#initialclaims

Text

Jobless Claims Drop, But Labor Market Still Faces Challenges

#continuingclaims #initialclaims #Joblessclaims #labormarkettrends #unemploymentbenefits

0 notes

Photo

Don’t be surprised by #initialclaims use #alternativedata #ai #machinelearning #markets https://www.instagram.com/p/CLcLy3rAmpO/?igshid=soeg1n2yl0y9

0 notes

Text

Important PSA to people in the USA:

If you need to file for unemployment, it's HIGHLY recommended to file your claims online. Call centers nationwide are BURIED in calls. Even if you PREFER phone contact, Internet claims are going to be the best, fastest way to get your claims established. PLEASE SHARE THIS POST.

Here are the websites for your state:

• Alabama: https://labor.alabama.gov/uc/ICCS/

• Alaska: https://labor.alaska.gov/unemployment/

• Arizona: https://des.az.gov/services/employment/unemployment-individual/apply-ui-benefits

• Arkansas: https://www.dws.arkansas.gov/unemployment/how-to-file-a-ui-claim/

• California: https://www.edd.ca.gov/unemployment/

• Colorado: https://www.colorado.gov/pacific/cdle/file-claim

• Connecticut: http://www.ctdol.state.ct.us/UI-online/index.htm

• Delaware: https://ui.delawareworks.com/

• Florida: https://www.stateofflorida.com/articles/florida-unemployment/#two

• Georgia: https://dol.georgia.gov/file-unemployment-insurance-claim

• Hawaii: https://labor.hawaii.gov/ui/information-about-filing-online/

• Idaho: https://www.labor.idaho.gov/dnn/Unemployment-Benefits/How-To-Apply

• Illinois: https://www2.illinois.gov/ides/individuals/UnemploymentInsurance/Pages/default.aspx

• Indiana: https://www.in.gov/dwd/2362.htm

• Iowa: https://www.iowaworkforcedevelopment.gov/file-claim-unemployment-insurance-benefits

• Kansas: https://www.getkansasbenefits.gov/Home.aspx

• Kentucky: https://uiclaims.des.ky.gov/ebenefit/eben.htm

• Louisiana: http://www.laworks.net/UnemploymentInsurance/UI_MainMenu.asp

• Maine: https://reemployme.maine.gov/accessme/faces/login/login.xhtml

• Maryland: https://secure-2.dllr.state.md.us/NetClaims/Welcome.aspx

• Massachusetts: https://www.mass.gov/how-to/apply-for-unemployment-benefits

• Michigan: https://www.michigan.gov/leo/0,5863,7-336-78421_97241---,00.html

• Minnesota: https://www1.uimn.org/ui_applicant/applicant/logoff.do

• Mississippi: https://mdes.ms.gov/unemployment-claims/unemployment-applicant-services/

• Missouri: https://labor.mo.gov/unemployed-workers

• Montana: https://montanaworks.gov/

• Nebraska: https://dol.nebraska.gov/UIBenefits/Programs/DUA/FilingAClaim

• Nevada: https://secure.ui.nv.gov/CSSReg/CSSCreateAccount.htm

• New Hampshire: https://www.nhes.nh.gov/services/claimants/file.htm

• New Jersey: https://myunemployment.nj.gov/labor/myunemployment/before/about/index.shtml

• New Mexico: https://www.jobs.state.nm.us

• New York: https://labor.ny.gov/ui/how_to_file_claim.shtm

• North Carolina: https://des.nc.gov/apply-unemployment

• North Dakota: https://www.jobsnd.com/unemployment-individuals/file-claim

• Ohio: https://unemployment.ohio.gov/PublicSelfServiceChoice.html

• Oklahoma: https://unemployment.state.ok.us/

• Oregon: https://www.oregon.gov/employ/Unemployment/Pages/default.aspx

• Pennsylvania: https://www.uc.pa.gov/unemployment-benefits/file/Pages/File%20an%20Initial%20Claim.aspx

