#Amit Wadhwa

Text

Cannes Lions 2022: Dentsu Creative bags second Grand Prix, India’s metal tally stands at 20 after day three

Cannes Lions 2022: Dentsu Creative bags second Grand Prix, India’s metal tally stands at 20 after day three

After winning a total of ten metals in the last two days, India added another ten metals on the third day of the Cannes Lions International Festival of Creativity 2022. Dentsu Creative continued its winning streak as it won a Grand Prix for Vice Media’s The Unfiltered History Tour under the Brand Experience and Activation category for use of mobile and devices sub category. The same entry also…

View On WordPress

#Ajay Gahlaut#Amit Wadhwa#Cadbury Celebrations#Cannes Lions 2022#Cannes Lions International Festival of Creativity#DDB Mudra#Dentsu International#Dentsu Webchutney#FCB India#Maxx Flash#McCann India#Ogilvy#Political Shakti Times Of India#Shah Rukh Khan - My Ad#The Killer Pack#The Nominate Me Selfie#The Unfiltered History Tour#Ujjivan Small Finance Bank#Vice Media#VMLY&R Mumbai

0 notes

Text

The growing cyber threat to India from Far East

The growing cyber threat to India from Far East

Around 2,000 Indian websites were hacked in June-July 2022 alone. This is one of the most serious cyber attacks on India in the recent past.

Following this, Amit Wadhwa, DCP of Ahmedabad’s Cyber Police, wrote a letter to the Indonesian and Malaysian governments as well as to Interpol. In this letter, two cyber groups ‘Dragonforce Malaysia’ and ‘Hacktivist Indonesia’ were held responsible for…

View On WordPress

0 notes

Video

youtube

In conversation with an amazing team from Surdaan Ameya, Sanchay, Kavni, Kriti and Milli.

Inspiration Masters, LLC is dedicated to making a positive difference in the lives of people on the planet by helping everyone search their purpose of life, find what they are passionate about, and then helping with tools, techniques, and strategies to reach their true purpose in life by following their passion.

As a part of our “Inspiring Series”, we invite the difference makers, entrepreneurs, artists, business owners, and individuals who have interesting stories to share which can inspire everyone.

This week we got the privilege to meet an amazing team from Surdaan Ameya, Sanchay, Kavni, Kriti and Milli.

Surdaan will be holding their fifth Annual Charity Benefit Concert on August 9th. Each year high school students of Alaap School of Music come together for Surdaan - summer musical concert. The students showcase their singing talents while using their voices to help others in need. Surdaan 2020 is extra special. This year the musical event will be online allowing the kids to reach audiences all over the world. And the funds raised from ticket sales and donations will benefit 2 charities.

For those purchasing tickets in the US, each ticket is $25 per family. You can purchase additional tickets for $10 for family and friends in India under your bundle. In the US, payment will be accepted in the form of cash, cheques, or zelle.

For residents in India wishing to purchase the ticket, it is 500 rupees per family. In India, the payments will be accepted through Google pay. Please check out our previous post for more information on how to purchase tickets.

For more information regarding this event or tickets please contact or email [email protected].

instagram.com/surdaan/

https://www.facebook.com/surdaan/

For ticket: https://www.facebook.com/events/3998581140213296/

Phone: 972.948.8476

Email: [email protected]

Website: www.inspirationmasters.com

Facebook Page: www.facebook.com/inspirationmasters/

YouTube: https://www.youtube.com/channel/UCaqsWGFDdqc2Puhu3UKuvNw…

#inspiringseries #inspiration #motivation #inspirationmasters #positivedifference #followyourpassions #inspirationmasters #becomeremarkablenow #inspiringseries #purposeoflife #livelife #liveyourdreams #followyourdreams #passion #learn #irving #coppell #Lascolinas #carollton #inspire #DFWmetroplex #dallas #southlake #lewisville #frisco #plano #allen #bollywood #charitableorganizations #CityHouse #transitionalhousing #nonprofit

#CharityEvent #Concert #ClassicalSinging #BollywoodSinging #Fundraising

Pause-14:17

Additional Visual Settings

Enter Watch And Scroll

Click to enlarge

UnmuteClick to expand

Jay Pujara with an amazing team from Surdaan Ameya, Sanchay, Kavni, Kriti and Milli.

Send Message

8People Reached

0Engagements

Boost Post

Inspiration Masters LLC

Like

Comment

Share

See All

See More

Chat with friendsYOUR PAGES

SEE ALL

Inspiration Masters LLC9

Inspiration Masters Speakers Group for youth9

Fun N Frolic Montessori1

CONTACTS

Soujanya Ar

Srirekha Potturi

Krishna Puttaparthi

Rashmi Bedi

Swati Halady

Dena Soliman

Megha Vyas

Chandni Somaya

GROUP CONVERSATIONS

Tulsi, Bhakti, Cherry, 7 others

Neelima, Rachita, Tulsi, 13 others

Minu, Nitu, Rachna, 9 others

MORE CONTACTS (411)

