#wetalktrade

Text

Long vs Short positions in forex Trading.

https://www.andywltd.com/blog/long-vs-short-positions-in-forex-trading/

0 notes

Photo

A winner's tutorial.

#forex#pivotpoints#capital#stoploss#pricelevels#technicalanalysis#tradingtips#plan#profit#wetalktrade

0 notes

Text

what is a lot in forex

Forex trading is an exciting way to invest, especially for those who love watching markets fluctuate. Investing in the foreign exchange market (forex) is risky and can result in the loss of your entire initial investment. However, for investors willing to take on that risk, forex offers the opportunity to profit from changing currency rates. In order to make sure you’re not getting caught up with risky strategies, it’s important to know what a lot is in forex trading before you get started. A lot refers to the quantity of units being traded in a single transaction. It’s important to know how much money you’re investing so you have a better understanding of how much risk you’re taking with each trade. Let’s take a closer look at what is a lot in forex and how it impacts your strategy as an investor.

What is a lot in forex trading?

A lot in forex, also known as a contract, is the amount of currency that is being traded in one contract. The amount of currency a lot can trade depends on the currency pair, the trading venue, and the forex broker. Forex pairs include currencies like the Australian dollar (AUD), Japanese yen (JPY), the Euro (EUR), and the US dollar (USD). When trading USD and EUR, the amount a lot can trade is $10,000. When trading the JPY and AUD, the amount a lot can trade is 1 million Australian dollars. The amount of a lot depends on the currency pair and the trading venue.

How much is a lot in forex trading?

The amount of a lot in forex trading depends on the currency pair, the trading venue, and the broker. A lot can be between $10 and $50,000. The amount of a lot depends on the currency pair and the trading venue.

Learn how a lot in forex trading affects your strategy

When you’re new to forex, it helps to know how a lot in forex affects your strategy. Let’s say you want to make a $10,000 investment in the USD/EUR rate. If the rate shifts from 1.3737 to 1.3798, you’d gain $137. The amount of a lot you’re trading in a single transaction is $10,000. This means you could gain or lose $137 from that single trade. However, if you’re able to repeat your $10,000 investment 10 times, you’d end up making $13,370 in profit. If one of your investments lost $137, you’d only have to repeat the trade 10 times, so you wouldn’t lose $10,000 and would still end up with $13,370 in profit. The amount of a lot affects your strategy as an investor, so it’s important to understand how it affects your trades. This way, you can make the most of your strategy as an investor.

Once you know what a lot is, it’s time to get started!

Now that you know what a lot is, it’s time to get started! Forex trading is a great way to make money, but it comes with a lot of risk. Make sure you’re willing to take on that risk before you start investing. Forex trading is a very risky investment. The value of your funds can go down as well as up. In fact, forex is one of the riskiest types of investments. A large amount of your initial investment can be lost in a single trade.

Things to consider before investing in Forex

Forex is a very risky investment. There are many factors that can affect the value of a currency. Some of these factors include the strength of the US dollar, the state of the global economy, and the strength of a particular currency pair. Forex trading is also very speculative. You’re trading the chance that the value of a currency will change over time. It’s important to be mindful of the risks involved before you invest. You should think of forex trading as an investment rather than a way to make money quickly.

The Biggest Risks for Forex Trading

One of the biggest risks for forex trading is getting caught up in a high-frequency trading (HFT) strategy. HFT strategies are automated trading programs that use high-frequency trading software and algorithms to buy and sell large amounts of a specific currency very quickly. The advantage of HFT strategies is that they can make very large profits in a very short amount of time. However, the disadvantage is that the investor doesn’t have the opportunity to profit from small price changes.

Conclusion

Forex trading is a great way to make money, but it comes with a lot of risk and can result in the loss of your entire initial investment. Start by knowing what a lot in forex trading is and how it affects your strategy as an investor. Once you’re aware of the risks, you can start investing in forex.

#finance#business#education#entrepreneur#forexsignals#forexeducation#forextrading#forextips#forexstrategy#trader#wetalktrade#forexbrokersreview

1 note

·

View note

Text

Effective Exit Strategies

Effective Exit Strategies for Trading

Capital management is one of the essential factors of trading. Various traders, for example, join into a trade without any effective exit strategies and usually have more potential to earn early profits or fatal losses. Traders must know what exits are open for them and try to make an exit plan that will help to reduce the losses and close in profits.

How to Exit a Trade

There are only two methods you can get out of trade: Via Bearing a loss or earning a profit. When discussing exit plans, we use the words such as take profit and stop loss demands to guide the type of exit created. Through traders, sometimes these words are shortened as T/P and S/L.

Stop-Loss (S/L) Orders

Stop losses are a type of order you can put with your agent to sell the shares or equities at a specific price automatically. When this price is gone, the stop loss will instantly transform into a market demand to sell. These orders can help reduce the market’s losses fast against you.

Various rules are involved in all stop-loss orders.

Stop-losses are still set above the existing asking price on the purchase and below the current price of the bid on sell.

Once the stock is mentioned at the stop-loss price, the new york stock exchange stops losses from evolving into market demand.

NYSE and AMEX stop losses allow you to have the right to the next market sale when the price exchanges at the stop cost.

There are three kinds of stop-loss orders.

Good till canceled:- This kind of order suggests till an implementation happens or till you cancel the order manually.

Day orders:-This order expires after one day of trading.

Following stop:- This order tracks at a fixed distance from the market cost but never drives downward.

