#(which they were only on my cardholder not on my bank account)

Text

life really just loves to drop kick me down the stairs sometimes

#personal#have been trying to do this to get my life more in order#like getting my medical testing and records#and applying for financial assistance to get out of the red#and every single thing has just not worked or gone wrong#i found out in order to apply for financial assistance for bills i have to have proof of food stamps to fast track it#easy right? no. i forgot i changed my name through the benefits system to my chosen name#my chosen name that does not match my legal name#my legal name that is attached to the accounts i'm applying to financial assistance to#and in order to change your name you have to call#which i tried and got transferred and put on hold so long they closed#so then i decided to order grubhub instead of going out to eat cause its raining and im now emotionally exhausted#just to have grubhub “refuse” my card#except when i called my cardholder number it listed SIX CHARGES OF THE ORDER#the order that is not on grubhub or on the restaurant (we called both)#and the second they went on their system to try and figure out why the charges were there#(which they were only on my cardholder not on my bank account)#the cardholders entire system went down#and now im just waiting for it to go back up to call back#but i did have an actual panic attack because if i can't get that figured out immediately thats legit over $200 worth of charges#and now i'm literally so fucking hungry cause any energy/fuel i had left went into my panic attack#oh! also forgot to mention that i was finally able to pick up a copy of my medical records from my childhood doc!#which i've been trying to get for like 2 months and shit just kept getting in the way (transportation/money for the records/limited hours)#got the thumb drive home#booted it up to the encrypted password page aaaaaand#the password doesn't fucking work#so now i have to get back to their office to figure out what the actual password is#i literally am so done with today i just want to phase out of existence forever please

2 notes

·

View notes

Text

Monzo growth

I've been asked a few times recently how we got customers to sign up to Monzo in the early years and I haven't been able to give a satisfactory answer in a sufficiently short space of time. I thought I'd write out my thoughts in a longer piece so I can feel less bad about giving an incomplete answer - anyone who wants to know the details can read this instead.

Let's start with a rough timeline, which I'll then flesh out below.

2015

Started the company in February 2015.

We had a big, ambitious goal - to start a bank - and worked hard to get press coverage before publicly launching.

Ended the year with 3k "Alpha" cardholders and a waitlist of 20k.

2016

We launched an early prototype and continuously improved it.

Scarcity (waitlist) seemed to drive more signups - there was a standard "invite a friends and we'll bump you up the queue" mechanic.

A lot of hustle and hard work (100+ in-person events).

Community + Mission + Transparency - lots of blogging and social media. Crowdfunding.

Ended the year with about 70k "Beta" cardholders.

2017

Genuinely great product.

Market-leading customer service.

Hot coral card!

We consciously worked on viral product features & referral mechanics for the first time.

Ended the year with about 600k "Beta" customers.

2018

Full banking licence.

Hit 1m customers in September!

---

First, a note about the context. We started the company in the UK in February 2015, when "digital banks" weren't yet a popular idea. BankSimple had launched in 2012 with some big plans, but sold to BBVA in early 2014 with about 100,000 accounts, having struggled to raise sufficient funding to continue. N26 started development in late 2013, initially as a card for kids, while Revolut was founded a few months after Monzo, in April 2015. At around the same time, the UK regulator had announced plans to make it easier to start new banks, following the "too-big-to-fail" mess of the financial crisis, and it was on the back of this initiative that Monzo was born.

We spent the first couple of months of the company’s life furiously writing a banking licence application, believing that the licence might be granted within 12 months. In fact, it took 3 years before we were able to open full bank accounts for the bulk of our customers. Even 12 months felt slow; it had only been a handful of years since I'd gone through Y Combinator with my previous startup, GoCardless, and I was terrified of spending too much time building something without a real indication that customers wanted what we were building. Going back through my notes from the time, I found I'd peppered them with YC mantras like "Do things that don't scale", "Launch early and talk to users" and "Make something people want". So we looked for ways to get a product into users’ hands as soon as possible.

Pretty quickly we figured out that we could use prepaid debit cards as a sort of hacky prototype for a full bank. Before that point, prepaid cards had only really been used for kids' accounts (Osper and GoHenry had both been founded in 2012) and the financially excluded - people who couldn't get full bank accounts. These prepaid cards were horribly loss-making, and lacked about 60% of the functionality of a full bank account, so we budgeted for 10,000 cards. At the time, we couldn’t imagine more than 10,000 people would be willing to test out an incomplete bank account. In fact, we had almost 600,000 active prepaid cards by the time we transferred all customers to the full bank almost 3 years later. Despite the cost, these prepaid cards let us get a product into the hands of real users, who could help us figure out what product features to focus on.

---

So, about 3 months after the company was formed, we had a couple of dozen live prepaid cards linked to our backend systems and a very, very basic iOS app. We gave Eileen Burbidge, our first investor, one of the very earliest prototype cards and she was so excited about the payment push notifications that she immediately tweeted about it, which led to a Techcrunch article in May (and a reply from the N26 founder saying that it was nothing special 😆)

I don't think we were really ready for the press - we quickly scrambled to get a waitlist up on the website and launched our blog a few days later.

In any case, we got so much interest following the Techcrunch article that we doubled down on PR as a strategy. One of my notes at the time said we were aiming to get "Press at fever-pitch". Eileen seemed to know everyone in the UK press, and I worked really hard to meet journalists and explain what we were trying to build. More press followed over the next few months:

We were covered in the Guardian, The Memo, Bloomberg (complete with weird sci-fi photoshoot), Business Insider, Techcrunch again, plus a bunch more. It's important to note that we had zero real customers at this stage. Just two dozen internal test prepaid cards, a very basic iOS app and a lot of storytelling.

I spoke to Kiki recently (now the Director Of Communications at Monzo) about a conversation we had at the time. “I remember you turning up to my office when I was at the Sunday Times, signing me up with a Monzo account and telling me all about your plans to grow the business (and deep fry your Christmas turkey that year!)

You invested in forging relationships with the press and that paid dividends for you and Monzo. You were never too important to pick up the phone and explain simple stuff or go for a coffee with a journalist. Something many start-up founders don't do because they think it's all about finding angles and firing out press releases.”

PR is not a strategy that works for all early stage startups. I've been thinking a little about how it worked so well for Monzo in 2015 and 2016. Timing and context were important - the UK press was getting interested in startups (the Social Network movie honestly felt like a tipping point), but there weren't actually that many successful startups to write about in the UK in 2015. I had started another startup previously, and Eileen, our first investor, was very well known in the tech press, so I guess journalists were interested in covering us.

Probably more importantly, it seemed like we were embarking on a bold, ambitious project - to build a new bank from scratch - and we felt like underdogs in the way that the British press loves. So we got a lot of press, and I was the very visible figurehead. I'm pretty sure all that press was the reason for the hype and user signups we got by the end of 2015 - we didn't have a product live with users, nor did we really have any other meaningful marketing activity that year.

Looking back, I'm not sure how I feel about it. At the start, it was exciting to see my face in newspapers and it felt good when my friends and family told me that they'd seen me in an article or on TV. I guess I felt important, and it seemed to drive user signups. It was also a Faustian bargain. When we became a national brand name 4 years later, we were no longer the underdog - we were a big bank that the press could criticise.

I'm also not sure it was great for my relationship with my cofounders - we had 5 cofounders at the start, but it was often just my face in the picture. It was impractical to interview or photograph 5 people. They were busy working. Or at least that's what I told myself.

---

"Is it a bit early to hire a Head of Marketing?" - conversation with Eileen in June 2015, four months into the life of the company. Throughout June, July and August 2015 we were interviewing marketing candidates.