Aaliya Aekta Sangani

Aarti Dewan

Abhi Trivedi

Abhishek Shivajirao Satham

Acharya Harshvardhan Shukla

Adi Campuzano

Aditi Kharel

Ajanta Patil Khetade

Alay Thakkar

Alba Hatcher

Ali Khan

Ali Malyani

Alka Soni

Alpa Patel

Alpana Jacob

Amanda Kaufman

Amit Anand

Amit Thakkar

Amit Trivedi

Amna Khan

Angela Wulz Deaton

Angie Cox

Angie McIntyre Buford

Anil Kilaru

Anil Sankaramanchi

Anitha Chandran

Anjali Chhabria

Anjali Desai

Anjum Varshney

Ankit Wani

Ansi Vincent

Anu Malhotra

Anupa Goyal

Aparna Joshi

Apurva Shah

Arathi Shah

Arun Ji Kumaar

Arun Sharma

Aruna Patibandla

Asha Amin

Ashish Khetarpal

Ashraf Feerasta Daredia

Ashwinikumar Sanakal

Asim Mehta

Atul Patel

Atul Shah

Avi Anand

Avinash Bardoli

Bharat Gandhi

Bijoya Saha

Bill Woodard

Blake Powers

Bobby Roberti

Brandi Davenport Mieger

Bryan Linder

Burra Vinod Kumar

Carly Alacahan

Carolina Bustamante de Poché

Chakori's Terracota

Chandra Pal

Chandra Viswanathan

Charmi Gandhi Ramchandani

Chennam Preetham Reddy

Chirag Patel

Chris Betts

Chris Bhatti

Chris Hampton

Christian Lem-Grace Collada

Christina Thomas

Christina Vance

Col Virendra Tavathia

Daliyah Jehangir Raja

Dallas Buzz

Dallas Terka

Danny Mehta

Darlene King Stark

Darshana Sheth

Deepa Barve

Deepa Raghavachari

Deepa Shahani Sood

Deepa Shankar

Deepak Patel

Deepak Patel

Deepali Naidu

Deepika Agarwal

Deepti Kalra

Devi Singh

Dharmendra Chaudhari Puniyani

Dhillon P Singh

Dinesh Muthyam

Dipesh Acharya

Dipti Gupta

Dipti Parikh

Dolly Solanki

Dreamy Patel

DrPankaj Jain

Efti Bali

Elizabeth Esparza

Elizabeth Gormly De Moraes

Erin Smith Gregor

Gans Subramanian

Gary Coffman

Gayathri Rao

George M. Kim

Girija Anand

Gladson Varghese

Gretchen Besco House

Guru Chandrahasreddy

Hamid Abbas

Hasan Soomro

HD Shah

Heather Boyce Parks

Hemachandra Reddy

Hemal Doshi

Hemang Thakkar

Hetal Dave

Himanshu Chaudhari

Himanshu Patel

Hope Hill

Humaira Malik

Hussain Ajani

Jagadeesh Unnikrishnan

Jagan Mohan Vinukula Vinukonda

Jagmohan Singh Kohli

Janak Bedi

Jared Patterson

Jasmina Bhattacharya

Jasmine Xavier

Jason D York

Jaswant Singh

Jeff Cheney

Jerry Kampiyil

Jess Oberoi

Jetal Chauhan

Jignasa Patel

Jim Neumann

Jimmy Singh

Jobin Panicker

Joga Sandhu

John Allen RedmondJr

Jonathan Baldwin

Josh Hurtado

Jothi Krishnamoorthy

Juan Carlos Cruz

Jyoti Ranjan Das

Jyoti Soni

K R Raghuveer Reddy

Kanchan Thareja Bhatti

Kanhaiya Moharir

Karen Kim

KaRri SaSi

Kathy Todryk

Kaushal Kathwadia

Kavita Gupta

Kavita Patil Doddamane

Kavita Sreedhar

Keith Burr Car Pro

Kenneth Allen Dugger

Kenneth George Wincorn

Kim Gill

Kimberly Armstrong

Kimberly Y. Evans

Kiran Samran

Kiran Walia Pulugurta

Kishore Chukkala

Kp Singh

Kris Wise

Krish Dhanam

Krishna Nemani

Krishnaveni Radhakrishna

Kuntal Ray

La Meglio

LaByron Thomas

Lakshmi Narayana Chintha

Lakshmi Srinivasan

Lavanya Reddy

Laxmi Tummala

Leah Frazier

Leo Kanell

Lilian Chavira

Little Musicmaker

Lubi Lafdewali

Madhuri Lad

Mahak Miglani Dhingra

Mahesh Chitnis

Mandar Wadekar

Manesh Lilani

Mani Raveendran

Manish Jariwala

Manish Lodha

Manjunath Rao

Mano Kunderu

Manoj Pillai

Manoj Singamsetti

Manoj Solanki

Manu's Mehendi

Maria Stillisano

Mathews Abraham

Maushmi Sabat

Max Miller

Medha Atre Kulkarni

Meena Gupta

Meenakshi Anipindi

Meera Yagnik

Mehul Patel

Micah Bellieu

Michael Simmons

Milan Sasmal

Milie Rajput

Missterry Perfume

Mohit Seth

Monika Khurana

Mukesh Sundesha

Murali CA

MusicMentor-Singer Prashant Soni

Nabeel Shams

Nagamani Gudipati

Nagavalli Medicharla

Nagesh Sikand

Naidu Mrc

Namrata Banga

Namrita Yuhanna

Nanda Mehta

Nanda Tiwari

Narender Kasarla

Neal Walters

Neelam Shah

Neelu Gupta

Neeta Bhasin

Neetu Jain

Neha Jain

Ner de Leon

Nidhi Shah

Nidhi Sharma

Nikeeta Sanger Pradhan

Nilesh Patel

Nishi Bhatia

Nitika Kohli

Nitu Shukla

Noundla R Srinivas

Noureen Dhanani

Parmeet K Randhawa

Patrick Subedi

Payal Patel

Payal Thakkar

Pooja Ghiya

Pooja Mehrotra

Pooja Sethi

Poojitha Vasireddi

Prabhat Chaudhary

Pramod Rajput

Pramodh Vaiccath

