#virtual bookkeeping service

Text

#virtual bookkeeping services#virtual bookkeeping service#bookkeeping services#virtual bookkeeping services brisbane#Brisbane#best bookkeeping service#bookkeepingsolutions#professional bookkeeping services#small business bookkeeping#bookkeepingservices#bookkeeping#bookkeeper for business#payroll bookkeeping

0 notes

Text

2 notes

·

View notes

Text

I will do Xero Bookkeeping and Accounting for your Business.

Running a business can be quite challenging, especially when it comes to managing finances. Keeping track of your business's financial transactions is crucial to its success. That's why bookkeeping is essential for any business. And now, with technological advancements, bookkeeping has become more accessible and efficient than ever. Xero accounting is a cloud-based software that is designed to streamline bookkeeping and accounting for small and medium-sized businesses. In this article, we will discuss how Xero accounting can benefit your business and how I can help you with your Xero bookkeeping and accounting needs.

What is Xero Accounting?

Xero accounting is a cloud-based software that provides an easy and efficient way to manage your business's finances. It's a powerful tool that allows you to create and send invoices, track your expenses, reconcile your bank accounts, and manage your payroll. Xero accounting is user-friendly and has a simple and intuitive interface that makes it easy to navigate.

Why use Xero for Bookkeeping?

Xero accounting is a popular choice for businesses of all sizes because of its many benefits. Firstly, it's easy to use and accessible from anywhere, which means that you can access your financial information from anywhere with an internet connection. Secondly, Xero accounting is cost-effective, and it can save you a lot of money in the long run. You won't have to worry about purchasing expensive software or hiring an in-house bookkeeper. Thirdly, Xero accounting is secure, and your financial information is protected by the latest security measures. Fourthly, Xero accounting is constantly evolving, and its developers are continuously updating and improving the software.

Benefits of Xero Bookkeeping

Xero bookkeeping has many benefits for your business. Firstly, it's efficient and time-saving. With Xero accounting, you won't have to spend hours manually entering data into a spreadsheet. The software can automatically import your bank transactions and categorize them for you. Secondly, Xero bookkeeping is accurate, and it reduces the chances of errors. The software can reconcile your bank accounts and ensure that all your transactions are accounted for. Thirdly, Xero bookkeeping is customizable, and it can be tailored to your business's unique needs. You can create custom invoices and reports, and you can even integrate other software applications with Xero. Fourthly, Xero bookkeeping is flexible, and it can grow with your business. You can add new users and features as your business expands.

Xero Accounting and Amazon Bookkeeping

Xero accounting is an excellent choice for businesses that sell on Amazon. With Xero accounting, you can easily manage your Amazon transactions and keep track of your expenses. You can integrate your Amazon account with Xero, and the software can automatically import your sales data and fees. Xero accounting can also reconcile your Amazon transactions with your bank accounts and ensure that your financial records are accurate.

How I Can Help with Xero Bookkeeping and Accounting

As a professional bookkeeper, I can help you with your Xero bookkeeping and accounting needs. I have experience working with Xero accounting, and I can provide the following services:

1. Setting up your Xero account and customizing it to your business's unique needs.

2. Importing your financial data into Xero, including bank transactions and sales data from Amazon.

3. Reconciling your bank accounts and ensuring that your financial records are accurate.

4. Creating custom reports that provide insights into your business's financial health.

5. Managing your payroll and ensuring that your employees are paid accurately and on time.

6. Providing ongoing support and training to ensure that you can effectively use Xero accounting for your business.

With my help, you can save time and focus on growing your business, while I take care of the bookkeeping and accounting. I can provide you with regular financial reports that give you a clear view of your business's financial performance. By working with me, you can rest assured that your financial records are accurate and up to date.

Conclusion

In conclusion, Xero accounting is a powerful tool that can streamline your bookkeeping and accounting needs. As a professional bookkeeper, I can help you get the most out of Xero accounting and provide you with ongoing support and training. With my help, you can save time, reduce costs, and focus on growing your business. If you're interested in Xero bookkeeping and accounting services, please don't hesitate to contact me.

