#Market insights

Text

Choosing The Right Market Research Company For Your Business

Market research firms collect data using various methods, including surveys, interviews, focus groups, observations, and data analysis.

Tips to Choose the Best Market Research Company

1. Experience And Expertise

When choosing a market research firm, the first thing to consider is their experience and expertise. You want to choose a company with a proven track record of researching your industry. Look for companies that have experience working with companies like yours. Also, consider the expertise of company researchers.

2. Choose A Responsive Market Research Firm

marketing and strategy decisions are made based on the results of this market research. Responsiveness does not only mean rapid implementation of market research findings. It’s important to answer questions and expect them before you ask them.

3. Choose A Low-Cost Market Research Company.

Market research often has a bad reputation as being very expensive. This is often the market research firm or research firm you work with rather than the industry as a whole.

#market research#market research firm#market research company#market research services#market analysis#market trends#market insights

2 notes

·

View notes

Text

"Deciphering Market Trends: Navigating the Terrain with Stock Market Indicators 📊📈 #MarketInsights #TradingStrategies"

#investing#finance#investors#stock market#trade#tradingtools#intraday trading#market insights#profit#stockcharts#economy and trade#economy#ecommerce#intraday#profitabletrades#price analysis#personal finance#income

3 notes

·

View notes

Text

#Market research#market insights#market analysis#market trends#data-driven reports#industry trends#market research firm#market research organization#market reports#business

2 notes

·

View notes

Photo

Did you know that the top 10 e-commerce companies account for over 80% of global sales? This makes the e-commerce market highly competitive, but don't let that discourage you. With the right strategy, you can still succeed and stand out from the crowd. Our e-commerce data extraction services can help you gather valuable insights and stay ahead of the game. Contact us today to learn more.

For more information, https://webscraping.us/web-data-extraction/ or contact us at [email protected]

2 notes

·

View notes

Text

Disinfectant Spray Market Driven By COVID-19 and Growing At 8.2% Y.O.Y

The global disinfectant spray market size is expected to reach USD 18.6 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 8.2% from 2022 to 2030. A rise in hospital-acquired infections such as central line-associated bloodstream infections, surgical site infections, catheter-associated urinary tract infections, hospital-acquired pneumonia, and ventilator-associated pneumonia is expected to have a positive impact on the market. Rising demand for advanced products to reduce the potential for virus contamination in non-healthcare settings, such as in the home, office, schools, gyms, publicly accessible buildings, faith-based community centres, markets, transportation and business settings or restaurants and importance to prevent infection from the COVID-19 virus across the globe is anticipated to drive the industry. The growing demand for a healthy and hygienic lifestyle is likely to fuel the overall demand. Sales of disinfectant sprays have risen drastically over the past few years, owing to the rising consumer awareness towards the benefits of disinfection and sanitization.

Gain deeper insights on the market and receive your free copy with TOC now @: https://www.grandviewresearch.com/industry-analysis/disinfectant-spray-market-report

EPA approved two products, Lysol Disinfectant Spray and Lysol Disinfectant Max Cover Mist, based on laboratory testing that shows the products are effective against SARS-CoV-2. According to USA Today, in March 2020, sales of disinfectant sprays increased more than 300% owing to the need to prevent COVID-19 infection. Major manufacturers such as 3M, Clorox, and Kimberly-Clark Corporation were not prepared for the unprecedented surge in the demand for disinfectants and sanitizers, resulting in a shortage in hospital facilities, clinics, and households. Thus, owing to this spike in demand, major manufacturers such as Clorox and Reckitt Benckiser Group are focusing on increasing their production capabilities, to suffice the rising demand from both B2B and B2C consumers. The conventional spray segment accounted for a larger share during the forecast period.

According to the U.S. Centers for Disease Control and Prevention (CDC), the overall incidence of surgical site infection (SSI) has been estimated to be 2.8%. To prevent such infections and diseases, conventional disinfectant sprays are used by all hospitals, medical facilities, nursing homes, and clinics. Thus, the rise in Hospital Acquired Infections (HAIs) across the globe is leading to a rise in demand for conventional disinfectant sprays for prevention. The B2B distribution channel segment held the larger segment in 2021 and is expected to maintain dominance over the forecast period. The rise in demand for infection prevention practices across hospitals and nursing homes is anticipated to fuel the demand for disinfectant sprays across the globe.

