#and Discharge- Student Loan Forgiveness

Text

Apply for Student Loan Forgiveness (and Other Ways the Government Can Help You Repay Your Loans)

Apply for Student Loan Forgiveness (and Other Ways the Government Can Help You Repay Your Loans)

Quickly apply for Student Loan Forgiveness and learn other ways the Government can assist you in repaying your loans. godcentvc.com is here to answer the common questions from students who have taken out student loans from government. Most students ask this question: can my federal student loans be forgiven or can I get help in repaying them? The answer is completely YES! Read on to find out how.…

View On WordPress

#AmeriCorps Student Loan Forgiveness#and Discharge- Student Loan Forgiveness#Cancellation#Income-Driven Repayment (IDR) Forgiveness#Learn About Differences Between Forgiveness#Military Service Loan Forgiveness#One-time Student Loan Debt Relief#Public Service Loan Forgiveness (PSLF)#Teacher Loan Forgiveness

0 notes

Text

The Best News of Last Week

1. ‘It was an accident’: the scientists who have turned humid air into renewable power

Greetings, readers! Welcome to our weekly dose of positivity and good vibes. In this edition, I've gathered a collection of uplifting stories that will surely bring a smile to your face. From scientific breakthroughs to environmental initiatives and heartwarming achievements, I've got it all covered.

In May, a team at the University of Massachusetts Amherst published a paper declaring they had successfully generated a small but continuous electric current from humidity in the air. They’ve come a long way since then. The result is a thin grey disc measuring 4cm across.

One of these devices can generate a relatively modest 1.5 volts and 10 milliamps. However, 20,000 of them stacked, could generate 10 kilowatt hours of energy a day – roughly the consumption of an average UK household. Even more impressive: they plan to have a prototype ready for demonstration in 2024.

2. Empty Office Buildings Are Being Turned Into Vertical Farms

Empty office buildings are being repurposed into vertical farms, such as Area 2 Farms in Arlington, Virginia. With the decline in office usage due to the Covid-19 pandemic, municipalities are seeking ways to fill vacant spaces.

Vertical farming systems like Silo and AgriPlay's modular growth systems offer efficient and adaptable solutions for converting office buildings into agricultural spaces. These initiatives not only address food insecurity but also provide economic opportunities, green jobs, and fresh produce to local communities, transforming urban centers in the process.

3. Biden-Harris Administration to Provide 804,000 Borrowers with $39 Billion in Automatic Loan Forgiveness as a Result of Fixes to Income Driven Repayment Plans

The Department of Education in the United States has announced that over 804,000 borrowers will have $39 billion in Federal student loans automatically discharged. This is part of the Biden-Harris Administration's efforts to fix historical failures in the administration of the student loan program and ensure accurate counting of monthly payments towards loan forgiveness.

The Department aims to correct the system and provide borrowers with the forgiveness they deserve, leveling the playing field in higher education. This announcement adds to the Administration's efforts, which have already approved over $116.6 billion in student loan forgiveness for more than 3.4 million borrowers.

4. F.D.A. Approves First U.S. Over-the-Counter Birth Control Pill

The move could significantly expand access to contraception. The pill is expected to be available in early 2024.

The Food and Drug Administration on Thursday approved a birth control pill to be sold without a prescription for the first time in the United States, a milestone that could significantly expand access to contraception. The medication, called Opill, will become the most effective birth control method available over the counter

5. AIDS can be ended by 2030 with investments in prevention and treatment, UN says

It is possible to end AIDS by 2030 if countries demonstrate the political will to invest in prevention and treatment and adopt non-discriminatory laws, the United Nations said on Thursday.

In 2022, an estimated 39 million people around the world were living with HIV, according to UNAIDS, the United Nations AIDS program. HIV can progress to AIDS if left untreated.

6. Conjoined twins released from Texas Children’s Hospital after successfully separated in complex surgery

Conjoined twins are finally going home after the pair was safely separated during a complex surgery at Texas Children’s Hospital in June.

Ella Grace and Eliza Faith Fuller were in the neonatal intensive care unit (NICU) for over four months after their birth on March 1. A large team of healthcare workers took six hours to complete the surgery on June 14. Seven surgeons, four anesthesiologists, four surgical nurses and two surgical technicians assisted with the procedure.

7. From villains to valued: Canadians show overwhelming support for wolves

Despite their record in popular culture, according to a recent survey, seven in 10 Canadians say they have a “very positive” view of the iconic predators.

Here's a fascinating video about how wolves changed Yellowstone nat'l park:

youtube

----

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation:

Support this newsletter ❤️

Also don’t forget to reblog.

1K notes

·

View notes

Note

Hey Sam, do you remember how long it took for your student loan discharge to show up on your credit report? It's been eight months and my loans are still on my credit report and I can't get Mohela to answer me about when they'll report it. I submitted a complaint to the DoE a few weeks ago, but who knows when I'll hear back. I guess I was just wondering if this type of delay is out of the ordinary.

Oh, man, it never even crossed my mind to look. My credit score was hovering around 800 when I began the loan discharge process and is now in the 810 range, so I never bothered to check. I had to go log into CreditKarma just now to see.

I think this must be backdated, but according to TransUnion, my loans were closed in September 2020. The reason this must be backdated is that my forgiveness wasn't finalized and approved until April of 2021. Like my balance didn't zero out until 2021, but the paperwork went into the system in September 2020, so presumably the closure was retroactive to that. I don't think any closed loan falls off for several years, but I don't know how they handle an open loan that you have actually discharged. I don't know what kind of delay is normal (I may have even had one myself and just not noticed).

As far as I know carrying a student loan balance doesn't have a huge impact on your credit score as long as they're not reporting you in arrears/late, so hopefully it's not killing your credit somehow. You might consider sending a registered letter to the bureaus, disputing the error; they may be able to shake that information loose from the loan administrators. In any case, good luck with it!

Readers, if you have advice please do share! Remember to comment or reblog, as I don't post asks sent in response to other asks.

