#buyingabusiness

Photo

. _ Buying a Restaurant _ With so many types of hospitality business on offer weighing up the options is never easy.

If you have a brand or concept in mind you may think that paying for someone’s existing business is a waste but remember the site will be fitted, have planning and the existing customer base could be your customers going forward, so giving you a head start with your new venture.

It maybe that you are looking for a lifestyle change or wish to purchase a successful business which you can build on so reducing any risk factors.

At Boston Brokers we have a wide range of restaurants for sale, at all levels, so can give you honest advice on the current business, its goodwill, any lease terms, and the obligations going forward such as staff. As we deal with going concern businesses every day we know what matters.

We remember that, as a buyer you are starting out on a journey, and we are there to help you raise finance, insure, and run your restaurant through the Boston Group network, so you can either grow or sell when the time is right. _ Nathan Lihari

Director

M: 0411 988 999

E: [email protected] #businessforsale #bizforsale #businessforsaleaustralia #bar #restaurant #bistro #food #hotel #reception #wedding #coffee #chef #waiter #somelier #mixology #sellingbusiness #buyingabusiness #functions #lease #garden #kitchen #instagood #instagram (at Melbourne, Victoria, Australia) https://www.instagram.com/p/CmBz1QYrysr/?igshid=NGJjMDIxMWI=

#businessforsale#bizforsale#businessforsaleaustralia#bar#restaurant#bistro#food#hotel#reception#wedding#coffee#chef#waiter#somelier#mixology#sellingbusiness#buyingabusiness#functions#lease#garden#kitchen#instagood#instagram

1 note

·

View note

Text

Understanding Seller’s Discretionary Earnings when Buying a Small Business

Net income may vary significantly from SDE

By Dave Driscoll

Seller’s discretionary earnings (SDE) – also known as seller’s discretionary income - may be a new term for those considering buying a business. Understanding what the term means and how it’s calculated is important when analyzing what the business makes compared to what the business is worth.

Think of SDE as the total amount of cash the business generates through operations that is available to the owner to spend at their discretion. The “discretionary” part of SDE is just that - the owner chooses how to allocate that cash. The follow up question is, does the business need that expense to operate the business?

The expenses the owner chooses to have the business pay that are NOT needed for the company to operate are called add backs because they are added back to net income.

Why would an owner choose to have their company pay an expense that is not necessary to run the business?

Because many, if not most, owners attempt to show as little income as possible to reduce the taxes they must pay on the annual business earnings. Conversely, when it's time to sell the business,, the owner has the opposite objective…then they want to show as much earnings as possible to justify the highest asking price. Therefore, these non-essential expenses paid by the business are documented as add backs to show the prospective buyer a more accurate picture of the cash that could be at their disposal.

A well-prepared adjusted profit and loss statement representing five years of data anticipates buyer questions and clearly defines the expenses on the operating statement, including which are not necessary for efficient management of the business. But not every seller or business broker knows how to provide that information in a way that's easy to understand. And not everyone is willing to engage in full and complete disclosure.

Any prospective buyer should carefully review and assess each item on the income and expense statement when considering buying a business, asking for clarification of any questions or concerns.

Important financial questions a buyer may ask include:

Is each itemized expense necessary to operate the business properly?

Is the listed total for each item the actual expense, or is the real cost lower or higher than what has been entered in the books?

What percentage of the total expenses does each item account for, and how does that compare to the percentages in prior years? If there is a substantial change in any single category, what is the reason?

A smart business buyer does not simply accept the figures listed in the P&L, tax returns, or other financials of a company being considered without question, but instead does some investigation to learn what the figures truly represent.

Some typical add backs to net income that are recognized without question by SBA lenders include:

owner's annual salary

payroll taxes for the owner-manager

owner’s pension

owner’s health insurance premium

amortization

depreciation

interest expense (typically for loans that will be paid off when the business is acquired)

one-time business expenses (an expense the new owner will not have in the future)

salary expense for family members who don't actually work daily in the business

The above items are discretionary because either the owner decides the amount to be paid or the expense is solely for the owner’s benefit.

In addition, there are many other potential adjustments, such as:

owner's personal auto expenses (lease, insurance, gas, repairs, etc.),

charitable donations, reduction or addition to fair market value for rent paid to owner(s)

owner's personal life, health, and disability insurance

non-business meals and entertainment

non-business travel

non-business telephone and internet

Buyers and sellers should note that SDE works both ways. For example, if the owner-manager’s family member works in the business but is receiving no pay or less-than-fair-market-value pay, then the new owner will have to pay more for a replacement employee and that needs to be deducted from the SDE.

