#what is private mortgage insurance

Text

Time for some tracts:

"How do we create jobs?" You raise the minimum wage, because if people don't need to work three jobs to make rent, those other two jobs will mysteriously open up.

"How do we support small businesses?" You raise the minimum wage, staggered to the biggest corporations first.

"How do we reduce homelessness?" You raise the minimum wage.

"How do we make sure raising the minimum wage doesn't negatively impact prices or--?"

Prices are already rising faster than wages are, this is playing catch up.

Put a cap on CEO salaries and bonuses, they can't earn more than 100 times more than their lowest paid workers. Current US ratio is 342, which is insane. (This list is mostly about the US.)

Hit corporations first, give small businesses time to adjust. McDonald's and Walmart can afford to raise wages to $20/hr before anyone else does, they have that income.

Drop the weekly hours required for insurance from thirty to fifteen. This will disincentivize employers having everyone work 29hrs a week, partly because working only 14hrs a week is a great way to have undertrained, underpracticed staff. Full time employment becomes the new rule.

Legalize salary transparency for all positions; NYC's new law is a good start.

Legislation that prevents companies from selling at American prices while paying American wages abroad. Did you know that McDonald's costs as much or more in Serbia, where the minimum wage is about $2/hr? Did you know that a lot of foreign products, like makeup, are a solid 20% more expensive? Did you know that Starbucks prices are equivalent? Did you know that these companies charge American prices while paying their employees local wages? At a more extreme example, luxury goods made in sweatshops are something we all know are a problem, from Apple iPhones to Forever 21 blouses, often involving child labor too. So a requirement to match the cost-to-wage ratio (either drop your prices or raise your wages when producing or selling abroad) would be great.

Not directly a minimum wage thing but still important:

Enact fees and caps on rent and housing. A good plan would probably be to have it in direct ratio to mortgage (or estimated building value, if it's already paid off), property tax, and estimated fees. This isn't going to work everywhere, since housing prices themselves are insanely high, but hey--people will be able to afford those difficult rent costs if they're earning more.

Trustbusting monopolies and megacorps like Amazon, Disney, Walmart, Google, Verizon, etc.

Tax the rich. I know this is incredibly basic but tax the fucking rich, please.

Fund the IRS to full power again. They are a skeleton crew that cannot audit the megarich due to lack of manpower, and that's where most of the taxes are being evaded.

Universal healthcare. This is so basic but oh my god we need universal healthcare. You can still have private practitioners and individual insurance! But a national healthcare system means people aren't going to die for a weird mole.

More government-funded college grants. One of the great issues in the US is the lack of healthcare workers. This has many elements, and while burnout is a big one, the massive financial costs of medical school and training are a major barrier to entry. While there are many industries where this is true, the medical field is one of the most impacted, and one of the most necessary to the success of a society. Lowering those financial barriers can only help the healthcare crisis by providing more medical professionals who are less prone to burnout because they don't need to work as many hours.

And even if those grants aren't total, guess what! That higher minimum wage we were talking about is a great way to ensure students have less debt coming out the other side if they're working their way through college.

------------------

Linda P requested something either really interesting or really silly and this is... definitely more of a tract on a topic of interest (the minimum wage and other ways business and government are both being impeded by corporate greed) than on a topic of Silly. Hope it's still good!

2K notes

·

View notes

Text

Trump and his sycophants have destroyed the Republican Party. They are no longer conservatives either fiscally or on foreign policy. They are a party of chaos beholden to the right-wing culture warrior oligarchs. They are the derogatory agents of those oligarchs and the corporations owned by them. They make decisions based on the whim of a deranged madman.

They have gone from being closet racists/bigots to being full blown Nazis that call for the extermination of their culture war scapegoats they call “vermin” (marginalized people/political rivals). They take this term directly from Hitler who they openly embrace in speech and writing. They no longer care about tax cuts for all but just for the 1% and corporations. They want endless wars to profit from and to distract and rally their deplorable base. They no longer want small, limited government but opt for a massive government that intrudes into its citizens private lives and tramples their freedoms.

The party of law and order is now a party of criminals, sex offenders, grifters, traitors, and murderous street thugs. They are proud of this and fund raise and merchandise from their lawlessness. They have bought control of what is now an illegitimate SCOTUS which never allows them to be held accountable.

They use the KKK, Neo-Nazi groups, armed right-wing militias, Neo-Confederates, and white supremacists to persecute their opponents and victims in the streets and inside the Capitol itself. They tell us to “get over it” when mindless gun violence decimates our families in every public venue from churches, to schools, to 4th of July celebrations, movie theaters, shopping malls, and even a Super Bowl parade.

The police, courts, and legislatures are infested with their white nationalist/supremacists and Christo-fascists. They openly take money from Russia and others to influence our foreign policy and economic policy. Money from Russia is funneled into the NRA and Congress to allow a massive proliferation of gun violence on our streets that destabilizes our society.

They claim to be the party of the military but they degrade and insult our troops and cast our veterans into the streets. They abandon our allies and our treaty obligations at the behest of foreign dictators that bribe them.

They bust our unions and pass laws to weaken or prevent organized labor. They are forcing society to become wage slaves with no security, insurance, or pensions. They force our workers into the “gig economy” where everyone works incredible hours 7 days a week at multiple jobs and still are left unable to afford rent or mortgages. Nearly the entire population is one or two paychecks away from being homeless.

Decades of trickle down economics has seen our tax dollars poured into the accounts of billionaires, millionaires, and corporations with not a penny trickling down to the working class. The middle class has been practically wiped out by cruel Republican legislation written by political think tanks established and funded by oligarchs. The only thing these pseudo-conservatives conserve is their own wealth.

This is late stage capitalism run amok. The economy has been drained and now the oligarchs and corporations are plundering the government. They have taken advantage of decades of right-wing propaganda proliferated by Fox News, conservatives talk radio, and internet podcasts that have brain washed the rural areas into blaming the Democrats that are trying help them while convincing them to vote for the Republicans who have impoverished them. The French Revolution in reverse.

They see the Orange Dictator as their last best chance to completely take over the government and create a kleptocracy that pulls the strings behind an autocracy that pretends to be a republic.

