#RBI MPC Meet

Text

RBI raises repo rate to 4.9%; expects inflation to hurt for 3 quarters

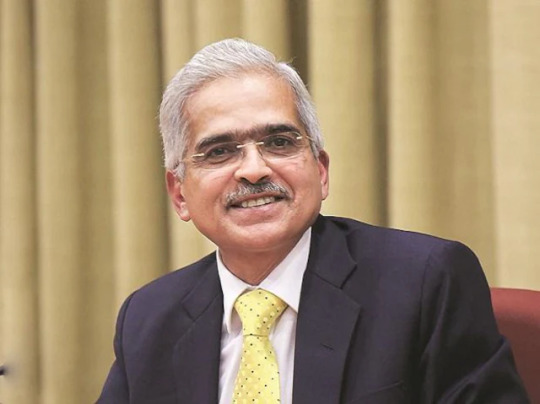

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Wednesday raised the repo rate by 50 basis points to 4.9 per cent (bps), citing inflation concerns.

The committee has decided to retain GDP growth estimate for FY23 at 7.2 per cent, said RBI Governor Shaktikanta Das.

The Governor said the Inflation likely to remain above upper tolerance band for three quarters of this financial year. The inflation projection for the current financial year is seen at 6.7 per cent, with Q1 at 7.5 per cent, Q2 at 7.4 per cent, Q3 at 6.2 per cent, and Q4 at 5.8 per cent.

The CPI inflation forecast for FY23 increased to 6.7 per cent from 5.7 per cent.

#RBNI#RBI MPC meet#RBI MPC meeting#monetary policy#RBNI MPC meet 2022#RBI MPC meet today#monetary policy decision today#RBI monetary policy meet

0 notes

Text

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

RBI Monetary Policy: रिजर्व बैंक ऑफ इंडिया (Reserve Bank of India) बुधवार को अपनी आगामी मौद्रिक समीक्षा नीति (MPC Meeting) की बैठक करेगा. इस समय मुद्रास्फीति में लगातार तेजी देखने को मिल रही है. ऐसी उम्मीद की जा रही है कि आगामी बैठक में सरकार नीतिगत दरों में इजाफा कर सकती है. एक्सपर्ट ने यह अनुमान जताते हुए कहा कि गवर्नर शक्तिकांत दास पहले ही इसके संकेत दे चुके हैं.

0.35 फीसदी की हो सकती है…

View On WordPress

#business news in hindi#RBI#rbi monetary policy 2022 dates#rbi monetary policy june 2022#rbi monetary policy meeting#RBI MPC#RBI MPC Meet#rbi repo rate 2022#repo rate#आरबीआई#आरबीआई एमपीसी#आरबीआई रेपो रेट#बिजनेस न्यूज इन हिंदी#मौद्रिक समीक्षा नीति#रिजर्व बैंक ऑफ इंडिया#रेपो रेट्स#शक्तिकांता दास

0 notes

Text

RBI might hike rate by 50 bps, recession ‘very unlikely’

By Kotak Editorial Team

Last Wednesday, the US Federal Reserve increased its benchmark rate by 75 basis points. This is the third time the Fed has hiked the federal funds rate by 75 basis points this year. It now stands at 3-3.25%, the highest since January 2008. Retail inflation in the US is at a record high. With this, the Indian central bank’s monetary policy committee is likely to raise interest rates by 50 bps, says Kotak AMC’s Lakshmi Iyer and reveals what it means for the Indian economy.