According to the COVID-19 Nursing Home Data by the Centers for Medicare and Medicaid Services (CMS), nursing homes across the U.S. reported nearly 1,800 COVID-19 deaths among residents and staff in August 2021 and a steady increase from the approximately 350 deaths reported in July 2021. This has led to an increase in precautionary measures such as the use of disinfectant sprays in nursing homes to prevent the spread of the deadly virus. The market is consolidated in nature with the presence of a large number of international players and few regional players. Reckitt Benckiser Group, Ecolab Inc., Procter and Gamble, 3M, Gojo Industries Inc., Whiteley Corporation, Kimberly- Clark, S.C. Johnson & Son Inc., Medline Industries, and Clorox Company are among the prominent players in the global market.

For Any Questions or Inquire please visit @: https://www.grandviewresearch.com/industry-analysis/disinfectant-spray-market-report/request/rs5

Grand View Research has segmented the global disinfectant spray market on the basis of type, distribution channel, and region

#Disinfectant Spray#Disinfectant Spray Market#Size#Share & Trends#Market Insights#COVID-19 Impacts#Growth Outlook#Manufacturers

3 notes

·

View notes

Link

The Roots Analysis report features an extensive study of the current market landscape and future potential of the tissue engineering-based regeneration products market. The study features an in-depth analysis, highlighting the capabilities of various stakeholders, and also features better biocompatibility, faster tissue regeneration, easy availability, and high affordability. Get the future market insights & reports now!

1 note

·

View note

Text

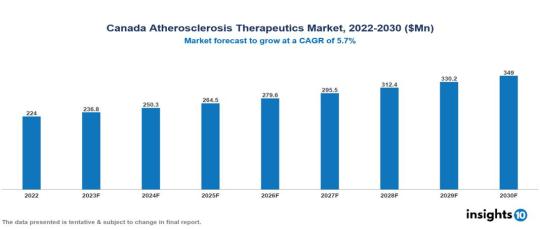

Canada Atherosclerosis Therapeutics Market Report 2022 to 2030

Canada Atherosclerosis Therapeutics Market was valued at $224 Mn in 2022 and is estimated to reach $349 Mn in 2030, exhibiting a CAGR of 5.7% during the forecast period. The increasing prevalence of cardiovascular diseases, driven by the global aging population and rising occurrences of sedentary behaviour and unhealthy diets, is expected to fuel the demand for atherosclerosis therapeutics. The leading pharmaceutical companies currently operating in the industry are Pfizer, Novartis, AstraZeneca, Sanofi, Bayer, Johnson & Johnson, Eli Lilly, AbbVie, Roche and Teva Pharmaceutical Industries

#Canada#market analysis#market forecast#market research#market insights#market report#Atherosclerosis#therapeutics market#pharmaceutical#healthacre

0 notes

Text

Surprise from the #Fed! https://markets.tradermade.com/breaking/fed-holds-rates-steady-fue_ling-market-volatility. They held #interestrates steady, defying market expectations. Volatility ensues across #globalmarkets as investors assess the implications.

0 notes

Text

The Brazil Atopic Dermatitis Therapeutics Market was valued at US $308 Mn in 2022, and is predicted to grow at (CAGR) of 9.8% from 2023 to 2030, to US $650 Mn by 2030. The key drivers of this industry include the upward trend in prevalence of Atopic Dermatitis (AD), supportive government policies and shifting treatment preferences. The industry is primarily dominated by players such as Sanofi, AbbVie, Pfizer, Bayer, GlaxoSmithKline, Merck among others.

0 notes

Text

What is Fundamental Analysis for Successful Trading - A Full details

SUBTITLE - Assessing Management Quality and Corporate Governance

SUBTITLE - Risk Management: Mitigating Downside Risks through Fundamental Analysis

In the world of financial markets, knowledge of the fundamentals is akin to wielding a powerful tool. Fundamental evaluation, the bedrock of informed buying and selling choices, delves deep into the economic statements of companies to find their actual fee. In this complete guide, we're going to explore the nuances of fundamental analysis, dissecting balance sheets, income statements, and coin flow statements to equip you with the expertise to end up a savvy trader. Let's embark on this journey to unravel the secrets and techniques of economic markets.

Embarking on the path of successful trading requires more than only a fundamental expertise of the markets. It needs a mastery of essential analysis—the cornerstone of knowledgeable selection-making. Through this aid, we will dig into the complexities of money-related explanations, opening the secrets that lie inside. By decoding stability sheets, earnings statements, and coin float statements, you'll gain valuable insights into the actual well-being of agencies. Armed with this knowledge, you may be empowered to navigate the complex terrain of monetary markets with self-belief and precision.

