#va home loan benefits

Link

0 notes

Text

How to Apply for a VA Home Loan

The VA domestic mortgage application is one of the most recommended perks reachable to cutting-edge and former participants of the U.S. military. This initiative, managed via the Department of Veterans Affairs (VA), objectives to assist provider members, veterans, and eligible surviving spouses reap the dream of homeownership with favorable phrases and conditions. If you are thinking about making…

View On WordPress

#apply for va benefits#apply for va home#guide to va home loans#help buying a home#home loans#home loans for veterans#how to buy a house#how to get an va loan#how to reduce your closing costs for a va home loan#how to use va loans#how va loans work#va home loans#va home loans for veterans#va loan for investment property#va loans#va loans explained#va loans what you need to know#va mortgage loans#veterans home loans#what is a va home loan

0 notes

Text

If you’re thinking about making a move this year, a turnaround in the housing market could be exactly what you’ve been waiting for. Work with a local real estate professional to learn about the latest trends in your area. To know more about the details, visit our website today: https://mortgage-maestro.com

#first time home buyer loan#first time home buyer incentive#first time homebuyer credit#va construction loan#first time home owner#first time home buyer benefits#first time buyers home program

0 notes

Text

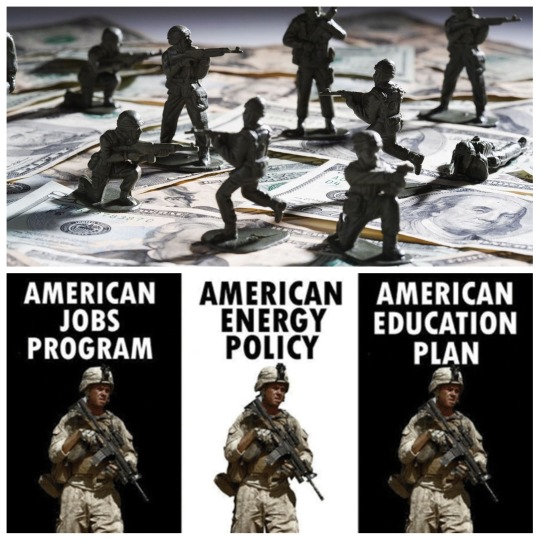

Truth, Justice & Northrup Grumman

Four genocides are happening right now:

Palestine/Gaza

Sudan

Congo

Tigra

Last 3 are in Africa so no mainstream news coverage.

US is funding the 1st one because of Zionism (Israel).

There is a 3 front war coming due to US presidential election being next November: Palestine (siding with Israel, Russia (siding with Ukraine), Iran (siding with Israel vs Iran & Palestine).

Biden is asking for $100 billion -- $60 billion for Israel & $40 billion for Ukraine.

He refuses to say how long the US engagements in Israel & Ukraine would be or to give any kind of timetable yet he is demanding 100 billion US dollars fund the genocide in Palestine & the war in Ukraine.

Biden is already openly threatening Iran using very bellicose statements that they had better stay out of Palestine and essentially doing everything he can to start WW3.

Biden is already making an argument that wars in Palestine & Ukraine are good for the US economy in trying to get Congress to approve the $100 billion in aid to Israel & Ukraine.

He claimed that US weapons manufacturing plants that make the weapons in the Israeli and Ukrainian conflicts would be responsible for creating 15k+ US jobs.

It is the Iraq War all over again.

Trumped up, contrived, fake as fuck, only happening to prop up sagging presidential approval ratings, to assure reelection & to drum up jingoism, nationalism & virulent blind patriotism that leads to nihilistic militarism, warmongering, national bloodlust & endless empire building on the corpses of young men, some idealistic, many black brown & poor, endlessly exploited by the capitalist war machine.

Ads to Be All You Can Be while Uncle Sam pays for college education that should be free when student loans literally just went back into repayment will coincide nicely with the aggressive push for WW3.

American jobs. American corpses. American mothers weeping for their dead sons.

Caskets draped in US flags for 21 year old boys.

18 year olds dying in a country they've never visited for no fucking reason.

Hamas is the enemy. Russia is the enemy. Iran is the enemy.

Go die for your country.

Go die for Biden.

Go die to build Americas empire.

Go kill people you've never even met.

Go pull a trigger when your only experience with guns is Call of Duty.

Go destroy your innocence.

Go make your parents proud.

Go risk your life for $30k.

Go risk your life for the VA to treat you like shit if you manage to survive.