Proper calculation of SDE is vital to both sellers and buyers. For example, a business showing a "profit" of $140,000 could easily have an actual SDE of $400,000; that's a huge difference in business value. An experienced business broker is the best resource for a thorough analysis and explanation of add backs and SDE.

Dave Driscoll is president of Metro Business Advisors, a mergers & acquisitions, valuation and exit/succession planning firm helping owners of companies with revenue up to $20 million sell their most valuable asset. Reach Dave at [email protected] or (314) 303-5600. www.MetroBusinessAdvisors.com

As seen in St Louis Small Business Monthly

#netincome#sellersdiscretionaryearnings#sellersdiscretionaryincome#buyingabusiness#smallbusinessowners

0 notes

Text

youtube

Roland Frasier on Leveraged Buyouts: A Better Strategy To Acquire New Businesses

#buyingabusiness #sellingabusiness #sme #businessbrokers #business #commercialproperty #bsaleaus #businessforsale #aibb #smallbusinessowner #solicitors #businessbroker #buyingafranchise #shareholdersagreements #commerciallitigation #lawyer #businesslaw #owningafranchise #shareholders #franchising #commercialsolicitors #businessowners #uk #bsalemagazine #entrepreneur #employmentlaw #businessopportunities #valuation #businessnews #stayinformed

0 notes

Photo

"He was super communicative with us and really tenacious in protecting our interests. He's smart and tough and doesn't waste anyone's time." #5StarReview #HappyClient #businesslawyer #businessattorney #corporateattorney #corporatelawyer #assetsale #mergersandacquisitions #sellinganasset #buyinganasset #buyingabusiness #sellingabusiness #lawyer #lawfirm #corporatelawfirm #contracts #assetpurchase agreement

0 notes

Photo

ISSUE 78 ONLINE NOW! In this edition, we feature a great interview with Jasmine Robson about all things business, how she started her career, became a business broker, and continues to encourage women in business. Whether you're looking to buy or sell a business, we share useful information to help you make informed decisions. https://bsale.com.au/magazine #bsaleMagazine #bsaleaus #businessbrokers #buyingabusiness #sellingabusiness (at Australia Gold Coast) https://www.instagram.com/p/CV2JrXRp3BO/?utm_medium=tumblr

0 notes

Photo

When it comes to sell or buy a business, Turner Butler is the most trusted name in the list of UK’s Business Brokers that specialises in business sales.

Visit here for more details: http://bit.ly/2TGJ2cZ

#TurnerButler#UKBusinessBrokers#UKBusinessTransferAgents#FreeBusinessValuation#WeSellBusinesses#BusinessesForSale#BuyingaBusiness#SellingYourBusinesses#SellMyBusiness#BusinessBrokersUK

0 notes

Text

AN042-Specialist Printer & Supplier of Corporate Pens Established for over 10 years

Specialist Printer & Supplier of Corporate Pens Established for over 10 years

Ref.AN042

Location Buckinghamshire

Asking Price £150,000

Business Profile

This is an excellent opportunity to acquire a very well established, specialist printing company for corporate pens that has traded successfully, in the same ownership since 2006. The business, which was established by the current vendor, offers a professional sales service with a comprehensive choice of every quality of corporate pen and supplies to internal marketing departments, event companies and marketing agencies.

Key attributes include:

• Highly competitive prices

• Excellent print quality

• A wide range of products to suit your budget

• Fast delivery

• Free artwork preparation service

• A friendly, efficient approach

The business is managed by a full time manager and does not rely on the vendor for any decisions relating to day to day activity. The general manager is supported by an assistant and a team of reliable part-time staff responsible for machine operation, packing and delivery.

This is an excellent opportunity to purchase a relied upon national business with an excellent historic reputation and significant potential.

Click here to know more about the business

#turnerbutler#turner butler#Businessdetailsupdated#Business details updated#businessesforsale#businesses for sale#buyingabusiness#buying a business#printer#corporatepens#businessopportunity#business opportunity#supplier#Buckinghamshire#wesellbusinesses#we sell businesses

1 note

·

View note

Text

Melvin Feller MA Illustrates How You Can Buy Any Business

According to Melvin Feller MA, if you’re thinking about running your own business, especially in buying a company that’s already established may be a lot less work than starting from scratch. However, you will need to put time and effort into finding the business that’s right for you.

This article was written by Melvin Feller MA in order to take you through the steps of buying an existing business, including how to assess and value a business, your obligations to any existing staff and where you can get professional help.

Actually, there are advantages and disadvantages of buying an existing business and If you get it right, there can be many good reasons why buying an existing business could be the right move for you. Remember though, that you will be taking on the legacy of the business’ previous owner, and need to be aware of every aspect of the business you’re about to buy.