46 notes

·

View notes

Text

It’s never been a better time to get rid of your student debt.

Although President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court, his administration has explored all of its existing authority to leave people with less education debt.

As a result, more than 3.7 million Americans have received loan cancellation during Biden’s time in office, totaling $136.6 billion in aid.

In a recent exclusive interview with CNBC, Rep. James Clyburn, D-S.C., who has been a vocal advocate for student loan borrowers, said he’s heard from the U.S. Department of Education that every two months over the next four years, another 75,000 people will be eligible to have their debt forgiven due to changes in income-driven repayment plans and Public Service Loan Forgiveness.

-----

The Biden administration has been evaluating millions of borrowers’ loan accounts to see if they should have had their debt forgiven. So far, more than 930,000 people have benefited, receiving over $45 billion in debt cancelation.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Recently, the Education Department also announced it would soon cancel the debts of those who’ve been in repayment for a decade or more and originally took out $12,000 or less. To qualify, borrowers need to be enrolled in the administration’s new Saving on a Valuable Education, or SAVE, plan.

-----

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 790,000 public servants have gotten their debt erased as a result, amounting to more than $56 billion in relief.

------

The Biden administration has also forgiven the student debt of more than 510,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability Discharge.

----

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

-----

The Biden administration is also working to revise its broad forgiveness plan to make it legally viable.

The president may try to deliver that relief before November.

That alternative plan, which has become known as Biden’s “Plan B,” could forgive the student debt for as many as 10 million people, according to one estimate.

#thanks Biden#Joe Biden#student loans#student loan debt#student loan forgiveness#if you have student loan debt one of these programs likely applies to you#check it out

63 notes

·

View notes

Text

116 notes

·

View notes

Text

Barry takes his glasses off and presses the heels of his hands against his eyes. He’s been staring at his computer for far too long today. The computer in question sits on the couch next to him, screen obscenely bright in his dim living room.

He’d been ignoring the emails that infiltrated his inbox with growing frequency and urgency, all of them riddled with subject lines like “Payment Plans for Upcoming Semester,” and “Payment Due Soon,” and “Seriously, You Owe Us Tens of Thousands of Dollars and We Aim to Collect.” You know, normal stuff.

He’d always figured that actually doing the coursework would be the hardest part of grad school, not figuring out how to fund it without owing his soul and first-born child to the federal government. But the fact of the matter is that he’s reached a dead end; most of everything his mom left him was used to pay off his undergrad loans some years back. His university has mentioned scholarships and work study but he’s convinced the scholarships are a myth and also his university declined to mention that the work study they offer doesn’t actually pay him in money, rather they just pay for three course credits. Don’t get him wrong, that’s better than nothing but that doesn’t help pay his rent or buy textbooks.

Once again he mourns the fact that the only applied arcane theory program that accepted him just had to be a private university many states away.

He returns his glasses to his face and pulls his laptop closer to him. He’s about three modules into his ten-module long loan counseling. It’s basically an online program that explains in excruciating detail just how deeply the federal government has his future in their pocket. “Oh, hey Barry! If you Ever fall behind on your loans, we can garnish your wages that already probably won’t be able to pay for a studio apartment in Neverwinter and also you’ll be paying these back for anywhere from ten to twenty five years! You also cannot declare bankruptcy because you live in hell!! Only way to get off the hook for these is if your school shuts down before you get your degree or you die! Now sign on the dotted line after you hyperventilate a little when you look at just how much money you’re going to be responsible for!”

The whole process makes his stomach hurt; there’s no good reason education should be this much. He’s going to be saddled with loans worth more than any yearly salary he could hope to have and now he’s gotta pay them back or die.

Wait.

He rereads the loan forgiveness terms. “If your loan servicer receives acceptable documentation of your death, your federal student loans will be discharged,” he reads to himself.

He's got it.

He lets loose a laugh that borders on maniacal and roots around for his phone. It rings once before someone picks up on the other end.

“Lup!” He whoops.

“Bear? What’s up? You sound extremely excitable right now.”

“Okay, remember when you wanted to get married for tax benefits?”

“I do! I also remember you turned me down because you didn’t want to our marriage to be for convenience.”

Barry laughs to himself. “Yeah, I still stand by that.”

“You sap,” she sighs fondly.

“Well, I think I found a way to scam the federal government through a loophole.”

“Gods I love when you talk dirty to me!”

“We can talk more when you come home but I can almost promise you neither of us are paying off our student loans.”

“Barry, I don’t have a clue what you’re talking about and I can’t wait to hear your devious plan. Love you!”

“Love you.” He clicks end on the call and looks around for his theoretical necromancy notes from a few semesters ago.

#taz#taz balance#blupjeans#barry bluejeans#lup#reese writes#the adventure zone#listen sometimes you decide to become a lich to dodge your student loans#i was doing fafsa shit earlier and uh well. here you go djfbdjfjsjdbsj

278 notes

·

View notes

Text

The announcement spelled out efforts aimed at four groups of borrowers: those who owe more money than they did at the start of their repayment, borrowers who started paying more than 20 years ago, those already eligible for existing loan forgiveness or discharge programs but haven't yet applied, and borrowers facing economic hardship.

8 notes

·

View notes

Text

So About that Student Loan Forgiveness thing

I just got around to filling out my application for the $10k federal student aid forgiveness ($10k for me because I didn’t get any Pell grants, but $20k for you if you did, btw!)

You’ve probably seen people talking about how the app is really short - and it is, it’s literally

- name

- SSN

- Date of birth

- contact info

- you promise you’re who you say you are and you’re submitting this app on purpose? Ok type your name here, check this box, now hit submit

So if you’re worried about it not actually being that simple, that really is all there is to it, I promise.