Although the hiring process was slow and frustrating, we learned a lot. We wanted to assess the paid social media ad skills of one candidate, so we had him set up and run 4 small Facebook campaigns. The first three were focussed on product benefits - "Here's a card that has no FX fees", "Turn off your overdraft", "Instant notifications". They all performed fine. But the fourth campaign outperformed the others by almost 300% - "Help us build a bank you'd be proud to call your own". This was to become a core part of our marketing over the next couple of years.

I eventually interviewed about 10 or 15 candidates, finally picking a woman who had decades of experience at a very large tech company and a UK media company. We hired her as a CMO. Looking back on my notes, all our conversations were about picking the right agency to run PR and another agency to run our paid social campaigns. She was used to running teams that were bigger than the entire headcount of the company at the time. I think she lasted less than 4 months.

At the same time, we interviewed and hired a young guy called Tristan as a community manager - he was in his early twenties, he'd graduated in Economics and spent the previous year in Egypt working with a local startup, where he'd picked up Arabic. He'd taught himself web development as a young teenager, and seemed to be extremely hands-on and impact-focussed.

Looking back, I think I would have counselled myself to think about what we wanted this person to do for the next ~12 months or so. If you hire a big-name CMO from a large, international brand, they are going to naturally assume there's a budget to spend on agencies and a marketing team. Even if they talk about being "hands-on" and "scrappy", that's probably only true relative to their previous work. For the first 12 months, what we really wanted was someone to write blog posts, respond to social media and edit the copy for our app and website. Tristan was perfect for us because he was representative of our customer base. Young, cosmopolitan lifestyle, socially conscious. He had never employed a marketing agency or really hired anyone at all, so it just didn't really occur to him to do that stuff. It was just obvious to him that he should write our Twitter posts himself.

We made another Head of Marketing hire later in 2016 who also didn't work out, and from that point onwards Tristan was put in charge of all marketing at Monzo.

---

Before talking about the launch of the product - the Alpha and then Beta programmes, I want to touch on a couple of things that didn't work.

First, we repeatedly thought about trying to pitch a TV production company to make a fly-on-the-wall documentary about Monzo in the early days. I still think that this might have been a great marketing idea to propel the brand onto a national stage (although may have made the eventual press backlash even harsher), but we just never followed through on it. Maybe it was just a vanity project!

We spent more time on a second idea - hackathons and developer relations. A lot of the early team (including me) were software developers and we were really excited about the idea of a bank account with an API. We ran 3 or 4 hackathons early on (even before we had live prepaid cards) and folks came up with a handful of interesting ideas, but we realised pretty quickly that this wasn't going to be a big growth mechanic. We only got 300 extra users, but it definitely helped hire several early engineers.

---

We finally got the "Alpha" prepaid debit card programme live to the public by November 2015 - it was a chance for people to get a card, try out the app and give us feedback to help improve the product. We capped the number of customers at 3000 because I think that was the limit for Testflight. There wasn't even a public release of the app you could download from the App Store.

What was the rationale here? The product wasn't even nearly "complete" - the list of things that were missing before you could call it a full bank account spanned several pages. Customers had to come to an event at our office to pick up the card because we hadn't yet built the functionality to collect customers’ postal addresses or post out cards. As a consequence, I met all 3000 of these users face-to-face - many of them would turn up to company events for the next 6 years and greet me with a smile.

Even though the app wasn't polished, exclusivity & scarcity was a big part of the strategy early on (drawing on early Gmail launch tactics). I read somewhere that human brains are basically wired to seek out scarce resources and perceive them as more valuable than those that are abundant. Being "in the know" - the first amongst your peers to get access to some new product or service - is a badge of honour amongst early adopters, and we harnessed that. Even the physical cards had "Alpha" printed on them - people would brag years later how early they'd signed up to Monzo. For these people, finding a bug wasn't an annoyance - it was proof that they were experiencing something at the bleeding edge of development, and they were excited to help improve the product. So we ran with that.

This is the first archived version of our website I can find - "We’ve only got 3000 invites for our Alpha Preview. Sign up now to be in with a chance"

It turns out this strategy also works on tech journalists. The early preview accounts we gave to Techcrunch and Business Insider journalists led to great coverage.

This strategy also let us organise events at a number of London's top companies. We would promise to come along with 50 or 100 Monzo cards, give a 20 minute presentation during the lunch break, and enable attendees to skip the waiting list. This proved irresistible - I got into companies like Transferwise, McKinsey and the BBC. Much like the hackathons, it didn’t actually turn out to be a very effective way to sign up users, but it was an incredibly strong recruiting strategy. We'd get a flood of inbound CVs a week or two after each talk.

Looking back, it’s quite surprising how many major pieces of functionality were missing from the app. You couldn’t make bank transfers or pay bills, for example, because we didn’t yet have access to the payments infrastructure we needed. Instead, we obsessed over the tiny details that we could control - accurate merchant logos that represented your spending, rather than the cryptic data you normally find on bank statements. Jonas (one of our cofounders) first came up with the idea to add emojis to the push notification customers received to alert them about spending. Plane tickets might show 🛫, while spend at a coffee shop would show ☕. I have so many notes from that first year about improving the logos - I even wrote some of the early code to put the right emojis onto transactions. We really cared about making it a delightful experience.

Even before we'd opened up the product to the full waitlist, we decided to run a £1m crowdfunding campaign early in 2016. Again, we ran the "scarcity" and "exclusivity" playbooks. We anticipated the round would sell out, so we set up a pre-registration system so that our customers could invest before the general public, and we capped individual investment at £1000 to maximise the number of people who could invest. Along with owning shares in the company, investors would get "Investor" printed on their debit card (and this is still honoured to this day). Investors would also be able to skip the main queue and get access to a Monzo card if they didn't already have one.

The campaign turned out to be a huge PR coup, but mainly for reasons we had not anticipated. Approaching the launch date, we told our crowdfunding partner to expect larger than normal volumes of people looking to invest, as we already had 6500 pre registrations. For whatever reason, they did not take this warning very seriously, and their servers buckled under the load just seconds after the round opened on Monday. This was very annoying and stressful at the time, especially since 6500 simultaneous visitors is not a huge amount of load. We quickly decided we'd rebuild the investment registration page ourselves, and planned to relaunch the campaign a few days later.

While our engineers rebuilt the site, we thought about how to communicate this to the press and our customers. It was an absolute gift of a PR story - we had so much demand to invest that the crowdfunding site had crashed. This story ran continually over the next couple of days. By Thursday, the campaign relaunched and sold out in 96 seconds, making it the fastest crowdfunding in history, and the press attention was intense.

We ultimately raised £1m from 1861 investors, out of the 6500 people who had pre-registered. In comparison, we only had 3000 cardholders who up to that point had only spent £1m in total on our cards. I'm not sure how repeatable this lesson is - lots of companies have tried crowdfunding since, and it's no longer newsworthy. I think we had an incredible amount of hype at the time, and we played the scarcity/exclusivity angles well. It also helped that we already had 45,000 customers on a waitlist, and £5m investment committed from Passion Capital - this was an extra £1m investment that normal people could get access to on the same terms as a VC.

---

Soon after the crowdfunding completed, we announced a public Beta in March 2016, the Alpha having capped out at 3000 users (the Testflight limit). This was 13 months after the company was founded.

Anyone (as long as they were an iOS user) could download the Monzo app and see their place in the queue. People could improve their place in the queue by inviting friends to join and a certain number of people at the top of the queue every week would have a card sent out. In the spirit of “doing things that don’t scale”, we figured out a basic system for collecting addresses in the app and posting cards directly from our office. When we had a particularly big week of signups, the whole team would have to stop their regular work to help stuff all the prepaid cards into envelopes to catch the last post. I vividly remember stuffing envelopes at the time, thinking “each of these cards is another person who wants to use our product”. It really felt like customers were signing up faster than we could ship out cards - one of the first indications that we had “product-market fit”. It seemed like we were on the verge of something huge.