Take-Profit (T/P) Orders

Take profits is also named a limit order, and this order is parallel to stop losses which they convert into market orders. when the price is gone. Apart from this, take profit price stick to the exact rule as stop-loss has in terms of implementation performs on the NASDAQ, NYSE, AND AMEX trading.

Yet, there are two differences

There is no trailing price

The exit point should be placed above the current market cost rather than below.

Creating Effective Exit Strategies

Three things that should be evaluated when creating Effective exit strategies

How long am I preparing to be in this trade?

This answer entirely depends on what kind of trader you are. If you are doing trade for the long term(More than one month), you must focus on the following point.

Fixing profit targets to be hit in many years will determine your trades.

You are developing the trailing points of stop-loss that enable profits to closed each iso usually to limit your downside possibility. The immediate goal of long-term investors is usually to keep capital.

Bearing profit in increments over some time to lower volatility. While liquidating.

You are enabling volatility to save your trades to a minimum.

Based on the fundamental aspects of the long term, you can create exit plans.

If you are in the trade for the short term, you must examine yourself with these things. Developing near-term profit targets that implement at appropriate times to increase profits. Here are some typical implementation points

Pivot

Points

Fibonacci

Levels

Trend

line breaks

Other

points

Immediately eliminate the underperforming holding by developing strong stop-loss points.

You can create exit strategies that impact the short-term based on technical or fundamental aspects.

#forex#forex trading#forex analysis#forex account#forexstrategy#forexsignals#forex news#forex education#forexindonesia#forexmalaysia#forextrading#wetalktrade#forexsingapore#forexbrunei#forexdubai

1 note

·

View note

Text

youtube

#forexprofit#forexmentor#forexlifestyle#forextrading#forexsignals#forex news#forexindicator#forexstrategy#forexlive rss breaking news feed#wetalktrade#Youtube

1 note

·

View note

Text

#forex strategy#investor#invest#health & fitness#fashion#entrepreneur#bitcoin#travel#technology#pets#forex indices#forex course#forexstrategy#forex smart trade#forextrading#forex news#forex mentorship program#forexsignals#wetalktrade#news

1 note

·

View note

Photo

Useful Forex Trading Tips From the Experts.

14 notes

·

View notes

Photo

No matter the change in technology, these tips still remain contemporary. Do remember it always!

34 notes

·

View notes

Photo

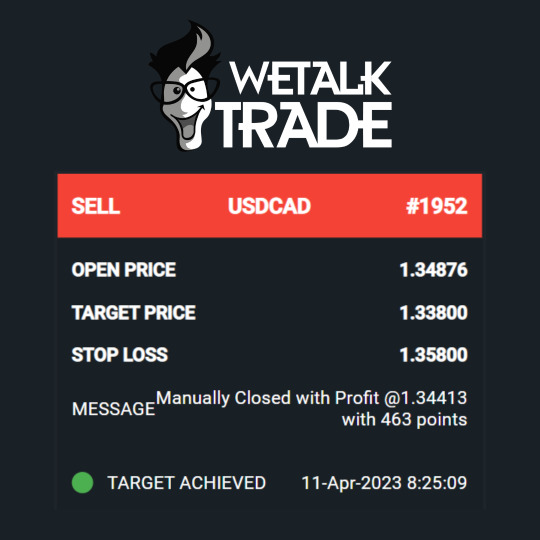

USD/CAD - Target Achieved at 1.34413 with 463 points.

Download the app now. It's completely free!!!

Web App: https://signal.wetalktrade.com

Android App: https://play.google.com/store/apps/details?id=free.forex.signals.wetalktrade

IOS App: https://apps.apple.com/app/id1563551543

#signals#premiumsignals#freesignals#forex#commodities#stock#tradingsignals#technicaltool#wetalktrade

3 notes

·

View notes

Photo

A trader and a gambler are not one and the same.

6 notes

·

View notes

Photo

The secret is you have to keep doing it until you become successful.

#forextrading#tradingstrategies#tradingplan#forexmarket#marketmovement#moneymanagement#riskmanagement#wetalktrade

12 notes

·

View notes

Photo

Get Pipbreaker in your trading gear to get rid of fear. Make confident entries with the best forex indicator. Get it today.

https://wetalktrade.com/best-indicator-for-mt4/

2 notes

·

View notes

Photo

Do delve deep. Stay afloat, guys.

17 notes

·

View notes

Photo

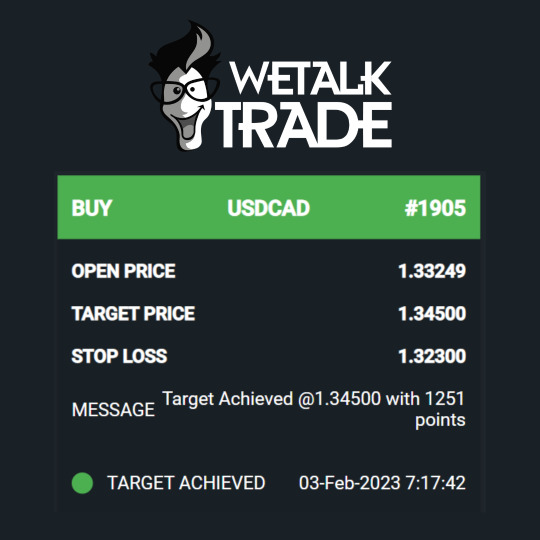

USD/CAD - Target Achieved at 1.34500 with 1251 points.

Download the app now. It's completely free!!!

Web App: https://signal.wetalktrade.com

Android App: https://play.google.com/store/apps/details?id=free.forex.signals.wetalktrade

IOS App: https://apps.apple.com/app/id1563551543

2 notes

·

View notes