#fireblogger

Text

Small Life Update

Hello everyone!

I just got married, and moved to a different state!

Both decisions were financially motivated (no I did not marry him for the money - I mean, I did. But not his money. I wrote us a prenup that made it clear his money was his and mine was mine).

I've mentioned in the past the potential tax benefits of getting married. Especially the increased HSA contributions and the potential reduced tax burden. Well, my dropping to part time and his getting a way better job meant that filing jointly would actually save us several thousand on our federal tax bill. Not counting his ability to contribute $7k to his HSA pre-tax!

Beyond that, I've left the state I was born and raised in. And have instead moved to a gorgeous state with no income tax, this will save both of us about 7% of our incomes. And we are renting here (and renting out the duplex we own) so we don't pay the higher property taxes. Win win! In fact, the rent for half our duplex is almost exactly what we will be paying for an apartment in the new state, so our net expense change will be almost neutral.

Honestly, the best part is being around trees again. I've always lived in a desert, and my favorite vacation was driving about four hours to the nearest national forest. Now I live in a tree filled city, that's actual trees rather than flower only fruit trees carefully placed by the city.

1 note

·

View note

Photo

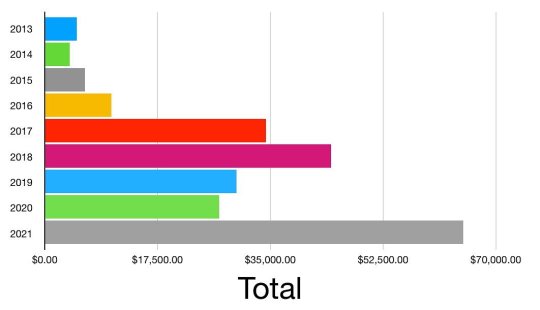

Total distributions in 2021 are absolutely crushing it. I was expecting Capital gains distributions and dividend increases but not to this extent. Almost a 500% YOY increase in CG and 35% YOY increase in dividends. #reinvested #StockMarket #personalfinance #fireblogger #finacialfreedom https://www.instagram.com/p/CX40VdKlfnb/?utm_medium=tumblr

1 note

·

View note

Text

Common Money Mistakes

Disposing of disposable income. As you move into the corporate world, or your trade, or even get a promotion at your current job you may start seeing more money coming into your account. Bigger paychecks, better benefits, maybe even bonuses. You’ll probably also start seeing some bigger temptations. When I first started getting a decent paycheck my temptation was to go to the mall and shop at stores like JCPenney’s or Torrid. Now, I spent my entire life buying clothes at second hand stores a couple shirts and pairs of jeans a year. So Torrid’s nice business clothes? That was fancy. I went, I found a brand they carried that I liked quite a bit and I bought several shirts and a few pairs of pants, a blazer with some blouses Maybe spent a couple hundred over a few months, now it would not be exaggerating to say that’s about how much I had spent on clothes my entire life. ($10-15 annual budget 6th grade onwards). And at first it was nice, I was so happy to have made it to the point where I could go out and buy myself a nice shirt. And you know what, that was nice. But it didn’t make me happy in the long-term. After two or three months I stopped going – because sure now I had some nice shirts and business clothes, but I never really wore them. Instead, I started buying Gildan brand shirts online from shops like blankapparel. They’re $2-3 heavy cotton shirts that last forever and are really nice quality. All that disposal income I had been disposing of on clothes was rerouted to high-yield savings accounts instead.

Spending too much on housing. Now, I’m a sucker for an apartment with a washer and dryer in the unit. When I bought my duplex literally what I was most excited about was the fact that there was a washer and dryer. I’m not kidding the first night I drove up an hour from my apartment just to do half a load of laundry. So I can absolutely understand wanting to spend extra on a location with a washer and dryer – but the question is how much extra in my area a washer and dryer can increase rent by ~$100/month if not more. The rule I’ve heard several times is to spend less than 30% of your income on your housing, however that percent is greatly dependent on the cost of living. My rule of thumb – get the cheapest livable place you can find with as many roommates as you can stand. I spent years wishing I had a washer and dryer and instead spent years saving that extra $100 a month (well $50 since I had at least one roommate). So my advice is to find somewhere that’s close enough to your job/school that you can still get there with heating/cooling/no pests and to start saving money from there. Of course, if having an really nice apartment, or having privacy with no roommates is important to you take that into consideration. Just make sure you are considering the future value of that extra rent money instead of just the present value.

