#but what happens when the government demands that Amazon (or Apple or any other company pulling this crap) give over their records?

Text

But I don't wanna live in a dystopian world!!!

#i just saw this video about amazon having this pay with your palm technology#guys why would you give away your biometric data for convenience?!?!#we're really at this point where we will sell our privacy to save 30 seconds#and i know people have been saying this for forever#but what happens when that becomes the only way to pay?#like we are getting so close to what they describe in revelations it's scary#and yeah i get that people said that about barcodes and credit cards#but having your payment method be your literal hand?#that's too close for comfort#and it's literally not smart to give these companies that info#if they have a data breach who knows what a hacker can do with that?#i know this is a crazy scenario but what if a hacker gets ahold of your fingerprints and currupts the digital record for a crime?#on top of that you only need your fingerprints registered with the police for a few reasons like if you are a criminal or work with kids#you have the right to not have the government have your info without reason#but what happens when the government demands that Amazon (or Apple or any other company pulling this crap) give over their records?#now they have that whether you are a criminal or gave your permission or not#that would be a violation of your 4th amendment rights: to be secure in your person houses papers and effects against unreasonable seizures#don't think the government would do that? police in my area will absolutely violate that right by running plates#to see if you have an expired registration even if you weren't doing anything that required they run your plates#so yeah i fully believe the government would violate the 4th amendment#and what's more... i don't even think that they would have to demand the info i think amazon or apple would offer to sell that info to them#ok sorry for the rant#this world is just getting scary y'all

8 notes

·

View notes

Link

Bryan Fogel’s “The Dissident” was too hot to handle.

The documentary about the murder of Jamal Khashoggi, the journalist and political activist who was allegedly killed in 2018 on the orders of the Saudi Royal Family, was one of the hottest films at last year’s Sundance. It had glowing reviews, a ripped from the headlines subject, and a big-name director in Fogel, fresh off the Oscar-winning “Icarus,” a penetrating look at Russian doping that got the country banned from the Olympics.

And yet, Netflix, which had previously released “Icarus,” and other streaming services such as Apple and Amazon steered clear of “The Dissident.” Without any interested buyers, the film languished until last fall. That’s when Briarcliff Entertainment, an obscure distributor run by former Open Road CEO Tom Ortenberg, announced it would release the movie on-demand.

Fogel thinks the subject matter was too explosive for bigger companies, which have financial ties to Saudi Arabia or are looking to access the country’s massive population of well-to-do consumers. Using interviews with Khashoggi’s fiancee Hatice Cengiz, as well as friends and fellow activists, Fogel creates a damning portrait of Crown Prince Mohammed Bin Salman’s apparent involvement in brutally silencing the writer and thinker and the country’s crackdown on free speech. Thanks to previously unreleased audio recordings, “The Dissident” draws a direct line between Khashoggi’s assassination at the Saudi embassy in Turkey and the Saudi government’s anger over his outspoken criticism of the country’s human rights abuses and mismanagement.

“The Dissident” is currently available on-demand, but its rather muted release isn’t the way Fogel had dreamed of provoking a larger conversation around Khashoggi’s murder. He spoke to Variety about the difficulty of making “The Dissident” and then getting it seen and why he thinks his new movie had the major streamers running scared.

Why did you want to make “The Dissident”?

After the success of “Icarus,” I felt a great burden and social responsibility to make a worthy follow-up. I was looking for a story regarding human rights, regarding freedom of speech, freedom of press, journalism. I also wanted a story that had real world implications that could create real world change through social action or political action.

As the investigation into the murder of Jamal unfolded, my ears perked up and I immediately started reading more about this man. I hadn’t heard of him, but I found out how trusted and regarded he was as a voice on the Middle East. He was also being presented in many media circles as a terrorist sympathizer or member of the Muslim Brotherhood or a friend of Bin Laden. This was not true. He was a moderate, who was fighting for free speech for his country and believed women should have rights. He believed Mohammed Bin Salman’s policies were putting the country on the wrong direction.

Was it difficult to get his friends and fiancee and family to speak to you?

It was very very difficult. This is where the accolades and recognition of “Icarus” and the Academy Award really changed the conversation. In those weeks following his death every journalist was after Hatice. As I approached her and other people, they were able to see my prior work. Hatice invited me about a month after his murder to come and meet with her in Istanbul. I didn’t bring a film crew. I spent the next five weeks there just building trust. It was a harrowing time in her life and I just kept explaining that I was not there for a day or a week or a month. I told her: if we do this, we’re going to go on this journey together. I promised that if she let me into her life, I was going to protect Jamal.

At the Sundance premiere, you challenged distributors to “…not be fearful and give this the global release that this deserves.” How did that turn out?

[Netflix CEO] Reed Hastings was there that day and so was Hillary Clinton. We had a standing ovation. People were wiping tears from their eyes as Hatice took the stage. It was the same scene at each one of our screenings. We were blessed with incredible reviews from all of the trades. In any normal circumstance, you’d think of course this film is going to be acquired and distributed. And yet not only was it not acquired and distributed, there was universal silence. Not a single offer. Not for one dollar or not 12 million dollars, which was what was paid for another documentary title at the festival. Nothing. It was literally as if nobody knew me. It was that startling and that shocking.

Six months later Tom Ortenberg and Briarcliff Entertainment stepped forward and said, hey we want to distribute this film. That’s wonderful. People will be able to rent this film on-demand. But what I wanted was for this film to be streaming into 200 million households around the world. I wanted people to have easy access to it. Instead we pieced together global distribution here and there.

Will this have a chilling effect on movies that want to tackle these kinds of controversial subjects?

This is a depressing and eye-opening moment that any filmmaker that wishes to tell a story like this needs to pay attention to. These global media conglomerates are aiding and abetting and silencing films that take on subject matter like this despite the fact their audiences want content like this. I was told that “Icarus” has had somewhere in the neighborhood of 700 million views. I don’t know if that’s accurate, but I know it was substantial. The decision not to acquire “The Dissident” had nothing to do with its critical reviews, had nothing to do with a global audience’s appetite to watch a docu-thriller, but had everything to do with business interests and politics and, who knows, perhaps pressure from the Saudi government. Netflix did remove Hasan Minhaj’s episode of “Patriot Act” [at the Saudi government’s request] in 2019 and defended that decision by saying, “we’re not a truth to power company. We’re an entertainment company.” It has been a struggle to get this film into the world and to shine a light on the human rights abuses that are happening in that kingdom. These companies, that have chosen not to distribute this film, in my opinion, are complicit.

Have you had conversations with these companies about why they didn’t want to release “The Dissident”? If so what has been their response?

It has been to not respond.

Is this about money? Are they wary of angering the Saudi Royal Family because they have money from Saudi Arabia or want to access their market?

My guess is both. Decisions are being made that it’s better to keep our doors open to Saudi business and Saudi money than it is to do anything to anger the kingdom. Netflix released a statement regarding Black Lives Matter that is in direct contrast to their statement regarding Hasan Minahaj. One stands behind truth to power and the other says we’re not a truth to power company, so it appears they are a truth to power company when it is convenient. But when their business doesn’t align with that or it might impact their subscriber growth, they’re not. The same can be said for all the streaming companies. In the film, there’s Jeff Bezos on the stage with Hatice. Jamal worked for Jeff Bezos [at the Washington Post, which Bezos owns]. So the same can be said of Amazon. I don’t want to point a finger at anyone because it’s all of them. This is a situation where business, subscriber growth, investment was more important than human rights. There’s got to be greater accountability. Not just on a business level, but on a political level. Trump vetoed the desire of both the House and the Senate to hold Saudi Arabia accountable for this crime. He continued to sell them weapons. He’s trying to get the Justice Department to grant Mohammed Bin Salman immunity from prosecution.

Would you still work for Netflix or the other streamers who declined to release “The Dissident”?

Listen, this is my career. This is my work. I’m sure that I will have other projects that might not take on subject matter like this and are not at odds with their business interests. When those projects come along, I will be glad to work with any of these companies. Look, I love Netflix. I really, really do. I’m so grateful to them because without Netflix, “Icarus” would not have become what it became. I’m not insulted by this. I’m not personally offended. I don’t view anything that is happening as personal. I just view it as business. I can understand it on a business level. I don’t agree with it, but I get it. I’m not mad. I’m disappointed.

What message do you want viewers will take away from the film?

