#virtual bookkeeping

Text

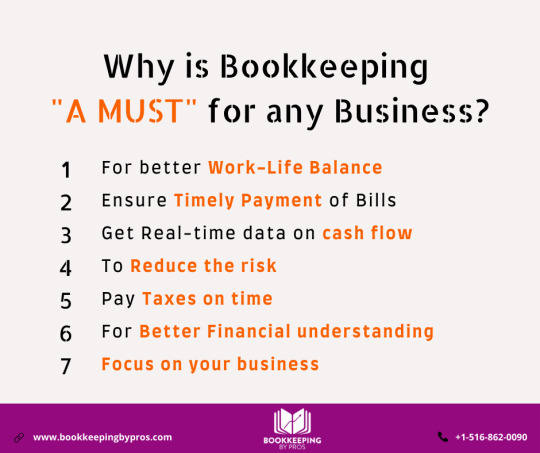

Why Bookkeeping is "A MUST" for any Business?

What are the benefits of hiring bookkeeping services? Outsourcing Professional Bookkeeping services can help you maintain the cash flow, manage assets, handle taxes, manage payroll, and many more so you run your business smoothly. Are you a business owner & looking for expert bookkeeping assistance for your business? If yes, contact us at (516) 858-1234 or visit www.bookkeepingbypros.com now to know more about our services!

2 notes

·

View notes

Text

Looking for Outsourced Bookkeeping Services in Birmingham, AL? Save Money & Hire Bookkeeper Virtual Assistant in Birmingham from $6.25/Hour.

Hire Now: https://codigsys.com/hire-virtual-assistant-bookkeeping-birmingham-al-us/

0 notes

Text

What Does an Ecommerce Bookkeeper Do

What Does An Ecommerce Bookkeeper Do?

Juliet Aurora

May 13, 2022

5:12 pm

Estimated reading time: 6 minutes.

This is a guest blog written by our friends at A2X. Read on to the end to download a free 113 point ecommerce bookkeeping checklist that we helped to create!

“If you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see.”

AIS Solutions

Professional bookkeepers can save your ecommerce business time and money.

Keeping accurate and up-to-date accounts is a vital part of running a resilient business. And having an expert onside as early as possible is invaluable.

So if you’re thinking about hiring one, or interested in understanding exactly what they can do for your business, you’re in the right place.

In this guide about ecommerce bookkeepers, you’ll find:

Bookkeeping vs accounting: what’s the difference?

What makes ecommerce bookkeeping unique?

Benefits of having an ecommerce bookkeeper

When to hire an ecommerce bookkeeper

A free resource to streamline your ecommerce bookkeeping

Let’s jump in.

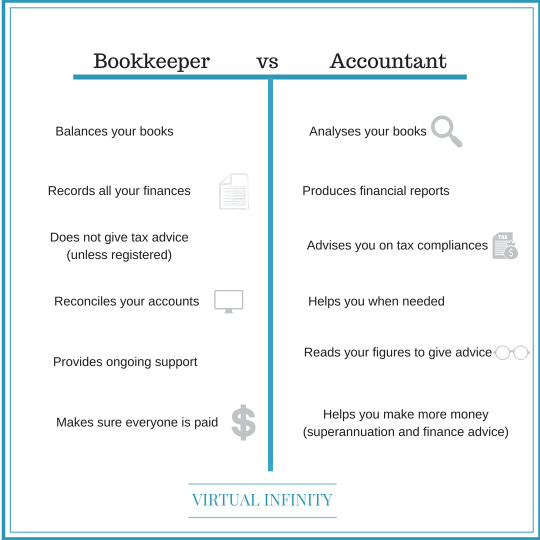

Bookkeeping Vs Accounting: What’s The Difference?

Accounting services for SaaS and accountants deal with your company’s financial records. But there are some key differences between the two.

Bookkeeping

Bookkeeping is the ongoing maintenance of your company’s accounts.

This involves implementing and advising on a wide range of processes, including:

Recording and tracking transactions

Bank account reconciliations

Payroll, invoicing and debt collection

Bill management

Remitting sales tax

Budgeting, reporting and forecasting

Bookkeeping helps you to record and understand the day-to-day state of your finances.

Accounting

Accounting looks at the bigger picture.

An accountant uses information compiled by the bookkeeper to prepare financial statements and tax returns.

They also conduct analyses and make financial projections for the company’s future.

Without efficient bookkeeping, accountants will have to spend longer tidying and organizing your records rather than helping you grow and make more money.

What Makes Ecommerce Bookkeeping Unique?

There are some key challenges when it comes to bookkeeping for ecommerce businesses specifically.

Sales tax is complicated

Sales tax has become a real challenge for ecommerce sellers. Particularly for those who sell in the United States, but also here in Canada.

Every state has its own rates, and jurisdictions within them that have varying rates too. The rates you pay depend on where you’re located compared to your buyers.

And things change year on year.

That’s before we think about overseas taxes.

Transaction volumes can be huge

As you grow, so will your transaction volumes. And they’re limited only by your available inventory (and addressable market). So you could be looking at hundreds or thousands of transactions every day.

It’s great for your revenue.

But sales channels like Amazon don’t include a breakdown of fees, taxes and other costs in their lump sum payments to you.

Deciphering the data for each transaction requires specialized accounting software.

Inventory management is key but tricky

“The challenge is in keeping track of how much product you have in production, en-route, in customs, at your storage warehouse, in a shopping cart, or in a returns pile.”

A2X.

Inventory for ecommerce is a balancing act.

You’ll need to consider things like sales channels, returns and third party fulfilment fees.

Carrying too little means you’re missing out on business and customers are left waiting.

Carrying too much can cause cash flow problems.