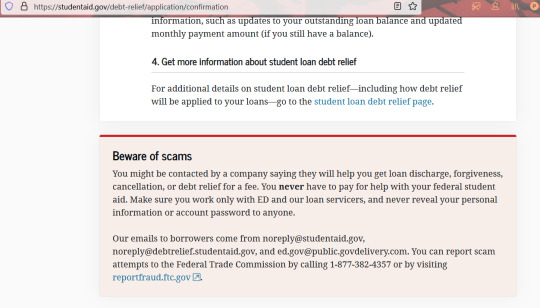

The application also loaded this reminder after I submitted it, and... look, I used to work as a student loan counselor on the Department of Education contract, I heard way (way, way, wayyyy) too many sad stories of people getting suckered and got to try to help them put the pieces back together after they found out their credit score is tanked and they have tens of thousands of dollars of capitalized interest on loans they paid thousands of dollars to get forgiven and all sorts of awful stuff, so.

I’m just reposting the image here. Just in case anybody needs to see it.

[image ID: screenshot of a notification from the website studentaid.gov reading Beware of scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with ED [note: ED = Department of Education] and our loan servicers, and never reveal your personal information or account password to anyone.

Our emails to borrowers come from [email protected], [email protected], and [email protected]. You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov. /end ID]

15 notes

·

View notes

Text

For anyone who missed this email that got sent out today about the loan stuff. Emphasis in blue for things I hadn't known about, or that clarify confusion I've seen.

I don't want anyone missing out on the little concession they've given us regarding this stuff because while we are owed more, this can still make a difference for someone. Talk to people offline about the details so they know it's not automatic and that they're probably eligible.

Who's eligible

You are eligible if you have most federal loans (including Direct Loans and other loans held by the U.S. Department of Education) and your income for 2020 or 2021 is either:

Less than $125,000 for individuals

Less than $250,000 for households

If you are a dependent student, your eligibility is based on your parental income.

What you might be eligible for

Up to $20,000 in debt relief if you received a Pell Grant in college

Up to $10,000 in debt relief if you didn’t receive a Pell Grant

How it’ll work

In October, the U.S. Department of Education will launch a short online application for student debt relief. You won’t need to upload any supporting documents or use your FSA ID to submit your application.

Once you submit your application, we’ll review it, determine your eligibility for debt relief, and work with your loan servicer(s) to process your relief. We’ll contact you if we need any additional information from you.

What’s next

Right now, you don’t need to do anything! We will contact you when the sign-up period for student debt relief opens.

We will send you regular updates with more details over the coming days, as we near the application period, which will begin in October 2022 and last through December 2023.

In the meantime, visit our Frequently Asked Questions page to find out more information on the student debt relief program.

Beware of Scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with the U.S. Department of Education and our loan servicers, and never reveal your personal information or account password to anyone.

Our emails to borrowers come from [email protected], [email protected] or [email protected]. You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357 or visit reportfraud.ftc.gov.

They also linked to this website

17 notes

·

View notes

Text

The Best News of Last Week — July 4, 2022

🐂 — Last week has been a troubled week for the US. Let’s read some much needed good news

1. Atlanta lawyers will rep anyone prosecuted for abortions for free

Attorney Steve Sadow said he is willing to defend any doctor throughout the country free of charge. He will only charge travel expenses if he has to travel long distances.

“If a doctor believes that it is appropriate to violate the law, at least as written, I want to be there to defend them because they need somebody in their corner and that is what I do,” he said Friday, hours after the Supreme Court released its opinion.

2. Boy missing for eight days in Germany found alive in sewer

Eight-year-old Joe, who lives in the city of Oldenburg in northwest Germany, disappeared on 17 June from his front garden, sparking a huge police search.

A passer-by heard a soft whimper coming from the direction of a manhole cover in the early hours and called emergency services. Rescuers rushed to the scene around 200m from his home and found Joe at the bottom of the sewer.

A firefighter entered the sewer to bring him out. The child was taken to hospital suffering from hypothermia, but had no major injuries.

3. More Than 200,000 Borrowers Now Qualify for Student Debt Forgiveness

The Department of Education agreed to a $6 billion settlement to cancel debt for 200,000 borrowers. Borrowers will receive a full discharge of their loans, a refund, and credit repair.

An additional 60,000 borrowers will have their cancellation decisions reviewed individually. The settlement stems from a 2019 class action lawsuit, Sweet v. Cardona, which argued many borrower defense claims for loan cancellation were being ignored by the Department of Education.

4. Pride in London: More than a million attend ‘biggest ever parade’

More than a million people have taken part in the 50th anniversary of the UK’s first Pride parade in London. The parade paid homage to the original 1972 march, organised by the Gay Liberation Front (GLF), and saw revellers pass significant sites from the UK’s LGBTQ+ movement.

At the front of the parade, the star of Netflix coming-of-age drama Heartstopper, Joe Locke, said it was an honour to be celebrating “being queer when the world might not be so accepting”.

5. Principal with his students turns Indian school into a green oasis with over 300 plant species

A government primary school in Firozabad’s Keethot village has become a centre of attraction for its lush greenery comprising over 300 species of plants, including a four-foot tall sandalwood tree. Spread over, 5,500 square feet area of school campus, the garden is a result of the efforts of the school headmaster Mohammad Shahid , who with the help of the students, has sown and nurtured plants that bear fruits and flowers, and vegetables used for preparing midday meals for the children.

6. Grand Canyon won’t seek volunteers to kill bison this fall

A bison herd that lives almost exclusively in the northern reaches of Grand Canyon National Park won’t be targeted for lethal removal there this fall.

The park used skilled volunteers selected through a highly competitive and controversial lottery last year to kill bison, part of a toolset to downsize the herd that’s been trampling meadows and archaeological sites on the canyon’s North Rim.

Introducing the sound of gunfire and having people close to the bison was meant to nudge the massive animals back to the adjacent forest where they legally could be hunted. But the efforts had little effect. The park is now working with other agencies and groups on a long-term plan for managing the bison, an animal declared America’s national mammal in 2016 and depicted on the National Park Service logo.