Throughout this adventure, we're going to employ smooth-to-understand language, making sure that even beginner traders can draw close to the ideas effortlessly. From exploring key metrics like income according to share and going back on fairness to unraveling the significance of ratios which include debt-to-fairness and current ratio, we will cover all of it. Alongside, we're going to sprinkle within the critical keywords, associated key phrases, and related words to optimize your expertise and enhance your trading prowess.

So, buckle up as we embark on this enlightening excursion into the arena of essential evaluation. Together, we will unravel the secrets that separate successful investors from the relaxation and pave the way for your triumph in economic markets.

Short Overview:

Fundamental Analysis: This method entails studying a business enterprise's economic statements to decide its real fee. It enables traders to make informed decisions approximately which stocks to buy or sell based on a corporation's financial health and ability to increase. It's like searching under the hood of a vehicle to peer how well it's jogging earlier than determining to shop for it.

Technical Analysis: This approach entails analyzing inventory fee charts and styles to expect future charge moves. It permits financial backers to see advancements and styles inside the commercial center, permitting them to settle on all-around coordinated speculation choices. It resembles concentrating on the weather conditions conjecture to are expecting whether it'll whatever may happen day after today.

Trading Plan /Exchanging Plan: A trading plan is somewhat of a guide that frames a merchant's venture objectives, risk resistance, and procedures. It empowers purchasers to stay trained and engaged, prompting higher navigation and high-level execution in the business sectors. It resembles having a blueprint sooner than going directly into a game match.

Risk Management/Risk The board: Chance administration includes recognizing, surveying, and relieving limit gambles connected with trading or effective financial planning. It assists purchasers with safeguarding their capital and breaking point misfortunes, ensuring extensive period accomplishment in the business sectors. It resembles wearing a safety belt while heading to decrease the risk of damage in the event of a mishap.

2A - Unveiling the Basics of Fundamental Analysis JOIN NOW

Before we plunge into the nitty-gritty details, permit us to first grasp the essence of essential evaluation. Imagine it as peeling returned the layers of an onion to reveal its middle—except in this case, the onion is an organization's monetary fitness, and the core is its intrinsic value.

Fundamental analysis is like Sherlock Holmes dissecting clues; it's approximately delving right into a corporation's financial statements to find hidden treasures. Unlike its counterpart, technical analysis, which specializes in reading the tea leaves of fee actions, fundamental evaluation dives deep into the tangible components—sales, costs, belongings, and liabilities. It's the difference between analyzing the celebrities and scrutinizing bloodless, difficult numbers.

Think of fundamental evaluation as your economic GPS. By meticulously analyzing a business enterprise's monetary statements, analysts can gauge its ordinary well-being and capacity for increase. It's like peeking below the hood of a car to evaluate its engine—except in this case, we are inspecting income margins, debt tiers, and cash float.

From the perspective of principal assessment, we're presently not simply looking through on a superficial level; we are looking into the actual soul of an organization. It's tied in with grasping its past, present, and future direction — the highs, the lows, and the entire in the middle between.

Thus, lock in as we leave on this illuminating experience into the universe of fundamental examination. Together, we will translate the secrets of budget summaries and furnish you with the devices to make keen financing choices. equity). It's a chunk like peeking at someone's financial institution statement—it tells you a lot approximately their economic fitness.

But wait, there may be more! Within this economic snapshot lie hidden gemstones—key metrics that can free up treasured insights. Take the current ratio, for instance. It's like a company's economic CPR—telling us if it can cover its brief-term debts with its modern property. Then there is the debt-to-equity ratio, which offers us a glimpse into its economic leverage—are they borrowing too much or playing it safe? And let's now not forget about about return on equity (ROE)—the golden ticket to understanding how efficaciously a business enterprise is the uses of its shareholders' fairness to generate profits.

So, as we adventure through the labyrinth of balance sheets, don't forget to keep your eyes peeled for these treasure troves of statistics. They hold the keys to information on an employer's economic balance, efficiency, and typical fitness. Get prepared to unlock the mysteries of stability sheet evaluation and elevate your monetary prowess to new heights!

3A - Deciphering Financial Statements

Income Statement Examination

Now, allow's shine a spotlight on the profits announcement—a window right into a company's monetary overall performance over a described length. Think of it as a play-via-play of the company's financial adventure, revealing its triumphs, challenges, and entirety.

