#va home refinance

Text

HARP 2 Refinance For Homeowners With Underwater Mortgages

In order to assist homeowners with underwater mortgages in refinancing their houses, the Federal Housing Finance Agency (FHFA) launched the Home Affordable Refinance Program (HARP) in 2009. HARP 2, an enhanced version of the 2012-introduced program, gives borrowers who are having trouble making their mortgage payments greater flexibility. We'll look more closely at the HARP 2 refinance in this blog post and how it can help homeowners with underwater mortgages.

What is an Underwater Mortgage

Let's start by defining an underwater mortgage. A homeowner who owes more on their mortgage than the value of their home at the time is said to be in an underwater mortgage position. A decrease in property prices, a change in the homeowner's financial condition, or other circumstances may be to blame for this.

It can be challenging to refinance a property when a homeowner has an underwater mortgage since conventional lenders could be reluctant to offer a refinancing loan. Herein is the value of HARP 2. With more lax conditions, the program enables qualified homeowners to refinance their underwater mortgage.

Benefits of HARP 2 Refinance

One of HARP 2's key advantages is that it enables homeowners to refinance their mortgage at a loan-to-value (LTV) ratio that is generally higher than what traditional lenders would permit. Homeowners may be able to refinance with an LTV ratio of up to 125% in some circumstances. This implies that homeowners may still be able to refinance and lower their monthly payments even if their home is worth less than what they owe on their mortgage.

Another advantage of HARP 2 is that it enables homeowners to refinance even with bad credit or a history of financial troubles. The program can assist homeowners who have had trouble getting approved for other forms of refinance loans because it has more lenient credit requirements than typical lenders.

Requirements to Qualify for HARP2 Refinance

Homeowners must fulfill specific eligibility conditions in order to be eligible for HARP 2. These consist of the following:

The mortgage must have originated on or before May 31, 2009, and it must be owned by or insured by either Fannie Mae or Freddie Mac.

The homeowner's mortgage payments must be up to date, with no more than one late payment in the previous 12 months and no late payments in the previous six months.

An LTV ratio of at least 80% is required.

The homeowner must demonstrate their ability to pay the increased mortgage payment.

Not all homeowners with underwater mortgages will be eligible for HARP 2; it is crucial to keep this in mind. But for those who do meet the requirements, the program can offer important advantages and support them in maintaining their homes.

To Sum Up

In conclusion, the HARP 2 program can offer assistance to homeowners who have underwater mortgages. It enables qualified homeowners to refinance their mortgages with less stringent conditions, such as a greater loan-to-value ratio and lenient credit standards. Homeowners must fulfill a number of qualifying criteria, such as having a mortgage owned by or insured by Fannie Mae or Freddie Mac, being current on their mortgage payments, and having an LTV ratio larger than 80%, in order to be eligible for HARP 2. HARP 2 can be a useful tool for homeowners who meet the requirements to lower their monthly mortgage payments while maintaining their houses.

#mortgages#gca mortgages#real estate#property#loans#fha loan#va loans#harp 2 program#bad credit score#homw owners#refinance#payments#united states#usa#first time home buyer#homebuyers#Underwater Mortgages#gustancho associates#gca mortgage#non qm loans#jumbo loans#conventional loans

2 notes

·

View notes

Text

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Louisville Kentucky VA Home Loan Mortgage Lender: Kentucky VA Home Pest Termites Inspection Fees and…: Veterans Benefits Administration Circular 26-22-11 Department of Veterans Affairs June 15, 2022 Washington, D.C. 20420 Pest Inspection Fees…

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Veterans Benefits Administration Circular 26-22-11

Department of…

View On WordPress

#Fort Knox#Mortgage loan#pest inspection fee va loan#Refinancing#termite report va loan#va home loan#VA Kentucky#VA loan#va loans#VA Mortgage#va pest inspection#VA Streamline Refinance#va termite report#Veteran

2 notes

·

View notes

Text

Home Purchase Mortgage Process For First-Time Homebuyers

Buying a home is an essential milestone in every part of life, but for first-time home buyers who don't know what to expect, the process is often as intimidating as it is exciting. If you are a first-time home buyer, you must understand each step involved, and the various options available can make the journey more accessible and manageable. This article will explore the home purchase mortgage process and first-time home buyers programs that can help you achieve your dream of homeownership.