Go risk your life so you can have your college education paid for.

Go get PTSD and night terrors.

Go be a man.

Go fight for your country.

Go get permanently injured and disabled.

Go be a wounded warrior.

Go for the propaganda.

Go so people can "Thank you for your service."

Go for free burgers at Applebees on Veterans Day.

Go so you can see your best friend in your squad get blown to smithereens in front of you.

Go to see civilians used as gun fodder and pregnant women used as shields.

Go to see toddlers killed and babies exploded.

Go so you can be given orders that will kill you just so your CO can look good.

Go to get endlessly hazed, bullied, harrassed and almost killed by your fellow Marines so you can get a fancy certcomm later.

Go so you can add "US veteran Armed Forces" to your LinkedIn.

Go endlessly traumatize yourself as an infantryman for noone to hire you once the "conflict" is over and you come home.

Go so you can see endless horrors in war then have endless difficulties "transitioning to a civilian career" once you get home.

Go for the death squads and rape parties.

Go to be captured by the enemy and tortured.

Go to be a prisoner of war.

Go so your weeping mother can be handed a folded flag at your burial to be put inside a glass case.

Go so you can fill the burial plots at military cemeteries across the country.

Go so Biden gets reelected and Trump gets reinstated on twitter.

Go for the chevrons and the stripes.

Go to get pinned.

Go for the trauma and nightmares.

Go so your VA benefits can get cut later.

Go so you can blow your brains out in a VA parking lot since theres still a waiting list to see a psychiatrist for your PTSD, depression, suicidal ideation, insomnia and night terrors.

Go for the sleep demon paralysis.

Go for the disfigurement.

Go for the IEDs.

Go for the bombs on the side of the road.

Go to drive a Humvee.

Go for the Nazi dress blues and shining saber.

Go for valor.

Go for courage.

Go to brag at future Christmas dinners and family parties.

Go to be a dutiful son.

Go because America needs her sacrificial lambs.

Go to be a colonizer.

Go to build empires.

Go to liberate people by destroying their country.

Go to be dehumanized in boot camp.

Go to be broken down and never built back up.

Go to be hazed by the biggest fraternity in the world, the United States military.

Go for the toxic masculinity, stay for the lifelong traumatization.

Go to be a stone cold killer.

Go to kill without blinking or thinking.

Go for the brainwashing and endless conditioning.

Go for the psychological torture.

Go for the pseudosexual sadomasochistic ritualistic tortures and humiliations of boot camp.

Go for the endless mindless roll calls.

Go for the halls of Montezuma to the shores of Tripoli.

Go to lose your humanity.

Go to have your sensitivity shredded in a blender.

Go to assert your manhood.

Go because the NFL had fighter jets fly over the stadium during Sunday Night Football.

Go because youre proud to be an American.

Go because its The American Way.

Go because of Pat Tillman.

Go because its what tough guys do.

Go because you cant find a job anyway.

Go because you can make a career out of it.

Go because of Modern Warfare III.

Go because of the Star Spangled Banner.

Go because of the Stars and Stripes.

Go because of the Pledge of Allegiance.

Go for the bald eagle.

Go for Reagan and the shining city on the hill.

Go for Dubya.

Go for the rockets red glare and the bombs bursting in air.

Go for the Super Bowl honoring you at half time.

Go for the proof through the night that our flag was still there.

Go for the home of the free and the land of the brave.

Go for spacious skies and amber waves of grain.

Go for purple mountains majesty above the fruited plains.

Go to crown thy good with brotherhood from sea to shining sea.

Go for the blood on your hands.

Go to blow someones brains out.

Go to rape a local girl.

Go to vent some steam.

Go for the myth and to build your own mystique.

Go to build a persona.

Go to reinvent yourself.

Go for GI Joe.

Go for Captain America.

Go to be superman.

Go to be a boy scout.

Go for truth, justice and the American Way.

Go to spray nerve gas on a local population.

Go to commit war crimes.

Go for the genocide.

Go for chemical warfare.

Go for psychological warfare.

Go for espirit de corps.

Go for teen spirit.

Go for Northrop Grumman and Raytheon.

Go for Lockeed Martin.

Go for Skunkworks.

Go for the CIA.

Go because pain is weakness leaving the body.

Go to get your head shaved and humanity stripped away.

Go be a cog in the machine.

Go because you havent done anything for your country today.

Go for the military industrial complex.

Go so your father can Friday Night Lights you and vicariously live through your military experience.

Go to be a neighborhood small town hero.