And it only gets more complicated as you expand your product range.

But that’s what ecommerce bookkeepers are for…

It’s not easy to juggle the complexities of ecommerce bookkeeping while maintaining your accounts.

But ecommerce bookkeepers are skilled at managing these challenges.

And this is what makes them so valuable.

They’re experts in ecommerce bookkeeping so you don’t have to be.

Benefits Of Having An Ecommerce Bookkeeper

You’re required by law to keep records of the financial activities of your business.

But having an ecommerce specialist managing your accounts has added benefits for your business. Here are some, just to name a few:

Bookkeeping protects your profits

There are numerous expenses when selling online.

Production, storage, subscriptions and shipping – not to mention fees! You need to keep on top of these to ensure that you still make a profit, and you know what your breakeven is.

Efficient bookkeeping gives you visibility.

You can monitor your expenses and returns, and maintain a profitable business.

You’ll make better business decisions

Tidy accounts give a clear view of what’s working and what’s not in your ecommerce business.

This visibility makes it easier to set a profitable course for your company’s future.

Tidy books mean lower accountant fees

The time your accountant spends fixing bad bookkeeping costs you more than hiring a bookkeeper in the first place.

Use your accountant for what they do best. Have your bookkeeper manage the rest.

You’ll likely save time, stress, and money.

Your business is more attractive to buyers

If you’re considering selling your ecommerce business one day, good bookkeeping is a must.

Those who pay the best prices don’t have time to investigate untidy books.

And accurate financial records show potential buyers that your business isn’t hiding any unwelcome surprises.

Hiring An Ecommerce Bookkeeper

Can you keep your own books? Of course!

Should you keep your own books? Maybe not…

Many new business owners are lured into do-it-yourself bookkeeping hoping they’ll save a few dollars.

But as your business grows, things can get out of hand. Bookkeeping gets more complex, and manual processes are time-consuming and error-prone.

As your bookkeeping scales up, you’ll want to hire a professional.

While at-home bookkeeping isn’t a sustainable option, AIS Solutions offers QuickBooks training and support for those still in the DIY phase.

When should I hire a bookkeeper?

The sooner the better!

Having solid bookkeeping processes from the start will prevent you from getting behind. You’ll also have a clearer picture of your finances as your business progresses.

Signs that it might be time to hire a bookkeeper:

Your business is growing, along with the difficulty of your bookkeeping.

You have financial resources, but you’re time-poor.

You’re being pinged with late fees and fines for making mistakes with your tax.

You have employees and you’re not sure about payroll tax.

Options for outsourcing your ecommerce bookkeeping

There are a few options for bringing in a professional bookkeeper.

Hire an employee

You could hire a professional bookkeeper as an employee of your business.

They’ll be available for you all day every day, and they’ll get to know your business well.

However, hiring a full-time employee can be costly, and not all bookkeepers are well-versed in the ecommerce landscape.

Bookkeeping also isn’t a regulated industry, so you’ll want to be sure that you’re hiring someone who knows their stuff.

If you decide to hire a full-time bookkeeper, AIS Solutions have created a handy tool to test their knowledge.

Work with a contractor

Hiring a contractor can be more affordable and more flexible than an employee.

But flexibility can go both ways. Juggling other clients may impact your contractors turnaround times. Plus, if they’re sick or on holiday, there’s no one to take their place.

Again, you’ll need to consider who you’re hiring and their ecommerce experience.

Team up with a specialist ecommerce firm

Specialist ecommerce firms like AIS Solutions work with online sellers all the time.

They have tried and tested solutions to the challenges of ecommerce bookkeeping.

Bookkeeping firms give you other advantages.

You’ll have access to a wider range of specialist knowledge. And, you can work more efficiently and flexibly than with a solo bookkeeper.

Take Charge of Your Ecommerce Bookkeeping With Our Free Checklist

Standardizing and recording your bookkeeping processes helps you grow your business.

That’s what our Essential Ecommerce Bookkeeping Checklist is for.

We’ve teamed up with leading ecommerce accountants AIS Solutions and Ledger Gurus to help you systematize your bookkeeping.

The checklist goes into detail about the best practice bookkeeping processes for ecommerce businesses. We show you why, how, and when to do them.

You’ll have confidence that the right processes are in place. Your bookkeeping will be consistent and error-free if you follow the steps correctly.

And handing over tasks will be easy, giving you more time to focus on your strengths.

Download the checklist here.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

0 notes

Text

AIS Virtual Accounting Solutions Canada

accounting services for ecommerce in Canada

First things first – What are virtual accounting solutions?

Simply put, virtual bookkeeping is a form of bookkeeping that is carried out over the internet. It allows a bookkeeper to telecommute instead of carrying out the work in a physical setting.

Instead of entering receipts and expenses manually, the accountant uses accounting software to carry out the necessary work. This facilitates the collaborative process and grants the business executives easy access to vital information.

Due to the fast-paced evolution of cloud computing over the past few years, virtual accounting solutions, or cloud accounting as it is also known, are quickly gaining widespread popularity. This is mainly due to the high degree of comfort and accessibility this type of accounting solution provides. We’ll dive deeper into the benefits of virtual bookkeeping below on this page.

virtual bookkeeping services in Canada

a close up of a metal object with numbers on it

How do virtual bookkeepers operate?

Virtual accounting companies usually employ the latest cloud-based bookkeeping software to carry out their work. When setting up a collaboration with a virtual bookkeeping firm, the service offer is designed around the specific needs of each company. Modern accounting software allows bookkeepers to easily manage the complexities of taxes, payroll, budgeting, expenditures or billing.

