#it's been. five months. soh what are you doing...

Text

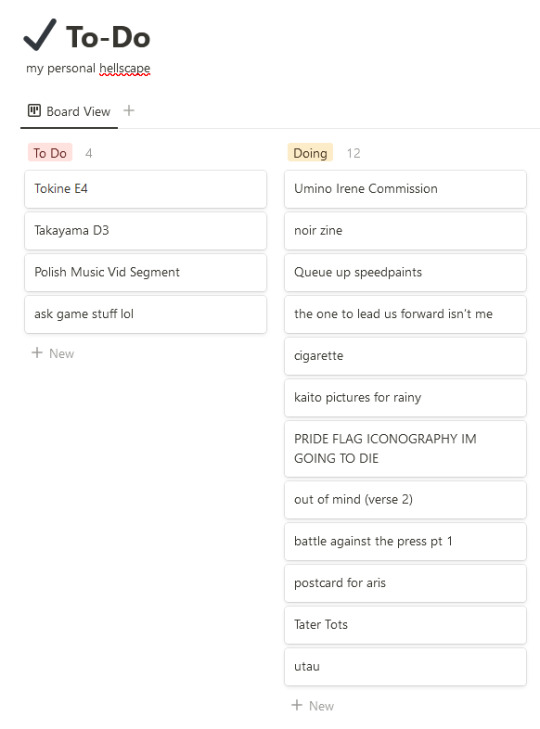

todo list. top is most urgent bottom is least urgent

#just thinking thoughts...#I'm glad I backlogged like 4 speedpaints before going on vacation. I still haven't missed an upload yet#although I keep forgetting to link it on tumblr and twitter#I should go do that now I suppose#yesterday was the last one though...#noir zine kinda staring me in the face. but I'll stare back at it don't you worry.#OH I need to post my ksbb art today as well#gah. gotta go to bed early so I don't oversleep#the lines for the commission are technically done...but something about it doesn't sit well with me. I want to add more details.#(client didn't take my birdiscount so. well. still in my pay grade technically.)#out of mind is that low on the list because I decided to learn how to use fusion in da vinci resolve LOL#I couldn't keep bashing out all the effects#I think I get fusion as a concept now. but I gotta figure out how the put the 3D stuff together#pride flag iconography :skull:#it's been. five months. soh what are you doing...#GRANTED. MY ESSAY IS SO MUCH BETTER AND SUBSTANTIAL THAN WHAT IT WAS#lol tater tots. and cycles isn't even on this list#GOD WAIT. RHM BONUS COMIC NEEDS TO BE ON THIS LIST TOO HELLO#wow. wow. hold on a moment. I think I need to remind myself gently that I am human.#hold on...#okay. normal again. let's tackle this!

6 notes

·

View notes

Text

new years, new family

harry styles x reader (SOH masterlist)

summary: y/n meets anne and gemma for the first time, and harry's just happy. || w/c: 2.2k

a/n: felt i should post a bit more before im back to class, enjoy and have a good new year!

Anne was an amazing mother. She was kind, empathetic, and had the strong will that helped her do what was right. Harry loved his mum too. Despite all the arguments and the fame, he has always had faith in her. He truly felt the love and comfort that a mother should give any child—and he still does to this day as an adult.

Anne prided on being someone her kids could go too if they needed an ear and always gave her kids space, but that didn’t stop her from being curious about their lives. She would sometimes sneak in a “do you like someone” or “when do you think you’ll have kids” every now and then, but they knew she just had their best interest at heart.

Anne was very careful about what she asked Harry though, not to say that she would be blunt with Gemma, but there were certain questions that would sound too much like a TMZ journalist asking questions. So, Anne would turn to Gemma to maybe slip some detail about Harry’s life.

The last time Gemma came around her mothers though, she did tell Anne that Harry’s got a crush that sort-of, maybe, turned into his girlfriend. “But don’t quote me on this. I don’t know for sure.” Gemma reminded her mother.

But Anne was bubbling with excitement. She knew the girlfriend in question is Y/n, the women Harry might of suitably alluded to having a crush on, and she couldn’t be more excited for her boy. She reminded herself though that she can’t be too pushy, but she can watch the young actresses movies.

After just under six months of dating, Harry decides he wants to tell his family.

“I know my mum won’t tell and Gemma will just make fun of me, I just don’t like keeping you a secret from everybody important in my life.” Harry confessed, kissing his lovers face all over as a way to win her over.

Y/n had a habit of overthinking, but seeing her boyfriends puppy dog eyes she just couldn’t say no.

“I believe you.” She kissed him back. “Just don’t embarrass me when you tell them.”

The next morning Harry was practically jumping from excitement, yet feeling like he needed the bathroom every five seconds from nerves. Harry knew his family wouldn’t hate Y/n or everything of the sort. It was just the fact they would be one of the first to know and their secret relationship wouldn’t be a secret anymore. He knew Y/n wasn’t just in it because of the the secrecy, but the fact still didn’t make him feel any better.

Harry powered through, and made the call.

The line rang a couple times before the cheery voice of Anne rang through. “Hi Honey, so good to hear from you!”

Harry laughed, walking around his London flat aimlessly. “It’s nice to talk to you too. Been feelin’ so busy from work that I think I’ll go crazy.”

“Oh no, well remember to take breaks and focus on you.” Anne thought this was her chance. “Do you have someone you can talk to or someone you feel comfortable with? Go out with them and forget about work.”

Harry blushed, he was in the kitchen and he could see the back of y/n. He thinks she is getting her morning coffee all ready as well as a cup for him.

“Yeah, actually, I’ve met someone.”

The pure joy running through Anne's body was something she last felt when Gemma told her about her last boyfriend.

"And is it who I think it is?"

"Have you been talkin' to Gemma recently?" Harry ask, false annoyance slipped through his voice. "But uh-" He cleared his throat. "Yeah, I think so. "

Anne practically screamed through the phone, excitement radiating though.

"But we are talking about Y/n, right?"

"Yes! Yes, oh my goodness, you finally are together! You two look so adorable together and I know to never buy into something TMZ or Daily Mail says but I saw your little photo and then when Gemma finally told me that you told her that you were talking to Y/n I started watching all of her movies so far and she is very talented, although, i have to admit, when she kissed that other boy in the movie I kept thinking how you would been feeling and--"

A couple seconds into her rant, Harry put Anne on speaker phone and was suffering from the adrenaline rushing though him. He was coming down from the high of fear and going into a tired yet happy state.

Y/n handed Harry a cup of coffee, half cream with a ton of sugar added in, then sat down next to him with her own coffee in hand. Y/n was trying to hide her smile through a look of embarrassment, but the actress couldn't quite hide her emotions from Harry.

Harry nudged Y/n, a smile on his rosey face. They look at each other with such adoration that it was sickening to anyone single.

"Harry? Harry, you still there?" Anne's voice snapped Harry from Y/n's trance on him.

"Yeah, I'm here mum." Harry chided, clearing his throat. "Just got a bit side tracked. What did you say?"

"When are you two coming over then? I know Gemma is coming round for new years so six could work, maybe five, or is that too early for new years?"

Y/n's eyes went wide with shock as she heard Anne's words then she could've sworn her heart stopped beating when Harry replied, as nonchalantly as ever, sure mum.

"Six'll work." Harry said, saying his goodbyes. He hung up his phone and smiled at Y/n. "You excited?"

"Definitely."

...

Y/n was not excited. Not in the slightest.

Y/n and Harry spent the holidays with their own families. They called each other, constantly; and much to Annes delight, and Gemma's partial annoyance, they've been hearing all about Y/n constantly. But a few day's after the holidays, they both met up at Harry's flat to make the journey to Anne's.

Currently, they were in Harry's Range Rover, close to Anne's house. They left a couple hours after Anne's call, knowing the drive is long and traffic would most likely be a nightmare. Harry has made the long drive quite a few times since he has moved to London, he knew it like the back of his hand; Y/n, while she hasn't made this specific drive, has gone on plenty of long trips in her life.

Yet, this drive, was pure torture.

She didn't want to tell Harry thats she is scared. She knows Harry would turn the car around and say it's no big deal, but he would be disappointed.

It wasn't like she didn't like what she has heard about his family, the opposite in fact. It's what they have heard about her.

Currently, the media is portraying Y/n as a serial dater, using someone for a night, or weekend if they're lucky, then dumping them and repeat. And poor Harry is the unconfirmed boyfriend that Y/n is dragging along for a long time.

They got all that from one group photo at a party last month.

It's not true. She knows it's not true, Harry knows it's not true, but does Anne and Gemma know it's not true? Anne invited her when there wasn't too much drama going on, but now? She was terrified for what would happen.

Y/n is just glad that it is just Gemma and Anne tonight, as much as she would want to meet Robin or Desmond, she can't deal with anymore people in one night.

