Us Today!

Company Formation Experts | Foreign Company Formation and Registration Services in India

#audit#accounting & bookkeeping services in india#income tax#ajsh#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

The Role of Accounting and Bookkeeping in Tax Industry

Accounting and bookkeeping are tedious and arduous but are necessary for the company to gain an advantage over competitors and to make decisions. Bookkeeping is the recording of financial details of the company in an orderly manner over some time. Bookkeepers are people who maintain the accounts. Ileadtax LLC is one of the best tax preparation and planning companies based in New York, India, and California. It offers accounting and bookkeeping services and are adviser for many companies. This article discloses the importance of accounting and bookkeeping in the tax industry and how it is useful to a company.

Accounting and bookkeeping are dependent on each other. Bookkeeping is a sub-branch of accounting that organizes and summarizes financial data and it has accurate financial data. Bookkeepers have access to all financial data of the company and can track their transactions. They ensure the data is up to date and is complete. Bookkeeping helps the company with decisions related to investing and operations. IleadTax LLC is a global company that consists of tax accounting experts in India, New York, and California. They provide their tax experts for all companies which are in need. The accounting and bookkeeping services provided contain detailed records of past transactions.

The first step in achieving flawless tax preparation is keeping accurate financial records. The foundation of this process is accounting and bookkeeping. These tasks entail the meticulous documentation of financial transactions, which results in an accurate depiction of earnings, outlays, assets, and liabilities. Having structured financial records is essential for tax season. Identification of deductible expenses is made possible for people and organizations through accounting and bookkeeping. Taxpayers can properly minimize their taxable income by accurately categorizing their costs and keeping track of the necessary supporting records. This may lead to significant cost savings and a better tax situation.

Beyond tax time, accounting and bookkeeping are important. They serve as the cornerstone for budgeting, investments, and future tax planning, enabling both individuals and corporations to make well-informed choices. It's advantageous to obtain professional advice when dealing with the complicated realm of tax preparation. CPAs (Certified Public Accountants) and seasoned bookkeepers may provide priceless insights, ensuring that you successfully navigate tax season.

A thorough and accurate bookkeeping procedure gives businesses a reliable way to assess their success. It also serves as a benchmark for its income and revenue targets and information for general strategic decision-making. A trustworthy source for businesses to gauge their financial performance is bookkeeping.

Accounting and bookkeeping are more than simply administrative duties; they are also effective instruments that can lessen the strain of tax season and enhance your financial security. A sound accounting and bookkeeping system can result in significant savings, compliance, and financial peace of mind whether you're a business owner or an individual taxpayer. So, as tax season draws near, keep in mind that having a solid financial foundation is the key to success. ILeadTax LLC attempts to deliver results that meet the expectations of the client.

#Accounting and bookkeeping#tax preparation#tax accounting experts in India#accounting and bookkeeping services

4 notes

·

View notes

Text

Tax Budget Highlights 2024

Income tax budget 2024 highlights: The nation’s finance ministry Nirmala Sitharaman asserts that there won't be any major amends to India's direct tax system for FY 2024–2025, or starting on April1,2024, despite the fact that the Finance Act 2024 modifies several income-tax regulations, such as how agricultural revenue is treated.

Nirmala Sitharaman, the finance minister of India has made it clear that, as of April 1, 2024 (FY 25), there would be no more modifications made to the income tax system, either old or new. Therefore, due to this reason, both the previous and the new regimes are still subject to the income tax slabs specified in the Union Budget for 2023–2024.

Some key points of budget

It is significant to remember that adjustments made to the previous year's budget will take effect for the current fiscal year. However, some new budget highlights are as follows:

Nirmala Sitharaman, the finance minister, highlighted five "Disha Nirdashak" baatein: Implementing social justice as a viable government model involves prioritizing the underprivileged, women, youth, and farmers; focusing on infrastructure; employing the latest technology to enhance production; and establishing a high-power committee to address issues with demographic shifts.

India has achieved three years of continuous 7% GDP growth, making it the G20's most rapidly expanding economy.

GDP stands for Performance, Government, and Development. We have improved economic management and delivered on development. Despite extremely difficult circumstances, we are reducing the fiscal deficit.