One of the biggest advantages of virtual accounting solutions is the ability to scale with a business. If your company grows rapidly or finds itself in need of short-term additional help, it can be quite difficult to find that transition. Nowadays companies no longer have to put in the effort to find and install a new in-person accounting team. Instead, they can simply scale up their current contractual terms of service to fit their business needs.

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

1 note

·

View note

Text

What Does an Ecommerce Bookkeeper Do

What Does An Ecommerce Bookkeeper Do?

Juliet Aurora

May 13, 2022

5:12 pm

Estimated reading time: 6 minutes.

This is a guest blog written by our friends at A2X. Read on to the end to download a free 113 point ecommerce bookkeeping checklist that we helped to create!

“If you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see.”

AIS Solutions

Professional bookkeepers can save your ecommerce business time and money.

Keeping accurate and up-to-date accounts is a vital part of running a resilient business. And having an expert onside as early as possible is invaluable.

So if you’re thinking about hiring one, or interested in understanding exactly what they can do for your business, you’re in the right place.

In this guide about ecommerce bookkeepers, you’ll find:

Bookkeeping vs accounting: what’s the difference?

What makes ecommerce bookkeeping unique?

Benefits of having an ecommerce bookkeeper

When to hire an ecommerce bookkeeper

A free resource to streamline your ecommerce bookkeeping

Let’s jump in.

Bookkeeping Vs Accounting: What’s The Difference?

Both bookkeepers and accountants deal with your company’s financial records. But there are some key differences between the two.

Bookkeeping

Bookkeeping is the ongoing maintenance of your company’s accounts.

This involves implementing and advising on a wide range of processes, including:

Recording and tracking transactions

Bank account reconciliations

Payroll, invoicing and debt collection

Bill management

Remitting sales tax

Budgeting, reporting and forecasting

Bookkeeping helps you to record and understand the day-to-day state of your finances.

Accounting

Accounting looks at the bigger picture.

An accountant uses information compiled by the bookkeeper to prepare financial statements and tax returns.

They also conduct analyses and make financial projections for the company’s future.

Without efficient bookkeeping, accountants will have to spend longer tidying and organizing your records rather than helping you grow and make more money.

What Makes Ecommerce Bookkeeping Unique?

There are some key challenges when it comes to bookkeeping for ecommerce businesses specifically.

Sales tax is complicated

Sales tax has become a real challenge for ecommerce sellers. Particularly for those who sell in the United States, but also here in Canada.

Every state has its own rates, and jurisdictions within them that have varying rates too. The rates you pay depend on where you’re located compared to your buyers.

And things change year on year.

That’s before we think about overseas taxes.

Transaction volumes can be huge

As you grow, so will your transaction volumes. And they’re limited only by your available inventory (and addressable market). So you could be looking at hundreds or thousands of transactions every day.

It’s great for your revenue.

But sales channels like Amazon don’t include a breakdown of fees, taxes and other costs in their lump sum payments to you.

Deciphering the data for each transaction requires specialized accounting software.

Inventory management is key but tricky

“The challenge is in keeping track of how much product you have in production, en-route, in customs, at your storage warehouse, in a shopping cart, or in a returns pile.”

A2X.

Inventory for ecommerce is a balancing act.

You’ll need to consider things like sales channels, returns and third party fulfilment fees.

Carrying too little means you’re missing out on business and customers are left waiting.

Carrying too much can cause cash flow problems.

And it only gets more complicated as you expand your product range.

But that’s what ecommerce bookkeepers are for…

It’s not easy to juggle the complexities of ecommerce bookkeeping while maintaining your accounts.

But ecommerce bookkeepers are skilled at managing these challenges.

And this is what makes them so valuable.

They’re experts in ecommerce bookkeeping so you don’t have to be.

Benefits Of Having An Ecommerce Bookkeeper

You’re required by law to keep records of the financial activities of your business.

But having an ecommerce specialist managing your accounts has added benefits for your business. Here are some, just to name a few:

Bookkeeping protects your profits

There are numerous expenses when selling online.

Production, storage, subscriptions and shipping – not to mention fees! You need to keep on top of these to ensure that you still make a profit, and you know what your breakeven is.

Efficient bookkeeping gives you visibility.

You can monitor your expenses and returns, and maintain a profitable business.

You’ll make better business decisions

Tidy accounts give a clear view of what’s working and what’s not in your ecommerce business.

This visibility makes it easier to set a profitable course for your company’s future.

Tidy books mean lower accountant fees

The time your accountant spends fixing bad bookkeeping costs you more than hiring a bookkeeper in the first place.

Use your accountant for what they do best. Have your bookkeeper manage the rest.

You’ll likely save time, stress, and money.

Your business is more attractive to buyers

If you’re considering selling your ecommerce business one day, good bookkeeping is a must.

Those who pay the best prices don’t have time to investigate untidy books.

And accurate financial records show potential buyers that your business isn’t hiding any unwelcome surprises.

Hiring An Ecommerce Bookkeeper

Can you keep your own books? Of course!

Should you keep your own books? Maybe not…

Many new business owners are lured into do-it-yourself bookkeeping hoping they’ll save a few dollars.

But as your business grows, things can get out of hand. Bookkeeping gets more complex, and manual processes are time-consuming and error-prone.

As your bookkeeping scales up, you’ll want to hire a professional.

While at-home bookkeeping isn’t a sustainable option, AIS Solutions offers QuickBooks training and support for those still in the DIY phase.

When should I hire a bookkeeper?

The sooner the better!

Having solid bookkeeping processes from the start will prevent you from getting behind. You’ll also have a clearer picture of your finances as your business progresses.

Signs that it might be time to hire a bookkeeper:

Your business is growing, along with the difficulty of your bookkeeping.

You have financial resources, but you’re time-poor.

You’re being pinged with late fees and fines for making mistakes with your tax.