Schedule A Meeting

1 note

·

View note

Text

#virtual cfos#mis reporting#fundraising services#payroll management#accounting services#bookkeeping#startupfino

0 notes

Text

0 notes

Text

Unleash Success - Master Virtual Bookkeeping Services with Universal Accounting School

Unlock the power of virtual bookkeeping services with expert guidance from Universal Accounting School. Our specialized training equips you with the skills and tools needed to excel in delivering seamless virtual bookkeeping solutions. From leveraging cutting-edge technology to optimizing remote communication, our comprehensive program prepares you to meet the demands of today's digital economy. Join Universal Accounting School and elevate your proficiency in virtual bookkeeping services, empowering you to thrive in the modern business landscape while providing unparalleled support to your clients.

0 notes

Text

A CFO Service will oversee your current bookkeeping and controller staff to ensure all procedures have a series of checks and balances to strengthen security and present accurate financials. It also includes to oversee and ensure all statutory compliances as per statutory deadlines.

To Know More About CFO Services Visit Our Website: https://bit.ly/4aLOP5H

#virtual cfo services in gurgaon#outsourcing bookkeeping to india#CFO Services and Virtual CFO Services

0 notes

Text

Unlocking Business Success with Professional Bookkeeping Services

In the fast-paced world of modern business, staying ahead of the curve is paramount to success. One of the most crucial aspects of a thriving enterprise is maintaining accurate financial records and ensuring compliance with regulations. It's no secret that bookkeeping is the backbone of any successful business, enabling informed decision-making, strategic planning, and sustainable growth.

The Value of Professional Bookkeeping

Professional bookkeeping services offer a myriad of advantages that extend beyond mere number-crunching. Accurate and up-to-date financial records are essential for understanding the Financial Health of a business, making it easier to secure funding, attract investors, and ultimately drive profitability.

By employing bookkeeping professionals, businesses can seamlessly track their expenses, monitor cash flow, and make well-informed financial decisions. This level of financial transparency provides a solid foundation for sustainable growth and minimizes the risk of errors and financial setbacks. A recent survey conducted in Victoria, Melbourne revealed that 85% of businesses that outsource bookkeeping services experienced improved financial accuracy and efficiency, leading to enhanced profitability.

The Impact on Business Performance

Consider a growing boutique retail Business In Melbourne that recognized the impending need for professional bookkeeping services. By leveraging the expertise of a dedicated bookkeeping team, the business was able to streamline its financial operations, gain valuable insights into its cash flow, and identify cost-saving opportunities. This not only facilitated better resource allocation but also nurtured a more robust fiscal strategy, setting the stage for accelerated growth and expansion.

Harnessing the Power of FOMO

The fear of missing out is a powerful motivator. In a competitive business landscape, the fear of falling behind can propel businesses to embrace the latest trends and best practices. Those who hesitate to enlist professional bookkeeping services risk being left in the dust, unable to keep pace with their more prudent counterparts, and missing out on crucial opportunities for strategic growth.

Why Others Embrace Bookkeeping Services

Industry leaders across various sectors in Melbourne consistently turn to professional Bookkeeping services to capitalize on the expertise and precision that these services offer. By outsourcing bookkeeping tasks, they free up valuable time and resources to direct toward core business activities, innovation, and client relations. In doing so, they effectively mitigate risks, reduce operational costs, and gain a competitive edge in their respective markets.

The Call to Action

In conclusion, the value of professional bookkeeping services cannot be overstated. Business owners and professionals in Victoria, Melbourne are urged not to overlook the transformative impact that expert bookkeeping can have on their enterprises. As we continue to witness the tangible benefits enjoyed by businesses that opt for professional bookkeeping, I invite you to explore the possibilities that such services could unfold for your success.

Medium offers a wealth of resources and insights into the world of professional services. I encourage you to explore the various perspectives and experiences shared on Medium, which can provide valuable guidance on embracing professional bookkeeping services to drive your business to new heights.

#Bookkeeping Services#online accounting#business bookkeeping#xero accounting package#virtual bookkeeper#bookkeeping packages#payroll bookkeeping services#bookkeeping services near me

0 notes

Text

Optimize Your Financial Performance with Qualitas Accounting Inc

In today's fast-paced business landscape, the need for reliable financial management solutions has never been more critical. At Qualitas Accounting Inc, we understand the challenges that businesses face in managing their finances effectively. As one of the leading accounting firms Columbia MO, we are dedicated to providing top-notch virtual bookkeeping services tailored to meet your specific needs.

