#RBI MPC

Link

Starting from October 8, banks will cease accepting Rs 2,000 notes for exchange. However, people can still exchange or deposit these notes following RBI guidelines from October 8, 2023.

#rbi policy#rbi mpc#RBI Issue Offices#Issue Offices#reserve bank of india#reserve bank#reserve bank governor#currency verification#bank note#2000 rupees#inr#2000 rupees note#deadline day#currency#value matters#two thousand rupees

0 notes

Text

Rbi: RBI interest rate decision, global trends to drive markets in holiday-shortened week: Analysts - Times of India

NEW DELHI: RBI‘s interest rate decision, macroeconomic data and global trends would dictate terms in the equity market in a holiday-shortened week, analysts said.Besides, the focus will also be on foreign portfolio investors’ trading activity, they added.Equity markets will remain closed on Tuesday for ‘Mahavir Jayanti‘ and on Friday on account of ‘Good Friday’.“Investment by FIIs, who are…

View On WordPress

0 notes

Text

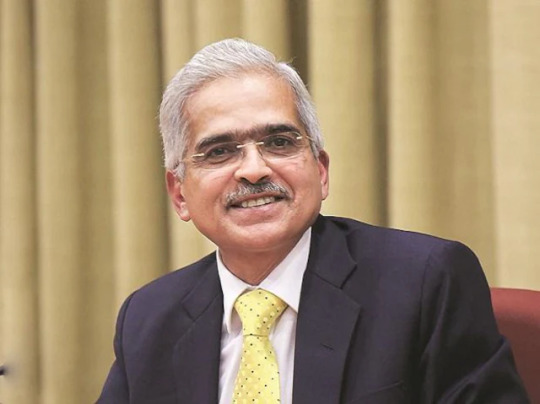

Shaktikanta Das: RBI ready to inject more cash, if needed: Governor Das | India Business News - Times of India

Shaktikanta Das: RBI ready to inject more cash, if needed: Governor Das | India Business News – Times of India

MUMBAI: The Reserve Bank of India is ready to inject additional cash through Liquidity Adjustment Facility (LAF) operations if need arises, governor Shaktikanta Das said on Wednesday. “The RBI remains nimble and flexible in its liquidity management operations. So, even though the RBI is in absorption mode, we are ready to conduct LAF operation that injects liquidity as may be needed,” Das said,…

View On WordPress

#Business news#Liquidity Adjustment Facility#rbi governor#rbi liquidity#rbi monetary policy#rbi mpc#shaktikanta das

0 notes

Text

RBI allows credit cards to be linked with UPI platform; to start with RuPay

The Reserve Bank on Wednesday allowed credit cards to be linked with the unified payments interface (UPI), which will enable more people to make payments using the popular platform.

Till now, only debit cards connected to savings bank accounts and current accounts were allowed to link up to the UPI platform.

At present, making UPI payments is free, while credit card companies usually depend on the merchant discount rate (MDR), which is charged on every usage for making merchant payments as a revenue stream.

"... the basic objective of linking credit cards to UPI is to provide a customer (with) a wider choice of payments. Currently, UPI is linked through debit cards to savings accounts or current accounts," Reserve Bank Deputy Governor T Rabi Sankar told reporters at the customary post-policy press conference.

Earlier in the day, RBI Governor Shaktikanta Das announced that such linking will be possible starting with the credit cards issued by the RBI-promoted National Payments Corporation of India (NPCI).

He said the new arrangement will be implemented after system developments and instructions will be issued to the NPCI for the same.

Das said the new arrangement is expected to provide more avenues and convenience to the customers in making payments through the UPI platform.

UPI has become the most inclusive mode of payment in India, with over 26 crore unique users and 5 crore merchants onboarded on the platform, he added.

