#Asset Performance Management Market Trends

Text

Asset Performance Management Market: Examined in New Market Research

The Insight Partners declares the examination on Worldwide Resource Execution Asset Performance Management Market. This Worldwide Resource Execution Asset Performance Management Market Report covers around the world, nearby, and country level market size, bits of the general business, progressing design, the impact of covid19 on around the world

Statistical surveying Report Examinations Exploration Approach audit involves Optional Exploration, Essential Exploration, Organization Offer Investigation, Model (counting Segment data, Macroeconomic pointers, and Industry markers for instance Use, structure, region improvement, and workplaces, etc), Exploration Impediments and Income Based Displaying. Complete assessment of Worldwide Resource Execution The executives Market In view of current examination and future assessment, which relies upon prominent data moreover remembered for this Reports. Presenting the Worldwide Resource Execution, The executives Market Component Investigation Doormen Five Powers, Supply/Worth Chain, PESTEL assessment, CAGR regard, Market Entropy, Patent/Brand name Examination, and Post Coronavirus Effect Investigation.

(**Note: The example of this report is refreshed with Coronavirus influence analysis**)

To Know What Coronavirus Pandemic Will Mean for Worldwide Resource Execution The executives Market |

Get an Example Duplicate of Report, Snap Here:

Report Presentation, Outline, and top to bottom industry investigation

• 150+ Pages Exploration Report

• Incorporates Rundown of table and figures

• Local Investigation with Graphical Portrayal of Size, Offer and Patterns

• Give Part wise direction on Solicitation

• Realities and Elements research system

• Report Incorporates Top Market Players with their Business Procedure, Deals Volume, and Income Examination

NOTE: Our examiners checking what is going on across the globe makes sense of that the market will create gainful possibilities for makers post the Coronavirus emergency. The report intends to give an extra outline of the most recent situation, monetary log jam, and Coronavirus influence on the general business.

The report is a mix of subjective and quantitative investigation of the computer-generated experience industry. The worldwide market significantly thinks about five significant districts, to be specific, North America, Europe, Asia-Pacific (APAC), Center East and Africa (MEA) and South and Focal America (SACM). The report additionally centers around the comprehensive Bug examination and broad market elements during the estimate time frame.

Organizations Referenced:

1. ABB Ltd.

2. Aspen Innovation Inc.

3. AVEVA Gathering plc

4. Bentley Frameworks Consolidated

5. General Electric Organization

6. Intel Enterprise

7. Worldwide Business Machines Partnership

8. OSIsoft LLC

9. Schneider

10. Siemens AG

Motivation to Purchase

• Save and decrease time completing passage level examination by recognizing the development, size, driving players and portions in the worldwide Resource Execution Asset Performance Management market.

• Features key business needs to direct the organizations to change their business techniques and secure themselves in the wide geology.

• The critical discoveries and proposals feature significant moderate industry patterns in the Resource Execution Asset Performance Management market, consequently permitting players to foster powerful long haul methodologies to earn their market income.

• Create/alter business extension plans by utilizing significant development offering created and developing business sectors.

• Examine top to bottom worldwide market patterns and viewpoint combined with the elements driving the market, as well as those limiting the development at a specific degree.

• Upgrade the dynamic interaction by understanding the techniques that support business interest regarding items, division and industry verticals.

Gratitude for perusing this article; you can likewise modify this report to get select sections or district wise inclusion with locales like Asia, North America, and Europe.

#Asset Performance Management Market#Asset Performance Management Market Size#Asset Performance Management Market Trends#Asset Performance Management Market Forecast#Asset Performance Management Market Growth#Asset Performance Management Market Analysis

0 notes

Text

Maximize Your Returns: Best Investment Recommendation for Long-Term Wealth Growth

Are you looking for the best investment recommendation to grow your wealth over the long-term? Look no further! In this comprehensive investment recommendation, we'll guide you through the most promising investment opportunities in today's market. Discover how to diversify your portfolio, manage risk effectively, and achieve optimal returns for sustained wealth growth. Whether you're a beginner or an experienced investor, this investment recommendation is your ticket to financial success. Don't miss out on the opportunity to secure your future!

#Investment analysis#market trends#portfolio management#diversification#performance evaluation#asset allocation#investment strategies

0 notes

Text

The Fundamental 3 Things to Check in a Stock Report

Embarking on the journey of stock market investment requires a keen eye and strategic understanding of the information presented in stock reports. For both novice and seasoned investors, there are three fundamental elements within a stock report that demand careful scrutiny for informed decision-making and successful portfolio management.

1. Financial Health and Performance:

The cornerstone of stock analysis lies in a comprehensive examination of the company's financial health and performance. Vital indicators such as revenue growth, profit margins, and debt levels offer insights into the company's stability and potential for sustained growth. Investors should assess the company's financial statements, including income statements, balance sheets, and cash flow statements, to gain a holistic view of its financial prowess.

2. Market and Industry Trends:

Understanding the broader market and industry dynamics is pivotal in evaluating a stock's potential. Stock reports should provide insights into current market trends, economic conditions, and industry-specific factors influencing the company's performance. Investors should assess how external factors might impact the company's operations and position within its sector. Industry analysis, including competitive landscape and growth projections, is crucial for making informed decisions in a dynamic market environment.

3. Management Competence and Corporate Governance:

The efficacy of a company's leadership plays a significant role in its success. A thorough examination of the management team's competence, strategic vision, and past performance is critical. Investors should assess whether the company adheres to sound corporate governance practices, ensuring transparency and ethical decision-making. Information on executive compensation, board structure, and any recent changes in leadership should be scrutinized to gauge the company's commitment to effective management.

In the pursuit of mastering stock analysis, investors should approach stock reports with a strategic mindset. By focusing on these three foundational aspects—financial health and performance, market and industry trends, and management competence and corporate governance—investors can make more informed decisions and build a resilient, well-balanced portfolio.

Remember, successful stock analysis goes beyond numbers; it requires a holistic understanding of the company's position in the market, its leadership's ability to navigate challenges, and the broader economic landscape. As you delve into stock reports, equip yourself with the knowledge to decipher these critical elements, and you'll be well-positioned to navigate the complexities of the stock market with confidence and intelligence.

#Stock analysis#Mutual fund analysis#Investment trends#Market insights#Portfolio management#Diversification#Risk assessment#Performance evaluation#Asset allocation#Investment strategies

0 notes

Text

Optimizing B2B Contact Databases: Strategies for Better Targeting

Article by Jonathan Bomser | CEO | AccountSend.com

As a B2B business, your contact database is one of the most valuable assets you have. It enables targeted sales outreach, precision marketing, and effective lead generation, thus driving sales and growth. In this article, we will explore seven key strategies for enhancing your B2B contact database for superior targeting. By implementing these strategies, you can significantly enhance your targeting, boost conversions, and drive business growth.

DOWNLOAD THE B2B CONTACT DATABASES INFOGRAPHIC HERE

Regularly Cleanse and Update Your Database

A clean and updated B2B contact database is essential for effective sales prospecting and business development. Regularly purge outdated information, remove duplicates, and update existing contact data to maintain accuracy. CRM integration can automate this process, ensuring your database remains current and reliable. By keeping your database clean and up-to-date, you can ensure that your sales and marketing efforts are based on accurate and relevant information.