Our team at Qualitas Accounting Inc is committed to delivering excellence in finance and accounting outsourcing USA. By leveraging our expertise and cutting-edge technology, we streamline your financial processes, allowing you to focus on what you do best – growing your business. Whether you're a small start-up or a well-established corporation, our virtual CFO services USA are designed to optimize your financial performance and drive strategic decision-making.

At Qualitas Accounting Inc, we take pride in offering comprehensive solutions that cater to the unique requirements of each client. Our tailored approach sets us apart from other accounting firms in Columbia, MO, ensuring that you receive personalized attention and expert guidance every step of the way. With our virtual bookkeeping USA services, you can rest assured that your financial data is accurate, up-to-date, and easily accessible whenever you need it.

Your Path to Financial Success Begins with Qualitas Accounting's Premier CFO Services!

When it comes to finance and accounting outsourcing in the USA, Qualitas Accounting Inc stands out as a trusted partner for businesses looking to enhance their financial management capabilities. Our virtual CFO services in the USA empower you to make informed decisions, optimize resources, and drive growth effectively. Partner with us today and experience the difference that professional, customer-centric financial management can make for your business.

Contact Qualitas Accounting Inc today to learn more about how our accounting firm in Columbia, MO, can elevate your financial operations with top-tier virtual bookkeeping, finance and accounting outsourcing, and virtual CFO services in the USA. Reach out to us now to schedule a consultation and embark on a journey towards financial success.

#accounting firms columbia mo#finance and accounting outsourcing USA#virtual CFO services USA#virtual bookkeeping USA

0 notes

Text

Our Outsourced Accounting Services in the United States: Customize your financial services with our expert services.

As a leading logistics provider

accounting solutions, we provide tailored services for businesses throughout the United States.

Our experienced team specializes in a wide range of accounting services,

Includes Outsource bookkeeping Services, payroll outsourcing , preparing financial statements, remote CFO

and handling accounts payable.

The focus will be on accuracy, efficiency, and compliance

We make sure to keep your financial records accurate and up to date. By outsourcing your accounting needs to us, you can reduce transaction costs,

It reduces risks, freeing up valuable time to focus on core business activities. Work with us and enjoy the benefits of simplicity, reliability, and affordability

Outsourced accounting services tailored to your unique needs

0 notes

Text

0 notes

Text

What Does an Ecommerce Bookkeeper Do

What Does An Ecommerce Bookkeeper Do?

Juliet Aurora

May 13, 2022

5:12 pm

Estimated reading time: 6 minutes.

This is a guest blog written by our friends at A2X. Read on to the end to download a free 113 point ecommerce bookkeeping checklist that we helped to create!

“If you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see.”

AIS Solutions

Professional bookkeepers can save your ecommerce business time and money.

Keeping accurate and up-to-date accounts is a vital part of running a resilient business. And having an expert onside as early as possible is invaluable.

So if you’re thinking about hiring one, or interested in understanding exactly what they can do for your business, you’re in the right place.

In this guide about ecommerce bookkeepers, you’ll find:

Bookkeeping vs accounting: what’s the difference?

What makes ecommerce bookkeeping unique?

Benefits of having an ecommerce bookkeeper

When to hire an ecommerce bookkeeper

A free resource to streamline your ecommerce bookkeeping

Let’s jump in.

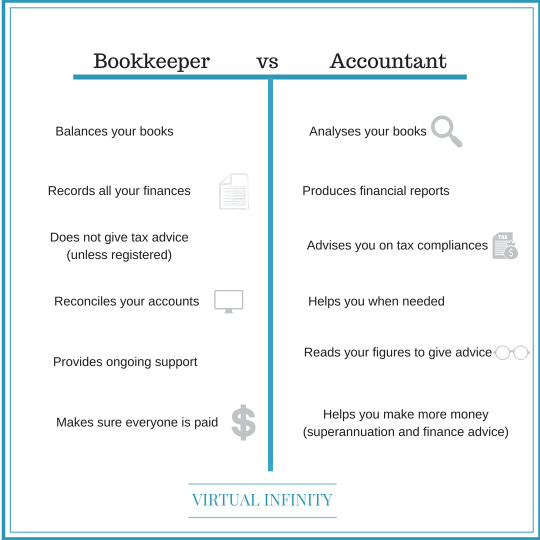

Bookkeeping Vs Accounting: What’s The Difference?