The government's capital expenditure program will not end, FM said, and it will be continued.

The India, Middle East, European Corridor (IMEC) project will go ahead in spite of the Red Sea setbacks.

According to Revenue Secretary Sanjay Malhotra, the exchequer would pay less than ₹3,500 crore for the removal of 1.1 crore pending minor direct tax requests for certain years.

FM reaffirmed that there will be no extension of the reduced tax rate to new industrial units starting beyond March 2024.

According to Tuhin Kanta Pandey, secretary of DIPAM, there is no set goal for disinvestment in FY25.

We are not only aligning with the previously given fiscal consolidation path, but we are also overextending it, according to a message from Finance Minister Nirmala Sitharaman to credit rating agencies.

According to Finance Secretary TV Somanathan, the goal of bringing the Center's debt-to-GDP ratio down to 40% was established prior to the COVID-19 period and needs to be reexamined.

Highlights from Interim budget 2024

The 2024 budget key highlights are as follows:

Direct Tax Proposal

The FM declared that for direct taxes, the same tax rates would be maintained in FY 2024–2025. Taxpayers earning up to Rs. 7 lakh will not be required to pay any taxes under the new tax system.

Existing domestic enterprises will pay corporation taxes at a rate of 22%, while some newly established manufacturing companies would pay taxes at a rate of 15%.

The FM declared that throughout the past ten years, direct tax collections have more than tripled, while the number of return filers has increased by 2.4 times.

The FM has suggested extending the deadline for several tax breaks for start-ups and investments made by pension and sovereign wealth funds. Additionally, the proposal calls for an exemption from paying taxes on a certain type of investment for units of the IFSC that will expire on March 31, 2024. This has been extended to March 31, 2025.

Goods and Services

The FM declared that in FY24, the total collection of GST on average has increased to Rs. 1.66 lakh crore each month.

The Finance Minister has announced that the tariffs on imports and customs rates will remain the same for the fiscal year 2024-2025.

Empowering the Youth

Training has been provided to 1.4 crore youth through the Skill India Mission.

Encouraging young people's dreams of becoming entrepreneurs: 43 crore loans were approved under the PM Mudra Yojana.

An amount of Rs. 1 lakh crore has been set aside to provide tech-savvy young people with a 50-year, interest-free loan with minimal or no interest charges for financing or re-financing.

Infrastructure and Investment

The government aims to implement three primary railway corridors under PM Gati Shakti: port connection, high traffic density corridor, energy, minerals, and cement. This will reduce costs and improve logistics efficiency.

Trade agreements between the two parties will be used to encourage foreign investment.

The UDAN program is dedicated to the expansion of existing airports as well as the construction of new airports to improve air connectivity. This initiative is expected to boost the tourism industry and promote economic growth in various regions of the country.

Agriculture and Food Processing

The government is intended to foster both public and private investment in post-harvest operations.

All agroclimatic zones will see an expansion in the use of Nano-DAP.

It is necessary to have a comprehensive strategy for the development of dairy products.

The Pradhan Mantri Matsya Sampada Yojana will be executed with greater zeal in an effort to double exports, expand employment opportunities, and enhance aquaculture productivity.

Budget 2024 summary

The budget 2024 summary presents a comprehensive analysis of the nation's economic well-being and the government's strategic priorities. Though it may not contain any groundbreaking proposals, it offers valuable information and a glimpse into the country's financial stance and future direction.

Budgeting is a vital tool for individuals and corporations alike, as it helps identify and allocate resources in a planned and efficient manner. Creating a budget can establish clear financial goals and objectives and develop a comprehensive plan.

It also helps minimize unnecessary expenses and maximize the use of available resources. Understanding the purpose and benefits of budgeting can go a long way in ensuring financial stability and success.

#deloitte india#ai generated#technology#analytics#union budget#artificial intelligence#finance strategy#ai#technology innovations#deloitte#income tax update#taxi service#taxes#financial#taxation#budget#bookkeeping

0 notes

Text

A CFO Service will oversee your current bookkeeping and controller staff to ensure all procedures have a series of checks and balances to strengthen security and present accurate financials. It also includes to oversee and ensure all statutory compliances as per statutory deadlines.

