#personal loan companies

Text

How to Compare Personal Loan Companies in Oman?

When looking for the best personal loan companies in Oman, it's crucial to conduct a thorough comparison to find options that best suit your financial needs. This guide will help you navigate the process, focusing on various aspects such as interest rates, loan terms, and customer service.

1. Understand the Types of Loans Available

In Oman, you can find a variety of loans, including corporate business loans, pre-owned vehicle loans, and general personal loans. Each loan type serves different purposes and comes with specific terms and conditions. For instance, pre owned vehicle loans often have different rates and terms compared to new car loans or personal loans used for other purposes like education or medical expenses.

2. Interest Rates and Fees

One of the first factors to compare is the interest rates. Banks in Oman might offer different rates for personal loan companies, which can be either flat rates or reducing balance rates. For example, typical rates can range from as low as 3.75% to around 4.6% depending on the loan product and bank (yallacompare).

It’s also important to look at the fees involved, such as processing fees, prepayment penalties, and any other administrative charges. These can significantly affect the total cost of your loan.

3. Loan Terms

Loan terms, including the loan amount and tenure, are critical to compare. Some banks offer loan tenures as long as 10 years, which can impact your monthly repayment amount and the total interest paid (yallacompare).

4. Eligibility Requirements

Check the eligibility requirements, which may include minimum salary requirements, employment conditions, and nationality. For example, some banks require a minimum monthly salary of OMR 250 for Omanis and higher for expatriates (yallacompare) (Oman Arab Bank).

5. Additional Features and Benefits

Some loans come with added benefits such as repayment holidays, insurance options, or flexible repayment options. For example, certain personal loan companies may offer Islamic finance options or loans without the requirement for a salary transfer (yallacompare) (yallacompare).

6. Customer Service and Accessibility

The quality of customer service and the ease of access to banking services are also important. Look for reviews and feedback on the bank’s customer service, including their response times and the convenience of their online and mobile banking platforms (yallacompare).

7. Use Comparison Tools

Utilize online comparison tools available on platforms like Bank Muscat, National Bank of Oman, and yallacompare. These tools allow you to input your loan requirements and compare different products side by side (yallacompare) (yallacompare).

Conclusion

Choosing the right personal loan in Oman requires careful consideration of various factors including the type of loan, interest rates, fees, loan terms, and the bank’s customer service. By methodically comparing these aspects, you can find a loan that not only meets your financial needs but also offers the best terms and conditions.

Remember, taking out a loan is a significant financial decision, and it’s advisable to consult with financial advisors or conduct ample research before committing to a loan agreement.

0 notes

Text

Stupid Personal Money Shit Below the cut:

I want to scream. I want to throw things. I want to yell at people but Im not going to cause that's not who I am.

But I am so fucking angry right now.

TLDR; Last January I took out a business equipment loan for a machine to help me with my business. I was NEVER given the machine. They never delivered it.

In Feb this year I told them I wanted my money back, they agreed, and the loan company told me I would get all my money back minus insurance fees.

They then told me to wait 2 months (of which I paid my normal monthly $800/month fees)

The loan company then finally got back to me two months later and only returned 1/3rd of it because apparently (and the rep who told me Id get my money back apparently was unaware of this) because they only return the money minus finance charges as part of policy-- which I was not informed of (or else I'd have fought to have the machine delivered finally, cause who just wants to lose that kind of money?)

So I'm down $6500 and they're saying there's nothing they're gonna do about it. Getting a lawyer would cost more than what I'm owed at this point ($250 for 20 mins of work for a lawyer) so I guess I am just ultra fucked? This is after having to shut my business down because it put me too much in debt, and I'm still trying to claw my way out of it.

I guess their policy is Fuck you small businesses? Fuck women/queer owned businesses? Or just flat fuck me? $6500 is NOT a small amount for me, and they're just gonna fucking keep it.

What the shit eating dick nippling piece of ass cockroach bullshit is THIS1?!?!?!?!? "Oh well its not our policy" fuck your policy, the vendor fucked me, fuck THEM not ME-- go get the money from them!

I'm so angry. I just have to yell into the void for a while, sorry. I may even delete this like I did in discord because I really shouldn't be bugging anyone but I feel like im gonna implode if i dont get it out somehow.

15 notes

·

View notes

Text

Whenever you have to deal with government paperwork they should let you yell into the void for ten minutes as a coping mechanism

3 notes

·

View notes

Text

i love wanting to detail everything but also knowing nothign abotu what businesses and ppl working there Actually do like ah yes heres my cog oc they work here uhm they do uhm

They Do Some Kind Of Paperwork...!!!!