Accounting services for SaaS and accountants deal with your company’s financial records. But there are some key differences between the two.

Bookkeeping

Bookkeeping is the ongoing maintenance of your company’s accounts.

This involves implementing and advising on a wide range of processes, including:

Recording and tracking transactions

Bank account reconciliations

Payroll, invoicing and debt collection

Bill management

Remitting sales tax

Budgeting, reporting and forecasting

Bookkeeping helps you to record and understand the day-to-day state of your finances.

Accounting

Accounting looks at the bigger picture.

An accountant uses information compiled by the bookkeeper to prepare financial statements and tax returns.

They also conduct analyses and make financial projections for the company’s future.

Without efficient bookkeeping, accountants will have to spend longer tidying and organizing your records rather than helping you grow and make more money.

What Makes Ecommerce Bookkeeping Unique?

There are some key challenges when it comes to bookkeeping for ecommerce businesses specifically.

Sales tax is complicated

Sales tax has become a real challenge for ecommerce sellers. Particularly for those who sell in the United States, but also here in Canada.

Every state has its own rates, and jurisdictions within them that have varying rates too. The rates you pay depend on where you’re located compared to your buyers.

And things change year on year.

That’s before we think about overseas taxes.

Transaction volumes can be huge

As you grow, so will your transaction volumes. And they’re limited only by your available inventory (and addressable market). So you could be looking at hundreds or thousands of transactions every day.

It’s great for your revenue.

But sales channels like Amazon don’t include a breakdown of fees, taxes and other costs in their lump sum payments to you.

Deciphering the data for each transaction requires specialized accounting software.

Inventory management is key but tricky

“The challenge is in keeping track of how much product you have in production, en-route, in customs, at your storage warehouse, in a shopping cart, or in a returns pile.”

A2X.

Inventory for ecommerce is a balancing act.

You’ll need to consider things like sales channels, returns and third party fulfilment fees.

Carrying too little means you’re missing out on business and customers are left waiting.

Carrying too much can cause cash flow problems.

And it only gets more complicated as you expand your product range.

But that’s what ecommerce bookkeepers are for…

It’s not easy to juggle the complexities of ecommerce bookkeeping while maintaining your accounts.

But ecommerce bookkeepers are skilled at managing these challenges.

And this is what makes them so valuable.

They’re experts in ecommerce bookkeeping so you don’t have to be.

Benefits Of Having An Ecommerce Bookkeeper

You’re required by law to keep records of the financial activities of your business.

But having an ecommerce specialist managing your accounts has added benefits for your business. Here are some, just to name a few:

Bookkeeping protects your profits

There are numerous expenses when selling online.

Production, storage, subscriptions and shipping – not to mention fees! You need to keep on top of these to ensure that you still make a profit, and you know what your breakeven is.

Efficient bookkeeping gives you visibility.

You can monitor your expenses and returns, and maintain a profitable business.

You’ll make better business decisions

Tidy accounts give a clear view of what’s working and what’s not in your ecommerce business.

This visibility makes it easier to set a profitable course for your company’s future.

Tidy books mean lower accountant fees

The time your accountant spends fixing bad bookkeeping costs you more than hiring a bookkeeper in the first place.

Use your accountant for what they do best. Have your bookkeeper manage the rest.

You’ll likely save time, stress, and money.

Your business is more attractive to buyers

If you’re considering selling your ecommerce business one day, good bookkeeping is a must.

Those who pay the best prices don’t have time to investigate untidy books.

And accurate financial records show potential buyers that your business isn’t hiding any unwelcome surprises.

Hiring An Ecommerce Bookkeeper

Can you keep your own books? Of course!

Should you keep your own books? Maybe not…

Many new business owners are lured into do-it-yourself bookkeeping hoping they’ll save a few dollars.

But as your business grows, things can get out of hand. Bookkeeping gets more complex, and manual processes are time-consuming and error-prone.

As your bookkeeping scales up, you’ll want to hire a professional.