To Know More About CFO Services Visit Our Website: https://bit.ly/4aLOP5H

#virtual cfo services in gurgaon#outsourcing bookkeeping to india#CFO Services and Virtual CFO Services

0 notes

Text

Every firm, be it a start-up or a well-established, Legal Liability Partnership, OPC, or Private Limited Company each kind of business needs to maintain a record of Financial transactions. This can be done by maintaining proper accounting and bookkeeping services.

Differences between Accounting and Bookkeeping:

Accounting is the process by which a record of earnings and expenses is maintained. An accountant is a person, who will guide with financial advice and he is also well-versed in the company’s financial situation.

In other words, bookkeeping is the process, in which a record of financial transactions is maintained. It involves the preparation of financial statements such as balance sheets and income tax statements. The Bookkeeper must ensure that employees are filing invoices and expenses accurately. Also, managing the payroll comes under the scope of Bookkeeping.

#Accounting and bookkeeping services#accounting and bookkeeping services in india#best accounting and bookkeeping services in india#top accounting and bookkeeping services in india

0 notes

Text

Advantages of Outsourcing Bookkeeping for Startup Success

Unlock startup potential with outsourced bookkeeping services, saving costs, gaining expertise, and ensuring compliance. Flexible support, error prevention, and operational efficiency set the stage for financial success. Partner with StartupFino for secure data management.

#accounting bookkeeping service#accounting services#bookkeeping services#bookkeeping services in india#statupfino

0 notes

Text

NetworkLeaf - Where Global CPA Firms Turn for Accounting Precision

In an age where globalization has become the linchpin of success for many businesses, the necessity for impeccable financial management cannot be overstated. NetworkLeaf emerges as a pivotal player in this realm, offering premier outsourced accounting in India to a discerning clientele spanning the USA, Canada, Australia, and the UK. Our tailored services are meticulously designed to cater to the specific needs of each client, ensuring that the complexities of international monetary transactions are made straightforward and manageable.

As one of the most reputable accounting outsourcing companies in Ahmedabad, NetworkLeaf brings to the table an array of outsource bookkeeping services India-based CPA firms and businesses can rely on. The global market teems with challenges, including varying financial laws, currencies, and tax systems, but our expertise ensures that your business navigates these with ease and confidence. With NetworkLeaf, you gain more than just an outsourced service provider; you gain a strategic ally committed to the financial health and growth of your business.

Leading Accounting Outsourcing Companay in Ahmedabad, India

Our visionary approach combines the latest in accounting technology with the sharp acumen of seasoned financial professionals. This enables us to deliver results that are not just accurate but also strategically aligned with your business goals. Whether you're a startup looking to establish solid financial footing or an established enterprise aiming to streamline operations, NetworkLeaf's services are the keystone to unlocking your potential in a competitive international landscape.

Choosing NetworkLeaf means placing your trust in one of the leading outsourced accounting India has to offer, further bolstered by our unwavering dedication to quality and customer satisfaction. The result is a harmonious financial operation that aligns with your ambitions of scaling your business globally. Experience the peace of mind that comes with knowing every aspect of your finances is expertly managed, allowing you to focus on what you do best—growing your business. Welcome to NetworkLeaf, where global financial management is redefined.

#outsourced accounting in India#accounting outsourcing companies in Ahmedabad#outsource bookkeeping services India#outsourced accounting India

0 notes

Text

How Bookkeeping Outsourcing Benefits Businesses in the USA

In today’s competitive business landscape, organizations in the USA are continually seeking innovative solutions to streamline operations, optimize resources, and drive growth. One such solution gaining momentum is bookkeeping outsourcing—a strategic approach that offers numerous benefits for businesses of all sizes. This blog delves into how bookkeeping outsourcing benefits businesses in the USA, focusing on efficiency, cost-effectiveness, compliance, and strategic advantage.

Enhanced Efficiency and Focus on Core Competencies

1. Expertise and Specialization:

Bookkeeping outsourcing enables businesses to leverage specialized expertise, knowledge, and skills.

By partnering with experienced professionals, organizations can ensure accurate financial record-keeping, compliance with regulatory requirements, and adherence to industry best practices.

