#GST Related Updates

Photo

Interesting fact about NGOs in india:

Follow us for more interesting updates..!

Contact us to know more details

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

#NGOs#Non-governmentalorganization#NGOs Update#Interesting Updates#GST Related Updates#All Tax Related Updates#Humsabka Group#Humsabka Advisor

0 notes

Text

GST Registration 2023: जीएसटी रजिस्ट्रेशन कैसे करें | जीएसटी रजिस्ट्रेशन ऑनलाइन कैसे करें? पूरी जानकारी हिंदी में

GST Registration 2023: जीएसटी रजिस्ट्रेशन कैसे करें | जीएसटी रजिस्ट्रेशन ऑनलाइन कैसे करें? पूरी जानकारी हिंदी में

GST Registration 2023: GST Registration से लेकर Cancellation तक, यहाँ जानिए सबकुछ! यदि आप भी भारत सरकार द्धारा लागू किये गये GST देते है औऱ इसके लिए पंजीकऱण प्रक्रिया के शुरु होने का इंतजार कर रहे है तो आपके लिए खुशखबरी है कि, GST Registration 2023 की प्रक्रिया को शुरु कर दिया गया है

साथ ही साथ हम आप सभी को बता देना चाहते है कि, इस आर्टिकल में, हम ना केवल आपको GST Registration 2023 के…

View On WordPress

#2023#Bihar Board Inter Result 2021 Date#Business#csc#gst#jankariyan#news#online#process#prosess#registration#related#services#update#usefull#ऑनलाइन#करें#कैसे#जानकारी#जीएसटी#पूरी#में#रजिस्ट्रेशन#हिंदी

0 notes

Text

Etsy Charging GST & HST on Canadian Sellers’ Fees - Possibly Incorrectly

UPDATED: September 6, 2022

As posted May 31, Etsy intended to start charging GST and HST on some Canadian seller fees, to comply with the government of Canada’s new(ish) tax rules for digital economy businesses. Despite these rules being released back in April 2021, Etsy was inexplicably unable to comply with them by the final deadline of July 1, 2022; an Etsy Support person told me on July 15 that they were still working on the coding. (They also messed up the GST and HST they were supposed to charge on sales as of July 1; more on that here.)

Suddenly on August 30th, some Canadian sellers reported that Etsy had started retroactively charging the GST and HST on sales going back to July 31, with one-line-per-charge entries in seller payment accounts, in some cases draining the accounts entirely and even forcing them into the negative. A few days later, the above announcement appeared on our payment account pages, although some of us still haven’t had any tax charged. We don’t know if Etsy received an extra month’s exemption from the July 1 deadline, or if they are paying the July taxes out of Etsy profit.

This raises 2 key questions:

Is it legal for them to back-charge GST and HST on seller fees?

Why are they charging GST/HST-registered sellers tax, when other platforms are not, and the federal government’s info states these taxes should apply to non-registered sellers only.

Several people are investigating point 1, but we do not have a clear answer yet. You can contact Canada Revenue Agency’s (CRA) digital economy business phone line or email address here to ask them about this.

Point 2 seems pretty clear: despite what Etsy thinks, they aren’t supposed to be charging GST and HST on the fees of tax-registered sellers.

Why Tax-Registered Shops Shouldn’t Be Taxed on Etsy Seller Fees

Some of us became suspicious of Etsy’s plan to tax all Canadian seller fees, since Amazon only charges GST and HST on order-related fees of sellers who do not provide a GST registration number. (Marketplace Tax Collection is Amazon’s method of allowing individual businesses to charge the correct taxes on their sales; fees from those sales are not taxed by Amazon.) My website builder, Squarespace, does the same with subscriptions. Were these other companies wrong and Etsy right, even though Etsy needed more than an extra year to code the site?

While tickets have been submitted, I am not yet aware of the CRA telling anyone Etsy should not be charging these taxes on the fees of GST-registered sellers. However, the government website seems quite clear. When defining what gets taxed, the CRA says:

“You have to charge and collect tax on specified supplies that are generally taxable supplies of intangible personal property or services that you make to specified Canadian recipients.”