7. Kitten rescued from inside Pepsi vending machine at Walmart store

Firefighters responded to a Walmart store in Tennessee to rescue a kitten heard mewing from inside a Pepsi vending machine. “Crews could hear the kitten crying. They unplugged the machine and removed the cover on the back, but couldn’t see the kitten,” the post said.

The firefighters were able to find another opening in the machine and made visual contact with the feline. The rescuers were able to coax the cat to safety. The post said the kitten was adopted by the employee who originally heard the cat’s cries.

. . .

That's it for this week. Until next week, You can follow me on twitter. Also, I have a newsletter :)

Subscribe here to receive a collection of wholesome news every week in your inbox :D

347 notes

·

View notes

Text

The Biden administration announced on Thursday updated guidelines that will make it easier for those struggling with their student debt to discharge it in bankruptcy.

The new bankruptcy policy comes from the U.S. Department of Justice and the U.S. Department of Education, and allows federal student loan borrowers to prove that they’re experiencing financial distress requiring a fresh start. Under the rules, the agencies may recommend that a bankruptcy judge discharge a borrower’s student debt if they find their case warrants it.

Currently, it’s difficult, if not impossible, for someone to walk away from their federal student debt in a normal bankruptcy proceeding.

“Today’s guidance outlines a better, fairer, more transparent process for student loan borrowers in bankruptcy,” said Vanita Gupta, associate attorney general of the U.S.

The announcement comes as the White House is battling to defend its sweeping student loan forgiveness plan in the courts. The Biden administration stopped accepting applications for its program, which would cancel up to $20,000 in student debt for tens of millions of Americans, last week after Judge Mark Pittman of the U.S. District Court for the Northern District of Texas called the policy “unconstitutional” and struck it down.

The DOJ has appealed.

Before the Education Department closed its forgiveness portal, roughly 26 million people applied for the relief. Outstanding student debt exceeds $1.7 trillion, and even before the pandemic, some 10 million borrowers were in delinquency or default.

STUDENT DEBT HAS A HIGH BAR FOR BANKRUPTCY DISCHARGE

Student loans are currently treated differently than other types of debt in bankruptcy courts, and legal experts and consumer advocates have long said that the bar for being able to discharge the loans is too high.

In the 1970s, lawmakers added a stipulation that student loan borrowers had to wait at least five years after they began repayment to file for bankruptcy; the move came in response to concerns raised by policy makes and pundits that students would rack up a bunch of loans and then try to discharge them after graduation. In 1990, that waiting period was upped to seven years.

The rules changed again almost a decade later, requiring that people with federal or private student loans prove that their debt poses an “undue hardship” to discharge it in bankruptcy. Congress, however, never spelled out what that term means, and lawyers and advocates say the uncertainty leads to unfairness in the courts.

Federal Reserve chairman Jerome Powell has said that he’s “at a loss to explain” why student loans are treated differently than other types of debt in the proceedings.

Around 250,000 student loan debtors file for bankruptcy each year, but fewer than 300 walk away from their education debt in the proceeding, according to research published in the Duke Law Journal in December 2020. That’s a success rate of just 0.1%.

#us politics#news#biden administration#department of education#student debt forgiveness#forgive student debt#cancel student debt#student loan forgiveness#student loan debt#bankruptcy#cnbc#department of justice#Vanita Gupta#bankruptcy court#Judge Mark Pittman#Jerome Powell#Duke Law Journal

10 notes

·

View notes

Text

President Joe Biden on Wednesday will announce $1.2 billion of student debt relief for nearly 153,000 borrowers

The administration’s latest tranche of loan forgiveness covers borrowers who are enrolled in Biden’s new loan repayment program, initially borrowed $12,000 or less and have been repaying their debt for at least 10 years.

The administration says that it has now approved loan discharges totaling nearly $138 billion for nearly 3.9 million borrowers through dozens of administrative actions since coming into office.

#student loans#student loan debt#Thanks Biden#Joe Biden#politics#us politics#good news#debt relief#student loans canceled

27 notes

·

View notes

Text

* * * * *

Justice Kagan wrote: "In every respect, the Court today exceeds its proper, limited role in our Nation’s governance" and "the Court, by deciding this case, exercises authority it does not have. It violates the Constitution."

I woke up thinking about her dissent from the student loan decision as quoted briefly by Heather Cox Richardson, and decided to read it in full. Some excerpts below and you can read the full thing at (scroll down to the dissent a billion pages in: https://www.supremecourt.gov/opinions/22pdf/22-506_nmip.pdf). She writes:

The Court’s first overreach in this case is deciding it at all. Under Article III of the Constitution, a plaintiff must have standing to challenge a government action. And that requires a personal stake—an injury in fact. We do not allow plaintiffs to bring suit just because they oppose a policy. Neither do we allow plaintiffs to rely on injuries suffered by others. Those rules may sound technical, but they enforce “fundamental limits on federal judicial power.” Allen v. Wright, 468 U. S. 737, 750 (1984). They keep courts acting like courts. Or stated the other way around, they prevent courts from acting like this Court does today. The plaintiffs in this case are six States that have no personal stake in the Secretary’s loan forgiveness plan. They are classic ideological plaintiffs: They think the plan a very bad idea, but they are no worse off because the Secretary differs. In giving those States a forum—in adjudicating their complaint— the Court forgets its proper role. The Court acts as though it is an arbiter of political and policy disputes, rather than of cases and controversies.

The HEROES Act’s text settles the legality of the Secretary’s loan for- giveness plan. The statute provides the Secretary with broad authority to give emergency relief to student-loan borrowers, including by altering usual discharge rules. What the Secretary did fits comfortably within that delegation. But the Court forbids him to proceed.

The result here is that the Court substitutes itself for Congress and the Executive Branch in making national policy about student-loan forgiveness. Congress authorized the forgiveness plan (among many other actions); the Secretary put it in place; and the President would have been accountable for its success or failure. But this Court today decides that some 40 million Americans will not receive the benefits the plan provides, because (so says the Court) that assistance is too “significan[t].” Ante, at 20–21. With all respect, I dissent.