While at-home bookkeeping isn’t a sustainable option, AIS Solutions offers QuickBooks training and support for those still in the DIY phase.

When should I hire a bookkeeper?

The sooner the better!

Having solid bookkeeping processes from the start will prevent you from getting behind. You’ll also have a clearer picture of your finances as your business progresses.

Signs that it might be time to hire a bookkeeper:

Your business is growing, along with the difficulty of your bookkeeping.

You have financial resources, but you’re time-poor.

You’re being pinged with late fees and fines for making mistakes with your tax.

You have employees and you’re not sure about payroll tax.

Options for outsourcing your ecommerce bookkeeping

There are a few options for bringing in a professional bookkeeper.

Hire an employee

You could hire a professional bookkeeper as an employee of your business.

They’ll be available for you all day every day, and they’ll get to know your business well.

However, hiring a full-time employee can be costly, and not all bookkeepers are well-versed in the ecommerce landscape.

Bookkeeping also isn’t a regulated industry, so you’ll want to be sure that you’re hiring someone who knows their stuff.

If you decide to hire a full-time bookkeeper, AIS Solutions have created a handy tool to test their knowledge.

Work with a contractor

Hiring a contractor can be more affordable and more flexible than an employee.

But flexibility can go both ways. Juggling other clients may impact your contractors turnaround times. Plus, if they’re sick or on holiday, there’s no one to take their place.

Again, you’ll need to consider who you’re hiring and their ecommerce experience.

Team up with a specialist ecommerce firm

Specialist ecommerce firms like AIS Solutions work with online sellers all the time.

They have tried and tested solutions to the challenges of ecommerce bookkeeping.

Bookkeeping firms give you other advantages.

You’ll have access to a wider range of specialist knowledge. And, you can work more efficiently and flexibly than with a solo bookkeeper.

Take Charge of Your Ecommerce Bookkeeping With Our Free Checklist

Standardizing and recording your bookkeeping processes helps you grow your business.

That’s what our Essential Ecommerce Bookkeeping Checklist is for.

We’ve teamed up with leading ecommerce accountants AIS Solutions and Ledger Gurus to help you systematize your bookkeeping.

The checklist goes into detail about the best practice bookkeeping processes for ecommerce businesses. We show you why, how, and when to do them.

You’ll have confidence that the right processes are in place. Your bookkeeping will be consistent and error-free if you follow the steps correctly.

And handing over tasks will be easy, giving you more time to focus on your strengths.

Download the checklist here.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

0 notes

Text

0 notes

Text

How do bookkeeping services in Toronto help small businesses?

Imagine you are a local business owner in Toronto, and you have more than a thousand things to do. In place of drowning in spreadsheets and receipts, just have a remote team do your bookkeeping efficiently, as seen by a skilled team. That is what virtual bookkeeping in Toronto is all about: freeing you up to concentrate on the multiple things you are good at, but the numbers remain in the safe hands of the experts.

What makes remote bookkeeping services stand out is their flexibility, as they work without a set schedule or a given location. Whether in the busy downtown of Toronto or somewhere else in the suburbs, you are able to access your financial data anywhere at your convenience. It's like having a dedicated team of finance experts at your disposal, always ready to take care of your numbers whenever you need them.

And let's talk about cost-effectiveness. Running a business in Toronto isn't cheap, but virtual bookkeeping can help you save where it matters most. Entrusting accounting responsibilities to external professionals can help you avoid paying for high fees and office rent. The service you require is paid for at a specific time and without any additional charges. It's a wise investment that leaves money for other aspects of your business.

However, it's more than just about cost-cutting. Virtual bookkeeping brings peace of mind, knowing your finances are handled by competent professionals. They grasp local market trends and regulatory demands, ensuring your records remain precise and compliant.

By adopting remote bookkeeping, businesses can unlock efficiency, accuracy, and scalability while simultaneously reducing costs and ensuring compliance. In this digital age, leveraging the expertise and technology provided by Canadian Cypress is essential for driving sustainable growth and success within Toronto's business landscape.

0 notes

Text

What Does an Ecommerce Bookkeeper Do

What Does An Ecommerce Bookkeeper Do?

Juliet Aurora

May 13, 2022

5:12 pm

Estimated reading time: 6 minutes.