Advantages:

According to Melvin Feller MA, it may be easier for you to get finance as the business will have a proven track record. A market for the product or service will have already been demonstrated.

There may be established customers, a reliable income, a reputation to capitalize and build on, and a useful network of contacts.

A business plan and marketing method should already be in place.

Existing employees should have experience you can draw on.

Many of the problems will have been discovered and solved already.

You can always re-sell the business.

Disadvantages:

Melvin Feller Discusses Starting Your Business.

Melvin Feller Talks Buying a Business.

You often need to invest a large amount up front, and will also have to budget for professional fees for solicitors, surveyors, accountants, etc.

If the business has been neglected you may need to invest quite a bit more on top of the purchase price to give it the best chance of success.

You will need to honor or renegotiate any outstanding contracts the previous owner has in place.

Deciding on the right type of business to buy:

.Ideally your business needs to fit your own skills, lifestyle and aspirations. Before you start looking, think about what you can bring to a business and what you’d like to get back. List what is important to you. It is useful to consider:

Your expectations in terms of earning — what level of profit do you need to be looking for to accommodate your needs?

Your commitment— are you prepared for all the hard work and money that you will need to put into the business to get it to succeed?

Your strengths — what kind of business opportunity will give you the chance to put your skills and experience to good use?

The type of business —limited company, partnership etc. — that you’re interested in buying.

The business sector you’re interested in — learn as much as you can about your chosen industry so you can compare different businesses. It’s important to take the time to talk to people already in similar businesses.

Location — but don’t restrict your search to your local area. Some businesses can be easily relocated.

Where to look for a business to buy:

Many national and local newspapers carry advertisements for businesses and business locations or lots.

Depending on what sector you’re interested in, you could look in trade journals. Or put in your own advertisement, saying what you are looking for. You can get contact details for most newspapers, magazines and trade journals from press directories available on the internet.

Melvin Feller Recommends Being Your Own Boss.

Some magazines, many of them with their own websites, specialize in buying and selling property and businesses. Of course, do not forget Realtors who use their publications and websites like loopnet.com, Crexi.com, Showcase.com, as well as Marcusmillichap.com and get familiar with their websites, including Craigslist and eBay.

How to value a business:

Understandably, how to value a business is often the most worrying part of buying a new business. Remember, though, that what a business is worth to you will not be the same as it is to someone else with a different set of priorities and objectives.

To get a general idea of how healthy the business is, look at:

the history of the business

its current performance (sales, turnover, profit)

its financial situation (cash flow, debts, expenses, assets)

and why the business is being sold

The following list of questions will help you discover possible areas where you could financially get hurt.

How healthy is the business?

Stock:

How much is there?

What condition is it in?

Assets:

Does the asking price take into account depreciation?

Is anything leased or currently being purchased?

Intangible assets:

How much goodwill comes with the business?

Melvin Feller Talks Valuing Your Business.

Are any trademarks registered?

Products:

What are the profit margins on each product or service?

Which products or services account for the majority of sales?

Licenses:

Which ones are required to conduct business?

Are there any outstanding issues with the licenses?

Debts:

How old are the debts?

Which debtors owe the most?

Creditors:

What does the business owe?

What is the credit history like?

Suppliers:

What are their prices?

What’s their credit policy?

Employees:

Is the business adequately staffed?

Is it over-staffed?

Do all employees have the necessary skills?

Do all of the employees have the necessary equipment to do their job safely?

Premises:

Do they need refurbishing?

Are they leased or company owned?

Competition

What percentage of the market do the competitors have?

Valuation methods:

Your accountant can advise on how to put a specific value on the business and do the actual calculations. You can then decide how much you want to offer, or if you want to buy it at all. If you do decide to make an offer, the research you do now will be completely verifiable once you’ve agreed a purchase price and terms with the seller.

Make sure the business is worth buying by doing your due diligence:

Having done your research, it is important to verify the information you now have. A period of time is allowed for you to access the business’ books and records in order to verify that all of the information that you have discovered up to now is accurate, and this is known as due diligence period. It should give you a realistic picture of how the business is performing now and how it is likely to perform in the future.

When to begin due diligence.

Don’t start due diligence until you’ve agreed to a price and terms with the seller. For a down payment they may agree to take the business off the market during your investigation.

The investigation period is negotiable — but most small businesses need at least three to six weeks.

Where to get help

You should get accountants and attorneys to help you identify various risk areas but you can also get information about companies directly from the internet. Remember, due diligence is much more than the finances of a business. You need to come out of this period knowing exactly what you are getting yourself into, what needs to be fixed, what the costs are to fix them and if you are the right person to take over this business.