If the plaintiff has no such stake, a court must stop in its tracks. To decide the case is to exceed the permissible boundaries of the judicial role.

That is what the Court does today. The plaintiffs here are six States: Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina. They oppose the Secretary’s loan cancellation plan on varied policy and legal grounds. But as everyone agrees, those objections are just general grievances; they do not show the particularized injury needed to bring suit. And the States have no straightforward way of making that showing—of explaining how they are harmed by a plan that reduces individual borrowers’ federal student-loan debt. So the States have thrown no fewer than four different theories of injury against the wall, hoping that a court anxious to get to the merits will say that one of them sticks. The most that can be said of the theory the majority selects, proffered solely by Missouri, is that it is less risible than the others. It still contravenes a bedrock principle of standing law—that a plaintiff cannot ride on someone else’s injury. Missouri is doing just that in relying on injuries to the Missouri Higher Education Loan Authority (MOHELA), a legally and financially independent public corporation. And that means the Court, by deciding this case, exercises authority it does not have. It violates the Constitution.

The majority and I differ, as I’ll soon address, on whether the Executive Branch exceeded its authority in issuing the loan cancellation plan. But assuming the Executive Branch did so, that does not license this Court to exceed its own role. Courts must still “function as courts,” this one no less than others. Ibid. And in our system, that means refusing to decide cases that are not really cases because the plaintiffs have not suffered concrete injuries. The Court ignores that principle in allowing Missouri to piggy-back on the “legal rights and interests” of an independent entity. Warth, 422 U. S., at 499. If MOHELA wanted to, it could have brought this suit.

It declined to do so. Under the non-manipulable, serious version of standing law, that would have been the end of the matter—regardless how much Missouri, or this Court, objects to the Secretary’s plan.

The tell comes in the last part of the majority’s opinion. When a court is confident in its interpretation of a statute’s text, it spells out its reading and hits the send button. Not this Court, not today. This Court needs a whole other chapter to explain why it is striking down the Secretary’s plan. And that chapter is not about the statute Congress passed and the President signed, in their representation of many millions of citizens. It instead expresses the Court’s own “concerns over the exercise of administrative power.” Ante, at 19. Congress may have wanted the Secretary to have wide discretion during emergencies to offer relief to student-loan borrowers. Congress in fact drafted a statute saying as much. And the Secretary acted under that statute in a way that subjects the President he serves to political ac- countability—the judgment of voters. But none of that is enough. This Court objects to Congress’s permitting the Secretary (and other agency officials) to answer so-called major questions. Or at least it objects when the answers given are not to the Court’s satisfaction. So the Court puts its own heavyweight thumb on the scales.

So, again, Congress delegates broadly. Except that this Court now won’t let it reap the benefits of that choice.

And that is a major problem not just for governance, but for democracy too. Congress is of course a democratic institution; it responds, even if imperfectly, to the preferences of American voters. And agency officials, though not them-selves elected, serve a President with the broadest of all political constituencies. But this Court? It is, by design, as detached as possible from the body politic. That is why the Court is supposed to stick to its business—to decide only cases and controversies (but see supra, at 3–13), and to stay away from making this Nation’s policy about subjects like student-loan relief. The policy judgments, under our separation of powers, are supposed to come from Congress and the President. But they don’t when the Court refuses to respect the full scope of the delegations that Congress makes to the Executive Branch. When that happens, the Court becomes the arbiter—indeed, the maker—of national policy. See West Virginia, 597 U. S., at ___ (KAGAN, J., dissenting) (slip op., at 32) (“The Court, rather than Congress, will decide how much regulation is too much”). That is no proper role for a court. And it is a danger to a democratic order.

From the first page to the last, today’s opinion departs from the demands of judicial restraint. At the behest of a party that has suffered no injury, the majority decides a contested public policy issue properly belonging to the politically accountable branches and the people they represent. In saying so, and saying so strongly, I do not at all “disparage[ ]” those who disagree.

The question, the majority maintains, is “who has the authority” to decide whether such a significant ac- tion should go forward. Ante, at 19; see supra, at 23. The right answer is the political branches: Congress in broadly authorizing loan relief, the Secretary and the President in using that authority to implement the forgiveness plan. The majority instead says that it is theirs to decide.

So in a case not a case, the majority overrides the combined judgment of the Legislative and Executive Branches, with the consequence of eliminating loan forgiveness for 43 million Americans. I respectfully dissent from that decision.

3 notes

·

View notes

Text

Dec. 1 (UPI) -- The U.S. Supreme Court will hear oral arguments on President Joe Biden's $400 billion student loan forgiveness program.

The court announced the order Thursday, putting off an imminent decision on student loan forgiveness to more thoroughly weigh its legality. Oral arguments will be heard beginning in February. Until a ruling is made, the program will remain on hold. A decision is expected by June, according to CNN.

The announcement comes after a second federal appeals court blocked the debt relief program on Wednesday. The Fifth Circuit Court of Appeals in New Orleans declined to overturn a ruling by Judge Mark Pittman of the U.S. District Court for the Northern District of Texas stating Biden's effort to cancel student debt was illegal.

The ruling upheld Pittman's order while the court weighs Biden's appeal, adding it would expedite the case.

Earlier this month, the Eighth Circuit Court of Appeals in St. Louis also blocked the loan forgiveness plan in response to another lawsuit.

The White House had already put student loan payments on hold until June 30, while his forgiveness program works its way through the courts.

The debt relief plan would grant as much as $10,000 in loan forgiveness for people making less than $125,000 annually and up to $20,000 for Pell grant recipients.

The Biden administration swiftly asked the U.S. Supreme Court to lift the lower-court injunction when it was rejected by the New Orleans appeals court. The White House said on Wednesday it will likely "seek relief from the Supreme Court in this case if this court declines to stay the district court's judgment."