I think there are a couple of interesting things worth mentioning in 2016 - both related to company values. The first is our name-change. We had been threatened with a trademark lawsuit from a German fintech company which had a similar brand name (we were "Mondo" at the time) and considerably more funding than us. I fought this for several months (against the counsel of my board and investors), before accepting we had to change our name. To make the most of a bad situation, we decided we'd ask our community members - our customers - to suggest new names. The only constraint was that it had to begin with "M" because we had recently designed a great new logo that we didn't want to give up. Incredibly, bearing in mind we only had around 20,000 customers at the time, we received 12,000 suggestions in about two weeks. 6 people suggested the name we chose - Matt from Bristol had studied a rock called "Monzonite" and another customer, Ashley, told us it was slang for money when he was a kid in Scotland. We hosted a big party and live-streamed the announcement of the new name - Monzo.

Predictably, our power-users overwhelmingly hated it, suggesting it sounded too much like "gonzo" (a form of first-person journalism and, later, pornography). It took a little while to stick, but I like it - it sounds much more dynamic and active than "Mondo", which now feels quite staid to me.

The second was our transparent Product Roadmap. In a world where the big banks had huge head offices and enormous marketing budgets, but very little personal trust, we wanted to come across as different. Where big banks were faceless and corporate, we would be human and personal. Where they were impenetrable and secretive, we would be transparent and approachable. So, in May 2016, we announced we'd publish the plans for our product, and take input from our community. In other situations, when things went wrong, we'd proactively tell our users about it and explain what we were doing to fix the situation. Invariably, this transparency generated more customer goodwill and positive PR.

These two core values - Community and Transparency - permeated almost everything we did throughout the life of the company. They became a fundamental part of our brand. Prior to Monzo, I didn’t really believe in the concept of “brand” - I thought it was a made-up thing that marketing agencies tried to sell you. And that “brand” didn’t really extend beyond a company’s name and logo. I now believe it can be a superpower for any company - and particularly consumer-facing businesses.

There’s been good stuff written about brand-building elsewhere, so I won’t try to recreate it all - I’ll offer just a handful of thoughts. A great brand is like a promise you make to your customers. It’s a shared set of beliefs, or the “why” behind the company. Building your brand is not a one-off thing; you build (or damage) your brand with every decision you make. Events like crowdfunding and the company rename were perfect examples to reinforce the brand. It has to be authentic - a lot of big banks’ marketing towards younger customers felt really painful. Monzo, in contrast, felt human and relatable.

And when a brand really resonates with a customer, it becomes an extension of their identity. I wear Patagonia. I drive a Tesla. I use an iPhone. I bank with Monzo. I think a lot of customers were proud to pull out their Monzo card and feel like they were part of something.

In the UK, at least, Monzo has become a verb.

---

We grew from about 3,000 users at the start of 2016 to 70,000 by year-end, which seemed pretty good, but I think we realised in the summer of 2016 that our strategies so far weren't going to scale to drive the kind of continued growth we ultimately needed. So, towards the end of the year we really started to think about product features with network effects, and referral mechanics. Pretty quickly, this became "Monzo with Friends" - we aimed to build a product that worked better and better as more of your friends joined. We started working on ideas, but nothing really launched until early 2017, so I'll talk about this more in the next section.

Before that though, here are two things that failed in 2016. First was the idea of "Campus Insiders" - university students that we employed to represent the Monzo brand and sign up new customers. They required a lot of babysitting and delivered no measurable impact, as far as I can tell. One of our early ideas was to have a custom Monzo card for each university - similar to how we had "Alpha" and "Beta" subtly printed on the corner of the card. Students might get Monzo "Oxford" or Monzo "Birmingham" if they signed up with a student email address. This could have maybe extended into discounts at local shops, but it seemed like too much work and we never followed through with it.

The second was a campaign to work with local businesses in the Old Street area of London in the run up to Christmas. I think we had folks out flyering and offering discounts in local shops, but again it was a lot of manual work with no discernible impact.

---

2017 was the year of product-driven growth. We had a slide in several of our early investor presentations that said "Viral mechanics will get us to the first million customers", but investors overwhelmingly didn't believe it. We set out to prove them wrong.

I'll make a distinction between two related ideas - viral mechanics and network effects. A "viral mechanic" normally uses the existing customer base to spread the product to friends. It’s sometimes called "member-get-member", and it can be incentivised or free. An example is the way Wordle allowed you to post your "score" to social media. Other people see it and sign up for Wordle themselves. The game isn't really improved in any way by having your friends join - they're just curious to check it out. Gmail used a viral waitlist + invitation mechanic in the early days - again, your experience of Gmail wasn't really improved if you convinced your friends to switch from Outlook.

A network effect is different - the product itself actually improves as more of your network joins. Whatsapp and Skype are great examples. The more of your friends who join, the more people you can communicate with for free. That was a big hook at a time when people paid for SMS and international phone calls.

Great products have both network effects and viral mechanics. Facebook's early photo tagging is an example. "You've been tagged in a photo" email - prompts you to sign up for Facebook, see the photos you're in, upload your own photos, tag more friends, repeat. The network gets more valuable and drives more growth as more users join.

At Monzo we had both of these, and 2017 was the year they really took off.

I'll talk about "Golden Tickets" first - a silly allusion to the Willy Wonka story. We had a pretty big waiting list at this point, but the "Invite friends to get bumped up the queue" felt a little old and ineffective. People who wanted an account enough would just create a bunch of throwaway email addresses. We figured that the best people to be making referrals were those who were already actively using the product. Presumably they liked it enough because they kept using it, and they'd all had the experience of having to wait in the queue, so they perceived a Monzo account to be both scarce and valuable.

Rather than paying our users to refer friends like most apps did, we decided that once you'd used the account for about two weeks, we'd send you a single "Golden Ticket". This was a one-time-use invitation that you could send to one friend to enable them to skip the queue entirely and get a Monzo account straight away. You can think about the psychology by analogy - you've queued all afternoon to attend a cool new event in your city, you’ve just managed to get in the door, and you've been able to talk the bouncer into getting your friend a queue-jump ticket. You get the early-adopter social credibility of having known about the event before your friends, plus you’ve done your friend a favour by getting them access. It just worked incredibly well - about 40% of our signups in 2017 came from Golden Tickets, and it cost us nothing.

Second, "Monzo with friends" was our drive to make Monzo work better if you invited your friends to use it. This might sound obvious now, but I can't really think of any other bank that had previously done this, beyond suggesting you get a joint account with your spouse. If you used Barclays and your friends used Natwest, there was no change in how useful the account was, right? We wanted to change that.

We started with peer-to-peer payments, based on the contact-list of your mobile phone. For US audiences, this was Venmo, but inside your bank account. UK banks already allowed you to pay any other UK account holder instantly, for free, but you needed to know their account number and sort-code, and the interface was really clunky. It basically worked, but it wasn't a delightful experience. We asked people to share their phone contact lists (using some clever encryption so that we'd never actually saw your friends' mobile phone numbers), and then allowed you to pay your friends on Monzo with just a couple of taps. For contacts who weren't on Monzo, that's where Golden Tickets came in! It was a really slick interface, and we allowed you to include longer-than-normal messages with the payment, including emoji. Later that year, we added "Reactions" - if you'd received money from a friend, you could send a quick response - just a single emoji. This was just a quick way of saying "thanks, payment received". And we let people quickly upload profile pictures to make it feel more personal.