As we dissect the earnings announcement, we're peeling lower back the layers to show the organization's sales streams, expenses, and income. It's like unraveling a thriller novel, besides as opposed to clues, we're uncovering numbers—sales figures, working charges, and net profits.

But why is that this monetary tale so tremendous? Well, it is like reading the heartbeat of an agency. The profits assertion tells us how properly it's acting—Is it raking within the dough or struggling to stay afloat? By scrutinizing revenue streams and cost systems, analysts can gauge the corporation's revenue-producing skills and profitability. It's like deciphering a code—unlocking the secrets in the back of its financial achievement or failure.

But that is now not all. Within the labyrinth of numbers lie key metrics—like profits according to a percentage (EPS), gross margin, and operating margin—that provide helpful insights. EPS is like the business enterprise's financial DNA, revealing how a whole lot income each shareholder earns. Gross margin tells us how efficiently the organisation is popping revenue into profit, even as running margin sheds mild on its operational performance.

So, as we adventure via the maze of earnings statements, keep your eyes peeled for those nuggets of awareness. They hold the important thing to expertise a company's economic fitness, profitability, and operational prowess. Get ready to get to the bottom of the mysteries of earnings assertion examination and embark on a thrilling journey into the arena of finance!

3A - Deciphering Financial Statements

Cash Flow Statement Analysis

Let's dive into the area of coin drift statements—a vital pulse test for any employer. Think of it as a heartbeat reveal, monitoring the ebb and float of coins inside the corporation's veins over a particular duration.

Cash drift statements are the lifeblood of a company, revealing its monetary vitality and resilience. They provide an in-depth breakdown of cash inflows and outflows and portray a bright image of ways coins move in and out of the enterprise's coffers. It's like tracing the drift of water in a river—following its twists and turns to understand its course.

But why is this economic lifeline so vital? Well, it is like assessing a company's financial CPR—is it respiratory easily or gasping for air? By scrutinizing running, investing, and financing sports, analysts can gauge the corporation's capacity to generate coins, fund investments, and meet monetary duties. It's like peering into a crystal ball—predicting the agency's economic destiny based totally on its cash flow styles.

Within the labyrinth of coins float statements lie key metrics—like unfastened coins drift, operating cash drift, and cash waft from financing—that shed mild on the enterprise's liquidity, capital allocation, and economic flexibility. Free coins float is like the company's monetary oxygen, indicating how tons cash is left after protecting working expenses and capital prices. Operating coins go with the flow famous the organization's potential to generate cash from its middle enterprise sports, whilst cash flow from financing unveils its capital-elevating and debt-reimbursement activities.

So, as we navigate through the intricacies of cash waft statements, keep your eyes peeled for these nuggets of knowledge. They preserve the important thing to knowledge of a corporation's economic resilience, agility, and capability to climate storms. Get geared up to unravel the mysteries of coins drift statement evaluation and embark on an exhilarating journey into the coronary heart of economic management!

4A - Becoming a Great Trader: Strategies and Tips

Educate Yourself Continuously JOIN NOW

Embarking on the journey to turning into a fantastic dealer is akin to putting a sail on a good-sized ocean of opportunities. But worry not, for understanding is your compass, guiding you via the turbulent waters of monetary markets. It's like having a relied-on map—showing you the manner ahead, even amidst storms and uncertainty.

Continuous schooling is the cornerstone of hit buying and selling. Think of it as sharpening your sword before struggle—equipping yourself with the gear and insights needed to conquer the markets. Stay abreast of marketplace trends, financial signs, and industry traits like a vigilant sentinel, maintaining watch over your financial citadel.

But where do you locate this treasure trove of information? Fear now not, for the virtual age has bestowed upon us a bounty of sources. Dive into books, immerse yourself in publications, and discover legitimate financial websites like a curious adventurer uncovering hidden treasures. It's like embarking on a quest for understanding, with each nugget of statistics propelling you closer to buying and selling mastery.

Continuous getting to know is not just about acquiring facts; it's about honing your instincts and intuition. It's about developing a 6th experience—an intestine feeling that publications you while all else fails. As you amplify your monetary acumen, you'll gain the self-belief to make informed choices and navigate volatile markets with grace and poise.

So, fellow trader, heed this advice: never prevent learning, by no means prevent exploring. The journey to greatness is paved with information, and the search for mastery is a never-finishing journey. Embrace the thrill of discovery, and permit the winds of expertise to convey you to new heights in the international of trading.