Debt. Emergency funds are important, and everyone should have something even if it’s not the 3 – 6 months salary that’s often recommended. Honestly, even an emergency $100 could be very important to have. Some people will use credit cards as their emergency fund, this should be your absolute last resort. Credit cards have very high interest rates, which means that any expenses paid for on a card will grow at an alarmingly fast rate. Say you have a sudden $500 expense, and you have a 24% APY credit card. That means that you will need to pay an additional 2% of interest every month. But because that 2% of interest is compounding it’s not the same as adding $10 every month, instead it’s adding $10 of principal. Which means that your next 2% interest add is 510 * 1.02 rather than 500 * 1.02. Let’s say in this scenario that you make a payment of $15 a month towards your $500 debt. It will take you 56 months to pay down the balance, and you will end up paying over $332 in interest. Making your total cost closer to $832.It will take almost two years before your $15 payment goes more towards principal than interest! Now imagine spending that $500 on a new phone, or pair of shoes, or some other non-essential non-emergency. It’s a bad idea.

Not saving for Retirement. Now this whole blog is geared towards early retirement, but that’s not everyone’s cup of tea. Maybe you like your job. Maybe you don’t mind your job and prefer living at a certain income level rather than trying to save every penny for retirement. Maybe you’re early in your career and don’t feel like you make enough to save for early retirement. You should still be saving for retirement. The greatest asset we have is time, and investing earlier even if it’s in small amounts, gives it time to grow. A $1,000 invested when you’re 25 can grow to be double what $1,000 invested when you’re 35 would. Even if it’s only a few dollars a week start investing early, brokerage platforms like Robinhood have very low minimums and you can invest in funds or ETFs on it.

If you invest, don’t be conservative. I had this problem when I first started investing. I let an older finance manager invest my first $3,000 with the understanding that it would be a retirement account. HE PUT IT ALL I N BONDS???? Okay, I’m young, I should be focused on growth with most if not all of my funds in stock. They’re higher risk, but if I’m planning on holding them for 20-30 years that risk is greatly mitigated. I lost over a year of growth before I realized that the retirement fund he had put my money in was intended for people in the 50s to 60s that already had a decent amount of value and now needed lower risk and lower growth investment vehicles. Since I moved my portfolio out of bonds and into stocks it has nearly doubled, the red line is when I realized my mistake and switched my funds into a stock portfolio.

Go big or Go Home!

0 notes

Photo

Лесной ароматный кофе в турке #карантин #lsa_bushcraft_outdoor© #lsa_outdoor #lsaoutdoor #shepochnitsa #bushcraft #bushcraftblogger #bushcrafttools #bushcraftstove #туркадлякофе #кофевтурке #щепочница #печьщепочница #безопасность #stoves #stove #foodphotography #fireblogger https://www.instagram.com/p/B-2rImlBPjb/?igshid=n4fcjeucc12m

#карантин#lsa_bushcraft_outdoor©#lsa_outdoor#lsaoutdoor#shepochnitsa#bushcraft#bushcraftblogger#bushcrafttools#bushcraftstove#туркадлякофе#кофевтурке#щепочница#печьщепочница#безопасность#stoves#stove#foodphotography#fireblogger

0 notes

Photo

💯"Hustle Until"...!👍Keep Moving...!👣Shout out @fire.blogger - #fireblogger #followme #me #quotes #innovation #love #friday #positive #motivation #wisdom #inspiration #quote #repost #HustleUntil #Winning @and14all_brand

#fireblogger#love#me#friday#motivation#wisdom#quote#quotes#positive#winning#followme#inspiration#repost#innovation#hustleuntil

0 notes

Photo

This one's HOT! Get yours quick!! www.BomberoDesigns.com ・・・ #bomberodesigns #firefighter #fireshirt #offdutyfirefighter #bombero #firefighterowned #firstresponderowned #firefighterwife #firewife #fireblogger #paramedic #emt #firemedic

#fireblogger#bomberodesigns#offdutyfirefighter#firefighterowned#firefighterwife#firefighter#firewife#emt#firemedic#fireshirt#paramedic#firstresponderowned#bombero

0 notes

Text

Have you ever wanted to win the lottery?

Not going to lie, I have daydreamed about winning it sooo many times. Planned exactly how I would invest all the money, how I would retire on it. How I would be able to help my family out financially, etc.

But, it’s impossible for me to win. Why? Because it doesn’t make sense to buy lottery tickets. Your return on investment is going to be extremely low unless you’re extremely lucky.

However, I recently found a “bank” (its a pass through bank like Chime where your actual money is under a different bank but you use their app to access it) with a weekly prize drawing. Prizes up to 10 million dollars.