Continue reading…

0 notes

Text

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

!1 New UpdateClick here for latest updates

To knock high inflation out of the park, central banks are having to step out of the crease and come out swinging with tight monetary policy. Today’s hike by 50 basis points on the top of an inter-meeting 40 basis points hike in May is reflective of inflation elbowing its way to the top of the RBI’s priority list and it belatedly looking to catch up…

View On WordPress

#Featured#monetary policy meeting#RBI#rbi meeting#rbi monetary policy#rbi mpc#RBI MPC LIVE#RBI MPC Meet LIVE#RBI Policy LIVE#rbi rate#rbi repo rate

0 notes

Text

RBI MPC meet begins today: Another rate hike on cards, say experts

RBI MPC meet begins today: Another rate hike on cards, say experts

RBI MPC meet begins today: Another rate hike on cards, say experts

With inflation showing no signs of abatement, the Reserve Bank is likely to increase the benchmark lending rate in quick succession in its forthcoming monetary policy review on Wednesday, a hint for which has already been given by Governor Shaktikanta Das, opined experts.There are speculations that the central bank may go for at…

View On WordPress

0 notes

Text

RBI MPC Meeting December 2022: Check policy date, BoB-SBI-Kotak rate hike prediction, experts opinion, latest news

RBI MPC Meeting December 2022: Check policy date, BoB-SBI-Kotak rate hike prediction, experts opinion, latest news

RBI Rate Hike News: The RBI has hiked key benchmark lending rate by 50 basis points (bps) thrice since June over and above an off-cycle 40 bps increase in the repo in May.

source https://zeenews.india.com/economy/rbi-mpc-meeting-december-2022-check-policy-date-bob-sbi-kotak-rate-hike-prediction-experts-opinion-expectation-latest-news-2544651.html

View On WordPress

1 note

·

View note

Text

What is RBI's Monetary Policy and Its Impact on the Economy?

Welcome to the blog of Raj Malhotra Academy, the Best HAS Coaching Institute in Chandigarh! Today, let's discuss the Monetary Policy Committee (MPC) meeting and how it affects India's economy. The Reserve Bank of India (RBI) decided to keep its policy rates the same, including the repo rate, SLR, and bank rate. But why did the RBI choose this, and what does it mean for the economy? Let's dive into RBI's monetary policy's details and importance in ensuring economic growth and stability.

RBI's Monetary Policy Decision:

In the last MPC meeting, the RBI decided not to change its policy rates. Even though the economy is growing and more people are investing, the RBI chose to keep things the same. This is because they are worried about inflation, especially because food prices are going up. The RBI keeps an eye on inflation between 2% and 6%. While inflation has decreased, food prices are still high, making it hard for the RBI to balance growth and keep prices stable.

Impact on the Economy:

Keeping the policy rates unchanged affects different parts of the economy. One sector that can benefit is real estate because stable interest rates help it grow more. Also, when the RBI doesn't change its policy, other countries think India's economy is doing well. This makes foreign investors want to invest in India more, which helps the economy grow. The RBI's job is to control inflation and ensure enough money in the economy, which allows it to grow and stay stable.

Challenges Faced by RBI:

The RBI faces the challenging task of managing inflation and boosting growth. Lowering interest rates can help the economy grow, but with inflation staying high, it's tricky. Also, global economic ups and downs make decisions even harder. To handle all this, the RBI needs to be innovative. It must find ways to control inflation while letting the economy grow steadily. Balancing these goals is crucial for a healthy economy.

Future Policy Directions:

Moving forward, the RBI needs to handle the changing economy carefully. They have to make rules that prevent prices from going up too fast while also helping the economy grow. The RBI should be open and transparent about its decisions so everyone understands what's happening. It's also essential for the RBI to learn from what's happening in other countries and use that knowledge to make good choices for India's economy.

Towards the End

The recent decision by the RBI to keep its policy rates unchanged underscores the delicate balancing act faced by central banks in managing inflation and promoting growth. While stability in interest rates benefits sectors like real estate, the broader implications for economic growth and stability remain paramount. As India's economy continues to evolve, policymakers must adapt their strategies to navigate the complexities of the global financial landscape. The RBI plays a vital role in shaping India's economic trajectory by fostering a conducive growth environment while addressing inflationary pressures.