You have employees and you’re not sure about payroll tax.

Options for outsourcing your ecommerce bookkeeping

There are a few options for bringing in a professional bookkeeper.

Hire an employee

You could hire a professional bookkeeper as an employee of your business.

Bookkeeping services for SaaS ’ll be available for you all day every day, and they’ll get to know your business well.

However, hiring a full-time employee can be costly, and not all bookkeepers are well-versed in the ecommerce landscape.

Bookkeeping also isn’t a regulated industry, so you’ll want to be sure that you’re hiring someone who knows their stuff.

If you decide to hire a full-time bookkeeper, AIS Solutions have created a handy tool to test their knowledge.

Work with a contractor

Hiring a contractor can be more affordable and more flexible than an employee.

But flexibility can go both ways. Juggling other clients may impact your contractors turnaround times. Plus, if they’re sick or on holiday, there’s no one to take their place.

Again, you’ll need to consider who you’re hiring and their ecommerce experience.

Team up with a specialist ecommerce firm

Specialist ecommerce firms like AIS Solutions work with online sellers all the time.

They have tried and tested solutions to the challenges of ecommerce bookkeeping.

Bookkeeping firms give you other advantages.

You’ll have access to a wider range of specialist knowledge. And, you can work more efficiently and flexibly than with a solo bookkeeper.

Take Charge of Your Ecommerce Bookkeeping With Our Free Checklist

Standardizing and recording your bookkeeping processes helps you grow your business.

That’s what our Essential Ecommerce Bookkeeping Checklist is for.

We’ve teamed up with leading ecommerce accountants AIS Solutions and Ledger Gurus to help you systematize your bookkeeping.

The checklist goes into detail about the best practice bookkeeping processes for ecommerce businesses. We show you why, how, and when to do them.

You’ll have confidence that the right processes are in place. Your bookkeeping will be consistent and error-free if you follow the steps correctly.

And handing over tasks will be easy, giving you more time to focus on your strengths.

Download the checklist here.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

Ecommerce Sales Tax Rules Canada

How Does Selling Bookkeeping services for SaaS and Sales Tax Work?

Canadian eCommerce Sales Tax Rules

The rules outlined by CRA provide that all Canadian retailers making sales in Canada, either through a physical “bricks and mortar” location or online, are required to be registered for GST/HST unless they are considered a small retailer (which is a business with sales of less than $30,000 annually).

In addition, a retailer (that is not a small retailer) with only one physical location in Canada that sells across Canada through their on-line store would be required to charge and collect GST/HST at the rate that applies to the province in which the taxable goods are delivered to. For example, a retailer with a physical location in Alberta that sells and delivers goods to an Ontario customer would be required to charge and collect GST/HST at the current rate in Ontario, not Alberta.

Sales Tax Nexus by State

A Canadian resident on-line retailer with no physical “bricks and mortar” location would also be required to charge GST/HST at the rate that applies to the province in which the taxable goods are delivered to. For example, let’s say a company incorporated in Ontario that does not have any physical stores, sells taxable sporting goods online via ecommerce. If the company arranges for the delivery of its product to a consumer in British Columbia, it is required to charge and collect GST/HST at the rate in British Columbia from the customer, even though the company was established in Ontario.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

Our Purpose at AIS Solutions

Our Purpose

It’s not just about what we do here at AIS, it’s also about WHY we do it.

We’re more than just a business. We care about our team members, our clients, and the world around us. We believe that if we’re going to be a part of a community, it’s our responsibility to do everything we can to give back to that community.

So, that’s what we do!

Yes, we know, everyone says that. But we also believe that actions speak louder than words.

AIS Solutions logo

Juliet Aurora

Our Mission

It’s our mission to combine cutting-edge bookkeeping and financial services with philanthropy. Each element is important on its own – so why not do both?

Bookkeeping services for SaaS leverage the latest technology to empower entrepreneurs in Canada using real-time financial insights. And we love doing it! We also really, really love making tangible differences for good causes that help people.

That’s why we’re on a mission to end the cycle of violence against women and empower those who have had their power taken away, starting with the Kninja Foundation and the Knina House project (more on that below).

Our Vision

Our vision is simple: to reshape the bookkeeping industry for entrepreneurs, to foster innovation, and to leave this world a better place than we found it.

We do more than just talk the talk – we walk the walk. We believe that providing the best services for our small business and entrepreneurial clients, spearheading industry innovation, and improving the world around us all comes down to the small decisions we make on a daily basis.

We make our decisions in accordance with our core values so that slowly but surely, we’re on track to turning those visions into reality.

Steve Loates

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

Bookkeeping for SaaS

Accounting and Bookkeeping Services for SaaS Businesses

Accounting and Bookkeeping Solutions Designed Exclusively for SaaS

As a SaaS business, you’re not like the others. You’re navigating an exploding industry, managing unique pricing models, and likely scaling your business at an impressive rate as you provide innovative and evolving solutions to your customers. We get it, because we’ve been there ourselves. As a fully virtual accounting and bookkeeping firm we understand the cloud because we live in the cloud (and we were living there long before virtual workforces were a thing).

You know what it means to forge your own path and make choices that make sense, even if they defy tradition. So do we (in fact, that’s AIS Solutions in a nutshell).

Your business is nothing like the brick-and-mortar shops of the past, so why use an accounting or bookkeeping firm entrenched in outdated solutions? At AIS Solutions, we’re proud to provide professional accounting and bookkeeping services designed specifically for software as a service businesses like yours. With our virtual expertise and niched knowledge you can confidently leave your books in our hands so you can focus on growing and enhancing the solutions your customers rely on.

What’s So Special About Bookkeeping for SaaS Businesses?