There’s a hashtag #JusticeForJamal and the question has to become what does justice mean? We know that Mohammed Bin Salman will not stand trial for this murder. We know that the henchmen he sent are unlikely to truly stand trial. We have to look to the future. So what I hope people will take from the film is knowledge, because knowledge is power. Just like “Icarus” or “Blackfish” or “The Cove,” I hope this film has the ability to change hearts and minds. As more and more people come to “The Dissident,” I hope there’s a call to action. I hope that takes place on social media or through writing letters to congressmen or senators. The first thing I hope is people will spread the word. The second thing is I hope they will use the power of free speech that we have in this country and are so blessed to have to change the narrative. The Arab Spring happened because of Twitter, the Black Lives Matter and #MeToo movements took hold because of social media. We’ve seen that through combined action, change can come.

Disclosure: SRMG, a Saudi publishing and media company which is publicly traded, remains a minority investor in PMC, Variety’s parent company.

#netflix#saudi arabia#mohammed bin salman#jeff bezos#the dissident#sundance#jamal kashoggi#bryan fogel#cinema#film#censorship

4 notes

·

View notes

Conversation

Unnecessary Arguments - Breaking up the FAANG Companies like Facebook

Person #1: Let’s just agree on one thing - Facebook is trash and will lead to the end of society. Facebook content is trash. Facebook ads are trash. The algorithm is trash, everything about it is horrible, and we would all be better suited torching it and starting over

Person #2: You know that we post these on Facebook, right?

Person #1: Speaking of trash, Instagram is also trash. I look forward to seeing the government put its foot down and tell these tech companies that they can’t take control of the world without consequence. This is unregulated capitalism. This is the reason we have things like the horrific treatment of factory workers at the hands of Apple, or the atrocities committed in the Amazon warehouses

Person #2: Do you actually dislike any of these tech companies, or are you just jealous that you came nowhere close to getting job offers from them?

Person #1: I have always advocated for collections of large open source communities. Let’s do away with these large corporations

Person #2: You mean like Google, the company that has arguably done more for the open source community than any other tech company?

Person #1: That’s completely untrue

Person #2: And how much of an idiot are you? Seriously. All you had to do on that Amazon challenge was use the string find function. Check to see if you get npos. And for the love of everything holy, why did you think it was a good idea to use an array of size one billion instead of the standard unordered map?

Person #1: I was implementing my own unordered map

Person #2: That’s like asking a staff member to please grab you 1000 whiteboard markers during the interview, then throwing 999 away in front of him. But let’s be completely honest here. Do you use Google, Amazon, and Facebook?

Person #1: Yeah, because I have no choice

Person #2: What do you mean? You absolutely have a choice. Delete Facebook. I dare you

Person #1: Ugh

Person #2: Yeah, you can’t. Because they’re the best. At the end of the day, and this is an argument you will never win, they have the best products. We use Google because the most searched result on Bing is how to delete Bing. We use Facebook because myspace was a massive pile of garbage. If we demand that these companies produce lower quality products, then Silicon Valley will no longer be Silicon Valley. Another country, perhaps China, will emerge as the new tech giant. Can you imagine a world where the most popular form of social media is TikTok? TikTok is the worst thing to come out of China since-

Person #1: DON’T SAY IT

Person #2: ...I was about to say “The Great Wall,” starring Matt Damon

Person #1: It wasn’t even bad

Person #2: And what about all the good they’ve done? Google, granting access to all the world’s knowledge thanks to a constantly evolving set of search algorithms. Apple, with its improving hardware. Amazon, with its-

Person #1: Amazon, with its rapid conquest for world supremacy. Amazon doesn’t just deliver the products anymore, it strives to be all the products. Did you know that 13% of their revenue is from AWS? 33% of all cloud is on AWS. So now we have these Amazon foot soldiers who control our goods, our means of production, our delivery, our network infrastructure, and pretty soon our media and our banking

Person #2: I don’t know what you’re talking about with the last one

Person #1: You will soon. An investigation uncovered a private email Zuckerberg sent to his team, describing Instagram as a serious threat that needed to be neutralized

Person #2: I’ve heard that, and I don’t see how it’s damning. Shortly before he died, Steve Jobs asked the Dropbox founder to sell the company. When he refused, Jobs said he would destroy him

Person #1: Case in point

Person #2: No, that’s just how business works. You have a big company. Some smaller company emerges and tries to cut into your market. So you eliminate them

Person #1: Sounds pretty evil to me

Person #2: It’s kind of funny...I’m getting Microsoft vibes from this. Why is Microsoft not part of FAANG? Oh, that’s right, because it’s a BS term that has more to do with the stock market than REAL value

Person #1: Wut

Person #2: The government couldn’t stop Microsoft then because they had no case

Person #1: They couldn’t stop Microsoft then because tech companies are now, in this horrible dystopia we’ve allowed to come into being, more powerful than the government. Democrats hate FAANG companies because they’re such large entities. Republicans hate FAANG companies because they censor the truth

Person #2: What do you mean “censor the truth”?

Person #1: Type “What percent of Trump supporters are racist” into google. It will instantly give you back 50%

Person #2: No it won’t

Person #1: Really? Huh. It used to

Person #2: No it didn’t. And tech companies are just that...Facebook isn’t the news. If you get 100% of your news on Facebook, you deserve to believe that Epstein didn’t kill himself

Person #1: Epstein definitely didn’t...okay I’m not touching that one. You may think this is all a joke now, while there are still little start-ups and such. Not for long. These tech companies will buy out the world like the titans leaving the confines of the walls

Person #2: Did you just make a reference to...stop, I haven’t watched any of the new seasons yet. But if I bend down to your level and use the reference, why not just let the titans fight it out?

Person #1: Google tried to do that with Google+

Person #2: What’s Google+?

Person #1: Exactly

Person #2: Have you seen the Facebook campus? I didn’t even really want to go, I was in a bad mood that day...and it lifted my spirits. All-you-can-eat buffet. The campus is modeled after Disneyland. they had their own ice cream parlor...like, just kind of had this 9-5 ice cream parlor employees could go to whenever they wanted with its own hired staff

Person #1: Stop making it sound like I’m jealous

Person #2: You suck at Leetcode. I get it. Well there’s this book called “Cracking the Coding Interview,” you should definitely check it out instead of just complaining that we should destroy the companies that don’t hire you

Person #1: Enough with your personal attacks

Person #2: You’re right. I want to watch that new Netflix original about that talking panda with a drinking problem

Person #1: See? See what’s happened? Tech is in so many places we’ve forgotten what the Internet is supposed to be about

Person #2: Fine...what is the Internet supposed to be about?

Person #1: Free speech! Free information

Person #2: Well it’s succeeded at that. And it’s only going to get better from here

Person #1: The nightmare is just beginning and the only hope we have is that these lawsuits against Facebook and Google will go through

Person #2: I’ll be sure to Google what you’re talking about later

2 notes

·

View notes

Text

Pluralist, your daily link-dose: 24 Feb 2020

Today’s links

How “Authoritarian Blindness” kept Xi from dealing with coronavirus: Zeynep Tufekci in outstanding form.

The Snowden Archive: every publicly available Snowden doc, collected and annotated.

Key computer vision researcher quits: facial recognition is a moral quagmire.

My interview on adversarial interoperability: you can’t shop your way out of late-stage capitalism.

81 Fortune 100 companies demand binding arbitration: monopoly and its justice system.

I’m coming to Kelowna! Canada Reads is bringing me to the BC interior, March 5.

A flat earther commits suicide by conspiracy theory: conspiracies are comorbid with corruption.

This day in history: 2019, 2015, 2010, 2005

Colophon: Recent publications, current writing projects, upcoming appearances, current reading

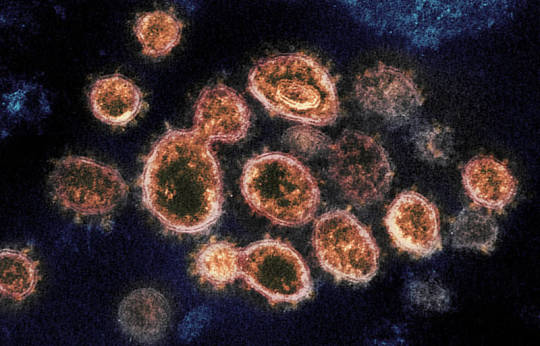

How “Authoritarian Blindness” kept Xi from dealing with coronavirus (permalink)

Xi Jinping’s refashioning of the Chinese internet to ratchet up surveillance and censorship made it all but impossible for the Chinese state to use the internet to detect and contain Corona Virus, writes Zeynep Tufekci in The Atlantic. Tufekci talks about “authoritarian blindness,” where people too scared to tell the autocrat the hard truths makes it impossible for the autocrat to set policy that reflects reality.

https://www.theatlantic.com/technology/archive/2020/02/coronavirus-and-blindness-authoritarianism/606922/

(Cue Mao telling China to “eat 5 meals a day” because his apparats were too scared to warn him of impending famine, then selling off the nation’s food reserves for foreign currency because he thought it was surplus. Food production collapsed.)