Analyze your financial situation: Before buying your first home, it's crucial to analyze your finances. Take a closer look at your income, savings debt, and credit score. This will help you and give a clear picture of how much house you can afford and what type of mortgage you qualify for.

Get Pre-Approved for a mortgage: This is a crucial step in homebuying. It involves submitting financial documents to a lender who will assess your creditworthiness and determine how much they will lend you. Pre-approval gives you a clear idea of your budget and makes you a more competitive buyer in the eyes of sellers.

Find a Real Estate Agent: First-time homebuyers benefit from working with an experienced real estate agent who understands their needs and priorities. An experienced agent can help you navigate the housing market, identify pocket-friendly properties, and navigate on your behalf.

Start Looking for a home: After pre-approval, trust your agent and then start exploring homes that meet your criteria. Make sure to consider factors such as location, size, amenities, and resale potential.

Make an Offer: Once you have found your dream home, your real estate agent will help you make an offer to the seller. This offer will include many details, such as the purchase price, contingencies, and proposed closing date.

Secure Your Mortgage: If the seller accepts your offer, it's time to finalize your mortgage. Make sure you work closely with your lender to lock in your interest rate and give them any extra paperwork they may need. Your lender will examine the property's value to ensure it matches the loan amount.

Close the Deal: The final step in the home purchase mortgage process is the closing. This is where you sign all the necessary papers and become the land owner. You may have to pay closing costs, including fees for getting the loan, title verification, and property taxes.

First-Time Home Buyers Programs:

Various first-time home buyer programs are available to assist individuals in purchasing their first home. These programs may offer down payment assistance, lower interest rates, or reduce closing costs. Some standard programs include:

Down Payment Assistance (DPA) :

A down payment is a significant initial expenditure representing a portion of the cost of the house. It is required for most types of mortgage loans. These programs are typically grants or low to no-interest loans. First-time home buyers may be eligible to receive down payment assistance. These programs include national and statewide programs offered exclusively in cities and countries. Program eligibility requirements for loans and grants may vary.

A close study of over 2,000 down payment assistance programs concluded that 87% of homes are eligible for some form of down payment assistance. Many assume these initiatives are exclusively for low-income, but most middle-class households qualify for down payment assistance.

Tax Deductions:

Several tax deductions allow you to reduce the burden of taxes. Deductions from federal and state revenue may reduce your taxable household income.

Closing Cost Assistance:

As with DPA (Down Payment Assistance), government-sponsored and private programs can help you pay closing costs. However, Closing Costs are additional fees you must pay at the end of the mortgage process. These costs are typically some percentage of the total loan amount. Closing Cost Assistance can come through a grant or loan, the same as down payment assistance.

You can also ask your seller for a seller concession to help with closing costs. The seller may cover attorney fees, real estate tax services, and title insurance. They may also assist with paying property taxes and mortgage points upfront to reduce your interest rate.

Home Buyers Education Programs:

Home Buyer Education Programs can be a good resource if you aren't sure how to start your home search. The best homebuying classes can be free or low-priced and also help students learn about loan options, the buying process, and how to apply for a mortgage.

Federal First-Time Home Buyer Programs:

One of the best programs is the Federal First Time Home Buyer program, Which is open to anyone who is a citizen and legal resident of the U.S. Some of the most popular federal programs for first-time home buyers-

Government- Backed Home Loans:

A government or mortgage loan sponsored by the federal government can also help acquire first-time home buyers programs with no down payment. It can also allow you to buy a home with poor credit. Government-backed loans are less risky for mortgage lenders since the government insures them.

Lenders may now provide borrowers with cheaper interest rates due to this.

These are three Government-Backed Home Loan options-

FHA Loans:

FHA loans are a good option for borrowers needing help to qualify for a conventional loan. The qualification requirements for FHA loans are much more lenient than conventional loans. This includes options for home buyers with credit scores as low as 500 (to qualify for a 3.5% down payment, you must have a credit score of at least 580).