“Specified Canadian recipients” are defined as:

“...a recipient of a supply in respect of which the following conditions are met:

the recipient has not provided to the supplier, or to a distribution platform operator in respect of the supply, evidence satisfactory to the Minister that the recipient is registered under the normal registration regime; and

the usual place of residence of the recipient is situated in Canada.” [my emphasis]

I’m unable to find any exceptions that would make seller fees related to sales on the site taxable federally for GST registrants.

So there you have it: once again, Etsy has completely botched their tax obligations, and sellers are the ones who suffer. Given the pace with which Etsy usually moves on these things, it may take months to get this mistake reversed, meaning some sellers will be paying up to 15% more on their seller fees, knowing that they will have to wait a long time to get this money back.

Why doesn’t Etsy simply hire an expert when these new tax obligations arise? It’s clear, after multiple mess-up like this one, including with the charging of VAT on fees and the incorrect charging of BC PST on orders coming from outside of Canada, that they do not have any staff competent to deal with these issues.

I still have not been charged GST on my seller fees, but promise to update this post when I file my complaints with Etsy and the CRA. Please let me know if you have anything to add!

Looking for my article on Etsy forcing tax-registered sellers to add the GST into their prices? Click here to read that piece.

2 notes

·

View notes

Text

GST Registration For VAT & Service Tax Holders

If you were previously registered under VAT (Value Added Tax) or Service Tax and need to transition to GST (Goods and Services Tax) registration, the process typically involves the following steps:

Check Eligibility:

Determine if your business meets the threshold for GST registration. As of my last update, the threshold for GST registration varies based on location and type of business.

Obtain Documents:

Gather necessary documents such as PAN (Permanent Account Number) card, proof of business registration, identity and address proof of promoters/partners/directors, bank account details, etc.

Online Registration:

Visit the GST online portal and fill out the registration form. Provide accurate details about your business, such as the nature of business activities, turnover, etc.

Verification:

After submission, the details will be verified by the GST department. They may seek additional information or documents if required.

Issuance of GSTIN:

Upon successful verification, you'll be issued a GST Identification Number (GSTIN). This is a unique 15-digit identification number that is used for all GST-related transactions.

Transition Period:

Depending on the regulations in your jurisdiction, there may be a transition period during which you'll need to comply with both the old tax system (VAT/Service Tax) and GST.

Compliance:

Ensure compliance with GST regulations, including filing of GST returns, payment of taxes, and maintenance of proper records.

Cancellation of Old Registrations:

Once you are successfully registered under GST, you may need to cancel your old VAT and Service Tax registrations. This step ensures that you're not liable to pay taxes under the previous regime.

It's important to note that the process might vary slightly based on your location and specific circumstances.

Therefore, it's advisable to consult with a tax professional or visit the official GST portal of your country for the most accurate and up-to-date information. For all your business solutions efiletax.

0 notes

Text

Expert Guidance for GST Compliance: LegalNtax's Top GST consultants in delhi

In the intricate world of taxation, navigating Goods and Services Tax (GST) regulations can be daunting for businesses. From registration to filing returns and managing audits, ensuring compliance with GST laws is essential for smooth operations and financial stability. At LegalNtax, our team of expert GST consultants in Delhi is dedicated to providing unparalleled guidance and support to businesses, helping them navigate the complexities of GST compliance with ease and confidence.

Why Choose LegalNtax for GST Consultancy in Delhi:

Comprehensive Expertise: With years of experience and deep expertise in GST laws and regulations, our consultants possess the knowledge and skills to address a wide range of GST-related challenges. Whether you're a small business or a large corporation, we have the experience to provide tailored solutions that meet your specific needs and objectives.

Personalized Solutions: We understand that every business is unique, which is why we take a personalized approach to GST consultancy. Our consultants work closely with clients to understand their business operations, identify areas of concern, and develop customized strategies to ensure GST compliance while optimizing tax efficiency.