#this is about ridge#shes not a mgr who i can think of fun quirks for shes a regular ass loan shark.exe#well regular - she is generally just in a more higher position but its funny#uhm yeah ... ! my characters do uhm .... Stuff At This Company :]#bc like unlike half of them she doesnt like fuck around she like mostly does paper shit and like checks up on how everyone below her is sor#sorta doin yknow :sob:#my brain isnt braining today sorry#shes gonna be hard to develop because ill be honest fellas i just made her to be a fun design i didnt have much of a story or anything in#mind honestly. like at All#crowleys a bit similar but he has ideas and a lot of potential i just have to open the doors for myself and i can figure out interesting#things for him#especially if ill be expanding the world#thats why im doing it i want it to be easier for Me Personally to give my ocs stories#or at least like.. why theyre in the company what they do how they are#yknow?#its not like dpau where im making some genuine grandiose story with meanings and things i wanna bring to the table#im just making silly guys here man#rambles#anyways ygeah im doodling her rn

3 notes

·

View notes

Text

I think I might hate my boyfriend.....

#every single joke he makes is either racist sexist or putting someone down#he tells me all of the worst things about me all of the time LIKE IM NOT ALREADY AWARE#hes a stoner through and through and never wants to do anything other than smoke enevr has any money cos he owes it all out on bud#he hits his dogs:(#he doesnt reciprocate my heartfelt moments : perfect example being i told him i every time i see him i think how attractive he is and how#lucky i am to be able to call him my boo and he just says i don't feel the same about you u look a state in the mornjngs#like lol but also ouch#then earlier he said tell me u love me and when i wss half way through saying ily a chip hit me in the eye#like am i dating a five year old#we barely ever have sex its just 3min blowjobs#although last night i got it gooooood🤤🤤#idk i just dont think i can love someone i dont actually rly even like#hes such good company and a proper laugh but as a person.....problematic fave🤣#he is speaking to me rn about getting an 8k loan to buy a car#just shut up#shut the fuuuuuck up#pls#boo boo

2 notes

·

View notes

Text

In Japan, pet fish playing Nintendo Switch charges the owner's credit card

CNN

—

Here’s something you don’t see every day. Pet fish playing a video game Japan managed to log into the Nintendo Switch Store, change their owner’s avatar, set up a Pay Pal account, and collect a credit card bill.

And everything seemed to be streamed live in real time on the internet.

The fish in question belong to a YouTuber named Mutekimaru, whose channel is popular with the gaming…

View On WordPress

#animals and society#asia#banks#business and industrial sectors#company#Consumer Loans and Credits#continents and regions#credit cards#domestic business#domestic warnings#east asia#economy and trade#finance and investments#iab Business Banking & Finance#iab computing#iab credit cards#iab internet#iab personal loan#iab pets#iab shop#iab social networking#iab software and applications#iab technology & computing#iab technology industry#iab video games#iab-Economy and Finance#iab-industries#iab-personal debt#iab-personal finance#Informatics and Information Technology

2 notes

·

View notes

Text

I slept in and just woke up, so here's what I've been able to figure out while sipping coffee:

Twitter has officially rebranded to X just a day or two after the move was announced.

The official branding is that a tweet is now called "an X", for which there are too many jokes to make.

The official account is still @twitter because someone else owns @X and they didn't reclaim the username first.

The logo is 𝕏 which is the Unicode character Unicode U+1D54F so the logo cannot be copyrighted and it is highly likely that it cannot be protected as a trademark.

Outside the visual logo, the trademark for the use of the name "X" in social media is held by Meta/Facebook, while the trademark for "X" in finance/commerce is owned by Microsoft.

The rebranding has been stopped in Japan as the term "X Japan" is trademarked by the band X JAPAN.

Elon had workers taking down the "Twitter" name from the side of the building. He did not have any permits to do this. The building owner called the cops who stopped the crew midway through so the sign just says "er".

He still plans to call his streaming and media hosting branch of the company as "Xvideo". Nobody tell him.

This man wants you to give him control over all of your financial information.

Edit to add further developments:

Yes, this is all real. Check the notes and people have pictures. I understand the skepticism because it feels like a joke, but to the best of my knowledge, everything in the above is accurate.

Microsoft also owns the trademark on X for chatting and gaming because, y'know, X-box.

The logo came from a random podcaster who tweeted it at Musk.

The act of sending a tweet is now known as "Xeet". They even added a guide for how to Xeet.

