#gstfiling

Text

File Your GST Return On Time

(Avoid the last-minute rush)

👉🏻Contact us now 📞 +91-9811811991 / 9355533535

👉🏻Inquiry Form:- https://forms.gle/f1cyTwU9fetVMZkA8

#GSTReturnFiling#GST#GSTRegistration#shaaviprofessionalpvtltd#Gurgaon#taxprofessional#taxpayers#business#return#gstfiling#taxation#AvoidLateFees

3 notes

·

View notes

Text

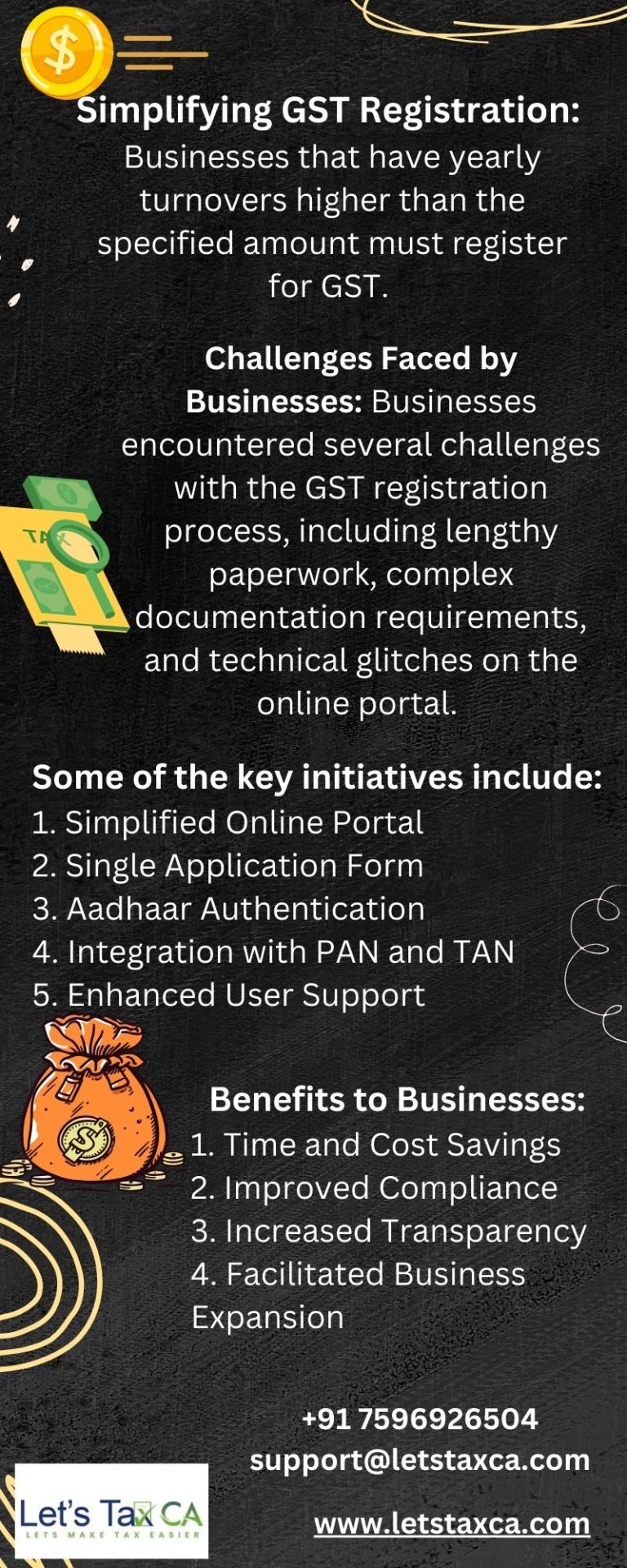

Streamline your business today with GST registration and make your business more efficient and organized!

#GSTRegistration#GSTIN#businessgrowth#GST#gstindia#business#startup#india#gstfiling#accounting#ofinlegal

4 notes

·

View notes

Text

#ddhan#tax#taxes#taxconsultant#taxation#taxaccountant#taxcompliance#taxadvice#taxcredits#taxhelp#professionals#taxprofessional#taxprofessionals#gst#gstreturns#gstfiling#incometax#incometaxreturn#incometaxindia#taxfiling#gstcompliance#incometaxreturnfiling#tds#directtax#indirecttax#taxmanagement

3 notes

·

View notes

Text

1 note

·

View note

Text

Future Trends and Innovations of E-way bills:

As we gaze into the crystal ball of logistics, what does the future hold for e-way bills? One emerging trend is the integration of e-way bill systems with emerging technologies such as blockchain and artificial intelligence.

These innovations promise to enhance the efficiency and security of e-way bill management, ushering in a new era of digitized logistics. Moreover, with the advent of smart transportation solutions and IoT-enabled tracking devices, the monitoring and management of e-way bills are set to become even more streamlined and automated.

Indeed, the future of e-way bills is brimming with possibilities, poised to revolutionize the way we transport goods across borders.

#gstfiling#businesstaxes#gststructure#gstreturns#businesscompliance#businesssupport#financialhealth#taxcompliance#financialmanagement#taxregulations

0 notes

Text

Get your GST Number through GST Registration from Registration Guru.