V.A. Loans:

V.A. Loans offer the potential to buy a home without any down payment, lower interest rates, and other special loan terms offered exclusively to members and veterans of the U.S. military.

USDA Loans:

USDA loans allow home buyers to purchase a home without any down payment. These loans are intended for borrowers with low-to-moderate income. In addition to not requiring any money down, you can also finance the loan's closing costs.

Navigating the home purchase mortgage process as a first-time homebuyer may seem complicated, but with the proper guidance and resources, it can be a rewarding experience. By taking the time to educate yourself, secure pre-approval, and explore available programs, you can confidently take the first steps towards homeownership.

#usa home financing#loan#fha loan#va loans#refinances#mortgage process#usda loans#jumbo loans#programs#homeownership#united states

0 notes

Text

Discover the power of smart financial planning with our Mortgage Refinance Calculator. This comprehensive guide walks you through the intricacies of mortgage refinancing, helping you make informed decisions about your home loan. Use our advanced calculator to analyze potential savings, compare interest rates, and determine the most favorable terms for your mortgage refinance. Empower yourself with the tools you need to unlock financial freedom and secure a brighter future for your home investment. Start your journey towards a more affordable mortgage today

#mortgage refinance calculator#loan comparison calculator#Mortgage Affordability Calculator#Homebuying Budget Calculator#Home Affordability Calculator#VA Loan Calculator (Veterans Affairs)#FHA Loan Calculator#Check your FHA mortgage payment#30-Year Fixed-Rate Mortgage#VA home Loans

0 notes

Text

Refinance Mortgage Lender Margate - Osprey Mortgage Lending

Can I refinance my home loan online?

Yes, many lenders offer the option to refinance a home loan online. Online mortgage refinancing has become increasingly common, providing convenience and accessibility for borrowers. Here's a general outline of the process:

Research Lenders:

Explore various lenders and their refinancing options. This can include traditional banks, credit unions, online lenders, and mortgage brokers.

Compare Offers:

Use online tools and resources to compare interest rates, loan terms, fees, and other aspects of different refinance offers.

Prequalification:

Many lenders allow you to prequalify for a refinance online. This involves providing basic information about your financial situation, and the lender gives you an estimate of the loan amount and terms you might qualify for.

Application:

Once you've chosen a lender, you can often complete the refinance application online. This typically involves providing detailed financial information, such as income, employment history, and details about your existing mortgage.

Document Submission:

You may need to upload or submit documents to support your application. These documents can include pay stubs, tax returns, and information about your current mortgage.

Appraisal and Underwriting:

The lender may order an appraisal to determine the current value of your home. The underwriting process involves a thorough review of your financial documents and the property.

Approval and Closing:

If your application is approved, you'll receive a loan offer. Review the terms carefully, and if you agree, you can electronically sign the documents. The final step is the closing process, which may involve signing paperwork with a notary.

Funding and Repayment:

Once everything is finalized, the new loan is funded, and the proceeds are used to pay off your existing mortgage. You start making payments on the new loan according to the agreed-upon terms.

It's essential to be cautious and choose a reputable lender when refinancing online. Read reviews, check for any fees associated with the refinance, and ensure you understand the terms of the new loan. If you have any questions or concerns, many online lenders also provide customer support through various channels.

#apply va mortgage margate#home loan lenders pompano beach#mortgage refinance coconut creek#hard money loan margate#home loan lending coral springs#va loans margate#mortgage company coral springs

0 notes

Text

Finding The Best VA Home Lender: Key Questions To Ask

VA home loans are used to buy or build a home or make home improvements. However, the VA does not directly lend money to borrowers but guarantees a portion of the loan to approved lenders. Moreover, it reduces the risk for the lender and makes it easier for veterans to obtain financing. So, it is crucial to ask questions that cover essential topics such as the lender's experience with VA loans. By asking these questions, borrowers can make informed decisions about which lender to choose and ensure that they get the best VA home lenders.

Crucial Questions To Ask VA Home Lender

In this section of the blog, you will understand the crucial questions to ask your VA lender. Therefore, to know more in detail, you should read further and enhance your knowledge.

What Is Your Experience In Handling VA Loans?