Segment Your Contact Database

Segmentation is a powerful tool for B2B lead generation and sales prospecting. It involves categorizing your database into distinct groups based on shared characteristics, such as industry type, company size, or role. This facilitates personalized communication, enhancing engagement and conversion rates. By segmenting your contact database, you can tailor your messaging and content to specific audience segments, increasing the relevance and effectiveness of your communication.

Implement a Lead Scoring System

Lead scoring is a crucial aspect of B2B lead generation and sales funnel optimization. It assigns value to each contact based on their potential to convert into a customer. It helps prioritize your outreach, ensuring you focus on high-value leads, which can lead to improved sales opportunities. By implementing a lead scoring system, you can allocate your resources effectively and focus on the leads that are most likely to result in conversions.

Embrace Account-Based Marketing (ABM)

Account-Based Marketing (ABM) is a highly effective B2B marketing strategy that targets specific high-value accounts with customized campaigns. Integrating ABM with your B2B contact database ensures a highly tailored approach, enhancing your chances of winning over key accounts. By aligning your marketing and sales efforts with the specific needs and preferences of target accounts, you can increase engagement and drive business growth.

youtube

Leverage Data Analysis

Data analysis is a powerful tool for B2B lead generation and sales prospecting. It helps you uncover invaluable insights into your contacts' behavior and preferences, guiding your marketing and sales strategy. By analyzing data from your B2B contact database, you can make data-driven decisions and optimize your targeting efforts. You can also use data analysis to identify emerging markets and stay ahead of the competition.

Utilize AI for Enhanced Database Management

Artificial Intelligence (AI) is transforming the way B2B businesses manage their contact databases. AI-powered systems can automate tasks like data cleansing, lead scoring, and market segmentation, leaving your team free to focus on creating effective sales and marketing strategies. By leveraging AI technology, you can improve the efficiency and accuracy of your database management processes, saving time and resources.

Adopt a Continuous Improvement Approach

Data management is not a one-time activity. Consistently review your strategies and update them based on performance data and evolving market trends. This will keep your database agile and ensure your targeting remains effective. By continuously improving your B2B contact database and refining your targeting strategies, you can stay ahead of the competition and drive ongoing business growth.

In summary, optimizing your B2B contact database involves regular updates, effective segmentation, lead scoring, ABM, data analysis, AI integration, and a continuous improvement mindset. These strategies, when implemented correctly, can significantly enhance your targeting, boost conversions, and drive business growth. By leveraging the power of a well-optimized B2B contact database, you can unlock the full potential of your sales and marketing efforts.

#AccountSend#BusinessOwnersDatabase#VerifiedB2BEmails#B2BContactDatabase#CEOEmailAddresses#SalesLeadsDatabase#B2BEmailList#B2BLeadsDatabase#VerifiedBusinessLeads#B2BLeadsList#Youtube

20 notes

·

View notes

Text

Strengthen Brand Identity and Fuel Creativity with Sales Quoting Software

For value-added resellers in the IT and office supplies sector, creating a strong brand identity is indispensable. A brand identity not only sets a company apart from its competitors but also fosters trust and loyalty among customers.

However, maintaining a consistent brand image while striving for innovation can be a challenging task. This is where sales quoting software steps in to streamline processes, enhance brand identity, and fuel creativity. The business sales quoting software serves as a comprehensive solution for value-added resellers (VARs) to generate accurate quotes quickly and efficiently.

However its benefits extend beyond mere sales operations; it can play a pivotal role in reinforcing brand identity and fostering creativity within an organization. Here's how:

Consistency in Brand Messaging

A cohesive brand identity is built upon consistent messaging across all customer touchpoints. Sales quoting software allows businesses to incorporate branded templates, logos, and messaging into every quote, ensuring that the brand identity remains consistent throughout the sales process. This consistency reinforces brand recognition and strengthens the brand's overall image in the eyes of customers.

Personalization

While consistency is key, personalization is equally important for connecting with customers on a deeper level. A business quote generator enables businesses to tailor quotes to each customer's specific needs and preferences. By incorporating personalized elements such as customer names, relevant product recommendations, and customized pricing options, businesses can demonstrate their commitment to providing personalized experiences, thus enhancing brand loyalty.

Streamlined Workflows

Creativity thrives in environments where processes are streamlined and efficient. The software that has connections with Cisco Direct data feed automates repetitive tasks such as data entry, pricing calculations, and quote generation, allowing sales teams to focus their time and energy on more creative endeavors, such as crafting compelling sales pitches and developing innovative solutions to meet customer needs.

Data-Driven Insights

Creativity flourishes when fueled by insights and feedback. Sales quoting tools connected to catalog management solutions provide valuable data and analytics on quote performance, customer preferences, and sales trends. By leveraging these insights, businesses can identify areas for improvement, uncover new opportunities, and fine-tune their sales strategies to better resonate with their target audience, ultimately fostering a culture of continuous innovation.

Collaboration and Communication

Effective collaboration is essential for unleashing creativity within an organization. This software system integrated with catalog solutions software facilitates seamless collaboration among sales teams, marketing departments, and other stakeholders involved in the quoting process. Features such as real-time updates, commenting, and version control ensure that everyone is on the same page, fostering a collaborative environment where ideas can flow freely and innovation can thrive.

Brand Differentiation

In a crowded marketplace, standing out from the competition is crucial. Sales quoting tools that have built-in connections with the Cisco catalog empower businesses to differentiate themselves by offering unique value propositions, showcasing their expertise, and highlighting the benefits of their products or services in a visually compelling manner. By effectively communicating their brand's unique selling points through quotes, businesses can carve out a distinct identity in the minds of customers.

Sales quoting software is not just a tool for generating quotes; it is a powerful asset for strengthening brand identity and fueling creativity within an organization. By ensuring consistency in brand messaging, enabling personalization, streamlining workflows, providing data-driven insights, fostering collaboration, and facilitating brand differentiation, sales quoting software empowers businesses to elevate their brand image, engage customers more effectively, and drive innovation forward.

As businesses continue to navigate an ever-evolving marketplace, investing in this software application is not just a wise decision; it's a strategic imperative for success in the digital age.