End-to-End Support: From GST registration and classification to filing returns and managing audits, our consultants offer comprehensive support at every stage of the GST compliance journey. Whether you need assistance with GST implementation, compliance reviews, or representation before tax authorities, we're here to help.

Proactive Compliance: Staying compliant with GST regulations is crucial for avoiding penalties and legal issues. Our consultants take a proactive approach to GST compliance, keeping abreast of changes in GST laws and regulations and providing timely updates and advice to ensure that your business remains compliant at all times.

Transparent Communication: We believe in transparent communication and strive to keep our clients informed and empowered throughout the GST compliance process. Our consultants are accessible and responsive, providing clear explanations and guidance to address any questions or concerns you may have.

Cost-Effective Solutions: At LegalNtax, we understand the importance of cost-effective solutions for businesses. Our GST consultancy services are competitively priced, offering excellent value for money without compromising on quality. We aim to deliver tangible results that contribute to your business's success and growth.

Conclusion:

With LegalNtax's expert GST consultants in Delhi by your side, you can navigate the complexities of GST compliance with confidence and peace of mind.

Whether you're a startup, a small business, or a large corporation, we have the knowledge, experience, and resources to help you achieve GST compliance while optimizing tax efficiency.

Contact us today to learn more about our GST consultants in delhi services and take the first step towards seamless GST compliance.

1 note

·

View note

Text

Supreme Court transfers to itself 27 writ petitions pending in 11 High Courts challenging the imposition of 28% GST on online gaming companies

Today (April 05, 2024), the Supreme Court (SC) transferred to itself 27 writ petitions pending in 11 High Courts challenging the imposition of 28% GST (Goods and Services Tax) on online gaming companies. The bench also tagged all these pending petitions with a petition pending in the SC filed by GamesKraft. The matter was heard today by a three-judge bench comprising Chief Justice of India DY Chandrachud, Justice JB Pardiwala, and Justice Manoj Misra. The SC bench posted the matter for hearing in the last week of April 2024. Online gaming companies such as Dream 11, Head Digital Works, and Games 24X7 have also filed petitions before the SC against the imposition of 28% GST on online gaming companies. Earlier on December 15, 2023, the SC refused to pass an interim order against GST demand notices to e-gaming companies and posted the matter for hearing on January 08, 2024. While hearing the matter on January 08, 2024, the top court sought response from the Centre Government on a batch of petitions challenging the constitutional validity of the imposition of 28% GST on online gaming companies. Today, the SC bench transferred all the pending petitions in High Courts related to the matter to itself and posted them for hearing in the last week of April 2024.

Also Read: Supreme Court Latest Updates

Also Read: Legal Articles

Also Read: Legal News

0 notes

Text

Section 13 of the CGST Act Explained: Key Points and Implications

Are you scratching your head trying to decode what Section 13 of the CGST Act is all about? Don't worry; we've got your back! In this blog post, we'll break down Section 13 into simple terms, highlighting its key points and implications, so you can navigate the complex world of GST with ease.

What is Section 13 of the CGST Act?

Section 13 of the Central Goods and Services Tax (CGST) Act, 2017, deals with the time of supply of goods and services. In simple words, it determines when you need to pay GST on your transactions.

Also Read:- How to Use Section 50 of GST to Your Advantage

Key Points to Remember:

Time of Supply: Section 13 establishes the time when a transaction is considered to have occurred for GST purposes. This timing is crucial because it determines when you need to account for GST in your books.

Supply of Goods: For the supply of goods, the time of supply is determined by three events:

Date of issue of invoice

Date of receipt of payment

Date of completion of the supply

Supply of Services: Similarly, for the supply of services, the time of supply is determined by:

Date of issue of invoice

Date of receipt of payment

Date of completion of the service

Date of receipt of advance payment

Earlier of the Events: Among these events, the time of supply is the earliest of:

Date of issue of invoice

Date of receipt of payment

Date of completion of supply or service

Implications of Section 13:

Understanding Section 13 is crucial for businesses for several reasons:

Compliance: Knowing when to pay GST ensures compliance with tax laws and avoids penalties.