The chaos of the Republican puppets is to distract everyone from the takeover by the oligarchs, corporations, and deep pocketed foreign adversaries.

#vote Biden Harris 2024#vote blue always#vote democratic down the ballot#republican assholes#traitor trump#crooked donald#Republican corruption#Republican chaos

96 notes

·

View notes

Text

By Thom Hartmann

Common Dreams

March 31, 2023

The Republican Party's most dangerous grift today has been their embrace of the lie that America is not a democracy but instead is a theocratic republic that should be ruled exclusively by armed Christian white men. It's leading us straight into the jaws of fascism.

Nobody ever accused Republicans of not knowing how to make a buck or BS-ing somebody into voting for them. Lying to people for economic or political gain is the very definition of a grift.

Whenever there’s another mass- or school-shooting, Republican politicians hustle out fundraising emails about how “Democrats are coming to take your guns!” The result is a measurable and profitable spike in gun sales after every new slaughter of our families and children, followed by a fresh burst of campaign cash to GOP lawmakers.

But the GOP’s ability to exploit any opportunity that comes along — regardless of its impact on America or American citizens — goes way beyond just fundraising hustles.

When Jared Kushner was underwater and nearly bankrupt because he overpaid for 666 Fifth Avenue and needed a billion-dollar bailout to cover his mortgage, his buddies in the Middle East (Saudi Arabia and the UAE) blockaded American ally (and host to the Fifth Fleet) Qatar until that country relented and laundered the money to Jared through a Canadian investment company.

Just this week, after Trump deregulated toxic trains leading to a horrible crash and the contamination of East Palestine, Ohio, Steve Bannon — already charged with multiple fraud-related crimes and then pardoned by Trump — showed up this week to hustle $300+ water filters to the people of that town.

The grift is at the core of the GOP’s existence, and has been since Nixon blew up LBJ’s peace talks with the Vietnamese in 1968 and then took cash bribes from the Milk Lobby and Jimmy Hoffa in the White House while having his mafia-connected “plumbers” wiretap the DNC’s offices at the Watergate.

— Republicans successfully fought the ability of Medicare to negotiate drug prices for decades; in turn, Big Pharma pours millions into their campaign coffers and personal pockets (legalized by 5 Republicans on the Supreme Court).

— Republicans beat back Democratic efforts to stop insurance giants from ripping off seniors and our government with George W. Bush’s Medicare Advantage privatization scam; in turn, the insurance companies rain cash on them like an Indian monsoon.

— Republicans oppose any effort to replace fossil fuels with green energy sources that don’t destroy our environment; in turn, the fossil fuel industry jacked up the price of gasoline into the stratosphere just in time for the 2022 election (and you can expect them to try it again in 2024).

— Republicans stopped enforcement of a century’s worth of anti-trust laws in 1983, wiping out America’s small businesses and turning rural city centers into ghost towns while pushing profits and prices through the ceiling; in turn massive corporate PACs fund ads supporting Republican candidates every election cycle.

— Republicans authored legislation letting billionaires own thousands of newspapers, radio stations, and TV outlets; in turn the vast majority of those papers (now half of all local papers are owned by a handful of rightwing New York hedge funds) and stations all run daily news and editorials attacking Democrats and supporting the GOP.

— Republicans Trump and Pai killed net neutrality so giant tech companies can legally spy on you and me, recording every website we visit and selling that information for billions; in turn, major social media sites amplify rightwing voices while giant search engines stopped spidering progressive news sites.

Newspeak — George Orwell’s term for the grift where politicians use fancy phrases that mean the opposite of what people think they mean — has been the GOP’s go-to strategy for a half-century.

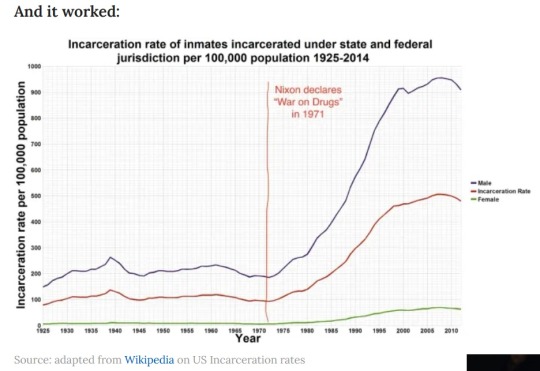

Richard Nixon, for example, promised to crack down on drugs, but instead used that as an excuse to crack down on anti-war liberals and Black people. Instead of an economic grift, it was a political grift.

As Nixon‘s right hand man, John Ehrlichman, told reporter Dan Baum:

“You want to know what this was really all about? The Nixon campaign in 1968, and the Nixon White House after that, had two enemies: the antiwar left and Black people. Do you understand what I’m saying?

“We knew we couldn’t make it illegal to be either against the war or Black, but by getting the public to associate the hippies with marijuana and Blacks with heroin and then criminalizing both heavily, we could disrupt those communities.

“We could arrest their leaders, raid their homes, break up their meetings, and vilify them night after night on the evening news.

“Did we know we were lying about the drugs? Of course we did.“

The grift is a recurrent theme through Republican presidencies in the modern era.

Ronald Reagan told us if we just destroyed America’s unions and moved our manufacturing to China and Mexico, great job opportunities would fill the nation.

He followed that up by promising if we just cut taxes on the morbidly rich, prosperity would trickle-down to the rest of us.

Reagan even assured us that raising the Social Security retirement age to 67 and taxing Social Security benefits would mean seniors could retire with greater ease.

All, of course, were grifter’s lies. Republican presidents since Reagan have continued the tradition.

George W. Bush called his program to make it easier to clear-cut America’s forests and rip roads through wilderness areas the “Healthy Forests Initiative.”

His program to legalize more pollution from coal-fired power plants and immunize them from community lawsuits (leading to tens of thousands of additional lung- and heart-disease deaths in the years since) was named the “Clean Air Act.”

Bush’s scam to “strengthen” Medicare — “Medicare Advantage” — was a thinly disguised plan to privatize that program that is today draining Medicare’s coffers while making insurance executives richer than Midas.