Raj IAS Academy, the best HAS coaching institute in Chandigarh, is committed to providing expert guidance and support to all UPSC aspirants. Our overall coaching approach is designed to meet the unique needs of the HAS exam. With experienced teachers and modern facilities, we ensure students get the best education and preparation possible. Like this, we simplify essential topics for UPSC aspirants, making complex concepts easy to understand and master. With our strong commitment, we help students succeed in their UPSC journey and reach their goals.

0 notes

Text

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

New Post has been published on https://petn.ws/vgi2B

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

Stocks to buy after RBI monetary policy: The Reserve Bank of India (RBI) left the repo rate unchanged at 6.50 percent for the seventh straight Monetary Policy Committee (MPC) meeting. However, stock market experts look at this RBI move as an opportunity for long-term investors who want to buy banking and financial stocks. They said […]

See full article at https://petn.ws/vgi2B

#OtherNews

0 notes

Text

RBI Monetary Policy updates - Repo rate unchanged at 6.50%

The Reserve Bank of India's Monetary Policy Committee (MPC) recently announced its decision to maintain key interest rates at 6.50%, aligning with market expectations. The policy stance remains at 'withdrawal of accommodation', indicating a cautious approach towards economic support measures.

The MPC's decision was supported by a 5:1 majority vote, highlighting a broad consensus among members. This move was largely anticipated by economists and experts, who welcomed the decision as a prudent step by the central bank.

Economists believe that the RBI has ample room to keep the repo rate unchanged, especially given the robust GDP growth forecast of 7% for FY25. This strong growth outlook, coupled with the central bank's commitment to targeting a 4% inflation rate, suggests that any future rate cuts are likely to be gradual and measured.

However, analysts point out that the timing of rate cuts may be influenced by external factors, such as the US Federal Reserve's (Fed) monetary policy stance. Many expect that the RBI will wait for the Fed to initiate its rate cut cycle before considering similar actions in India.

Looking ahead, the RBI's focus on financial stability is expected to remain paramount. This could mean that in certain circumstances, ensuring stability in the financial system may take precedence over managing inflation.

The GDP growth forecast for FY25, pegged at 7%, reflects the RBI's confidence in the economy's resilience and recovery. Growth projections for the June and September quarters stand at 7% and 6.9% respectively, with expectations of sustained growth momentum in the third and fourth quarters as well.

The MPC's decision to maintain status quo on policy rates and stances in its last review meeting, held in February 2024, underscores the central bank's commitment to a cautious and balanced approach towards monetary policy.

In conclusion, the RBI's decision to keep key rates unchanged reflects a balanced assessment of the current economic landscape, with an eye towards supporting growth while ensuring financial stability. The central bank's future actions are likely to be guided by a combination of domestic economic indicators and global developments, particularly the trajectory of the US Fed's monetary policy.

0 notes

Text

Upcoming Monetary Policy Committee Meeting and it’s Dilemma

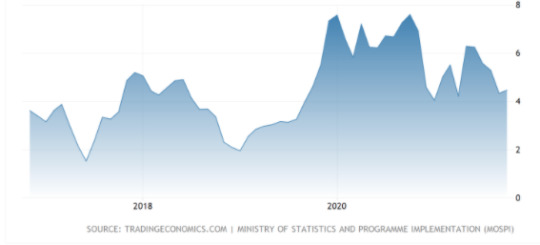

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) will meet between 6-8 December 2021 to take stock of the unfolding macroeconomic conditions and to debate and decide on the future monetary policy direction. Though for the last four months (July to October 2021) the consumer price inflation (CPI) is well within the target of the RBI (Figure 1; inflation within 2 to 6%) there is pressure on the central bank to normalize its monetary policy given the fact that there is excess liquidity in the banking system. The RBI had created this excess liquidity to ease the government borrowing in wake of Covid’19 but keeping the system in high liquidity for long may lead to asset price bubbles in stock and bond markets.

On the other hand, bank loan growth which may be taken as a proxy to gauge investment demand in the economy has just started to take off (Figure 2) and any increase in the repo rate (the RBI’s policy rate) will adversely affect loan demand.