It is vital to choose the best VA home lenders with a strong track record of handling VA loans. However, you can ask about the number of VA loans they have processed, their success rate, and their time of experience in the business. A lender with experience in handling VA loans is more likely to understand the process and requirements, making the entire process easier.

What Are Your Interest Rate And Loan Terms?

VA home loan refinance rates, and loan terms vary from lender to lender. Furthermore, it is crucial to ask about the interest rate and loan terms, including the loan length and monthly payment. Be sure to compare the interest rates and loan terms with other lenders to ensure you are getting the best deal.

What Are The Closing Costs And Other Fees?

Additionally, regarding the interest rate and loan terms, you should ask about the closing costs and any other fees associated with the loan. So, the fees can include appraisal, title, and origination fees. Besides, it is best if you ask for a breakdown of these costs so you can compare them with other VA home lender and ensure you are getting the best deal.

What Are The Eligibility Criteria For A VA Loan?

For a certified VA loan, you must meet certain eligibility requirements. Moreover, requirements can vary from lender to lender, so it is essential to ask about them upfront. Some lenders may have more rigid requirements than others, so be sure to ask about any potential roadblocks upfront.

Get The Best VA Home Loans Today!

Ask the best VA home lenders the questions you need to ask for a safe and secure loan experience. To know more, you need to visit the United Funding website to connect with professionals. However, professionals will inform you about different loans according to your preference. Connect with skilled experts by visiting the website now!

0 notes

Link

0 notes

Text

youtube

WHAT DO I NEED TO GET A HOME LOAN / MORTGAGE TO BUY A HOUSE? Here is Marco Milton from Price Mortgage to guide you in the initial lending process. Brought to you by Cristal Garcia, Listing Broker & Realtor® 575-650-5039.

#mortgage#lender#homebuyer#homebuyers#firsttimehomebuyer#homebuyingtips#lascrucesbroker#lascrucesrealestate#lascrucesnm#las cruces#home loan#refinance#fha#conventional#va loan#jumbo loan#Youtube

0 notes

Text

VA Streamline Refinance: How It Works and When to Get One

For more information about VA streamline refinance and how to buy a house, Read The SCOOP! Blog 1l.ink/HS84K2Z

Just answer a few simple questions to find out why they call it a (VA IRRRL) VA Rate Reduction Refinance Loan. You could easily save thousands! bit.ly/3LOvxR0

#applynow#homebuyer#realestate#refinance#refinancing#mortgage#home#homeowner#homeownership#housing#va#valoans#buyahouse#buyahome#firsttimehomebuyer

1 note

·

View note

Link

#what is a va loan#mortgage rates california mortgage rates mortgage refinance va loans rates california va loans usda home loan

0 notes

Text

Buying A House With A FHA 203k Loan Explained

If you're in the market for a new home, you may have heard of the FHA 203k loan. This type of loan allows you to purchase a home that needs some renovations with a single loan that covers both the purchase price and the cost of the renovations.

What is an FHA 203k Loan?

An FHA 203k loan is a type of mortgage that allows you to purchase a home and finance the cost of renovations at the same time. There are two types of 203k loans: the standard 203k loan and the limited 203k loan. The standard 203k loan is for more extensive renovations, such as structural repairs, while the limited 203k loan is for smaller repairs, such as replacing appliances or installing new flooring.

With an FHA 203k loan, you'll need to work with a contractor to create a detailed renovation plan as per FHA loan requirements, which will be submitted to the lender for approval. Once the loan is approved, the funds will be disbursed to the contractor as the work is completed. This means that you won't have to pay for the renovations out of pocket, and you'll only have one loan payment to make each month.

Step 1: Determine if You're Eligible for an FHA 203k Loan

Before you can apply for an FHA 203k loan, you'll need to make sure you meet the FHA loan requirements. To qualify for this loan, you must:

Have a minimum credit score of 580

Have a debt-to-income ratio of no more than 43%

Have a down payment of at least 3.5%

Use the loan to purchase a property that will be your primary residence

Have a reliable source of income

Step 2: Find a Property That Needs Renovations

Once you know you meet all the FHA loan requirements for an FHA 203k loan, you can start searching for a property that needs renovations. It's important to keep in mind that not all properties are eligible under FHA loan requirements for this type of loan. The property must meet the following requirements:

It must be a one- to four-unit property that has been completed for at least one year.