The high court also could combine the two cases and make one decision.

The White House said more than half of borrowers eligible for forgiveness had applied for the program before courts temporarily halted it.

The Education Department had approved some 16 million applications. The department told borrowers that the administration will discharge the debt if and when it wins in court.

5 notes

·

View notes

Text

Students whose colleges misled them would have an easier time seeking loan forgiveness from the federal government under a series of regulatory proposals the U.S. Department of Education released Wednesday.

One long-awaited rule would apply to the borrower defense to repayment process, which discharges loans for defrauded students. The proposed changes would also address flaws in the beleaguered Public Service Loan Forgiveness program, which clears the debt of borrowers who work in fields like teaching or government jobs and make a decade’s worth of qualifying payments. PSLF has suffered from notorious administrative problems, leading to a fraction of eligible borrowers securing loan relief.

The Biden administration aims for the new rules to take effect by July 1 next year. They would streamline procedures for seeking loan forgiveness, covering all pending and future claims as of that date.

The process for receiving borrower defense relief now is determined by a loan’s disbursement date. That’s because the prior two presidential administrations issued regulations that applied to a certain time period of loans. The new proposal would “remove the patchwork tied to the disbursement date of the loan,” an Ed Department official said in a call with reporters Wednesday.

The agency also said the borrower defense rule would make clearer what would be considered misconduct by a college and that would potentially fall under the regulation. The Ed Department’s proposal introduces a new category of such fraud — aggressive and deceptive recruitment.

Students who attended institutions that substantially misrepresented or omitted facts about themselves could also be eligible for loan forgiveness.

Colleges would be on the hook for the cost of such discharges, the Ed Department said.

Proposed changes to the PSLF program include allowing more payments to qualify toward its forgiveness threshold.

Other proposals released Wednesday would eliminate interest capitalization — when accrued interest is added to a loan’s principal balance — except in cases where the law requires it. They would also expand discharge eligibility for borrowers with disabilities, use the closed-school discharge program to automatically forgive debts for many borrowers after institutions close, and improve rules allowing discharges for students whose colleges certified them as eligible for loans even though they were not.

The proposals now go to a 30-day comment period. The department intends to publish a final iteration of the rules in the fall.

8 notes

·

View notes

Text

I posted 1,865 times in 2022

That's 126 more posts than 2021!

259 posts created (14%)

1,606 posts reblogged (86%)

Blogs I reblogged the most:

@/barry-j-blupjeans

@/phantasmagoric-acquaintance

@/holdmecloser-gandydancer

@/anistarrose

@/herbgerblin

I tagged 1,771 of my posts in 2022

Only 5% of my posts had no tags

#rip (reeses in pieces) - 214 posts

#not taz - 157 posts

#srb - 92 posts

#reese writes - 54 posts

#taz balance - 53 posts

#taz - 51 posts

#taz amnesty - 50 posts

#asks - 37 posts

#the adventure zone - 34 posts

#lup - 27 posts

Longest Tag: 139 characters

#[reese aren't you working on a long piece with hali in another window?] yeah and? sbtts has been simmering in our shared brains for a while

My Top Posts in 2022:

#5

Barry takes his glasses off and presses the heels of his hands against his eyes. He’s been staring at his computer for far too long today. The computer in question sits on the couch next to him, screen obscenely bright in his dim living room.

He’d been ignoring the emails that infiltrated his inbox with growing frequency and urgency, all of them riddled with subject lines like “Payment Plans for Upcoming Semester,” and “Payment Due Soon,” and “Seriously, You Owe Us Tens of Thousands of Dollars and We Aim to Collect.” You know, normal stuff.

He’d always figured that actually doing the coursework would be the hardest part of grad school, not figuring out how to fund it without owing his soul and first-born child to the federal government. But the fact of the matter is that he’s reached a dead end; most of everything his mom left him was used to pay off his undergrad loans some years back. His university has mentioned scholarships and work study but he’s convinced the scholarships are a myth and also his university declined to mention that the work study they offer doesn’t actually pay him in money, rather they just pay for three course credits. Don’t get him wrong, that’s better than nothing but that doesn’t help pay his rent or buy textbooks.

Once again he mourns the fact that the only applied arcane theory program that accepted him just had to be a private university many states away.

He returns his glasses to his face and pulls his laptop closer to him. He’s about three modules into his ten-module long loan counseling. It’s basically an online program that explains in excruciating detail just how deeply the federal government has his future in their pocket. “Oh, hey Barry! If you Ever fall behind on your loans, we can garnish your wages that already probably won’t be able to pay for a studio apartment in Neverwinter and also you’ll be paying these back for anywhere from ten to twenty five years! You also cannot declare bankruptcy because you live in hell!! Only way to get off the hook for these is if your school shuts down before you get your degree or you die! Now sign on the dotted line after you hyperventilate a little when you look at just how much money you’re going to be responsible for!”

The whole process makes his stomach hurt; there’s no good reason education should be this much. He’s going to be saddled with loans worth more than any yearly salary he could hope to have and now he’s gotta pay them back or die.

Wait.

He rereads the loan forgiveness terms. “If your loan servicer receives acceptable documentation of your death, your federal student loans will be discharged,” he reads to himself.

He's got it.

He lets loose a laugh that borders on maniacal and roots around for his phone. It rings once before someone picks up on the other end.

“Lup!” He whoops.

“Bear? What’s up? You sound extremely excitable right now.”

“Okay, remember when you wanted to get married for tax benefits?”

“I do! I also remember you turned me down because you didn’t want to our marriage to be for convenience.”

Barry laughs to himself. “Yeah, I still stand by that.”

“You sap,” she sighs fondly.

“Well, I think I found a way to scam the federal government through a loophole.”

“Gods I love when you talk dirty to me!”

“We can talk more when you come home but I can almost promise you neither of us are paying off our student loans.”

“Barry, I don’t have a clue what you’re talking about and I can’t wait to hear your devious plan. Love you!”