Reliable bookkeeping is a must for any business, SaaS included. When it comes to SaaS businesses, however, the unique business model calls for some special attention.

Here’s what you can expect from SaaS-specific accounting and bookkeeping services:

Reliable Revenue Tracking

With tiered subscription fees, pay-as-you-go, add-on services, and upgrades/downgrades to manage, SaaS revenue tracking requires a special touch. Benefit from revenue tracking you can count on from an accounting firm who gets it.

Seamless Software Integration

Whether it’s subscription management software or recurring billing platforms, you need accountants and bookkeepers with the tools to incorporate your software solutions and apply SaaS industry best practices.

Conquer Cash Flow

Never lose sight of your cash flow again with specialized accounting services to handle your complex SaaS pricing models. Keep your finger on the cash flow pulse to make savvy business decisions when opportunities arise.

Services That Scale with You

SaaS businesses can scale like no other. Don’t let lagging accounting or out of date books drag you down, and instead choose an accounting solution that can scale alongside you and complement your growth.

Connect on the Cloud

Your business operates online. Bookkeeping services for SaaS should too! Benefit from 100% virtual accounting done safely and securely through the Cloud, working with a cloud-based firm who operates virtually, just like you do.

Statements to Help You Soar

Receive monthly financial statements that provide snapshots of all the pertinent information you need to make informed decisions and keep doing what you do best.

I Want to Know More!

LET'S GET STARTED!

The virtual accounting and bookkeeping services AIS offered are based on years of experience operating online ourselves and designed specifically for SaaS business models. Our expertise and seamless, online operations are just what you need to streamline your processes, facilitate your rapid growth, and rest assured that your books are in the best hands. Running a SaaS business is no easy feat, and you need all hands on deck – so let us take the financials off your plate!

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

AIS Virtual Accounting Solutions Canada

AIS Solutions – Virtual bookkeeping services in Canada

First things first – What are virtual accounting solutions?

Simply put, virtual bookkeeping is a form of bookkeeping that is carried out over the internet. It allows a bookkeeper to telecommute instead of carrying out the work in a physical setting.

Instead of entering receipts and expenses manually, the accountant uses accounting software to carry out the necessary work. This facilitates the collaborative process and grants the business executives easy access to vital information.

Due to the fast-paced evolution of cloud computing over the past few years, virtual accounting solutions, or cloud accounting as it is also known, are quickly gaining widespread popularity. This is mainly due to the high degree of comfort and accessibility this type of accounting solution provides. We’ll dive deeper into the benefits of virtual bookkeeping below on this page.

virtual bookkeeping services in Canada

a close up of a metal object with numbers on it

How do virtual bookkeepers operate?

Virtual accounting companies usually employ the latest cloud-based bookkeeping software to carry out their work. When setting up a collaboration with a virtual bookkeeping firm, the service offer is designed around the specific needs of each company. Modern accounting software allows bookkeepers to easily manage the complexities of taxes, payroll, budgeting, expenditures or billing.

accountant for ecommerce business of the biggest advantages of virtual accounting solutions is the ability to scale with a business. If your company grows rapidly or finds itself in need of short-term additional help, it can be quite difficult to find that transition. Nowadays companies no longer have to put in the effort to find and install a new in-person accounting team. Instead, they can simply scale up their current contractual terms of service to fit their business needs.

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

1 note

·

View note

Text

AIS Solutions Home

Cloud Bookkeeping and Accounting Services for Amazon Sellers and Shopify Online Stores

AIS Solutions specializes in Bookkeeping for eCommerce for Canadian based eCommerce firms.

We understand the hectic world of eCommerce and the importance of accurate numbers to grow your business. We will record all sales, expenses, reconcile your bank and credit cards, process your payroll, file your sales tax returns and create and maintain a bookkeeping process to meet all of your company’s needs.

We believe if you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see. Having good records for taxes is for sure important but leveraging those numbers to make better business decisions is the only way to drive your business toward a better future.

https://aissolutions.ca/bookkeeping-services-overview/bookkeeping-for-ecommerce/ accounting technology work better for you

We are recognized thought leaders in the accounting technology world, and we work really hard to make accounting and eCommerce technology better for everyone, starting with our clients. We are constantly testing new products, providing feedback to dozens of vendors, and making introductions between vendors to help them create ecosystems that make e-commerce accounting simpler, easier, and better for all small businesses.

A2X is the gold standard for accurate ecommerce accounting for Shopify, Amazon, Walmart, eBay and Etsy businesses. Learn about the benefits of A2X here.

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

1 note

·

View note

Text

Our Purpose at AIS Solutions

Our Purpose

It’s not just about what we do here at AIS, it’s also about WHY we do it.

We’re more than just a business. We care about our team members, our clients, and the world around us. We believe that if we’re going to be a part of a community, it’s our responsibility to do everything we can to give back to that community.

So, that’s what we do!

Yes, we know, everyone says that. But we also believe that actions speak louder than words.

AIS Solutions logo

Juliet Aurora

Our Mission

It’s our mission to combine cutting-edge bookkeeping and financial services with philanthropy. Each element is important on its own – so why not do both?

We leverage the latest technology to empower entrepreneurs in Canada using real-time financial insights. And we love doing it! We also really, really love making tangible differences for good causes that help people.

That’s why we’re on a mission to end the cycle of violence against women and empower those who have had their power taken away, starting with the Kninja Foundation and the Knina House project (more on that below).

Our Vision

Our vision is simple: to reshape the bookkeeping industry for entrepreneurs, to foster innovation, and to leave this world a better place than we found it.

We do more than just talk the talk – we walk the walk. accountant for ecommerce business believe that providing the best services for our small business and entrepreneurial clients, spearheading industry innovation, and improving the world around us all comes down to the small decisions we make on a daily basis.