Read more

#Reserve Bank of India#credit card to be attached with UPI platforms#RBI MPC#Credit cards#UPI platform#RuPay cards

0 notes

Text

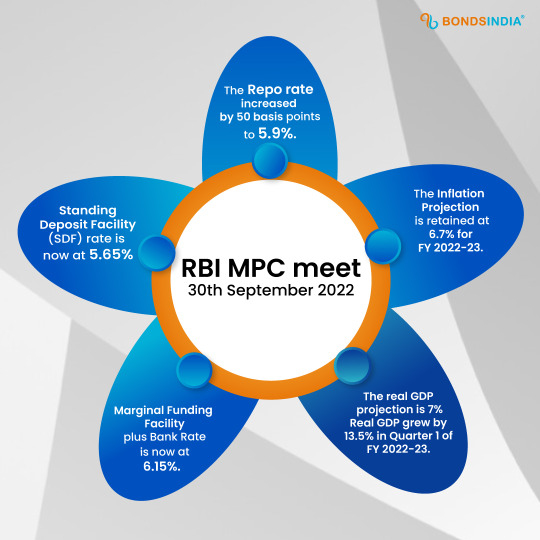

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

!1 New UpdateClick here for latest updates

To knock high inflation out of the park, central banks are having to step out of the crease and come out swinging with tight monetary policy. Today’s hike by 50 basis points on the top of an inter-meeting 40 basis points hike in May is reflective of inflation elbowing its way to the top of the RBI’s priority list and it belatedly looking to catch up…

View On WordPress

#Featured#monetary policy meeting#RBI#rbi meeting#rbi monetary policy#rbi mpc#RBI MPC LIVE#RBI MPC Meet LIVE#RBI Policy LIVE#rbi rate#rbi repo rate

0 notes

Text

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

RBI Monetary Policy: रिजर्व बैंक ऑफ इंडिया (Reserve Bank of India) बुधवार को अपनी आगामी मौद्रिक समीक्षा नीति (MPC Meeting) की बैठक कर��गा. इस समय मुद्रास्फीति में लगातार तेजी देखने को मिल रही है. ऐसी उम्मीद की जा रही है कि आगामी बैठक में सरकार नीतिगत दरों में इजाफा कर सकती है. एक्सपर्ट ने यह अनुमान जताते हुए कहा कि गवर्नर शक्तिकांत दास पहले ही इसके संकेत दे चुके हैं.

0.35 फीसदी की हो सकती है…

View On WordPress

#business news in hindi#RBI#rbi monetary policy 2022 dates#rbi monetary policy june 2022#rbi monetary policy meeting#RBI MPC#RBI MPC Meet#rbi repo rate 2022#repo rate#आरबीआई#आरबीआई एमपीसी#आरबीआई रेपो रेट#बिजनेस न्यूज इन हिंदी#मौद्रिक समीक्षा नीति#रिजर्व बैंक ऑफ इंडिया#रेपो रेट्स#शक्तिकांता दास

0 notes

Text

India turns a corner in July

Kotak Editorial Team

The disappointing economic data and corporate performance from US, the world’s largest economy had a negative sentiment globally across equity markets, but India stood strong with the board Nifty 50 index gaining close to 8.6% in July.

Why did this happen? How come India has performed well compared to its global peers or has India decoupled from its global counterparts?

There are three possible reasons for India to perform better than its peers.

Continue reading...

2 notes

·

View notes

Photo

As expected, the RBI has joined the Bank of England and the US Fed Reserve in the interest rate hike by raising the repo rate by 50 basis points to 5.9%.

0 notes

Text

RBI raises repo rate to 4.9%; expects inflation to hurt for 3 quarters

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Wednesday raised the repo rate by 50 basis points to 4.9 per cent (bps), citing inflation concerns.

The committee has decided to retain GDP growth estimate for FY23 at 7.2 per cent, said RBI Governor Shaktikanta Das.

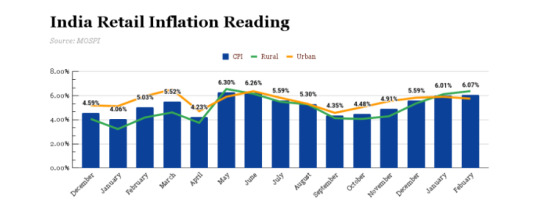

The Governor said the Inflation likely to remain above upper tolerance band for three quarters of this financial year. The inflation projection for the current financial year is seen at 6.7 per cent, with Q1 at 7.5 per cent, Q2 at 7.4 per cent, Q3 at 6.2 per cent, and Q4 at 5.8 per cent.