“Love you.” He clicks end on the call and looks around for his theoretical necromancy notes from a few semesters ago.

264 notes - Posted August 12, 2022

#4

Lucretia pulled the door of her room shut and scrubbed tears from her face. Magnus just needed to sleep it off. He’d be fine. They’d all be fine, Lucretia kept telling herself like some kind of chant to a long-forgotten god. She just had to find the others.

She happened upon Merle and Davenport first. They were at the dining room table. Merle watched Davenport carefully as the captain shook like a soaking wet dog. Lucretia plastered a tight smile on her face though she was certain it would fool nobody. At least, it wouldn’t have ten minutes prior.

“Are you both okay?” she asked, glancing between them.

“Uh. I’m a little confused myself. Who’re you? And where exactly are we?” Merle squinted his eyes at her.

Her stomach twisted. Her plan was working, it seemed. And she hated every moment. “I’m…I’m a friend, of sorts. And we are on a vessel that will dock very soon. And then I’m gonna take you home. Soon. I promise.” She spoke slowly, chose her words carefully, and hoped that Merle’s bad memory would give her some breathing room.

“Davenport.”

Lucretia turned and looked at Davenport, a slight furrow in her brow. “Yes, you’re Davenport.”

He looked up at her and she saw a look in his eyes she would never forget. She saw panic and fear on his face like she’d never seen before, not even during their closest encounters with the Hunger. “I-I’m Davenport,” he repeated, voice shaking.

No. Gods no there was no way. She nodded and forced her smile to widen. “Right. Davenport, do you know where you are?”

“Davenport.”

She looked back to Merle. “Has he said anything besides his name in the past ten or so minutes?”

He shook his head. “Nope. Just Davenport.” He thought for a second, tilting his head consideringly. “Well, I guess he said my name right before he started saying his. Kinda weird ‘cuz I never told him my name. But that’s what we’re working with.”

She already wanted to bring out cups of ichor and abort the plan. How could she do this? Her plan might work but at what cost? “Okay. How’s your head feel?”

“Davenport.” His voice was tight and pained.

“Shitty, now that you mention it. Kinda feels like I got hit over the head with a club or something,” Merle said, frowning deeply.

She nodded. “Right. Do you want to go lie down? A nap might help. I have a room for each of you.”

Davenport looked at her blankly. His gaze was haunted and filled Lucretia with sickening regret.

“I could use a nap,” Merle agreed before standing.

“If you’ll both follow me,” she said primly.

She led them wordlessly down to their rooms, surreptitiously grabbing obvious red flags that were present within them. She grabbed Merle’s jacket, a handful of trinkets from the beach cycle, a memento from the First Church of Fungston, and shut his door without another word. Davenport’s room was easier; his jacket was folded on the edge of his bed and few personal affects that would remind him of the mission were clearly visible.

“I’m so sorry,” she whispered, almost more to herself than to him.

She left before she had to hear him say his own name again.

Barry and Taako were nowhere to be found inside the ship. Should have known that they’d be on the deck; they’d both been spending days on end pouring over maps of the realm, touching down to search for Lup, before coming back and feeling defeated.

What she found on the deck stopped her dead in her tracks. Taako’s wand was at his feet, he was staring into space, eyes welling with tears. He had a white-knuckle grip on the railing. Barry wasn’t there. Barry was nowhere on the ship.

She approached Taako carefully. “Taako?”

He snapped his head up and looked in her direction though his gaze seemed to pass right through her. “H-he told me to blast him. He said he was forgetting someone’s face and he told me to blast him. He was panicked and he was scared and I wanted to help him and I don’t know why. I don’t know why. I blasted him. I killed him. I-I just killed him and he smiledwhile I did it,” Taako babbled. He looked like he was about to snap the whole railing with his bare hands.

“Taako, it’s okay,” she said, reaching to put a hand on his shoulder.

He flinched away from her and glared. “Don’t fucking touch me! This isn’t okay! I-I killed a guy. I killed a guy and he probably had a fucking family or something at home.”

“Taako, please. I need you to breathe, okay?” Lucretia did her best to be firm and kind. It usually worked.

“How do you know my name? Who are you? A-and where are we? And who was that guy?” Taako snapped. He was putting on a big front but Lucretia knew what this was. He had on the same feral cat façade that he did when she first met him.

See the full post

286 notes - Posted March 7, 2022

#3

Lup can feel her soul vibrating in her body. This isn’t an uncommon occurrence, just the nature of a lich contained. The sweat prickling her scalp though? That’s all nerves, the kind of physiological vulnerability Lup hates. See, everyone’s getting together later for the largest event of the season; the garden party the twins are throwing for their birthday. It’s going to be obnoxious and extravagant and unbecoming, surely. That’s not the source of her anxiety, though.

Lup’s called Taako over early to give him his gift. (If she’s being honest, it’s as much for her as it is for him but who really wants to argue semantics?) She’s reminded him about it no less than four hundred times in the past week. The timing on this is vital, she thinks.

She glances at the clock that hangs over the kitchen sink and bites at her thumbnail; he’s not even late yet, she’s getting worked up over nothing. She murmurs a quick message to Barry through her Stone of Far Speech before filling a kettle and putting it on the stove to boil. She’s pawing through the pantry for honey and tea, fingertips just able to nudge the honey down without a casualty when she hears a key turn in the lock.

“In here!” she calls, retrieving three teacups from a cabinet near the stove. She methodically drops a large dollop of honey in the bottom of each. She pushes them back from the edge of the counter and moves to lean against the island in the middle of the kitchen.

“Lup, the fact that you made me get up early on my birthday is a crime, frankly,” Taako bemoans as he enters the kitchen, sliding onto a stool as he does.

“Our birthday,” she corrects with a dramatic eye roll. She darts a glance back at the clock again.

“Why’re you being weird?” Taako squints at her. Lup turns to look back at Taako and tries to play it as cool as she can. She’s certain she’s reapproaching normalcy already.