Prasanna Kumar

Prashanth Holla

Prathyusha Davuluri

Praveen Bhosale

Praveena Vajja

Preeti Shroff Gandhi

Preeti Sodhi Sharma

Prina Shah

Prithi Narasimhan

Priyanka Sinha

Puja Kaura Athale

Purvi Parakh

Pushpalatha Arakotaram

Rachel Olson

Rachel Samuel

Radha Karanam

Rahul Walia

Rajbhog Hicksville

Rajendra Gondhia

Rajesh Jyothiswaran

Raju Sethi

Ram Ganta

Ram Majji

Ramji Krishnamoorthy

Ramzan A Virani

Rao Medikonda

Ravi Jandhyala

Reddy N. Urimindi

Reema Khanolkar

Reena Nandani

Reet Wadhwa

Reflects You

Rehan Qaiser

Rekha Chopra

Rekha Nair

Renuka Bhandari Chauhan

Renuka Samudrala

Rhonda Ray

Riaz Ali

Rick Stopfer

Rita P Singh

Rita Pujara

RJ Vaibhav

Ro Simmons

Robert Cox

Rohit Bhatia

Roshan Bharti

Roshni B Deo

Roshni Thakkar Suchde

Rupa Thakkar

Rupal Desai

Ruth Riddle Thompson

Salim Lalany

Sami Ahmed

Samta Lodha

Sangeetha Sridharan

Sanjeev Sharma

Sapna Sohani

Sarada Karthik

Saravanan Kunjithapatham

Savitha Namuduri

Sayani Ravichandran

Shailaja Kumar

Shamik Shastri

Shardula Joshi

Sharmistha Das

Sharon Duffy Hamel

Shashi Kaligotla

Shayema Rahim

Shayona Shubha

Shelina Hawkins-Sajwani

Shelley Beaty

Shikha Gupta

Shipra Majji

Shirley Wilson Moon

Shital Kalpesh

Shobha Michaels

Shravya Reddy

Shreya Choudhury

Shruthi Sriram

Shruti Ravindran

Shubhada Kshirsagar Sharma

Shweta Dubey

Shweta Paralikar Tamhane

Siddhu Govindaswamy

Sim Bains

Simi Arora

Siri Katti

Smita Gupta Choudaha

Snehal Shah

Sobia Taimoor

Sonal Patel

Sonika Kukreja

Sonny Chatrath

Sonu Bhalla

Sonya Reddy

Sowmya Ananth

Sowmya Gadiraju

Sree Vas Kallepalli

Sridevi Tummalapalli

Srini Tillu

Stephanie Schnitzius Hengstenberg

Subba Yantra

Subha Ramanan

Sudipa Ray

Sugandha Agarwal

Sujata Bagde

Sumaira Baig Mughal

Sumit Shrivastava

Summer Neimann

Sunaina Panchal

Sunny Dhillon

Sunny Lal

Suresh Madha

Surinder Massey

Suroma Sinha

Susan Jones

Sushma Maitreyi Sharma Gangaraju

Sushma Prasad

Taher Ali

Tamim Shakir

Tanu Madan

Tarang Soni

Tarulata Agrawal

Ted Halladay

Tejal Patel

Terri West

Tina Patel

TJ Patel

Tracy Marshall

Uma Venkatesan

Umang Mehta

Umar John

Usha Venkataraman

Ushi Chaturvedi

Vamsi Kalakuntla

Vandana Tilak

Vani Sinha

Veenu Gaba

Venu Kolipaka

Veronica S Jones

Vibha Mistry

Vidisha Gupta

Vidya Rao

Vijay Moksha

Vijay Naraharishetty

Vijaya Botla

Vijayalakshmi Kariamal

Vikram Reddy

Vinay Kumar

Vini Tandon Keni

Vinod Devlia

Visa Shanmugam

Vishal Gandhi

Vruddhi Choksy Shah

Yatini Desai

Zahra Jahanyfard

Zin Sakshi Bhardwaj

कनिका वर्मा

More stories loaded.

7 notes

·

View notes

Text

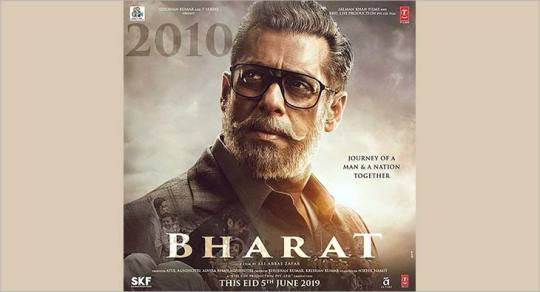

★Marketers expecting big money from ‘Bharat’ & Brand Salman!

May 20, 2019

All eyes are on the launch of Salman Khan's ‘Bharat’ and if predictions from film trade analysts are anything to go by, the Eid release is expected to be another blockbuster with a mass appeal.

It is just not the producers who are looking to rake in the moolah, brands and market influencers too are also excited to tag along.

From being partners for promotional initiatives to in-film branding, brands are trying out all formats to associate with ‘Bharat’. The craze, however, is being mostly driven by Brand Salman Khan.

But what do brands see in the star? We asked a few industry experts for an explanation.

“Salman Khan is among the few global faces of Bollywood with a mass appeal. He is known for massy hits while his movie releases on Eid have been strategically planned for the last few years and have always proved worthwhile. Bharat too is another mega movie that is up for release and we wish Salman along with the entire production crew another success story,” said Harkirat Singh, Managing Director, Woodland. Singh strongly supports in-film branding and Woodland has been heavily investing in the proposition for the many years now.

“Salman is a mass brand. He has proved himself in multiple profiles or characters and his macho looks are an added advantage that goes in-line with the profile of Woodland. We look forward to working with him,” Singh added.