The CPI inflation forecast for FY23 increased to 6.7 per cent from 5.7 per cent.

#RBNI#RBI MPC meet#RBI MPC meeting#monetary policy#RBNI MPC meet 2022#RBI MPC meet today#monetary policy decision today#RBI monetary policy meet

0 notes

Text

Quand est-ce, comment regarder Shaktikanta Das Address LIVE ; Détails

Quand est-ce, comment regarder Shaktikanta Das Address LIVE ; Détails

Rencontre RBI MPC juin 2022: La Reserve Bank of India avec son comité de politique monétaire a déjà commencé sa réunion de trois jours, qui prendra fin le 8 juin, mercredi. Le jour même, le gouverneur de la RBI, Shaktikanta Das, annoncera les décisions de la banque centrale prises lors de la réunion bimensuelle du comité de politique monétaire “Attention à la déclaration de politique monétaire du…

View On WordPress

#comment regarder la politique de rbi se rencontrer#l&039;heure de la politique monétaire rbi aujourd&039;hui#politique rbi aujourd&039;hui#rencontre mpc#rencontre rbi mpc#shaktikanta das#temps de politique monétaire rbi#temps politique rbi

0 notes

Text

RBI MPC Meeting December 2022: Check policy date, BoB-SBI-Kotak rate hike prediction, experts opinion, latest news

RBI MPC Meeting December 2022: Check policy date, BoB-SBI-Kotak rate hike prediction, experts opinion, latest news

RBI Rate Hike News: The RBI has hiked key benchmark lending rate by 50 basis points (bps) thrice since June over and above an off-cycle 40 bps increase in the repo in May.

source https://zeenews.india.com/economy/rbi-mpc-meeting-december-2022-check-policy-date-bob-sbi-kotak-rate-hike-prediction-experts-opinion-expectation-latest-news-2544651.html

View On WordPress

1 note

·

View note

Text

What is RBI's Monetary Policy and Its Impact on the Economy?

Welcome to the blog of Raj Malhotra Academy, the Best HAS Coaching Institute in Chandigarh! Today, let's discuss the Monetary Policy Committee (MPC) meeting and how it affects India's economy. The Reserve Bank of India (RBI) decided to keep its policy rates the same, including the repo rate, SLR, and bank rate. But why did the RBI choose this, and what does it mean for the economy? Let's dive into RBI's monetary policy's details and importance in ensuring economic growth and stability.

RBI's Monetary Policy Decision:

In the last MPC meeting, the RBI decided not to change its policy rates. Even though the economy is growing and more people are investing, the RBI chose to keep things the same. This is because they are worried about inflation, especially because food prices are going up. The RBI keeps an eye on inflation between 2% and 6%. While inflation has decreased, food prices are still high, making it hard for the RBI to balance growth and keep prices stable.

Impact on the Economy:

Keeping the policy rates unchanged affects different parts of the economy. One sector that can benefit is real estate because stable interest rates help it grow more. Also, when the RBI doesn't change its policy, other countries think India's economy is doing well. This makes foreign investors want to invest in India more, which helps the economy grow. The RBI's job is to control inflation and ensure enough money in the economy, which allows it to grow and stay stable.

Challenges Faced by RBI:

The RBI faces the challenging task of managing inflation and boosting growth. Lowering interest rates can help the economy grow, but with inflation staying high, it's tricky. Also, global economic ups and downs make decisions even harder. To handle all this, the RBI needs to be innovative. It must find ways to control inflation while letting the economy grow steadily. Balancing these goals is crucial for a healthy economy.