“I’m not being weird,” Lup says, giving a weird little smile. Too plasticine, she realizes too late. She doesn’t do this whole nerves bullshit well. It’s annoying and gross.

“You’re being certifiably weird, Lu. But go ahead, try to pull a fast one over on your dear brother,” Taako laments, putting his chin in his hands. The kettle whistles before Lup’s able to tease him about being a drama queen. At once she gets to work, adding a small splash of hot water to the bottom of each teacup, swirling them around to loosen the honey. She then dumps a healthy amount of tea leaves in each cup and covers them with water. She grabs three small plates from the cupboard and covers them. When she turns around, Taako’s staring at her, his eyes narrowed.

“What?” she asks innocently.

“Why are you making three cups? I thought Barold was out doing errands?”

“He is.”

Taako crosses his arms. “Lup, what’s going on? I don’t dig cagey and I do believe I was promised a gift that couldn’t be given in front of everyone else,” he says expectantly.

Lup takes a breath to steady herself. “Taako, I found her.”

His face folds in on itself in confusion. He glances back over at the three teacups and suddenly his face is opening back up in understanding and disbelief. “Bullshit. There’s no way. I-I’ve asked Kravitz about that a thousand times. He said that you can’t just go dipping in the Astral Plane of other planarverses. He said that not even the Raven Queen could clear something like that. Said it wasn’t possible. That’s the whole reason he wasn’t chasing our asses until we touched down in Faerun,” Taako babbles, trying to ignore that defiant, stomach flipping hope bubbling up inside of him.

Lup beams and ignores the clenching in her throat. “Well, you’re not supposed to be able to. But Kravitz, Barry, RQ, and I have been looking for a workaround. Not just for this, apparently RQ and some of the other gods have been looking for a way to connect with their cross-planar counterparts. I guess to like, aid in the smooth running of each planar system? To be honest when she was talking about it I couldn’t really follow but the point is that I found her, Taako. I haven’t talked to her yet. Wouldn’t do that without you. But we did some tests to make sure it’d all be okay and they went perfect. It’s not like it’s a forever open door or anything, though. Strictly speaking, us lowly non-gods still won’t be able to do this but it’s kinda hard to argue with a few saviors of the universe.” Lup cringes for a minute. “I hate playing that card sometimes but I feel like this is worth it.” Her voice catches at the last moment and she clears her throat. She’s determined not to cry.

Taako’s determination to not cry was shattered roughly ten seconds into Lup’s explanation. “How long?” he asks, voice wobbly. He’s not stupid, play too rough with the boundaries of the world and things can get a little fucky. But he wants to make the most of this.

“Few hours? That’s why I had you come over so early. I wanted us to have plenty of time. Didn’t wanna bring her to the party later, that’s just too much. But if you’re okay with it, I do want Barry to drop in for just a minute. He really wants to meet her.”

Taako scoffs and tries to sweep his emotion under a bravado coated façade. “I mean you’re outta your gourd if you think I’m not getting Krav or Angus in here for like ten minutes. I just…I need to know if she heard the Song. I want her to see it was worth it.”

And there goes Lup’s resolve. She nods and smiles a tremulous smile, paying no mind to the tears welling. She removes the plates from the teacups and brings them over to the counter. A sweep of her hand and a scythe materializes out of thin air. She steadies herself against it for a moment as Taako rises to stand beside her. They exchange a glance before Taako gives an encouraging nod. Lup swings the blade effortlessly like she has countless times before. A familiar riiiiip sounds through the kitchen and Lup extends her hand through the tear that formed, waving the scythe away as she does.

Out of the rip walks an older, plump elf woman, a purple shawl wrapped around her shoulders. Soft lines mark her face that indicate a lifetime of joy. She’s a little shorter than the twins but not by much. Her dark waves are pinned up in a bun, her stark white streak still hanging down free like an accessory. She looks incredible. She looks the same as she did when they first met her. She’s smiling wider than the whole world, it seems.

Taako and Lup are doing their best not to openly sob but it’s hard. How can they not? A moment of hesitation passes before they both sweep her up in the tightest hug any of them have ever experienced. The twins each rest their heads on one of her shoulders.

They don’t speak for a moment as they all take in the incredulity, the impossibility of what happened.

“Hi, Tía,” Taako manages to get out between sniffles.

“We have a lot to catch you up on,” Lup says with a wet laugh.

“Believe me, darlings, I’ve heard so much.”

426 notes - Posted April 4, 2022

#2

at least one of thb should have died in wonderland. the place has been designed to get the max suffering out of everyone but it was love that kept them all alive.

Merle (and to a lesser extent, Magnus) gave precious hp to Taako to keep him from biting it

Taako and Merle literally pulled Magnus's soul away from the Astral Plane

Lup devoured and destroyed Edward which destroyed Lydia in the process

and Barry kept them safe in every possible way he could

all huge acts of love in a place full of despair

674 notes - Posted March 24, 2022

My #1 post of 2022

I think being in such close contact with the Light for so many years did kinda do Something to the birds.

because Taako is not charismatic, that's canonical. but, even joke canonical, everyone adores him, desires him, wants to give him all their possessions. people cannot get enough of Taako, even after he dooms a town

Magnus, thanks to his rustic hospitality, is a likeable guy. but he was able to help lead the rebellion that gave him his folk hero status that gave him his rustic hospitality. people were willing to die by his side, this guy who was fairly new to their community

Lucretia managed to begin a whole secret organization and employ a large staff. These missions were deadly, dangerous, and promised the potential to have their very beings wiped from existence. yet people were willing to join the Bureau

these are the most striking instances of this but it's almost like a bit of that craveability brushed off on each of them through all their encounters with it

1,251 notes - Posted March 24, 2022

Get your Tumblr 2022 Year in Review →

#tumblr2022#year in review#my 2022 tumblr year in review#your tumblr year in review#false#rip (reeses in pieces)#long post#god is it a long post#not taz

5 notes

·

View notes