#ecommerce platform#sales quoting software#quote creation#business software#cpq software#varstreet#ecommerce software#free rich content

2 notes

·

View notes

Text

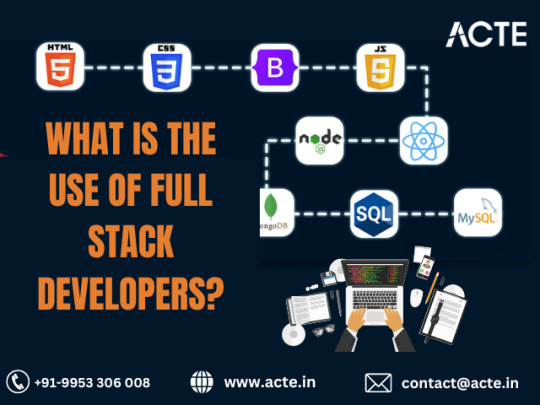

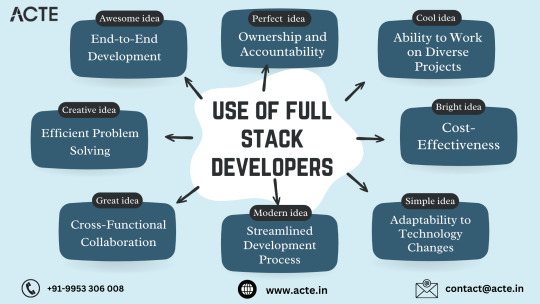

Unveiling the Essential Role of Full Stack Developers in Modern Web Development

Introduction:

Within the dynamic realm of web development, full stack developers stand out as indispensable assets, offering a unique blend of expertise in both frontend and backend technologies. Their versatility enables them to navigate through various aspects of web application development, from crafting user interfaces to managing databases and server-side logic.

In this article, we'll delve into the essential role of full stack developers, shedding light on their pivotal contributions to streamlining development processes and fostering innovation within the industry.

1. Comprehensive Development Capabilities:

An integral aspect of full stack developers lies in their adeptness at overseeing end-to-end development projects. From initial concept to deployment, these professionals are proficient in every stage of the development lifecycle. They excel at designing intuitive user interfaces, implementing intricate frontend functionality, crafting robust backend logic, seamlessly integrating databases, and orchestrating smooth deployment of applications. This holistic approach ensures coherence and uniformity across the entirety of the project.

2. Proficient Problem Solvers:

Full stack developers possess a profound understanding of both frontend and backend technologies, equipping them with the skills to address issues at varying levels of the application stack. Their extensive skill set enables them to identify and resolve challenges efficiently, thereby minimizing downtime and ensuring the seamless operation of web applications. Whether it entails debugging frontend UI glitches or optimizing backend performance, full stack developers excel in devising effective solutions to intricate technical hurdles.

3. Collaborative Cross-Functional Engagement:

Effective collaboration is paramount in any development endeavor, and full stack developers are adept at fostering cross-functional teamwork. With their comprehensive grasp of frontend and backend technologies, they facilitate seamless communication and collaboration among designers, frontend developers, backend developers, and project managers. This cohesive teamwork ensures alignment on project objectives and facilitates smooth execution of tasks throughout the development journey.

4. Streamlined Development Processes:

The presence of a single developer proficient in both frontend and backend tasks results in a more streamlined and efficient development process. Full stack developers seamlessly transition between frontend and backend development, thereby mitigating communication gaps and reducing the need for handoffs between different team members. This streamlined approach translates into faster development cycles, rapid iterations, and ultimately, shortened time-to-market for web applications.

5. Adaptability to Technological Advancements:

In a landscape characterized by constant evolution, full stack developers are well-equipped to adapt to emerging trends and integrate new technologies into their projects. Their ability to stay abreast of the latest developments ensures they remain at the forefront of innovation in web development, thereby enabling them to deliver cutting-edge solutions tailored to meet the evolving needs of clients and users alike.

6. Cost-Efficiency:

Employing separate specialists for frontend and backend development can incur substantial costs for businesses. Conversely, engaging a full stack developer who can adeptly handle both roles offers a more cost-effective alternative. This approach not only reduces development expenditures but also minimizes overhead and administrative burdens associated with project management. Furthermore, having a singular point of contact for development tasks enhances communication and expedites decision-making processes.

7. Versatility in Project Execution:

Full stack developers possess the versatility to tackle a diverse array of projects, ranging from simple websites to complex web applications. This flexibility enables them to address varied challenges and contribute effectively to a wide spectrum of projects. Whether it involves crafting e-commerce platforms, content management systems, or social networking sites, full stack developers boast the expertise and adaptability to deliver bespoke solutions tailored to the unique requirements of each project.

8. Ownership and Commitment:

Often assuming ownership of the projects they undertake, full stack developers exhibit a heightened sense of accountability and dedication. This intrinsic ownership fosters a greater commitment to project success, as developers become personally invested in achieving favorable outcomes. By assuming responsibility for the entire development process, full stack developers ensure projects are delivered punctually, within budget constraints, and in adherence to the highest quality standards.

Conclusion:

In summary, full stack developers occupy a pivotal position in the realm of web development, leveraging their versatile skill sets and comprehensive understanding of frontend and backend technologies to drive innovation and excellence. By harnessing the unique capabilities of full stack developers, businesses can streamline development processes, stimulate innovation, and deliver unparalleled web experiences to their audience.

#full stack developer#education#information#full stack web development#front end development#frameworks#web development#backend#full stack developer course#technology

4 notes

·

View notes

Text

Set the Standard: Atlas NYC Unveils the Best Property Management Companies in NYC

Set the Standard: Atlas NYC Unveils the Best Property Management Companies in NYC

The success of your investment depends on selecting the correct property management partner in the dynamic and quick-paced world of New York City real estate. Of all the options, Atlas NYC stands out as a model of quality, establishing the benchmark for property management in the city that never sleeps. In this piece, we examine the essential characteristics that set Atlas NYC apart as one of the best property management companies in NYC, providing a smooth fusion of experience, creativity, and unmatched customer care.

Unrivaled Local Knowledge

A thorough awareness of the local environment is necessary to successfully navigate the complexity of the New York City real estate market. The team at Atlas NYC has unmatched experience since they have developed a thorough understanding of the various neighborhoods, laws, and market trends that make up the city. Atlas NYC’s ability to adjust its property management techniques to the specific needs and problems of each property under its care is made possible by its local understanding.

All-inclusive Property Management Solutions

To maximize the performance and value of your investment, Atlas NYC provides a full range of property management services. Every area of property ownership is managed with accuracy and care according to the company’s holistic strategy, which includes tenant relations, maintenance, financial administration, and strategic planning.

Important Services Consist of:

1. Tenant Relations and Screening:

· Strict screening procedures to find qualified tenants.

· Tenant relations should be proactive and responsive to promote happy living situations.

2. Upkeep and Fixtures:

· Proactive maintenance plans to deal with problems before they get worse.

· Effective management of maintenance, guaranteeing the durability and allure of every asset.

3. Accounting for Finances:

· Efficient and open financial administration.

· Rent collecting, planning, and reporting done on time to maximize profits.

4. Adherence to the Law:

· Observance of regional laws and compliance standards.

· Reduction of the legal hazards related to property administration.

5. Planning Strategically:

· Customized plans to optimize value and return on investment for every property.

· Proactive preparation to keep up with changes and developments in the industry.

Inventive Integration of Technology

Efficiency is critical in a city renowned for its fast-paced way of living. Atlas NYC uses state-of-the-art technology to make property management processes more efficient. Technology is smoothly incorporated to improve the customer experience, from online portals that give property owners real-time insights to automated processes that improve communication and productivity.

Client-Centered Methodology

Atlas NYC’s steadfast dedication to customer satisfaction distinguishes it as one of the top property management firms in NYC. The organization places a high value on candid communication, openness, and a customized strategy to meet the particular requirements of every property owner. Throughout the management process, Atlas NYC makes sure that you feel informed and confident, regardless of your level of experience as an investor.