The property must be located in a community that meets certain standards for safety and livability.

The cost of the renovations must be at least $5,000.

The renovations cannot include any luxury items, such as swimming pools or outdoor kitchens.

It's important to work with a real estate agent who is experienced in working with FHA 203k loans, as they can help you identify properties that meet these FHA loan requirements.

Step 3: Work with a Lender to Get Pre-Approved for a Loan

Once you've found a property you're interested in, you'll need to work with a lender to get pre-approved for an FHA 203k loan. During this process, the lender will review your credit score, debt-to-income ratio, and other financial information to determine how much you can borrow.

It's important to work with a lender who has experience with FHA 203k loans, as the process can be more complex than a traditional mortgage. Your lender can help you navigate the process and answer any questions you may have.

Step 4: Get a Home Inspection and Create a Renovation Plan

Before you can apply for an FHA 203k loan, you'll need to get a home inspection and create a renovation plan. The home inspection will identify any issues with the property that need to be addressed, and the renovation plan will outline the scope of work and estimated costs.

It's important to work with a licensed contractor to create the renovation plan, as this will be submitted to the lender for approval. The renovation plan must be detailed and include all of the work that will be done, as well as the estimated costs.

Step 5: Close on the Property and Begin Renovations

Once your loan is approved and you've closed on the property, you can begin the renovations. The funds from the loan will be disbursed to the contractor as the work is completed. It's important to work closely with your contractor throughout the renovation process to ensure the work is done to your satisfaction.

Buying a house with an FHA 203k loan can be a great option if you're interested in a fixer-upper. By following these steps and working with experienced professionals, you can successfully navigate the process and create the home of your dreams.

#united states#gca mortgage#usa#refinances#gustancho associates#real estate#property#fha loan#va loans#fha 203 k loans#homenuyers#first time home buyer

2 notes

·

View notes

Text

FREQUENTLY ASKED QUESTIONS FOR KENTUCKY VA MORTGAGE LOANS

FREQUENTLY ASKED QUESTIONS FOR KENTUCKY VA MORTGAGE LOANS

What are VA Home Loans?

VA Loans provide military veterans and current service members a distinct advantage when it comes time to purchase or refinance a home. Today’s VA Loans have the most favorable terms available for most veterans. VA Loans can be used to purchase a new home with no down payment with no mortgage insurance or refinance up to 90% of homes current equity.

What are the…

View On WordPress

#FHA loan#Kentucky#Loan#Louisville Kentucky#Mortgage loan#VA Funding Fee#VA Guidelines#va home loan#va home loan program#VA HOME LOANS KY#VA loan#va loan credit score ky#va loan kentucky#VA LOANS KY#va mortgage#VA MORTGAGE GUIDES ky#va mortgage kentucky#va mortgage ky fico scores#VA MORTGAGE STUDENT LOANS#va refinance#Zero down home loans

0 notes

Text

FHA home loans | Supreme Lending

Real estate financing is made possible by FHA home loans, which are supported by the US Federal Housing Administration. Due to the fact that they have fewer restrictions than other loans, these loans are appropriate for first-time homebuyers or those with less-than-perfect credit. Borrowers need a minimum credit score of 580 and a 3.5% down payment to qualify for an FHA loan. Visit USA Housing Financing's website to learn more about the requirements for FHA loans.

1 note

·

View note

Text

Threads of You: Beyond the Bay 🌊

Monthly Devlog #2: November 30th, 2023

Yet another month, another devlog... Hey, everyone! 🎉 Welcome to the mass post for all things Threads of You: Beyond the Bay, where we spill the beans on what's been brewing... behind the scenes.

This month has been a whirlwind as we inch closer to the big reveal of our demo! Crunch time has hit, and the Lavendeer team has been putting in extra hours. How about a virtual pat on the back for our hard work? 🙌

But, hey, enough about that. Let's dive right in! ✨

Our socials! @lavendeerstudios | Follow our Twitter!