Donald Trump told Americans he had the coronavirus pandemic under control while he was actually making the situation far worse: America had more deaths per capita from the disease than any other developed country in the world, with The Lancet estimating a half-million Americans died needlessly because of Trump’s grift.

Jared and Ivanka cashed in on their time in the White House to the tune of billions, while Trump squeezed hundreds of millions out of foreign governments, encouraging them to illegally pay him through rentals in his properties around the world.

Other Trump grifts — most leading to grateful industries or billionaires helping him and the GOP out — included:

— Making workplaces less safe

— Boosting religious schools at the expense of public schools

— Cutting relief for students defrauded by student loan sharks

— Shrinking the safety net by cutting $60 billion out of food stamps

— Forcing workers to put in overtime without getting paid extra for it

— Pouring more pollution from fossil fuels into our fragile atmosphere

— Gutting the EPA’s science operation

— Rescinding rules that protected workers at federal contract sites

— Dialing back car air pollution emissions standards

— Reducing legal immigration of skilled workers into the US from “shithole countries”

— Blocking regulation of toxic chemicals

— Rolling back rules on banks, setting up the crisis of 2023

— Defenestrating rules against racially segregated housing

While Nixon was simply corrupt — a crook, to use his own term — in 1978 when five Republicans on the Supreme Court signed off on the Bellotti decision authored by Lewis Powell himself, giving corporations the legal right to bribe American politicians, the GOP went all in.

Ever since then, the GOP has purely been the party of billionaires and giant corporations, although their most successful political grift has been to throw an occasional bone to racists, gun-nuts, fascists, homophobes, and woman-haters to get votes.

Democrats at that time were largely funded by the unions, so it wasn’t until the 1990s, after Reagan had destroyed about half of America’s union jobs and gutted the unions’ ability to fund campaigns, that the Democratic Party under Bill Clinton was forced to make a big turn toward taking corporate cash.

Since Barack Obama showed how online fundraising could replace corporate cash, however, about half of the nation’s Democratic politicians have aligned with the Progressive Caucus and eschewed corporate money, returning much of the Party to its FDR and Great Society base.

The GOP, in contrast, has never wavered from lapping up corporate money in exchange for tax cuts, deregulation, and corporate socialism.

Their most dangerous grift today, though, has been their embrace of the lie that America is not a democracy but instead is a theocratic republic that should be ruled exclusively by armed Christian white men. It’s leading us straight into the jaws of fascism.

Bannon’s grift in East Palestine is the smallest of the small, after his being busted for a multi-million-dollar fraud in the “Build the Wall” scheme and others, but is still emblematic of the Republican strategy at governance.

When all you have to offer the people is a hustle, then at the very least, Republicans figure, you should be able to make a buck or gain/keep political power while doing it.

92 notes

·

View notes

Text

At first glance, the Silicon Valley Bank debacle seems to be a cut-and-dried financial caper. The executives running the 16th-largest bank in the US made the wrong choices in handling what seemed a fortuitous situation—a roster of clients, flush with venture capital funding, handing over billions of dollars of cash for storage in the institution's coffers. But the bank’s leaders misjudged the risks of higher interest rates and inflation. Pair that with a mini tech downturn, and the bank’s spreadsheets began turning colors. When word of its perilous situation got out, panicky depositors pulled their money. After a government takeover, everyone’s money was safe.

But although no depositor lost money, the saga looks like a traumatic event whose consequences will linger for months, or even years. Things happened that we can’t unsee. The SVB saga reminds me of what my wife, a true-crime reporter, says when people ask why she finds murder stories so interesting. A killing, she’d say, reveals the previously private, shrouded actions that define the way people live. In the course of investigating the crime, lives that looked ideal from the outside are exposed as unmade beds of secrets and lies.

Start with the bank. As has been widely reported—only now with a critical eye—Silicon Valley Bank was not only the bank of choice among Silicon Valley companies, but an ingratiating cheerleader for startup culture. The VCs and angels funding new companies would routinely send entrepreneurs to the bank, which often handled both company accounts and the personal finances of founders and executives. SVB would party with tech people—and vintners, another sector they were deep into. Some bankers had wine fridges in their offices. Salud!

Normally, you’d have to hold my family hostage before I became a banker—I picture the buttoned-up prig who hired Mary Poppins. But I might think differently if banking were a world of parties, high-end Cabernets, and elbow-rubbing with universe-denting geniuses who keep millions in the bank and take out mega-mortgages. By all accounts, SVB shared and perhaps amplified the freewheeling vibe of the swashbucklers it served. This is not what you necessarily want from a fiduciary. And as we learned this week, SVB’s CEO reportedly indulged in one of the worst things a founder can do—selling off stock when trouble lies ahead.

When that trouble arrived, we also learned a lot about the investment lords of the Valley who give founders the millions they need to move fast and make things. As word began to leak of SVB’s weaknesses, VCs who style themselves as tech’s smartest people had a choice: help bolster the financial partner holding the industry’s assets or pull funds immediately. The latter course would trigger a panic that would assure disaster for the startup ecosystem—but not you, because you were first in line.

Despite years of talk about how companies in the tech world are united in a beneficial joint mission, some of the biggest players went into self-preservation mode, essentially firing the starting pistol for a bank run. One notable bailout leader was Peter Thiel’s Founders Fund, which got an early sense of SVB’s troubles and advised all its companies to get out ASAP. As word spread, a classic bank run took shape, with other VC firms urging pullouts, until it was impossible to connect online with SVB to move funds. By the time a group of VCs came together to pledge support for SVB, its virtual doors were shut. In the mad rush to the lifeboats, hundreds of companies were stranded on deck. When the Federal Deposit Insurance Corporation (FDIC) took over Silicon Valley Bank last Friday, with all activity frozen, those whose holdings in the bank far exceeded the $250,000 limit on insured accounts truly faced the abyss.

I get it—saving one’s own skin is human nature. But in the future, let’s go easy on hyping the camaraderie of tech.