4A - Becoming a Great Trader: Strategies and Tips

Develop a Robust Trading Plan

Imagine yourself as a seasoned captain navigating through treacherous waters. To steer your ship appropriately to its vacation spot, you need more than just a compass; you want a meticulously crafted map—a trading plan.

A strong buying and selling plan is your beacon of light amidst the murky waters of economic markets. It's like having a GPS on your trading adventure—guiding you with precision and clarity. But what does this plan entail? Picture it as a blueprint—a detailed roadmap that outlines your funding goals, danger tolerance, and access/exit criteria.

Start using defining your funding objectives—what are you aiming to obtain? Whether it is wealth accumulation, capital renovation, or chance-adjusted returns, clarity of reason is paramount. Next, verify your danger tolerance—how much volatility can you stomach? It's like knowing your limits earlier than embarking on a roller coaster journey—crucial for shielding your sanity and capital.

But wait, there is greater! A strong buying and selling plan does not simply prevent targets and danger tolerance. It's like a fortress with multiple layers of defense—incorporating hazard control techniques to guard you from potential pitfalls. Implement prevent-loss orders and function sizing to mitigate losses and hold capital. It's like putting in protection nets and barricades to defend your treasure from marauders and plunderers.

Yet, the maximum essential component of a buying and selling plan lies in its execution. Stay disciplined, my buddy. Stick to your plan steadfastly, resisting the siren call of impulsive trades driven using emotions or marketplace noise. It's like staying in the direction amid a hurricane—steadfast and unwavering in your resolve.

So, as you embark on your trading odyssey, bear in mind this: a nicely described trading plan isn't only a luxury; it's a need—a lifeline within the tumultuous sea of economic markets. Craft it with care, nurture it with discipline, and let it guide you to the shorelines of trading achievement.

4A - Becoming a Great Trader: Strategies and Tips

Master Technical and Fundamental Analysis

In the significant realm of buying and selling, there are two potent pillars—technical analysis and fundamental analysis. Like yin and yang, they complement each other, forming the bedrock of informed choice-making.

Technical evaluation is like reading the celebrities—a mystical artwork that unveils market sentiment and fee actions. It's approximately deciphering the language of charts and patterns, uncovering hidden clues inside the ebbs and flows of the marketplace. But while technical evaluation paints a photograph of marketplace psychology, fundamental analysis delves into the center—the intrinsic fee of belongings.

Fundamental analysis is the anchor that grounds us. It's like peeling again the layers of an onion, revealing the actual worth of a business enterprise beneath the floor. By scrutinizing monetary statements and economic signs, we benefit from insights into an organization's increased possibilities, profitability, and economic health.

But right here's the magic—by way of integrating each tactic, we unlock a treasure trove of insights. It's like wielding a twin-edged sword, cutting through the noise and uncovering hidden gems. Use essential analysis to discover undervalued stocks with robust boom potential, whilst technical evaluation courses you in timing your access and go-out points with precision.

So, fellow traders, heed this recommendation: embody the synergy of technical and essential analysis. Let them be your guiding stars in the significant expanse of economic markets. By getting to know both tactics, you will unencumber an international of opportunities and raise your buying and selling sport to new heights.

5A - Conclusion: Empowering Your Trading Journey JOIN NOW

As we draw the curtains in this enlightening adventure through the sector of buying and selling, it is time to look at the invaluable instructions discovered and the trails yet to be traversed. In the dynamic panorama of financial markets, studying fundamental evaluation emerges as a beacon of mild—a guiding precept for aspiring traders searching to carve their area of interest in the tremendous expanse of finance.

Delving into monetary statements and discerning key metrics is corresponding to mining for treasure in a good-sized cave of opportunities. With every analysis, we unearth hidden gemstones—companies with robust fundamentals, poised for boom and prosperity. Armed with this expertise, we go beyond mere hypothesis, making knowledgeable investment choices rooted in sound analysis and rational judgment.

But the journey does not cease there. No, it's merely the beginning. Cultivating a strong buying and selling plan turns into our compass—a steadfast guide via the turbulent waters of market fluctuations. By integrating technical and fundamental analysis, we toughen our arsenal, equipping ourselves with the equipment needed to navigate the unpredictable currents of financial markets with poise and precision.