"Okay so a couple tips." Harry started, turning down the volume of the song on the radio, Fleetwood Mac obviously. "One, don't ask Gemma if she is dating someone unless you want her to give you a silent treatment."

She nodded.

"Don't mention fame or anything too out of touch. Not really specific, just general advice because my mum always scoffs at people who flaunt their money."

"You say this in your custom two-hundred-thousand car." Y/n joked, trying to keep her cool.

"I got teased a bit." Harry shrugs, flipping the indicator and turning down a neighborhood. "But that's just teasing."

Harry sighs as he pulls to the side of the road in front of a nice house. It was cozy, yet big enough for a couple and a guest or two. "Ready?"

"Nothing else?"

"Not really sure." Harry fidgeted. "You're the first they would or could meet so..."

Y/n just nods as Harry's voice trails off, it's all she can do. Their thoughts mimic each other.

She's meeting her future in-laws.

I'm meeting my future in-laws.

The only difference was the tone. Excitement and fear.

Harry walked round to the other side, opening her door and holding his hand to help her out. Y/n felt like the paparazzi was watching her, but instead of flashing lights it was curtains suspiciously moving.

Harry knocked on the door, hand in a death grip with Y/n's. "Deep breaths. They're going to love you."

"Harry!" Anne swung open the door and smiled, when she looked over she saw Y/n, causing her to smile brighter and nearly bring tears to the women's eyes. "Y/n! I'm so glad you're here. Come in come in!"

Y/n had her red carpet smile on. She was carful to not make her smile look too obnoxious, but not like she was not excited to be here.

"Ms Twist you're house is beautiful." She complemented, earning her first awe of the night.

"Please, call me Anne." She blushed. "And thank you sweetheart."

"Where's Gem?" Harry asked, taking his shoes off and brushing his hand on Y/n's.

"Living room. She's on the phone with someone." She winked and walked into the house. "Come in, I've got some nibbles for you two."

Y/n mouthed, someone?. Harry just rolled his eyes and mouthed, "ex." She nodded and followed Harry into the the house.

"Gemma get off the phone." They heard Anne yell. "Say hi to the couple."

Gemma’s jaw dropped as she hugged Harry. She saw Y/n and her smile grew. "You're the famous Y/n we've been hearing about!"

Y/n nervously laughed but nodded, excepting the hug happily. Harry sighed thought, face turning a shade of pink. "It's so nice to meet you!" Y/n was smiling. Their first impressions were so far good. They seemed excited to meet her, and Y/n was able to breath finally now.

"Not long until midnight, so I've got to get going on the dinner." Anna decided.

"Let me help!" Y/n jumped at the opportunity to get to know Anne and get in her good graces. Following her to the kitchen and leaving the siblings behind.

"Mum's going to love her." Gemma whispered to Harry, shoving his shoulder. Harry just blushed, happy that his girlfriend is getting along with his family.

~

Midnight struck, cheers and hugs were done, and a sneaky kiss between the two young and in love celebrities were shared. Anne was tired, so the rest decided to retire to their rooms for the night. Harry took their two bags up to the stairs and revealed the small room that housed talented singer: Harry Styles.

It had grey walled with posters hung all around. As Y/n looked closer behind the records and old CDs tapped to the wall, she found a poorly covered up dent in the wall. "What's this?"

"Something that will definitely give my mum a heart attack." Harry smiled, dropping the bags. "Was playing with some of my friends and one "accidentally" threw a nerf gun at me."

"Sounds fun." She mused, continuing to look around the room. "Seems like your music taste has not changed." Y/n noticed the Joni Mitchell collection, right next to the Stevie Nicks one.

"Nope." Harry sighed, standing next to his girlfriend, but she could sense the smile forming on his face. "I'm glad I threw out all of those porno mags."

"So thoughtful." Y/n pushed Harry away as he laughed. Harry grabbed her and threw themselves onto the small, twin sized bed that had superman sheets on.

"Superman? At sixteen?" She asked.

"Hey, don't hate on superman." Harry defends. "These sheets are too comfy to get rid of."

They laugh a bit more, settling slowly into the silence that the small room gives them. They can hear Gemma talking to someone through the wall, though they don't mind--they're too wrap up in themselves to care.

"Think your family likes me?" She asked.

"Oh definitely. You're much better then any guy Gemma brought round." Harry remarked. "Plus mum loves you loads, it's really easy to see. She doesn't just offer her special margaritas to anyone."

"I'm glad." Is all Y/n says. She's tired now, a long stressful day of nerves really washed her out, but thankfully, she's got an amazing boyfriend to sleep next to.

"I'm glad you got to meet them." Harry admits. "No way you can break up with me now. Mum'll miss you too much."

"I'd miss her too. Not that I'd ever want to break up with you."

Harry kissed her sweetly, "Good, because I'd never do that too. Wouldn't even think of it."

#harry styles#harry styles x reader#harry styles x y/n#harry styles fluff#harry styles x you#harry styles x actress!reader#harry styles x famous!reader#harry styles x fem!reader#harry styles fic#harry styles one direction#harry styles smut#harry styles one shot#harry styles imagine#harry styles fanfic#harry styles fanfiction#harry styles writing#harry styles blurb#harry edward styles#boyfriend!harry#boyfriend harry styles

1K notes

·

View notes

Note

He said you called on his birthday. You were off by like ten days- Ruthie

There was a time in Ruthie’s life when her mother was good and present. Emilie Ann would wake her kids up in the morning with the smell of pancakes and the sound of Fleetwood Mac playing on the radio on her favorite station, 106.1 The Riot! . It was strange to Ruthie to think back to the times in which her mother was a “good mother”, because after her dad died everything changed.

Emilie Ann was flighty, manic, and unmedicated. Her mental health had taken a big hit after the loss of her husband. No one was there to remind her to take her medication so she didn't. No one was there to remind her that bills were due, so she didn���t pay them. Emilie started drinking more, drinking earlier, sending Ruthie to walk Sweet Pea to school over at Southside Elementary. Ruthie got a job at Pop’s so that she would be able to have money to pay for bills and for groceries; she had to call the electric company and argue her way into getting the bill put in her name and not her moms, even though Ruthie was only sixteen.

Later than year, Emilie started disappearing for weeks on end, leaving an envelope of money on the table and claiming to be staying with old friend or new suitors. Weeks turned into months, and soon Ruthie and Sweet Pea hadn’t seen their mom in almost two years.

Ruthie liked to pretend that she didn’t care, that she didn’t need her mother or anyone else to help her out because time had proven that she could get by just fine on her own. She worked at Pop’s every day after school and all day on the weekends, she woke Sweet Pea up for school every day and made the two of them breakfast, made sure he got dressed and was out the door and on the way to the Fogarty’s house where Maria would take him and Fangs to school. Ruthie was doing well in school, she got a good score on her PSATs and an A- on her midterm paper for English class (Dante got a B+, which she was proud of considering that she finished his paper for him). She made enough money to pay for utilities and had enough to spend on snacks at Ignacio’s bodega when her friends got hungry and too stoned. She didn’t need her mother. She didn't.

September was a busy month for the Soh-Peterson siblings. Ruthie and Sweet Pea’s birthdays were five days apart and there was always going to be some sort of celebration of the fact, no matter how much they told both Maria and Atzi that they weren’t really in the mood for celebrating.

Both Ruthie and Sweet Pea absolutely hated their birthdays. It was always awkward and uncomfortable, a lackluster day filled with reminders of what they were missing. There was no Mom there to make their favorite birthday cakes (red velvet and carrot cake, respectively), no Dad there to take pictures of their smiling faces as they opened the few presents they got. It felt fake and put-on for the sake of others, rather than their own personal enjoyment. But Ruthie and Sweet Pea smiled and told the Fogarty’s thank you, told the Abrejo’s that they appreciated their efforts and that they appreciated knowing that there would always be some sense of family and community they could turn to.

“You know our doors are always open for you two” Maria says, looking Ruthie dead in the face to make sure that she understood.

Ruthie nods her head yes and tries not to flinch when Maria sets another plate of food in front of her, poking the notches of vertebrae behind her neck that poked out, complaining that both her and Sweet Pea were too skinny and needed to put some meat on their bones.

“Thank you, Abuela” The siblings say in unison, making eye contact from across the table and sharing a knowing glance.