And what did the Valley’s rugged individuals do when oblivion loomed? They begged for a government rescue, of course. It’s hard not to empathize with some of the rank and file tech workers, many of them far from California, who wouldn’t be able to meet their bills. And indeed, there were some acts of generosity, as investors extended loans to their portfolio companies. But the loudest voices urging bailouts didn’t seem to be those most in jeopardy, but super-rich investors and speculators likeself-described angel investor Jason Calacanis, PayPal mafia billionaire David Sacks, and Machiavellian hedge fund magnate Bill Ackman, bombing Twitter with over-the-top pleas to rescue depositors.

Their case was that if depositors didn’t have immediate access to their funds, SVB’s woes might be “contagious,” setting off a wider bank panic. A reasonable concern. But it’s unlikely these pundits would have made the same arguments if the institution in question were some regional bank of similar size in the Midwest. Some people arguing for a federal bailout had previously opined that the government should keep its tentacles away from the innovative geniuses of the Valley.

The spectacle is particularly ironic because a huge part of startup lore is not just accepting risk but embracing it. We hear endlessly of the bravery of entrepreneurs who step into the breach and put millions of dollars in jeopardy, hoping to buck the dismal odds of creating a difference-making company that, by the way, makes its founders ludicrously wealthy. It’s part of the game to lose your investor’s money and a couple of years of your life because you felt that a $400 juice machine would be the next iPhone.

Now those noble risk-takers were demanding retroactive protection—because tech-company money was unavailable due to a totally avoidable risk. Any idiot knows that FDIC covers only $250,000. So why did so many firms store all their assets in uninsured accounts in a single bank? You might give a pass to naive founders who blindly accepted the recommendation of their funders to use Silicon Valley Bank. (Though maybe not to big companies like Roku, which had $487 million on deposit in SVB.) But what’s the excuse of those who did the recommending? Did they notice that SVB executives actively lobbied to avoid stringent regulation? Or that for eight months, SVB failed to replace its retired chief risk officer? Did they understand that an entire startup monoculture patronizing one bank made a huge industry dependent on a single point of failure?

Meanwhile, less verbose investors and VCs quietly worked behind the scenes on convincing the FDIC to guarantee all deposits. One of the Valley’s top seed investors, Ron Conway, reportedly even got Vice President Kamala Harris on the phone to hear his plea for a depositor bailout. The case they made for protecting funds from a maximum $250,000 to, well, infinity, was a more refined version of what the Twitter panics-spreaders were saying: It would stem a collapse in the tech sector and calm people all over the country who were suddenly worried about their own banks’ stability. (It would also mean that from this point forward, holding to the limit is indefensible.) It’s not clear whether the lobbying affected the actual decision. But the attempts were unseemly, an unattractive display of the power of this massive industry.

So what has been uncovered in the week since we learned that Silicon Valley Bank was no more trustworthy than a crypto spam text? A startup culture once considered the gem of the economy has been exposed as careless with its money, clueless in its judgment of character, hypocritical in its ideology, and ruthless in exercising its political clout as a powerful special interest. Meanwhile, the financial world is still jittery, with other banks failing and just about everyone wondering what comes next. And from here on, the concept of a cap on FDIC insurance is at risk. But at least the SVB credit cards are working again. And VCs can take a victory lap as they brag about how they saved the day.

16 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure.

— Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

6 notes

·

View notes

Text

What Would an Economy That Loved Black People Look Like? - Non Profit News | Nonprofit Quarterly

What would it look like if the economy loved Black people? I hold this question in my heart every day as I reflect on our current economic conditions and strategize about building a reimagined economy rooted in equity, justice, and liberation.

To be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South.

One thing I am certain of is that the systemic barriers and inequities that are embedded in present financial structures have no place in a reimagined economy. I would further contend that to transform our economy into one that loves Black people, movements need to get more intimate with the topic of power. Alicia Garza defines power as “the ability to change your circumstances and the circumstances of other people.” She talks about how being precise about power helps us be precise about strategy. Without a clear destination, the steps that are taken are going to be disordered.

As a financial activist and reparative capital investor, power and power building in this context means shifting financial policies, practices, and infrastructure into ones that seed and sustain change. It means joining with values-aligned wealth holders and investors to disrupt power by dismantling the systems that have obstructed Black communities from building generational wealth. And it means that to be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South, where roughly 56 percent of Black people in the United States call home. We must invest in the Southern Black creatives, innovators, and leaders who are the biggest exporters of culture around the world and on the frontlines of change and community power building.

Closing the Racial Wealth Gap in the South

US researcher and agricultural law expert Nathan Rosenberg has said, “If you want to understand wealth and inequality in this country, you have to understand Black land loss.” Jubilee Justice, an organization founded by Konda Mason, who serves as the strategic director of my firm RUNWAY, recognizes that land ownership provides a pathway to create generational wealth, access financial resources, have agency over agricultural and sustainable land management practices, and foster community resilience.

In the rural South, Black farmers have historically experienced—and continue to experience—a lack of access to agricultural resources and credit. They also continue to face discrimination, and exclusion from government programs, loans, and subsidies. This result is the loss of farmland and restricted opportunities for economic growth.

Of all private US agricultural land (excluding Indian Country), according to a US Department of Agriculture study, White people comprise 96 percent of farmers, own 98 percent of the acres, and generate 97 percent of farm earnings. From 1900 to 1997, the number of Black farmers decreased by more than 97 percent; in the South, Black landowners lost 12 million acres of farmland over the past century, amounting to $326 billion worth of lost land in the United States due to discrimination.

The unjust policies that denied, dispossessed, and restricted Black individuals and communities of land ownership in the past have cast a long shadow. Policies that have routinely prevented Black communities from building generational wealth, like redlining and denying Black people mortgage loans and insurance, persist and are reflected in the massive racial wealth gap we’re still seeing today.

Even as the struggles for civil rights, inclusion, and economic justice gain ground, investment in the South remains uneven. Grantmakers for Southern Progress shares that the South receives less than three percent of all philanthropic investment in the United States. We must increase philanthropic action to build the capacity of community-based organizations and networks leading structural change work in the region.