This is a guest blog written by our friends at A2X. Read on to the end to download a free 113 point ecommerce bookkeeping checklist that we helped to create!

“If you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see.”

AIS Solutions

Professional bookkeepers can save your ecommerce business time and money.

Keeping accurate and up-to-date accounts is a vital part of running a resilient business. And having an expert onside as early as possible is invaluable.

So if you’re thinking about hiring one, or interested in understanding exactly what they can do for your business, you’re in the right place.

In this guide about ecommerce bookkeepers, you’ll find:

Bookkeeping vs accounting: what’s the difference?

What makes ecommerce bookkeeping unique?

Benefits of having an ecommerce bookkeeper

When to hire an ecommerce bookkeeper

A free resource to streamline your ecommerce bookkeeping

Let’s jump in.

Bookkeeping Vs Accounting: What’s The Difference?

Both bookkeepers and accountants deal with your company’s financial records. But there are some key differences between the two.

Bookkeeping

Bookkeeping is the ongoing maintenance of your company’s accounts.

This involves implementing and advising on a wide range of processes, including:

Recording and tracking transactions

Bank account reconciliations

Payroll, invoicing and debt collection

Bill management

Remitting sales tax

Budgeting, reporting and forecasting

Bookkeeping helps you to record and understand the day-to-day state of your finances.

Accounting

Accounting looks at the bigger picture.

An accountant uses information compiled by the bookkeeper to prepare financial statements and tax returns.

They also conduct analyses and make financial projections for the company’s future.

Without efficient bookkeeping, accountants will have to spend longer tidying and organizing your records rather than helping you grow and make more money.

What Makes Ecommerce Bookkeeping Unique?

There are some key challenges when it comes to bookkeeping for ecommerce businesses specifically.

Sales tax is complicated

Sales tax has become a real challenge for ecommerce sellers. Particularly for those who sell in the United States, but also here in Canada.

Every state has its own rates, and jurisdictions within them that have varying rates too. The rates you pay depend on where you’re located compared to your buyers.

And things change year on year.

That’s before we think about overseas taxes.

Transaction volumes can be huge

As you grow, so will your transaction volumes. And they’re limited only by your available inventory (and addressable market). So you could be looking at hundreds or thousands of transactions every day.

It’s great for your revenue.

But sales channels like Amazon don’t include a breakdown of fees, taxes and other costs in their lump sum payments to you.

Deciphering the data for each transaction requires specialized accounting software.

Inventory management is key but tricky

“The challenge is in keeping track of how much product you have in production, en-route, in customs, at your storage warehouse, in a shopping cart, or in a returns pile.”

A2X.

Inventory for ecommerce is a balancing act.

You’ll need to consider things like sales channels, returns and third party fulfilment fees.

Carrying too little means you’re missing out on business and customers are left waiting.

Carrying too much can cause cash flow problems.

And it only gets more complicated as you expand your product range.

But that’s what ecommerce bookkeepers are for…

It’s not easy to juggle the complexities of ecommerce bookkeeping while maintaining your accounts.

But ecommerce bookkeepers are skilled at managing these challenges.

And this is what makes them so valuable.

They’re experts in ecommerce bookkeeping so you don’t have to be.

Benefits Of Having An Ecommerce Bookkeeper

You’re required by law to keep records of the financial activities of your business.

But having an ecommerce specialist managing your accounts has added benefits for your business. Here are some, just to name a few:

Bookkeeping protects your profits

There are numerous expenses when selling online.

Production, storage, subscriptions and shipping – not to mention fees! You need to keep on top of these to ensure that you still make a profit, and you know what your breakeven is.

Efficient bookkeeping gives you visibility.

You can monitor your expenses and returns, and maintain a profitable business.

You’ll make better business decisions

Tidy accounts give a clear view of what’s working and what’s not in your ecommerce business.

This visibility makes it easier to set a profitable course for your company’s future.

Tidy books mean lower accountant fees

The time your accountant spends fixing bad bookkeeping costs you more than hiring a bookkeeper in the first place.

Use your accountant for what they do best. Have your bookkeeper manage the rest.

You’ll likely save time, stress, and money.

Your business is more attractive to buyers

If you’re considering selling your ecommerce business one day, good bookkeeping is a must.

Those who pay the best prices don’t have time to investigate untidy books.