Charminar, the flagship roofing solution brand from the house of HIL Ltd, has already announced its brand association with Salman Khan’s upcoming movie. But what could a roofing solution brand get out of a Bollywood film? Explaining the intent behind the association, Dhirup Roy Choudhary, MD & CEO, HIL said, “We strive to explore new and innovative opportunities to connect with our customers and take these virtues of our brand ahead. Salman Khan is Bollywood’s leading actor. He is as dependable on Box Office as our products. Through our association with ‘Bharat’, we hope to engage our customers, increase brand awareness and provide a fresh take to evolve the market for Charminar.”

Trade experts are confident about the Eid and Salman Khan combination proving to be a hit again.

“Salman Khan’s mass appeal commands connect with both single screen and multiplex audiences. The release of ‘Bharat’ on Eid is surely expected to pull audiences to the screen. The entertainment quotient of Salman Khan has proven to bond with the audience and conversion in terms of Box Office collection. On a festival, people normally go for their favourite superstar’s movie with family and friends and hence the occupancy is bound to be higher,” said Rajee M Shinde, President, Epic TV Network.

Brand experts also consider Salman a safe bet with his Eid releases. Saurabh Uboweja, international brand expert and CEO, Brands of Desire, said, “Bharat is the annual Salman Khan pilgrimage for his fans. There are no expectations or surprises in store. Almost all his movies over the years follow the ‘Hero’s Journey’, a common template of a broad category of tales that involves a hero who goes on an adventure and in a decisive crisis wins a victory, and then comes home transformed. With so much experience, Salman is effortless in playing this template role. He is also intelligent not to divert away from it. Why change the recipe if your food is loved by all?”

Advertising experts, however, have a slightly different take on the matter. According to them, the star must be backed by good content too. “No doubt that Salman’s appeal guarantees a grand opening but for that to sustain it needs good content if not great. The audience of today is maturing (if not completely matured) and would need something beyond Salman too. Having said that, it still has a mass following which the brands would like to tag on as the chances of it cracking gold are quite high,” said Amit Wadhwa, President, Dentsu Impact.

Roma Balwani, Senior Advisor, Brand and Group Corporate Communications, Vedanta, opined, "Brand Salman has been an enigma for the masses! His persona has a fair share of humanism that appeals to the millennial audiences, and controversy contributes to his mass appeal as that fuels his celebrity stature. Bharat with an emotive title, with the right mix of patriotism, is potent and the Eid release of his film aptly titled Bharat just when the country is waiting with bated breath on the outcome of the polls! For the audience of yesteryears, Salman essaying the role of a man who has seen life from the time of Independence is intriguing. Enough masala for the ‘Being Human’ star to hit the box office with an Eid release!"

Film trade analyst Atul Mohan says, “The last two quarters have been good for the cinema industry, and the next push will come from ‘Bharat’. The movie is expected to do well in single screens and multiplexes across segments and should bring in nothing less than Rs 300 crore as Box Office collections. Ali Abbas Zafar and Salman have been a hit pair and have given Bollywood blockbuster hits like ‘Sultan’ and ‘Tiger Zinda Hai’. There is no doubt that the magic will work again. Salman here is playing everything from a romantic hero to an old man to a patriot giving the audience enough treat. With high occupancy at the theatres, Bharat will only add to the popularity of Brand Salman Khan.”

Vinod Bhanushali, President, Marketing, Media and Publishing, T-Series, said: “As producers of the film, we see Bharat smashing Salman Khan’s previous box office records. My prediction is that the film will cross Rs 400 crore and set a new benchmark in box office collections. As far as the perception of Brand Salman is concerned, it remains to be strong and Bharat is definitely going to prove that.”

1 note

·

View note

Text

Dentsu India elevates Amit Wadhwa to CEO, Dentsu Creative India

Dentsu India elevates Amit Wadhwa to CEO, Dentsu Creative India

பங்குப்படி, சந்தையில் டென்சு கிரியேட்டிவ் நிறுவனத்திற்கான ஒட்டுமொத்த மூலோபாயத்தின் ஒருங்கிணைப்பு, ஒருங்கிணைப்பு மற்றும் செயல்படுத்தலுக்கு அமித் வாத்வா பொறுப்பேற்பார். அவர் டென்சு இந்தியா கிரியேட்டிவ் சர்வீஸ் லைன் தலைமைக் குழுவை வழிநடத்துவார், ஆனந்த் பட்கம்கர் மற்றும் பிராந்திய டென்ட்ஸு கிரியேட்டிவ் தலைமைக்கு அறிக்கை அளிப்பார்.

அதன் உலகளாவிய நிறுவன மறுவடிவமைப்பின் பின்புறத்தில், டென்சு…

View On WordPress

0 notes

Link

The government has notified forms for filing tax returns for income earned in 2019-20 and made it mandatory for people to file ITR in case their deposits in a current account exceed Rs 1 crore or electricity bill in the fiscal is Rs 1 lakh or more.

The Central Board of Direct Taxes (CBDT) on May 30 notified Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V for the assessment year 2020-21 (income earned between April 1, 2019 to March 31, 2020).

The new ITR forms require taxpayers to furnish details of specified high-spend transactions, such as deposit of Rs 1 crore or more in a current account, expenditure of Rs 2 lakh or more on foreign travel or spending of Rs 1 lakh or more on consumption of electricity, in case such persons are otherwise not required to income tax returns.

The department has also revised the I-T return forms to allow assessees to avail benefits of various timeline extension granted by the government following the COVID-19 pandemic.

Accordingly, the new ITR forms also require taxpayers to furnish details of tax saving investments/ donations made during June 2020for the 2019-20 separately.

ALSO READ: Delhi govt seeks Rs 5,000 cr from centre to pay salaries: Sisodia

The government has extended various timelines under the Income Tax Act, 1961, through the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020.

