#gstnews

Text

#gstupdates#gst#gstindia#gstr#incometax#tax#gstreturns#gstregistration#gstcouncil#india#taxes#business#incometaxindia#gstnews#accountant#charteredaccountant#taxation#incometaxreturn#accounting#finance#gstfiling#startup#gstreturn

2 notes

·

View notes

Text

Get Your GST Registration For Your Services and Takes GST Benefits...

#Legalcy#OfficialLegalcy#LegalcyPrivateLimited#gstregistration#gst#gstupdates#incometax#gstr#gstreturns#gstindia#tax#business#startup#india#gstfiling#taxes#incometaxreturn#incometaxindia#gstcouncil#gstnews#itr#accountant#accounting#companyregistration#charteredaccountant#msme#finance#ca#gstreturn#gsttax

1 note

·

View note

Text

Interim Budget 2024: A Comprehensive Analysis

Read Full Article: https://www.mygstrefund.com/interim-budget-2024-comprehensive-analysis/

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com

Join Our Community: community.mygstrefund.com

Contact Us: +91 9205005072

Mail- [email protected]

#NirmalaSitharaman#ViksitBharatBudget#Budget2024#UnionBudget#Budget#gst#gstcouncil#council#gstupdates#gstnews#gstindia#tax#costly#cheaper#items#gstrefund

0 notes

Text

#gst#gstindia#gstupdate#gstnews#gst2023#gstupdate2023#gstregistrationonline#GSTRegistration#gstregistrationconsultant#legaltax

0 notes

Text

GST, which stands for Goods and Services Tax, is a unified indirect tax system implemented in many countries, including India, Australia, Canada, and others. It is designed to replace multiple cascading taxes such as sales tax, value-added tax (VAT), and excise duty, streamlining the tax structure and promoting ease of doing business.

When it comes to e-commerce, GST plays a crucial role in ensuring fair taxation and a level playing field between online and offline sellers. Here are some key points to understand about GST in e-commerce:

Registration: E-commerce sellers are required to register for GST if their annual turnover exceeds the specified threshold set by the tax authorities. The threshold amount may vary between countries.

Tax Collection at Source (TCS): In some jurisdictions, e-commerce platforms are mandated to collect tax at source, known as Tax Collection at Source (TCS), on behalf of sellers. This is done to prevent tax evasion and improve tax compliance. The TCS amount is deposited with the government and can be utilized for claiming input tax credit.

Input Tax Credit (ITC): Under GST, registered e-commerce sellers can claim input tax credit on the taxes they have already paid on their purchases. This helps eliminate the cascading effect of taxes and reduces the overall tax burden.

Marketplace and Inventory-based Models: E-commerce platforms can operate under different models. In a marketplace model, the platform acts as an intermediary connecting buyers and sellers, while in an inventory-based model, the platform owns and sells the goods directly. The tax implications can vary based on the model, with different rules for TCS, invoicing, and compliance.

Place of Supply: GST considers the "place of supply" to determine the applicable tax rates and jurisdiction. For e-commerce transactions, the place of supply is typically the location of the buyer. Therefore, e-commerce sellers may need to charge GST based on the buyer's location, even if the seller is located in a different state or country.

Compliance and Filing Returns: E-commerce sellers are required to comply with GST regulations, including timely filing of tax returns, maintaining proper records, and providing accurate information. Non-compliance can result in penalties and legal consequences.

It's important to note that specific regulations and rules regarding GST in e-commerce can vary from country to country. Therefore, it's advisable to consult with a tax professional or refer to the official guidelines provided by the tax authorities in your jurisdiction for accurate and up-to-date information.