As Tamieka Mosley of Grantmakers for Southern Progress and Nathanial Smith of the Partnership for Southern Equity, share: “If the South—the birthplace of historic and destructive inequities—rallies to end structural injustice, it can model for the country what the journey toward racial justice and equity looks like.”

Black communities continue to experience the ongoing legacy of slavery and racism through blatant discrimination from financial institutions whose inequitable lending practices limit Black entrepreneurs from attracting early critical investments. On average, early-stage entrepreneurs need about $30,000 in capital to get their initiatives off the ground, with friends and family of entrepreneurs on average providing $23,000 or more than three quarters, of the needed amount. All told, nationally friends and family investing exceeds $60 billion a year, nearly three times the investment level of venture capitalists.

However, not everyone has equal access to this vital source of capital. In 2019, the median White family in the United States had $184,000 in wealth compared to just $38,000 and $23,000 for the median Latinx and Black families, respectively. With this racial wealth disparity, Black entrepreneurs are less likely to receive early-stage funding from friends and family—a critical lifeline for business startups and growth opportunities.

It is especially critical because capital from friends and family typically has more flexible lending terms and is not tied to a person’s credit score; rather, it is based on the level of trust people have in the preparation of the business owner. These relationships and informal networks also provide other nonfinancial resources such as business advising, referrals, and support systems. For many Black entrepreneurs, particularly women, racial wealth inequality is the leading factor in why their great ideas never leave the napkin.

RUNWAY believes giving every Black entrepreneur access to the “friends and family” round of investing will be transformational for Black communities. The key to this process, as mentioned, is trust.

By infusing trust into exploitative and extractive systems, we can facilitate pivotal early-stage investments along with wraparound entrepreneurial ecosystem support like business coaching and advising. We can provide “friends and family” funding using patient, flexible capital to advance resiliency for Black businesses and the communities they serve.

Investing in people and places that have been historically excluded from traditional investment support will always appear risky to foundations and fund managers. The best antidote to that risk is to build trust-based, honest relationships with local community leaders and changemakers who deeply understand the region and the specific needs of that region. In the South, those relationships will be based on listening, mutual aid, and physical presence. These types of relationships are critical to making investments that shift the balance of power toward equity and wealth regeneration for Black communities.

Listening to the Community

I recently gathered in my home state of Alabama with a delegation of fund managers, investors, and philanthropists to bring reparative finance to the people and places that have been systemically blocked from wealth building opportunities as part of RUNWAY ROOTED, my organization’s latest initiative to invest in Southern Black entrepreneurship, creativity, and innovation.

It takes long-term, non-extractive, reparative investments . . . to undo the systemic design of racial hierarchy and imagine new possibilities.

We spent a week moving through the region to learn from community leaders, creatives, and local representatives about the unique economic challenges in the area. The experience illuminated the fact that Black business ownership is a mechanism that not only builds economic power, but social and political power as well.

Truth be told, in most cases, resistance from investors and wealth holders goes back to power. Those in power don’t want to let go of it. But the conversations like the ones we had in Alabama signal that things are changing. We must be deliberate in how we apply pressure. This involves deep collaboration between movement leaders, creatives, and community, as well as with investors, funders, and wealth holders. We must collaborate on ways to work together and co-conspire to build collective power.

Building collective power takes telling the truth about why Black people in places like Jackson, MS remain deeply entrenched in age-old, stubborn barriers to economic opportunity. It takes investors who are willing to reckon with a history that built wealth by stealing land from Indigenous nations and extracting free labor from enslaved Africans—and to invest in repairing the conditions that presently uphold the racial wealth gap. And it takes long-term, non-extractive, reparative investments that remind us that the real work is to undo the systemic design of racial hierarchy and imagine new possibilities.

Investing in Southern Creatives

Shaping our collective future into one that loves Black people needs the joy, inspiration, and useful critique of our political, economic, and social systems that come from creative thinkers and makers through their art, organizing, and visionary disruption. To tap into this dynamic force of change, it is vital to ensure that the extractive finance of the past does not block our collective ability to invest in the talent and innovation of the future.

This work requires long-term, flexible commitments of capital, time, and . . . support for Black-led businesses and innovation in the South.

Reimagining and collaboratively shaping a world where Black people are loved means prioritizing investments in creative entrepreneurs and creative placemaking. It means investing in places like Gee’s Bend, AL, to bring long-term business capital to the women who carry the legacy and tradition of West African quilting—one of the most important cultural contributions to the history of art in the United States. It means partnering with organizations like Upstart Co-Lab and Souls Grown Deep Foundation, who journeyed with us in Alabama, to invest in the arts, cultural, design, and innovation industries in the South with a mission toward repair and justice.

Philanthropy and investments that are transformative and inclusive are not only about diversifying the seats at the decision-making table. They also invite multiple voices into the design rooms where the table is carved out and set, ensuring it is broad and deep enough to nourish the future of local and national communities.

This work requires long-term, flexible commitments of capital, time, and capacity with a willingness to resolve disparities in funding and support for Black-led businesses and innovation in the South. It’s also necessary to acknowledge that the economic development programs that work for coastal metros or major cities may not be the same for the South—and need to be thoughtfully adapted to meet the distinct community needs, local infrastructure, and pulse of the region. By listening deeply and building authentic relationships with community leaders, community transformation over time can occur on community terms. Through this process, people are transformed—and so are community social and economic conditions.

I’ve always felt like investing in artists, creatives, and innovators does what Nina Simone famously said: “An artist’s duty, as far as I’m concerned, is to reflect the times.” Simone believed that artists and creatives have a responsibility to create work that reflects and addresses the social, political, and cultural climate of their era; that art has the power to serve as a mirror of society, bringing attention to important issues and fostering dialogue and understanding.

Today, the creative economy represents $985 billion in economic opportunity. This is also a time when art from creators like Amanda Gorman, who became the youngest inaugural poet in US history when she performed “The Hill We Climb” during President Joe Biden’s inauguration in 2021, is being banned in Florida schools. Responses like this tell us that art does indeed have power. Creativity has power. Innovation and truth-telling have power. And power is transformative.

…..