The “Birthday Party” was rather painless, or as painless as an unwanted party could be. The Abuelas made sure that everyone’s bellies were stuffed with warm food and sweet cake, despite the protests from everyone saying that they were physically unable to eat another bite. Neither Ruthie nor Sweet Pea expected presents so that was a pleasant surprise. Sweet Pea got a big plastic bag of hand-me-down clothes that Maria had been saving. Fangs gives him a new lego set and CD gives him one of the big jawbreakers from the big glass jar at Ignacio’s. Atzi gives Ruthie a yellow sundress she’d been sewing for her (with the stipulation that Ruthie needed to come over for final fittings and alterations). Spyder made her a mix CD and said that her real present would have to be given to her when the adults weren’t around. Dante said that he was the one who paid for Ruthie’s “real present” and Fangs gives her a plastic beaded bracelet with her name on it, something that he had made in art class. It wasn’t much but it was way more than either Ruthie or Sweet Pea expected so they were happy with their presents nonetheless.

The siblings walk home tired, full, and happy. Their respective birthdays come and go in the blink of an eye and soon both Sweet Pea and Ruthie move on. Sweet Pea assembles all of his legos and moves on to charting how many licks it would take to get to the next layer of his jawbreaker, though he has to restart too many times because he forgot that he was supposed to be counting. Ruthie stands on top of the kitchen chair in the middle of the Abrejo’s living room and Atzi only manages to stick her with a pin two times. She puts her bracelet from Fangs away in her drawer because she liked it too much to see it get broken.

Ruthie gets home from school one day and the phone is ringing off the hook. Dropping her backpack and her house keys in the entryway, she rushes to grab the phone before whoever was on the other line hung up.

“Hello?” Ruthie says sharply into the receiver, somewhat out of breath. She’s met with silence on the other end but she can hear moving and breathing. She looks at the digital numbers on the phone and recognizes the area code. “Mom?”

“Oh my, Ruthann, you sound more grown up every time” Emilie coos into the phone, sounding so syrupy sweet that Ruthie can’t help but feel sick to her stomach.

“You wouldn't be saying that if you were actually here...” Ruthie is too tired to pretend to enjoy hearing from her mother. “What do you want, Emilie?”

Emilie scoffs on the other line. “Now young lady, is that any way to talk to your mama? I was just calling to tell you happy belated birthday but I guess you don’t wanna hear it from me...Hell, Ruthann, I called your brother on his birthday. He at least wanted to talk to me.”

“Yeah right, Emilie.” Ruthie liked using her mother’s first name. She liked how sharp it could sound coming out of her mouth, sharp enough to grate at her mother’s nerves and make her get to the point faster, skipping around the fake pleasantries. “He said you called on his birthday...his birthday was on the 17th. You were off by like ten days.”

Ruthie rolled her eyes and cradled the phone against her ear as she hopped up onto the kitchen counter, cracking the window and grabbing her cigarettes and ash tray from the top shelf of the cupboard where Sweet Pea couldn’t reach.

“Don’t I get a few points for trying?”

Ruthie laughs. “Close but not close enough” She hangs up the phone without letting Emilie make her rebuttal and unplugs the phone from the wall so that no one could angrily call back. She knew that Emilie would come back eventually, whenever Ruthie and Sweet Pea would least expect it, but she had time to worry about that later.

5 notes

·

View notes

Photo

Get to know you tag - Mimo Giocatore.

Tagged by my loveliest Pru @treason-and-plot Let’s see what this scraggy f*er has to say.

Mario: Oh, now you are coming to get to know me - after some unknown chicks and ugly mofo apes you came to me. Again. To the good stuff... Bene! Let’s see what you got.

► Name ➔ Should I still need to introduce myself?! Seriously?!

► Are you single ➔ No! I’m in a relationship with the nicest and sweetest and most gorgeous girl one can ever imagine!

► Are you happy ➔ I’ve never been happier.

► Are you angry? ➔ At this exact moment - yes. With Jessica’s grandma. But I’m trying to stay as cool as possible for my baby's sake.

► Are your parents still married ➔ Of course they are! I mean, they are considered something like a power couple in Monte Vista.

NINE FACTS

► Birth Place ➔ Monte Vista

► Hair Color ➔

► Eye Color ➔ You should know by now I’m the sweet mascarpone boy with the coffee/chocolate hair and eyes. I’m like tiramisu, but much better ;)

► Birthday ➔ July 7

► Mood ➔ Horny. All the time.

► Gender ➔ Male.

► Summer or winter ➔ Summer.

► Morning or afternoon ➔ I used to hate mornings until I started waking up with warm smooth Jess wrapped around me. Now I love them!

EIGHT THINGS ABOUT YOUR LOVE LIFE

► Are you in love ➔ Truly, madly, deeply. No man has ever been or will ever be more in love than me.

► Do you believe in love at first sight ➔ I do, yes. It’s just that I didn’t recognize it as such at first.

► Who ended your last relationship ➔ I’m currently in my first and only relationship and I have no intention ending it.

► Have you ever broken someone’s heart ➔ The only heart I care of told me that she loves me yesterday so...

► Are you afraid of commitments ➔ Not anymore. Being committed to the right person is the best feeling of responsibility ever.

► Have you hugged someone within the last week? ➔ Jessica. 10 million times.

► Have you ever had a secret admirer ➔ I don’t know and I don’t care.

► Have you ever broken your own heart? ➔ ?!?

SIX CHOICES

► Love or lust ➔ I don’t see them as two separate things anymore.

► Lemonade or iced tea ➔ Lemonade, made by pappa. I can’t wait for Jess to try it!

► Cats or Dogs ➔ Little monkeys. :P

► A few best friends or many regular friends ➔ I don’t know anymore. Since Jessica came into my life true friendship looks so different to me. Probably a few best friends. And definitely, your partner being one of them.

► Wild night out or romantic night in ➔ A wild night inside Jessica :P

► Day or night ➔ Whatever. Yes, of course, next to Jess.

FIVE HAVE YOU EVERS

► Been caught sneaking out ➔ Ehehehehe! *looks at his fingernails* Of, course not. Never been caught, I mean.

► Fallen down/up the stairs ➔ If you are referring to falling down drunk, we Giocatores never get drunk. We know how to drink like pros.

► Wanted something/someone so badly it hurt? ➔ YESSSS!!! For a whole fucking month!! But it worthed every second of the waiting.

► Wanted to disappear ➔ Never. The World would be such a sad and ugly place without me.

FOUR PREFERENCES

► Smile or eyes ➔ Smile that reaches the eyes every time. Have you seen Jessica smiling? It’s brighter and warmer than all the suns in the Universe together.

► Shorter or Taller ➔ My tall girl with her endless legs.

► Intelligence or Attraction ➔ My gorgeous, smart and super talented girl.

► Hook-up or Relationship ➔ In Relationship with my girl. Am I pathetic? Well, I don’t give a fuck. I LOVE HER!!!!

FAMILY

► Do you and your family get along ➔ With 2/3 of it. But the other day mamma said on the phone pappa says hi next to her. And I actually heard him saying it. So I’m very optimistic.

► Would you say you have a “messed up life” ➔ No. Not at all. If you know my family and my girlfriend you would know it’s impossible. I don’t even have a messed up room anymore :D:D

► Have you ever ran away from home ➔ No.

► Have you ever gotten kicked out ➔ Ehehehe. With a mother like mine, it can’t happen. She would be the happiest if I and LuLu live there until we become 89.

FRIENDS

► Do you secretly hate one of your friends ➔ No. I’m not a very secretive person. That trait went completely to my twin sister. She is big on secrets.

► Do you consider all of your friends good friends ➔ Again... I don’t know anymore. I’m not that keen on my buddies anymore. They are more bugging me with their behavior than amusing me. But there are some new players on the field like Devin - I like him a lot. My boss Victor is quite pleasant company too - he is just different but in a good way. Well, of course, Jess! She is my best friend actually. Just don’t tell LuLu - she is a bit possessive of her people. But yeah, some laid back dude with similar interests and SOH to mine would be nice.

► Who is your best friend ➔ I said it already - Jessica. And LuLu! LuLu, LuLu...

► Who knows everything about you ➔ Jessica and mamma. Yeah, I’m henpecked and a mama's boy all at once - and proud. Suck on it.

45 notes

·

View notes

Text

Fiction: To Where I Belong by Peter Soh

Image by Tim Wright on Unsplash

“You do not know how to teach because you are not a trained teacher. There is nothing to do with whether you know the syllabus or not—you are just not fit to be a teacher.“

I sat in the meeting room looking at my PowerPoint slides. Tears started to well up in my eyes, but I had to keep them from running down my face. Ms Angeline looked puzzled. She thought today’s interview was just a procedural one since my first interview with the principal was impressive.

“I will further discuss with the human resource manager on your suitability of this job. We will call you again.” My interviewer stormed out of the meeting room without giving me a handshake.

Later, Ms Angeline did not expect this to happen. Her face was filled with apprehension. She told me my contract was all ready and I could start scouring for a place to live.

“Wait for me. I will be right back.”

“Sure. Thank you.” I looked at her and smiled weakly, and my eyes darted over to my slides again.