Before Xi, a certain amount of online dissidence was tolerated because it helped root out dangerously corrupt local leaders before they could do real damage. It’s always hard to make autocracies sustainable because corruption and looting leaves them hollow and brittle.

When Xi took power in 2012, he restored “one man rule” and began a series of maneuvers, including purges, to consolidate power for himself. The rise and rise of China’s mobile internet made this far more effective than at any time in history.

“Authoritarian blindness” kicked off the Hong Kong protests because the state so badly misjudged the cause and severity of the grievances there. The same thing happened in Wuhan when doctors and netizens faced retaliation for describing early virus outbreaks.

The reality-debt built up by official denial always results in reality bankruptcy, eventually – so finally, the reports of the virus were so widespread and alarming they could no longer be suppressed. But by then, the virus had proliferated. This is an important point: “the killer digital app for authoritarianism isn’t listening in on people through increased surveillance, but listening to them as they express their honest opinions, especially complaints.”

That’s how you stabilize the unstable: by using digital authoritarianism to fine tune the minimum viable amount of good governance to diffuse public anger. It’s how you maximize your looting without getting strung up by your ankles.

The Snowden Archive (permalink)

The Snowden Surveillance Archive collects “all documents leaked by former NSA contractor Edward Snowden that have subsequently been published by news media.”

https://snowdenarchive.cjfe.org/greenstone/cgi-bin/library.cgi

It’s indexed and searchable, created by Canadian Journalists for Free Expression and the Politics of Surveillance Project at the Faculty of Information at the University of Toronto. (Canada is a “Five Eyes” country that partners with the NSA on global mass surveillance)

There’s a “Portable Archive” version – a tarball with all the docs so you can create your own mirror:

https://snowdenarchive.cjfe.org/greenstone/collect/snowden1/portablearchive.html

They provide instructions for turning this into a kiosk they call a “Snowden Archive-in-a-Box.” Costs about CAD120.00

Key computer vision researcher quits (permalink)

Joseph Redmon is the creator of YOLO (You Only Look Once), a key Computer Vision technology. He’s just announced his resignation from computer vision work, citing ethical concerns with Facial Recognition.

https://twitter.com/pjreddie/status/1230523827446091776

His thread is really important, calling out the gap between what ML researchers SAY they want to do about ethics and how they actually deal with ethical issues: “basically all facial recognition work would not get published if we took Broader Impacts sections seriously.”

“There is almost no upside and enormous downside risk.” That’s some serious Oppenheimer stuff right there. The kicker? “For most of grad school I bought in to the myth that science is apolitical and research is objectively moral and good no matter what the subject is.”

My interview on adversarial interoperability (permalink)

The Firewalls Don’t Stop Dragons podcast (which offers information security advice and analysis for non-technical people) just posted part 2 of our interview on Adversarial Interoperability, Right To Repair, and technological fairness.

http://podcast.firewallsdontstopdragons.com/2020/02/24/adversarial-interoperability-part-2/

Part one went live last week:

https://twitter.com/doctorow/status/1229842619380858885

In this one, I try to explain how John Deere’s war on farm-based repairs is connected to Apple’s war on independent repair, and how consumer choices can’t solve either problem — but collective action can!

It’ll take a movement, not individual action. Thankfully, such a movement exists. EFF’s Electronic Frontier Alliance, a network of groups nationwide working on local issues with national coordination. It’s the antidote to individual powerlessness.

https://www.eff.org/electronic-frontier-alliance/allies

81 Fortune 100 companies demand binding arbitration (permalink)

Binding arbitration was originally created as a way for giant corporations to resolve their disputes with each other without decades-long court battles costing tens of millions of dollars. SCOTUS ratified the principal in 1925: firms of similar size and power could use binding arbitration as an alternative to litigation.

http://www.onthecommons.org/magazine/we-now-have-a-justice-system-just-for-corporations

In the century since, corporations have eroded the idea of arbitration as something reserved for co-equals and have turned it into a condition of employment and of being a customer.

In an era of both monopoly and monoposony, it can be hard to find a single employer OR vendor who will conduct business with you unless you first surrender the rights your elected lawmakers decided that you are entitled to.

Today, the largest corporations in the world require you to “agree” to binding arbitration before you can conduct business with them: your monopolistic ISP or cable operator probably does.

As do Walmart, Uber, and Amazon (and not coincidentally, all three have crowded out all the competitors you might choose to take your business to if this strikes you as unfair).

In 2019, SCOTUS ratified the practice.

https://www.cnn.com/2020/02/13/business/binding-arbitration-consumers/index.html

81 out of the Fortune 100 non-negotiably require binding arbitration if you want to conduct business with them. “Arbitration is often confidential and the outcome doesn’t enter the public record” – if you get screwed you won’t know if it’s a one-off or a pattern.

This is especially pernicious in the realm of US health care. There is ONE pain specialist in all of Southern California that my insurer covers who doesn’t require binding arbitration. When I took my daughter to the ER with a broken bone, they threatened not to treat her unless we signed an arbitration waiver – and that ER is now owned by a PE firm that bought every medical practice in a 10mi radius and now they all do it.

We are literally replacing public courts with private corporate justice, where the “judge” is paid by the company that maimed you, or ripped you off, or killed you.

I’m coming to Kelowna! (permalink)

I’ve never been to Kelwona, BC or anywhere in BC apart from Victoria and Vancouver, so I am SO TOTALLY EXCITED to be appearing in Kelowna for Canada Reads on Mar 5. Please come and say hello! (it’s free!)

https://www.eventbrite.ca/e/cbc-radio-presents-in-conversation-with-cory-doctorow-tickets-96154415445

The event is a collaboration between the Kelowna Public Library and CBC Books, and I’m being emceed and interviewed by Sarah Penton. It’s going to be recorded for airing later as well (I’ll be sure to fold it into my podcast, which you can get here: http://craphound.com/podcast/)

A flat earther commits suicide by conspiracy theory (permalink)

A(nother) flat-earther has tried to prove that the Earth is disc-shaped by launching a homemade rocket. This one (“Mad” Mike Hughes) killed himself by pancaking into the desert.

https://www.nbcnews.com/news/us-news/daredevil-mad-mike-hughes-dies-homemade-rocket-launch-filmed-tv-n1141286

This is awful. Jokes about “Darwin Awards” don’t change that.

When you scratch a conspiracist, you generally find two things:

Someone who knows chapter-&-verse about real conspiracies (e.g. “If you think antivax is so outlandish, let me tell you about the Sackler family”)

Someone who has been traumatized by conspiracies (belief that the levees were dynamited during Katrina to drown Black neighborhoods are often embraced by people whose family were flooded out in 58 when the levees in Tupelo were dynamited to drown Black neighborhoods).

A belief that the aerospace industry engages in coverups and conspiracies is not, in and of itself, irrational. Aerospace is the land of conspiracies and coverups. Look at the Boeing 737 Max!

Conspiracies are an epiphenomenon of market concentration. “Two may keep a secret if one of them is dead”: the ability to conspire is a collective action problem, wherein linear increases in the number of conspirators yield geometric increases in the likelihood of defections. When an industry is reduced to 3-5 giants, the likelihood is that every top exec at each company worked as a top exec at one or more of the others (to say nothing of the likelihood of intercompany friendships, marriages, etc). Moreover, an industry that concentrated will almost certainly be regulated by its own former execs, as they are likely the only ones qualified to understand its workings.

Many of us were appalled by the sight of the nation’s tech leaders gathered around a table at Trump Tower after the inauguration.

But we should have been even more alarmed by the realization that all the leaders of the tech industry fit around a single table.

We are living in both a golden age of conspiratorial thinking and of actual conspiracies. The conspiracy theories don’t necessarily refer to the actual conspiracies, but “conspiracy” is a plausible idea with a lot of explanatory power in 2020.