So, fellow trader, as you embark on your buying and selling journey armed with information, discipline, and diligence, recollect this: the world of finance is a huge ocean of possibilities, ready to be explored and conquered. Seize the myriad possibilities that look forward to, and let your journey be fueled using curiosity, guided by way of understanding, and driven via the pursuit of excellence. For inside the global of finance, the possibilities are countless, and the journey is yours to chart.

#Fundamental Analysis#Trading Strategies#Market Insights#Economic Indicators#Financial Statements#Industry Analysis#Management Quality#Market Sentiment#Earnings Reports#Risk Management

0 notes

Text

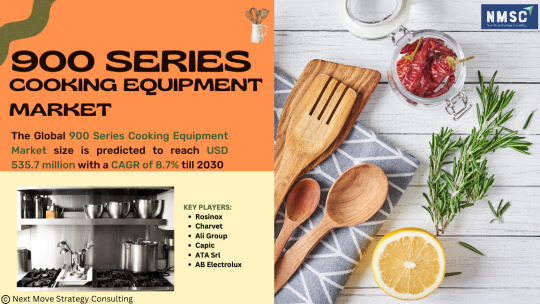

𝑬𝒙𝒄𝒊𝒕𝒊𝒏𝒈 𝑵𝒆𝒘𝒔 𝒊𝒏 𝒕𝒉𝒆 𝑪𝒖𝒍𝒊𝒏𝒂𝒓𝒚 𝑾𝒐𝒓𝒍𝒅!

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝒇𝒐𝒓 𝒂 𝑭𝑹𝑬𝑬 𝑺𝒂𝒎𝒑𝒍𝒆:https://www.nextmsc.com/900-series-cooking-equipment-market/request-sample?utm_source=sanyukta-16-April-24&utm_medium=sanyukta-tumblr&utm_campaign=sanyukta-900-series-cooking-equipment-market

Thrilled to share insights on the booming 900 Series Cooking Equipment Market!

As the culinary landscape evolves, chefs and restaurateurs are seeking top-tier equipment to elevate their kitchens. The 900 Series stands out as a game-changer, offering unparalleled performance and innovation. From sleek design to advanced technology, it's revolutionizing the way we cook!

𝑲𝒆𝒚 𝑯𝒊𝒈𝒉𝒍𝒊𝒈𝒉𝒕𝒔:

1️. 𝑷𝒓𝒆𝒄𝒊𝒔𝒊𝒐𝒏 𝑪𝒐𝒐𝒌𝒊𝒏𝒈: With cutting-edge temperature control and uniform heat distribution, the 900 Series ensures flawless results every time.

2️. 𝑽𝒆𝒓𝒔𝒂𝒕𝒊𝒍𝒊𝒕𝒚: From grilling to baking and beyond, these multifunctional units adapt to diverse culinary needs with ease.

3️. 𝑬𝒇𝒇𝒊𝒄𝒊𝒆𝒏𝒄𝒚: Engineered for maximum efficiency, they optimize energy usage without compromising on output or quality.

4️. 𝑫𝒖𝒓𝒂𝒃𝒊𝒍𝒊𝒕𝒚: Built to withstand the rigors of professional kitchens, the 900 Series boasts durability that chefs can rely on day in and day out.

𝑴𝒂𝒓𝒌𝒆𝒕 𝑰𝒏𝒔𝒊𝒈𝒉𝒕𝒔:

The 900 Series Cooking Equipment Market is experiencing exponential growth, driven by demand for premium appliances in commercial and residential settings.

Industry leaders are investing in research and development to push the boundaries of culinary innovation, driving further market expansion.

With sustainability becoming a priority, manufacturers are focusing on eco-friendly designs and energy-efficient solutions, aligning with the green initiatives of modern establishments.

Join the Movement: Whether you're a seasoned chef, restaurateur, or passionate home cook, the 900 Series Cooking Equipment offers unparalleled performance and endless possibilities. Elevate your culinary journey with the latest in kitchen innovation!

𝑲𝒆𝒚 𝑷𝒍𝒂𝒚𝒆𝒓𝒔: The 900 series cooking equipment market, which is highly competitive, consists of various market players. Some of the major market players include Rosinox, Charvet, Ali Group, Capic, ATA Srl, AB Electrolux, Illinois Tool Works Inc., Fagor Industrial, MKN, The Middleby Corporation and Modular Professional Srl among others.