*

This was my umpteenth interview. I was confident that I was going to nail the interview this time and everything would, once again, fall into place. I was at the end of my tether after travelling up and down, from Malacca to Kuala Lumpur, Penang to Sarawak, just to attend numerous job interviews that ended in vain.

Just like my mixed ancestry that manifested in my outlook and lifestyle—tanned skin and big rounded eyes, and speaking a patois concocted from Malay, Hokkien, and sometimes, the English language—which often confused the others, my ability to excel in both the Science and the Arts was not appreciated, and sometimes, confused the prospective employers. Transgressing the norm or staying in between the poles was unwelcomed and undesirable. It could be a deadly threat—you just did not belong to anyone and anywhere.

‘Jack-of-all-trades, master of none’ was how one interviewer described me. Despite the efforts, struggles, and many late nights spent to catch up with the knowledge that I did not gain previously as a microbiology student, I was deemed incomplete despite the fact that I was later conferred a Master of Arts in Creative Writing and had written and published more than 30 articles.

“Your article is well-researched, but it lacks originality somehow. You need to emphasise how great our products are. Not just the general benefits of taking the supplements,” one interviewer told me.

“Thank you for your suggestions. I did not do so because I am unsure of the degree of effectiveness of those supplements and I want to leave room for any possible mishaps,” I replied.

“Are you insinuating about the safety of our products?”

“Of course not. I just want to protect your company and also, myself as a writer.”

“You are a great writer. But we would prefer someone who can bring in the sales. It is business at the end of the day. We need solid numbers.”

*

Increasingly frustrated with my attempts to secure a writing job, I started to look out for an English-teaching job. Father told me my time just had not arrived and it was a good move to look for something else at the moment.

“Be adaptive like your great-grandfather. If he did not settle here and marry your Indonesian great-grandmother, he would not have such a beautiful great-grandchild today. You are the pride of the Tan family,”

“I just do not understand. I worked hard on every minute that God sends but I did not attain a job. I just do not know what is going wrong. I wasted five years to complete my university, just to gain nothing. Except debts!”

“I never think time could be wasted. You grew and that is all that matters.”

I did not know what to reply to father. His advice was always sage and insightful. In times of turbulence and chaos, he had always remained that calm and poised. Even when his mother passed away, father did not shed a single tear throughout the funeral. He had always been the family’s rock.

*

“Sorry for the long wait. After discussing with Ms Eunice and the principal, we would like to offer you the job, still,” Ms Angeline handed me the contract that she had prepared earlier. “Your winning point is your publication, and we would like to give you a chance.”

“Thank you for this.”

She just didn’t buy the idea of me not knowing the IGCSE syllabus. I already told her today’s presentation was all I could get from the internet. I could not suppress my rage any longer and started losing my professionalism.

“Don’t worry. It was just a minor misunderstanding. She came from the perspective of a teacher and you came from the perspective of a writer. This was why she was dissatisfied with your teaching because she thought what you had presented was too difficult for the students. You have to teach the students on how to write the introduction, the body, and also the conclusion. Straight teaching the students on how to edit an article is way too advanced for these students.”

“But these students are Year 10, aren’t they? They are sitting for the IGCSE exam next year and they should have known the structure of an essay.” I continued to probe for more bizarre justifications, not remembering to keep my cool anymore.

“It is a little different here, Mr William. These kids are spoon-fed most of the time and they get used to mollycoddling. They don’t remember things.”

I looked at the contract on the transparent table. I hesitated to ink my contract. I was still bitter about the unfair judgement thrown at me just because I deviated from the interviewer’s expectation. I could not accept the reason of me not being a trained teacher; the management should know I was not a trained teacher ever since they called me up for interviews. I had had enough of constantly being judged and questioned for my ethnicity, lifestyle, choice of studies, and my abilities, just because I did not fit the boxes.

I just could not breathe in the meeting room.

*

“Welcome the new teachers in Melody International School! Please stand up when your name is being called,” the principal, announced, looking excited, at the staff meeting.

I signed my contract and landed a job after idling for six months. Father’s words kept echoing in my mind when I told him that I did not want to work at a place where I was judged pre-emptively.

He said, “It is all about survival of the fittest in this world. You need to survive before you can do whatever you want. It is wise to take up this offer—you don’t have any offers now. You can leave when you have a better offer.”

That night, I quickly learnt and accepted the fact that I need to anchor somewhere for a start. It was pointless to think of a change if I was still floating around because the world just did not operate in such mechanism since the first human appeared. I started to think whether my great-grandfather married my great-grandmother just for survival or because they were in love. I contemplated that growing up means losing one’s faith to keep up with the dogma of life and the more resistant one tries to change it, the more hurtful and defeated one will be. And I gave in to life that night because I needed a job desperately.

“And we have Mr William Tan. He will be teaching Year 7 English as a Secondary Language.”

The thunderous applause seemed to congratulate me for making a right choice in life. I stood up from my seat and gave my colleagues a practiced smile.

“The new term is starting next week.” The principal looked serious after introducing the new teachers. I could feel the air in the hall was becoming still and forbidding.

“As all of you know, last year was a good to great year but nowhere near excellent! The number of students who opt out from the school increases, and I want you to know that at the end of the day, it is all about business. I want all teachers to show more care to the students. If you take care of my students, I will take care of your salary and bonus.”

I shudder at the speech. It was disgusting. Since when education becomes a job that pleases the students and their parents?

And it dawned on me at that moment that being a teacher was not much different than being a writer. At the end of the day, it is all about business and it is all about numbers. And one can only get the chance to find themselves if they survive playing the game of life. You can’t find yourself when you are dying of hunger.

The principal locked eye contact with me. I nodded my head at what she had just said. After all, I was still under probation.

The game had only just started.

*

Peter Soh is an ambitious Malaysian writer whose stories are about darkness, pain, struggles, identity searching and what makes us a human.

2 notes

·

View notes

Text

‘KABALI’ PEAKED AT THE TRAILER. HERE’S WHY

First of all, I don’t do movie reviews. I am the guy who just watches a movie and then maybe talks about it during lunch at work to avoid awkward silences. So, why am I writing this review about a movie I watched a half hour ago? Because you know, how sometimes when you have a near death experience, your perspectives change and suddenly you want to do all this good in life, save lives, be a better person? Yeah, I am in that zone right now. I have been hit by something powerful. And it’s time to share it with the rest of my species.

Two months before today, I accidentally came across the trailer of Kabali on YouTube. I was immediately arrested by the killer original soundtrack for the movie. That’s where it had begun, for me.

Every time I watched the trailer at home, I’d go on and on to my wife about how I would not miss this movie. I don’t know why I had suddenly become such an aggressive fan of Rajinikanth. My mom was always a diehard fan, though. Two decades ago, I stumbled upon a large biology drawing book that had cut-out pictures and childlike hand-drawn sketches of him at my house in Bangalore. The book belonged to my mother. When I confronted her, she said that she was supposed to get rid of that book after marriage, but somehow it had come along with her. Super jealous of the superstar, my father would often mock Rajinikanth. I don’t blame him. He was just an ordinary South Indian man born in a conservative family. He is well educated and open-minded, yes, but he is still a man. I mean, when my wife used to look at Jason Momoa’s buttocks in Game of Thrones, I would run to the bedroom and do 50 squats and come out like I was all chill.

When you watch a Rajinikanth film, you better go to a local theatre. Not the multiplex ones where one is too shy to even release a silent fart. No, go to a local theatre. The kind where women best not venture. That’s the kind of place where you will know what it is like to be a Rajini fan.

In these theatres, as the lights dim, a new wave of energy crackles to life. Whistles, throat-burning screaming, firecrackers, shirtless dancing on seats. The entire room becomes a five-dimensional stimulation ride. Your seats rock. The walls vibrate. You smell smoke. It’s exhilarating to witness the madness, but deafening and annoying beyond a point as you can’t hear shit. Because from the time Rajini’s name pops up in the opening credits till the interval (where the fans begin to get a little tired), it’s a war zone. You would be lucky if you came out of the theatre entirely unbroken.

When you are watching a Rajinikanth movie, there is a 3000% chance that you will see something superhuman. Death-defying. Nonconforming to every law of nature. But you tell your mind to hush. During a Rajinikanth movie, only his fans can make a sound. If you are a non-fan and say something mocking, well, leave the address to your coffin.

Well, this time, I watched the film in a multiplex. Families and kids. So even if I had said something, I probably wouldn’t have got my ass whooped. Still, I watched quietly and saved everything for my keyboard. So now I’m going to spill my shit out. Here, I am Spartacus. Unyielding. Veracious.

Being 2016, being Kabali, being Rajini, you’d think, mafia being the spine of the story, it’d have all the beef in the universe to make Martin Scorsese take note. The opening scene, is the ending scene. When will writers learn that when you are showing Rajinikanth to be the gangster (especially when he is being released from jail), you know for sure that all his enemy gangsters will be dead, no matter what! Keep a little surprise, man! Henceforth, I want Santa Claus to write all the scripts for Rajini movies.