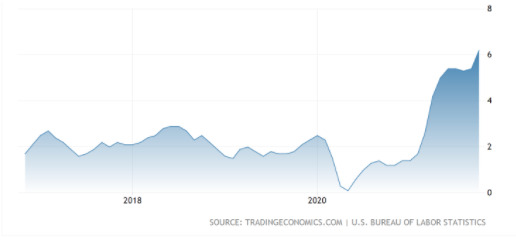

Complicating the matter for the RBI is the high inflation rate in the USA (Figure 3) which may force the Fed Reserve to tighten its monetary policy much before what the Fed Governor Dr. Jay Powell earlier communicated to the market. With the tightening of the USA monetary policy, there may begin a great Indian sale in the stock and bond market resulting in a significant depreciation of the Indian rupee (remember Taper tantrum of 2013).

Under this prevailing scenario, the MPC will meet to decide the future monetary policy path in India. If the bond market is to be believed, it is already preparing for higher interest rates in the future as the 10-year government bond yield has increased from 6% on Jun 1, 2021, to 6.33% on 26 November 2021.

0 notes

Text

Expectations for RBI's First FY25 Meeting: Likely Reasons for Keeping Repo Rate Unchanged

As the Reserve Bank of India (RBI) gears up for its first Monetary Policy Committee (MPC) meeting of the financial year 2024-25 in April, all eyes are on the potential decisions regarding the repo rate and monetary policy stance. Here's a breakdown of what to expect and why the central bank may opt to maintain the status quo.

Forecast and Outlook: Deutsche Bank's projections suggest that the RBI might uphold its FY25 CPI inflation forecast at 4.5%, while possibly revising upward the growth forecast for the next fiscal year to 7.4% from the current 7%.

Steady Repo Rate Anticipated: Market analysts widely predict that the MPC will choose to keep the repo rate unchanged at 6.5%. This expectation is grounded in the backdrop of seven consecutive meetings where the rate has remained stagnant following a 25-basis point hike in February 2023.

Cautionary Approach: The RBI is likely to exercise caution due to persistent risks to food inflation, which could have repercussions on the consumer price index (CPI) or retail inflation. The mandate to maintain inflation at 4% with a comfort band of 2% in both directions necessitates a vigilant stance until durable achievement of the target.

Monetary Policy Stance: While the prevailing stance of 'withdrawal of accommodation' is expected to persist, there's speculation among analysts about a potential shift to a 'neutral' stance. This adjustment could hinge on various factors, including past instances of RBI's surprising decisions.

Projections and Forecasts: Deutsche Bank's projections indicate a likely unchanged CPI inflation forecast for FY25 at 4.5%, while the growth forecast for the next fiscal year might witness an upward revision to 7.4%. These estimates provide insights into the RBI's outlook on the economic trajectory.

Impact on Lending Rates: In the event of an unchanged repo rate, lending rates linked to external benchmark lending rates (EBLR) will likely remain stable, offering relief to borrowers. However, there might be a possibility of interest rate adjustments on loans linked to the marginal cost of fund-based lending rate (MCLR).

Future Rate Cuts: Forecasts by Goldman Sachs suggest potential rate cuts of 25 basis points each in the third and fourth quarters of the 2024 calendar year, indicating a forward-looking approach by the central bank.

As the financial landscape evolves, the decisions taken by the RBI during its upcoming meeting will have far-reaching implications for various stakeholders. Stay tuned for updates on the monetary policy trajectory and its impact on the economic landscape.

0 notes

Text

Monetary Policy Committee (MPC) Meeting of October 2023

Context: The RBI’s Monetary Policy Committee (MPC) has kept the policy rates unchanged at 6.5% in its recent meeting.

Decision of MPC

No change in Policy Rate (Repo Rate)

It is the rate at which RBI lends money to banks to meet their short-term funding needs.