Future Policy Directions:

Moving forward, the RBI needs to handle the changing economy carefully. They have to make rules that prevent prices from going up too fast while also helping the economy grow. The RBI should be open and transparent about its decisions so everyone understands what's happening. It's also essential for the RBI to learn from what's happening in other countries and use that knowledge to make good choices for India's economy.

Towards the End

The recent decision by the RBI to keep its policy rates unchanged underscores the delicate balancing act faced by central banks in managing inflation and promoting growth. While stability in interest rates benefits sectors like real estate, the broader implications for economic growth and stability remain paramount. As India's economy continues to evolve, policymakers must adapt their strategies to navigate the complexities of the global financial landscape. The RBI plays a vital role in shaping India's economic trajectory by fostering a conducive growth environment while addressing inflationary pressures.

Raj IAS Academy, the best HAS coaching institute in Chandigarh, is committed to providing expert guidance and support to all UPSC aspirants. Our overall coaching approach is designed to meet the unique needs of the HAS exam. With experienced teachers and modern facilities, we ensure students get the best education and preparation possible. Like this, we simplify essential topics for UPSC aspirants, making complex concepts easy to understand and master. With our strong commitment, we help students succeed in their UPSC journey and reach their goals.

0 notes

Text

CENTRAL BANK CONUNDRUM.

Whenever there is a hike in the interest rate, the economist is apprehensive about its impact on growth. The recent rate hike by RBI also poses the same apprehensions among the economists that these decisions could be growth restrictive as the economy has not revived completely.

If we look at the inflation rate, it was seeing a continuous surge from October, and the recent data of May shows that it has reached 8.6% highest since 1981. This exponential increase in the inflation rate is attributed to the rise in food inflation. Various economists suggest that the R.B.I rate hike will not be able to tame this inflation because of the international phenomenon. Instead, it will hurt the growth prospects.

If we look at the data more carefully, we will find that a fast-forwarded rate hike was unavoidable because of five primary reasons- (Joshi, 2022)

Broad-based inflation- The recent inflation is not just the result of the international phenomenon; various factors have made it long-lasting and broad-based. It’s not just our headline inflation (which includes food and fuel) surging. Our core inflation, too, is hovering around 6.8%. Every commodity in RBI’s basket shows an increase in prices, making inflation broad-based.

Constitutional obligation- Monetary policy committee is constitutionally obligated to keep the interest rate at 4% (+/- 2%); if we look at the graph since January, it has been above the allowed limit, and even the recent R.B.I inflation expectation is showing that it will be 6.7% which means that this fiscal year inflation will be above the allowed threshold. R.B.I. has to give the government reasons for the same as the Monetary policy committee’s primary responsibility is to control inflation.

Negative Real Policy Rate- Our repo rate is still below the pre-pandemic level. If we see our real policy rate, i.e. interest rate minus inflation, we will find that it is negative, which means that the value of money deposited in our bank is getting eroded in real terms; this will have a direct impact on savings pattern.

Higher inflation expectation- The recent RBI inflation expectation survey and IIM Ahmedabad inflation expectation survey show that people feel that inflation will also remain high for the upcoming period. The different studies suggest that higher inflation expectations hurt household expenditure patterns; Juster and Wachter, in 1972, did the research and established that higher inflation expectations result in lower spending on durable goods. (Shankar, 2015)

Increase in interest rate by Federal reserve- With the increase in federal fund rate, India has seen a massive outflow of capital; till the 10th of June, 25 billion dollars had been withdrawn by the foreign portfolio investors. The Fed is expected to increase its fund rate further; hence, RBI must increase its repo rate to tackle the impact.

Though the rate hike was unavoidable, that doesn’t mean we can negate the impact it will create on consumption patterns and demand in the economy. But the normal forecast of monsoon and increase in consumer confidence, as reflected in the RBI survey, does give the cushion to MPC to decide on a rate hike. Also, the allowance of credit cards to be linked to UPI will push the consumption of small, durable goods like laptops, smartphones and other small-ticket items. The risk that this unanchored inflation poses to macroeconomic stability is enormous, and the central bank must be ready to answer these complications.