You get a ticket per $25 in your account. And can get bonus tickets for setting up recurring deposits and direct deposits.

The beauty of it is you don’t have to spend anything to get tickets and chances to win. The money you have deposited is FDIC insured. What you are paying with is the opportunity to make more money elsewhere, for the chance to win here.

The bank is called Yotta, and it pays 0.2% interest (compared to a 0.6% high yield savings account you can get elsewhere). However, depending on your winnings your returns might be higher. Think of it like a slightly riskier and slightly more rewarding investment than a regular high yield savings account is, with no risk regarding your principal (the money you deposit) the only thing you stand to lose is that extra 0.4% interest rate!

One last minor perk! If you sign up with my link you get an extra 100 tickets - but they aren’t applied to your account immediately. They apply at the beginning of the next week (or current week if a number hasn’t been drawn) to maximize your possible return!

Im seizing my chance to play the lottery! And I’m going to continue to do it until high yield savings accounts start offering rates a bit better than 0.6% 😁

Hey - Join me on Yotta using my referral code AMANDA9374 and we’ll both get 100 tickets. Yotta is an FDIC insured savings account recently featured in Bloomberg and Forbes where you can win prizes up to $10M every week. https://join.withyotta.com/AMANDA9374

12 notes

·

View notes

Text

New Plan

January this year I spent $5,000 to pay off my under-grad student loan.

July this year I got a $5,000 student loan, the first semester’s distribution.

My plans have changed. Originally I was going to work part time during school and pay for it out of pocket. But then this fall I got into a bunch of extra-curriculars that I really want to participate in - and that are nice lines on a resume.

My new plan is to pay for school with student loans, and quit my job to focus on school. I’m really not happy about being in (non-mortgage) debt. But, if I pay the loan off in 5 years (which should be feasible) then it’s basically a $3,000 fee to be able to be a full time student without the stress of work.

Fingers crossed it works out!

2 notes

·

View notes

Text

Tips to Reduce Spending

I’ve never had a problem with my monthly budget, mainly because it doesn’t exist. I naturally spend less than I make, therefore there’s always some money for the bills and rarely some time spent managing my money. It’s not a good situation to be in, it’s not the worse by any means, but if you want to build your savings and retire earlier you need to be deliberate with your spending and savings choices.

This is traditionally done with a budget. Now I’m not going to lie, I’m terrible at budgets. I can create them no problem, but remembering to actually follow them? Good luck.

1. The first step to create a budget is to document your expenses. If you don’t know how much you tend to spend then it will be very difficult to create an effective budget. If most of your transactions are on debit and credit cards, then you can go back through previous months to track your spending. Or you can start tracking today so you have a better idea in the future.

2. Once you have a good idea of how much money you tend to spend on various categories you can start building the budget itself. (Don’t forget about annual or semi-annual expenses like car insurance). Make sure you are aware of the differences between needs and wants when you are budgeting.

3. Once you have a budget you aren’t done, you should continue to track your expenses and adjust the budget as needed.

So, now you have a budget. How does that translate to actually spending less money? Here are some behavioral tips to help spend less money:

· Now that you know about how much you spend on things start paying for them in cash. When you go to a grocery store with a $100 bill (or a $100 gift card) you are forced to spend less than that $100. You can’t go over, but if you had a debit card a $112 bill would approve even though it was $12 over your budget.

· Change your daily habits to avoid temptation. Does your route to or from home pass by a fast-food restaurant that you just love? Did you just notice that you actually spend $50 a month there on coffee and French fries? Try taking a side street so you never see the sign. Do you habitually order delivery through your handy-dandy phone? Try deleting the apps, not seeing them on the phone can reduce temptation and the extra step of needing to redownload every time can slow you down when you’re thinking about ordering. Even if you don’t want to delete the app you can hide in somewhere in the back folders of your phone so you don’t see the icon and thing huh, think imma get myself some pizza.

· If there’s a consistent ‘treat’ you like to get, think about low-cost alternatives. For example, I love pizza. Like, it’s not healthy, neither is my solution but we’re talking about money not fitness. I will often keep some tortilla shells, a cheese blend, and a bag of pepperonis on site. Then if I’m craving pizza, I can make myself a 400 calories pizza roll that costs less than 50 cents instead of spending the minimum of $10 (to deliver) which usually ends up being a $12 order which also has a delivery charge, tax, and tip and becomes something closer to $20 for a single craving?