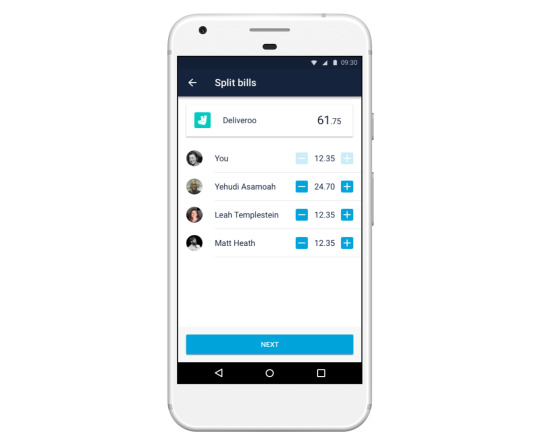

We then added "Split the bill" functionality for a single payment, plus a more general "Request money" feature, and finally more complex "Shared Tabs" for multi-day trips away with friends and family that might include dividing several payments. If your friends weren't on Monzo, you could still request money with your personal Monzo.me link, which would allow folks to pay you using another bank card or Apple/Google Pay (and Monzo covered the transaction fees), and included a little upsell for Monzo at the end. Mine is https://monzo.me/tomblomfield. If you clicked on this link with a Monzo app installed, it would just deep-link straight into the Monzo account with all the payment information pre-populated.

Alternatively, if you went for dinner or drinks and wanted to split a bill with someone who already had Monzo, but who wasn’t in your phone’s contact list, you could securely broadcast your account details by bluetooth, so you could pay each other without having to type in any account information. It's an incredibly slick experience that I am proud of to this day.

Peer-to-peer payments drove massive adoption - time and time again we saw Monzo take hold in a new group of friends and then quickly spread to the entire group. At the start of 2017, only 5% of our users had 10 or more friends on Monzo. By the end of 2017, more than 40% of our users had 10+ friends on Monzo. Today, the average Monzo user has more than 100 friends on Monzo. This is network effect in full force.

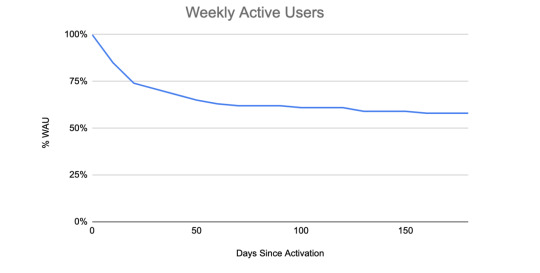

2017 was also the year that we really got a handle on our metrics - particularly retention. There are much more complete retention guides out there, but I'll give a quick summary here. Say 100 users sign up for Monzo, complete KYC, register a card and load money into the account. That's the denominator - 100 funded accounts. Fast forward say three months - how many are still using the account? Maybe 60? That's the numerator. So we have 60% (60/100) retention at Month 3 (or day 90). You can draw a curve to show how quickly retention falls off day by day since signup.

What does "still using the account" actually mean? We decided to count "at least one financial transaction in the 7 days" would make you a Weekly Active User (WAU). "At least one financial transaction in the preceding 30 days" would make you a Monthly Active User (MAU). Clearly, a WAU was more engaged than a MAU. I dug out our stats for 2017 - about 60% of our signups were WAU on day 90.

These retention rates still strike me as surprisingly high, especially considering that every user had to proactively add money to the account every time they ran low on funds. This wasn't (yet) a bank account where you sort of "defaulted" into retention once a customer set up the account - users could not deposit their salary into the account until 2018, and there was no auto-top up functionality.

Monzo started 2017 on 70k users and ended the year on around 650k - averaging just under 5% compounding weekly growth for 52 weeks of the year.

So why did it grow organically and retain so well? First of all, I think the day-to-day product experience (for all its functional limitations) was world-class - it was a delight to use, especially compared to the clunky old banking apps in the market. Without that, basically nothing else would have mattered. The customer service was also exceptional - this was often mentioned in our NPS surveys (NPS was around +70 at the time).

Secondly, I think the brand we had started to build really resonated with people. Our mission and values (mainly transparency and community) seemed to strike a chord with customers. Even the card itself was visibly different to traditional banks. The Monzo card was "hot coral" (aka bright pink) - the colour alone often started a conversation when customers pulled it out of their wallets to pay. Our tone of voice was youthful, direct and extremely personal. By 2019, Monzo was the single most recommended brand in the UK.

And third, the network effect really started to kick in - if you had 3+ friends on Monzo when you joined, you had a 70% chance of being a WAU by day 90, versus only a 50% chance if you didn't have any friends on the platform.

As a result of these things, Monzo hit 1 million customers in September 2018, without having spent any significant money on marketing.

---

This feels like a good place to draw this chapter of a story to a close. There are other topics I’d like to write about - getting a full UK banking licence, fixing unit economics, and spending money on paid advertising to catapult the bank from 1m to 4m customers - but they will have to wait for another time.

7 notes

·

View notes

Text

GNR concert - 1st July 2022, London (UK)

Not sure if anyone is still interested in reading this, much less commenting or sharing it, but this is basically the whole story about this post. I needed to diggest everything first and have a day’s rest (my blisters are killing me) before writing it all down. I have some pictures and videos too, not sure if I will post those though.

The whole story can be found below.

Here is the whole saga about what happened to me (and also to others who were with me) during the GNR concert at the Tottenham Hotspur Stadium in London, UK.

The whole organisation was a mess from the beginning. At first, I was promised that my ticket would be sent out by post up to 5 days prior to the concert, which mind you is only sent out via ordinary post and not registered, was changed to a print-at-home ticket. I contacted Ticketmaster and was told to wait 48 hours before the concert and even after that, I still didn’t have my ticket. I contacted Ticketmaster again, and I was sold another story by them telling me that I wasn’t the cardholder of the person who purchased the ticket and therefore, they couldn’t give me any information regarding my ticket because according to their system it was Guns N’ Roses who was the cardholder who paid for the ticket!! It took my brain like half-minute to process this and then, a maniacal laugh escaped me while I wrote a reply to Ticketmaster by sending them a screenshot of the purchase from my bank account. This was so freaking ridiculous, I wished GNR had paid for my ticket though, it would have saved me a lot of troubles and worries, although I would have still sent them a message saying ‘hey remember your concert on July 1st in London? Well, it kind of sucked and I’m sorry you paid for my ticket and that is why I would like to refund you for it’.

Nevertheless, after like 20-30 emails (or more) back and forth (because there is no phone number to contact Ticketmaster and their online chat seems only to work on some occasions) I received my ticket directly to my email on Thursday, 30th, 2022 at 2 pm! I totally understand that last-minute changes can happen, especially when the concert provider comes to them with changes, and that probably nobody is really at fault for this, but sending out tickets so late doesn’t give people time to organise their journey to and from the venue, or accommodation if they fly in from another country only for the concert!

And to finish off the ticket saga, Ticketmaster even wrote my last name on it wrong, which made it difficult for the staff on-site to find my booking and verify that I had the ultimate package. This reminds me, on my ticket, it also said “Gold Circle Pitch Standing Entrance 8 or 10”, and I bought the Ultimate Golden VIP Package! I was about an hour late to the stage tour because I was kept sending to the wrong entrance and if it wasn’t for me being a stubborn b*tch, I wouldn’t have gotten to the right entrance and the group I was supposed to be with! The staff at the stadium was extremely nice and try their best, bless them ❤️!! I know it is no easy job, I used to assist in events too and understand the hard work, stress, and pressure it comes with and they were so so patient too! They are not at fault for not being informed on time and properly. I even offered to help them solve the issue since I do a lot of event planning too, especially complex ones with many different time zones and I’m thankful for the staff there.

But once I was at the right place and with the group and our guide (Matt), I realised that it was Friday, 1st July 2022, and the GNR concert is finally happening – after over two years of waiting and of build-up excitement it finally was becoming real!! Or so I thought.