Joshi, D. (2022, June Friday). Google. Retrieved from Indian express: Dharmakirti Joshi writes: RBI leans harder to rein in inflation, but rebound in services will put upward pressure on prices

Shankar, S. Y. (2015). Inflation Expectations and Consumer spending in India; evidence from consumer confidence survey. Reserve bank of India occasional papers, 41-43.

0 notes

Text

Repo Rate News: क्या होता है रेपो रेट? आने वाले समय में और बढ़ेगा, जानें खास बातें

Repo Rate News: क्या होता है रेपो रेट? आने वाले समय में और बढ़ेगा, जानें खास बातें

Repo Rate in India : भारतीय रिजर्व बैंक (Reserve Bank of India) की मौद्रिक नीति समिति (MPC) ने नीतिगत ब्याज दर में 50 बेसिस प्वाइंट की बढ़ोतरी की है. जिसके बाद अब रेपो रेट बढ़कर 5.40 फीसदी हो गई है. इस समय महंगाई बढ़ रही है और भारतीय रुपये कमजोर हो रहा है, इसका असर आर्थिक स्थितियों पर पड़ता है.

ऐसे समझे रेपो रेटआपको सरल भाषा में बताये तो जिस प्रकार लोग अपनी जरूरतों के लिए बैंकों से पैसा लेकर ब्याज…

View On WordPress

#mpc#rbi policy#repo rate#Reserve Bank Governor Shaktikanta Das#Reserve Bank of India#आरबीआई नीति#एमपीसी#भारतीय रिजर्व बैंक#रिजर्व बैंक के गवर्नर शक्तिकांत दास#रेपो दर

0 notes

Text

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

New Post has been published on https://petn.ws/vgi2B

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

Stocks to buy after RBI monetary policy: The Reserve Bank of India (RBI) left the repo rate unchanged at 6.50 percent for the seventh straight Monetary Policy Committee (MPC) meeting. However, stock market experts look at this RBI move as an opportunity for long-term investors who want to buy banking and financial stocks. They said […]

See full article at https://petn.ws/vgi2B

#OtherNews

0 notes

Text

RBI Monetary Policy updates - Repo rate unchanged at 6.50%

The Reserve Bank of India's Monetary Policy Committee (MPC) recently announced its decision to maintain key interest rates at 6.50%, aligning with market expectations. The policy stance remains at 'withdrawal of accommodation', indicating a cautious approach towards economic support measures.

The MPC's decision was supported by a 5:1 majority vote, highlighting a broad consensus among members. This move was largely anticipated by economists and experts, who welcomed the decision as a prudent step by the central bank.

Economists believe that the RBI has ample room to keep the repo rate unchanged, especially given the robust GDP growth forecast of 7% for FY25. This strong growth outlook, coupled with the central bank's commitment to targeting a 4% inflation rate, suggests that any future rate cuts are likely to be gradual and measured.

However, analysts point out that the timing of rate cuts may be influenced by external factors, such as the US Federal Reserve's (Fed) monetary policy stance. Many expect that the RBI will wait for the Fed to initiate its rate cut cycle before considering similar actions in India.

Looking ahead, the RBI's focus on financial stability is expected to remain paramount. This could mean that in certain circumstances, ensuring stability in the financial system may take precedence over managing inflation.

The GDP growth forecast for FY25, pegged at 7%, reflects the RBI's confidence in the economy's resilience and recovery. Growth projections for the June and September quarters stand at 7% and 6.9% respectively, with expectations of sustained growth momentum in the third and fourth quarters as well.

The MPC's decision to maintain status quo on policy rates and stances in its last review meeting, held in February 2024, underscores the central bank's commitment to a cautious and balanced approach towards monetary policy.

In conclusion, the RBI's decision to keep key rates unchanged reflects a balanced assessment of the current economic landscape, with an eye towards supporting growth while ensuring financial stability. The central bank's future actions are likely to be guided by a combination of domestic economic indicators and global developments, particularly the trajectory of the US Fed's monetary policy.

0 notes