Read more: https://myefilings.com/understanding-gst-in-e-commerce/

#gst registration#myefilings#business#india#taxes#income tax#accounting#gst#company#gstupdates#gstnews#tax

0 notes

Text

GST Registration In Chennai

GST Registration In Chennai

Company Registration in Chennai

Chennai-1 Corporate office Asirvadham Apartment,No. 12, Flat No. 12A, Puliyar 2nd Main Road, 1st Lane, Trust Puram, Kodambakkam, Chennai - 600 024 Chennai-2 Address #56/80, Medavakkam Main Road, Keelkattalai, Chennai - 600 117. Landmark : Opp to Andhra Bank New Delhi Address B44,Birbal Road, Lajpat Nagar II, Lajpat Nagar, New Delhi, Delhi 110024 Bangalore Address No. 117/1, First Floor, 2nd Main Road, Shesadripuram, Bangalore – 560020 Landmark : Near Mantri mall Metro station Copyright © 2016 All rights Reserved;

INTRODUCTION GST :

All persons classified as taxable person under GST are required to obtain GST registration and begin filing GST monthly returns from the month of September, 2017. In this article, we look at the list of documents required for GST registration in India.

We provide below services:

1.GST Registration Consultants In Chennai

2.GST Consultants In Chennai

3.GST Registration Procedure In Chennai

4.GST Services In Chennai

Documents Required for GST Registration

1. PAN Card of the Business or Applicant

GST registration is linked to the PAN of the business. Hence, PAN must be obtained for the legal entity before applying for GST Registration.

2. Identity and Address Proof along with Photographs

The following persons are required to submit their identity proof and address proof along with photographs. For identity proof, documents like PAN, passport, driving license, Aadhaar card or voters identity card can be submitted. For address proof, documents like passport, driving license, Aadhaar card, voters identity card and ration card can be submitted.

Proprietary Concern — Proprietor

Partnership Firm / LLP — Managing/Authorized/Designated Partners (personal details of all partners are to be submitted but photos of only ten partners including that of Managing Partner are to be submitted)

Hindu Undivided Family — Karta

Company- Managing Director, Directors and the Authorized Person

Trust — Managing Trustee, Trustees and Authorized Person

Association of Persons or Body of Individuals-Members of Managing Committee (personal details of all members are to be submitted but photos of only ten members including that of Chairman are to be submitted)

Local Authority — CEO or his equivalent

Statutory Body — CEO or his equivalent

Others — Person(s) in Charge

3. Business Registration Document

Proof of business registration must be submitted for all types of entities. For proprietorships there is no requirement for submitting this document, as the proprietor and proprietorship are considered the same legal entity.

In case of partnership firm the partnership deed must be submitted. In case of LLP or Company, the incorporation certificate from MCA must be submitted. For other types of entities like society, trust, club, government department or body of individuals, registration certificate can be provided.

4. Address Proof for Place of Business

For all places of business mentioned in the GST registration application, address proof must be submitted. The following documents are acceptable as address proof for GST registration.

5. For Own premises

Any document in support of the ownership of the premises like latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

6. For Rented or Leased Premises

copy of the valid rental agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill. If rental agreement or lease deed is not available, then an affidavit to that effect along with any document in support of the possession of the premises like copy of electricity bill is acceptable.

7. SEZ Premises

If the principal place of business is located in an SEZ or the applicant is an SEZ developer, necessary documents/certificates issued by Government of India are required to be uploaded.

8. All Other Cases

For all other cases, a copy of the consent letter of the owner of the premises with any document in support of the ownership of the premises of the Consenter like Municipal Kharta copy or Electricity Bill copy. For shared properties also, the same documents can be uploaded.

9. Bank Account Proof

Scanned copy of the first page of bank passbook or the relevant page of bank statement or scanned copy of a cancelled cheque containing name of the Proprietor or Business entity, Bank Account No., MICR, IFSC and Branch details including code.

10. Digital Signature

All application for GST registration must be digitally signed with a Class 2 Digital Signature. Hence, its important that digital signature be obtained for the following person who is authorized to sign the GST registration application before beginning the application process.

0 notes

Text

Guidelines for Filing a Well-Known Trademark in India

A trademark serves as a visual representation of a company’s brand identity and reputation, making it a crucial asset. Notably, a well-known trademark offers firms an additional layer of legal protection because it is considered highly distinctive and exclusive in its sector.

The Trade Marks Act of 1999 governs well-known trademarks in India and gives companies a competitive edge. This article will discuss the guidelines for filing well known trademark in India.