We spend a lot of time wondering about how we can fix the false beliefs that people have, but some of our focus needs to be on reducing the plausibility of conspiracy itself. Make industries more competitive and diverse, make regulators more accountable.

Put out the fires, sure, but clear away the brush so that they don’t keep reigniting.

I strongly recommend Anna Merlan’s REPUBLIC OF LIES for more.

https://boingboing.net/2019/09/21/from-opioids-to-antivax.html

This day in history (permalink)

#15yrsago: Labour MP Brian Sedgemore excoriates his own government’s terror laws in the speech of his lifetime: https://web.archive.org/web/20050227035611/http://www.publications.parliament.uk/pa/cm200405/cmhansrd/cm050223/debtext/50223-21.htm

#10yrsago: How ducks, Nazis and themeparks gave America its color TV transition: https://www.theguardian.com/technology/2010/feb/23/digital-switchover-bbc-spectrum

#5yrsago: Alex Stamos, then CSO of Yahoo, publicly calls out then-NSA Director Adm. Mike Rogers on crypto backdoors: https://arstechnica.com/tech-policy/2015/02/yahoo-exec-goes-mano-a-mano-with-nsa-director-over-crypo-backdoors/

#5yrsago: A chronology of the Canadian Conservative Party’s war on science under PM Stephen Harper: https://scienceblogs.com/confessions/2013/05/20/the-canadian-war-on-science-a-long-unexaggerated-devastating-chronological-indictment

#5yrsago: Citizenfour, Laura Poitras’s movie about Edward Snowden, wins the Academy Award for best documentary: https://www.aclu.org/press-releases/edward-snowden-congratulates-laura-poitras-winning-best-documentary-oscar-citizenfour

#1yrago: Every AOC staffer will earn a living wage: https://www.rollcall.com/2019/02/22/alexandria-ocasio-cortezs-call-for-a-living-wage-starts-in-her-office/

#1yrago: Richard Sackler’s “verbal gymnastics” in defending his family’s role in killing 200,000 Americans with opiods: https://arstechnica.com/science/2019/02/sackler-behind-oxycontin-fraud-offered-twisted-mind-boggling-defense/

#1yrago: German neo-Nazis use Qanon memes to signal-boost their messages: https://www.thedailybeast.com/how-fringe-groups-are-using-qanon-to-amplify-their-wild-messages

#1yrago: French courts fine UBS €3.7b for helping French plutes dodge their taxes: https://www.thelocal.fr/20190220/breaking-french-court-hits-swiss-bank-ubs-with-37-billion-fine-in-french-tax-fraud-case

#1yrago: Apple to close down its east Texas stores to avoid having any nexus with America’s worst patent court: https://www.macrumors.com/2019/02/22/apple-closing-stores-in-eastern-district-texas/

#1yrago: Small business cancels its unusably slow Frontier internet service, Frontier sticks them with a $4,300 cancellation fee: https://arstechnica.com/information-technology/2019/02/frontier-demands-4300-cancellation-fee-despite-horribly-slow-internet/

#1yrago: Fast food millionaire complains that social media makes kids feel so entitled that they are no longer willing to work for free: https://amp.news.com.au/finance/work/careers/muffin-break-boss-fury-over-youth-who-wont-work-unpaid/news-story/57607ea9a1bbe52ba7746cff031306f2

#1yrago: Apps built with Facebook’s SDK shovel incredible quantities of incredibly sensitive data into Facebook’s gaping maw: https://www.cnbc.com/2019/02/22/facebook-receives-personal-health-data-from-apps-wsj.html

#1yrago: Super-high end prop horror-movie eyeballs, including kits to make your own: https://fourthsealstudios.com/

#1yrago: EU advances its catastrophic Copyright Directive without fixing any of its most dangerous flaws: https://arstechnica.com/tech-policy/2019/02/european-governments-approve-controversial-new-copyright-law/

Colophon (permalink)

Today’s top sources: Four Short Links (https://www.oreilly.com/feed/four-short-links), Slashdot (https://slashdot.org), Naked Capitalism (https://nakedcapitalism.com/”).

Hugo nominators! My story “Unauthorized Bread” is eligible in the Novella category and you can read it free on Ars Technica: https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

Upcoming appearances:

Canada Reads Kelowna: March 5, 6PM, Kelowna Library, 1380 Ellis Street, with CBC’s Sarah Penton https://www.eventbrite.ca/e/cbc-radio-presents-in-conversation-with-cory-doctorow-tickets-96154415445

Currently writing: I just finished a short story, “The Canadian Miracle,” for MIT Tech Review. It’s a story set in the world of my next novel, “The Lost Cause,” a post-GND novel about truth and reconciliation. I’m getting geared up to start work on the novel now, though the timing is going to depend on another pending commission (I’ve been solicited by an NGO) to write a short story set in the world’s prehistory.

Currently reading: I finished Andrea Bernstein’s “American Oligarchs” this week; it’s a magnificent history of the Kushner and Trump families, showing how they cheated, stole and lied their way into power. I’m getting really into Anna Weiner’s memoir about tech, “Uncanny Valley.” I just loaded Matt Stoller’s “Goliath” onto my underwater MP3 player and I’m listening to it as I swim laps.

Latest podcast: Persuasion, Adaptation, and the Arms Race for Your Attention: https://craphound.com/podcast/2020/02/10/persuasion-adaptation-and-the-arms-race-for-your-attention/

Upcoming books: “Poesy the Monster Slayer” (Jul 2020), a picture book about monsters, bedtime, gender, and kicking ass. Pre-order here: https://us.macmillan.com/books/9781626723627?utm_source=socialmedia&utm_medium=socialpost&utm_term=na-poesycorypreorder&utm_content=na-preorder-buynow&utm_campaign=9781626723627

(we’re having a launch for it in Burbank on July 11 at Dark Delicacies and you can get me AND Poesy to sign it and Dark Del will ship it to the monster kids in your life in time for the release date).

“Attack Surface”: The third Little Brother book, Oct 20, 2020.

“Little Brother/Homeland”: A reissue omnibus edition with a very special, s00per s33kr1t intro.

15 notes

·

View notes

Text

The Amazon-ification of America

By Steven Miller 8-14-2020

Last week, tech leaders spoke to Congress on Capitol Hill. Google’s Sundar Pichai, Facebook CEO Mark Zuckerberg, Apple CEO Tim Cook and Amazon CEO Jeff Bezos all spoke from prepared remarks. As the US economy shrank by 32.9%, Amazon’s share price rose by half, and Facebook’s growth rate approached 60%.

Congresspeople were supposedly “grilling” these uber-capitalists, but they were politely slobbering at their wealth. Since COVID began, American billionaires have made $637 billion, while 50 million people have lost their jobs. Timidly asking these billionaires questions about monopoly practices, the politicians refuse to address how this mega-wealth could be used to help people out in the greatest collapse in the history of capitalism.

Tech capitalism is fomenting the Amazon-ification and the Google-ization of America, right now in real time. This will culminate in a major re-organization and the State. This is class warfare on the rights of humans to control their own basic needs to live and thrive. Private property is on the march to seize every resource of the public and to re-organize society in its own image.

Microsoft has controlled the Pentagon’s cloud computing efforts since October, 2019. Big tech is constantly making inroads into the military, including $11 billion in contracts in the last 3 years.:

“’As we continue to execute the DOD Cloud Strategy, additional contracts are planned for both cloud services and complementary migration and integration solutions necessary to achieve effective cloud adoption,’ the Pentagon said”. (https://www.reuters.com/article/us-pentagon-jedi-idUSKBN1X42IU)

Then just look at what we are already seeing! Capitalism’s massive collapse as a result of COVID means that an estimated 40% of African-American business will not open. One-third of restaurants will never open again.

What happens when the restaurants close? People increasingly order online. Big Tech becomes ever more dominant. Then Big Box stores enter the scene and become the only places that provide the distribution of the necessities of life. Private equity corporations and hedge funds actively finance this extermination. Amazonification aims far higher than replacing mom and pop stores. It also rises to counter the demand for the domination and extension of public property to benefit everyone..