Key areas to cover are:

Melvin Feller MA Discusses Valuation Methods.

employment terms and conditions

outstanding litigation

major contracts and orders

IT systems and other technology

environmental issues

commercial management including customer service, research and development, and marketing

Information sources

Dig as deeply as you can and use whatever documents are available. For instance, if you’re looking at employee records, you could check out:

payroll records

staff files

copy of retirement and profit-sharing plans plus financial statements, if relevant

employment contracts

the staff manual

union contracts, if relevant

you may also need information from external sources such as the landlord, tax office or bank.

A step-by-step process on how to buy a business

Get professional advice

Professional help is invaluable as you go through the negotiation, valuation and purchase process. You may find it useful to contact the professional organizations to get advice and help on finding a lawyer or an accountant.

Research

Research the business sector you’re interested in, including the best time to buy. Shortlist two or three businesses.

Make sure a business is worth buying: conduct due diligence and verify any information you have been given. As well as checks on the business, your attorney will conduct searches in order to verify relevant licenses etc.

If you’re planning to arrange a loan, the lender will insist on carrying out their own survey and valuation at your expense, but you may want to pay for an additional independent survey and valuation.

Initial viewing and valuation

Be discreet — the owner may not want staff to know they are selling, but be thorough and record key findings.

Arrange finance

Lenders generally require:

details of the business/sales particulars

accounts for the last three years

financial projections even if no accounts are available

details of your personal assets and liabilities

Make a formal offer

If you make your initial offer by phone, follow this up in writing. Head your letter subject to contract and include this phrase in all written communication.

Negotiation

Before completing the sale, try to negotiate an overlap period so you have time to become familiar with the business before taking over. Record all the main point agreed.

Completion

Even after you reach an agreement on the price and terms of sale, the deal could still fall through. You have to meet certain conditions of sale to complete, including:

verification of financial statements

transfer of leases

transfer of contracts/licenses

transfer of finance

Looking after existing employees:

There are regulations that govern what happens to employees when someone new takes over a business. These apply to all employees when a business is transferred as a going concern, meaning employees automatically start working for the new owner under the same terms and conditions. For more information, check on your responsibilities to employees if you buy or sell a business.

Inform and consult employees

If you do want to discuss reducing numbers of employees or reorganizing the staff it’s a good idea to do this once you’ve completed the due diligence period, but before you take over the business. As the new employer you should inform and consult all employees — including employee representatives — who may be affected.

Employee Retirement Plans

As their new employer, you do not have to take over rights and obligations relating to employees’ retirement plans put in place by the previous employer. However, if you don’t provide comparable retirement plan arrangements, you could theoretically face a claim for unfair dismissal.

Related guides on www.USA.gov:

Buy an existing business or franchise

www.sba.gov/business-guide/plan-your-business/buy-existing-business-or-franchise

Franchising or buying an existing business can simplify the initial planning process. Starting a business from scratch can be challenging. Franchising ...

Help Buying a New Home | USAGov - Official Guide to ...

www.usa.gov/buying-home

Your qualifications to buy a HUD home depend on your credit score, ability to get a mortgage, and the amount of your cash down payment. You can also ...

Buying a Business - Small Business Administration

Melvin Feller Believes that Employees add to the Bottom Line.

www.sba.gov/course/buying-business

The process of buying a business and resources to help decide if buying a business is right for you. The process of buying a business and resources to ...

Choose your business name

www.sba.gov/business-guide/launch-your-business/choose-your-business-name

You can find the right business name with creativity and market research. Once you’ve picked your name, you should protect it by registering it with ...

Professional and occupational licenses - Wisconsin DNR

dnr.wi.gov/Permits/professionalicenses.html

Professional and occupational licenses. First time applicants must submit their applications directly to DNR. Renewal licenses can be obtained from ...

Start A Small Business - San Antonio

www.sanantonio.gov/SBO/Start-A-Small-Business

FROM START-UP TO BIG SUCCESS. The City of San Antonio's Small Business Office makes it easy for your start-up to grow into a big success. Take ...

Oregon Secretary of State: Starting a Business

sos.oregon.gov/business/Pages/starting-business.aspx

The How to Start a Business in Oregon guide (PDF) provides a checklist to guide you through the process of registering your business. 2. Create a ...

Women-owned businesses - Small Business Administration

www.sba.gov/business-guide/grow-your-business/women-owned-businesses

The SBA helps women entrepreneurs launch new businesses and compete in the marketplace. Connect with the training and funding opportunities ...

Veteran-owned businesses

www.sba.gov/business-guide/grow-your-business/veteran-owned-businesses

The SBA offers support for veterans as they enter the world of business ownership. Look for funding programs, training, and federal contracting ...