The branding change is inconsistent. Some icons have changed, some have not, and the words "tweet" and "Twitter" are still all over the place on the site.

TweetDeck is currently unaffected and I hope it's because they forgot that it exists again. The complete negligence toward that tool and just leaving it the hell alone is the only thing that makes the site usable (and some of us are stuck on there for work).

This is likely because Musk was forced out of PayPal due to a failed credit line project and because he wanted to rename the site to "X-Paypal" and eventually just to "X".

This became a big deal behind the scenes as Musk paid over $1 million for the domain X.com and wanted to rebrand the company that already had the brand awareness people were using it as a verb to "pay online" (as in "I'll paypal you the money")

X.com is not currently owned by Musk. It is held by a domain registrar (I believe GoDaddy but I'm not entirely sure). Meaning as long as he's hung onto this idea of making X Corp a thing, he couldn't be arsed to pay the $15/year domain renewal.

Bloomberg estimates the rebranding wiped between $4 to $20 billion from the valuation of Twitter due to the loss of brand awareness.

The company was already worth less than half of the $44 billion Musk paid for it in the first place, meaning this may end up a worse deal than when Yahoo bought Tumblr.

One estimation (though this is with a grain of salt) said that Twitter is three months from defaulting on its loans taken out to buy the site. Those loans were secured with Tesla stock. Meaning the bank will seize that stock and, since it won't be enough to pay the debt (since it's worth around 50-75% of what it was at the time of the loan), they can start seizing personal assets of Elon Musk including the Twitter company itself and his interest in SpaceX.

Sesame Street's official accounts mocked the rebranding.