• Puerto Rico: https://www.trabajo.pr.gov/

• Rhode Island: http://www.dlt.ri.gov/ui/fileclaim2.htm

• South Carolina: https://dew.sc.gov/individuals/apply-for-benefits/claims-process

• South Dakota: https://dlr.sd.gov/ra/individuals/file_claim.aspx

• Tennessee: https://www.tn.gov/workforce/unemployment/apply-for-benefits-redirect-2/online-application.html

��� Texas: https://twc.texas.gov/jobseekers/unemployment-benefits-contact-information-claimants

• Utah: https://jobs.utah.gov/ui/home

• Vermont: https://labor.vermont.gov/unemployment-insurance/ui-claimants/establishing-unemployment-claim

• Virginia: http://www.vec.virginia.gov/unemployed/online-services/apply-for-unemployment-benefits

• Washington: https://esd.wa.gov/unemployment

• Washington DC: https://does.dcnetworks.org/initialclaims/

• West Virginia: https://workforcewv.org/unemployment/claimants/filing-an-initial-claim

• Wisconsin: https://dwd.wisconsin.gov/uiben/apply/

• Wyoming: https://wyui.wyo.gov/

#unemployment#ui#unemployed#layoffs#lack of work#covid-19#coronavirus#quarantine#shutdown#psa#help#claims#benefts#money#finances#hard times#advice#links#websites#state government#social service#support

2 notes

·

View notes

Text

Discouraging Economic Data and Outlook from Deere This Morning

The last third quarter report for the week (still 9 companies left to report for the season) came from Deere this morning. The company blew past expectations on both the top and bottom-line, with EPS of $1.83 beating the Estimize consensus by $0.16 and the Wall Street consensus by $0.25. Revenues came in at $8.04B, well above the Estimize expectation for $7.83B and the Street’s estimate of $7.79B. Despite the third quarter beat, Deere forecast a decrease in equipment sales for the fourth quarter as lower grain prices has translated to weaker demand for tractors and agricultural machinery. The outlook sent shares down 3.5% at the open.

Additionally, there was some discouraging economic data this morning. The headline number for October Durable Goods Orders was much stronger than expected, reporting MoM growth of 0.4%, above the Estimize expectation for a 0.4% decrease. However, the core number which excludes transportation, fell 0.9% from September. While defense aircraft jumped 45.3%, non-defense aircraft orders were down 0.1%. The outlook for equipment investment also continued to moderate. Non-defense capital goods orders excluding aircraft declined 1.3%, while shipments were down 0.4%, missing the Estimize consensus for a MoM increase of 0.06%.

Initial Jobless Claims were also disappointing, reporting a weekly increase of 313,000, up 7.2% from last week, and much higher than our expectation of 286,652. This is the highest figure seen since the September 6 report showed 316,000 initial claims. This morning’s release breaks the streak of 10 consecutive weeks of claims below 300,000.

How Are We Doing?

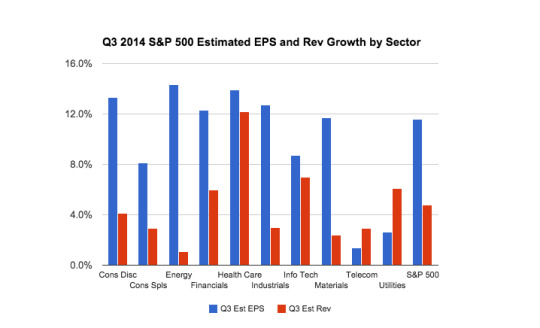

Expectations for S&P 500 earnings growth for the third quarter stand at 11.6%. Revenues are anticipated to come in with 4.8% growth. All 10 sectors are anticipated to post positive YoY growth on both the earnings and revenue front.

Leaders

Earnings:

Energy (14.3%). Notable industry: Oil, Gas and Consumable Fuels (14.8%)

Health Care (13.9%). Notable industry: Biotechnology (45.1%)

Consumer Discretionary (13.3%). Notable industry: Internet Retailers (25.3%)

Revenues:

Health Care (12.2%). Notable industry: Biotech (39.0%).