Policy Stance: Withdrawal of Accommodation

An accommodative stance means the central bank is prepared to expand the money supply to…

View On WordPress

0 notes

Text

Highlights of RBI’s Monetary Policy meeting

Highlights of RBI’s Monetary Policy meeting

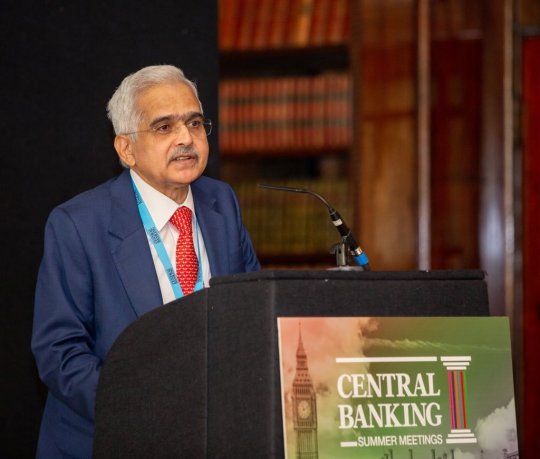

Reserve Bank of India (RBI) Governor Shaktikanta Das announced the bi-monthly monetary policy for the financial year 2023-24.

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) unanimously kept the repo rate unchanged at 6.5 per cent.

There is no big surprise in the recent policy. The tone of the RBI Governor persisted hawkish as he…

View On WordPress

0 notes

Text

महंगे लोन, बढ़ी हुई EMI, क्या आपको भी सता रही यह चिंता? जानिए RBI के बड़े फैसले से पहले के संकेत

नई दिल्ली : क्या लोन (Loan) महंगा होने वाला है? अब ईएमआई (EMI) में ज्यादा रकम देनी होगी? ये कुछ ऐसे सवाल हैं, जो (RBI MPC Meeting) से पहले लोगों के मन में रहते हैं। इस हफ्ते आरबीआई की मौद्रिक नीति समिति की बैठक होने वाली है। बैठक के बाद आरबीआई गवर्नर रेपो रेट (Repo Rate) में बदलाव से जुड़ी घोषणा करेंगे। उम्मीद है कि इस बार आरबीआई रेपो रेट को अपरिवर्तित रख सकती है। हालांकि, महंगाई को लेकर सतर्क रुख अपनाया जा सकता है। क्योंकि अमेरिका में आगे ब्याज दरों में सख्त रुख के संकेत हैं। दूसरी तरफ कच्चे तेल की कीमतें 10 महीनों के उच्च स्तर पर पहुंच गई हैं।

लगातार चौथी बार रेपो रेट रह सकती है अपरिवर्तित

आरबीआई की मौद्रिक नीति समिति की बैठक 4 से 6 अक्टूबर के बीच होगी। 12 बाजार प्रतिभागियों के ईटी पोल से पता चलता है कि आरबीआई एमपीसी रेपो रेट को 6.50 फीसदी पर बरकरार रख सकती है। इस तरह लगातार चौथी बार आरबीआई रेपो रेट को अपरिवर्तित रख सकता है। ऐसा हुआ तो लोन पर ब्याज दरें प्रभावित नहीं होंगी। बैंक आमतौर पर रेपो रेट में बदलाव होने पर ही लोन की ब्याज दरों में बदलाव करते हैं।

काफी बढ़ गए कच्चे तेल के भाव

डीबीएस बैंक के सीनियर इकोनॉमिस्ट राधिका राव ने कहा, 'आरबीआई एमपीसी रेपो रेट में यथास्थिति बनाए रखने की अपनी नीति को आगे बढ़ा सकती है। क्रूड ऑयल के वैश्विक भाव नवंबर, 2022 के हाई पर पहुंच चुके हैं। ये आरबीआई के 85 डॉलर प्रति बैरल के अप्रैल अनुमान को पार कर गए हैं।'