Building an economy that truly loves Black people requires a profound shift in financial structures and the way money moves. Investing in the South and supporting Southern Black creatives, innovators, and leaders is a pivotal step in redressing land loss and the discriminatory lending practices Black entrepreneurs continue to face.

We live in a moment of incredible opportunity. The mission (and the challenge) here is to take this moment and turn it into a movement that sustains the transformative work required to build an economy where we all have the power—and the right—to thrive.

#What Would an Economy That Loved Black People Look Like#Black Economics#Black Peoples Money#Black Money Matters#Black Finance#Black Lives Matter#Black Lifestyles Matter#Finance#financial structures#Black Entrepreneurs

2 notes

·

View notes

Text

Homan Ardalan - What Are The Risks Of Private Lending?

Private lending has labored properly for me as a lender and borrower for the beyond ten years, and I even have used this investment version to construct a portfolio of over a hundred properties, earn heaps of passive earnings, in addition, to pay out loads of heaps of greenbacks in passive earnings to my creditors.

All that said, there may be truly a risk of worrying about personal lending. If you're aware and careful, it may be simply as clean to lose cash as make it! Private lending isn't without risk. There are masses of methods to lose your cash in case you aren't paying near attention.

To know more: Homan Ardalan What Are Leads And What Are The Ways To Track Down The Best Leads For Your Business.

However, Homan says, there are multiple risks involved. Here are the top 4 Types of Risks in Private Lending

Credit risk

Collateral risk

Market risk

Investment risk

Credit Risk

Credit risk is successfully the risk that there will, sooner or later, be trouble together with your borrower. Most in all likelihood in an effort to be the borrower is not able or unwilling to make a price or bills at the mortgage and consequently fall into default. Of course, there might be a nearly limitless variety of underlying motives for his or her default.

Credit risk is the risk that something is going incorrect with/to your borrower and that they forestall making bills at the mortgage

Collateral Risk

There is, of course, a ton of stuff which could move incorrect with actual property, particularly at some stage in maintenance tasks, along with (however truly now no longer restrained to):

Some got here in below price range and cheaper. Others got here over price range and took manner longer than anticipated. There truly isn't any genuine technological know-how to it. You discover what you actually need to do as soon as your contractor genuinely receives in there and begins off evolving taking matters apart.

You may also have troubles with your name, however with a bit of luck you took my recommendation and closed your mortgage via the ideal name agency or legal professional who did complete name work, and also you additionally were given your self creditors' name insurance!

Investment Risk

The possibility or probability of prevalence of losses relative to the anticipated goes back on any specific funding. Your lending standards and due diligence procedure is designed to align you with debtors and tasks that you could be cushty making an investment in.

Simply put, funding risk is the extent of the uncertainty of success. The ever-gift capability for now no longer accomplishes the anticipated or projected funding returns specified in your plan and paperwork. In short, funding risk is a gift any time you convert to cash in go back for an anticipated result.

But, you need a great private money lender for this. Why? Well, check out the following details to know more: Homan Ardalan – Instructions To Get Started In Commercial Real Estate Investing.

Market Risk

Even a damaged clock tells the proper time two times a day!

That said, you have to apprehend the wider dynamics of the financial system and actual property markets. Even in a downturn marketplace, there are first-rate possibilities to spend money on actual property, so simply try and apprehend the micro photo of the project, in addition to the macro photo of the broader marketplace.

22 notes

·

View notes

Text

As the US faces the risk of default one should remember about 70% of the US public debt is owed to the US.

Social Security, public (state and city) and private pension funds, and the Federal Reserve hold a significant portion of US debt. Over all the US owes 70% of all public debt to itself.

The debt ceiling was established in 1917. It didn't exist before then, and there's nothing giving Congress the power or authority to actually default on its debt. It's a very merky constitutional question: "can the US default?" Given how our system is set up. The Constitution specifically states in the 14th amendment:

"The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned."

Does raising the debt ceiling resolve US spending issues? No.

Raising the debt ceiling today does nothing to resolve America's spending issues. The debt ceiling is to authorize money that has ALREADY been spent and approved by Congress in previous sessions. Raising the debt ceiling does not authorize new money to be spent.

Inflation and the National Debt:

The US national debt is issued in yesterday's dollars from previous Congressional spending bills but paid back in tomorrow's dollars. The majority of this is in fixed-rate securities. That means that inflation actually cuts the real dollar amount of US debt. Inflation makes old debt easier to pay off.

In plain terms this means that the US has been decreasing its real dollar value of US national debt under the Biden Administration faster than at anytime in US History.

When measuring the US debt against the US Ecconomy, our debt is set to drop by the biggest amount in two decades. This is important and really the only thing that actually matters. This is a huge break for the US Government and taxpayers.

Example: in the first 14 months since Biden assumed office, America inflated away 2.7 trillion dollars of it's national debt.

In April of 2021 the Treasury could borrow one-year money at 0% interest. That corresponded to a very attractive real rate of about -4% by the time 2022 rolled around. In effect people paid the US Government 4% interest for the privilege of getting to borrow money from us. The current Tbill rate is even higher at 5.10%.

I can not understate this fact:

The US Taxpayer makes money off the US Government borrowing money.

The US Taxpayer makes a profit off raising the US borrowing limit.

WHY?

In simple terms, just think in terms of supply + demand. If you'll take my terms for a 2% payment why would I offer to pay you 3%, 4%, 5%? Demand for US Debt is high, so the US can offer it at very, very, low interest rates.

WHAT IS US DEBT'S ROLE IN THE GLOBAL FINANCIAL SYSTEM?

Everything. US Debt is the backbone of the world financial system. It underpins everything else. Stocks. Corporate Bonds. Mortgage rates. Life insurance. Everything is built on the bedrock of US debt. US Treasuries are considered risk-free investments, so it's the measurement to which every other financial tool is valued.

So when a corporation issues bonds to raise capital it's forced to compete with Treasuries for investment dollars. If said corporation becomes insolvent there's no guarantee bond holders will get all or even any of their money back. It must offer a rate of return good enough to justify the increased risk compared to US Treasuries. US debt is the foundation everything else is built on.