Cash Flow Management: It helps in managing cash flows by anticipating GST payments.

Input Tax Credit (ITC): Properly timing the supply can affect the availability of ITC, thereby impacting the overall tax liability.

Conclusion:

Section 13 of the CGST Act lays down the rules for determining the time of supply of goods and services for GST purposes. By understanding these rules, businesses can ensure timely compliance, efficient cash flow management, and optimal utilization of input tax credit.

We hope this article has shed some light on this important section of the CGST Act, helping you navigate the world of GST with confidence. Stay tuned for more insights and updates on GST-related matters!

For more simplified explanations and insights on GST and other tax-related topics, keep exploring gstgyaan.com!

0 notes

Text

How can businesses stay informed about updates and changes in GST regulations?

Staying informed about updates and changes in GST regulations is essential for businesses to maintain compliance and adapt to evolving tax requirements. Some ways to stay informed include:

Subscribing to official GST portals and government websites for regular updates and notifications.

Following reputable tax publications, blogs, and news outlets that cover GST-related developments.

Participating in industry forums, seminars, and webinars focused on GST topics to gain insights and exchange knowledge with peers and experts.

Engaging with professional tax advisors or consultants who can provide personalized guidance and updates on GST regulations relevant to the business.

Read our blog for more information!

#GST#Compliance#Business#Taxation#India#Regulations#Transparency#Simplicity#Fairness#LegalCompliance#gstfiling#businesssupport#taxcompliance#financialhealth#gststructure#financialmanagement#gstreturns#businesstaxes#taxregulations#businesscompliance

0 notes

Text

GST Services in India — Xpert Accounting

Xpert Accounting, situated at 405, Ground Floor, Adarsh Kunj, Roshan Garden, Masudabad, Najafgarh, Delhi, 110043, is your trusted partner for comprehensive GST services in India. With a deep understanding of India’s Goods and Services Tax (GST) regulations, our expert team provides tailored solutions to meet your specific business needs.

Navigating the complexities of GST compliance can be daunting, but with Xpert Accounting by your side, you can ensure seamless adherence to all legal requirements. Our services encompass a wide range of GST-related tasks, including registration, filing returns, and resolving any GST-related issues that may arise.

At Xpert Accounting, we recognise that each business is unique, which is why we take a personalised approach to every client engagement. Whether you’re a small start-up or a large corporation, we offer customised solutions designed to optimise your GST processes and minimise any potential risks.

Our team of dedicated professionals stays up-to-date with the latest changes and updates in GST legislation, ensuring that your business remains compliant at all times. We strive to provide prompt and efficient service, allowing you to focus on what matters most — growing your business.

When you choose Xpert Accounting for your GST services in India, you can rest assured that you’re partnering with a trusted advisor who is committed to your success. We value transparency, integrity, and excellence in everything we do, and we work tirelessly to exceed your expectations.

For expert GST services that you can rely on, contact Xpert Accounting today at +91–93063 24967 or email us at [email protected]. Let us take the hassle out of GST compliance so that you can concentrate on achieving your business goals.

0 notes

Text

Impact of GST (Goods and Services Tax) on Business Strategies in India

The Goods and Services Tax (GST), delivered in India on July 1st, 2017, has had a profound effect on the country’s business landscape. Let’s explore the nuances of this tax reform and understand how it has influenced business strategies across various sectors.

Streamlined Compliance and Cost Reduction

Manufacturers, Distributors, and Retailers

GST replaced a complex net of indirect taxes, which includes excise responsibility, provider tax, and fee-delivered tax (VAT). For manufacturers, distributors, and stores, this simplification has been a boon. Here’s how:

Reduced Compliance Burden: Previously, organizations needed to navigate multiple tax regimes, each with its very own set of guidelines and office work. GST streamlined compliance by unifying these taxes right into a single framework. Manufacturers, distributors, and shops now address fewer tax filings and administrative hassles.

Cost Savings: The elimination of cascading taxes (tax on tax) has brought about cost financial savings. Businesses no longer face the load of paying tax on inputs used for production, as GST permits enter tax credit. This has definitely impacted earnings margins and average competitiveness.