Understanding What a Well-Known Trademark Is

A trademark with significant public recognition in India and widespread recognition within a certain industry is considered well-known. According to the Trade Marks Act, a trademark is well-known if it has gained widespread recognition among a sizable portion of the public who use the goods or services it is applied to.

The originality, distinctiveness, and superior quality of a well-known trademark are recognized, and its registration gives businesses a higher level of legal protection.

Conducting a Thorough Trademark Search

trademark registration, it is essential to conduct a thorough trademark search before submitting an application for a well known trademark. A thorough trademark search should consider common law trademarks, domain names, social media handles, foreign trademark databases, and the Indian trademark database. A thorough search lowers the possibility of disputes, protests, or opposition from other parties throughout the trademark registration procedure.

Choosing the Right Classification for Your Trademark

The Nice Classification System is used in India’s trademark system to categorize products and services into 45 classes. To avoid rejecting your application, choosing a suitable class for your products or services is crucial.

Businesses must classify their trademark by the Nice categorization System, an internationally recognized scheme that organizes products and services according to their nature.

Filing Well Known Trademark: Preparing the Application

To file a well-known trademark, businesses must apply with the Trade Marks Registry, and the application should include the following details:

1-The applicant’s name, address, and country of citizenship

2-The proposed trademark, together with any applicable translation or transliteration

3-The category or categories of products or services that the mark will cover

4-Documentation to support the claim that the mark is well-known

Providing Evidence of the Well-Known Status of Your Trademark

You must show that your trademark has been used and recognized in the marketplace in order to prove that it is well-known. This may consist of market research, sales information, press coverage, and other pertinent records.

The applicant bears the burden of proof, and the evidence must be convincing, unambiguous, and show both the trademark’s extensive use and distinctiveness.

Responding to Objections or Oppositions from Third Parties

The registration of your well-known trademark may be challenged by third parties throughout the trademark registration procedure. These objections or oppositions may be founded on a number of grounds, including the existence of competing trademarks, similarity to already-registered marks, or lack of distinctiveness.

It is crucial to respond to any protests or oppositions quickly and effectively and offer any extra justification or documents for your application.

Maintaining and Renewing Your Well-Known Trademark Registration

Once your well-known trademark has been registered, keeping up with registration renewals is essential to guarantee continued protection. Trademark registrations must be renewed every 10 years, and it is crucial to preserve correct and up-to-date records of your trademark use and registration.

Your well-known trademark protection could only be recovered if you renew your registration or keep appropriate documents.

Conclusion

It can be a difficult process that demands careful planning and attention to detail to file for a well-known trademark in India. Businesses can improve their chances of success in the trademark registration process by understanding the definition and advantages of a well-known trademark, conducting an exhaustive trademark search, choosing the right classification for your trademark, and offering convincing evidence of filing well known trademark.

To assure continued protection, it is also crucial to swiftly and effectively respond to any complaints or oppositions from third parties and to keep correct records of your trademark registration and use. By adhering to these rules, businesses may safeguard their brand identity and reputation in the marketplace and build a solid position in their sector.

Gstnitbuddies can help individuals and businesses file a well-known trademark in India by providing expert guidance and support. Our team of experienced trademark lawyers can assist with conducting a comprehensive search to ensure that the trademark is available for registration and meets the criteria for being classified as a well-known mark.

#taxconsultant#audit#msme#gstnews#caipcc#taxseason#tds#registration#cma#money#gstfiling#csstudents#charteredaccountants#bookkeeping#icaistudents#company#companyregistration#gstnitbuddies#fssai#tally#entrepreneur#taxrefund#accountingsoftware#taxreturn

1 note

·

View note

Text

Best Long Duration Mutual Funds

If you want to make long-term investments, then mutual funds are a great option. Mutual funds are an investment vehicle that pools the resources of multiple investors to purchase a portfolio of stocks, bonds, and other securities.

When it comes to long-term investments, picking the right mutual fund is key. With so many mutual funds available, choosing which is best for you can take time. To help you, we’ve compiled a list of the best long-duration mutual funds.