Market research and competitive analysis

www.sba.gov/business-guide/plan-your-business/market-research-competitive-analysis

Market research helps you find customers for your business. Competitive analysis helps you make your business unique. Combine them to find a ...

[PDF] How to Grow Your BUSINESS - Small Business Administration

www.sba.gov/sites/default/files/files/resourceguide_3158.pdf

Welcome to the 2019-2020 edition of the U.S. Small Business Administration’s Wisconsin Small Business Resource Guide. The SBA helps make the American ...

Finance Your Business | USAGov - Official Guide to ...

www.usa.gov/funding-options

Finance Your Business. Explore the variety of government-backed loans and funding programs for your business. Small Business Loans. Government loan ...

[PDF] Home Buyer’s Guide - Ohio Department of Commerce

www.com.ohio.gov/documents/real_HomeBuyersGuide.pdf

Home Buyer’s Guide How to Make the Most of Your Home Buying Experience. ... ensure that they conduct their business in a legal and ethical manner. The ...

[PDF] CENTERS FOR MEDICARE & MEDICAID SERVICES 2020

www.medicare.gov/Pubs/pdf/02110-medicare-medigap-guide.pdf

Who should read this guide? This guide can help if you’re thinking about buying a Medicare Supplement Insurance (Medigap) policy or already have one ...

State and Territory Business Resources | USAGov

www.usa.gov/state-business/puerto-rico

Open a Business. Learn what it takes to start a business in Puerto Rico. Start a Business in Puerto Rico. Expand or Relocate a Business in Puerto Rico ...

Checklist for Starting a Business | Internal Revenue Service

www.irs.gov/businesses/small-businesses-self-employed/checklist-for-starting-a-business

Each state has additional requirements for starting and operating a business. For information regarding state-level requirements for starting a ...

Small Business Administration

www.sba.gov/business-guide

The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their business. We support America's small businesses. The ...

A Consumer’s Guide to Buying a Franchise | Federal Trade ...

www.ftc.gov/tips-advice/business-center/guidance/consumers-guide-buying-franchise

Will you need the franchisor’s ongoing training, advertising or other help to remain in business? Will you have access to the same suppliers? Could ...

Buy assets and equipment - Small Business Administration

www.sba.gov/business-guide/manage-your-business/buy-assets-equipment

Your business will need special assets and equipment to succeed. Figure out which assets you need, how to pay for them, and whether you should buy ...

Starting a Business Checklist | California Secretary of State

www.sos.ca.gov/business-programs/business-entities/starting-business-checklist/

The “Starting a New Business in California” brochure should be used as a general tool to help you broadly assess how to start a business in ...

#Melvinfellerma#buyingabusiness#small business#melvinfellerbusinessgroup#entreprenuership#entrepreneur#success#Business#startup#melvinfeller#melvinfellerfacebook#melvinfellertexas#melvinfelleroklahoma#melvinfellerentrepeuner#melvinfellersuccess#businesswithmelvinfeller

0 notes

Text

GK292 - Well Established Manufacturer Supplier & Installation of High Quality PVCu Windows & Glass to Private, Commercial & Trade Sectors

New Business For sale - Well Established Manufacturer Supplier & Installation of High Quality PVCu Windows & Glass to Private, Commercial & Trade Sectors

Ref. GK292

Location Ireland

Asking Price £2,250,000

Turnover £1,800,000

Gross Profit £595,000

Business Profile

The business was established in 1969 and has enjoyed continued success due to offering quick, reliable and quality sales and after sales service.

The business is one of the largest family run glass/window companies in Ireland and caters for the private, commercial and trade sectors supplying everything from double and triple glazed windows to conservatories, toughened/safety glass, balustrades, splash backs, stained glass and doors. The business has potential to increase output with the introduction of an additional shift or increasing production equipment (space available).

Key Opportunities:

There are opportunities for further expansion that could include trading nationwide and/or expanding into other countries.

Click here to know more about the business

#turnerbutler#newbusinessforsale#manufacturingbusinessesforsale#PVCuWindowsforsale#Supplier#UKbusinesstransferagents#buyingabusiness#businessbrokerageUK#rupertcattell#Ireland

0 notes

Photo

. _ Buying a Restaurant _ With so many types of hospitality business on offer weighing up the options is never easy.

If you have a brand or concept in mind you may think that paying for someone’s existing business is a waste but remember the site will be fitted, have planning and the existing customer base could be your customers going forward, so giving you a head start with your new venture.

It maybe that you are looking for a lifestyle change or wish to purchase a successful business which you can build on so reducing any risk factors.