Pan-India Service Providers

Service vendors, together with IT agencies, insurance firms, and banks, operate throughout state obstacles. For them, GST has delivered the subsequent benefits:

Uniform Taxation: Service carriers already functioned in a unified marketplace, and GST further harmonized their tax duties. The elimination of nation-unique levies guarantees consistency in compliance and reduces complexity.

Place of Supply Rules: Service vendors need to sign up one at a time in each nation in which they operate. However, the uniform tax structure simplifies move-nation transactions.

Sector-Specific Impacts

Agriculture and Agri-Processing

India’s agricultural sector, which contributes drastically to the GDP, faced demanding situations related to inter-state movement of agricultural products. GST has eased those hurdles:

Efficient Supply Chain: With GST, agricultural goods flow seamlessly throughout country borders. This has progressed supply chain performance, benefiting each farmers and customers.

Input Tax Credit: Agri-processing devices can now declare enter tax credit on equipment, device, and different inputs. This incentivizes funding in modernization and era.

Conclusion

In end, corporations running inside the GST generation ought to adapt their techniques to leverage the benefits of this tax regime:

Stay Informed: Regularly update yourself on GST rules and changes. Awareness is fundamental to compliance.

Optimize Processes: Use GST to streamline operations. Identify regions in which price financial savings can be achieved through input tax credit.

Explore New Markets: With a unified tax machine, recall increasing your enterprise across states. Explore untapped possibilities.

Remember, successful business techniques require agility, innovation, and a keen understanding of the evolving tax landscape. For any further inquiries or assistance, feel free to contact us. We’re here to help you navigate the complexities of GST and enhance your business strategies.

0 notes

Photo

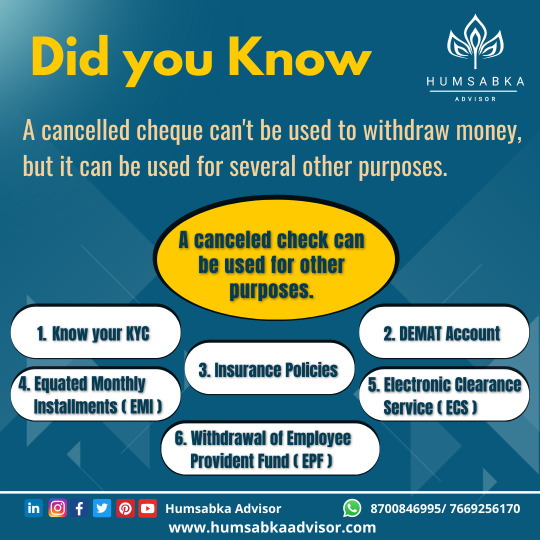

A canceled check can be used for other purposes.

Follow us for more interesting updates..!

Contact us to know more details

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

#Interesting Updates#GST Related Updates#All Tax Related Updates#Finance Updates#Humsabka Group#Humsabka Advisor

0 notes

Text

Revolutionizing Business Operations: The Goods and Services Tax Bill; the Crucial Role of Billing Software

Introduction:

The Goods and Services Tax (GST) bill, a transformative force in the realm of financial regulations, restructures business operation methods. This comprehensive tax reform streamlines taxation processes; moreover, it necessitates companies to manage their finances through an entirely new paradigm. Advanced billing software emerges as one key element that is now indispensable in this landscape. This blog post delves into the nuanced provisions of the Goods and Services Tax bill, examines its influence on businesses, and highlights billing software's crucial role in guaranteeing compliance and efficiency.

Understanding the Goods and Services Tax Bill:

Replacing the complex web of indirect taxes, the introduction of Goods and Services Tax aims to unify and simplify our tax structure. Under a single tax regime, it amalgamates both goods and services - an action that fosters transparency as well as efficiency. Consequently, businesses face far-reaching implications due to the GST bill: they must re-evaluate their financial processes—ensuring compliance with these new regulations becomes paramount.