The story takes place in Kuala Lumpur, Malaysia. It’s a beautiful city. But they decided to show only the dark world. The Tamils. Their dark skin. Their dark labour problems. Their dark mafia. In all of this darkness, the only contrast in the colour palette was the ostentatious bling that these gangstas flaunted from start to finish.

After all these great movies in the West about drugs and gangsters, you’d go on to have this divine hope that the Tamil industry would go easy on making every hero a superhero. But nope. First of all, what kind of a gangster is comfortable with only a handful of business associates who also moonlight as security? I comprehend the fact that it is Rajinikanth and he can take care of himself, but he is old now. Besides, he carries only one gun. Not even an extra magazine!

When you are out of commission for 25 years, don’t you need money when you come back? Don’t you still need to be in business? Apparently, when Rajini is a gangster you don’t need to do gangster business to earn money. You just have it all sorted. Somehow he is able to run a free school for drop outs, drug addicts and ex-gangster kids. The funny part is, he himself is a gangster and hires kids on his team. So the point is that when you are in Kabali’s gangster squad, you don’t need to be rehabilitated, life’s all good.

P.A. Ranjith, before I forget, take this — you suck. You suck big time. Basha, for that time, had so much more swag than you have managed to squeeze out of Kabali. To a gangster, his family is very important. I mean to all of us, families are important. But to a gangster, it’s more of a prestige issue. If a gangster has let his enemy harm his family, it would convey that he is weak, incapable of protecting his own family . . . how then will he protect his business and other people who are dependent on him? But you could have involved his family saga in the movie in such a better way. There was no need for all the flashbacks. You have permanently ruined “once upon a time” for me.

I still cannot digest the fact that the director completely omitted to show us or explain Kabali’s business model. Maybe every time Kabali and his men whimsically went after the villains and delivered some soggy dialogues the producers would give them some candy money? Also, I think Indian movies should stop making the villains troll the hero and his affiliated people with dummy guns. Can’t take that shit anymore. If you want to shoot, just pull that plastic trigger and be done with it. Why do you have so many extras pointing all those useless toy guns at one old guy and still end up getting laid low by his stunt double?

Radhika Apte, who plays Rajini’s wife in the movie is a good actor. However, in this movie, she is a bad actor. When you have a bad script and a dumbass director, even a lion becomes a pig. I was happy to know that she was killed by the villains. Good riddance, I thought that’s what she must have thought. But no, she was brought back from the dead 25 years later and made to run for her life again. What torture, marrying Kabali!

Dhansika has tried to play a version of Rooney Mara in The Girl With The Dragon Tattoo, but the result is extremely unpleasing. The director concluded, perhaps, that if she is a girl and an assassin, she’s got to sport a punk bob cut and a lot of badly done temporary tattoos (which keep drastically changing and moving places). By the way, she is Kabali’s daughter, who he reunites with. Sadly.

What’s with the suit? I thought when you wore a suit, you had the license to kill. Oh, wait a minute! That was 007. In Kabali, if you wore a suit, well, you have the license to get killed.

The villain gangsters are real pussies, I tell you. I can’t fathom why they are so scared of Kabali. He is just a vintage chap with a few old friends who masturbate on the rusted bullets in their guns. Then again, it is Rajini. He can get bin Laden to marry Gandhi if he wanted to.

Movies in the south always thrive on comedy. In Kabali, there is nothing to laugh about. Nothing to cry for. Absolutely nothing to rejoice about. The soundtrack was the only saving grace. The movie was a drab, unsexy 150-minute quest for finding his family, which he could very well have done without us having to sit and watch. I liked the free trailer on YouTube. Not the full movie I spent 200 bucks for. Kabali, no magizhchi for you.

Reminds me of the famous Bruce Lee quote: “I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.” With all due reverence and respect for you as a great human being, I am afraid, Rajinikanth Sir, we are no longer afraid of your 10,000th kick. You have overdone it. It’s the same kick and it doesn’t give us any kick anymore. I know it’s the directors asking you to do lame stuff, not you per se. However, you could say no to them, yes? Maybe make meaningful cinema? You have earned that. But not the right to disappoint us, after all that hype.

P.S. Watch out for Tony Stark. He makes a sensational cameo.

Photo by Soloman Soh

0 notes

Text

Secrets Of The Skinny - How to Get Skinny in a Month

youtube

https://youtu.be/v44IzBMOjFU

Search Results

Videos

5:57

Secrets Of The Skinny - How to Get Skinny in a Month

Frances Kennedy

YouTube - 2 hours ago

PREVIEW

4:27

Naturally Skinny Secrets

The Better Show

YouTube - Nov 20, 2013

PREVIEW

1:23

Stay-Skinny Secrets of Women Who Never Diet

Woman's Day

YouTube - Dec 5, 2014

PREVIEW

9:57

10 Secrets of the 'Naturally' Slim People... Shhhh....

Joanna Soh Official

YouTube - Apr 30, 2013

3:57

The 6 Secrets of Thin People

jerry5040

YouTube - Apr 28, 2015

PREVIEW

6:34

The Secret of Your Naturally Skinny Friends: New book ...

Monica Swanson

YouTube - Oct 31, 2015

PREVIEW

3:14

Skinny Habits: The Six Secrets of Thin People (Bob Harper)

Auritt

YouTube - Jun 24, 2015

PREVIEW

8:26

The 6 Secrets of Skinny People

Bob & Brad

YouTube - Jan 3, 2019

People also ask

What is the secret to being skinny?

How can a skinny person lose weight?

How do people stay skinny?

How do you get a skinny mindset?

Feedback

Web results

How to Be Skinny - Secrets of Thin Women Who Don't Diet

www.womansday.com › health-fitness › nutrition › ways-to-stay-skinny

Nov 8, 2018 - Not every thin women has great genes, and those women don't even diet. Get their easy, diet-free secrets for getting and staying skinny here.

Secrets Of The Skinny - Jessica Secrets Of The Skinny Review ...

www.youtube.com › watch

▶ 5:57

2 hours ago - Uploaded by Frances Kennedy

Skinny Habits: The 6 Secrets of Thin People (Skinny Rules) [Bob Harper, Greg Critser] on ... Author ...

5 Secrets Skinny People Live By | Skinny Bitch

www.skinnybitch.net › skinny-kitchen

Secret #1: Diets Make You Fat; Lifestyle Makes You Thin Skinny people don't diet. At least not those who are permanently thin. These folks are often described as naturally skinny because they are. They gravitate to a more natural way of eating that does not include dieting.

Secrets Of The Skinny Review – Tips To Be Health And Fit For ...

tipsforweightlosswomen.home.blog › 2020/03/12 › secrets-of-the-ski...

11 hours ago - If you have been always wondering how to become skinny, but most importantly what the skinny people do and do they make some secret ...

50 Best-Ever Weight-Loss Secrets From Skinny People

www.eatthis.com › skinny-people-secrets

Sep 25, 2015 - 50 Best-Ever Weight-Loss Secrets From Thin People. Padma Lakshmi, Maria Menounos, Shaun T. and more tell you how to stay slim—for life!

Secrets of the skinny women who NEVER diet | Daily Mail ...

www.dailymail.co.uk › femail › article-3591682 › Secrets-skinny-wo...

May 15, 2016 - Secrets of the skinny women who NEVER diet: They love fast food and never say no to cake. How do they look this good? By Kerry Potter for ...

Secrets Of The Skinny Review — Does It Really Work? - Medium

medium.com › secrets-of-the-skinny-review-does-it-really-work-c714...

Mar 1, 2020 - This program has discovered that there are numerous inconspicuous propensities that skinny individuals do that really set their bodies up to stay ...

The Secrets of Skinny Chicks: How to Feel Great In Your ...

www.amazon.com › Secrets-Skinny-Chicks-Favorite-Naturally

The Secrets of Skinny Chicks: How to Feel Great In Your Favorite Jeans -- When It Doesn't Come Naturally [Karen Bridson] on Amazon.com. *FREE* shipping on ...

The surprising secret of skinny people - Sydney Morning Herald

www.smh.com.au › Lifestyle › Health & wellness

Feb 22, 2016 - By Sarah Berry. The secrets of skinny people are often pretty predictable. According to the Cornell University Food and Brand Lab, they eat breakfast - mainly fruit, vegies or eggs - they work out up to five times a week and about half keep an eye on the scales.

Searches related to Secrets Of The Skinny

how to stay skinny forever

how to be skinny

how to get bone skinny

how i got skinny

how to get skinny in a month

foods to eat to be skinny

how to get skinny in a day

how to get skinny overnight

How to Lose 10 Pounds in a Month: 14 Simple Steps

Do More Cardio. Share on Pinterest. ...