We had some lunch mostly consisting of some appetizers, two dessert options, and some alcohol (mostly cheap beer and wine). This was supposed to be like an hour and half and afterward, we would make our way to our seats or the pit – the ticket included to be in the pit or seat where the coaches sit during the football matches, we could use both, but of course I chose going and staying in the pit. However, this was delayed due to an issue with the power supply (at least, that is what we were told it was) and they didn’t communicate this to us until like 20 minutes before the issue was resolved. Basically, our entrance to the stage was delayed from 3.30pm to around 5.15pm, which then, of course, this delay caused the whole scheduled program to be delayed too. Even Matt, our guide, didn’t know what the issue was until we told him. He tried to find out via radio and mind you he had an all-access GNR badge and wasn’t informed about what the issue was.

There were supposed to be two opening acts – one by Gary Clark Jr and the other by Michael Monroe. The first one happened and I would even go as far as saying that they were better than GNR, and as for Michael Monroe that one was cancelled in order to hopefully catch up with the agenda. Moreover, there was supposed to be an intro before Knockin’ on Heaven’s Door by Alice Cooper!! This, of course, didn’t happen either and despite me not being a big fan of his, I would have loved to see him do the intro. Carrie Underwood came on stage twice and I didn’t remember who she was until I googled her and remember that I heard two songs of her in my life, Champion (ft. Ludacris) and Two Black Cadillacs.

In terms of the sound quality, it always fluctuated from good to poor, and then, from poor to good. Axl even stopped the show during Estranged because people at the back kept yelling they couldn’t hear the band (mostly people starting from the golden pit circle onward). The end result was that we got the shortest setlist in the history of a rock concert…

This was what we were supposed to get:

The intro would be the two opening acts.

I have to say that Axl (and Carrie Underwood) seemed to be the most enthusiastic of all of them to be there and perform. I can understand the guys have been doing this for decades and don’t really have to do much, but it was like the rest of them were physically there but they weren’t with their hearts there. It is also sad Izzy and Steven weren’t there either, so I only got like 50% of GNR experience… After they finished Paradise City and they left, we the VIPs went to the afterparty (without the group of course) which consisted of some good/expensive free alcohol finally (not that I’m a big fan of alcohol), but as a VIP you do expect to receive some higher service. I only had one drink and left because I didn’t want to be in one room with so many people who were overly drunk already and it would take me over two hours to get home too.

If we put the issue with the power supply aside, for which I know nobody can be at fault as these things can happen last-minute (and even blaming people doesn’t help anyone) and take into consideration the issue with the ticket and the concert overall, I must say I do feel disappointed…

I paid almost £1’000 for a ticket that yes, it had some few fancy merchandising, a short tour around the stage, and some acceptable food (which wasn’t really necessary or could have had a better selection, especially more vegetarian and vegan options), and a Q&A session from a GNR crew member who has been with them from the beginning. Yet, for that amount of money, I do expect to meet some of the GNR members or at least, get an autograph, and I got neither of those (I would have loved for them to sign me dress shirt). You could now argue that this was communicated from the beginning (that no band member would be there), but since the schedule was changed last minute, then this could have been include as well? Or at least do NOT sell tickets for such a high price. I’m really trying to be understanding and considering all perspectives here, and I don’t want to point with my finger on anybody, but a VIP experience in 9 out of 10 cases includes a Meet & Greet with the band or some of the members in question. I don’t know if people organising these events ever ask themselves to which extremes people have to go to get that kind of money together (and especially knowing that such tickets are not available for long). Some of us had to take on three jobs and do over dozens and dozens of extra shifts and even so, I will feel the consequences of this in the coming few months, but I said to myself it would be okay it would be worth it, because it is a GNR concert, or that is what I thought. All of this made the concert, okay, but I certainly didn’t get my money’s worth. Overall, I do not care about the money, but I would have loved to have a more extraordinary experience…

#guns n roses#guns n roses concert#guns n’ roses#london#london concert#carrie underwood#gnr#gnr 2022#gnr tour 2022#gnr concert

2 notes

·

View notes

Text

Cash Against Credit Card in Tiruppur

Instant Cash on credit card Starts @2.5 %

Cash On Credit Card in Tiruppur

Credit Card Swipe for Cash in Tiruppur. Swipe Credit Card for Cash, Instant Cash on Credit Card in Tiruppur +91-72999-27000, and throughout India. The Best Services for spot cash on Credit card within a min. No Background verification, You just make a call enough. We provide cash on Credit card. If when you need immediate cash and you don’t have an Urgent or emergency fund get money from us. Easy step for the Instant cash for a Credit Card through Online. Credit Card cash Withdrawal Charges are based on your Transactions.

Get Cash Against Credit Card in Tiruppur

Credit Card to Cash in Tiruppur

How Can I Apply for a Cash Against Credit card in Tiruppur?

You are qualified to get an advance against your Credit Card in the event that you satisfy the accompanying conditions: Normally, banks offer an advance against Credit Card for both existing and new clients. Notwithstanding, banks like HDFC offer it for existing HDFC Credit Cardholders as it were. Having a Credit Card account is an unquestionable requirement to get this advance.Credit Card to Cash in Tiruppur.

Swipe Credit Card for Cash Tiruppur

What are the documents required to Apply for a Cash Against Credit Card in Tiruppur?

Any of your Address Proof-Like: AADHAR Card, Driving License, Ration Card, Voter ID, Passport.

Bank documents and Bank PassBook and your Credit Card.

Any Authority Signature If Needed.

Then, Easily you’ll Get Cash from Credit Card in Tiruppur.

Spot Credit Card To Cash in Tiruppur

Can I Available a Cash Against Credit Card in Tiruppur Which is more than My Card’s Credit Limit?

Benefit individual advances Online from Bank at appealing … Financing costs on such Credit is higher than home advance, vehicle advance or cash as there is a … The assessment models for endorsing such Cash incorporate pay level,

Credit Card … can pick when you wish to reimburse your Credit Card sum and lessens pressure …

Get Cash On Credit Card Swipe in Tiruppur @ Our Office

Cash from Credit Card in Tiruppur

Call to us: +91 72999 27000 and Get a Payment Link to pay through the link or visit our office to Get Instantly Cash from Credit Card.

Cash Against Credit Card in TiruppurSecure Payment Method

After Getting a payment link, you can pay securely through the link, OTP has been sent to your personal number and then finish the transaction successfully or Swipe Credit Card to Get Cash from Credit Card instantly.

Money From Credit Card in TiruppurGet Instant Cash

After Getting a payment to our Account, After Verification We will Transfer your cash to your Bank Account instantly.

Transferring money from credit card to bank account?

Yes, Of Course, you can transfer money from your credit card to your debit card. You cant able to do the direct transfer from credit card to bank method.

But you can get money over a credit card swipe for cash in Tiruppur. It’s very simple that you need to swipe your card and get funds in your debit account. credit card swipe for cash in Tiruppur

Withdrawing cash from credit card

Yes, People can withdraw money from credit cards. Nowadays credit cards are not only used for shopping, paying bills but you can even withdraw money. During an emergency, you can swipe your credit card and get spot cash. No need to go for Cash. The interest rate on cash withdrawal from a credit card is Starting at @2.5%. Interest on cash withdrawal from a credit cards is also the same interest.

Which Credit Card is Best for Cash Withdrawals?

Indian people have many types of credit like Amex, Dinners club, visa, Master, and Maestro card. We would suggest a visa, Master, and Maestro card because always pay a very less percentage. So India’s best credit card to cash for Visa, Master, Rupay, and maestro cards are beneficial.

Cash On Credit Card in Tiruppur

Cash On Credit Card in Tiruppur – We have been running this cash against credit card business for more than 8 years.

We are trustworthy and transparent to all our customers. We have more than 10000 customers across India. We always support your financial needs so that we work all day in the year.

Cash On Credit Card in Tiruppur - Near me

Credit Card swipe for Cash Near me in Tiruppur. Our head office is in Tiruppur. We provide cash-on-credit card services throughout Tiruppur. We are in this industry only to support the people for their needs.