2. Resource Optimization:

Outsourcing bookkeeping tasks allows businesses to reallocate internal resources, personnel, and capital to core competencies, strategic initiatives, and revenue-generating activities.

Organizations can focus on innovation, customer engagement, and business development by eliminating the administrative burden associated with bookkeeping.

Cost-Effectiveness and Financial Management

1. Reduced Operational Costs:

Bookkeeping outsourcing offers cost-effective solutions tailored to your business’s specific needs, size, and industry.

Organizations can achieve significant cost savings, scalability, and flexibility by leveraging economies of scale, shared resources, and variable cost structures.

2. Budget Management and Forecasting:

Outsourcing bookkeeping enables businesses to maintain accurate, up-to-date financial records, budgets, and forecasts.

By accessing real-time financial insights, organizations can make informed decisions, identify opportunities, mitigate risks, and optimize financial performance.

Compliance, Accuracy, and Risk Management

1. Regulatory Compliance:

Bookkeeping outsourcing ensures compliance with federal, state, and local regulations, tax laws, and financial reporting requirements.

Organizations can avoid penalties, fines, and legal repercussions by staying abreast of regulatory changes, updates, and deadlines.

2. Accuracy and Precision:

Experienced bookkeeping professionals utilize advanced technologies, software, and methodologies to ensure accuracy, consistency, and reliability.

Organizations can build trust, credibility, and transparency with stakeholders, investors, and regulators by maintaining precise financial records, reconciliations, and audits.

3. Risk Mitigation:

Outsourcing bookkeeping tasks enhances risk management strategies, controls, and frameworks.

Organizations can safeguard assets, optimize performance, and sustain long-term success by identifying, assessing, and mitigating financial, operational, and compliance risks.

Strategic Advantage and Business Growth

1. Strategic Insights and Analysis:

Bookkeeping outsourcing provides access to strategic insights, analysis, and recommendations tailored to your business objectives, challenges, and opportunities.

By leveraging data-driven insights, organizations can identify trends, patterns, and areas for improvement, enabling informed decision-making and strategic planning.

2. Scalability and Growth:

Outsourcing bookkeeping services offers scalability, flexibility, and adaptability to accommodate evolving business needs, market dynamics, and growth objectives.

Organizations can capitalize on opportunities, expand market presence, and achieve sustainable growth by aligning financial management strategies with business goals, aspirations, and market trends.

Conclusion

Bookkeeping outsourcing offers numerous benefits for businesses in the USA, encompassing enhanced efficiency, cost-effectiveness, compliance, accuracy, risk management, strategic advantage, and growth. Organizations can navigate today’s competitive landscape, mitigate challenges, and capitalize on strategic insights by leveraging specialized expertise, optimizing resources, ensuring regulatory compliance, and capitalizing on strategic insights. Partnering with a trusted, experienced bookkeeping outsourcing provider like Glocal Accounting ensures customized solutions, industry expertise, and unparalleled value, empowering businesses to achieve operational excellence, financial stability, and long-term success.

Glocal Accounting is a leading bookkeeping outsourcing provider specializing in delivering customized, scalable, and cost-effective financial solutions tailored to businesses in the USA. With specialized expertise, advanced technology infrastructure, comprehensive service offerings, and a commitment to compliance, Glocal Accounting empowers organizations to optimize resources, drive growth, and maintain a competitive edge in today’s dynamic marketplace. Partner with Glocal Accounting to elevate your financial management strategies, enhance operational efficiency, and unlock unparalleled value for your business.

#accounting outsourcing services usa#sales tax outsourcing#sales tax outsourcing solutions#bookkeeping outsourcing services usa#outsource bookkeeping services india

0 notes

Text

Outsource Bookkeeping Services to India with AKM Global

Efficiently outsource bookkeeping services to India with AKM Global. Your reliable financial partner for accurate and professional solutions. Boost productivity and streamline your accounting processes today!

Address - 101, First Floor, Bestech Business Towers, Sector – 48, Sohna Road, Gurgaon – 122018, Haryana, India

Official Email - [email protected]

Phone Number - [+91-124-6647500]

0 notes