Cut Back on Refined Carbs. Cutting down on carbs is another simple way to improve the quality of your diet and further weight loss. ...

Start Counting Calories. ...

Choose Better Beverages. ...

Eat More Slowly. ...

Add Fiber to Your Diet. ...

Eat a High-Protein Breakfast. ...

Get Enough Sleep Every Night.

More items...

•

Oct 1, 2018

How to Lose 10 Pounds in a Month: 14 Simple Steps

www.healthline.com › nutrition › lose-10-pounds-in-a-month

Feedback

About Featured Snippets

People also ask

How can I slim down in 30 days?

Can you lose weight by not eating for a month?

How can I slim down in 4 weeks?

Feedback

Web results

How to Lose Weight in One Month (with Pictures) - wikiHow

www.wikihow.com › ... › Weight Loss Diets › Short Term Diets

Rating: 88% - 26 votes

Sep 6, 2019 - Losing weight in a month may seem like a daunting task, but you can do it if you work hard and stay focused. The key is to lose weight in a healthy, sustainable way through a nutritious diet and regular exercise. ... Remember, dramatic weight loss is risky and often ineffective; the ...

How to Get Skinny in a Week: 10 Steps (with Pictures) - wikiHow

www.wikihow.com › ... › Weight Loss Diets › Short Term Diets

Rating: 81% - 74 votes

Losing more than that in a week isn't easy and can be bad for your health if ... One of the quickest and easiest ways to slim down is to lose water weight, ... "I stopped eating junk food completely, and the results in just a month are shocking!

One Month Weight Loss Plan | Health.com - Health Magazine

www.health.com › Weight Loss

Jan 11, 2019 - 30 Tips to Get Fitter in 30 Days ... A month's worth of easy but effective changes that can be tailored to fit your needs and fitness level lie ahead.

How to Become Slim in 3 to 10 Days - Practo

www.practo.com › Health Articles › Weight Loss

Dec 17, 2015 - Whether you have 3 days, 7, 10, 14 days, 2 weeks or 1 month, you can use these tips to look thinner for the big day. 1. Drink Water. Start your ...

How To Get Skinny Fast - A Week Is All You Need! - Stylecraze

www.stylecraze.com › Health and Wellness › Weight Loss

Jan 6, 2020 - If you want to get skinny in just a week, eat right. You will lose weight fast by choosing foods that burn fat, prevent fat accumulation, and help ...

How to become slim in a month - Quora

www.quora.com › How-can-I-become-slim-in-a-month

82 answers

Becoming slim (losing belly fat or losing waist inches) is not that difficult. Just some basic fundamentals need to be followed. 1. Eat less (at least 300–500 ...

How to Lose Weight in 1 Month - YouTubewww.youtube.com › watch

▶ 4:38

Aug 29, 2013 - Uploaded by blogilates

How to Lose Weight in 1 Month. blogilates. Loading... Unsubscribe from blogilates? Cancel Unsubscribe ...

The 30-Day Weight Loss Challenge That Makes It Easier to ...

www.shape.com › Fitness › Workouts

Dec 30, 2015 - Tackle all your get-healthy, be-stronger, love-your-body intentions with our exclusive. ... Yes, you absolutely can lose weight in 30 days. For the ...

How to Be Skinny - Secrets of Thin Women Who Don't Diet

www.womansday.com › health-fitness › nutrition › ways-to-stay-skinny

Nov 8, 2018 - Not every thin women has great genes, and those women don't even diet. Get their easy, diet-free secrets for getting and staying skinny here.

Related search

Weight loss diet

DASH diet

Atkins diet

Calorie restriction

Whole food

Related search

Food to avoid during diet

View 2+ more

Ice cream

White bread

Candy bar

Pizza

Snack

Fat

French fries

Feedback

Searches related to How to Get Skinny in a Month

how to lose weight in a month with exercise

how to become thin in 1 week naturally

how to lose weight in a month without exercise

lose weight in a month diet and exercise plan

maximum weight loss in a month

how to lose weight in one month without exercise

ingredients to lose weight

10 kg weight loss in one month

Secrets Of The Skinny - How to Get Skinny in a Month published first on https://wesleytvirgin.tumblr.com

0 notes

Text

Secrets Of The Skinny - How to Get Skinny in a Month

youtube

https://youtu.be/v44IzBMOjFU

Search Results

Videos

5:57

Secrets Of The Skinny - How to Get Skinny in a Month

Frances Kennedy

YouTube - 2 hours ago

PREVIEW

4:27

Naturally Skinny Secrets

The Better Show

YouTube - Nov 20, 2013

PREVIEW

1:23

Stay-Skinny Secrets of Women Who Never Diet

Woman's Day

YouTube - Dec 5, 2014

PREVIEW

9:57

10 Secrets of the 'Naturally' Slim People... Shhhh....

Joanna Soh Official

YouTube - Apr 30, 2013

3:57

The 6 Secrets of Thin People

jerry5040

YouTube - Apr 28, 2015

PREVIEW

6:34

The Secret of Your Naturally Skinny Friends: New book ...

Monica Swanson

YouTube - Oct 31, 2015

PREVIEW

3:14

Skinny Habits: The Six Secrets of Thin People (Bob Harper)

Auritt

YouTube - Jun 24, 2015

PREVIEW

8:26

The 6 Secrets of Skinny People

Bob & Brad

YouTube - Jan 3, 2019

People also ask

What is the secret to being skinny?

How can a skinny person lose weight?

How do people stay skinny?

How do you get a skinny mindset?

Feedback

Web results

How to Be Skinny - Secrets of Thin Women Who Don't Diet

www.womansday.com › health-fitness › nutrition › ways-to-stay-skinny

Nov 8, 2018 - Not every thin women has great genes, and those women don't even diet. Get their easy, diet-free secrets for getting and staying skinny here.

Secrets Of The Skinny - Jessica Secrets Of The Skinny Review ...

www.youtube.com › watch

▶ 5:57

2 hours ago - Uploaded by Frances Kennedy

Skinny Habits: The 6 Secrets of Thin People (Skinny Rules) [Bob Harper, Greg Critser] on ... Author ...

5 Secrets Skinny People Live By | Skinny Bitch

www.skinnybitch.net › skinny-kitchen

Secret #1: Diets Make You Fat; Lifestyle Makes You Thin Skinny people don't diet. At least not those who are permanently thin. These folks are often described as naturally skinny because they are. They gravitate to a more natural way of eating that does not include dieting.

Secrets Of The Skinny Review – Tips To Be Health And Fit For ...

tipsforweightlosswomen.home.blog › 2020/03/12 › secrets-of-the-ski...

11 hours ago - If you have been always wondering how to become skinny, but most importantly what the skinny people do and do they make some secret ...

50 Best-Ever Weight-Loss Secrets From Skinny People

www.eatthis.com › skinny-people-secrets

Sep 25, 2015 - 50 Best-Ever Weight-Loss Secrets From Thin People. Padma Lakshmi, Maria Menounos, Shaun T. and more tell you how to stay slim—for life!

Secrets of the skinny women who NEVER diet | Daily Mail ...

www.dailymail.co.uk › femail › article-3591682 › Secrets-skinny-wo...

May 15, 2016 - Secrets of the skinny women who NEVER diet: They love fast food and never say no to cake. How do they look this good? By Kerry Potter for ...

Secrets Of The Skinny Review — Does It Really Work? - Medium

medium.com › secrets-of-the-skinny-review-does-it-really-work-c714...

Mar 1, 2020 - This program has discovered that there are numerous inconspicuous propensities that skinny individuals do that really set their bodies up to stay ...

The Secrets of Skinny Chicks: How to Feel Great In Your ...

www.amazon.com › Secrets-Skinny-Chicks-Favorite-Naturally

The Secrets of Skinny Chicks: How to Feel Great In Your Favorite Jeans -- When It Doesn't Come Naturally [Karen Bridson] on Amazon.com. *FREE* shipping on ...

The surprising secret of skinny people - Sydney Morning Herald

www.smh.com.au › Lifestyle › Health & wellness

Feb 22, 2016 - By Sarah Berry. The secrets of skinny people are often pretty predictable. According to the Cornell University Food and Brand Lab, they eat breakfast - mainly fruit, vegies or eggs - they work out up to five times a week and about half keep an eye on the scales.

Searches related to Secrets Of The Skinny

how to stay skinny forever

how to be skinny

how to get bone skinny

how i got skinny

how to get skinny in a month

foods to eat to be skinny

how to get skinny in a day

how to get skinny overnight

How to Lose 10 Pounds in a Month: 14 Simple Steps

Do More Cardio. Share on Pinterest. ...

Cut Back on Refined Carbs. Cutting down on carbs is another simple way to improve the quality of your diet and further weight loss. ...