Then Rent Apocalypse is about to hit, with multi-billion dollar corporations waiting to evict up to 28 million people by Thanksgiving. This tidal wave is lead by Blackstone, the world’s largest private equity management corporation. Blackstone works closely with Blackrock, the world’s largest asset-manager, and shadow bank to the world, which was founded in partnership with Blackstone in 1988. While Blackstone proclaims that the rentership society is here, Blackrock manages the government multi-trillion bailout for financial speculators and the financial industry. By driving millions out of their homes, these criminals will keep the homes empty, and turning them into rentals, in an attempt to extract more wealth from our communities..

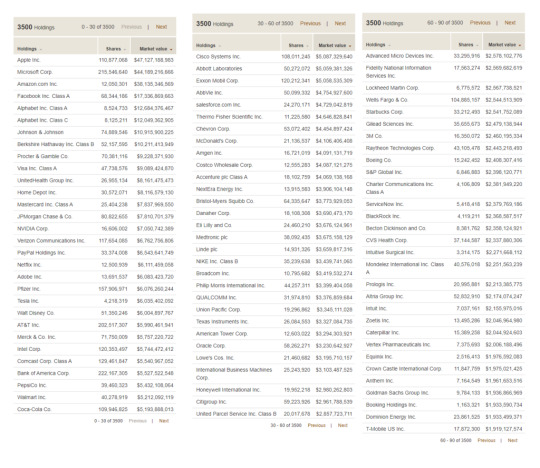

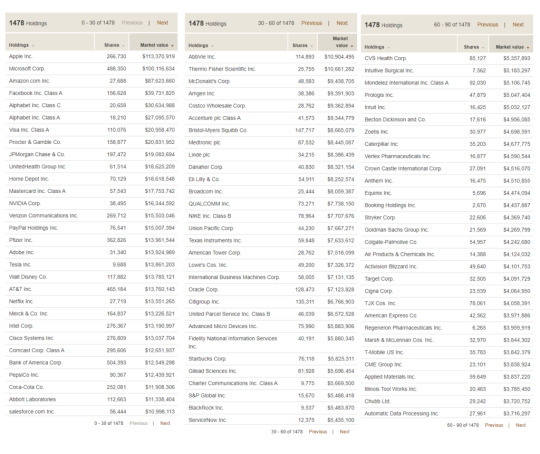

“Today the fast-growing ETF (“exchange-traded funds) sector controls nearly half of all investments in US stocks, and it is highly concentrated. The sector is dominated by just three giant American asset managers – BlackRock, Vanguard and State Street, the “Big Three” – with BlackRock the clear global leader. By 2017, the Big Three together had become the largest shareholder in almost 90% of S&P 500 firms, including Apple, Microsoft, ExxonMobil, General Electric and Coca-Cola….

“Giant pension and other investment funds largely control the stock market, and the asset managers control the funds. That effectively puts BlackRock, the largest and most influential asset manager, in the driver’s seat in controlling the economy.”

(https://www.counterpunch.org/2020/06/24/meet-blackrock-the-new-great-vampire-squid/)

These corporations are hell-bent on impose extractive capitalism on our communities and families. This model that vacuums wealth and information out of communities and sends it to the top. Oh yes, and what about the morality of evicting people to live on the street in the middle of a pandemic? Oh well, it’s just collateral damage.

That, of course, is what the Amazon-ification of America is all about. No longer even pretending to offer jobs, the capitalist class, lead by Big Tech, is re-organizing the economy and the government to extract wealth and give it to themselves.

Before COVID hit, the government had already authorized “Opportunity Zones” in 2017 to re-invest in impoverished American communities. Such predatory gentrification and dispossession is beloved by both Jared Kushner and Gavin Newsome. The giant capitalist equity companies and hedge funds are now in charge.

From “Displacement Zones: How Opportunity Zones Turn Communities into Tax Shelters for the Rich”:

“Boosters promised Opportunity Zones would help bring capital to the neighborhoods that most need it, but in reality allow wealthy investors to benefit from huge tax breaks while they speculate at the expense of the most vulnerable communities. The structure of the Opportunity Zones program was designed with the interests of speculators, not communities, in mind. Communities living inside many Opportunity Zones across the country are already experiencing rapid changes. Unregulated speculative investment will throw even more fuel on the fire. The Opportunity Zones program will exacerbate an already unbearable

“Opportunity Zones were created by the rich, for the rich.

“Opportunity Zones are an invention of the Silicon Valley millionaire-backed Economic Innovation Group, and contain some of the most generous tax breaks currently available. The program gives capital gains tax exemptions that scale up based on the length of time an investment is held, eventually culminating in a 15% reduction in the taxable basis of the principal, and complete tax exemption of any profits made on the investment after 10 years. Because the distribution of capital gains income is highly unequal, the overwhelming majority of these tax benefits will flow directly to the richest investors in the country. Indeed, 90% of all capital gains income in the United States is owned by the wealthiest 10% of people, and 70% of all capital gains is owned by the wealthiest 1%.” (www.saje.net/.../2019/11/SAJE_DisplacementZones.pdf)

This was before COVID. The virus is now aggravating and amplifying every tendency that existed before its advent. It should be no surprise, therefore, that New York Andrew Cuomo recently invited Google and Microsoft into the state to “re-imagine” the new world where Big Tech companies seize control of telehealth, public education and the entire society.

In other words, Cuomo is abrogating the responsibilities of government to guarantee a safe and healthy environment for everyone and turning this charge over to corporations. They, of course, will place private profit above the public good.

“This is a future in which, for the privileged, almost everything is home delivered, either virtually via streaming and cloud technology, or physically via driverless vehicle or drone, then screen “shared” on a mediated platform. It’s a future that employs far fewer teachers, doctors, and drivers. It accepts no cash or credit cards (under guise of virus control) and has skeletal mass transit and far less live art. It’s a future that claims to be run on “artificial intelligence” but is actually held together by tens of millions of anonymous workers tucked away in warehouses, data centers, content moderation mills, electronic sweatshops, lithium mines, industrial farms, meat-processing plants, and prisons, where they are left unprotected from disease and hyperexploition. It’s a future in which our every move, our every word, our every relationship is trackable, traceable, and data-mineable by unprecedented collaborations between government and tech giants.

“If all of this sounds familiar it’s because, pre-Covid, this precise app-driven, gig-fueled future was being sold to us in the name of convenience, frictionlessness, and personalization.” (https://naomiklein.org/the-screen-new-deal/)

The Social Response

Yes, the US capitalist class could have responded to the virus by taking steps, similar to Europe, to make things easier, but it didn’t. Now that the capitalist class is doubling down to make ever greater political and private profit from the crisis, we have already seen a decisive social force take the political stage. Two new generations have now mounted the stage of history. The great mass of protestors, though not all, in the massive George Floyd rebellion came from these new generations.

Millennials are roughly those who were born after 1980 and came to political awareness in 2000 or after, and who came into political maturity around 2000. This year they would be 40 years old. Rising behind them is he generation that came to political maturity with the Parkland Massacres in 2018, often called Gen Z by the corporate media. There are 74 million people in the US in this group who were born between 1995 and 2015.

These generations intend to assert their agency. They understand that their future will be there long after the Boomers have passed on. They intend to take control of the situation. For these generations, the American Dream is a hollow antiquated notion. They understood already that their future was imperiled with Climate Crisis. They already were the primary casualties of the digitally-driven laborless-production that is sweeping through every branch of the economy. Somehow, they must survive the Gig Economy that is consuming them. They are a substantial part of a new proletarian class, one that is being replaced by digitally-driven production.

The new social force already clearly holds government for guaranteeing the safety of the public. This issue began with the murder of Trayvon in 2012, and escalated with the response to Michael Brown’s and Eric Garners murders, to name a few. It expresses itself as righteous rage at white supremacy and police murder. And it correctly holds the government and the State accountable. This rising demand for the public good threatens to overflow the narrow limits that the Democratic Party tries to impose. Voices from myriad directions have been asserting that if government cannot do the job, we know very well how to govern ourselves and society.

This new proletarian class has much to learn, but objectively it cannot back down. We are witnessing the concretization for our times of Lenin’s famous statement that revolutions begin when the working class cannot live in the old way and the ruling class cannot rule in the old way.