We make our decisions in accordance with our core values so that slowly but surely, we’re on track to turning those visions into reality.

Steve Loates

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

0 notes

Text

AIS Solutions Home

Cloud Bookkeeping and Accounting Services for Amazon Sellers and Shopify Online Stores

AIS Solutions specializes in Bookkeeping for eCommerce for Canadian based eCommerce firms.

We understand the hectic world of eCommerce and the importance of accurate numbers to grow your business. We will record all sales, expenses, reconcile your bank and credit cards, process your payroll, file your sales tax returns and create and maintain a bookkeeping process to meet all of your company’s needs.

We believe if you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see. Having good records for taxes is for sure important but leveraging those numbers to make better business decisions is the only way to drive your business toward a better future.

accountant for ecommerce business accounting technology work better for you

We are recognized thought leaders in the accounting technology world, and we work really hard to make accounting and eCommerce technology better for everyone, starting with our clients. We are constantly testing new products, providing feedback to dozens of vendors, and making introductions between vendors to help them create ecosystems that make e-commerce accounting simpler, easier, and better for all small businesses.

A2X is the gold standard for accurate ecommerce accounting for Shopify, Amazon, Walmart, eBay and Etsy businesses. Learn about the benefits of A2X here.

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

1 note

·

View note

Text

AIS Solutions Home

Cloud Bookkeeping and Accounting Services for Amazon Sellers and Shopify Online Stores

AIS Solutions specializes in Bookkeeping for eCommerce for Canadian based eCommerce firms.

We understand the hectic world of eCommerce and the importance of accurate numbers to grow your business. We will record all sales, expenses, reconcile your bank and credit cards, process your payroll, file your sales tax returns and create and maintain a bookkeeping process to meet all of your company’s needs.

We believe if you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see. Having good records for taxes is for sure important but leveraging those numbers to make better business decisions is the only way to drive your business toward a better future.

Making accounting technology work better for you

We are recognized thought leaders in the accounting technology world, and we work really hard to make accounting and eCommerce technology better for everyone, starting with our clients. https://aissolutions.ca/bookkeeping-services-overview/bookkeeping-for-ecommerce/ are constantly testing new products, providing feedback to dozens of vendors, and making introductions between vendors to help them create ecosystems that make e-commerce accounting simpler, easier, and better for all small businesses.

A2X is the gold standard for accurate ecommerce accounting for Shopify, Amazon, Walmart, eBay and Etsy businesses. Learn about the benefits of A2X here.

#ecommerce bookkeeper#bookkeeping for ecommerce business#virtual bookkeeping#cloud bookkeeping#tax law

1 note

·

View note

Text

What Does an Ecommerce Bookkeeper Do

What Does An Ecommerce Bookkeeper Do?

Juliet Aurora

May 13, 2022

5:12 pm

Estimated reading time: 6 minutes.

This is a guest blog written by our friends at A2X. Read on to the end to download a free 113 point ecommerce bookkeeping checklist that we helped to create!

“If you only keep your books for the purposes of filing taxes then you are missing the most important reason to have clean, clear financials. You can’t proactively manage what you can’t see.”

AIS Solutions

Professional bookkeepers can save your ecommerce business time and money.

Keeping accurate and up-to-date accounts is a vital part of running a resilient business. And having an expert onside as early as possible is invaluable.

So if you’re thinking about hiring one, or interested in understanding exactly what they can do for your business, you’re in the right place.

In this guide about ecommerce bookkeepers, you’ll find:

Bookkeeping vs accounting: what’s the difference?

What makes ecommerce bookkeeping unique?

Benefits of having an ecommerce bookkeeper

When to hire an ecommerce bookkeeper

A free resource to streamline your ecommerce bookkeeping

Let’s jump in.

Bookkeeping Vs Accounting: What’s The Difference?

Accounting services for SaaS and accountants deal with your company’s financial records. But there are some key differences between the two.

Bookkeeping

Bookkeeping is the ongoing maintenance of your company’s accounts.

This involves implementing and advising on a wide range of processes, including:

Recording and tracking transactions

Bank account reconciliations

Payroll, invoicing and debt collection

Bill management

Remitting sales tax

Budgeting, reporting and forecasting

Bookkeeping helps you to record and understand the day-to-day state of your finances.

Accounting

Accounting looks at the bigger picture.

An accountant uses information compiled by the bookkeeper to prepare financial statements and tax returns.

They also conduct analyses and make financial projections for the company’s future.

Without efficient bookkeeping, accountants will have to spend longer tidying and organizing your records rather than helping you grow and make more money.

What Makes Ecommerce Bookkeeping Unique?

There are some key challenges when it comes to bookkeeping for ecommerce businesses specifically.

Sales tax is complicated

Sales tax has become a real challenge for ecommerce sellers. Particularly for those who sell in the United States, but also here in Canada.

Every state has its own rates, and jurisdictions within them that have varying rates too. The rates you pay depend on where you’re located compared to your buyers.

And things change year on year.

That’s before we think about overseas taxes.

Transaction volumes can be huge

As you grow, so will your transaction volumes. And they’re limited only by your available inventory (and addressable market). So you could be looking at hundreds or thousands of transactions every day.

It’s great for your revenue.

But sales channels like Amazon don’t include a breakdown of fees, taxes and other costs in their lump sum payments to you.

Deciphering the data for each transaction requires specialized accounting software.

Inventory management is key but tricky

“The challenge is in keeping track of how much product you have in production, en-route, in customs, at your storage warehouse, in a shopping cart, or in a returns pile.”

A2X.

Inventory for ecommerce is a balancing act.

You’ll need to consider things like sales channels, returns and third party fulfilment fees.