And accurate financial records show potential buyers that your business isn’t hiding any unwelcome surprises.

Hiring An Ecommerce Bookkeeper

Can you keep your own books? Of course!

Should you keep your own books? Maybe not…

Many new business owners are lured into do-it-yourself bookkeeping hoping they’ll save a few dollars.

But as your business grows, things can get out of hand. Bookkeeping gets more complex, and manual processes are time-consuming and error-prone.

As your bookkeeping scales up, you’ll want to hire a professional.

While at-home bookkeeping isn’t a sustainable option, AIS Solutions offers QuickBooks training and support for those still in the DIY phase.

When should I hire a bookkeeper?

The sooner the better!

Having solid bookkeeping processes from the start will prevent you from getting behind. You’ll also have a clearer picture of your finances as your business progresses.

Signs that it might be time to hire a bookkeeper:

Your business is growing, along with the difficulty of your bookkeeping.

You have financial resources, but you’re time-poor.

You’re being pinged with late fees and fines for making mistakes with your tax.

You have employees and you’re not sure about payroll tax.

Options for outsourcing your ecommerce bookkeeping

There are a few options for bringing in a professional bookkeeper.

Hire an employee

You could hire a professional bookkeeper as an employee of your business.

Bookkeeping services for SaaS ’ll be available for you all day every day, and they’ll get to know your business well.

However, hiring a full-time employee can be costly, and not all bookkeepers are well-versed in the ecommerce landscape.

Bookkeeping also isn’t a regulated industry, so you’ll want to be sure that you’re hiring someone who knows their stuff.

If you decide to hire a full-time bookkeeper, AIS Solutions have created a handy tool to test their knowledge.

Work with a contractor

Hiring a contractor can be more affordable and more flexible than an employee.

But flexibility can go both ways. Juggling other clients may impact your contractors turnaround times. Plus, if they’re sick or on holiday, there’s no one to take their place.

Again, you’ll need to consider who you’re hiring and their ecommerce experience.

Team up with a specialist ecommerce firm

Specialist ecommerce firms like AIS Solutions work with online sellers all the time.

They have tried and tested solutions to the challenges of ecommerce bookkeeping.

Bookkeeping firms give you other advantages.

You’ll have access to a wider range of specialist knowledge. And, you can work more efficiently and flexibly than with a solo bookkeeper.

Take Charge of Your Ecommerce Bookkeeping With Our Free Checklist

Standardizing and recording your bookkeeping processes helps you grow your business.

That’s what our Essential Ecommerce Bookkeeping Checklist is for.

We’ve teamed up with leading ecommerce accountants AIS Solutions and Ledger Gurus to help you systematize your bookkeeping.

The checklist goes into detail about the best practice bookkeeping processes for ecommerce businesses. We show you why, how, and when to do them.

You’ll have confidence that the right processes are in place. Your bookkeeping will be consistent and error-free if you follow the steps correctly.

And handing over tasks will be easy, giving you more time to focus on your strengths.

Download the checklist here.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

Ecommerce Sales Tax Rules Canada

How Does Selling Bookkeeping services for SaaS and Sales Tax Work?

Canadian eCommerce Sales Tax Rules

The rules outlined by CRA provide that all Canadian retailers making sales in Canada, either through a physical “bricks and mortar” location or online, are required to be registered for GST/HST unless they are considered a small retailer (which is a business with sales of less than $30,000 annually).

In addition, a retailer (that is not a small retailer) with only one physical location in Canada that sells across Canada through their on-line store would be required to charge and collect GST/HST at the rate that applies to the province in which the taxable goods are delivered to. For example, a retailer with a physical location in Alberta that sells and delivers goods to an Ontario customer would be required to charge and collect GST/HST at the current rate in Ontario, not Alberta.

Sales Tax Nexus by State

A Canadian resident on-line retailer with no physical “bricks and mortar” location would also be required to charge GST/HST at the rate that applies to the province in which the taxable goods are delivered to. For example, let’s say a company incorporated in Ontario that does not have any physical stores, sells taxable sporting goods online via ecommerce. If the company arranges for the delivery of its product to a consumer in British Columbia, it is required to charge and collect GST/HST at the rate in British Columbia from the customer, even though the company was established in Ontario.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note