For more information

Call us:- 9811536872

Visit us:- https://registrationguru.in/gst-registration

Email us:- [email protected]

1 note

·

View note

Text

Super rich and their (lol) taxes

#super rich kids#super rich#property taxes#us taxes#death and taxes game#filing taxes#taxes#tax#gst registration#gstfiling#gstreturns#gst accounting software for retail#gst#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#eat the rich#eat the fucking rich#tax avoidance#tax accountant#tax season#tax advisor & preparation

0 notes

Text

Know What is a Temporary Reference Number in GST

Registering GST for a business means getting a unique code of 15 digits. That is Temporary Reference Number (TRN).It is called a Goods and Services Tax Identification Number. GST registration is a fundamental need for business identification. It is also required for compliance verification and any tax purposes. You can track application status using Temporary Reference Number after registration.

Registration of GST is mandatory, if the aggregate value exceeds INR 40 lakhs.

"View More Information about What is a Temporary Reference Number in GST

0 notes

Text

GST Return Filing Services by Tax4India

GST Return Filing Services

Get your GST Return Filing with Tax4India expert team

Call Now: +91 92516 54050

Visit our website: www.tax4india.org

.

.

.

.

.

.

.

1 note

·

View note

Text

Gross Turnover Audit

A gross turnover audit ensures accuracy and respect for financial standards by carefully examining the entire sales income of the organization with ZE Global. A thorough review of contracts, invoices, financial statements, and sales records ensures that reported gross turnover figures are accurate. By performing a gross turnover audit, businesses can find faults, spot inconsistencies, and stop financial fraud or misstatements. It promotes openness and trust by giving stakeholders confidence about the accuracy of financial data. Businesses can easily navigate complex financial landscapes and make well-informed decisions with competent auditors skilled at financial analysis and regulatory compliance. Put your trust in the skills of experts to carry out a comprehensive Gross Turnover Audit, protecting the accuracy of your company’s financial reporting and boosting confidence with stakeholders, investors, and government agencies.

Visit Now: https://www.zeglobal.com.sg/audit-services

0 notes

Text

Unleash Your Business Implicit Get GST Registration with Muneemg

Are you ready to take your business to the coming position? Look no farther! Muneemg is then to streamline your GST enrollment process, making it easier than ever to misbehave with duty regulations and unlock growth openings for your business. Why choose Muneemg for your GST Registration needs? Then is what sets us piecemeal Expert Guidance Our platoon of educated professionals understands the sways and outs of GST enrollment . We will guide you through every step of the process, icing compliance with all applicable laws and regulations. effectiveness Time is plutocrat, and we value both. With Muneemg, you can say farewell to the hassle of navigating complex paperwork and lengthy processes. We will handle everything fleetly and efficiently, so you can concentrate on what you do stylish – running your business. Cost-Effective results We believe in furnishing top- notch services at affordable prices. With Muneemg, you will get quality backing without breaking the bank. Our transparent pricing ensures no surprises along the way. Peace of Mind With Muneemg by your side, you can rest easy knowing that your GST enrollment is in able hands. We will insure compliance with all legal conditions, giving you peace of mind to concentrate on growing your business.

0 notes

Text

GST Registration in India:

100% Easy Online Process

0 notes

Text

Best online GST Registration in Gurugram

Looking for expert assistance with GST registration in Gurgaon? Look no further than Adya Financial. With years of experience and a dedicated team led by CA Anita, we provide comprehensive GST registration services tailored to meet your business needs. Our team ensures a smooth and hassle-free registration process, handling all the paperwork and compliance requirements efficiently. Whether you're a small startup or a large corporation, we offer personalized solutions to help you navigate the complexities of GST registration.

Contact us today at +91 9873549201 to get started with your GST registration in Gurgaon. Don't let the complexities of GST compliance overwhelm you. Let Adya Financial take care of it for you, so you can focus on what you do best – growing your business. Trust us to be your reliable partner in ensuring seamless GST registration and compliance.

#adyafinancial #GSTRegistration #GSTRegistrationinGurgaon

0 notes

Text

COMPANY REGISTRATION PROCESS ONLINE WITH LEGALCY PRIVATE LIMITED.

#Legalcy#legalcyPvtLtd#legalcyPrivateLimited#companyregistration#gst#company#business#registration#startup#tax#trademark#businessregistration#companyformation#fssai#gstregistration#incometax#msme#gstupdates#startupbusiness#india#gstfiling#smallbusiness#cacregistration#privatelimitedcompany#llp#license#incometaxreturn#itr#accounting#entrepreneur

0 notes

Text

GSTR 1 Updates 2024: E-commerce Operator, Table 14 & 15 Explained!

Delve into the recent changes in GSTR 1 starting January 2024! Participate in our enlightening session as we unravel the inclusion of Table 14, which requires suppliers and online sellers to document e-commerce-facilitated supplies. Explore Table 15, shedding light on the responsibilities of e-commerce operators when reporting supplies through their platforms. Understand the implications of these modifications on Table 3.1.1 in GSTR 3B, now set to be automatically populated. Our discussion on GST portal alterations includes practical examples to clearly understand the practical impact of these crucial updates. Stay well-informed with this comprehensive guide to stay ahead in the game!

youtube

0 notes

Text

E-Way Bills in Practice:

Now that we’ve covered the theoretical aspects of e-way bills, let’s take a peek into how they work in the real world. Imagine a scenario where a manufacturer based in Gujarat needs to transport a consignment of goods to a distributor in Maharashtra.

To ensure compliance with e-way bill regulations, the manufacturer logs into the designated e-way bill portal, fills in the required details about the goods, and generates an e-way bill. This digital document accompanies the goods throughout their journey, serving as a virtual escort, guiding them safely across state borders.

At the same time, authorities can track the movement of the goods in real-time, ensuring transparency and tax compliance

#gstfiling#businesstaxes#businesscompliance#gstreturns#gststructure#businesssupport#financialhealth#financialmanagement#taxregulations#taxcompliance

0 notes