Photo

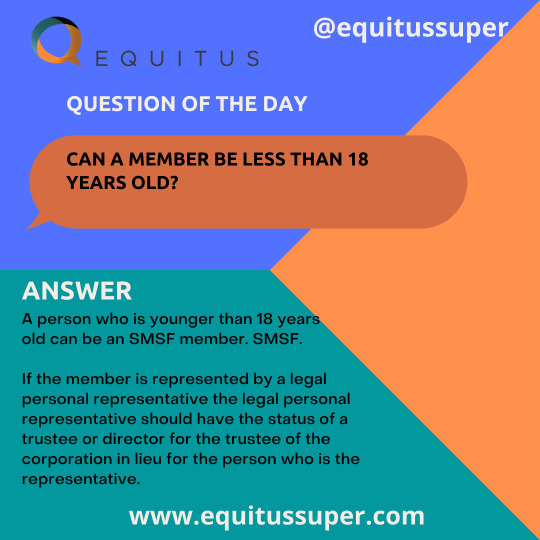

Question of the day?

Can a member be less than 18 years old?

Answer-

A person who is younger than 18 years old can be an SMSF member. SMSF If the member is represented by a legal personal representative, the legal personal representative should have the status of a trustee or director for the trustee of the corporation in lieu of the person who is the representative.

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#auditor#corporation#corporate#smsftax#taxation#auditingfirm#financeandaccounting#financetransformation#accountingfirm#accountingservices#accountingtips#accounting#smsfcomplinance#compliance#faqs#smsfaudting#financialplanning#faq#smsf#superfund#superannuation#auditfirms

0 notes

Photo

SMSF Administration Service

SMSFs provide excellent investment opportunities as well as tax benefits however, there are some risk factors that you should be wary of. Kick-off your all risk with us. Get all the SMSF administration services in one place.

✅SMSF Bookkeeping

✅SMSF Tax Return

✅SMSF Audit

Contact Us Now!

Email us - [email protected]

Call on - +61 425 345 795

Visit - www.equitussuper.com.au

#smsf#superfund#financialplanners#smsftips#superannuation#accountant#accountingservices#audit#tax#australia#enterpriseresourceplanning#smallbusinessowner#ato#australianpeople

0 notes

Link

0 notes

Photo

Consequences of becoming non-resident SMSF investment fund

In the event that the funds fail any of the residency tests, the tax rate rises from 15% to the maximum margin rate (currently 45 percent). Self-managed super funds will be considered non-compliant if it fails to meet the requirements necessary to satisfy the criteria of an Australian superannuation fund'. If the fund is non-compliant, an amount equal to the value of the total assets (less the contributions that are not deducted) will be added to an assessable amount for the funds. Each year the fund continues to be non-compliant the assessable income will be taxed at the most tax-efficient marginal rate.

Contact Us For More Info:-

Email us - [email protected]

Call on - +61 425 345 795

#investmentstrategy#investmentplanning#superannuation#superfund#investmentfund#investment#enterpreneurship#enterprises#smsf#consequences#australiansmallbusiness#saving#income#financialplanner

0 notes

Photo

WHAT IS SUPERANNUATION

What is lost superannuation?

As per the ATO, your super fund will declare you"lost" in any of the following circumstances occur:

They haven't been able to reach you, You have not received any rollover or contributions sums for you during the last five years, the account was transferred to another account as an account of a member that has been lost and there is no new address been discovered.

The ATO insists that it is actually super members who could be "lost" under the super laws of Australia but not their accounts or the funds in them.

Contact us

Email us - [email protected]

Call on - +61 425 345 795

#smsf#smsfaudit#superfund#superannuation#smsftips#accounting#accountant#smsfservice#smfstaxreturn#smsf tax return#financial planner#financial services#australia#ato

0 notes

Photo

Reduce Your tax with super

Top 5 Important Tips to Reduce Tax with Superfund

✅Financial Sacrifice

✅Government Co-Financing

✅Individual Contributions

✅Contributions from the Spouse

✅Contribution Dividing

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#smsf#superannuation#superfund#tax#taxation#taxreturn#bookkeeping#audit#taxpreparation#taxpreparer#taxes#australianproperty#australianpeople#accounting#australia#financialadvisors#financialplanner

0 notes

Photo

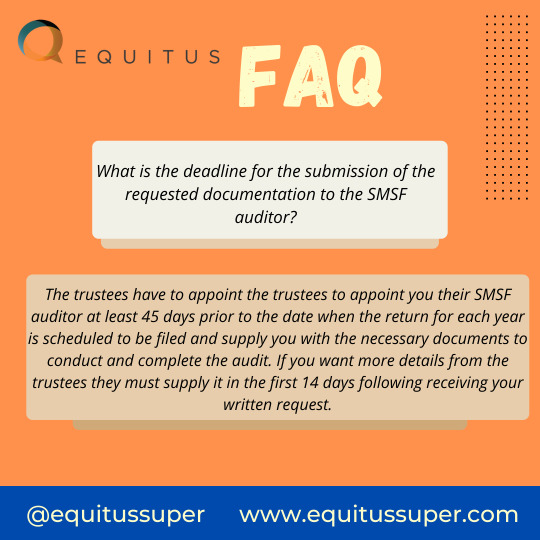

FAQ’S

Frequently Asked Question Answer?

What is the deadline for the submission of the requested documentation to the SMSF auditor?

The trustees have to appoint the trustees to appoint you their SMSF auditor at least 45 days prior to the date when the return for each year is scheduled to be filed and supply you with the necessary documents to conduct and complete the audit. If you want more details from the trustees they must supply it in the first 14 days following receiving your written request.