Programming wise, it's been busy this month! Relationship modifiers, arguably one of the most important things in a romance otome game, between the MC (You) and the characters were successfully implemented.

Alongside that, we've refined our scenes with proper animations to both our characters and UI to make it flow smoother and look pleasing to the eyes! It should also easier to navigate.

On the aesthetic front, our commissioned GUI is now not only complete, but seamlessly integrated into the game! Huge thanks to @sitraxis! We've shown a couple of sneak peeks, but look forward to more now that our key art made by Somate Studio is finished! Big thanks to them as well, we can't wait to show you guys how it looks!

The character customization progress has also undergone a significant overhaul. With a keen focus on every one of our players getting the representation they deserve, we've decided to add more options! Down to more skin tones (including albinism/vitiligo) to even adding religious wear and fashion styles. Feel free to send suggestions under this Twitter post!

Last but certainly not least, the programming team (it's just Lumi) has implemented a series of choices which can further personalize the main character and will reflect in-game (such as height or education)!

Our art team has also achieved a significant amount of milestones as well! The car interior/exterior BG art is now a finished masterpiece thanks to chuupew, Lumi, and newcomer, Jin!

BG art of the Hostel and its interior is currently a WIP, but we are expecting its completion pretty soon. All character sprites have been finished and 6/7 have been posted to all of our socials! Glad you guys are loving them. Huge thanks to @134340zzz and chuupew!

We have one more CG in the works as well! Keep an eye out for that~

Our commissioned keychains and standee designs have also been finished! Big thanks to mochibunny & Luii Lafete! The designs were made for Kickstarter, but Kickstarter's been sort of an issue for us recently... so we'll keep you updated with what we decide to do with these newly made designs.

Fun fact! Our character release sheets were actually inspired by my (siilycat/ai) scuffed Apple notes drawings. I was not home, but I still wanted to share my ~~artistic~~ vision SOMEHOW and I'm glad I did so through my notes app! (I am the only one on the team with no artistic talent whatsoever, but they turned it into something great!)

Who let me cook?

After further inspection, we realized how... lifeless and subpar some of the writing feels. So we have decided to revisit it and put life into an otherwise mediocre script.

Writing is pretty important in a visual NOVEL and we don't want to disappoint the people who play it. Hope you guys enjoy the new, revised script. We also had a concerning amount of... grammatical errors relating to past/present tense.

We also added more descriptive sections based on the player's choices which is always fun!

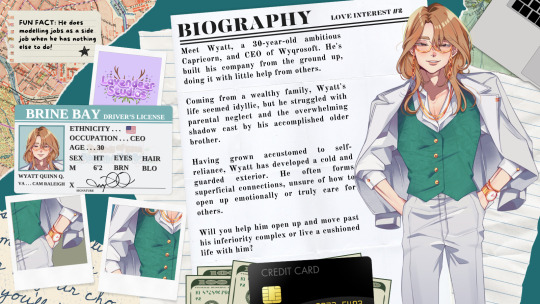

This has been a HUGE month for social media, most especially over on Twitter! We released 6/7 of our characters and VAs were announced! In case you missed it, here are the posts announcing the characters!

Kai Nguyen - Twitter | Tumblr

Wyatt Quinn Quiggley - Twitter | Tumblr

Vince Matador - Twitter | Tumblr ⭐

Jean Williams - Twitter | Tumblr

Andrew Mitchell - Twitter | Tumblr ⭐

Kevin Zuño - Twitter | Tumblr

and one more coming soon...

The stars ⭐ are the fan favourites! And their VAs in respective order are...

[not yet announced]

Cam Raleigh, Wyatt Quinn Quiggley - Twitter | Twitch

Noah Keawekane, Vince Matador - Twitter

Noir Thornton, Jean Williams - Twitter

Phil Ava, Andrew Mitchell - @philsterman01 | Twitter | YouTube

Jerron Bacat, Kevin Zuño - Twitter | Twitch

and one more coming soon...

In other news, we went from 100 to 1000 followers on Twitter in a month! Isn't that crazy? We were really worried about marketing the game, but I think we're making good progress!