158K notes

·

View notes

Text

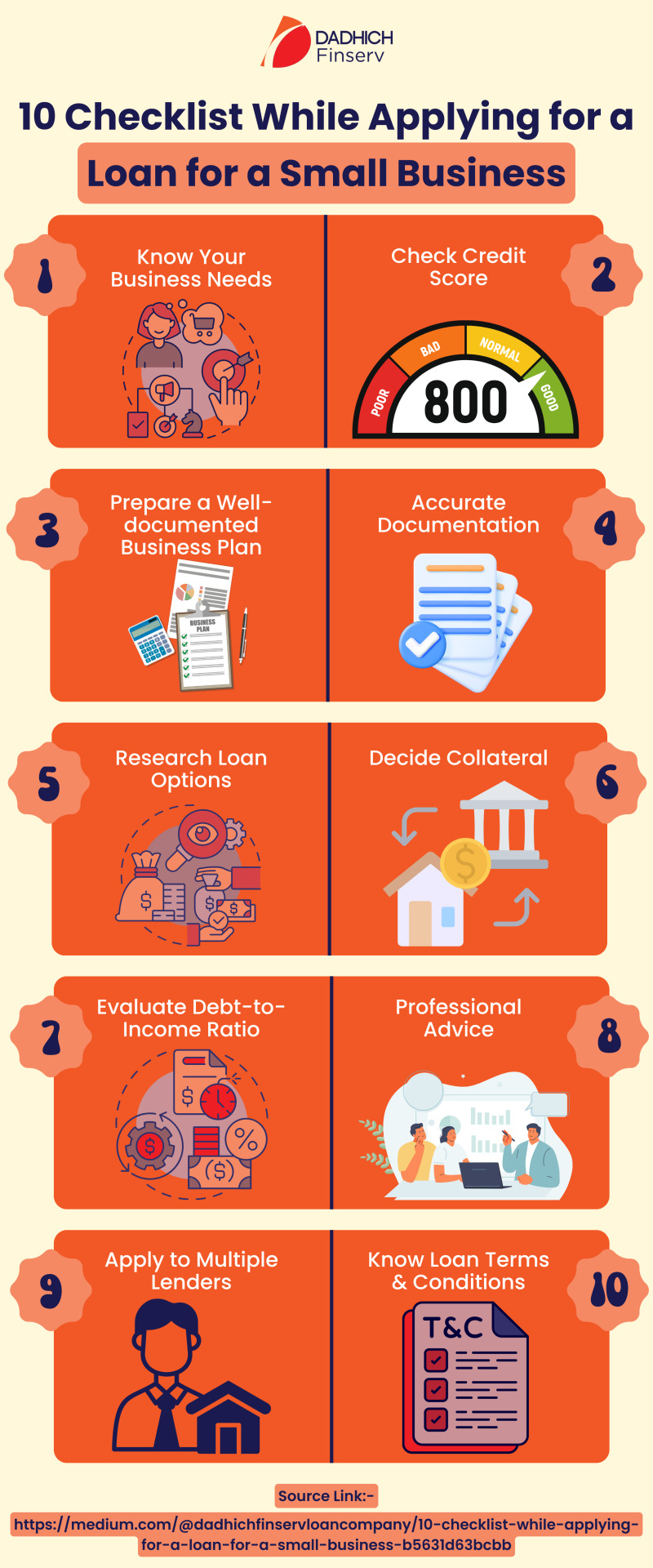

10 Checklist While Applying for a Loan for a Small Business

A small business loan company provides funds to small and medium-sized enterprises to support their financial needs, start a new business or grow an existing one. Some entrepreneurs apply for small business loans to cover operational expenses, buy inventory or equipment, or fund other initiatives related to the business.

#small business loan company#business loan#small business loan#personal loan#low interest business loan

0 notes

Text

0 notes

Text

How Payday Loans Can Help Maintain Financial Stability

Payday loans from Personal Cash USA INC can help keep your finances stable during emergencies. When you need money quickly for things like car repairs or medical bills, payday loans provide fast cash so you can pay for these unexpected expenses. They are especially helpful for people with poor credit who can't get traditional loans. With clear terms and quick approval, payday loans bridge the gap between paychecks, helping you avoid late fees and other financial problems. By offering a short-term solution, payday loans help maintain your financial stability during tough times.

0 notes

Text

Empowering Entrepreneurs: The Role of Corporate Business Loans

In the dynamic landscape of entrepreneurship, access to capital is often the catalyst for growth and innovation. Corporate business loans, pre-owned vehicle loans, and the services of personal loan companies play integral roles in providing entrepreneurs with the financial resources they need to pursue their ambitions. This article explores how these financial instruments empower entrepreneurs and drive economic progress.

Corporate Business Loans: Fueling Growth and Expansion

Corporate business loans serve as lifelines for businesses seeking to scale their operations, invest in new technologies, or expand into new markets. These loans, tailored specifically for businesses, offer flexible repayment terms and competitive interest rates, making them an attractive option for entrepreneurs looking to secure funding for their ventures.

Entrepreneurs can utilize corporate business loans to finance a wide range of initiatives, including hiring additional staff, purchasing inventory, acquiring new equipment, or even acquiring other businesses. The infusion of capital provided by corporate business loans enables entrepreneurs to seize opportunities for growth and innovation that would otherwise be out of reach.

Moreover, corporate business loans often come with additional benefits such as financial advice, access to networking opportunities, and strategic guidance from lending institutions, further supporting entrepreneurs in their quest for success.

Pre Owned Vehicle Loans: Enabling Mobility and Accessibility

For entrepreneurs who rely on mobility as part of their business operations, pre-owned vehicle loans offer a convenient and cost-effective solution. These loans provide entrepreneurs with the financing needed to purchase pre-owned vehicles, such as cars, trucks, or vans, which are essential for conducting business activities such as transportation, deliveries, or client meetings.

Pre-owned vehicle loan typically come with favorable terms and conditions, making them accessible to entrepreneurs with varying credit profiles. By enabling entrepreneurs to acquire vehicles without the burden of upfront costs, pre-owned vehicle loans facilitate greater mobility and accessibility, allowing businesses to operate more efficiently and serve their customers more effectively.

Personal Loan Companies: Bridging Financial Gaps

In some cases, entrepreneurs may turn to personal loan companies to bridge temporary financial gaps or address personal expenses related to their business ventures. Personal loan companies offer a variety of loan products designed to meet the diverse needs of individual borrowers, including entrepreneurs.

Whether it's covering unexpected business expenses, funding marketing initiatives, or managing cash flow fluctuations, personal loan companies provide entrepreneurs with the flexibility and convenience they need to navigate the ups and downs of business ownership. Additionally, personal loan companies often offer streamlined application processes, quick approval times, and personalized customer service, making them an attractive option for entrepreneurs seeking immediate financial assistance.

Conclusion

Corporate business loans, pre-owned vehicle loans, and personal loan companies play vital roles in supporting entrepreneurs on their journey to success. By providing access to capital, enabling mobility, and bridging financial gaps, these financial instruments empower entrepreneurs to pursue their dreams, overcome challenges, and achieve their business objectives.

As the backbone of the economy, entrepreneurs drive innovation, create jobs, and stimulate growth. By leveraging the resources and support offered by corporate business loans, pre-owned vehicle loans, and personal loan companies, entrepreneurs can continue to make significant contributions to the prosperity and vitality of their communities.

0 notes

Text

Didn't expect my boss to end our call with "Please don't kill yourself! :) Have a nice weekend!"