Increase Your Capital with Atlas NYC

Selecting the best property management company in NYC is an investment in the longevity and profitability of your real estate endeavors, not just a choice. At the forefront, Atlas NYC exemplifies the characteristics that characterize the best in property management. Visit atlasnyc.com to learn more about Atlas NYC’s extensive services and track record, and discover a new level of property management in the center of the never-sleeping metropolis.

GET IN TOUCH WITH US

Atlas NYC Property Management, LLC

77 14th Street Brooklyn, NY 11215

718-768-8888

#best property management companies nyc#property management Manhattan#Real Estate Management Companies Brooklyn#building management companies Manhattan

2 notes

·

View notes

Text

AI in Finance: Automating Processes and Enhancing Decision-Making in the Financial Sector

Introduction:

In today’s rapidly evolving world, technology continues to reshape various industries, and the financial sector is no exception. Artificial Intelligence (AI) has emerged as a game-changer, revolutionizing the way financial institutions operate and make critical decisions. By automating processes and providing valuable insights, AI is transforming the financial landscape, enabling greater efficiency, accuracy, and customer satisfaction.

AI Applications in Finance:

Automation of Routine Tasks: Financial institutions deal with massive amounts of data on a daily basis. AI-driven automation tools can streamline tasks such as data entry, processing, and reconciliation, reducing manual errors and increasing operational efficiency. Additionally, AI-powered bots can handle customer inquiries and support, freeing up human agents to focus on more complex issues.

Fraud Detection and Security: Cybersecurity is a top priority for financial institutions. AI algorithms can analyze vast datasets in real-time to detect unusual patterns and anomalies, flagging potential fraudulent activities before they escalate. This proactive approach enhances security measures and safeguards customer assets.

Personalized Customer Experience: AI-powered chatbots and virtual assistants offer personalized interactions with customers, providing quick responses to queries and offering tailored financial solutions based on individual preferences and behavior. This level of personalization enhances customer satisfaction and loyalty.

AI for Risk Assessment and Management:

Credit Scoring and Underwriting: AI-powered credit risk models can assess an individual’s creditworthiness more accurately, incorporating a wide range of factors to make data-driven decisions. This expedites loan underwriting processes, allowing financial institutions to serve customers faster while managing risk effectively.

Market Analysis and Predictions: AI algorithms can analyze market trends, historical data, and other influencing factors to predict market fluctuations with higher accuracy. By leveraging AI-driven insights, investment professionals can make more informed decisions, optimizing investment strategies and portfolios.

Improving Financial Decision-Making:

Algorithmic Trading: AI-driven algorithmic trading systems can execute trades based on predefined criteria, eliminating emotional biases and executing trades with greater precision and speed. This technology has the potential to outperform traditional trading methods, benefiting both investors and institutions.

Portfolio Management: AI can optimize portfolio performance by considering various risk factors, asset correlations, and individual investment goals. Through data-driven portfolio management, investors can achieve a balanced risk-return profile, aligning with their specific financial objectives.

Ethical and Regulatory Considerations:

As AI becomes more prevalent in the financial sector, it’s crucial to address ethical concerns and ensure compliance with regulatory requirements. Financial institutions must be vigilant in identifying and mitigating biases present in AI algorithms to maintain fairness and transparency in decision-making processes. Additionally, adhering to data privacy laws is essential to protect customer information and build trust with clients.

Real-world Examples of AI Adoption in Finance:

JPMorgan Chase: The multinational bank utilizes AI to streamline customer interactions through their virtual assistant, providing personalized financial advice and support.

BlackRock: The investment management firm employs AI-powered algorithms to enhance its portfolio management and make data-driven investment decisions.

Challenges and Future Outlook:

While AI offers tremendous benefits to the financial sector, challenges remain, including data privacy concerns, algorithmic biases, and potential job displacement. Addressing these challenges is vital to maximizing the potential of AI in finance. Looking ahead, the future of AI in finance is promising, with advancements in Natural Language Processing (NLP), predictive analytics, and machine learning expected to reshape the industry further.

Conclusion:

AI is revolutionizing the financial sector by automating processes, improving decision-making, and enhancing customer experiences. Financial institutions embracing AI can gain a competitive edge, providing better services, reducing operational costs, and managing risks more effectively. However, ethical considerations and regulatory compliance must remain at the forefront of AI adoption to ensure a sustainable and equitable financial landscape for the future. With responsible implementation, AI is set to continue transforming finance, empowering institutions to thrive in the digital age.

6 notes

·

View notes

Text

Aurum PropTech Ltd: Understanding Its Share Price and Influence in the PropTech Industry

Aurum PropTech Ltd, a notable player in the PropTech industry, has been a subject of interest for investors and industry analysts alike. The company's share price and its influence in the rapidly evolving PropTech sector are crucial indicators of its market standing and future potential.

Aurum PropTech Ltd Share Price Dynamics

As of the latest available data, Aurum PropTech Ltd's share price was INR 129.10 at the close of trading. The company has experienced fluctuations in its share price over time, with a 52-week range observed between INR 99.85 and INR 149.00. This variance reflects the dynamic nature of the stock market and the specific challenges and opportunities faced by the company in the PropTech sector.

Market Capitalization and Performance

Aurum PropTech Ltd holds a significant market capitalization, indicative of its size and the investor confidence in its business model and future prospects. However, the company's PE Ratio (Price to Earnings Ratio) and EPS (Earnings Per Share) data are not available, which could be due to various factors including recent financial performance and market conditions. Investors often use these metrics to gauge a company's profitability and future growth potential.

Influence in the PropTech Industry

Aurum PropTech Ltd is recognized as a key player in the PropTech industry, a sector that is rapidly transforming real estate through technological innovation. The company's role in this transformation is significant, given the growing importance of technology in real estate transactions, asset management, and customer engagement.

Emerging Trends and Aurum's Position

The PropTech industry is witnessing several emerging trends such as the integration of AI and big data, blockchain for secure transactions, and IoT for smart homes. Aurum PropTech's positioning in this landscape is vital, as its products and services can contribute to these evolving industry dynamics. Their role in shaping future real estate experiences, especially in the context of the Indian market, is increasingly important.

Conclusion

Understanding Aurum PropTech Ltd's share price and its industry influence involves considering its market performance, stock fluctuations, and the broader trends in the PropTech sector. While the share price provides a snapshot of its current market valuation, the company's strategic initiatives and alignment with industry trends will play a crucial role in its future growth and influence in the PropTech industry.

For investors and stakeholders, keeping a close eye on Aurum PropTech Ltd's financial performance, market trends, and industry innovations will be key to comprehending its position and potential in the rapidly evolving PropTech landscape.