Challenges Faced by Businesses:

Businesses face unique challenges with the implementation of the GST bill. They must meticulously document, adhere to stringent compliance standards and navigate through constant tax rate and rule evolutions; this demands a level of agility and precision that traditional methods often fail to provide. Billing software, however, presents itself as an essential solution for these challenges: it integrates seamlessly into modern business toolkits--providing robust functionalities which streamline operations related specifically to invoicing under new taxation regimes.

The Role of Billing Software in GST Compliance:

1. Automated GST Compliance:

Designed to automate and streamline the GST compliance process, modern billing software eliminates calculation errors' risk; it guarantees accurate - indeed, timely - submission of GST returns.

2. Real-time Updates:

Dynamic GST regulations undergo frequent updates to tax rates and rules. Billing software, endowed with real-time update features – a crucial tool for businesses – ensures not only constant information about these changes but also prompts the necessary adjustments.

3. Invoice Generation and GST Compliance:

Advanced billing software plays a crucial role in compliance by generating GST-compliant invoices. This process includes all necessary details: GSTIN, HSN codes, and applicable tax rates; thereby ensuring that businesses adhere strictly to the stipulations of the GST bill.

4. Input Tax Credit Management:

Businesses can efficiently manage Input Tax Credit (ITC) with the assistance of billing software. This feature guarantees that companies track and use ITC to optimize their tax liabilities, thus averting any plausible revenue loss.

5. Integration with Accounting Systems:

Effective billing software: it boasts a hallmark--seamless integration with accounting systems. This vital integration guarantees the synchronization, accuracy, and immediate availability of financial data for processes such as GST return filing and auditing; thus underpinning its effectiveness at ensuring swift compliance to regulatory requirements.

Keyword Focus: Billing Software:

We must delve deeper into the relationship between billing software and the GST bill, highlighting how businesses can optimally leverage advanced billing solutions; this is crucial for our understanding.

1. Customizable GST Templates:

Customizable templates, provided by billing software, enable businesses to tailor their invoices according to the specific requirements of the GST bill; this feature not only saves time--it also guarantees precision in documentation.

2. Data Organization and Accessibility:

Businesses must efficiently manage the sheer volume of data they generate. Robust billing software, with its advanced features; organizes and stores this data--thus ensuring easy accessibility for compliance reporting and informed decision-making.

3. User-Friendly Interface:

Businesses often face significant challenges while transitioning to a new tax system. However, they can ensure smooth adaptation to the changes induced by the GST bill and minimize disruptions in their daily operations through user-friendly billing software.

4. Automation of Tax Calculations:

Current GST rates serve as the basis for tax calculations in billing software, which automates this process. This automation eliminates the risk of errors and guarantees precise financial transactions; such a function is particularly crucial within a complex tax environment.

5. **Security Features:**

When handling financial data, one must prioritize security: billing software--enhanced with encryption and secure storage capabilities--guarantees the confidentiality of sensitive information; it also safeguards its integrity. In this manner, concerns regarding unauthorized access or data breaches receive immediate addressal.

Conclusion:

Navigating the complexities of the Goods and Services Tax bill, businesses find it strategically imperative to invest in advanced billing software. Integrating such solutions ensures not only seamless GST compliance but also enhances overall operational efficiency. In this era driven by technological advancements for business success, companies aiming to thrive in an ever-evolving economic landscape shaped by the GST bill view billing software as a key ally. Not only is embracing this technological evolution a necessity, but it also represents a strategic move towards an advanced business model: one that's more efficient, compliant—and critically—future-ready.

0 notes

Text

How To Build Your Career With Perfect Computer Education Tally Training Institute In Ahmedabad

Perfect Computer Curriculum Ahmedabad's Tally Training Institute is a notable option for anyone seeking to build a prosperous career in computerized accounting. This esteemed institution has a reputation for creating highly qualified individuals and for its unwavering commitment to quality. You'll embark on a revolutionary learning adventure at this institute thanks to well-created curricula, state-of-the-art facilities, and a group of knowledgeable faculty members. Students learn both the academic knowledge and the practical skills necessary to succeed in computerized accounting using Tally software in this course.