यूएस फेड हाई रखना चाहता है रेट

कच्चे तेल की कीमतों में उछाल डॉलर में मजबूती के साथ-साथ आया है। डॉलर इसलिए मजबूत हुआ, क्योंकि यूएस फेड ब्याज दरों को लंबे समय तक उच्च स्तर पर बनाए रखना चाहता है। इससे वैश्विक निवेशकों में उभरते बाजारों की सिक्योरिटीज के प्रति आकर्षण कम हो गया है। विदेशी फंड्स ने सितंबर में पहली बार इस वित्त वर्ष में भारतीय शेयरों में शुद्ध बिकवाली की, भले ही निफ्टी पहली बार 20,000 के स्तर को पार कर गया। http://dlvr.it/SwszxY

0 notes

Text

RBI MPC August 2023 Meeting LIVE: UPI Lite Transaction Limit Increased, Offline Payments on the Horizon, Announces Shaktikanta Das

In a significant development that will impact the digital payment landscape, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) convened in August 2023 to make some major announcements. The most notable among these is the decision to raise the transaction limit on UPI Lite, a move that aims to empower users and enhance the convenience of digital transactions.

The decision, which comes amidst the ongoing efforts to promote a cashless economy, is expected to make UPI Lite even more accessible to a larger segment of the population. UPI Lite has already gained popularity for its simplicity and ease of use, and the increased transaction limit is likely to boost its adoption further.

Speaking at the live updates session of the RBI MPC meeting, Shaktikanta Das, the RBI Governor, emphasized the importance of this decision. He stated, "The increased transaction limit on UPI Lite is a significant step towards fostering a digital payments ecosystem that is inclusive and efficient. This move aligns with our vision of a less-cash society, where digital transactions become the norm.

Post Monetary Policy Press Conference by Shri Shaktikanta Das, RBI Governor- August 10, 2023 https://t.co/a6SE9WdApa

— ReserveBankOfIndia (@RBI) August 10, 2023

The exact details of the revised transaction limit have yet to be disclosed, but it is anticipated that the new limit will enable users to conduct higher-value transactions through UPI Lite, providing more flexibility for a range of financial activities.

Furthermore, Governor Das also shared exciting news regarding the introduction of offline payments. This feature is expected to revolutionize the digital payment landscape by allowing users to perform transactions even in areas with limited or intermittent internet connectivity. This move holds immense potential, especially for rural and remote areas, where a stable internet connection can be a challenge.

While the specifics of the offline payment mechanism are yet to be unveiled, the mere announcement of its introduction has generated significant anticipation among businesses, consumers, and digital payment service providers.

RBI MPC August 2023 Meeting LIVE: Shri Shaktikanta Das, RBI Governor

The combination of the increased UPI Lite transaction limit and the forthcoming offline payments feature is poised to bring about a transformative change in the way Indians transact digitally. It underlines the RBI's commitment to creating an environment where digital financial services are not just convenient but also accessible to all, regardless of their location or connectivity constraints.

The financial and technological sectors will undoubtedly closely monitor the implementation of these changes, as they are likely to have a far-reaching impact on the country's economy and digital payments ecosystem. As we await further details, one thing is clear: the RBI's August 2023 MPC meeting has set the stage for a new era in digital payments, one that is more inclusive, efficient, and adaptable to the needs of a diverse population.

Click for more updates and latest Trending news along with Entertainment updates. Also get latest news and top headlines from India and around the world at The Like News.

Read the full article

#breakingnewstodaylive#Financial#LiveBusinessNews#monetarypolicyofrbi#RBI#RBIGovernor#rbimonetarypolicydate#RBIMPCmeeting#RBIpolicydate#reporatesunchangedat6.50percent#ShaktikantaDas#Trending#UPILite

0 notes

Text

RBI's MPC unanimous in keeping rates unchanged, member echoes reservation

New Delhi, June 22 : Though all the six members of Reserve Bank of India’s (RBI) monetary policy committee (MPC) unanimously voted to keep the repo rates unchanged during their meeting held earlier this month, one member expressed reservation at the decision, noting that the central bank’s stance has become increasingly disconnected from the reality.

MPC member Jayanth Varma expressed…

View On WordPress

0 notes