SIMPLE SUMMARY:

TL;DR: the entire world runs on US debt. Nothing will protect you from the catastrophic consequences of US default. Nothing. Not holding fiat, or stocks, or bonds. Not holding gold, diamonds, silver or Bitcoin. Nothing. All of these things are a financial system built on US Treasury builds.

There is no golden parachute if the US defualts.

Only needless suffering.

2 notes

·

View notes

Text

“Also among Lane’s clients: FTX. Federal prosecutors are now examining Silvergate’s role in banking Sam Bankman-Fried’s fallen empire. The more pressing problem is that the collapse of FTX spooked other Silvergate customers, resulting in an $8.1 billion run on the bank: 60 percent of its deposits that walked out the door in just one quarter. (“Worse than that experienced by the average bank to close in the Great Depression,” The Wall Street Journal helpfully explained.)

In its earnings filing, we found out that Silvergate’s results last quarter were absolute dogshit, a $1 billion loss. Then, on March 1st, Silvergate entered a surprise regulatory filing. It says that, actually, the quarterly results were even worse, and it’s not clear the bank will be able to stay in business.

(…)

“If Silvergate goes out of business, it’s going to push funds and market makers further offshore,” Ava Labs president John Wu told Barron’s. The issue is how easy it is to get into actual cash dollars, which in finance-speak is called liquidity. Less liquidity makes transactions more difficult. Already there is a broader gap between the price at which a trade is expected to go through at and the actual price at which it executes, Wu said.

So Silvergate’s troubles are a problem for the entire crypto industry.”

“Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank's 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company's downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

(…)

"This was a hysteria-induced bank run caused by VCs," Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. "This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face."

(…)

The roots of SVB's collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

(…)

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

(…)

Now, thanks to the bank run that ended in SVB's seizure, those who remained with SVB face an uncertain timeline for retrieving their money. While insured deposits are expected to be available as early as Monday, the lion's share of deposits held by SVB were uninsured, and it's unclear when they will be freed up.”

“First Republic shares fell 52% in early trading before storming back to near the previous day's closing level, only to then finish the day down 15%. Investors expressed concerns about unrealized losses on assets at the bank as well as its heavy reliance on deposits that could turn out to be flighty.

(…)

First Republic's shares have lost 34% of their value in the past week.

(…)

In its annual report, First Republic said the fair-market value of its "real estate secured mortgages" was $117.5 billion as of Dec. 31, or $19.3 billion below their $136.8 billion balance-sheet value. The fair-value gap for that single asset category was larger than First Republic's $17.4 billion of total equity.

All told, the fair value of First Republic's financial assets was $26.9 billion less than their balance-sheet value. The financial assets included "other loans" with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

(…)

Total deposits at First Republic were $176.4 billion, or 90% of its total liabilities, as of Dec. 31. About 35% of its deposits were noninter-est-bearing. And $119.5 billion, or 68%, of its deposits were uninsured, meaning they exceeded Federal Deposit Insurance Corp. limits.”

“Signature becomes the third-largest bank to ever fail in the U.S., behind Silicon Valley Bank and Washington Mutual in 2008, if its assets haven't changed significantly since the end of 2022. Signature had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

(…)

Signature served clients in the cryptocurrency world and had been trying to reduce its exposure. Like Silvergate Bank, another crypto-friendly bank that said last week it would voluntarily wind itself down, it suffered from a deposit outflow in the aftermath of the collapse of crypto exchange FTX. Deposits dropped 17% in the fourth quarter of 2022 as compared to the year-earlier period.

(…)

Now that Signature has been seized, Circle, issuer of the second largest stablecoin, "will not be able to process minting and redemption [for the stablecoin] through SigNet," and "will be relying on settlements through BNY Mellon,” CEO Jeremy Allaire said on Twitter Sunday evening.

Circle’s USD coin fell below its crucial $1 peg Friday after the company disclosed $3.3 billion in cash reserves held with the failed Silicon Valley Bank despite attempted withdrawals Thursday. After falling to 88 cents on Saturday, the company announced it planned to cover any shortfall from its SVB losses using “corporate resources.””

“Credit Suisse shares on Monday reached a new record low, falling as much as 15% as investors continued to hammer away at the stock of the Swiss banking giant after the collapse of banks in the U.S.

(…)

Credit Suisse CSGN CS has lost money for five straight quarters and says it’s expecting to post a loss before tax this year. It’s undergoing a big transformation after losing billions lending to the Archegos family office and having to freeze $10 billion worth of funds tied to Greensil Capital. Wealthy clients pulled out about $100 billion from Credit Suisse in the fourth quarter.”

#silvergate#silicon valley bank#svb#first republic bank#frb#signature bank#circle#bank#banks#crypto#currency#bank runs#credit suisse

5 notes

·

View notes

Text

Home Bureau Of Land Administration

At NewHomeSource.com, we update the content material on our site on a nightly foundation. We search to guarantee that all of the information introduced on the location relating to new homes and new home communities is present and correct. However, we do not assume any liability for inaccuracies. It is your duty to independently confirm the knowledge on the location.

Depending in your down cost and mortgage kind, you could additionally should pay private mortgage insurance as a half of your monthly mortgage payment. Many people start by figuring out what they'll afford as a month-to-month fee. A frequent place to begin is to calculate 25% of your gross month-to-month revenue to help decide a manageable month-to-month mortgage fee. Today’s mortgage and refinance charges See fee and APR data for well-liked loan sorts.

Here is a fast overview of what the brand new construction market currently appears like in Las Cruces. If you're looking to sell your personal home within the High Range area, our itemizing agents can help you get the most effective worth. Buy the proper homes for sale in las cruces new mexico home on the right worth close to High Range with a local Redfin actual property agent. Lovely customized home with spacious rooms, kiva hearth, beams and corbels. Upgraded cabinetry & appliances, custom window coverings, low E vinyl clad windows & GE smart wiring.

Real property listings held by brokerage corporations other than , are indicated by detailed information about them such because the name of the listing companies. One of the best indications could be the direction of inventory—and its speed of change. At first look, it might be simple to assume that stock home builders in las cruces (i.e. active listings for sale) is simply a measurement of provide, nonetheless, it’s additionally a measurement of demand. If homebuyers pull back, and homes sit in the marketplace longer, that may improve stock levels (currently up forty six.8% year-over-year) even if new listings (currently down 17.3% year-over-year) decline.