#900 series#cooking equipment#culinary innovation#kitchen revolution#chef life#restauran tindustry#linkedin post#market insights#innovationin cooking#market research#business insights#market trends

0 notes

Text

ConvertML Marketing Insights for Personalized Marketing

Drive marketing excellence with ConvertML. Elevate customer advocacy through multi-channel NPS insights, personalized marketing campaigns, and holistic churn analysis. Time for cutting-edge marketing insights.

0 notes

Text

Becoming a Top Realtor in Jamaica: Expert Strategies, Tips, and Tricks Unveiled

In Jamaica’s dynamic real estate landscape, rising to the top as a premier real estate agent and or realtor involves more than just closing deals; it’s about nurturing connections, its about understanding market intricacies relevent to the jamaican real estate market, and also mastering negotiation. Whether you’re a newcomer on the real estate scene or a seasoned agent aiming for excellence,…

View On WordPress

#Career advancement#Expert strategies#Jamaica#Market insights#Professional development#Real Estate#success#Tips#Top realtor#Tricks

0 notes

Text

Acute Pancreatitis Market: Breakthrough Treatments, Insights

Market Overview:

The Acute Pancreatitis Market Size was valued at USD 5.5 billion in 2023 and is projected to grow from USD 5.8 Billion in 2023 to USD 8.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.90% during the forecast period (2023 - 2030). The major market driver fueling the expansion is the increased prevalence of gastrointestinal issues.

Click here for full report:

https://www.pharmanucleus.com/reports/acute-pancreatitis-market

Acute Pancreatitis Market Trends

Increase in the occurrence of acute pancreatitis to propel market growth

According to the National Institute of Diabetes and Digestive and Kidney Diseases, approximately 275,000 Americans are hospitalized each year for acute pancreatitis (NIDDK). When the pancreas swells and becomes irritated, pancreatitis (swelling) results. It is not a widespread disease. The most common reasons are gallstones or excessive alcohol consumption. The disease can develop gradually over time or come on suddenly, causing serious injury. Treatment for pancreatitis may include intravenous (IV) fluids, painkillers, and other medications. Rising occurrence of acute pancreatitis globally will be a key factor in increasing the market growth rate. Gallstones and excessive alcohol consumption, especially in young people, are the main causes of acute pancreatitis. Gallstones are the most common cause of AP, accounting for 28-38% of cases, and alcohol consumption is the second most common cause, accounting for 19-41% of cases, according to an article published in the World Journal of Clinical Cases. - Assessment and management of acute pancreatitis in 2019. The likelihood of developing acute pancreatitis increases as the number of people with gallstones increases. Thus, this factor is driving the CAGR of the market.

Additionally, there is growing global interest in understanding the impact of chronic comorbidities on people with acute pancreatitis. Recent research published in BioMed Hub in November 2021 revealed a correlation between gastrointestinal symptoms in the early stages of acute pancreatitis and pre-existing conditions such as metabolic syndrome, obesity and diabetes mellitus. Another PLOS One article from June 2021 points out that obesity is an important public health problem in France, as it increases the likelihood of developing chronic diseases such as diabetes, hypertension and other conditions with psychological and serious social. The increasing prevalence of obesity and its association with excessive eating habits also increases the risk of pancreatitis, contributing to the growth of this market segment. As a result, the acute pancreatitis market is expected to grow steadily throughout the forecast period, driven by factors such as rising prevalence of obesity and growing use of intravenous therapy.

However, the sector will increase as the elderly population grows and government awareness efforts are implemented. Furthermore, changing consumer lifestyles and increasing government-welcoming policies will propel market growth. An growth in the number of R&D activities is another factor driving the market's expansion. As a consequence, this aspect is likely to increase acute pancreatitis market revenue globally.

Click here for request free sample:

https://www.pharmanucleus.com/request-sample/1191

Acute Pancreatitis Market Segment Insights:

Acute Pancreatitis Cause Insights

Gallstones, alcohol, and other factors are among the causes of Acute Pancreatitis Market segmentation. According to Acute Pancreatitis Market statistics, the gallstones category held the most share in 2023. Acute pancreatitis is becoming more common over the world, as are gallstones. Gallstones cause around 40% of instances of acute pancreatitis. Gallstones afflict around 20 million people in the United States. Approximately 300,000 cholecystectomies are done on these individuals each year.