Accordingly, the time for making investment or payments for claiming deduction under Chapter-VIA-B of the I-T Act that include Section 80C (LIC, PPF, NSC etc.), 80D (Mediclaim) and 80G (Donations) for the financial year 2019-20 had been extended to June 30, 2020.

Nangia Andersen Consulting Director Shailesh Kumar said the benefit of simpler forms ITR 1, ITR 2 and ITR 4 would not be available to individuals, who are either director in a company or have invested in unlisted equity shares.

"The ITR forms are modified in line with new disclosure requirements made in the Income Tax Act for AY 2020-21. Taxpayers would need to be careful of these new disclosure requirements, before filing their ITR and to select an appropriate ITR form," Kumar said.

AKM Global Tax Partner Amit Maheshwari said this comes as a relief as now joint owners of house properties and big spenders can use the same Sahaj and Sugam forms, which are easier to fill.

"However, high spenders will have to disclose more information like foreign travel, electricity consumption and deposit in current account in the form itself," Maheshwari said.

Returns in ITR-1 Sahaj can be filed by an ordinarily resident individual whose total income does not exceed Rs50 lakh, while Form ITR-4 Sugam is meant for resident individuals, HUFs and firms (other than LLP) having a total income of up toRs50 lakh and having presumptive income from business and profession.

While ITR-3 and 6 are filed by businesses, ITR-2 is filed by people having income from residential property; ITR-5 is filed by LLP and Association of Persons (AoP). ITR-7 is filed by person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

Taxmann DGM Naveen Wadhwa said that for the assessment year 2020-21, the tax department has notified the ITR forms twice. In the month of January 2020, the department notified two ITR forms (ITR-1 and ITR-4). Now, in the month of May 2020, all ITR forms (ITR-1 to ITR-7) have been notified which eventually replace the two previously notified forms.

"In the new ITR forms, a new Schedule DI has been inserted to seek details of the investment, deposit and payments made during the extended period till June 2020 for claiming deduction under Chapter VI-A or for rollover of investment in the financial year 2019-20," Wadhwa said.

Usually, the income tax department notifies the ITR forms in the first week of April of the relevant assessment year. However, this year, the department had notified forms 1 and 2 in January. However, with exceptional circumstances arising out of the COVID-19 pandemic, the I-T department had to revise the forms and has now notified all ITR forms in the last week of May.

"The department has notified the forms without the return filing utility. Thus, a taxpayer, who is required to file the return, cannot do so until the return filing facility is made available on the e-filing portal," Wadhwa said.

Accounting solutions provider HostBooks founder and Chairman Kapil Rana said that in ITR-1, government employees have been bifurcated in state, central government and a new type as "NA" added to the list.

In ITR-4, PAN number is made optional if Aadhaar number is provided.

"It shows the intention that the government is putting all efforts to curb the tax leakages and also allowing law-abiding taxpayers to take benefit of the spent and investments made during the difficult time even if they are done after the completion of the assessment year. This also shows the intention to make the process simple and smoother," Rana added.

0 notes

Text

Maruti Suzuki India - Swift Limitless Stories

Maruti Suzuki India, in collaboration with Dentsu Impact, has unveiled a brand-new campaign, Swift Limitless Stories for the 3rd generation Swift.

After the launch of the new model last year with the campaign #BeLimitless, MSIL was looking to take Swift’s legacy of performance forward. The objective of the campaign was to help people connect; not just physically but also emotionally with the concept of being ‘Limitless’.

A Banker Who Scaled Mount Everest | Vikas Dimri

Mother Of 2, Inspiration Of Millions! | Mary Kom

Sprinting To Glory With Just One Leg | Bhupendra Sharma

Commenting on the campaign, Shashank Srivastava, executive director-marketing and sales, Maruti Suzuki India said, “We want to engage with our target group (TG) in a more meaningful way. The Swift Limitless Stories is a way to build a higher level of brand salience to associate with performance but in an emotional way. It is also going to be our long-term strategy. These stories celebrate individuals who keep challenging themselves to become their better version. We wish to associate Maruti Suzuki with visual dynamism and pursuit for excellence. We also have a separate campaign for sales promotion for Swift. This campaign does not push for immediate sales. It, however, is meant to build brand salience."

Brought to life by Dentsu Impact, the creative agency from the house of Dentsu Aegis Network, the Swift Limitless Stories campaign celebrates three individuals who have overcome immense challenges in their lives while in their pursuit of greatness – Olympic and World Champion Mary Kom, Para-athlete Bhupendra Sharma, and a corporate banker Vikas Dimri, who conquered Mt. Everest and the Ironman Race the same year.

Speaking about the campaign, Anupama Ramaswamy, National Creative Director, Dentsu Impact said, “Swift has always celebrated performance. And the ‘Swift Limitless Stories’ campaign has been created to do exactly that, with one difference – it takes the ‘Be Limitless’ philosophy beyond just the car. It salutes the undying spirit of certain special achievers who never accept things as they are and keep pushing past all limits to achieve their dreams. These stories have been carefully selected, because we felt they strongly connect with our consumer’s ‘nothing-is-impossible’ attitude.”

The campaign relies on storytelling and celebrating the limitless heroes without consciously integrating the car. Reason being that the vision of this campaign is to personify the philosophy of ‘Be Limitless’ by highlighting the strength, passion and relentless determination of certain out-of-the-ordinary individuals.

Swift Limitless Stories has been created to engage specifically with audiences on social media, Maruti Suzuki’s content hub, as well as the individual social media handles of these heroes.

Hindol Purkayastha, Senior Vice President, Dentsu Impact said, “Swift has been an iconic brand which has been loved by multiple generations. Our latest campaign focuses on the digital

audience and with compelling storytelling it will truly allow us to inspire millions of followers and get newer younger audience. With performance at the core of the brand, it was time to shift the conversation to individuals from the product. Thus, the concept of #BeLimitless campaign was used as a trigger to invite more stories of individual achievements. With this, we continue to own the space of performance.”