In a typical actual property market, the vendor would obtain approximately 96% of the asking price after a cut price. Today, the consumers of Las Cruces are gaining a mean of 98% of their asking worth, and this pattern would increase. Redfin is redefining actual property and the house shopping for course of in High Range with industry-leading technology, full-service brokers, and lower fees that provide a greater worth for Redfin buyers and sellers. Here you will new homes las cruces discover all the homes for sale in Las Cruces NM. We offer all the newest listings, correct data, and up-to-date property details all through the Las Cruces area. Searching cheap houses for sale in Las Cruces, NM has by no means been easier on PropertyShark! Second, homeowners may be tempted to turn out to be landlords, wrote Taylor Marr, deputy chief economist for Redfin, in the true property brokerage’s 2023 forecast.

” Check out theIKEA Store Locatorand we hope to see you soon! No drawback, we’ve made shopping on-line at IKEA easier than ever. Browse our full retailer experience on-line to search out inexpensive home goods for every room, includinghome office,front room,kitchen,rest room,bedroomandoutdoor furnishings, and get deliveries straight to your doorstep! We additionally provide Click-and-collect the place you ought to purchase online and pick-up in store for even sooner and easier shopping. Welcome to IKEA, where you will all the time find affordablefurniture, stylishhome décorand revolutionary trendy home options, as nicely asdesign inspirationand distinctive home ideas!

You’ll find the city is small enough that you often run into people you know at your favourite grocery retailer or cafe. What’s extra is the superb homes for sale las cruces, rich culture in the neighborhood. Art, historic websites, agriculture, and multicultural cuisine are woven into the material of the Las Cruces neighborhood.

Las Cruces operates the RoadRUNNER transit, a small however efficient system and a good way to get round city. The fleet consists of fourteen 35 foot wheelchair accessible buses that run throughout city for a dollar a ride. There are 9 routes total, nevertheless it doesn't run on Sundays, so proudly owning a car, even if you've invested in a bus move, isn't a bad thought. Once you get to the Eastside or Main Street, Las Cruces could be surprisingly walkable, but getting there can be a pain if you don't have a set of wheels, as a end result of spread-out nature of Las Cruces. Some individuals bicycle from neighborhood to neighborhood, however spreading over greater than 70 square miles, that may be a bit impractical if you should make a longer journey. As of December 2022, the typical house rent in Las Cruces, NM is $554 for a studio, $850 for one bedroom, $767 for 2 bedrooms, and $1,004 for three bedrooms.

When folks keep their homes off the market, they reduce the availability of homes for sale. If demand stays the identical, home prices will resist falling. These constructing are by far the most effective homes for sale in las cruces nm I’ve seen and experienced with yet. Going to Covington sellers they've greatest customer service and make clients really feel as like they are shut household.

Would positively recommend for anyone in that area and even to locate completely different dealer however graceland is definitely game changer in transportable buildings. Every quarter, Moody’s Analytics assesses whether or not native fundamentals, including local income ranges, can support local home costs. Thesefrothy markets embrace places like Boise("overvalued" by 74%) and Austin ("overvalued" by 61%).

4 notes

·

View notes

Text

10 Myths About Income Protection Insurance

Income Protection Insurance is a long-term protection insurance that is meant to provide a policyholder with a guaranteed monthly income if they are unable to work due to illness or an accident. However, there are numerous prevalent fallacies about what a policy would protect and what will not be covered, as there are with many protection products such as Life Insurance and Income Protection.

In today's tutorial, we'll look at ten of the most common misunderstandings customers have expressed.

Purchasing an Income Protection policy is a prudent measure that many families may take to protect loved ones who are financially dependent on them. Many business listings why not ask yourself the following questions before deciding whether to obtain or investigate a policy in the future:

If you were to lose a considerable amount of money for three months or more due to illness or accident:

1 - Could you afford to pay your mortgage or rent?

2 - Do you have bills to pay, credit cards to use, or loans to take out?

3 - Unpredicted financial increase in spending

Statistics on the Workplace

Because the worldwide pandemic will have an influence on the years 2020-2022, we looked back at earlier years to find pertinent data. According to data collected from the Health and Safety Executive's website, 38.8 million work days were missed owing to sickness and workplace injuries in 2019/20. In 2019/20, the following were the leading causes of days missed due to work-related illness business listings:

1 - 17.9 million people suffer from stress, despair, or anxiety.

2 - 8.9 million people suffer from musculoskeletal problems.

Household Statistics on Insurance Types

The ABI (Association of British Insurers), like the Health and Safety Executive, does not have consistent statistics for 2020-2022. As a result, their most current household statistics data is from 2018-2019. Compulsory automobile insurance is the most common type of policy purchased by the UK's 26.5 million households.

Other short-term insurance options include:

Motor Insurance - 20 million

Contents Insurance - 19.3 million

Buildings Insurance - 16.5 million

Mortgage Protection - 2.8 million

Private Medical Insurance - 1.6 million

However, data show that families with longer-term protection insurance are less likely to purchase policies that they may need in the future. Many households may be hesitant to get longer-term insurance owing to prevalent myths and policy misunderstandings. As seen here, just about 2% of UK households have Income Protection, leaving the remaining 98 percent vulnerable to financial hardship in the event of a workplace accident or long-term illness.

Household long-term protection products:

Whole of Life Insurance - 4.8 million

Term Life Insurance - 0.6 million

Income Protection - 0.2 million

After reviewing data from the Health and Safety Executive and the ABI. Our handy guide to 10 Common Income Protection Insurance Myths will help you debunk some of the most common myths regarding long-term insurance policies free listing:

1 - It Isn't Necessary to Have Income Protection Insurance

Some individuals may believe that Income Protection is a waste of money and that it is unnecessary to acquire. Although many would agree that all people take their health for granted and sometimes overlook ailments or believe that they will not be affected, however, when you consider that 32.8 million working days would be lost in 2019/20, Income Protection may be more significant than you realize.