All i said was i've only slept two hours in the span of two days...

like omg no it's not like that... but also ty ily that gave me some strength to push through the day 💓

#he's not really my boss?#maybe like a manager?#i literally have no idea what our professional relationship is now that I think about it#like im a temp from a temp agency assigned to work at the company he is employed to#so like we aren't colleagues but he doesnt have any authority over me bc in a sense im just loaned out to his department#hes just the guy who communicates with me daily and provides me with tasks to do#but in my mind he's like a boss figure so im gonna keep referring to him as that#personal

0 notes

Text

#personal loan debt relief#debt solutions company#debt consolidation edmonton#debt consolidation loan

0 notes

Text

yes, doctors suck, but also "the medical ethics and patient interaction training doctors receive reinforces ableism" and "the hyper competitive medical school application process roots out the poor, the disabled, and those who would diversify the field" and "anti-establishment sentiment gets applications rejected and promotions requests denied, weeding out the doctors on our side" and "the gruesome nature of the job and the complete lack of mental health support for medical practitioners breeds apathy towards patients" and "insurance companies often define treatment solely on a cost-analysis basis" and "doctors take on such overwhelming student loan debt they have no choice but to pursue high paying jobs at the expense of their morals" are all also true

none of this absolves doctors of the truly horrendous things they say and do to patients, but it's important to acknowledge that rather than every doctor being coincidentally a bad person, there is something specific about this field and career path that gives rise to such high prevalence of ableist attitudes

and I WILL elaborate happily

#theres so much that contributes to this#and its such a traditional field that any change takes ten years to take effect even when its not as controversial as disability rights#ive no lost love for doctors as a whole#but the deeper causes here need to be examined to understand how this problem manifested and what can be done to fix it#disability#chronic illness#ableism#premed#medicine#salt baby talks

20K notes

·

View notes

Text

Personal Loans for Medical Professionals: A Comprehensive Guide

Medical professionals, including doctors, dentists, and veterinarians, often face unique financial challenges due to the high cost of education and the demands of their profession. Personal loans can be a valuable tool for medical professionals to manage their finances, whether it's covering unexpected expenses, consolidating debt, or investing in their practices. In this article, we'll explore the benefits of personal loans for medical professionals and what they should consider before applying.

Benefits of Personal Loans for Medical Professionals

Quick Access to Funds: Personal loans provide medical professionals with quick access to funds, making them ideal for covering unexpected expenses or emergencies.

Flexible Use: Unlike specific-purpose loans, such as practice loans or student loans, personal loans can be used for any purpose, giving medical professionals the flexibility to use the funds as needed.

Consolidating Debt: Medical professionals with multiple debts, such as student loans or credit card debt, can use a personal loan to consolidate their debts into a single monthly payment, potentially reducing their overall interest rate and simplifying their finances.

Competitive Interest Rates: Depending on their creditworthiness, medical professionals may qualify for personal loans with competitive interest rates, making them a cost-effective option for borrowing.

Improving Credit Score: Successfully repaying a personal loan can help medical professionals improve their credit score, which can benefit them in future loan applications.

Factors to Consider Before Applying

Before applying for a personal loan, medical professionals should consider the following factors:

Credit Score: A higher credit score can increase the likelihood of approval and qualify medical professionals for lower interest rates. Medical professionals should review their credit report and address any errors before applying.

Loan Terms: Medical professionals should compare loan offers from multiple lenders to find the most favorable terms, including interest rates, repayment terms, and fees.

Financial Situation: Medical professionals should assess their financial situation, including their income, expenses, and existing debt, to determine how much they can afford to borrow and repay each month.

Purpose of the Loan: Medical professionals should have a clear understanding of why they need the loan and how they plan to use the funds to ensure they borrow responsibly.

Repayment Plan: Medical professionals should have a repayment plan in place to ensure they can comfortably make their monthly loan payments without financial strain.

Conclusion

Personal loans can be a valuable financial tool for medical professionals, providing quick access to funds for various purposes. However, medical professionals should carefully consider their financial situation and the terms of the loan before applying to ensure they can borrow responsibly and repay the loan on time. By understanding how personal loans work and what factors to consider, medical professionals can make informed decisions about borrowing and manage their finances more effectively.

#Personal Loans for Medical Professionals#online loan companies#finance companies for bad credit#Loans for Medical Professionals

0 notes

Text

TechWareZen.shop Smart Solutions, Simple Living..!

#app development company in noida#best app development company in noida#best instant personal loan app in india

0 notes