Start Counting Calories. ...

Choose Better Beverages. ...

Eat More Slowly. ...

Add Fiber to Your Diet. ...

Eat a High-Protein Breakfast. ...

Get Enough Sleep Every Night.

More items...

•

Oct 1, 2018

How to Lose 10 Pounds in a Month: 14 Simple Steps

www.healthline.com › nutrition › lose-10-pounds-in-a-month

Feedback

About Featured Snippets

People also ask

How can I slim down in 30 days?

Can you lose weight by not eating for a month?

How can I slim down in 4 weeks?

Feedback

Web results

How to Lose Weight in One Month (with Pictures) - wikiHow

www.wikihow.com › ... › Weight Loss Diets › Short Term Diets

Rating: 88% - 26 votes

Sep 6, 2019 - Losing weight in a month may seem like a daunting task, but you can do it if you work hard and stay focused. The key is to lose weight in a healthy, sustainable way through a nutritious diet and regular exercise. ... Remember, dramatic weight loss is risky and often ineffective; the ...

How to Get Skinny in a Week: 10 Steps (with Pictures) - wikiHow

www.wikihow.com › ... › Weight Loss Diets › Short Term Diets

Rating: 81% - 74 votes

Losing more than that in a week isn't easy and can be bad for your health if ... One of the quickest and easiest ways to slim down is to lose water weight, ... "I stopped eating junk food completely, and the results in just a month are shocking!

One Month Weight Loss Plan | Health.com - Health Magazine

www.health.com › Weight Loss

Jan 11, 2019 - 30 Tips to Get Fitter in 30 Days ... A month's worth of easy but effective changes that can be tailored to fit your needs and fitness level lie ahead.

How to Become Slim in 3 to 10 Days - Practo

www.practo.com › Health Articles › Weight Loss

Dec 17, 2015 - Whether you have 3 days, 7, 10, 14 days, 2 weeks or 1 month, you can use these tips to look thinner for the big day. 1. Drink Water. Start your ...

How To Get Skinny Fast - A Week Is All You Need! - Stylecraze

www.stylecraze.com › Health and Wellness › Weight Loss

Jan 6, 2020 - If you want to get skinny in just a week, eat right. You will lose weight fast by choosing foods that burn fat, prevent fat accumulation, and help ...

How to become slim in a month - Quora

www.quora.com › How-can-I-become-slim-in-a-month

82 answers

Becoming slim (losing belly fat or losing waist inches) is not that difficult. Just some basic fundamentals need to be followed. 1. Eat less (at least 300–500 ...

How to Lose Weight in 1 Month - YouTubewww.youtube.com › watch

▶ 4:38

Aug 29, 2013 - Uploaded by blogilates

How to Lose Weight in 1 Month. blogilates. Loading... Unsubscribe from blogilates? Cancel Unsubscribe ...

The 30-Day Weight Loss Challenge That Makes It Easier to ...

www.shape.com › Fitness › Workouts

Dec 30, 2015 - Tackle all your get-healthy, be-stronger, love-your-body intentions with our exclusive. ... Yes, you absolutely can lose weight in 30 days. For the ...

How to Be Skinny - Secrets of Thin Women Who Don't Diet

www.womansday.com › health-fitness › nutrition › ways-to-stay-skinny

Nov 8, 2018 - Not every thin women has great genes, and those women don't even diet. Get their easy, diet-free secrets for getting and staying skinny here.

Related search

Weight loss diet

DASH diet

Atkins diet

Calorie restriction

Whole food

Related search

Food to avoid during diet

View 2+ more

Ice cream

White bread

Candy bar

Pizza

Snack

Fat

French fries

Feedback

Searches related to How to Get Skinny in a Month

how to lose weight in a month with exercise

how to become thin in 1 week naturally

how to lose weight in a month without exercise

lose weight in a month diet and exercise plan

maximum weight loss in a month

how to lose weight in one month without exercise

ingredients to lose weight

10 kg weight loss in one month

Secrets Of The Skinny - How to Get Skinny in a Month

0 notes

Text

The apps and gear you need to get fit without breaking the bank

Getting in shape doesn't have to empty your bank account. Heck, Rocky only needed a slab of beef, a snow-capped mountain and a barn full of farm equipment to prepare for his fight against Ivan Drago and look at how well that turned out for him. With a few strategic equipment purchases (resistance bands!), some handy smartphone apps and free YouTube channels, plus a bit of imagination, you too can get healthy while keeping your billfold plump.

One thing you won't need is a gym membership. Unless you require specialized facilities that you can't find elsewhere, why are you going to spend $100-plus a month to use workout equipment that other people sweat on? There are plenty of low-cost and no-cost alternatives available if you know where to look.

Workout apps and services

Just a few square feet of clear floor space is plenty of room to perform push-ups, sit-ups and a variety of other calisthenics. Add any of the myriad bodyweight workout routine apps available on Google Play and the Apple App store and you can start getting shredded in the privacy of your own home. At least there you'll actually know where the hairdryer has been.

I'm partial to Sworkit on Android. This free app offers circuit training routines with easy-to-follow visual explanations of each movement for both strength and cardio sessions that use only your body weight. You can set pre-selected workouts for five to 60 minutes, focusing on specific muscle groups or the whole body. And if you pay for the $4 full version, you can create and save routines of your own design. You Are Your Own Gym ($5) offers many of the same services but on both Android and iOS. I'm not super hot on Sworkit's yoga section -- I find it hard to get into a flow when using it -- but that's where the free app Yoga for Beginners (available on Android) comes in. Designed specifically for people getting back into yoga, the app offers three classes each of Vinyasa, Hatha and Restorative yoga, all with clear and concise instructions and form demonstrations so you're not left guessing and potentially hurting yourself in the process.

Brett Putman

Or, if you'd prefer to take a break from looking at your phone while you exercise but still want some instruction and guidance, YouTube is chock full of workout routines from some of the biggest names in personal fitness today. Whether you're blasting through circuits with Joanna Soh, strengthening your core with MadFit, flowing through yoga poses with Adrienne or performing pilates with Blogilates, there's an exercise video that can help you reach your fitness goals. These accounts are run by established and accredited fitness personalities with years of experience and extensive follower accounts, so you can feel assured you're taking workout advice from someone who actually knows what they're doing.

I've personally used Yoga with Adrienne on and off for years and found it to be very close to what you'd find at the local yoga studio. She explains not only how to perform each movement but also how those movements fit into the larger practice. The pacing is slow enough to not rush you from form to form but not so slow that you get bored waiting to move to the next one.

These are all perfectly fine options assuming you're a motivated self-starter. However, if you feel you need a bit more external motivation to get off the couch, Daily Burn could be right for you. This streaming service offers thousands of workout videos covering everything from yoga and barre to high-intensity interval training (HIIT) and pilates, across ability levels. These videos stream through Apple TV, Roku, Amazon Firestick and Chromecast as well as through the company's mobile apps. There's new content added daily in the form of a 30-minute "Daily Burn 365" video, which goes live every morning at 9am ET (and is available on demand after that). Additionally, the site offers a calorie counter, weight and workout tracking and weekly fitness goals to keep you motivated. The service costs around $13 a month, but that's a steal compared to what you'd pay for a gym membership and group classes.

Maybe you'd like to get a bit of fresh air with your exercise (or just don't want your living room to smell like stale sweat when you're done). There is still no need to blow a wad of cash on CrossFit lessons. Check your city's Parks and Rec department for listings of local open spaces, as well as free or low-cost classes and volunteering opportunities. The Calisthenics Parks organization maintains a similar database of publicly accessible fitness stations, trail runs and outdoor exercise areas all over the world.

If you're looking for group classes or just a workout buddy, the FitLink community can put you in touch with running clubs and personal trainers, as well as help you develop your own workout routines for the next time you exercise solo. Also take a stroll through your local Eventbrite -- it routinely offers a variety of group health and wellness classes.

Get your soon-to-be-fit butt down to the local park, public pool, dog run or playground. As long as the children's area isn't swarming with kids and toddlers, which you can easily avoid by going in the early morning or late afternoon, you should have the run of the place. Those chin-up stands and monkey bars that kicked your ass during the President's Challenge are just as difficult as you remember them, if not more so, now that you're pushing an adult's weight around. As the video below from Art of Manliness demonstrates, there are plenty of challenging bodyweight exercises you can do in a playground.

youtube

The equipment

Once you've settled on a workout regimen, it's time to get equipped. Luckily, you won't need much. If you're giving yoga a shot, sure, you could set down a beach towel or work on the bare floor, or you could get this sweat resistant yoga mat from Amazon ($16) so you're not turning your living room floor into a slip-n-slide the moment you get your chakras flowing. You can't go wrong with a set of generic gym towels ($22 for a 12-pack), plus they double as stretching aids and are cheap enough that you can afford to lose some in the bottom of your gear bag. And if you're just starting out with the practice and aren't yet as flexible as you'd like to be, pick up a pair of foam support blocks for $11.