Franklin India Bluechip Fund: This fund is a top performer in the large-cap category. It has an impressive track record of outperforming its benchmark index over the long term. It has a relatively low expense ratio and a high return on investment.

ICICI Prudential Balanced Advantage Fund: This fund is a balanced fund that invests in both stocks and debt instruments. It has a low-risk profile and is well-diversified. It has a good track record of outperforming its benchmark index over the long term.

SBI Magnum Multi Cap Fund: This multi-cap fund invests in stocks across market capitalizations. It has a good long-term track record and is well-diversified. It has a moderate risk profile and a low expense ratio.

HDFC Tax Saver Fund: This fund is a tax-saving fund that invests in equities. It has a good long-term track record and has outperformed its benchmark index over the long term. It has a moderate risk profile and a low expense ratio.

These are some of the best long-duration mutual funds you should consider investing in. While these funds have performed well in the past, there is no guarantee that they will continue to perform well. So it is important to research and evaluates your risk tolerance before investing in any of these funds.

When should I invest in long-duration mutual funds?

When investing in long-duration mutual funds, the most important factor to consider is your current financial goals and needs. If you are looking for a low-risk, steady investment that can generate long-term returns, then long-duration mutual funds could be a good choice. Generally, long-duration mutual funds are appropriate for investors with a medium to a long-term investment horizon of at least five years.

Before investing in long-duration mutual funds, assessing your risk tolerance and financial goals is important. These funds tend to be more volatile than short-term investments, so it is important to understand the implications of investing in them. You should also research the fund’s performance and fees, as well as its investment objectives and strategies.

When investing in long-duration mutual funds, it is also important to diversify your portfolio. This will help to reduce risk and provide greater potential for long-term returns.

Additionally, it would help if you considered how you can use these funds to meet your financial goals. For example, consider setting aside a portion of your portfolio for growth investments while also investing in funds with a higher level of stability.

What does investing in long-duration mutual funds actually mean?

Investing in long-duration mutual funds is a strategy that can help investors maximize returns by investing in stocks or bonds with a longer period of maturity or holding period. Long-duration mutual funds typically include stocks or bonds that have a maturity date of at least five years. By investing in these types of funds, investors can benefit from the compounding of returns over a long period of time, as well as the potential for higher returns than short-term investments.

When investing in long-duration mutual funds, investors can expect to be exposed to a variety of different industries and sectors, which can help to reduce risk and provide diversification. Additionally, most mutual fund providers offer different types of funds that can be tailored to meet individual goals and objectives.

Long-duration mutual funds can be a great way to grow wealth over the long term. However, it is important to understand the potential risks and rewards associated with these investments. Generally, the longer the holding period of the fund, the higher the potential returns; however, this also comes with higher levels of risk. Additionally, the performance of the fund will be dependent on the market conditions, so investors should always be aware of any changes that can affect their investments.

Investing in long-duration mutual funds can be a great way to diversify an investment portfolio and increase returns over the long term. However, it is important to understand the risks and rewards associated with these investments, as well as any market conditions that may affect the performance of the fund. Gstnitbuddies is an online legal services platform that can help you with mutual funds in a variety of ways

#taxconsultant#audit#msme#gstnews#caipcc#taxseason#tds#registration#cma#money#gstfiling#csstudents#charteredaccountants#bookkeeping#icaistudents#company#companyregistration#gstnitbuddies#fssai#tally#entrepreneur#taxrefund#accountingsoftware#taxreturn

1 note

·

View note

Text

Streamline Your Business Finances with Expert GST Consultants in Kochi

GST registration enables small, micro, and medium-sized businesses to explore opportunities to do business with Indian corporations. As a result, the growth and development of any business is straightforwardly relative to the country’s goods and services tax.

GST Registration and Compliances Consultants in Kochi, Kerala, Chennai, we assist new and existing businesses in GST Registration, Returns and Other Compliances.

GST registration in Kochi necessitates the submission of simply a few documents. In addition, depending on the organization or business, a few other documents may be necessary for GST registration. However, there are a few standard documents that are required by law.