· Consider how your spending habits change when you’re emotional, are you more likely to buy yourself a treat and how much does that treat cost a month? Make the decision before-hand to redirect emotional buying to other positive behaviors instead. Things like working out, calling a friend, drawing a doodle of whoever pissed you off then burning it in the sink, or meditating. Whatever you do, don’t open up Amazon.

· Ask yourself if you need something or want something before you buy it. Do you need those new shoes? Or do you want them? Taking the time to add one more mental step before actually spending the money can help reduce impulse purchases. My No Spend Year | Michelle McGagh | TEDxManchester is a great TED Talk on this topic.

· Forget trends. Don’t even bother trying to keep up with all the newest fads. And if a fad looks really cool? Take a step back and ask yourself if you really think that this new item is actually useful and will add joy to your life, or if you just think it is because of herd mentality.

· Don’t go into debt to buy things. This mainly applies to credit-card debt and doesn’t really apply to houses (especially if you plan on getting a duplex and renting out of it). If there’s something that’s really cool, it will still be really cool when you have the money saved up to buy it in cash. It might even be really cool and cheaper if a new model comes out in the meantime.

Pay down your debts. This is less advice to reduce immediate spending and more advice to avoid future spending on interest payments. There are two main schools of thought when it comes to paying down debt:

1. Start with the high interest debt. This makes the most logical sense as high-interest debt will end up costing you more in the long run.

2. Start with the lowest balance, regardless of debt: This makes the most emotional sense. People are human, and they like to see progress on their goals. The feeling of success when you pay off a debt completely can help spur you on to tackle the next debt.

Starting with the high interest debt is my preference. I want to save every penny possible, and that’s the way to do it. But if you know that you may have difficulty sticking to a plan, or if you want the satisfaction of paying off your debt then the second option is a fine one to take.

Changing your behavior and paying down debt are some of the harder steps to take when trying to spend less money overall. Here are some simpler, practical, pieces of advice:

· Buy in bulk. When you go grocery shopping do some meal planning first and buy in bulk. If you have a larger family then stores like Costco or Sam’s Club can be very useful to get some discounted prices. However, if you’re like me and live in a very small household then buying some items in bulk at a local cheap grocery store can be just as effective without cluttering up limited storage space.

· Explore secondhand shops for new appliances, clothes, furniture, etc. Online marketplaces like Craigslist and Facebook Marketplace can be great places to get good deals. There’s no need to spend $50 on a waffle iron when the Youth Ranch down the street or Bob around the corner is selling one for $5.

· Price-shop. Amazon won’t always have the cheapest prices, and while convenience is nice they aren’t the only home delivery store. Shop around to see where you can get the best price for your purchases.

· Don’t buy as much stuff, borrow it if you can. If anyone knows me then know how much I love books. I used to have multiple bookcase that I would move about once a year when I switched apartments. Over time I forced myself to give away or sell most of them, and now check the local library for my next read. And by now I mean pre-COVID-19. But post Covid I’m sure I’ll be back at it!

· Look for long lasting, high-quality versions of products. A nice pair of shoes can last you five years or more in my experience. If you can, save up for the longer lasting versions so you don’t have to replace them as often.

· Reduce any monthly bills that you can. If you consistently have rollover data that may mean that you should pay less for less data. If you’re going to the gym just to use the treadmill, consider walking around the block a few times instead. Decide if you really need all those streaming services that you pay for.

· Adjust the thermostat, especially if your home isn’t especially energy efficient. Keep the apartment a little colder in the winter and a little warmer in the summer for power savings.

Finally, this is all well and good. But how do you actually follow through? The best person to answer this is yourself, but here are a few options:

1. Get an accountability partner. You can go through each other’s finances to make sure you are hitting your goals. Having an extra set of eyes can be incredibly useful to not only spot places where expenses can be curbed, but to make sure that what’s on paper matches what you wanted there to be.

2. Pay for everything in cash. This is reminiscent of Dave Ramsey’s cash budget. But if you have an envelope of cash labeled food, and that’s all the fast food and grocery money you have for the month it will be difficult to go over the limit. There’s also something more visceral in giving up cash as opposed to sliding a card that may make you think twice about going through with your purchase.

3. Feel broke to be rich. Try opening a second bank account for your paycheck and bills, then set up a recurring transfer to your main checking account. If you never see the bulk of your money, and if your bank balance looks low every time you open the app to check it may be easier to avoid spending money. This isn’t a mindset that everyone wants to be in, but I’ve found that constantly feeling broke means I am far less likely to spend money on frivolities.

If you have more ideas on how to save money on a daily basis leave a comment below!