Information Technology (7.0%). Notable industry: Software (15.8%)

Laggards

Earnings:

Utilities (2.6%). Notable industry: Gas Utilities (-8.3%).

Telecommunication Services (1.4%): All five companies are within Diversified Telecom Services. Only Verizon posted YoY growth.

Revenues:

Energy (1.1%). Notable industry: Oil, Gas and Consumable Fuels (0.4%).

Materials (2.4%). Notable industry: Paper & Forest Products (-18.3%).

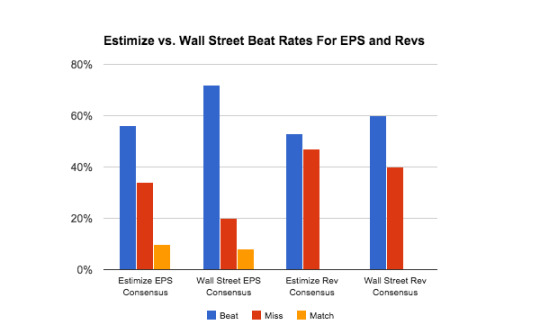

Beat/Miss/Match

Earnings: With 98% of the S&P 500 reporting thus far, 56% have beaten the Estimize consensus, 34% have missed and 10% have met. This is compared to Wall Street estimates, of which 72% of companies have beat on the bottom-line, 20% have missed and 8% have met.

Revenue: 53% have beaten the Estimize consensus, 47% have missed, and 0% have met. For revenues, 60% of companies have beat the Wall Street estimate, while 40% have missed.

4 notes

·

View notes

Text

Week at a Glance

The week started off lower, with fears out of Europe once again driving the market. Europe got firm warnings from the ratings agencies that they could be put on downgrade. This would be a huge problem for the Euro Zone, making it even tougher for the countries to raise money to pay off their debts. This is exactly what Europe is trying to avoid. The fears are growing due to very little activity coming from the Euro leaders. This is an issue that cannot be kicked down the street. The markets want to see something much more substantial, and hope that more backing from the ECB will take place.

This week out of the U.S. we are looking for continuing improvement. A strong week can help show investors that there is a possibility of the U.S. economy improving even with a slow down in Europe. Initial and continuing claims are expected to raise a little this week, but stay near where they have been lately. Industrial production is expected to slow, and the CPI is expected to increase by 0.1%. With that being said, these are not the best signs. Surprising numbers are something to hope about, but realistically our economy is still fragile. We have some good improving signs, but nothing indicating a robust recovery. This is something I have been indicating for a long time. We will not be seeing explosive numbers out of the U.S. for a while, with or without the Europe crisis. This type of recovery will take some time to get some footing. It was an extreme credit crisis and that is something that people seem to be overlooking. I know its hard, but allow time. We will continue with our ways soon enough. Stay bullish.

18 notes

·

View notes

Photo

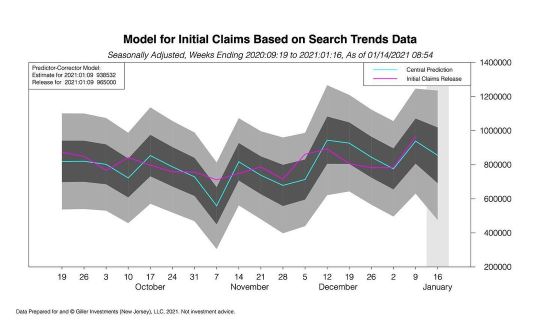

Consensus for initial claims was around 800,000. Our estimate for subscribers was 938,532 available last week. Release was 965,000 #datascience #alternativedata #ai #finance #markets #initialclaims #unemployment https://www.instagram.com/p/CKB0UhuAF6P/?igshid=15krgouy7dy3b

0 notes