Besides that, we have also started working on the itch.io and kickstarter page! Speaking of kickstarter, we're having issues with it so we're thinking of approaching a couple of publishers... Any suggestions or advice? Hit us up on Twitter!

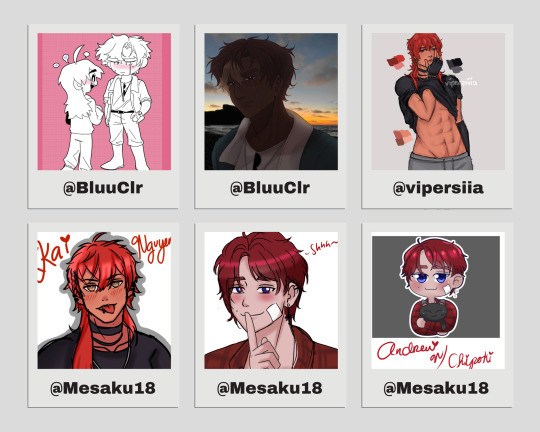

We also received fanart for the first time! A huge win! Our dear artists were so happy to hear that someone loved their character designs enough to draw them themselves!

Go check these wonderful artists out!

bluuescluues - @BluuClr

haven - @vipersiia

GreenVampBun(Only peace) - @Mesaku18

Thank you so so much for the fanart, you have NO IDEA how happy you've made the Lavendeer team 💖

Our plans for the next month include things like revealing our beautiful key art and final character, holding a raffle to celebrate the support we've gotten, finishing character customization and character expressions, and implementing a unique OST for the demo!

Commissioning music as a person who doesn't know anything about music is a really hard thing to do by the way. Shoutout to our composer, Ben Sigerson for putting up with my bullshit and going COMPLETELY based off of vibes. It's genuinely really good music and we're really low on budget so we thank him for all that he's done.

We really can't wait for you guys to see what we've been cookin' up for the past year. Also, stay on the lookout for an in character q&a soon!

#devlog#game development#visual novel#renpy game#otome game#renpy#vn#vndev#indie game#renpy visual novel#interactive fiction#indiegamedev#indiedev#gamedev#lavendeerstudios

25 notes

·

View notes

Text

What Are The Advantages Of Contacting A VA Home Lender Company?

A home lender company is a financial institution that provides financing for the purchase of a home or real estate property. These companies offer several mortgage loan products. When a mortgage loan is applied by a borrower from a VA home lender company, the lender evaluates the borrower's credit history, income, employment, and other factors. Thus, determining their eligibility and the terms of the loan. Once the borrower and lender agree to the terms of the mortgage loan, the lender provides the funds necessary to purchase the home. The borrower begins making monthly mortgage payments until the loan is fully repaid.

Top 5 Perks Of Taking Help Of A VA Home Lender Company

The VA home loan refinance rates program provides eligible veterans with several benefits when purchasing or refinancing a home. Contacting a VA home lending company can offer several advantages. The advantages include:

1. No Down Payment

One of the most significant advantage of a VA loan lender company is that eligible borrowers can finance 100% of the purchase price of a home. It can be especially helpful for veterans who may not have significant savings or may prefer to keep their funds for other expenses.

2. Lower Interest Rates

VA loans often offer lower interest rates compared to conventional mortgages. It is because VA loans are backed by the government, which reduces the risk to lenders, allowing them to offer more favorable rates. Lower interest rates can translate to lower monthly mortgage payments and significant savings over the life of the loan.

3. No Private Mortgage Insurance (PMI)

Unlike conventional loans, VA loans do not require borrowers to pay for private mortgage insurance (PMI). PMI is typically required when borrowers make a down payment of less than 20% of the purchase price of the home. By eliminating the need for PMI, best VA home lenders can save borrowers thousands of dollars over the life of the loan.

Get The Most Affordable Loan For The Best VA Home Lender!

Joining hands with a VA home lender company can offer several benefits when applying for a VA loan. These include access to specialized expertise, assistance with navigating the complex application process, and access to numerous loan products. These products are designed specifically for veterans and their families. You can receive these benefits by approaching United Funding. Contact them and avail of the most affordable home loan.

0 notes

Link

0 notes