9 notes

·

View notes

Text

High Income ≠ Being Rich

What do you think of when you say you want to be rich? Do you think you're tired of people calling you Richard?

Don't worry, I know I'm not funny :)

When I talk to people who say they want to be rich they're often thinking of high salaries, anywhere from $60,000 - $1,000,000 depending on where they live and what living expenses are to them. But your income doesn't determine how rich you are, instead your spending determines how rich you are. Your goals play into it too.

I mean, just look at https://newrepublic.com/article/158555/whiners-earn-200000-complain-theyre-broke. Your salary could double or more without changing your economic posistion. (I mean, in the long run. Short term it would surely help). Making $50,000 a year is very different in New York, New York compared to a small town in the middle of Montana. And $50,000 a year is different to people with high credit card debt than to brigh-eyed bushy tailed kids out of college.

Let's use me for an example, I can't really afford to eat out more than once a month. And when I say eat out - I mean iHop, Applebees, that sort of cost. Upgrading my internet in this rural town? Fuggedaboutit. But my friends, who are younger than me and still working in the retail/food jobs can afford to go out far more often! (I'm pretty sure their internet is cheaper too, but they still live about 40 minutes away from me and they have infrastructure).

Why? Because of expenses. I spend 70% of my paycheck on retirment accounts and taxes, and while I could stop those contributions and start buying some (insert fancy restaurant here, all I could come up with was Red Lobster. . . ) one a week I'm not going to. Instead I'm going to live far, farr below my means and work less.

So, who's rich? Me, or my friends? The answer is actually both of us.

I may be broke but I've got assets building and I can pay all my bills. I'm making progress towards my goals, and I live comfortably because my idea of living comfortably is pretty darn cheap. When I went car shopping my standard was air conditioning (and that it runs of course). That has saved me a ton of money in actual car costs as well as insurance and interst.

My friends may not be investing as much, but they are enjoying life and they can pay their bills. One of them has bought a nice car because having a nice car is important to them, they have a studio apartment because privacy is important to them.

My point is, figure out what's important to you. And then figure out how much that's going to cost you. Who cares if you're making $50,000 or $200,000 if you can be happy on $15,000?

And that's that. That's the secret to being rich, live on less that you get.

I'm going to follow up on this to say that I'm trying to be concious of people who don't yet make enough. Not everyone is in a position where they can reduce their means. You may want to move two cities over because the housing costs are so much lower, but you need a deposit first.

I'm not trying to say everyone is rich. Just that being rich is closer than $100,000 a year.

And the whole money doesn't buy happiness? Bullshit, to a point. Money makes you happier for as far as it covers your expenses and lets you experience new things. I belive $70,000 is the median income before the increased happiness to increased money correllation tapers off. Having $70,000 a year should would make me happier, but that doesn't change the fact that I am rich because I spent my entire working career spending as little as possible to save as much as possible. And I got used to having < $12,000 a year so now $15,000 makes me feel great!

#Rich#personal happiness#investing#finance#retirement#fireblogger#retire early#leave below your means#money

4 notes

·

View notes

Text

Pets & Finances

I love cats, and dogs are okay, I guess.

I bring it up because a friend got two kittens, and they are just adorable!!! Also, well, because there are many people from work who have adopted and are just constantly sharing pictures of their new animal companions.

What they aren't sharing is the increase in bills that they all surely have!

Animals can be expensive. Money-wise, a small dog can cost almost $750 a year to care for, a larger dog can get past $1,000 (Take a look at this chart). They can be expensive time commitments too. And they are long-term.

So, what can you do to get ready for a pet?

Build a budget. When you're planning on getting a pet you will need to consider all of the costs, including feeding, exercising, and caring for the animal. How much food will they eat, how much will that cost? While it's important to budget for all the recurring bills you also need to be aware of period bills or one-time expenses: neutering costs, a leash/collar, a scratching post? Is your chosen pet breed prone to health problems that will skyrocket end-of-life care for the animal? How much will you need to spend on vet bills and 'do it yourself' treatments like flea medication?

Think of equipment. I briefly mentioned one-time costs like leashes or collars, but what if you want to get a fish or a reptile of some kind? The initial setup for those kinds of animals can be high since you have to purchase vivariums/aquariums, UV lighting, heat lighting, humidity control, water filters, the little scuba guy for the tank, etc.

Look for resources at your local animal shelter. Not only is adopting far cheaper than purchasing a new animal many animal shelters will also spay/neuter your cat/dog for a low price. Depending on your area they may also offer vaccinations.