0 notes

Text

You paid down your credit card balances during the pandemic. Now what?

Meanwhile, many people who worked from home were spending much less on clothing, travel, and entertainment, and used that excess money to pay off credit card balances.

Overall, consumers slashed nearly $ 160 billion in credit card debt during the pandemic, about 15 percent less than in early 2020.

Will it go on like this?

Hopefully. There are many advantages to using a credit card: a month’s delay between purchase and payment; less need to carry cash; a proper record of your expenses; Reward points; and, in the event that an item you purchased is found to be defective, a refund option.

What’s not to love about credit cards?

On the one hand, it is frighteningly high costs when carrying a scale.

Here are some things to think about when considering a post-pandemic relationship with your credit cards:

Q. I have paid some credit card balances in the past 15 months. Should I close accounts that I think I won’t use again, or will it damage my creditworthiness?

A. Yes, it probably hurts your creditworthiness, at least a little. Closing a credit card lowers your credit limit and increases your credit utilization. And a high credit utilization lowers your credit rating. A simple example: You have two credit cards, each with a $ 1,000 credit limit, and you currently owe $ 500. With both accounts open, your credit limit is $ 2,000 and your credit utilization (the amount of credit you have used) is 25 percent. If you close one of the accounts, your credit limit will be $ 1,000 and your credit utilization will be 50 percent. Still, credit utilization is just one of several factors considered, including payment history, credit history, and credit types.

Q. What is the main disadvantage of using a credit card?

A. Interest rates. The average is over 18 percent. With an unpaid balance of $ 1,000, the monthly interest cost is approximately $ 15.

But the average consumer balance is around $ 8,000, and the interest on that amount of debt is around $ 120 per month. That’s nearly $ 1,500 a year. What exactly are you paying for? Bank profits, really.

Even those with near-perfect credit scores are typically charged more than 15 percent interest (and nearly 25 percent on cash advances) on credit cards.

You can find many websites that offer credit card comparisons by typing “shopping for a low-interest credit card” into your browser.

Q. But I thought the interest rates were at historically low levels?

A. They are. The average interest rate on a 30-year fixed-rate mortgage is around 3 percent. At that rate, an unpaid $ 8,000 balance would cost about $ 20 per month. Compare that to the $ 120 you would pay for the same balance at 18 percent interest.

Car loans are also around 3 percent. Why the price difference? Credit card debt is “unsecured,” which means that the lender has nothing to confiscate if payments are suspended. In contrast, mortgages are secured by real estate (and seized in foreclosure) and car loans are secured by car (and seized by seizure).

Some credit cards now charge up to 36 percent interest.

Q. Can’t the state limit interest rates?

A. Yes, Massachusetts law generally limits annual credit card interest rates to 18 percent, but this only applies to credit cards issued by banks within the state. If you have a credit card with a national bank in another country that allows higher interest rates, you may be charged the higher interest rate. Make sure you know the location of the bank that issued your credit card.

Q. What if I only pay the “Minimum Payment” due?

A. At first glance, it might seem like credit card companies are doing us a favor by setting very low minimum payments. However, this builds up consumer credit to the advantage of the banks.

Most charge a fixed amount – often $ 25 – or a percentage of the balance (some up to 2 percent), whichever is greater. Making these small payments on time will avoid late fees, which can be as high as $ 40, but you won’t make any real progress in paying your balance as part of that minimum payment is used to pay interest.

Q. How long does it take to settle a debt by paying the minimum amount?

A. Federal law requires credit card companies to include a “minimum payment warning” on monthly statements. Look for it. My credit card company warned in a recent statement that it would take me more than 10 years to pay the minimum due of $ 25 per month to pay off a balance of $ 1,900, and that it would be more than $ 1,600. Dollars in interest.

Q. Is there interest on debit cards?

A. No, debit cards are like cash: the payment is immediately deducted from your checking account. You get the convenience of shopping cashless but without interest costs. One downside is that you may not have the right to dispute problematic purchases.

Q. How can I lower my credit card interest rate?

A. You can negotiate with your card company by letting them know that you are ready to transfer your balance to a competitor at a lower price. Card companies often offer interest-free credit transfers – some with a maturity of up to 18 months – that you can use to pay off a balance without interest.

F. Sounds good. Any downsides?

A. Yes, lower prices, known as “teasers,” are for a limited time. After the teaser period has expired, a higher interest rate will be charged on the remaining credit. So it is best to calculate how much you will have to pay each month to get rid of the balance before the zero interest rate expires. In addition, card companies usually charge a “transfer fee” of 3 to 5 percent of the transferred balance.

Q. How can I protect myself from fraudulent use of my credit card?

A. Some companies allow cardholders to opt for real-time notifications when the card is in use. If you find out about a purchase that hasn’t been made, there’s a quick way to cancel the card.

Have a problem? Send your consumer problem to [email protected]. Follow him on Twitter @spmurphyboston.

source https://www.cassh24sg.com/2021/06/27/you-paid-down-your-credit-card-balances-during-the-pandemic-now-what/

0 notes

Text

Discovered a chargeback today on my website for an order which was already delivered. It’s incredibly frustrating especially for a small business entering into the holiday season. A chargeback means the money is removed instantly from my bank account. This money is given back to the person immediately and even if I win, I must wait 60-120 days. If there hadn’t been enough money in my bank account to cover it, I’d have faced fines and penalties from my bank. It means I also am charged a $20 fine from Shopify. In addition, I’m still out the cost of the shipping label and Shopify fees associated with the order. Too many chargebacks could result in my shop being closed. This order was for ~$100 which isn’t a big deal for me at this point in my life, but for some it could mean the difference between paying rent or being evicted. Or going hungry for the month. In addition, I must spend valuable time and energy to gather evidence against this customer and present it. Time and energy that could have been spent making new creations, communicating with current customers, sleeping, or pretty much any other productive task.

So from an online seller to potential customers. Please.

- Read what you are buying and read all the store policies to avoid any confusion later down the line. For example, If they don’t accept refunds and you have buyer’s remorse, a chargeback is not the appropriate solution. Don’t make a purchase if you don’t agree to the terms and conditions.

- Save receipt emails. If you don’t recognize an item on your bank statement, try to match the $ amount with recent purchases with a receipt. Or call the bank and ask for more information on the transaction. If you have given your card to anyone else to use, ask them if they made the charge.

- If a friend or family member placed an order without your consent because you gave them access to your card, please think twice before doing a chargeback. Legally, you are protected from any unauthorized use of your card, even if it was a friend or family member, even your minor child. Morally if you wouldn’t be willing to call the police and report your friend or family member to face legal consequences, then you probably shouldn’t expect a seller to be responsible either. Try to work things out between yourself and the friend/family member or try to contact the seller directly and explain the situation. Offer to return any goods that are sent to you.

- TALK TO THE SELLER before initiating a chargeback. Even if there is a billing error or issue with your order, they’ll likely be happy to fix any issues vs. a chargeback. Please don’t jump to any conclusions until you speak to them. If they are being rude or unwilling to help, by all means, contact your bank. But please give us a chance to make things right.

- Understand the consequences of a chargeback for you. For example, the seller may no longer be willing to do business with you. I refuse to sell to anyone who has done a chargeback in the past and I will ban them on social media if I can. It isn’t worth the risk for me to do business with them again. I’m not the only one either, even large companies like Sony will ban you from their services. Then there is the chance you could lose. Yes, even people who legitimately were the victims of fraud can lose a case. You’ll be required to pay all the money you received back again. Even if you spent it all. If a bank decides you were attempting to commit fraud, you may even face a lawsuit or loss of your credit card and banking privileges with that company. While it is difficult and costly, and therefore unlikely, a merchant can also choose to sue you to recover the goods if you kept them or force you to pay for the goods.

And from me to other sellers. Protect yourselves.