As society is drawn further into political crisis with re-opening schools, massive voter suppression and an election that may well be suborned, the social response, sooner or later, will build its political consciousness. As Engels observed long ago, the people today are transforming themselves into the people of tomorrow:

“You will have to go through 15, 20, 50 years of civil wars and national struggles not only to bring about a change in society but also to change yourselves, and prepare yourselves for the exercise of political power.” [Revelations concerning the Communist Trial at Cologne]

Steven Miller

August 9, 2020

Steven Miller is a retired public school science teacher in Oakland, California

1 note

·

View note

Text

Do As Buffett Does

Warren Buffett, the best investor of our lifetime, gave an interview on CNBC this past week. While he may still advocate passive investing for you, his personal choice is anything but. He runs a concentrated investment portfolio with one position, Apple, now over 25% of his investable assets.

Here’s what he shared in his interview:

US economy is humming.

Operating earnings, cash flow and free cash flow are very strong.

Inflationary pressures are intensifying.

Trade issues will be resolved.

Stocks are easily his asset class of choice over bonds and real estate.

He is buying stocks.

He is still having trouble buying whole companies, as the premium to buy is almost prohibitive. This comment is telling as he is really saying that the private value of companies far exceeds their current public values, hence today’s prices are undervalued.

Corporations, such as Apple, are huge buyers of their own stock and would welcome any price weakness to buy more shares at lower prices providing downside support.

Buffett is a true investor with a long-term perspective, but we can assure you that he hates losing money so if he is buying today, that says a lot. He mentioned buying back some Berkshire shares recently, too, under their new company guidelines to shrink the cap as long as it is under the intrinsic value of the shares rather than using stated book. That action is meaningful as Berkshire is essentially a giant holding company owning a cross-section of America ranging from insurance to rails to energy to retailing to housing to chemicals to aerospace components and so on.

So when the Oracle speaks, you better listen. No one has a better read on the economy or a greater sense of value than he. If Buffett sees opportunities in the stock market today, you should too. But always keep reserves and never use leverage to be able to take advantage of dips. Do as Buffett does.

Thank you, Warren, for your common sense and well-thought out view of the investable landscape. We resoundingly agree.

The markets finished the week and month on a high point for the year despite all the noise about trade and troubled areas abroad. If you traded based on all the continuous sound bites, you would have gotten whipsawed! The pundits keep crying wolf although the domestic house keeps hitting on all cylinders. This is not to say that we, as well as Buffett, are not cognizant of all the issues/potential problems and risks facing us. We factor them all in taking a longer term view looking over the valley owning great companies with winning strategies regardless of what may happen. And we outperform all indices, too.

Let’s take a look at what was reported around the globe during the normally slow, summer ending week:

1. The US continues to be the engine of global growth with strong consumer demand along with acceleration in business real and nominal growth, profitability, cash flow; and capital spending. Yes, the US is hitting on all cylinders as we move into the fall. We expect very strong Christmas retail sales.

Inflationary pressures are intensifying as Buffett mentioned, but we expect them to moderate as productivity accelerates offsetting wage increases next year. The all-important core PCE index, excluding food and energy, rose 0.2% in July from June and 2% from a year ago. We have not altered our view of Fed policy expecting a hike in the Federal Funds rate in September and most likely again in December.

We expect second-half real growth around 3% and only slightly less real growth next year. S & P earnings are likely to exceed $162/share in 2018 and $175/share in 2019. We see inflation hanging around 2% excluding any one-time impact from trade tariffs, which we do deem transitory as trade deals are reached.

2. Trade issues remain the number one news story around the world as it impacts everyone in some manner. The US successfully concluded a deal with Mexico but failed to cross the finish line with Canada. Politics rather than economics seems the over riding issue preventing a deal. The simple truth is that Canada needs a deal much more than the US, which plays into Trump’s hand. Exports to the US are three quarters of total exports and nearly one fifth of their total GNP. We wished that Trump took a more conciliatory tone towards our neighbors, as it would only improve the chances of closing a deal.

The US will mostly likely impose tariffs on an additional $200 worth of Chinese goods shortly. China is unable to reciprocate in kind but will most likely use other tactics to show that they are not paper tigers. We still see a chance that negotiators from the Eurozone and Japan will join with us dealing with China on trade, the WTO and protecting IP but only after deals are reached with each one.

We remain optimistic that trade deals will be reached with our allies over the next 6-9 months followed by one with China next year after our elections. As trade deals are reached, we expect acceleration in growth in those regions. Global growth has been stunted by all the trade talks, as businesses need some certainty before moving forward on hiring and spending plans.

3. China’s manufacturing gauge surprisingly picked up slightly in August. We continue to believe that China’s economy will decelerate meaningfully over the next six months despite government actions to stimulate growth by accelerating bank lending reversing earlier policies to strengthen the financial system, cutting taxes and pushing local governments to increase infrastructure spending.

China needs a deal more than us, so don’t believe all the government bravado that the country can sustain its growth despite US trade tariffs. In fact, there is some dissension in the ranks and cracks in President Xi’s stance on China 2025.

By the way, there is a bill in Congress doubling our funding for big infrastructure projects around the world to over $60 billion to counter China’s ambitious One Belt, One Road Initiative. Someone apparently woke up in DC.

4. India, the world’s 6th largest economy, reported a sensational second quarter with real growth over 8 percent. PM Modi has done an outstanding job promoting pro-growth, pro-business policies that are finally showing positive results throughout the economy. Walmart, Amazon and Alibaba’s focus on India is just one indication of the country’s future potential.

5. Eurozone economic activity and inflation weakened in August as anticipated. The ECB has no alternative but to maintain an overly easy monetary policy as growth in consumer demand/employment is not sufficient to offset weakness in exports. The Eurozone no doubt needs a trade deal before growth can re-accelerate. We remain concerned that Germany is moving to increase its dominance over the ECB to the detriment of its southern partners, especially Italy.

Let’s wrap this up.

We agree with Buffett that the US is the place to invest for all the reasons mentioned previously. In fact, our markets are undervalued based on S & P earnings over $167/share over the next twelve months with 10-year treasury bond yields under 2.85%. The truth is that the market multiple should be north of 19 today as financial risk factors are down with bank capital and liquidity ratios at all time highs. The market is selling with a Trump discount due to his unpredictability as he brings uncertainty into the marketplace. While we agree with most of his financial and economic policies, we hate his delivery and bully tactics dealing with our friends and foes alike. But that creates opportunity too for long-term investors like Buffett and us willing to look over the valley and invest for the long term.

Listening to the eulogies Saturday for John McCain only reinforced our belief that both parties need to come together for the common good of the country over party. He was a rebel with a cause that was to make America a better place, a beacon for all. We need many more like him. God bless him.

Paix et Prospérité has not altered its asset mix nor risk controls over the last several months. We remain long stocks, short bonds and have gone to a neutral dollar position as we expect dollar strength to weaken as trade deals get closer a la Mexico and overseas growth reaccelerates later in the year into 2019.

Our portfolios continue to be concentrated in the strongest US financials gaining market share; global capital goods and industrial companies; technology stocks selling at a fair multiple to growth; low cost, market dominant industrial commodity companies generating huge free cash flow; consumer nondurable and healthcare companies with strong unit growth and expanding pipelines; and many special situations where internal change will add to shareholder value. The common thread is great management, great financials and market leading technology selling at a discount to intrinsic value like Berkshire.

So remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset mix with risk controls continuously; do independent research and…