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#auditingfirm#financeandaccounting#financetransformation#smsfcomplinance#compliance#rollover#smsfaudting#financialplanning#superannuation#smsf#accounting#auditing#auditor#audit

0 notes

Photo

SMSF Components

The tax-free component is made up primarily of contributions that are not concessional by the participant of the account. It could also comprise spouse contributions, co-contributions of child contributions, or any other contributions made under the low income Superannuation Tax Offset (LISTO).

The tax-free portion of a super interest is the value of the member's super interest less the value of the tax-free portion.

The untaxed component includes those in which a trust has not paid any tax on income or contributions. Higher tax rates will apply to benefits with an untaxed component.

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#accountingfirms#accountant#accounting#financialcoaching#financialaccounting#smftips#taxation#taxelements#untaxed#taxable#components#taxcompliance#smsfcomponents#superannuation#superfund#smsf#accountants#taxconsultant#taxreturn#taxfree#taxpreparer#taxtime

0 notes

Photo

SMSF Audit Service

Get Professional SMSF Audit Service

We are providing an expert SMSF audit service. We assist in the preparation of audit work details. If you require let us know.

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#taxpreparation#australiansmallbusiness#australianpeople#smsftrustee#smsf#superfund#smsfaudit#audit#superannuation#accountants#australia#acountingservice#accountingfirms#directors#auditor#accountingprofessional

0 notes

Photo

A New will Help you manage your SMSF

A new guide will help you manage your SMSF. You are thinking of establishing an SMSF that is self-managed (SMSF) or do you know someone who has?

If yes this guide can help you determine if establishing an SMSF is the right choice for you. Australian Taxation Office

Read the article for the complete guide about SMSF.

Get back to us if you require any assistance.

Email us - [email protected]

Call on - +61 425 345 795

#entrepreneuer#smsf#superfund#superannuation#selfmanagedsuperfund#accounting#accountant#smsfupdate#smsftips#australiangorvenment#australianpeople#financialplanning#ato#smsftrustee#smallbusiness#taxadvice#taxaccountant#taxation#auditor#directors

0 notes

Video

Accounting Service from Deepak Rajput on Vimeo.

Are you Satisfied with your accountant or not?

If not then find the best accountant for your company before you ruined the business.

Aone Outsourcing Solution has an expert team of accountant & will you assists in all accounting solution : -

✅Self-managed Superfund (SMSF)

✅Bookkeeping

✅Payroll services

✅Tax Return Preparation

We are here to assist you. Kindly Contact

Call on-+91 9811548438

Email us- [email protected]

Visit on- aoneoutsourcing.com

0 notes

Photo

Accounting Quotes

Quote of the Day

Capital isn't this pile of money sitting somewhere; it's an accounting construct.

-------- Bethany McLean

#capitalfunding#capital#financeandaccounting#finance#superannuation#superfund#financialplanner#smsf#smsf audit#motivationalquotes#inspirationalquotes#lifequotes

0 notes

Photo

SMSF Administration Service

Start your Superfund Now & become the trustee of your fund.

Equitus Super is giving you the balance b/w work & life you require.

Contact us today to discuss how we can assist you to control your business from any part of the world.

Email us- [email protected]

Call- +61 425345795

#smsf#superfund#superannuation#financialplanner#financetips#accounting#realestate#mortgageadviser#realestateaccounting#australianbusiness#australiangovernment#australiansmallbusiness#business#trustee#smsftax#smsfaccountants#smsfaudit

0 notes

Photo

Superfund Investment

Our Service:-

✅The SMSF investment guide

✅How to tailor to your need and budget

✅How to analyze SMSF opportunities

Contact us! We Are Happy To Assist You.

Email us- [email protected]

Call- +61 425345795

#superfund#smsf#finance#superannuation#australia#retirementsavings#accountant#smsftrustee#accountingservices#enterpriseresourceplanning#retirementplanning#investment#smsftax#smsfaudit

0 notes

Photo

How to save money?

How to save money with a limited source of income for your future?

✅Make a budget

✅Track your spending

✅Pay off your credit card

✅Open a savings account

✅Control your impulses

✅Smooth your bills

#money #save #moneymanagement #saveyourmoney #savethatmoney #savemoneytips #business #investors #entrepreneur #accounting #smsf #superannuation #happyfriday #fridayfeeling #fridayfunnies

#savemoney#moneymanagement#savethatmoney#superannuation#superfund#financialplanner#australia#credit#debt#income#moneymindset#businessadvisors#businessowner

0 notes

Photo

Benefits Of SMSF With Us

Know the benefits of SMSF with us. Build your portfolio strong as a comparison to others.

Get assistance in SMSF with us.

Email us- [email protected]

Call- +61 425345795

#equitussuper#budget#superfund#smsf#superannuation#smsfbenefits#australianpeople#financialplanner#australia#smsftips#accounting

0 notes

Photo

SMSF Myth

Myth on You Need to be Financially Rich to Start SMSF.

But It is not necessary to be highly rich for SMSF. As per The Australian Securities and Investments Commission, (ASIC) no minimum balance is required to open an SMSF. But it is recommended you have a high opening balance, which is around $200,000.

Don't believe in myths blindly before taking any crucial step for your future investment. Consider all the things with SMSF advisers for proper guidance & rules.

Contact us for SMSF advice now!

Email us- [email protected]

Call- +61 425345795

#equitussuper#retirement#retirementsavings#retirementplanning#incomeinvesting#smsfservice#smsf#smsfmyth#superfund#superannuation#financialplanning#financetips#financialadvice#australiangovernment

0 notes