- Track all orders. A common scam is to say an item wasn’t received when it was. Tracking will show otherwise. Require signature confirmation on expensive orders.

- Keep all records for purchases. Don’t throw them away after a few weeks as customers can have a window of 60-120 days to dispute.

- Insure any items you can’t afford to have damaged in transport.

- Don’t accept an address change via email on large order if you can’t afford the loss. Cancel the order and ask them to place a new one with the correct address as in many cases you will be required to ship to the original address in order to keep your protections as a seller. An email asking for change of address may not be proof enough if the customer is trying to scam you.

- Take advantage of fraud protection tools. Shopify shows me, for example, that the billing address matches the shipping address. That the CVV was correct. That there was only 1 payment attempt with 1 credit card, that the location of the IP address is local to the customer, and it even gives me their IP address. These are all things I can use to help me prove that the cardholder is the one who placed this order.

- Provide good customer service and be willing to work with your customers. I’m not suggesting you violate your policies or harm your business to please your customers, but if there is a billing issue or you sent the wrong item, resolving it quickly can help avoid a chargeback.

So that’s my very long PSA of the day. As for me, I am annoyed and frustrated, but sadly no stranger to chargebacks. And, given the amount of evidence I have, I’m confident that in 60-120 days I will have the money returned to me and I will take my boyfriend out to sushi and we will have a good laugh.

162 notes

·

View notes

Text

How to Use Florida EBT Online at Walmart

This post is about how to use Florida EBT online at Walmart to shop for groceries for pickup and delivery. If you are a Florida EBT cardholder and are wondering how to use your SNAP card to shop online at Walmart, we are here to help.

Florida SNAP EBT recipients can now use their food stamp benefits to purchase eligible groceries online at Walmart.

In this post, we are going to provide you with a step-by-step guide on how to shop online and pay with SNAP EBT for Walmart groceries.

To learn about how to shop online on Amazon using Florida EBT, click here.

We will also cover:

EBT Online Purchasing Pilot Program

Walmart EBT Online Purchase Program for Florida

How to Use Florida EBT Online at Walmart

Florida EBT Card FAQs

EBT Online Purchasing Pilot Program

In 2017, the United States Department of Agriculture (USDA) announced a pilot program for online EBT purchases. The program allows EBT Cardholders to purchase groceries online for delivery or pick-up.

When the USDA initially set up the pilot program, the following states were approved for the program:

New York

New Jersey

Alabama

Iowa

Oregon

Washington

Nebraska

Maryland

In addition, the following grocery retailers were approved to work with the states above to launch the program:

Amazon

FreshDirect

Safeway

ShopRite

Hy-Vee, Inc.

Hart’s Local Grocers

Dash’s Market

EBT Online Pilot Rollout

New York state was the first to actually implement the program, starting in April 2019.

This was followed by Washington in January 2020.

In March 2020, the states of Alabama, Iowa, and Oregon launched their pilot programs.

On April 1, 2020, Nebraska joined the list.

As of April 2020, only two of the original pilot states (Maryland and New Jersey) are yet to implement their program.

Finally, on April 13, 2020, California, Arizona, Idaho, and Florida were approved by the USDA to join the pilot.

Here is a list of all the states that have implemented the only SNAP EBT grocery online program and the grocery stores they are working with.

State Merchant Name Alabama

Florida

Iowa

Nebraska

New York

Oregon

Washington Walmart, Amazon, and Wright’s Markets, Inc.

Amazon and Walmart

Walmart and Amazon

Amazon and Walmart

ShopRite, Walmart, and Amazon

Amazon and Walmart

Walmart and Amazon

Florida’s EBT Online Program

On April 14th, 2020, The Florida Department of Children and Families (DCF), the department in charge of the food stamps program announced it will begin a pilot program for SNAP recipients to purchase groceries online with the use of an EBT card.

SNAP participants in Florida are automatically eligible to participate in this program.

This means that Florida has been added to the pilot, and will join the states listed above in running a program that allows Florida EBT cardholders to buy groceries online for delivery.

The pilot program in Florida will begin with an initial launch on April 16, 2020.

Walmart EBT Online Purchase Program for Florida

If you have a Florida EBT card, you can now purchase groceries online from Walmart for Pickup.

You can only use your EBT card to buy eligible grocery items. In addition, you cannot use your food stamps dollars to pay for delivery.

How to Use Florida EBT Online at Walmart

Currently, Walmart only offers online grocery purchases with EBT for curbside pick-up and not for delivery. Delivery options will be added soon.

If you have a Florida EBT Card, you will now be able to use your cards to buy groceries and select curbside pick-up.

Here’s how it works:

Step 1 – Go to the Walmart Grocery website

The first step to purchasing groceries online at Walmart is to go to the Walmart Grocery website at www.grocery.walmart.com.

Step 2 – Find Walmart Store Near You

Next, enter your zip code to find the Walmart store location near you. This is the location you will pick-up your online grocery order from.

Step 3 – Shop for Groceries Online

Once you have selected your Walmart location, begin shopping for grocery items online by adding EBT eligible items to your shopping cart.

You will be asked to sign in to your Walmart Account or Create an Account once you place an item in your shopping cart.

Step 4 – Checkout and Choose Delivery Option

Once you sign into Walmart, you can continue shopping until you have selected all the grocery items you want.

Next, click the “Check out” button. There is a $30 minimum for Walmart online grocery shopping. You will not be able to proceed to checkout until you reach this limit.

Once you hit the check out button, you will be taken to a page where you can “Reserve a time” for pickup.

You will be provided available times when you can pick up your order. Select a pick-up time that is convenient for you, as shown in the image below.

Now it’s time to checkout and pick-up your order.

Follow the steps outlined below.

Step 5 – Checkout with your EBT Card

Next, you will be taken to the payment page where you will select “Pay with EBT at Pickup” option, as shown below.

Step 6 – Enter your Phone Number and Place Your Order

The final step is to enter your phone number, review your order to make sure everything looks good, then click on the “Place Order” button to complete your order as shown below.

Congratulations, you have successfully placed your online grocery order with Walmart. Continue reading for pick-up instructions.

Step 7 – Pick up and Pay with EBT Card

The final step in the process is to pick up your order and pay for it with your Florida EBT Card. You need to bring your EBT card with you when you pick up your order at the Walmart location you selected.

Be sure to follow the pick-up instructions included in the text or email instructions.

Designated Pick-up Locations

Some Walmart locations now have designated pickup locations, as shown above.

When you arrive at the pickup location, you will park in a reserved parking space marked in orange for Grocery Pickup customers.

Once in the spot, call the designated number to alerts an associate of your arrival.

You can also check-in through the Walmart Grocery app. An associate will quickly retrieve the prepared order and load it into your car.

The Walmart Associate will know that you are an EBT customer and will swipe your EBT card to pay for those items that are EBT-eligible.

For any items that are not EBT-eligible, the Associate will then take payment with another credit/debit card.

You will be required to enter your EBT pin to complete the pickup process.

Walmart Grocery Delivery

Walmart is currently working with the USDA to enable online payment with EBT. That way, EBT cardholders can shop online for groceries, pay with their EBT card, and use Walmart grocery delivery where available.

This will help eliminate all physical contact between associates and customers who want to use their SNAP benefits.

In addition, in locations where there are no Walmart Delivery options, online payment with EBT helps eliminate physical contact between associates and customers.

That’s because, since all the customers have to do is pull-up at the designated pickup location and their groceries will be loaded into their car by an associate.

The short video below from Walmart does an excellent job of explaining how the online ordering, pickup and delivery process works. We encourage you to watch it.

Florida EBT Card FAQs

Here is a list of our most frequently asked about the Florida EBT Card Grocery shopping online at Walmart.

Walmart FAQs

Can I make changes to my Walmart online grocery order?

Yes. Changes to your online grocery order can be made at any point before your cutoff time.