Carrying too little means you’re missing out on business and customers are left waiting.

Carrying too much can cause cash flow problems.

And it only gets more complicated as you expand your product range.

But that’s what ecommerce bookkeepers are for…

It’s not easy to juggle the complexities of ecommerce bookkeeping while maintaining your accounts.

But ecommerce bookkeepers are skilled at managing these challenges.

And this is what makes them so valuable.

They’re experts in ecommerce bookkeeping so you don’t have to be.

Benefits Of Having An Ecommerce Bookkeeper

You’re required by law to keep records of the financial activities of your business.

But having an ecommerce specialist managing your accounts has added benefits for your business. Here are some, just to name a few:

Bookkeeping protects your profits

There are numerous expenses when selling online.

Production, storage, subscriptions and shipping – not to mention fees! You need to keep on top of these to ensure that you still make a profit, and you know what your breakeven is.

Efficient bookkeeping gives you visibility.

You can monitor your expenses and returns, and maintain a profitable business.

You’ll make better business decisions

Tidy accounts give a clear view of what’s working and what’s not in your ecommerce business.

This visibility makes it easier to set a profitable course for your company’s future.

Tidy books mean lower accountant fees

The time your accountant spends fixing bad bookkeeping costs you more than hiring a bookkeeper in the first place.

Use your accountant for what they do best. Have your bookkeeper manage the rest.

You’ll likely save time, stress, and money.

Your business is more attractive to buyers

If you’re considering selling your ecommerce business one day, good bookkeeping is a must.

Those who pay the best prices don’t have time to investigate untidy books.

And accurate financial records show potential buyers that your business isn’t hiding any unwelcome surprises.

Hiring An Ecommerce Bookkeeper

Can you keep your own books? Of course!

Should you keep your own books? Maybe not…

Many new business owners are lured into do-it-yourself bookkeeping hoping they’ll save a few dollars.

But as your business grows, things can get out of hand. Bookkeeping gets more complex, and manual processes are time-consuming and error-prone.

As your bookkeeping scales up, you’ll want to hire a professional.

While at-home bookkeeping isn’t a sustainable option, AIS Solutions offers QuickBooks training and support for those still in the DIY phase.

When should I hire a bookkeeper?

The sooner the better!

Having solid bookkeeping processes from the start will prevent you from getting behind. You’ll also have a clearer picture of your finances as your business progresses.

Signs that it might be time to hire a bookkeeper:

Your business is growing, along with the difficulty of your bookkeeping.

You have financial resources, but you’re time-poor.

You’re being pinged with late fees and fines for making mistakes with your tax.

You have employees and you’re not sure about payroll tax.

Options for outsourcing your ecommerce bookkeeping

There are a few options for bringing in a professional bookkeeper.

Hire an employee

You could hire a professional bookkeeper as an employee of your business.

They’ll be available for you all day every day, and they’ll get to know your business well.

However, hiring a full-time employee can be costly, and not all bookkeepers are well-versed in the ecommerce landscape.

Bookkeeping also isn’t a regulated industry, so you’ll want to be sure that you’re hiring someone who knows their stuff.

If you decide to hire a full-time bookkeeper, AIS Solutions have created a handy tool to test their knowledge.

Work with a contractor

Hiring a contractor can be more affordable and more flexible than an employee.

But flexibility can go both ways. Juggling other clients may impact your contractors turnaround times. Plus, if they’re sick or on holiday, there’s no one to take their place.

Again, you’ll need to consider who you’re hiring and their ecommerce experience.

Team up with a specialist ecommerce firm

Specialist ecommerce firms like AIS Solutions work with online sellers all the time.

They have tried and tested solutions to the challenges of ecommerce bookkeeping.

Bookkeeping firms give you other advantages.

You’ll have access to a wider range of specialist knowledge. And, you can work more efficiently and flexibly than with a solo bookkeeper.

Take Charge of Your Ecommerce Bookkeeping With Our Free Checklist

Standardizing and recording your bookkeeping processes helps you grow your business.

That’s what our Essential Ecommerce Bookkeeping Checklist is for.

We’ve teamed up with leading ecommerce accountants AIS Solutions and Ledger Gurus to help you systematize your bookkeeping.

The checklist goes into detail about the best practice bookkeeping processes for ecommerce businesses. We show you why, how, and when to do them.

You’ll have confidence that the right processes are in place. Your bookkeeping will be consistent and error-free if you follow the steps correctly.

And handing over tasks will be easy, giving you more time to focus on your strengths.

Download the checklist here.

#Accounting services for SaaS#bookkeeping for saas#virtual bookkeeping#cloud bookkeeping#software as a service businesses

1 note

·

View note

Text

Empowering UK Businesses with Accounting Services and Strategic Outsourcing

In the dynamic world of business, where every penny counts and financial regulations are ever-evolving, mastering financial success can be a daunting challenge. This is especially true for businesses in the United Kingdom, where complex tax laws and stringent financial reporting requirements demand precision and expertise. Fortunately, there is a game-changing strategy that is transforming the way businesses manage their finances: accounting services and strategic outsourcing.

Unlocking the Potential of Accounting Services for UK Businesses

Accounting is the heartbeat of any thriving enterprise. It ensures not only financial stability but also compliance with the intricate web of tax regulations governing UK businesses. Professional accounting services, tailored to the unique needs of businesses in the UK, provide a lifeline in this complex landscape. They offer expert guidance on tax planning, compliance, and financial reporting, enabling businesses to stay ahead of the curve.