Think about pet insurance. There's rent insurance, home insurance, life insurance, car insurance, why shouldn't there be pet insurance? Medical bills can get expensive, and it's no different for vet bills. If you have pet insurance then you will have some peace of mind regarding any potential medical emergencies that may arise. Additionally, end-of-life care can be more affordable.

Be active! This is especially true for dogs, you should exercise with your pet. Things like taking them out for a walk, playing fetch, or engaging in other activities with your dog can reduce stress (yours and the dog's), improve health (yours and the dog's), and reduce behavioral problems! Cats also (obviously) benefit from interacting with their human! Playing with them increases their activity levels and thus exercise levels helping them maintain healthy weights, it also gives them breaks from boredom which will offset potential lethargic or depressed behaviors, and it improves their bond with you!

5 notes

·

View notes

Text

SMART Financial Goals

Specific

Measurable

Achievable

Rewarding

Trackable

SMART goals are great to use in all aspects of your life, and that includes your finances.

SPECIFIC:

When you set goals you want to be specific, sure “I want to be rich” sounds nice. But what does that mean? If I could get $40-50K in passive income a year I would consider myself very rich, but some people aim for $200k in passive income a year! It depends greatly on the life you want to live, and where you want to live it.

Similarly, “I want to retire early,” I want to retire early! But I’m not sure exactly when. Do I want to work until I’m 30? 50? My savings rate should reflect my retirement plans, as should my allocation between 401(k) accounts and personal brokerage accounts. (If I plan on working longer, I should put more in the 401(k), if I plan on working less I should put more in my brokerage account so it’s accessible before I turn 60)

MEASURABLE

Measurable goals can be difficult in other aspects of your life, but when it comes to personal finance most goals are measurable! The benefit of working with money and numbers is that you can track growth and extrapolate future values to see if you’re on track to hit your goal. (For example, there are a huge variety of online calculators & tools that will let you input your current savings, your savings rate, and estimated rate of return to see how much your portfolio will be worth in 10, 20, 50 years)

ACHIEVABLE

It’s a really nice feeling to make progress towards your goals, it’s even nicer if your progress is on track! Sure, it may be nice to max your 401(k), IRA, and HSA – but if you only make $30,000 a year that’s just not an achievable goal. Take a look at your financial situation and your goals, then figure out how long it would take to reach your goal. Or if you want to get to a specific amount by a specific date figure out what amount is achievable.

REWARDING

If you really enjoy your job, and have no desire to leave it – is it rewarding to be able to retire early? Your goal should be something you want, not what other people say your goal should be. And honestly, it should be a little difficult to achieve. If I set a goal to save $10 a month it wouldn’t be rewarding because saving $10 a month isn’t difficult for me. Stretch goals – think of something that will be hard but possible to achieve and achieving it will likely be more rewarding.

TRACKABLE

This ties into the idea that your goals should be measurable. But you should have a timeline as well as a dollar amount that you’re aiming for. To quote Antoine de Saint-Exupéry: “A goal without a plan is just a wish.” I want to have $1,000,000 in my retirement account. If you work until the average retirement age, and you actively contribute to your retirement accounts, then you are basically guaranteed to get that $1,000,000. If you start when you’re 25 and save $522 a month with a 6% rate of return, then you’ll hit the million in 40 years. If you get a 10% rate of return you’d only need to save $179. If you want to his a million in 10 years then you will need to save $1,382 assuming a 10% return. At 6% you will need to save $2,195 per month! (Check this out if you want to see how long it will take you to save $1,000,000)

6 notes

·

View notes

Text

Financial Literacy Month!

It has come to my attention that April is Financial Literacy Month! Assuming that this is not an April Fools joke, I am going to try and return to my post a day schedule for the duration of the month. . . and hopefully after that too, but Finals are early May, so there's that. . .

Anyway, to kick off my month (for which I have no plan), I'm going to write a short post on credit scores.

There are some people out there who will tell you that it's possible to live life without a credit score. . . *cough* Dave Ramsey *cough* . . . and while he may be technically correct, it's also possible to live life deep in the Amazon rainforest with no human contact. Both would be a major pain in the ass.

I'm going to point out here that the current FICO score was introduced in 1989, and Ramsey was born in 1960 (AKA, he was almost 30 and probably established by the time FICO scores were really being used for things). Times have changed, and just because he didn't need a credit score to start on life doesn't mean that we younger people don't need one.

Things like apartments require credit scores nowadays, and even small landlords will check your credit! His whole argument in videos like [this one] just doesn't work anymore. It's even based on faulty logic. Having a credit card is not the same as going into debt!! If you pay off your card every month, you have no debt and a great credit score.