Business PAN card or Applicant

Address Proof of Business

Identity & Promoters Address Proof

Bank Account Details

#gstindia#gst#gstupdates#gstr#incometax#tax#gstreturns#india#business#gstcouncil#gstregistration#taxes#incometaxindia#accounting#gstnews#accountant#taxation#ca#incometaxreturn#finance#icai#charteredaccountant#itr#startup#gstfiling#gstreturn#castudents#gstupdate#b#gsttax

0 notes

Text

youtube

#newrules#newyear2023#gst#rules#petrol#lpggas#indiaeconomy#gstgrowth#craditcard#cng#cnggas#gas#1jan2023#1january2023#newrules2023#indianpublic#gstnews#trendding#trendingnews#newrulesfromjanuary2023#govt#govtrules#Youtube

0 notes

Text

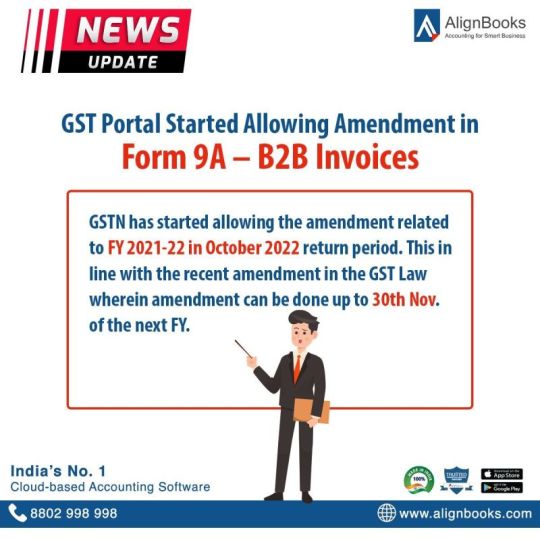

News Alert!!

In the October 2022 return period, GSTN began permitting amendments connected to the FY 2021–2022 period.

This is consistent with a recent revision to the GST Law that allows amendments up until November 30 of the next fiscal year.

The specifics of taxable outward supplies made to the registered person that has previously been reported in table 4A, 4B, 6B, and 6C - B2B Invoices - may be changed by the taxpayer.

To look for the invoice, the taxpayer must enter the financial year and invoice number before clicking on "Amend Record."

Visit to know more- GST - press release (https://buff.ly/39dj1rA)

To get your e-invoicing software click here & get a free trial- https://buff.ly/3TpmHwd

#news#gstnews#einvoice#accountingsoftware#erp#gstreforms#alignbooks#OnlyOnAlignBooks#AlignwithAlign#tax#billing

0 notes

Text

#gstcompliance#gstr#gst#gstindia#gstupdates#gstreturns#business#gstnews#gstregistration#india#startup#indiabusiness#reconciliations#trust#reliable#innovation#Ofinlegal

1 note

·

View note

Text

E-Invoicing and its Impact on GST Compliance

E-Invoicing is reshaping GST compliance, automating the exchange of invoices between businesses and tax authorities. It simplifies reporting, reduces errors, and enhances transparency. Stay ahead in the digital era with this game-changing technology.

Read Our Detailed article in the below link 👇- https://www.mygstrefund.com/e-Invoicing-impact-on-gst-compliance

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com

Contact Us:- +91 9205005072

Mail- [email protected]

1 note

·

View note

Text

#gstregistration#gst#gstupdates#incometax#gstr#gstreturns#gstindia#tax#business#startup#india#gstfiling#taxes#incometaxreturn#incometaxindia#gstcouncil#gstnews#itr#accountant#accounting#companyregistration#charteredaccountant#msme#finance#ca#gstreturn#gsttax#taxation#icai#company

1 note

·

View note

Text

Online Registration of Gst - Eligibility - Process - Benefits | Gst & It Buddies

#taxconsultant#audit#msme#gstnews#caipcc#taxseason#tds#registration#cma#money#gstfiling#csstudents#charteredaccountants#bookkeeping#icaistudents#company#companyregistration#gstnitbuddies#fssai#tally#entrepreneur#taxrefund#accountingsoftware#taxreturn#gstreturn

0 notes