How Accounting Outsourcing Empowers Small Businesses

Small businesses and startups often grapple with resource limitations when it comes to hiring in-house accountants. This is where accounting outsourcing steps in as a catalyst for growth. By outsourcing their accounting needs, small businesses gain access to the expertise of qualified professionals without the overhead costs of maintaining a full-time accounting department. It's a cost-effective strategy that ensures precise financial management while allowing businesses to focus on their core operations.

Driving Success with Outsourced Management Accounting Services

Beyond traditional accounting, management accounting services is the secret weapon for strategic financial planning, budgeting, and performance analysis. Outsourced management accounting services provide businesses with invaluable insights. They not only save time but also contribute to business growth by pinpointing areas for improvement and cost reduction.

Enhancing Cash Flow with Accounts Receivable Outsourcing Services

A healthy cash flow is the lifeblood of any business. Efficient management of accounts receivable is pivotal in achieving this. Outsourcing accounts receivable services streamlines invoicing, payment processing, and debt collection. The result? Businesses receive payments on time, thereby improving financial stability and sustainability.

The Power of Strategic Outsourcing Solutions

Strategic outsourcing goes beyond mere cost reduction; it's about partnering with specialized service providers who bring expertise and efficiency to specific business functions. By strategically outsourcing tasks like accounting, businesses can amplify their focus on core competencies, leading to increased productivity and sustainable growth.

Simplifying the Complexities with Bookkeeping Outsourcing Services

Accurate bookkeeping serves as the cornerstone of sound financial management. Bookkeeping outsourcing services expertly handle data entry, reconciliations, and financial recordkeeping. This not only minimizes errors but also ensures that financial statements are prepared accurately and promptly, equipping businesses with the insights they need to make informed decisions.

Optimizing Tax Strategies with Corporation Tax Outsourcing Services

Navigating the labyrinthine world of corporation tax in the UK requires finesse. Outsourcing corporation tax services to experts ensures compliance with tax laws while minimizing tax liabilities. This proactive approach helps businesses sidestep penalties and optimize their tax strategies, contributing to long-term financial success.

In conclusion, the journey to financial success for UK businesses is paved with challenges, but it's also brimming with opportunities. Embracing accounting services and strategic outsourcing is not merely a choice; it's a strategic imperative. These solutions offer a lifeline to businesses striving not just to survive but to thrive in a rapidly changing business landscape. They empower businesses to master their finances, enabling them to seize growth opportunities and write their own success stories.

#accounting outsourcing#accounting online#bookkeeping services#accounting services#accounting outsourcing services#accounting and bookkeeping#accountant#virtual accounting#virtual bookkeeping#outsourcing services

0 notes

Text

Steps to Transitioning from Traditional to Virtual Bookkeeping Services

Several businesses are embracing the advantages of online bookkeeping services in the quickly changing business landscape of today. Financial procedures can be streamlined, efficiency can be improved, and time and money can be saved by switching from traditional to virtual bookkeeping. To guarantee a successful and seamless transition, this change needs to be carefully planned and implemented. Let's look at the necessary actions to switch from traditional to virtual bookkeeping services

1. Assess Your Current Bookkeeping System

Examining your present bookkeeping system is the first step in making the switch. Examine your current bookkeeping procedures, programs, and tools in great detail. Find the advantages and disadvantages of the conventional system to determine what has to be improved. Tosuccessfully prepare the transfer, this assessment will offer insightful information.

2. Set Clear Objectives and Goals

Have definite objectives and goals before beginning the transformation path. Choose your goals before switching to virtual bookkeeping services. These objectives can include increased data accuracy, lower operational expenses,quicker financial reporting, and easier access to financial data. You can later gauge the success of the shift by precisely stating your goals.

3. Choose the Right Virtual Bookkeeping Service Provider

Selecting the right virtual bookkeeping service provider is critical to a successful transition. Look for experienced providers who specialize in your industry and have a track record of delivering top-notch services. Read reviews, seek recommendations, and compare different options to make an informed decision. A reliable and proficient provider will ensure a seamless transition and ongoing support.

4. Ensure Data Security and Privacy

Data security and privacy are paramount when transitioning to virtual bookkeeping services. Before finalizing any agreements, thoroughly review the provider's data protection measures and protocols. Ensure they comply with industry standards and regulations to safeguard your sensitive financial information. A secure and encrypted data transmission will give you peace of mind about the safety of your data.

5. Implement Cloud-Based Accounting Software

A fundamental aspect of virtual bookkeeping is utilizing cloud-based accounting software. Migrate your financial data to a secure cloud platform that offers real-time access and collaboration capabilities. Cloud-based software facilitates seamless communication between your team and the virtual bookkeepers, streamlining the entire process.

6. Train Your Team

Transitioning to virtual bookkeeping involves a shift in workflow and processes. To ensure a smooth adoption, provide comprehensive training to your team members. Familiarize them with the new cloud-based software and the revised bookkeeping procedures. Investing in training will empower your team to utilize the virtual bookkeeping system efficiently.

7. Gradual Migration of Financial Data

Avoid rushing the transition process; instead, opt for a gradual migration of financial data. Begin with less critical financial tasks and progressively move to more complex ones. This step-by-step approach will give your team the opportunity to adapt to the new system without disruptions to your business operations.

8. Regularly Monitor and Evaluate Progress

Once the transition is complete, consistently monitor and evaluate the progress of your virtual bookkeeping services. Review whether the set objectives and goals are being achieved. Gather feedback from your team and address any challenges or concerns. Continuous improvement is key to maximizing the benefits of virtual bookkeeping.

Conclusion

Transitioning from traditional to virtual bookkeeping services is a transformative journey for any business. By following these steps and carefully planning the transition, you can enhance your financial processes, drive efficiency, and achieve greater success in today's digital era. Embrace the power of virtual bookkeeping to propel your business to new heights.

1 note

·

View note