With the Limitless Stories campaign, MSIL is not just sharing inspiring stories, but is also creating a platform for its audience to share their own journey with the world.

The films have been directed by Sharat Sharma - Crazy Few Films.

Credits

President: Amit Wadhwa

Account Management: Hindol Purkayastha, Karun Arora, Arjan Soni, Arjun Shankar, Medini Pateria

Digital Account Management: Binodan KD Sarma, Dilpreet Singh, Varsha Bhatnagar

National Creative Director: Anupama Ramaswamy

Creative: Monish Gupta

Films Head: Suprotim Day

Production House – Crazy Few Films

Director – Sharat Kumar

Producers – Urfi Kazmi/Viraj Gawas

Associate Producer – Sunny Shah

Read the full article

0 notes

Text

New Post has been published on Titos London

#Blog New Post has been published on http://www.titoslondon.co.uk/amit-wadhwa-at-lakme-fashion-week-summerresort-2018/

Amit Wadhwa at Lakmé Fashion Week summer/resort 2018

1/13

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

Image: Sagar Ahuja/Vogue

The post Amit Wadhwa at Lakmé Fashion Week summer/resort 2018 appeared first on VOGUE India.

0 notes

Text

COVID-19: Attacking medics in India can cost up to 7 years in jail

A medical technician speaks to individuals visiting a cell Covid-19 testing van working throughout a lockdown imposed due to the coronavirus in New Delhi, India, on Monday, April 20, 2020.

Picture Credit score: Bloomberg

New Delhi: In a big transfer, India’s federal cupboard on Wednesday amended the Epidemic Illnesses Act, 1987 by means of an ordinance in order to guarantee security of well being staff at a time when there was a spate of assaults on them.

Any violence in opposition to well being staff could now convey steep fines and even imprisonments of up to seven years.

This transfer comes hours after Residence Minister Amit Shah addressed Nina Medical Affiliation by means of a video convention, assuring them of security and urging them to withdraw the symbolic protest scheduled for later this month in opposition to incidents of violence on well being staff pressed into COVID-19 obligation.

Any longer, not simply such violence is cognisable but in addition non-bailable offence. Moreover, it has provisions to present compensation for harm to well being care service personnel or for inflicting injury or loss to the property, the federal government stated on Wednesday.

Okay.S. Dhatwalia, Principal Spokesperson for the federal government, tweeted: “Ordinance would help protect health care service personnel and their living/working premises against violence”.

Non-bailable offence

“This actually helps protect the entire health fraternity including doctors, nurses, paramedics up to ASHA workers,” stated Union I & B Minister Prakash Javadekar. The Minister stated the modification was necessitated after incidents of violence have been witnessed in opposition to them whereas discharging their essential obligation for the nation.

The modification has ensured that the investigation takes place in a time-bound method. A particular provision can also be made in the ordinance in case autos or clinics are broken. In such circumstances, two occasions the cost shall be recovered from assailants.

Javadekar on Wednesday introduced the ordinance to finish violence in opposition to well being staff, which carries jail time period starting from six months to seven years as punishment for these discovered responsible.

“Such crime will now be cognisable and non-bailable. The investigation will be done within 30 days. Accused can be sentenced from three months to five years and penalised from Rs50,000 [Dh2,402] up to Rs2 lakh [Rs200,000],” he added.

This comes after a number of incidents of assaults and stigmatisation of medical employees and docs being reported from throughout the nation following the outbreak of COVID-19.

Medical doctors welcome transfer

A number of docs have lauded the efforts by the Central Authorities.

“The recent attacks on medical practitioners is shameful, however, something good has come out of it. Our Prime Minister Narendra Modi, Health Minister Dr Harsh Vardhan and Home Minister Amit Shah have assured us that special security arrangements will be done for the doctors,” Dr Ravi Malik, former Secretary of Indian Medical Affiliation (IMA), advised ANI.

“I want to tell the government that we, doctors, are not scared of such attacks and we will continue our work amid this crisis,” he stated.

Echoing comparable sentiments, Dr BB Wadhwa, Delhi Medical Affiliation (DMA) president, stated, “Though we feel disturbed due to the attacks, the doctors have not backed out from their duty. We want some laws which will put a stop on such attacks on doctors as we cannot work if we are always scared.”

He additional stated, “I appreciate Uttar Pradesh Chief Minister Yogi Adityanath for arresting 17 miscreants under the National Security Act. We want other states to do the same to prevent attacks like in Moradabad, Delhi and Indore.”

Whereas lauding Modi’s acknowledgement of labor being accomplished by medical employees amid the coronavirus outbreak, Dr Harish Gupta, Delhi Medical Council member and former president of DMA, stated, “Though the frequent attacks on doctors have a very demoralising effect on the medical fraternity, we have continued our work without taking a day off since the coronavirus outbreak. And we will continue to do so because we have always said — Jeet jayenge hum agar pura desh sangh hai [We will win if the country is with us].”

“However, we do demand legal impunity for our safety,” he added.

The IMA had earlier introduced that it’ll observe April 23 as Black Day if the federal government fails to enact Central Legislation on violence in opposition to docs and hospitals.

from WordPress https://ift.tt/34YC9rq

via IFTTT

0 notes

Text

Nationwide lockdown to impact housing sales, say realtors

New Post has been published on https://apzweb.com/nationwide-lockdown-to-impact-housing-sales-say-realtors/

Nationwide lockdown to impact housing sales, say realtors

New Delhi: The nationwide lockdown for next 21 days amid spread of coronavirus will severely impact residential real estate as housing sales have almost come to a standstill, which could affect builders’ cash flow and lead to default in repayment of bank loans, according to property developers and consultants. Market experts also fear that existing customers might delay payments of their instalments to developers, who in turn could default in repayment of principal and interest on bank loans.