After the cutoff time, your order will be submitted to the store so they can begin picking your order.

Unfortunately, changes cannot be made after your cutoff time.

If you would like to change your order, sign in, click Your Account, and then Recent Orders.

To update your pickup or delivery timeslot, click Change Time.

If you would like to increase, decrease, or remove items or to update your substitution preferences, click Edit Items.

To add more items to your order, click Keep Shopping, add items to your cart, and complete checkout. Your bank statement will reflect a second authorization amount which may vary depending on the item weight and/or type.

How do I pay for an online order using my Florida EBT Card?

Here is a summary of how to pay for Walmart groceries online using Florida EBT (see detailed steps above):

Select your store and timeslot.

Add items to your cart.

Tap or click Checkout.

Under Select Payment method, select + Add EBT Card.

Enter your EBT card number and tap or click Save Card.

Enter your EBT PIN.

Can I pay using multiple forms of payment?

Yes. You can pay for your order using your EBT card and another form of payment at pickup.

If you ordered non-SNAP eligible items, the Walmart associate at the pick-up location will swipe your EBT Card for EBT-eligible items. You can then provide another form of payment (credit, debit card, etc.) for items that are not on the EBT approved list.

However, you can only use one SNAP EBT card per order.

What are the wait times at the store during pickup?

In order to get a good gauge of waiting times for pickup, Walmart recommends that you use the Walmart mobile app (available for Apple and Andriod devices) to check in on your way to the store and enter your parking spot number when you arrive.

In addition, be sure to provide your phone number during checkout so you can receive important updates about your order.

If you decide not to pick up your Walmart will cancel your order.

For delivery, you can tell the delivery driver you’re refusing the order.

How can I place an order if there are no available time slots?

If your nearby Walmart does not have available pick-up times, please continue to check back—new time slots open every morning.

Can I leave a tip for the store associate or driver that brings my order?

Walmart store associates do not accept tips for Pickup or Delivery.

You can show your appreciation with a positive review on your customer survey after you receive your order.

However, for Delivery orders, third party delivery drivers do accept tips. Simply add your tip through the website or mobile app after your order is delivered.

Florida EBT FAQs

How do I check my Florida EBT Card balance?

You can check your Florida balance online, in-person, or by phone. To complete your Florida EBT Card balance check, follow the instructions below:

Here’s how to check the balance on your Florida EBT Card Balance.

Option 1 – Check your Last Receipt

The first option for checking your Florida EBT Card balance is to check your last receipt.

This is the easiest and quickest way to locate the current balance on your Florida EBT Card. Your balance will be listed at the bottom of your most recent grocery store or an ATM receipt.

Option 2 – Login to your Edge EBT Account

The second option for checking your Florida EBT Card balance is online through the ebtEDGE website.

To log in, visit the ebtEDGE website here, then enter your card number. Once logged in, you’ll be able to view your current balance and transaction history.

Option 3 – Check by Phone

The last option for checking your Florida EBT Card balance is by phone. Call the EBT Customer Service number (1-888-356-3281) on the back of your card.

After you call, enter your sixteen (16) digit EBT card number and you will hear your current food assistance or cash account balance(s).

Can Florida EBT be used to pay for delivery?

Only eligible food items can be purchased with Florida EBT benefits. Any delivery fees or charges may not be paid for with your SNAP benefits – you must use another form of payment.

When will I be able to purchase groceries from more stores online?

As the USDA Pilot progresses, more retailers will be launching the ability to pay with SNAP EBT online. To find out when more retailers accept Florida EBT online, check here for updates.

How to Use Florida EBT Online at Walmart Summary

We hope this post on How to Use Florida EBT Online at Walmart was helpful to you.

If you have additional questions or need help using your Florida EBT Card to shop online at Walmart, leave those in the comments section below.

Be sure to check out our other articles on Florida food stamps and EBT, including How to shop online with Florida EBT on Amazon, How to Buy Groceries Online with Florida EBT Card for Delivery, Disasater Food Stamps in Florida, and much more!

Like this:

Like Loading…

Related Articles

Source link

La entrada How to Use Florida EBT Online at Walmart se publicó primero en ᐅ My Access Florida – You Login to Access Florida ✅ ☎.

from WordPress https://my-access-florida.com/how-to-use-florida-ebt-online-at-walmart/

0 notes

Text

Will never use a Drury Hotel

On March 11th I made a Reservation through Expedia for 2 nights at the Drury Plaza Hotel, San Antonio Riverwalk. I choose the Reserve Now – Pay Later option and of course saw the pages on Expedia stating that no money was due now while finishing my reservation/check out. Within minutes I received my email confirmation from Expedia confirming my reservation. The next day I received a message from Expedia saying the hotel had cancelled my reservation and it was most likely due to the payment method I had listed. I immediately contacted Drury Hotels through their website using their contact form and asking what the issue was. I made it clear that I had used the pay later option. I further made it clear that the card was valid – it was my checking debit card through Capital One Bank. But that I did not typically keep much money in my checking and did not link my savings or have overdraft protection allowing charges to clear when the balance was low. See my email below:

Comments: Made a reservation yesterday through Expedia and the hotel cancelled it. I want to know why. It was a reserve now, pay later reservation. Expedia says it was because of my payment method. There should have been no attempt on my card as it was a pay later reservation and no deposit was requested. I used my Capital One Bank debit and I am aware there is not enough money in my checking account right now. I do not have my savings linked to cover shortfalls and do not keep much money in my checking at any given time, simply transferring money as needed. If it was for some other reason why was I not given one? I work in the hospitality industry and have run hotels. This is piss poor customer service. I would like the reservation reinstated or be given a legitimate reason why it was cancelled.

Hotel: Drury Plaza Hotel San Antonio Riverwalk - San Antonio, TX Date of Stay: 5/11/2018 12:00:00 AM

This was the response I received:

Dear Mr. Byers,

Whether you have a question, a suggestion, praise or criticism -- we always welcome hearing from our guests. Thank you for your email. Per our agreement with Expedia, a reservation made through them is required to have a valid credit card. To insure it is valid we authorize the card for $1.99. If the card declines the reservation is cancelled.

Again, thank you for taking the time to share your comments with us. Please let me know if I can be of further assistance.

Sincerely,

Staci Cowan

Customer Service Manager

Drury Hotels Company, LLC

On the surface perhaps, some would find this acceptable. It is not. It is an essentially boilerplate generic response. There was no apology for the inconvenience. No offer to allow me to fix the problem. No acknowledgement of the points I was making in my initial email. It came off as if I should have known what the problem was, and I was stupid if I didn’t and furthermore it was too much of an inconvenience for the respondent to bother giving me a personalized response.

But allow me to further explain. Going back to when AOL was king of the internet, some may recall that even after you cancelled accounts with them they were infamous for continuing to try to debit your bank for payment. This led me to no longer link my savings account and refuse overdraft protection to ensure that companies could not do what AOL was doing. I began leaving most of my money in my savings and only transferring as needed. I later had problems with Wells Fargo allowing charges to go through even without a balance high enough to cover them. As many may know Wells Fargo has been in trouble a lot in the last few years – including accusations of deliberately and wrongly attempting to generate fees. I was frustrated by this as I repeatedly told them I did not want any transactions approved unless there was a balance to cover it. So, I switched to Capital One – which honors that request. Under no circumstances do they allow a charge to go through unless the balance is there to cover it. I do a fairly good job of making sure I transfer money in from savings to cover any charges (and of course my paycheck is a direct deposit to my checking). As it happens I had just had several large payments taken out of my account the day I made the reservations and I think my balance at the time was something like $0.58. I made the reservations late at night after work and right before going to bed. I have made numerous reservations through Expedia with the pay later option and never had a problem – and had never seen any of them attempt a pre-authorization TWO months in advance of the reservation.