At Boston Brokers we have a wide range of restaurants for sale, at all levels, so can give you honest advice on the current business, its goodwill, any lease terms, and the obligations going forward such as staff. As we deal with going concern businesses every day we know what matters.

We remember that, as a buyer you are starting out on a journey, and we are there to help you raise finance, insure, and run your restaurant through the Boston Group network, so you can either grow or sell when the time is right. _ Nathan Lihari

Director

M: 0411 988 999

E: [email protected] #businessforsale #bizforsale #businessforsaleaustralia #bar #restaurant #bistro #food #hotel #reception #wedding #coffee #chef #waiter #somelier #mixology #sellingbusiness #buyingabusiness #functions #lease #garden #kitchen #instagood #instagram (at AJ717) https://www.instagram.com/p/CkHPA9yyV9n/?igshid=NGJjMDIxMWI=

#businessforsale#bizforsale#businessforsaleaustralia#bar#restaurant#bistro#food#hotel#reception#wedding#coffee#chef#waiter#somelier#mixology#sellingbusiness#buyingabusiness#functions#lease#garden#kitchen#instagood#instagram

0 notes

Text

Questions a Buyer should ask the Seller when investigating the purchase of a business

By Dave Driscoll

Buying a business is probably the most consequential purchase you can make in life. Not taking the time to thoroughly evaluate whether you and the business are suited for each other can result in a bad decision that is financially and emotionally disastrous for you and your family.

When investigating buying a business after execution of a Confidentiality Agreement, it is important to understand the inner workings of the business and realistically qualify interest early in the process. Prior to presenting a Letter of Intent, a prospective buyer should have a conversation with the seller to ask questions about the operations, customer base, employee relations, industry trends, the business’ history, and the owner’s background.

Asking the seller straightforward questions and getting forthright answers in return is an essential part of the buyer’s due diligence process. Posing the “right” questions and actively listening will help the buyer learn and assess important aspects of the business. So, what should the buyer ask to promote a substantive conversation with the seller?

First, I recommend determining the seller’s role and motivation by asking:

Why did you get into this business in the first place?

What still excites you about it?

What is your day-to-day role in the business?

What would your ideal transition look like? What do you want to do post-sale?

What are your expectations of a buyer?

What problem does your company solve for your customers?

Why do your customers buy from you rather than your competitors?

These are serious questions that deserve thoughtful, sincere responses. The answers allow the buyer to discern the seller’s true motivation, establish chemistry with the seller, and get the initial “feel of the business.” If the seller does not give serious, satisfactory replies to these questions, the prospective buyer should move on to a different opportunity… pursuing the purchase of the business would not be worth the energy.

The next series of questions clarify how the business works. Establishing trust with the seller prior to asking process questions is essential; otherwise, a seller will not be comfortable providing detailed responses.

Would you walk me through the entire process - from sales and sourcing to distribution and serving the end customer?

Does the business have a comprehensive operations manual?

Beyond the owner, what is the leadership structure and their duties within the company? (This should be based on job titles, not actual employee names.)

How long have your employees been with you on average and why do they stay?

What types of external and internal problems arise in your company regarding production, service, employees, and/or customers?

Who deals with those problems and how?

At what percentage of capacity is the business currently operating?

What capital expenditures should be made in this business annually?

What opportunities do you foresee in this market through the next three, five, or 10 years?

Prospective buyers should be gauging the seller’s sincerity and forthcoming nature, aiming for a broad understanding about how the business runs, as well as a realistic perception of the opportunities and challenges. Supporting that conversation with specific facts should happen in the due diligence phase, after the LOI is accepted.

The questions above have focused on understanding the basics and establishing trust and chemistry between the buyer and seller. After that has been accomplished, another series of questions zero in on providing a roadmap to promote success and avert disappointments:

What mistakes have you made and how can I avoid repeating them?

Are there industry associations and resources for advice and counsel on trends and best practices?

On what terms will you be available to assist or mentor me in taking over the business?

Are you personally responsible for relationships with any suppliers?

Are any customer relationships managed by you personally?

How dependent is future success on transferring and maintaining those relationships?

How likely are those relationships to continue after you are out of the picture?

Does the company have intellectual property? If so, how is that protected?

Are logos and business names trademarked? Do they convey with the business?

What marketing and promotional materials support sales?

If relevant, are the business’ inventions patented?

The seller should present five years of organized financial statements. When reviewing the financials, the buyer should ask detailed questions about:

the story the Profit & Loss statement tells about the business operations

the credibility of the source of the numbers

historical and current performance

Establishing trust and respect between buyer and seller early in the process is crucial. Both parties must recognize that this pre-LOI conversation is the foundation for determining the tone of any future negotiations. After the LOI is executed, the buyer will have the opportunity to verify the accuracy of the materials and statements that enticed them to pursue the purchase.