The Perfect Computer Tally Training Institute in Ahmedabad If you are interested in finding a Tally institute in Ahmedabad or any specific information about "Perfect Computer, such as conducting online searches, checking local directories, asking for recommendations, and contacting the institute directly if you have more specific details. This will help you gather more information about the institute, its courses, and its reputation in the field of Tally training.

Everything You Need to Know About Tally Certification in Ahmedabad By Perfect Computer Education

Tally is a popular accounting and business management software used by businesses for financial accounting, inventory management, and other related functions. Tally solutions are widely used in various industries for their accounting and reporting needs.

Tally Certification programs are typically offered by authorized training centers or institutes to provide individuals with the necessary skills and knowledge to effectively use Tally software for various business processes. These programs can vary in duration and content, but they generally cover topics such as

The Tally program and its functions are introduced.

Account creation and management for the company.

Create and maintain ledgers.

Inventory control.

Transactions and voucher entry.

Implementation and compliance with the Goods and Services Tax (GST).

Creating financial statements and reports.

Exploring the Benefits of Learning Accounting By Perfect Computer Education

Accuracy and Precision:

Perfect Computer ensures meticulous calculations and data processing, enhancing the accuracy of accounting tasks, minimizing errors, and providing reliable financial records.

Efficiency: Learning accounting with Perfect Computer:

Streamlines processes, reduces manual effort, and accelerates data entry, enabling accountants to complete tasks more efficiently.

Automation:

Perfect Computer automates repetitive tasks like data entry, transaction categorization, and report generation, freeing up time for accountants to focus on strategic analysis and decision-making.

Real-time Updates:

Accounting with Perfect Computer allows for immediate access to financial data, allowing for rapid decision-making and decreasing the time it takes to update financial statements.

Data Analysis:

Perfect Computer's computational power facilitates complex data analysis, allowing accountants to uncover insights, trends, and anomalies in financial data for better business planning.

Scalability:

Learning to account with Perfect Computer supports business growth by handling increased transaction volumes and maintaining accurate records without the need for extensive manual intervention.

If you have any questions or inquiries, please visit our website at perfecteducation. For assistance, you can contact us by telephone at +91 82646 39365 or send us an email at [email protected] We look forward to addressing your queries and providing the information you need.

#foreign accounting training#digital marketing course in ahmedabad#learn accounting in ahmedabad#usa accounting training#myob training#learn foreign accounting ahmedabad#xero training in ahmedabad#quickbook training ahmedabad#foreign accounting and taxation training#tally certification in ahmedabad

1 note

·

View note

Text

Procedure to Start a Publishing Company in India

Starting a publishing company in India involves several steps and considerations. Here's a general procedure to guide you through the process:

Market Research:

Conduct market research to understand the publishing industry in India, including the demand for various types of publications, target audience preferences, competition, and potential niche markets.

2. Business Plan:

Develop a comprehensive business plan outlining your publishing company's goals, target market, products/services, marketing strategy, financial projections, and operational requirements. A well-defined business plan will serve as a roadmap for your company's growth and success.

3. Legal Structure:

Choose a legal structure for your publishing company, such as a sole proprietorship, partnership, limited liability partnership (LLP), or private limited company. Consult with a legal advisor to determine the most suitable structure based on your business goals, liability considerations, and taxation requirements.

4.Company Registration:

Register your publishing company with the Registrar of Companies (ROC) in India. The registration process varies depending on the chosen legal structure. For example, if you opt for a private limited company, you'll need to register with the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013.

5. Obtain Necessary Licenses and Permits:

Obtain the required licenses and permits to operate a publishing company in India. This may include a trade license from the local municipal authority, GST registration for tax compliance, and any specific licenses or permissions related to publishing and distribution activities.

6. Copyrights and ISBN:

If you plan to publish books or other literary works, ensure that you obtain copyrights for the content and ISBN (International Standard Book Number) for each publication. This protects your intellectual property rights and facilitates distribution and cataloging of your books.