2 notes

·

View notes

Text

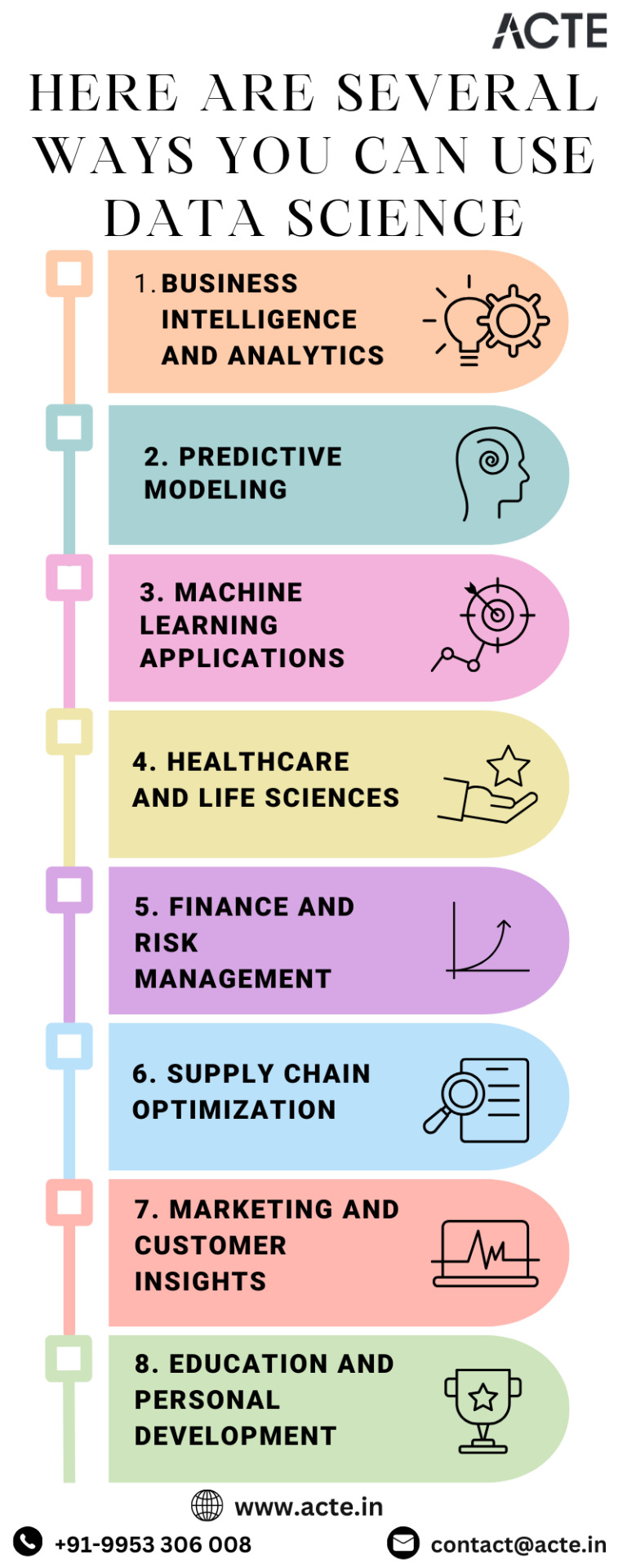

Empowering Decision-Making: Unlocking the Potential of Data Science Across Industries

In the era of information abundance, data has become a formidable asset. However, the real distinction for successful enterprises lies in their ability to derive meaningful insights from this vast sea of data. Enter data science – a field that transcends mere analysis and offers a transformative lens through which industries can innovate, optimize, and thrive. Opting for the Best Data Science Institute can further expedite your journey into this burgeoning industry. In this blog, we will delve into the diverse applications of data science across various sectors, spotlighting its pivotal role in steering informed decision-making and fostering innovation.

1. Business Intelligence and Analytics: Revealing Patterns for Growth

At the heart of data science is the ability to unravel intricate patterns within extensive datasets. For businesses, this translates into a powerful tool for business intelligence and analytics. By harnessing historical and current data, organizations can gain valuable insights into their performance, identify trends, and make informed decisions that drive growth. Whether optimizing operational processes or uncovering opportunities for expansion, data science serves as a compass for strategic decision-making.

2. Predictive Modeling: Forecasting the Future with Confidence

Predictive modeling stands out as one of the hallmark applications of data science. By analyzing historical data, organizations can develop models that forecast future trends and outcomes. This capability proves invaluable across various domains. In finance, predictive modeling aids in anticipating stock prices; in healthcare, it contributes to predicting patient outcomes. The ability to foresee potential scenarios empowers decision-makers to plan and strategize with confidence.

3. Machine Learning Applications: Infusing Intelligence into Applications

Machine learning, a subset of data science, takes analytical power a step further by enabling intelligent applications. From recommendation systems in e-commerce to fraud detection in finance and image recognition in healthcare, machine learning algorithms bring a layer of automation and adaptability to diverse domains. This not only enhances user experience but also improves the efficiency and effectiveness of various processes.

4. Healthcare and Life Sciences: Revolutionizing Patient Care and Research

In the realm of healthcare, data science acts as a catalyst for transformation. From patient diagnosis to personalized treatment plans and drug discovery, data-driven insights are revolutionizing the industry. Analyzing large datasets allows medical professionals to identify patterns, tailor treatment strategies, and accelerate medical research, ultimately leading to better patient outcomes.

5. Finance and Risk Management: Navigating Uncertainty with Data-Driven Insights

Financial institutions leverage the power of data science for risk assessment, fraud detection, and portfolio optimization. Predictive analytics aids in forecasting market trends, managing risks, and making informed investment decisions. In an industry where every decision carries significant consequences, data science provides a reliable compass for navigating uncertainties. Choosing the finest Data Science Courses in Chennai is a pivotal step in acquiring the necessary expertise for a successful career in the evolving landscape of data science.

6. Supply Chain Optimization: Enhancing Efficiency from End to End

Optimizing supply chain operations is a complex endeavor, but data science offers a clear path forward. By utilizing data to forecast demand, manage inventory effectively, and optimize logistics, organizations can achieve substantial cost savings and improve overall operational efficiency. From manufacturers to retailers, data science is reshaping how businesses approach the end-to-end supply chain process.

7. Marketing and Customer Insights: Tailoring Strategies for Success

In the realm of marketing, data science emerges as a game-changer. Analyzing customer behavior, preferences, and engagement patterns allows marketers to create targeted campaigns that resonate with their audience. The ability to derive actionable insights from data enhances customer experience, improves satisfaction, and maximizes the impact of marketing initiatives.

8. Social Media Analysis: Decoding Trends and Sentiments

The digital era has ushered in an abundance of social media data, and data science plays a crucial role in making sense of this vast landscape. By analyzing social media data, businesses can extract valuable insights into user behavior, sentiment, and trends. This information is instrumental in shaping social media strategies, engaging with the audience effectively, and managing online reputation.

9. Smart Cities and Urban Planning: Paving the Way for Sustainable Living

In the context of urban planning, data science contributes to the development of smart cities. By analyzing data from sensors, traffic cameras, and citizen feedback, urban planners can optimize city infrastructure, improve traffic flow, and enhance overall urban living. Data-driven insights play a pivotal role in creating sustainable and livable urban environments.

10. Education and Personal Development: Shaping the Future of Learning

Data science is making significant inroads into education, where it is utilized to analyze student performance, tailor learning materials, and provide personalized recommendations. This not only enhances the learning experience for students but also facilitates adaptive learning platforms. The application of data science in education is reshaping how we approach teaching and learning, with a focus on individualized and effective educational experiences.