Developers may hold on to apartment rates, but prices in the secondary or resale market could fall, they said.

To mitigate the impact, developers and brokers are adopting digital marketing tools to reach out to prospective home buyers.

When contacted, realtors’ apex body CREDAI President Satish Magar said the lockdown will greatly impact the sales transactions and new launches will be deferred.

“There are chances of many customers defaulting on their instalments because of tough economic conditions. These will have a cascading effect on developers-who will be battling with servicing their debts as cash inflows will be strained,” he added.

NAREDCO President Niranjan Hiranandani said overall sales numbers have dropped.

The lockdown has opened up opportunities for digital platforms for sales and marketing activities, as also payments, he said.

Bengaluru-based Puravankara MD Ashish R. Puravankara said: “At this point, no property registrations are taking place and all new project launches are postponed”.

As all construction sites are under lockdown, there will be a delay in completion leading to an increase in the interest cost, he added.

“Additionally the lockdown could hamper the cash flow cycle of the developers’ balance sheets and could result in bank defaults”, said Ashish.

Anarock Chairman Anuj Puri said the lockdown will have a negative impact on housing sales and new launches during the auspicious festivals of Gudi Padwa, Akshaya Tritiya, Navratri and Ugadi.

“This is a time when AV technology to enable virtual site visits and walk-throughs will gain increased relevance and use,” he said.

Anshuman Magazine, Chairman & CEO (India, South East Asia, Middle East & Africa), CBRE said: “It is too early to comment on the impact of Covid 19 given that the situation is still evolving … We are confident that once the situation normalises, sales will resume”.

Dhruv Agarwala, Group CEO, Housing.com and PropTiger.com, said the lockdown will have an adverse impact on real estate.

“We too have begun to see a dip in traffic on all our platforms,” he said, adding that the company has come out with innovative schemes for builders and brokers to advertise on its websites.

Siva Krishnan, MD (Residential Services and Developer Solutions), JLL India said the lockdown will definitely have an impact on housing sales, but briefly.

Shalin Raina, MD- Residential Services, Cushman and Wakefield, said the complete lockdown means lesser sales since most of the transaction closures happen only after site visits.

Housing prices have corrected by 15-20 per cent in the last few years and further decline is unlikely, Raina said.

Savills India CEO Anurag Mathur said: “Housing sales may see a sharp dip for at least the next one quarter… Even if the situation settles down quickly, it may take time for homebuyers to come back to the market.”

“Price elasticity is not a concern under the circumstances since the transaction activity is at a standstill anyway. Depending upon the duration and depth of the current crisis, prices may or may not see a downward movement,” he said.

Omaxe CEO Mohit Goel said the recovery in the housing segment has been halted.

“As for real estate prices, there will be no change as transactions are not taking place. The prices will resume at the level it has halted,” he said.

Gaurs’ MD Manoj Gaur said, “The sales are impacted, but it is temporary.”

Supertech Chairman R K Arora said, “housing sales have completely gone”. There are no buyers in the market.

Pune-based Gera Developments MD Rohit Gera said, “Real estate sales are at a standstill. So far there has not been any reduction or crash in prices of homes.”

“In the absence of some relief from the government, more real estate developers with debt obligations will default on account of the stop in cash flows thereby impacting the economy and jobs,” he added.

M3M Director Pankaj Bansal said housing sales would get impacted during this period of crisis, but it would also create a pent up demand once things get back to normal.

Experion Developers Senior ED Ananta Singh Raghuvanshi said, “Sales closures are temporarily getting pushed ahead. Prices won’t change.”

Raheja Developers ED Nayan Raheja said the sales and construction are badly impacted and at standstill.

ABA Corp Director Amit Modi said the sales velocity has definitely been slow.

Gulshan Homz Director Deepak Kapoor said, “People are deferring property buying decisions.”

PropEquity MD Samir Jasuja said: “For the real estate sector, this is a tough situation as it was just finding green shoots of recovery. We believe for the next few weeks, we will not see any new transactions for housing sales”.

Ambience President (Sales & Marketing) Ankush Kaul said: “Housing sales will be impacted for the next few weeks.”

Ekta World Chairman Ashok Mohanani said the lockdown has affected the business cycle deeply. Wadhwa group, Head – Sales, Marketing Bhasker Jain said the lockdown has impacted sales and the company is offering cashback on online bookings.

Brokerage firm 360 Realtors Ankit Kansal said the activities have come to a standstill after lockdown. Sales were down by 30-40 per cent during the first three weeks of March.

Investors Clinic Founder Honeyy Katiyal said sales would be impacted but not the price.

Wealth Clinic CMD Amit Raheja said, “It will hamper sales to a large extent, but we expect a good turnaround once the situation returns to normalcy.”

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

Source link

0 notes

Photo

INDIA, IIF Gr. Noida; March 8th, 2018 ASSOCHAM National Council Meeting on "Ease of Doing Business" at Indian Institute of Finance (IIF) campus * Prof. Saurabh Agarwal (Professor of Accounting & Finance, IIF, Principal IIF College of Commerce & Management Studies (CCS Meerut University) & Meeting Chair) * Mr. Arun Kumar Jagatramka (CMD, Gujarat NRE Coke) * Mr. J. K. Mittal (Advocate, Supreme Court and Delhi Hight Court; Co-Chairman, National Council on Indirect Taxes, ASSOCHAM) * Mr. Kapil Wadhwa (Director, Champion Computers) * Mr. Anil Khandelwal (Managing Partner, Lantoms Advisors LLP) * Mr. Amit Arora (At Advisor, E-waste Recycler India) * Mr. Ayush Jagatramka (AVP, Gujarat NRE Coke) and others.