Acute Pancreatitis Treatment Insights

The therapy segmentation of the Acute Pancreatitis Market covers intravenous fluid, nutritional assistance, analgesics, endoscopic retrograde cholangiopancreatography (ERCP), and others. The intravenous fluid segment dominated market growth in 2023 and is expected to be the fastest-growing segment during the forecast period, 2023-2030, owing to factors such as the increased prevalence of acute pancreatitis, gallstones, and obesity in the population, as well as the risk factors associated with them. Acute pancreatitis is connected with dehydration and extreme fluid loss, which can be lethal and end in the patient's death. Intravenous fluid supply keeps the body hydrated, ensuring adequate blood flow to the other organs.

Acute Pancreatitis Diagnosis Insights

Based on diagnosis, the Acute Pancreatitis Market data covers imaging tests and laboratory testing. The laboratory testing category led the acute pancreatitis market revenue in 2023 and is expected to increase at the fastest rate during the forecast period, 2023-2030. Amylase and lipase are important pancreatic enzymes that may be detected through laboratory testing. The following may cause blood to gush. Other blood tests can be performed to detect gallbladder obstruction or injury.

Click here for full report:

https://www.pharmanucleus.com/reports/acute-pancreatitis-market

Acute Pancreatitis End-User Insights

End-users in the worldwide acute pancreatitis sector include hospitals, clinics, and others. Hospitals led the market in 2023 and are expected to be the fastest-growing sector throughout the forecast period, 2023-2030. The fact that hospitals are usually well-stocked and offer all services under one roof motivates patients with acute pancreatitis to seek treatment there. Another factor driving rising hospital visits is the increasing penetration of connected devices and equipment.

Click here for request free sample:

https://www.pharmanucleus.com/request-sample/1191

Acute Pancreatitis Regional Insights

According to the research, the market is classified into four regions: North America, Europe, Asia-Pacific, and the Rest of the World. The acute pancreatitis market in North America is expected to reach USD 2.5 billion in 2023, with a share of around 45.80%, and to grow at a rapid CAGR throughout the research period. Acute pancreatitis, obesity, and gallstones are all on the rise. These factors, together with a well-established healthcare infrastructure and high healthcare spending, are driving market expansion.

Significant countries included in the market study are the United States, Canada, Germany, France, the United Kingdom, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia Pacific acute pancreatitis market is the world's second biggest. The risk of pancreatic inflammation has increased as a result of growing obesity rates caused by changing lifestyles, which is projected to fuel market growth. Acute pancreatitis pharmaceutical and device-based therapies are expected to be in high demand, driving market development as R&D efforts in the area expand. Furthermore, the acute pancreatitis market in China was the largest, while the acute pancreatitis market in India was the fastest growing. Between 2023 and 2030, Europe's acute pancreatitis market is predicted to develop at the quickest CAGR. This is due to growing demand for certain drugs, and rising healthcare expenditures will accelerate market expansion in this area even more. The presence of significant competitors, as well as growing usage of newer technologies, will hasten market development in this business. Furthermore, the acute pancreatitis market in the United Kingdom was the largest, while the acute pancreatitis market in Germany was the fastest expanding.

#acute pancreatitis#market insights#breakthrough treatments#pancreatic disorder#treatment advancements

0 notes

Text

Get Nuanced Consumer Insights with Custom Communities

Test anything, anytime: business Ideas, , concepts, product concepts, taglines, packaging, ingredients, even celebrity associations, and get real-time insights consumer behavior insights at every stage of development. Make smarter decisions faster with our specialized speed-testing solution.

0 notes

Text

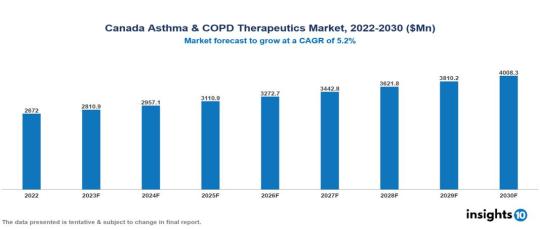

Canada Asthma and COPD Therapeutics Market Report 2022 to 2030

The Canada Asthma and COPD Therapeutics Market was valued at US $2.67 Bn in 2022, and is predicted to grow at (CAGR) of 5.20% from 2023 to 2030, to US $4.00 Bn by 2030. The key drivers of this industry include the upward trend in the prevalence of COPD and asthma, the adverse effects of COVID-19, rising healthcare expenses, and others. The industry is primarily dominated by players such as AstraZeneca, Abbott, GSK, Novartis Pfizer, and Boehringer Ingelheim, among others.

#Canada#market analysis#market forecast#market research#market insights#market report#Asthma#therapeutics market#pharmaceutical#healthacre

0 notes