As we delve deeper into the era of big data, data science stands as a beacon of innovation and progress. Its applications span across industries, touching every facet of modern life. From healthcare and finance to education and urban planning, data science is shaping the way we make decisions, solve problems, and envision the future. Embracing the power of data science is not just a choice; it's a necessity for those looking to thrive in a data-driven world.

3 notes

·

View notes

Text

Navigating Market Volatility: Strategies for Success in Uncertain Times

Introduction:

In the tumultuous world of the stock market, where the only constant is change, navigating through periods of volatility is a skill every investor should hone. The ability to not only weather the storm but to thrive amidst uncertainty can define an investor's success. In this blog post, we'll delve into effective strategies to navigate market volatility, offering insights for both seasoned investors and those just starting their journey into the financial markets.

Understanding Market Volatility:

Market volatility is the ebb and flow of prices in the financial markets. It is driven by a myriad of factors, including economic indicators, geopolitical events, and market sentiment. To navigate through these turbulent times, investors must first understand the root causes of volatility. Exploring historical instances of volatility, such as the 2008 financial crisis or the dot-com bubble, provides valuable lessons on the impact of these events on the market.

Risk Management Techniques:

One of the cornerstones of successful investing in volatile markets is effective risk management. Diversification, the practice of spreading investments across different assets, can mitigate risks and protect your portfolio from sharp declines in any one sector. Additionally, employing stop-loss orders, predetermined sell orders triggered when a security reaches a specified price, can limit potential losses and preserve capital.

Investing vs. Trading:

Investors face the choice of adopting a long-term investment strategy or engaging in short-term trading to capitalize on market fluctuations. Aligning your approach with your financial goals and risk tolerance is crucial. Long-term investors often weather short-term volatility with the understanding that markets tend to trend upward over time. On the other hand, traders seek to profit from short-term price movements, requiring a different set of skills and strategies.

Opportunities Amidst Chaos:

While market volatility poses risks, it also presents opportunities for astute investors. Certain sectors or industries may perform well during turbulent times, such as healthcare or technology. Contrarian investing, the strategy of going against prevailing market sentiment, can lead to identifying undervalued opportunities in the midst of chaos. Additionally, distressed assets, those whose value has fallen significantly, may present profitable opportunities for those willing to take calculated risks.

Market Analysis Tools:

Investors have an array of tools at their disposal to analyze market conditions. Technical analysis involves studying price charts and indicators, while fundamental analysis assesses a company's financial health. Embracing these tools empowers investors to make informed decisions based on data rather than emotions. The integration of artificial intelligence and machine learning further enhances the precision and efficiency of market analysis.

Psychology of Trading:

Understanding the psychological aspects of trading is crucial during volatile times. Behavioral biases, such as fear and greed, can cloud judgment and lead to irrational decision-making. Maintaining emotional discipline and making rational decisions based on a well-thought-out strategy is paramount. Learning from the experiences of successful investors who have mastered the psychological aspects of trading can provide valuable insights.

Global Events and Market Impact:

Global events, from elections to economic crises and pandemics, can significantly impact the stock market. Staying informed about unfolding events and understanding their potential impact on the market allows investors to adapt their strategies accordingly. Historical examples, such as the market reactions to the Brexit vote or the COVID-19 pandemic, highlight the importance of being nimble and proactive in response to global events.

Case Studies:

Real-life case studies of investors or traders who navigated volatile markets successfully provide practical insights. Examining their strategies, challenges faced, and lessons learned offers a roadmap for others to follow. These case studies serve as valuable examples of adaptability, resilience, and strategic thinking during uncertain market conditions.

Conclusion:

In the ever-evolving landscape of the stock market, being well-prepared for volatility is a prerequisite for success. By understanding the causes of market fluctuations, employing effective risk management, and staying informed through market analysis tools and global events, investors can position themselves not just to survive but to thrive. Successful investing is a journey that requires continuous learning, adaptability, and the ability to seize opportunities amid the ever-changing market dynamics.

2 notes

·

View notes

Text

Understanding the Working Model of Forex Prop Trading Firms

Most of the passionate people in trading know prop businesses but may need to learn exactly what they do. Property trading firms, or prop firms for short, are niche businesses that invite experienced traders to use their trading abilities on behalf of the company. Prop trading is distinguished from traditional trading by this special structure, which gives traders several benefits and chances in the financial sector.

Essentially, a prop trading company is a financial marketplace that provides funds to knowledgeable traders to trade stocks, commodities, and currencies, among other financial instruments. Through this extract, we intend to clear up the mystery surrounding prop trading and offer a thorough grasp of how it operates within the dynamic context of financial markets.

Business Model of Forex Prop Trading Firms

Capital Allocation and Proprietary Trading Desk:

Forex Prop Trading Companies differentiate themselves from one another based on the capital they offer their dealers. Capital allocation, which allows traders to profit from huge amounts of money above their own capital, is the cornerstone of their business plan. The best forex prop trading firms thoroughly assess risk before disbursing cash to traders.

These assessments consider the trader's approach, prior performance, and additional variables. Based on this evaluation, the company determines how much cash to provide each trader, ensuring that the strategy remains balanced and risk-controlled. Prop trading firms use the profit-sharing model in return for the provided funds. Traders do this by contributing a percentage of their profits to the business.

Trading Strategies and Risk Management:

Exclusive Trading in Forex Businesses uses a wide variety of trading techniques to take advantage of the existing market opportunities and turn it into a profit. Some of the most important trading tactics and risk management techniques these organizations use are statistical arbitrage, high-frequency trading, algorithmic trading, and quantitative strategies. Using sophisticated algorithms and fast data feeds, high-frequency trading allows for the execution of several deals in a matter of milliseconds. Using predefined algorithms to carry out trading strategies is known as algorithmic trading.

These algorithms can examine market data, spot trends, and automatically execute trades by preset parameters. Statistical analysis and mathematical frameworks are used to find trading opportunities in the quantitative trading process. Finding and taking advantage of arithmetic correlations between various financial instruments is the process of statistical arbitrage. By employing this tactic, traders hope to profit from transient disparities in price or mispricing among connected assets. You can control your earnings and losses more with a very successful risk management strategy.

Technology and Tools:

The capacity of Forex Prop Trading Organizations to utilize advanced technologies and apply skillful instruments to maneuver through the intricacies of the financial markets is critical to their success. Discover in this article how these companies' operations rely heavily on technology such as data analytics, trading algorithms, direct market access (DMA), etc. Large volumes of market data are processed in real-time by these companies using sophisticated analytics techniques.

Traders can obtain important insights that guide their trading methods by looking at past data and detecting patterns. Prop businesses use several trading tactics, one of which is algorithmic trading. These systems automate the execution of trades based on predefined conditions using intricate algorithms. A "direct market access" technique enables traders to communicate with financial markets directly and eliminates the need for middlemen. Forex Prop Trading Firms use DMA to provide quick and effective order execution by executing transactions with the least delay.