Anyway. . . small rant against Ramsey's whole 'you don't need a credit score' thing over. (And for the record, not trying to hate on him, I do generally enjoy his books. . . but that one piece just annoys me soooo much).

Credit scores are important.

If you ever plan to rent an apartment, get a car loan (I wouldn't do this one), buy a house, try and leverage credit card rewards, get some insurance types, or even get a new cell phone plan, your credit score will make an impact.

Higher credit scores will get you lower interest rates on almost any loans you're looking to take out and will qualify you for better credit cards with better rewards (for example, I just got 5 nights free at a hotel that averages $170 a night because of credit card rewards).

To improve and maintain your credit score, you should follow a few habits:

Pay your bills on time. This one is obvious.

Use less than 30% of your credit limit.

Pay your balances in full! Carrying balances does not help your credit score and costs you more money in the long term.

Try not to close old accounts. Your average account age does impact your score, so keep older accounts open.

You should also be in the habit of checking your credit report on a semi-regular basis. Each major reporting agency must give you one free report per year, so I check my report every 4 months with a different agency each time.

However, because of COVID and rampant fraud, you can actually check your report more frequently through April 2022. You're able to access your credit report weekly for the next year. I highly recommend taking advantage of that weekly report to ensure nothing unexpected on your report.

To get your free reports, go to AnnualCreditReport.com.

#credit report#money tips#fireblogger#financial literacy#financial literacy month#credit scores#ramsey#money advice#credit tips

3 notes

·

View notes

Text

Back to the Basics, Money Motivation!

Savings money is hard, and it takes forever. Well, it can take a long time, depending on your goal. My partner and I have a little inside joke be referring to everything as one marshmallow or two. We were referring to the Stanford marshmallow experiment (you can read about it here, or you can read about how it wasn’t as good a study as expected initially here). Regardless of the effectiveness of the actual experiment on predicting future success, we use the phrase to complain about delayed gratification. Sure, I’d like to buy this book, but it’s one marshmallow. I could just wait until it’s in the library and have the second marshmallow of saved money.

The only problem with this idea is how difficult it is to wait for the second marshmallow, especially if it’s months or years down the line. We, therefore, need a way to keep ourselves motivated and on track. Personally, my biggest motivator is watching my account balances grow, preferably in the form of a line graph. Personal Capital is an excellent tool for this as you can link all your accounts, and it will display a graph of your net worth over time. It will also sort your accounts into debt, cash, investments, mortgage, and other assets so you can see how your cash has grown or how your debt has decreased.

You may also be motivated by constant visual reminders of your goal. Keep some pictures of vacation destinations or hobbies you want to take up. A wallet-sized picture you’d need to see before you reach for your card could also be helpful to prevent impulse purchases.

Or, if you’re like me and don’t look in your wallet until the items are already scanned and totaled, you could focus on avoiding temptation in the first place. Take routes that avoid your favorite fast-food restaurants, use free grocery pickup services so you don’t impulse buy chips as you walk through the aisle, delete or hide your JCPenney app, so you aren’t tempted to buy a nice shirt when you’re bored.

You can also get help. Tell someone close to you what your goal is, and let them be your accountability partner. If you don’t have someone close who can help you with your financial goals (or other goals), you may find online support partners through programs like https://www.getsupporti.com/. My partner has always supported me, and he also reminds me of another important fact.

You don’t need to live like a pauper while you’re trying to save. Budget smaller treats and rewards for yourself along the way. I can’t tell you how many times I’ve said I can’t afford Arby’s just to get a raised eyebrow from him. I can totally afford to spend $6 on a gyro. . . And doing that every once in a while is not going to delay my retirement plans.

Most important, remember to be kind to yourself. If you veer off track, don’t sit and berate yourself. Get up, dust yourself off and get back on track. If you encounter a setback, you will just need to revisit your plan and revise as necessary. There’s nowhere to go but forward!