Buy Yoga Mat on Amazon - $16

Buy Hand towels on Amazon - $22

Buy Yoga blocks on Amazon - $11+

A set of resistance bands, like these from Serious Steel ($110), can also prove helpful if you're looking to improve muscle tone and mobility. There are full sets on Amazon, but nothing says you can't buy them piecemeal at $10 a pop and just pick up more as needed as you get stronger. Plus, even at a hundred bucks, they're still a third of the cost of many adjustable dumbbell sets.

Should you want something a bit more robust than a set of people-sized rubber bands, take a look at the BodyBoss Home Gym 2.0 ($179). It combines a folding platform with resistance bands and sturdy handles that mimic the feel of bars and dumbbells. From squats to curls to cardio, the BodyBoss offers more than 300 separate exercises as well as hundreds of instructional videos. Yet, when it's fully folded, the BodyBoss is small enough to fit in a suitcase so you can even take it with you when traveling.

Buy Serious Steel on Amazon - $10+

Buy Home Gym 2.0 on Amazon - $179

Are you working out at home and have access to a spare doorway? Then you're in luck because you can easily convert that doorway into a pull-up station with this upper body workout bar from Iron Gym ($30). Depending on how you hang it on the frame, it can also serve as a push-up stand or sit-up anchor. Or, if you want to get fancy, check out Monkii Bars 2 ($199). These suspension straps can attach to practically anything -- door frames, tree branches, playground equipment and what have you -- and leverage your own body weight as resistance on more than 300 exercises. Working in conjunction with the iOS/Android app, you can follow along with both time- and rep-based routines; track progress; and gain access to new, free workouts delivered to your inbox every Friday.

Buy Workout Bar on Amazon - $30

Buy Monkii 2 - $199

Should you choose to train in the great outdoors, you'll do well to pick up a few extra pieces of equipment. Workout gloves, like this set from Trideer ($14), are a must. You don't know where those monkey bars have been. You'll also need to stay hydrated, so be sure to pack a water bottle. Kleen Kanteen offers stainless steel bottles ($15-plus) that are practically indestructible under normal conditions. I picked one up in 2011 and it's still my daily carry. Or if you want a lightweight plastic option, Nalgene has a BPA-free widemouth bottle for just $10.

Buy Trideer Gloves on Amazon - $14+

Buy Kleen Kanteen on Amazon - $15+

Buy Nalgene bottle on Amazon - $10

If you're planning to exploit your local playground or schoolyard as a training area, you might as well go all out and get yourself a rainbow-colored beaded jump rope ($7-plus), you know, like from elementary school. Skipping rope is a great way to develop your coordination, cardio and stamina. And if you'd prefer to not just skip to your lou, give Jump Rope Training from Crossrope a try. Available on both Android and iOS (and syncable with both Google Fit and Apple Health), this instructional app works with the company's Infinity Rope system ($88-plus). Those ropes enable more accurate workout tracking but can get pretty pricey. Even so, the app is free, and you can easily follow along even if you don't have $88 for the smart ropes.

Finally, you're going to need a bag to tote this stuff around in. A lightweight drawstring bag, like this one from BeeGreen is just $10, but is large enough to carry everything you'll need for the session.

Buy Beaded Playground Rope- $7+

Buy Infinity Rope - $88+

Images: Brett Putman for Engadget (lead and interstitial photos)

ENGADGET'S GUIDE TO FITNESS AND HEALTH

The best workout headphones

Tuesday: How to get fit without breaking the bank

Wednesday: The best fitness wearables

Thursday: The best accessibility gadgets and tech for the elderly

Friday: The best apps to keep motivated and focused on your health goals

- Repost from: engadget Post

0 notes

Text

Sacre Coeur, chapter 6

Chapter one + chapter two + chapter three + chapter four + chapter five

(Oh and it’s on A03)

_____________________________________

At John’s kiss, the steamer trunk in Sherlock’s mind palace bursts open.

The papers fly out, igniting, scraps of burning map floating recklessly through the air. A gale is blowing through the corridors, urging the fire to burn brighter.

John eases away and places a hand onto Sherlock’s chest, over his healing scar. He can feel Sherlock’s heartbeat drumming against his palm, eyes shining, burning into him. John’s voice is rough, quiet, the breath of his words soft on Sherlock’s face.

“You kept me alive – you cared for me.” John ducks his head. “Because. What I said. It’s the same. For you.”

Sherlock slides his hand over John’s on his chest, squeezing it hard, his voice barely more than a breath.

“Obviously.”

John’s eyes fly up to meet his again, blinking rapidly.

The steamer trunk is consumed in flame. Sherlock swiftly closes the distance between their faces and John gives a surprised little gasp against his mouth. Sherlock folds his arms around him, slides his hands up John’s back, over the nape of his neck, sending shivers across his skin. He cups the curve of his skull and pulls him closer. John runs his hands into Sherlock’s tangled, unkempt curls and melts into him.

Vines are growing through the mind palace windows. Red-petaled hibiscus sprawl open, crowding out Sherlock’s thoughts, silencing his deductions, giving him only the raw information of his senses: the precise slick, soft texture of their lips together; the fast rhythm of John’s heartbeat against his as their chests press; the sharp enamel click of tooth-on-tooth as they each surge ahead in the same instant, the resulting wince and chuckle into one another’s mouths. Sherlock is vaguely aware as damp cheeks press together that at least one of them is crying.

There are so many kisses woven into this first tangle of lips and breath. The kiss they should have shared in the entryway of 221B the night Sherlock cured John’s limp. It would have tasted of laughter. Kisses in the backs of cabs. Kisses after adrenaline-fueled chases. Kisses to quiet nightmares; after brilliant deductions; after a life saved; after a subway bomb was disarmed and a bitter lie forgiven. Kisses to smooth harsh words; kisses when John left for the surgery, and more when he returned home.

The steamer trunk is gone, reduced to glowing coals and ash. Only the glass egg rests in the embers, sooty, a web of fine cracks obscuring its surface.

He remembers.

A cold shiver runs through him, throwing cloud shadows across the library windows in his mind. His lips slow. John senses a shift in Sherlock’s touch and pulls back to read his eyes. Brow furrowing with concern, he sees the mixture of want and stricken confusion etched into his weary, flushed face.

“Okay?”

Sherlock’s hands slide from John’ back to hold either side of his face, precious. His eyes try to swallow John, the way he is now, sleep-rumpled, creased with weariness and worry, the grief of the last few months clear in every shadow and hollow, but bright-eyed, glowing, all John. Sherlock’s chest aches with a painful joy.

This. It sits raw and new and fragile in their trembling hands. He can’t shake the feeling he would get as a child when he’d catch some small, brilliant wild thing and know it had to be let go for its own good.

“John–” he burrows his face into his shoulder, clings to him. John nuzzles his neck and rubs his back, combs his fingers through his hair, breathes him in while their hearts thunder together between them.

“Sherlock…” John gently pulls Sherlock off of his shoulder, presses their foreheads together. “I know my mind’s been toyed with a lot. I’ve been half-mad trying to make sense of things lately. But you need to know what I have never lost. What has never once faded from my mind.”

He slides his hands up to hold Sherlock’s face firmly, tenderly, his thumbs lightly stroking the damp skin below his eyes.

“Sherlock. I love you. I have always loved you.”

Sherlock inhales hard, a sob catching in his throat. The egg shatters.

“John,” Sherlock rumbles hoarsely. “Yes. Always. I’ve loved you. Since the beginning.”

John squeezes his eyes shut tight and smiles broadly, tears making tracks down his cheeks. He sniffs, his voice rough.

“I’m sorry… I’m so sorry it took me so long. To tell you.”

Sherlock surges in to kiss him, to stop John’s words. He can’t hear them, John cannot ever be the one apologizing. He presses kisses down John’s neck to the soft skin above his collar bone and then simply holds him, fiercely, their heartbeats slowly calming.

In the cooling embers of what was once the steamer chest, thin green sprouts begin to push up from the glass shards between the coals, oblivious to their heat. They twine together, becoming thicker and interwoven, growing rapidly until they form the trunk of a tree in the center of the library, branches spiraling outward, brushing against the ceiling. Folded into the living wood are small artifacts, among them shards of a silver-spun glass egg; small blue stones that hold the exact texture of John’s kisses; acorns that carry the precise beat of his heart; the leaves patter together, whispering the words John has just spoken. Within the very whorl of the wood is the singed encryption of seven years of buried love suddenly, fiercely ignited.

Wrapped tightly in Sherlock’s arms, head tucked into his collarbone, John begins to giggle.