Regulatory Framework:

Similar to other financial operations, prop trading is subject to several laws and rules that are designed to maintain market stability, equitable treatment, and transparency. Prop trading rules differ from nation to nation, but they are always intended to balance encouraging financial innovation with discouraging actions that would endanger the system. For instance, the US Dodd-Frank Act has placed several limitations on prop trading, especially for commercial banks. The purpose of these restrictions is to restrict trading activity that carries a high risk of destabilizing the financial system.

The minimum capital requirements for forex prop trading firms are frequently outlined in regulations. Regulators seek to improve the overall stability of the financial system and lower the danger of insolvency by setting minimum capital limits. Regulations also require prop trading companies to use effective risk management techniques, such as defining profit goals and using complex techniques like volatility/merger arbitrage to reduce risk. The execution of trading methods by forex proprietary trading firms is mostly dependent on prop traders. It is essential for a prop trader to be be clear about the legal and regulatory landscape in which they operate.

Success Factors and Challenges

The best Forex prop firms rely on a number of variables to be successful, including personnel management, technology, technological adaptation, good risk management, and strategic alliances. Prop businesses must address the difficulties of market saturation, liquidity constraints, technology risks, market volatility, talent retention, and regulatory compliance to succeed in the competitive and constantly changing world of forex trading.

The reason being that forex markets are dynamic, there is a chance that prices would observe fluctuations quickly and unexpectedly. In order to overcome increased volatility, best prop firms for forex need to have strong risk management methods. Businesses that rely heavily on technology run the risk of experiencing cybersecurity attacks and system malfunctions. Strong cybersecurity safeguards, regular monitoring, and upgrades are necessary to mitigate these dangers.

Conclusion

Navigating the intricacies of financial markets requires a thorough understanding of the Forex Proprietary Trading Firms operating model. It involves more than just making profitable trades; it also involves understanding the bigger picture, including subtle regulatory differences, new technological developments, and risk management techniques.

Prop traders need to be aware of the legal and regulatory landscape, the value of utilizing technology, and the crucial role they play in the success of their companies, regardless of their level of experience. The robustness and success of the larger financial ecosystem are strengthened by ongoing education and interaction with the complex components of Forex Proprietary Trading Firms.

2 notes

·

View notes

Text

Your Investment Report- Stocks, Bonds, Insurance & Mutual Funds

Embarking on a successful financial investment journey requires careful consideration and the selection of the right tools and platforms. After an extensive and meticulous research process, which involved delving into the offerings of various financial brokerage firms, both domestic and international financial courses, insightful YouTube reviews, and diverse social media feeds, it has become evident that Finology stands out as one of the premier fin-tech firms poised to guide individuals towards financial success.

One of the key differentiators that sets Finology apart from its counterparts is its commitment to realism and transparency. Unlike many other platforms in the financial education space, Finology refrains from making extravagant promises of overnight wealth or guaranteeing unrealistically high returns. This commitment to ethical practices establishes a foundation of trust, ensuring that individuals embarking on their investment journey are equipped with realistic expectations from the outset.

A notable feature of Finology's offerings is the substantive nature of their courses. These courses are designed to provide participants with a comprehensive understanding of the intricacies of financial markets, investment strategies, and risk management. The emphasis on substance over sensationalism ensures that individuals gain the knowledge needed to make informed decisions about their investments. Finology's educational programs serve as a valuable resource, empowering investors with the skills and insights necessary to navigate the complexities of the financial landscape.

For those eager to explore Finology's offerings, a visit to their website unveils a diverse array of services tailored to cater to various aspects of financial education and investment planning. The platform not only acts as a credible head-start for those venturing into the realm of investments but also provides a practical approach to financial planning. This approach is designed to align with the unique circumstances, goals, and aspirations of each individual.

Beyond the realm of education, Finology positions itself as a holistic solution for individuals seeking to fortify their financial standing. The platform's commitment to practical financial planning translates into personalized strategies that consider factors such as risk tolerance, investment horizon, and financial objectives. This personalized approach ensures that users are not only well-informed but also equipped with actionable plans that reflect their individual financial landscapes.

In an era where the financial education landscape is often cluttered with promises of quick riches and magical investment formulas, Finology's commitment to authenticity and education is a breath of fresh air. The platform's focus on substance and practicality aligns with the growing demand for reliable, ethical, and effective financial education resources.

As the financial markets continue to evolve and present new challenges and opportunities, the need for a solid foundation in financial education becomes increasingly crucial. Finology, with its unwavering commitment to providing quality education and practical financial planning solutions, emerges as a beacon for individuals seeking to navigate the complexities of the financial world with confidence and competence.

In conclusion, the journey towards financial success begins with a well-informed and realistic approach. Finology's position as a premier fin-tech firm is substantiated by its dedication to transparency, substantive education, and practical financial planning. For individuals embarking on their financial investment journey, exploring Finology's offerings is not just a recommendation – it is a strategic step towards building a strong and resilient financial future.

Moreover, for those seeking a personalised financial plan tailored to their income, monthly expenditures, and individual financial goals, CHECK THIS OUT.

#Investment analysis#market trends#portfolio management#diversification#risk assessment#performance evaluation#asset allocation#investment strategies#tax saving options#tax saving mutual funds#tax saving#stock ideas#mutual fund ideas

0 notes

Text

Strategic Real Estate Investment Management: Maximizing Opportunities

Real estate investment management orchestrates a comprehensive approach to optimizing property portfolios. By employing strategic planning and meticulous analysis, this discipline maximizes returns while mitigating risks. It involves asset selection, performance monitoring, and market assessment, enabling investors to make informed decisions, leverage market trends, and achieve long-term financial growth in real estate ventures.

2 notes

·

View notes

Text

Introduction : Brief overview of cryptocurrency investing.

Best Cryptocurrency to Invest in 2023: A Comprehensive Guide

Investing in cryptocurrencies can be both exciting and daunting. With the market constantly evolving, it's crucial to stay informed about the best options for potential investments. In this guide, we'll explore the landscape of cryptocurrency investments, highlighting the top choices and offering insights into the factors that influence their performance.

Introduction

Cryptocurrency has become a buzzword in the financial world, with investors seeking opportunities in the decentralized digital assets. As the market continues to expand, it's essential to navigate through the various options and make informed decisions.

Understanding Cryptocurrency

At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology, ensuring transparency and immutability.

Factors Influencing Cryptocurrency Investments

Market Trends and Analysis

The cryptocurrency market is known for its volatility, influenced by various factors such as market demand, technological advancements, and macroeconomic trends. Analyzing these trends provides valuable insights for investors.

Regulatory Factors Affecting Investments

Government regulations play a significant role in shaping the cryptocurrency landscape. Understanding the regulatory environment is crucial as it can impact the legality and acceptance of specific cryptocurrencies.

Best Cryptocurrencies to Invest In

Bitcoin

As the pioneer of cryptocurrencies, Bitcoin remains a prominent choice for investors. Its historical performance and market dominance make it a relatively stable option, especially for those new to the crypto space.

Ethereum

Beyond being a digital currency, Ethereum is known for its smart contract capabilities, enabling the creation of decentralized applications (DApps). Its potential for future growth is tied to the continued development of the Ethereum ecosystem.