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

2 notes

·

View notes

Link

Wall Street Rebels Against Exxon The little Engine … Exxon Mobil suffered a stunning loss at its annual shareholder meeting yesterday, as a small new activist investor focused on climate change, Engine No. 1, won at least two seats on its 12-member board. To corporate America, the upset was a clear sign that company boards and leaders need to pay attention to environmental, social and governance issues (known as E.S.G.) — or suffer rebukes. A big splash for a tiny fund. Exxon was the first activist campaign for Engine No. 1, which was founded last year by the energy and tech investor Chris James. Its head of active engagement is Charlie Penner, a veteran hedge fund executive who helped lead campaigns against companies like Apple while at Jana Partners. It was a victory long in the making. Engine No. 1 began agitating against the oil giant in December, calling on the company to diversify away from fossil fuels and reduce its carbon emissions. But it began work on the campaign last March, courting large investors like public pension funds that held far larger stakes in Exxon, and thus had more sway. That’s how it parlayed a stake of just 0.02 percent into seats on the oil giant’s board — a truly remarkable feat. Exxon’s shares rose 1.2 percent yesterday. Sources with knowledge of the matter told DealBook that the fund was betting on a confluence of events, including longstanding investor dissatisfaction with Exxon’s corporate governance and a growing appreciation on Wall Street for E.S.G. In a note explaining why it backed three of Engine No. 1’s board candidates, BlackRock — which owns nearly 7 percent of Exxon — said the company’s directors “need to further assess the company’s strategy and board expertise against the possibility that demand for fossil fuels may decline rapidly in the coming decades.” Exxon largely played down Engine No. 1’s concerns, and pressured the firm to drop its challenge after a much bigger hedge fund, D.E. Shaw, called off a campaign. But Engine No. 1 persisted, and also benefited from timing: It began its campaign while oil prices were still depressed by the pandemic. Had oil not rebounded in recent months, Engine No. 1 executives believe, all four of its directors might have been elected. Big Oil is facing a reckoning. A Dutch court ruled yesterday that Royal Dutch Shell must speed up its efforts to cut its carbon emissions. And Chevron shareholders backed a proposal to compel the company to help customers reduce their own emissions. One question we have: Is Darren Woods, Exxon’s C.E.O., who pushed back forcefully against Engine No. 1, now at risk of losing his job? HERE’S WHAT’S HAPPENING The Justice Department opens an inquiry into Archegos. Prosecutors have asked some of the fund’s lenders for information about its meltdown, Bloomberg reports. The rare blood clots associated with Covid-19 vaccines may have a fixable explanation. German scientists theorize that a feature of the AstraZeneca and Johnson & Johnson shots, one they say could be modified, may be responsible. Russia puts pressure on U.S. tech giants. Moscow’s internet regulator now regularly demands that Facebook, Google and Twitter comply with its content restrictions and data storage requirements, or risk losing access to Russian users. It’s the latest instance of governments squeezing Silicon Valley companies. Ford pours billions more into electric vehicles. The company will increase spending on the technology by a third, to $30 billion. It now expects 40 percent of the vehicles it produces worldwide to be electric by 2030. Purdue Pharma’s restructuring plan is set for a vote. The judge overseeing the OxyContin maker’s bankruptcy case said he would let the company’s proposal — in which it would become a nonprofit, and both it and its founding Sackler family would be shielded from future legal liability — be voted on by 614,000 claimants. A culture of fear at the Gateses’ investment firm Bill Gates’s longtime money manager, Michael Larson, bullied co-workers, made sexually inappropriate comments and engaged in a broad pattern of inappropriate workplace behavior, an investigation by The Times found. For the past 27 years, Larson has run Cascade Investment, also sometimes known as Bill and Melinda Gates Investments (B.M.G.I.), which manages the Gateses’ enormous fortune. Among The Times’s findings: Larson made inappropriate comments about female employees. At a work party in the mid-2000s, he asked male employees which of three female colleagues they would want to have sex with. In another case, he asked an employee who was on a Weight Watchers program, “Are you losing weight for me?” Larson denied making any of the comments. A racist comment from Larson led to an internal investigation. When a Black employee mentioned on Election Day that she had not had to wait in line to vote, Larson replied, “But you live in the ghetto, and everybody knows that Black people don’t vote.” A spokesman for Larson, Chris Giglio, denied that he made the remark. At least one employee reported it to human resources, resulting in an internal investigation. Larson was known for “Larson bombs.” In emails, he sometimes called colleagues “stupid” or their work “garbage.” Some employees were moved to different floors in order to put distance between them and him. “Years ago, earlier in my career, I used harsh language that I would not use today,” Larson said. “I regret this greatly but have done a lot of work to change.” “Any issue raised over the company’s history has been taken seriously and resolved appropriately,” said Bridgitt Arnold, a spokeswoman for Bill Gates. Courtney Wade, a spokeswoman for Melinda French Gates, said, “Melinda unequivocally condemns disrespectful and inappropriate conduct in the workplace. She was unaware of most of these allegations given her lack of ownership of and control over B.M.G.I.” Today in Business Updated May 26, 2021, 4:06 p.m. ET “During his tenure, Mr. Larson has managed over 380 people, and there have been fewer than five complaints related to him in total,” said Giglio, Larson’s spokesman. “Any complaint was investigated and treated seriously and fully examined, and none merited Mr. Larson’s dismissal.” Overdraft math lessons Yesterday, the Senate Banking Committee held a three-hour hearing with C.E.O.s from the country’s six biggest banks. It lacked much of the heat of sessions in the aftermath of the financial crisis, when Congress routinely castigated Wall Street chiefs. (The C.E.O.s gather again today for a hearing in the House.) The most contentious moment came when Jamie Dimon of JPMorgan Chase felt the wrath of Senator Elizabeth Warren, Democrat of Massachusetts. Warren was a teacher before entering politics; she revealed her roots when she took Dimon and others to task for charging overdraft fees during the pandemic. The four biggest banks took $4 billion in overdraft fees from customers last year, Warren said. She singled out Dimon, asking him how much his bank, the nation’s largest, collected in 2020. “I think your numbers are totally inaccurate,” he countered. Dimon noted that JPMorgan waived fees upon request, didn’t go into overdraft at the Fed (which had waived its fees for banks), and provided $120 million in Covid relief. The senator kept pressing and finally provided the figure herself: “It’s $1.463 billion dollars.” “I did the math for you,” Warren said, calling their claims about stepping up during the pandemic “about $4 billion dollars’ worth of baloney.” When challenged to return the fees, none agreed. She asked Dimon directly twice, and he said “no” twice. Amazon, MGM and the streaming wars Amazon said yesterday that it would acquire the 97-year-old film and television studio MGM for $8.45 billion — about 40 percent more than what other potential buyers, including Apple and Comcast, were willing to pay. The deal reportedly made MGM’s owner, the hedge fund Anchorage Capital, a $2 billion profit. DealBook talked with Brooks Barnes, a reporter at The Times who covers Hollywood, about why Amazon was willing to pay so much and what this means for the streaming wars. Are Amazon’s motives different from other streaming platforms’? Amazon is mostly in the Prime membership business, whereas Netflix wants to sell subscriptions purely to its TV and movies. If you’re Amazon, you want to bolster Prime Video to make people even happier to pay for a Prime membership. Is there a risk that regulators won’t allow the deal? The regulatory scrutiny will be considerable. Representative Ken Buck and Senator Amy Klobuchar, both of whom have important antitrust roles, immediately voiced concern because Amazon is Amazon. But the deal is unlikely to be scuttled because MGM is relatively small and so is Amazon Studios. What does the acquisition mean for the streaming wars? If you’re Apple, you’re probably looking around and thinking, well, we don’t have a library, we don’t have a big franchise of our own. Do we need to go out and buy? People think that it will increase the pressure on other streaming services to bulk up. And that’s becoming harder, right? It’s becoming harder, which is partly, I’m sure, how Amazon justified some of the price. Disney isn’t for sale. Sony has repeatedly said its TV and movie operation is not for sale. It’s also becoming harder in part because the corporate sibling studios are not licensing out as much — they’re supplying their own streaming services. More takes on the deal: Jason Hirschhorn, a former MGM board member, has been thinking out loud on Twitter about the deal, including the intriguing possibility that Amazon could buy out the family that controls MGM’s James Bond franchise, gaining more freedom to expand the Bond “universe.” Brad Stone, the author of the new book “Amazon Unbound,” shared Jeff Bezos’s 12 ingredients for hit shows. MGM owns the rights to “The Apprentice,” including unaired material that some claim contains unflattering footage of the reality show’s former host, Donald Trump. The tapes’ contractual status is unclear, but the notion that they might belong to Bezos, a frequent target of Trump’s ire when he was president, has set tongues wagging. THE SPEED READ Deals HSBC plans to sell or close most of its U.S. retail branches, as it focuses on Asia. (WSJ) Investors in Bill Ackman’s $5 billion SPAC are increasingly worried that it won’t strike a deal. (Institutional Investor) Politics and policy How Covax, the multibillion-dollar global vaccination program backed by governments and drug makers, ran aground. (WSJ) Tech Best of the rest A record number of American workers tested positive for marijuana last year. (Insider) The white woman who called police on a Black bird-watcher in Central Park last year sued her former employer, Franklin Templeton, for firing her over the incident. (NYT) We’d like your feedback! Please email thoughts and suggestions to [email protected]. Source link Orbem News #Exxon #rebels #Street #Wall

0 notes

Text

(Ir)rational investing

Summary

Human beings are generally not rational, and as an extension of that, they often do not make sound choices.

Emotions do have a place in successful investing.