0 notes

Text

Hindu Marriage Act, 1955, S.24--Maintenance--When the maintenance is awarded under two different provisions, the maintenance awarded on lower side should be adjusted in the maintenance awarded on the higher side and after adjustment of lesser amount, difference of amount awarded on higher side is required to be paid.

Hindu Marriage Act, 1955, S.24–Maintenance–When the maintenance is awarded under two different provisions, the maintenance awarded on lower side should be adjusted in the maintenance awarded on the higher side and after adjustment of lesser amount, difference of amount awarded on higher side is required to be paid.

2016(5) Law Herald (P&H) 4254 : 2016 LawHerald.Org 1229 INTHE HIGH COURT OF PUNJAB AND HARYANA Before The Hon’ble Mr. Justice Paramjeet Singh Dhaliwal CR-1790 of 2015 Dr. Anudeep Singh v. Dr. Geetanjali Singh Decided on 17/02/2016 For the Petitioner: Mr. Amit Jain, Advocate. For the Respondent: Mr. Jugal Wadhwa, Advocate. Maintenance—Amount paid by husband to wife towards her…

View On WordPress

0 notes

Link

The government has notified forms for filing tax returns for income earned in 2019-20 and made it mandatory for people to file ITR in case their deposits in a current account exceed Rs 1 crore or electricity bill in the fiscal is Rs 1 lakh or more.

The Central Board of Direct Taxes (CBDT) on May 30 notified Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V for the assessment year 2020-21 (income earned between April 1, 2019 to March 31, 2020).

The new ITR forms require taxpayers to furnish details of specified high-spend transactions, such as deposit of Rs 1 crore or more in a current account, expenditure of Rs 2 lakh or more on foreign travel or spending of Rs 1 lakh or more on consumption of electricity, in case such persons are otherwise not required to income tax returns.

The department has also revised the I-T return forms to allow assessees to avail benefits of various timeline extension granted by the government following the COVID-19 pandemic.

Accordingly, the new ITR forms also require taxpayers to furnish details of tax saving investments/ donations made during June 2020for the 2019-20 separately.

ALSO READ: Delhi govt seeks Rs 5,000 cr from centre to pay salaries: Sisodia

The government has extended various timelines under the Income Tax Act, 1961, through the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020.

Accordingly, the time for making investment or payments for claiming deduction under Chapter-VIA-B of the I-T Act that include Section 80C (LIC, PPF, NSC etc.), 80D (Mediclaim) and 80G (Donations) for the financial year 2019-20 had been extended to June 30, 2020.

Nangia Andersen Consulting Director Shailesh Kumar said the benefit of simpler forms ITR 1, ITR 2 and ITR 4 would not be available to individuals, who are either director in a company or have invested in unlisted equity shares.

"The ITR forms are modified in line with new disclosure requirements made in the Income Tax Act for AY 2020-21. Taxpayers would need to be careful of these new disclosure requirements, before filing their ITR and to select an appropriate ITR form," Kumar said.

AKM Global Tax Partner Amit Maheshwari said this comes as a relief as now joint owners of house properties and big spenders can use the same Sahaj and Sugam forms, which are easier to fill.

"However, high spenders will have to disclose more information like foreign travel, electricity consumption and deposit in current account in the form itself," Maheshwari said.

Returns in ITR-1 Sahaj can be filed by an ordinarily resident individual whose total income does not exceed Rs50 lakh, while Form ITR-4 Sugam is meant for resident individuals, HUFs and firms (other than LLP) having a total income of up toRs50 lakh and having presumptive income from business and profession.

While ITR-3 and 6 are filed by businesses, ITR-2 is filed by people having income from residential property; ITR-5 is filed by LLP and Association of Persons (AoP). ITR-7 is filed by person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

Taxmann DGM Naveen Wadhwa said that for the assessment year 2020-21, the tax department has notified the ITR forms twice. In the month of January 2020, the department notified two ITR forms (ITR-1 and ITR-4). Now, in the month of May 2020, all ITR forms (ITR-1 to ITR-7) have been notified which eventually replace the two previously notified forms.

"In the new ITR forms, a new Schedule DI has been inserted to seek details of the investment, deposit and payments made during the extended period till June 2020 for claiming deduction under Chapter VI-A or for rollover of investment in the financial year 2019-20," Wadhwa said.

Usually, the income tax department notifies the ITR forms in the first week of April of the relevant assessment year. However, this year, the department had notified forms 1 and 2 in January. However, with exceptional circumstances arising out of the COVID-19 pandemic, the I-T department had to revise the forms and has now notified all ITR forms in the last week of May.

"The department has notified the forms without the return filing utility. Thus, a taxpayer, who is required to file the return, cannot do so until the return filing facility is made available on the e-filing portal," Wadhwa said.

Accounting solutions provider HostBooks founder and Chairman Kapil Rana said that in ITR-1, government employees have been bifurcated in state, central government and a new type as "NA" added to the list.

In ITR-4, PAN number is made optional if Aadhaar number is provided.

"It shows the intention that the government is putting all efforts to curb the tax leakages and also allowing law-abiding taxpayers to take benefit of the spent and investments made during the difficult time even if they are done after the completion of the assessment year. This also shows the intention to make the process simple and smoother," Rana added.

0 notes

Video

youtube

Understanding Generation gap - Zindagi Ek Khubsoorat Safar #Ep 4 part 1

part 1 by Rj Amit – Amit Wadhwa

Generation Gap Ep#4 Part 1

A Common Complaint these days between family members, they don’t listen to us, they don’t understand us… is this true?

0 notes