Binance Coin

Operating within the Binance ecosystem, Binance Coin has gained popularity due to its various use cases, including transaction fee discounts and participation in token sales on the Binance Launchpad.

Cardano

Cardano stands out for its focus on sustainability and scalability. With a unique consensus algorithm and a commitment to research-driven development, Cardano offers features that set it apart from other cryptocurrencies.

Solana

Solana boasts impressive speed and scalability, making it a preferred choice for developers. Projects built on Solana benefit from its efficient and low-cost transactions.

Risks and Challenges

While the potential for high returns exists, cryptocurrency investments come with inherent risks. Market volatility, security concerns, and regulatory uncertainties are challenges investors must navigate.

Tips for Successful Cryptocurrency Investing

Diversification of the Portfolio

Diversifying your investment portfolio helps spread risk. Consider allocating funds across different cryptocurrencies to minimize the impact of poor performance in a single asset.

Research and Staying Informed

In the ever-evolving cryptocurrency market, staying informed is crucial. Regularly conduct research, follow market trends, and stay updated on news that may influence your investment decisions.

Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders and defining an exit strategy, can help protect your investment from sudden market fluctuations.

Future Trends in Cryptocurrency

As technology advances, new trends emerge in the cryptocurrency space. Keep an eye on developments such as decentralized finance (DeFi), non-fungible tokens (NFTs), and other innovative applications that could shape the future of the market.

Case Studies

Learning from the experiences of successful cryptocurrency investors can provide valuable insights. Additionally, understanding the mistakes made by others can help you avoid common pitfalls.

Frequently Asked Questions (FAQs)

Is cryptocurrency a safe investment?

While the potential for high returns exists, cryptocurrency investments come with risks. It's essential to conduct thorough research and only invest what you can afford to lose.

Which cryptocurrency is the most stable?

Bitcoin is often considered a more stable option due to its long history and market dominance.

How do I diversify my cryptocurrency portfolio?

Diversification involves allocating funds across different cryptocurrencies to minimize risk. Consider a mix of established and promising projects.

What are the security risks associated with cryptocurrency?

Security risks include hacking, fraud, and the potential for technological vulnerabilities. Using secure wallets and practicing good cybersecurity habits is crucial.

How often should I review my cryptocurrency portfolio?

Regularly review your portfolio to stay informed about market trends and adjust your strategy based on changing conditions.

Conclusion

Navigating the world of cryptocurrency investments requires a combination of research, risk management, and a forward-looking perspective. By understanding the factors influencing the market and exploring the best cryptocurrency options available, investors can make informed decisions that align with their financial goals.

3 notes

·

View notes

Text

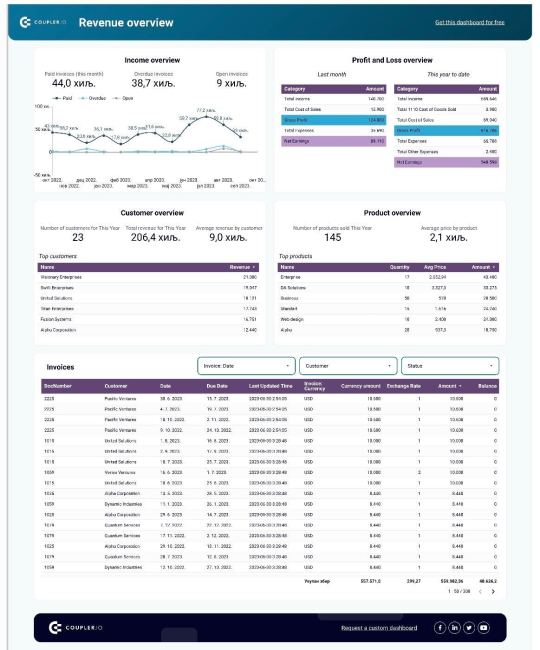

Navigating Real-Time Operations: The Power of Operational Dashboards

Operational dashboards are dynamic visual interfaces that provide real-time insights into an organization's day-to-day activities and performance. These dashboards are particularly valuable for monitoring short-term operations at lower managerial levels, and they find application across various departments. They stand as the most prevalent tools in the realm of business intelligence.

Typically, operational dashboards are characterized by their comprehensive nature, offering junior managers detailed information necessary to respond to market dynamics promptly. They also serve to alert upper management about emerging trends or issues before they escalate. These dashboards primarily cater to the needs of managers and supervisors, enabling them to oversee ongoing activities and make rapid decisions based on the presented information. Operational dashboards often employ graphical representations like graphs, charts, and tables and can be customized to display information pertinent to the specific user.

Examples of data typically showcased on an operational dashboard include:

Sales figures

Production metrics

Inventory levels

Service levels

Employee performance metrics

Machine or equipment performance data

Customer service metrics

Website or social media analytics

It is crucial to emphasize that operational dashboards are distinct from other dashboard types, such as strategic and analytical dashboards. These different dashboards serve varied purposes and audiences and contain dissimilar datasets and metrics.

Here are a couple of examples.

Below, you can see a Revenue overview dashboard for QuickBooks. It provides month-by-month overviews of invoices, products, customers, profit and loss. Such a dashboard can be used on a daily basis and help monitor and manage operating activities.

This data visualization is connected to a data automation solution, Coupler.io. It automatically transfers fresh data from QuickBooks to the dashboard, making it auto-updating. Such a live dashboard can be an important instrument for enabling informed decision-making.

This Revenue overview dashboard is available as a free template. Open it and check the Readme tab to see how to use it.

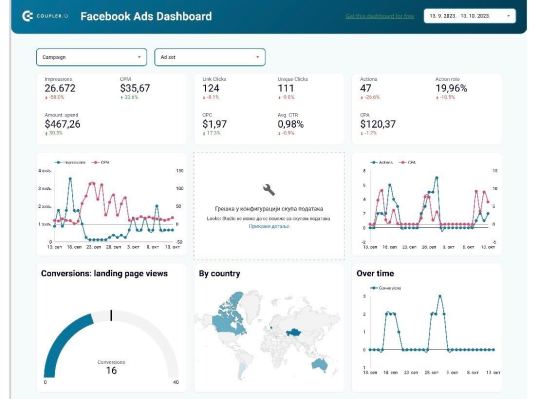

Here’s another example of an operational dashboard, the Facebook Ads dashboard. It allows ad managers to closely track their ad performance. This dashboard is also powered by Coupler.io, so it depicts ad data in near real-time. This allows marketers to quickly define what works and what doesn’t and make adjustments on the go.

Facebook Ads dashboard is available as a free template. You can grab it and quickly get a copy of this dashboard with your data.

In conclusion, operational dashboards are indispensable tools for organizations seeking to thrive in a dynamic business landscape. These real-time visual displays offer invaluable insights into day-to-day operations, equipping managers and supervisors with the information to make swift, informed decisions. As the most widely used business intelligence instruments, operational dashboards empower businesses to adapt to market changes, identify emerging trends, and maintain a competitive edge. Their versatility and capacity to monitor a wide range of metrics make them an essential asset for managing the intricacies of modern operations.

#marketing dashboards#digital marketing#dashboards#data analytics#data visualization#operational dashboards

2 notes

·

View notes