Our emotions are all-encompassing and need to be acknowledged in our investment-making decisions.

INVESTORS (AND HUMAN BEINGS) ARE NOT ALWAYS RATIONAL

In particular, those who invest purely on how they feel emotionally about an investment, not an objective assessment by a trained analyst, a witty television personality like Jim Cramer, or even a Wall Street Journal article with a certain hell-bent opinion on your garden variety S&P 500 sector. And the fact that many of our decisions in life are based on our emotions, it can be extrapolated that many investment decisions are driven by emotions as well. To be sure, ad nauseum, this could be seen in the late 1990's and early 2000’s when by the mere fact that a particular company had a presence on the Internet, which was still considered a new and exciting idea, meant that it was worthy of huge commitments of capital both by retail and institutional investors alike (yawn).

The psychology of rational and irrational investing lies in some concepts such as fight or flight. Or, more specifically, our adrenal glands which help regulate our response to stress. An awareness of the fight-flight-freeze response, and thus how our adrenaline helps and hinders our judgements, is important on so many levels, inside and outside of the daily grind of the stock market. For example, how you deal with your temperamental ten year old not wanting to do his homework every night or trying nicely to ask your significant other to scooch over on the couch so you can stretch your legs a little more. Both subtle, but real, examples of how we deal with our brimming emotions. Fight or flight is an unconscious physiological reaction to stress. Basically, most of us are not always aware that we are reacting to external stimuli. At the office, whether it is someone we don’t care for walking by our desk, in the summer, an annoying yellow jacket buzzing around our head, or the dizzying daily events like seeing analysts’ reactions to disappointing guidance by Salesforce and then the stock plummeting 20 points after the session close. We react to these things in different ways, depending on the event, and depending on the person. For example, some folks do not care who walks by their desk at 9 am every morning or whether or not that person is someone they’d like to invite out for a drink after work. Others brood when a colleague of whom does not share the same political views about tax policy or climate change saunters past their cubicle with that same, annoying, shuffling walk at lunchtime every day. That is the essence of fight or flight. An event that causes an emotional disturbance due to our primal nature to save ourselves from being harmed or killed. Yep, that’s the one. When you’re watching Squawk Box one morning and Joe begins (again) to expound on why bond yields are headed upward, your fight or flight response could be: Hyperinflation! Oh geez, let me log on and sell 90% of my position in Tesla, move that into an Aggregate Bond Index fund, and put on a total return swap to hedge myself against a global depression. Is that rational? This investor doesn’t think so, but it’s all relative.

Other market watchers experience that same stimuli and react to it in different ways. It is likely due to a number of factors, including biology, nurture, and nature. If you’ve been a trader since the 1980’s, your environment has conditioned you to experience stimuli such as this and have a certain, relatively muted, reaction. This could be said even in the event of a terrorist attack, another pandemic, or even a nuclear exchange (potentially). So, what some folks view as rational or irrational, others see it differently. And rightly so.

Some may remember theGlobe.com which went public in November of 1998. The company was originally founded for programming the website itself. The day of the IPO the share price climbed from $9 to as high as $97, and at the end of the trading day, the company was valued at $840 million. The high valuation did not come from an objective or quantitative assessment. It was based on little more than the excitement and emotions investors had about making a quick buck based on a novel idea, with most not even knowing what the novel idea was, and to an even lesser extent, how the company was going to turn a profit. After the euphoria of the new Internet economy subsided, theGlobe.com stock eventually traded down to 10 cents a share in 2001, thus shrinking the valuation to a mere $4 million in the span of three years. Everyone knows that the dot-com bubble burst, the stock market crashed, and the S&P 500 index went negative for three consecutive calendar years from 2000 – 2002. Conversely, who could've known the NASDAQ would rebound in 2003 and rise over 50%? Probably more than you think.

This is not to say that factoring in emotions into investment decisions, or into life in fact, does not have its merits. In mid-2007 Apple released its first iPhone with a similar euphoria to the dot-com era. The stock has since appreciated from a split-adjusted $5 per share to its current $116 price. A great long term investment. Is Apple the exception to the rule? You could argue both sides. Many will also remember a certain Mr. Blodget exclaiming that Amazon is on its way to $400 a share (gasp!). That was December of 1998. At the time, many said that would never happen and we're headed for a bubble, which we were. However, we really couldn't have known at the time that Amazon's far reaching influence would include Wholefoods, a streaming service, and selling golden glass roses targeted towards Valentines Day. And most know that although it took several decades, Amazon stock now trades around the $3,000 per share mark. So, an extremely (or what seemed to be) emotionally-charged recommendation by a new analyst at the time, made many savvy long term investors a lot of money. But not necessarily considered savvy investors at the time. Cisco is a another dot-com survivor. Their stock price declined 86% from its peak during the bust. It currently trades at a 14x's multiple with a 3% dividend yield. Hardly a high flyer.

We can agree on how important our emotions are in our personal lives. We care deeply about our loved ones. Some harbor distain for past and present politicians. Depending on who you ask, is any of this productive? Or, just a plain waste of thought that lasts all of ten seconds.

As we all know, the emotions leading up to the housing bubble and financial crisis of 2008 caused banks to lower their lending standards. The bubble came from lenders and homebuyers thinking that real estate would always go up and the exuberance surrounding that. If a home doubled in value in two years, would you buy it? The resounding answer was "yes". Same idea time and time again. Ultimately real estate went down and the bubble burst. Many large lenders and small homeowners went bankrupt. Moreover, the left over carnage resulting from our exuberance often goes unnoticed. Nomadland is a recent movie that won best picture for drama at the Golden Globes. During the opening it states that in 2011, due to a falloff in demand for sheetrock, a plant was closed in Empire, Nevada after 88 years. Within six months, "the Empire zip code....was discontinued." A tragedy for many of whom relied on real estate construction just to stay alive.

The reality is that most investors know they invest at the wrong times and for the wrong reasons, and still do it. In The Behavior Gap - Simple Ways to Stop Doing Dumb Things with Money, by Carl Richards, the author states, "....friends and colleagues...know their impulses to buy and sell are dangerous." And during market downturns, Mr. Richards opines, "It's okay to be scared, but it's a bad idea to act on your fear." Fear may be our most important emotion when it comes to affecting our investing mindset. How else do you account for such extreme market volatility? Certainly part can be attributed to fear. Fear is a byproduct of our fight-flight-freeze response. Fear was essential to our ancestors for survival purposes. Faced with a rattlesnake, our fear caused us to do something, instantaneously, preserve our lives, and perpetuate the human species. A survival mechanism. But is it still useful? When it comes to investing, not so much.

So what can our emotions teach us about investing? If we're too exuberant, we can cause bubbles. If we are too fearful, we may burst bubbles. Maybe too many of us watch too much CNBC (fact), and our emotions may get intensified sitting on the couch as helpless spectators.

The question for most of us? Where are our emotions taking us now? Are we bubbling up at this very moment? When is this bubble coming and what will be the focus? Government debt? Student loan debt? According to some, maybe it's a Tesla bubble bursting. The more we understand our own emotions and how they affect our daily functioning, the better our investing decisions will be. Keep in mind that we're all different and many folks have the utmost control over their emotions. Consequently, those who can do that will earn higher incremental returns and live a longer, healthier life, with more fruitful finances. -Neil

#psychology#behavioral finance#behavior#stock market#personal investing#rational investing#benefits#executive#401k#retirement#retirement plan services company#financial services#investment advice

0 notes

Text

Talk To Me When You Scale: Since Big Is Now Favored Over Small, Is It Time To Ignore Startups?

APRIL 30, 2018

INNOV8RS TEAM

Apart from some exceptions, the results for corporate-startup collaboration have been generally disappointing.

But Joe Haslam believes there is hope – and his optimism comes from experience. Not only is he a professor at IE Business School in Madrid, where he teaches founders and MBA students how to scale their startups, he has co-founded and grown a number of companies including Marrakech.com, which raised over $75m in Venture Capital, and Hot Hotels, the first startup founded in Spain to be accelerated by the Techstars program in the USA.

According to Haslam we’ve paid more than enough attention to startups and enterprises, and nowhere near enough to the scaleup phase: how a startup grows into an established, sustainable company.

So what is a scaleup exactly, and what distinguishes it from a startup? And how can corporations identify and work with scaleups in a way that benefits both? At Innov8rs Tel Aviv, Haslam walked us through it.

Startup vs Scaleup