5 notes

·

View notes

Text

Common Money Mistakes

Disposing of disposable income. As you move into the corporate world, or your trade, or even get a promotion at your current job you may start seeing more money coming into your account. Bigger paychecks, better benefits, maybe even bonuses. You’ll probably also start seeing some bigger temptations. When I first started getting a decent paycheck my temptation was to go to the mall and shop at stores like JCPenney’s or Torrid. Now, I spent my entire life buying clothes at second hand stores a couple shirts and pairs of jeans a year. So Torrid’s nice business clothes? That was fancy. I went, I found a brand they carried that I liked quite a bit and I bought several shirts and a few pairs of pants, a blazer with some blouses Maybe spent a couple hundred over a few months, now it would not be exaggerating to say that’s about how much I had spent on clothes my entire life. ($10-15 annual budget 6th grade onwards). And at first it was nice, I was so happy to have made it to the point where I could go out and buy myself a nice shirt. And you know what, that was nice. But it didn’t make me happy in the long-term. After two or three months I stopped going – because sure now I had some nice shirts and business clothes, but I never really wore them. Instead, I started buying Gildan brand shirts online from shops like blankapparel. They’re $2-3 heavy cotton shirts that last forever and are really nice quality. All that disposal income I had been disposing of on clothes was rerouted to high-yield savings accounts instead.

Spending too much on housing. Now, I’m a sucker for an apartment with a washer and dryer in the unit. When I bought my duplex literally what I was most excited about was the fact that there was a washer and dryer. I’m not kidding the first night I drove up an hour from my apartment just to do half a load of laundry. So I can absolutely understand wanting to spend extra on a location with a washer and dryer – but the question is how much extra in my area a washer and dryer can increase rent by ~$100/month if not more. The rule I’ve heard several times is to spend less than 30% of your income on your housing, however that percent is greatly dependent on the cost of living. My rule of thumb – get the cheapest livable place you can find with as many roommates as you can stand. I spent years wishing I had a washer and dryer and instead spent years saving that extra $100 a month (well $50 since I had at least one roommate). So my advice is to find somewhere that’s close enough to your job/school that you can still get there with heating/cooling/no pests and to start saving money from there. Of course, if having an really nice apartment, or having privacy with no roommates is important to you take that into consideration. Just make sure you are considering the future value of that extra rent money instead of just the present value.

Debt. Emergency funds are important, and everyone should have something even if it’s not the 3 – 6 months salary that’s often recommended. Honestly, even an emergency $100 could be very important to have. Some people will use credit cards as their emergency fund, this should be your absolute last resort. Credit cards have very high interest rates, which means that any expenses paid for on a card will grow at an alarmingly fast rate. Say you have a sudden $500 expense, and you have a 24% APY credit card. That means that you will need to pay an additional 2% of interest every month. But because that 2% of interest is compounding it’s not the same as adding $10 every month, instead it’s adding $10 of principal. Which means that your next 2% interest add is 510 * 1.02 rather than 500 * 1.02. Let’s say in this scenario that you make a payment of $15 a month towards your $500 debt. It will take you 56 months to pay down the balance, and you will end up paying over $332 in interest. Making your total cost closer to $832.It will take almost two years before your $15 payment goes more towards principal than interest! Now imagine spending that $500 on a new phone, or pair of shoes, or some other non-essential non-emergency. It’s a bad idea.

Not saving for Retirement. Now this whole blog is geared towards early retirement, but that’s not everyone’s cup of tea. Maybe you like your job. Maybe you don’t mind your job and prefer living at a certain income level rather than trying to save every penny for retirement. Maybe you’re early in your career and don’t feel like you make enough to save for early retirement. You should still be saving for retirement. The greatest asset we have is time, and investing earlier even if it’s in small amounts, gives it time to grow. A $1,000 invested when you’re 25 can grow to be double what $1,000 invested when you’re 35 would. Even if it’s only a few dollars a week start investing early, brokerage platforms like Robinhood have very low minimums and you can invest in funds or ETFs on it.

If you invest, don’t be conservative. I had this problem when I first started investing. I let an older finance manager invest my first $3,000 with the understanding that it would be a retirement account. HE PUT IT ALL I N BONDS???? Okay, I’m young, I should be focused on growth with most if not all of my funds in stock. They’re higher risk, but if I’m planning on holding them for 20-30 years that risk is greatly mitigated. I lost over a year of growth before I realized that the retirement fund he had put my money in was intended for people in the 50s to 60s that already had a decent amount of value and now needed lower risk and lower growth investment vehicles. Since I moved my portfolio out of bonds and into stocks it has nearly doubled, the red line is when I realized my mistake and switched my funds into a stock portfolio.

Go big or Go Home!

3 notes

·

View notes

Text

WallStreetSurvivor

If you're interested in investing in the stock market, but aren't quite ready to make the leap with your own money yet, there are many free stock market games online such as https://www.wallstreetsurvivor.com/ that give you $100,000 and let you invest in whatever you'd like. Your investment values then go up or down depending on how the real stock goes up and down.

It's a fun way to experiment with investments, and can be a fun competition if you get a few friends in it too!

1 note

·

View note