Buyers, use your time efficiently to determine whether you want to proceed toward acquiring the business. Avoid fatiguing the seller. Keep in mind that in addition to participating in the sale of the business, the owner needs to continue devoting their time and dedication to maintaining the business’ value. Some prospective buyers requests mountains of information, meetings, and time, yet can’t make a decision because they are in search of a mythical guarantee – watch out for this “analysis paralysis.”

Asking thoughtful, detailed questions will help determine quickly whether this business is a good fit for the buyer, while also gaining the information needed to craft a Letter of Intent that defines the “essence of the deal.”

Dave Driscoll is president of Metro Business Advisors, a mergers & acquisitions, valuation and exit/succession planning firm helping owners of companies with revenue up to $20 million sell their most valuable asset. Reach Dave at [email protected] or

(314) 303-5600. www.MetroBusinessAdvisors.com

As seen in Dave's monthly column in St. Louis Small Business Monthly

0 notes

Text

CQ196-Long Established Independent Funeral Directors

Long Established Independent Funeral Directors

Ref.CQ196

Location North Wales/Chester

Asking Price £375,000

Business Profile

This business was established by the vendor over 50 years ago and in that time has built up a sterling reputation in the region for providing a comprehensive funeral and undertaking service to clients in a highly personal yet professional manner. It has served the local communities impeccably and the company name is very well known throughout the area.

The business currently operates from three different leasehold properties. Two of the sites are located on the High Street in adjacent towns and are highly visible to the community. These two sites have receptions, offices and beautifully appointed chapels of rest, together with cold store, preparation areas, toilets, kitchen areas and ample staff/customer parking.

The third site is ideally based between the two above High Street locations and also has reception area, chapel of rest and offices, toilets, kitchen etc.

Click here to know more about the business

#turnerbutler#turner butler#businessbrokerUK#business broker UK#Businessesforsale#Businesses for sale#buyingabusiness#buying a business#funeral#NorthWales#businesstransferagents#business transfer agents#rupertcattell#rupert cattell

0 notes

Text

Crucial Factors for Successfully Concluding a Business Sale in New Jersey: Maximize Your Profit Now

Are you considering #buyingabusiness or #sellingabusiness in #NewJersey? If so, the #mergersandacquistions process can be quite complex. This #businesslawyer blog post will help you understand what happens after signing a #purchaseagreement before closing

Selling a business in New Jersey or buying a business in New Jersey can be a complicated process with many factors to consider. This business lawyer blog post outlines what to expect after signing a purchase agreement but before closing on the sale of a business in New Jersey.

What Happens After Signing a Purchase Agreement?

After you’ve signed a purchase agreement or an asset purchase…

View On WordPress

#business lawyer#business owner#contract#corporate lawyer#new jersey#new york#partnership agreement#sharheholders#small business

0 notes

Text

JD004-UK Based Manufacturer of Jersey and Knitwear

UK Based Manufacturer of Jersey and Knitwear

Ref.JD004

Location East Midlands

Asking Price £900,000

Business Profile

This business, established and trading successfully for more than 10 years, provides a comprehensive range of knitwear and jerseywear to well known brands and retailers throughout the UK, Ireland and Continental Europe. There is a significant portfolio of machine assets that makes this company one of the most modern, innovative and efficient in the UK.

The company follows strict standards of Ethical Trading and ensures that all parts of the company’s operations meet and often exceed UK Health & Safety Laws and Legislation. Quality Control Systems are incorporated into the production process, and all operators and technicians are highly trained to ensure full efficiency.

The state of the art manufacturing unit is regularly inspected to ensure excellent Health & Safety working conditions and audited by SEDEX. The company also operates a broken needle policy and metal detection to ensure all aspects of Health & Safety are covered to guarantee the very best working environment.

Click here to know more about the business

#turnerbutler#turner butler#businessbrokerUK#business broker UK#buyingabusiness#buying a business#Businessesforsale#Businesses for sale#jersey#EastMidlands#UKbusinesstransferagents#UKbusiness transfer agents#rupertcattell#rupert cattell

0 notes

Text

How to buy businesses with none of your own personal capital

Did you see my last blog

? I introduced my friend Guy Bartlett, who teaches business owners, entrepreneurs and property investors how to buy businesses with none of their own personal capital.

If you missed it, I’ve copied it below for you.

And if you’re curious to find out more, Guy has a great YouTube channel here:

https://youtu.be/aF0ofnIfxUk

This link sends you to a video explaining the concept of The Business Buyers Club, and how you can create greater wealth and freedom for yourself and your loved ones.