7. Set Up Office Infrastructure:

Set up your publishing company's office infrastructure, including workspace, equipment, and utilities. Consider investing in publishing software, editing tools, and design resources to support your publishing operations.

8. Recruit Staff and Freelancers:

Hire qualified staff or freelancers to handle various aspects of publishing, such as editorial, design, marketing, sales, and distribution. Build a team with diverse skills and expertise to ensure high-quality publications and efficient business operations.

9. Publishing Process:

Develop a systematic publishing process, including manuscript acquisition, editing, design/layout, printing, distribution, and marketing. Establish quality control measures to maintain the integrity and consistency of your publications.

10. Promotion and Distribution:

Implement a marketing and distribution strategy to promote your publications and reach your target audience. Utilize various channels such as bookstores, online retailers, libraries, literary events, and digital platforms to maximize visibility and sales.

11. Financial Management:

Set up accounting systems and financial management procedures to track income, expenses, royalties, and other financial transactions. Monitor your company's financial performance regularly and adjust your strategies as needed to achieve profitability and sustainability.

12. Compliance and Regulatory Requirements:

Ensure compliance with all applicable laws, regulations, and industry standards governing publishing activities in India. Stay updated on changes in copyright laws, censorship regulations, and other legal requirements that may impact your publishing operations.

By following these steps and investing time and effort into building a strong foundation for your publishing company, you can establish a successful and reputable brand in the Indian publishing industry.

#business fact#business startups#indian business#company registration#business solutions#business marketing#business publish#business ideas#efiletax

0 notes

Text

GST Billing Software Solution

Get your invoices, e-Invoices, delivery challans, estimates, bills of supply and many more in one place. Track everything from a single dashboard. Software is designed to manage a regulation firm’s case and client records, billing bookkeeping, and many more. Is the proper enterprise software to e-mail an invoice out of your Android Phone or Tablet immediately to your customer? A software program helps to fill your any kind of return; different compliance is on the market with many different data relating to GST - hitech e-invoice software.

Choose the proper service provider you'll discover lots of ERP service suppliers and that too at inexpensive prices. But, to find a way to get the best efficiency and business productivity, you must select the proper service provider. Stay on high of your inventory levels, get all the information you need to make smarter enterprise selections, fast. Different business departments work intently collectively to generate the utmost output. UBS integrates varied modules to find a way to have a whole view and control of your business. We continuously discuss with our customers what they want to see in future updates and work towards delivering them - GST E-Invoicing software.

All-in-one cloud-based GST toolkit simplifies your GST return filing experience with error-free automated ingestion to smart reporting. Fully integrated GST compliant invoice creation, payment tracking and stock management for enabling growth and compliance. Primarily, we are a GST provider. We were awarded a license after rigorous scrutiny of our technological and financial capabilities to serve our clients. The goods and services tax is a unified, multi-stage, and consumption-based tax levied on the supply of goods or services, combining all stages such as manufacture, sale, and consumption of goods and services.

It functions at a national level to replace most of the national and state tax systems like VAT, service tax, excise duty, etc. It removes the cascading effect of tax-on-tax, earlier prevalent. It applies to you if you are into manufacturing, trading, e-commerce, or providing services, and your annual turnover exceeds a prescribed limit. For more information, please visit our site https://billingsoftwareindia.in/e-invoice/

0 notes

Text

What is "supplies u/s 9(5) of the cgst" act?

The term "supplies u/s 9(5) of the CGST Act" refers to a specific provision under the Central Goods and Services Tax (CGST) Act in India. The CGST Act is a part of the Goods and Services Tax (GST) regime in India.

Section 9(5) of the CGST Act relates to the reverse charge mechanism. In the context of GST, reverse charge means the liability to pay tax is on the recipient of the supply instead of the supplier. Section 9(5) specifically deals with the situation where the government notifies certain categories of supply on which the recipient is liable to pay tax.

To get the most accurate and up-to-date information, it is recommended to check the latest version of the CGST Act or consult with a legal professional familiar with the current tax laws in India, as amendments or changes may have occurred since my last update in January 2022.

0 notes