It’s only 4 minutes long, and if you love the urban landscape it also gives you an interesting perspective of Manchester - Guy tours the city while he talks.

Watch it here https://youtu.be/aF0ofnIfxUk

Empire building like a Jedi

Do you remember when Disney bought Pixar? And then Marvel? And then Lucasfilm?

Some people thought they were crazy to buy Pixar, but the execs at Disney were on a mission to build an empire. All of these acquisitions paid off for them. And who wouldn’t want to own the studio behind the Star Wars franchise?!

The fact is, buying a competitor is a quick way to grow your business.

If you’ve built a business from scratch then you’ll know how long that takes. You’ll know all about the hours you have to put in, and all the time away from your family.

But buying a profitable business cuts down on that massive time investment.

You can double your turnover without slogging away for years to achieve it. And you don’t have to focus on a competitor – you can buy a supplier or another business that aligns with your goals.

Why am I telling you this?

Because I’ve discovered something that can help you reach your business or investment goals much faster.

My friend, Guy Bartlett, teaches business owners, entrepreneurs and property investors how to buy businesses with none of their own personal capital.

Founder of the Business Buyers Club, he’s been buying businesses for two decades… and he’s passionate about helping people to transform their lives and their levels of wealth through business acquisition.

If you’ve been working long hours - exchanging your time for money – or simply not seeing the returns you’d like on your investments, then this is worth a look.

You can download Guy’s book here:

https://bit.ly/BBC-Guy

Here’s what a well-respected entrepreneur had to say about the book:

“I read Guy’s book with great enthusiasm, as I did business the hard way for more than 20 years before learning the art of acquisitions. Guy is spot on with his down to earth, no nonsense approach, which will save readers learning some very expensive lessons the hard way.

Each seller has a different reason to sell and Guy explains how to educate the seller to understand the real market value of their business, so that there is a true win-win, fulfilling each other’s underlying motivations. It took me years of hard work and some very expensive courses to learn what Guy has included in his book.”

- Glenn Richards, Managing Director of Supplies Direct Ltd, Peterborough

The book covers:

Why investing in businesses should be a key part of your wealth strategy

How you can buy businesses without using any of your own capital

How you can put together ethical deals that are a WIN-WIN for you and the vendor

The key is to make sure you’re purchasing an asset rather than “buying a job” and Guy explains the whole process.

I highly recommend downloading and reading the book. It’s a fast read and it explains exactly how the process works.

You can download Guy’s book here:

https://bit.ly/BBC-Guy

If you want to learn more about Guy Bartlett, he will be talking at the Great Property Meet on Monday the 25th of June, you can book your place at

www.GreatPropertyMeet.co.uk

Read the full article

0 notes

Photo

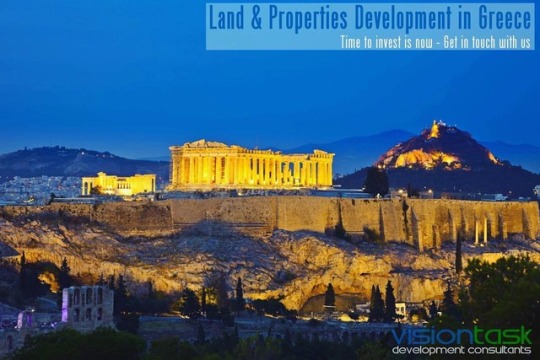

#Athens dominates the Attica region and is one of the world's oldest cities, with its recorded history spanning over 3,400 years and its earliest human presence starting somewhere between the 11th and 7th millennium BC. It is a global city and one of the biggest economic centers in southeastern #Europe. Athens will host the next #Mediterranean #Resort and #Hotel Real Estate Forum in October 2018. Foreign demand for Greek real estate is soaring as overseas investors are drawn by attractive asset prices and amid signs the Greek real estate market has bottomed out after years of decline. The vast majority of foreigners are buying properties in and around Athens, say industry sources, with investors coming from #China, #Turkey, #Russia, #Israel, #Egypt, #Lebanon and the United Arab Emirates. If you are planning to #invest in #Greece, do get in contact with us. Great #opportunities coming up everyday! #Greece #RealEstate #visiontask #selling #buyingahouse #buyingabusiness #development #consultinglife #realestateinvestor #tourism #hotelbuyer #athina (at VisionTask Development Consultants)

#hotel#opportunities#consultinglife#invest#china#hotelbuyer#visiontask#realestate#selling#buyingabusiness#russia#europe#development#greece#athina#egypt#athens#tourism#lebanon#mediterranean#resort#buyingahouse#realestateinvestor#israel#turkey

0 notes