Go to get your head blown off so your high school gymnasium can be named after you.

Go to be a local dead celebrity.

Go to be honored at your hometowns Memorial Day Parade next year.

Go for the NFL to have a collective moment of silence for you and the other dead boys before kickoff.

Go to be thanked in a random celebrity PSA.

Go for free pancakes at IHOP on Veterans Day.

Go to fulfill your fathers warped sense of manhood, masculinity and being a man.

Go to continue the US history of violence and patrimony.

Go for the blood.

Go for the foreign pussy.

Go for the horrors.

Go for the viscera.

Go for the spilled intestines.

Go for the agonizing screams.

Go for the panic attacks and endless insomnia.

Go be a paranoid android.

Go because you havent earned your freedom.

Go to write your name in future US history books.

Go to cotinue the endless cycle of war, terror and violence.

Go for the injustice and genocide.

Go for the inhumanity.

Go for bootcamp graduation.

Go for the framed picture in your dress blues.

Go to be brave and strong.

Go to be fearless.

Go to be John Wayne.

Go for Oppenheimer.

Go for 9/11.

Go for America.

Go because We're number 1!

Go for a US flag waving on a Ford pickup truck.

Go for a Budweiser commercial with galloping horses and amber waves of grain.

Go for the Korean War.

Go for Lyndon B. Johnson.

Go for Richard Nixon.

Go for General Dwight Eisenhower.

Go for the Department of Defense.

Go for the Vietnam War.

Go for Emperor Hirohito.

Go for Hitler, Mussollini and Stalin.

Go for General Franco.

Go for Lenin.

Go for Mao.

Go for Admiral Yamamoto.

Go for Pearl Harbor.

Go for Operation Iraqi Freedom.

Go for Ferdinand being assassinated.

Go for the Hundred Years War.

Go for the Spanish Inquisition.

Go for Columbus.

Go for the Founding Fathers.

Go for the sweet land of liberty.

Go for the land where my fathers died.

Go for the Pilgrims pride.

Go for General Washingtons apotheosis in the rotunda as a American god.

Go to deify yourself as a war hero.

Go to make yourself a comic book character.

Go so Ben Affleck can play you in a war movie.

Go for Blackhawk Down.

Go for Napoleon Bonaparte.

Go for Ridley Scott.

Go to be a gladiator.

Go for Julius Ceasar.

Go because Rome was built in a day.

Go for Christendom.

Go for Alexander the Great.

Go for manifest destiny.

Go for militaristic expansionism.

Go for your corpse to be found on the side of the road in a foreign country you cant even find on a fucking map.

Go so your Humvee can be exploded.

Go to terrorize the local populace.

Go to put on the armor of God and breastplate of righteousness.

Go be a christian soldier.

Go climb Jacobs Ladder.

Go be a soldier of the cross.

Go to be baptized in the blood.

Go wade in the water.

Go for the homesickness and depression.

Go for the drugs and alcoholism.

Go for the panic attacks and anxiety disorders.

Go have your sensitivity, vulnerability and innocence destroyed.

Go to be violated.

Go for the smell of napalm in the morning.

Go for Apocalypse Now.

Go for the victory formation.

Go for the mushroom cloud.

Go for the blitzkrieg.

Go for Army vs Navy.

Go to be politely saluted by strangers at airports.

Go to be a commissioned officer.

Go for the honorable discharge.

Go help Biden beat Trump.

Go help the Democrats look tough.

Go help the Army go viral on TikTok.

Go so Sexyy Red names her baby after you.

Go be used and abused.

Go for Saving Private Ryan and Tom Hanks.

Go for Schindlers List.

Go for Braveheart and Mel Gibson.

Go to remeber the Alamo!

Go for General Custer and Henry Fonda.

Go for John Ford and John Wayne.

Go for Green Berets.

Go for The Last Samurai and Tom Cruise.

Go for Gundam and Neon Genesis Evangelion.

Go for Star Blazers and the Battleship Yamato.

Go to rape comfort girls.

Go for Voltron.

Go to transform like Optimus Prime.

Go for the Gram.

Go for the likes.

Go for the follows.

Go for the LinkedIn reactions.

Go for a pinned tweet.

Go to blow up on the for you page.

Go for virality.

Go for the silver play button on Youtube.

Go for the blue checkmark and verified account.

Go for the clout.

Go to be respected and admired.

Go to be shipped home to your mother in a pine box.

Go to prove youre a man and unafraid.

Go to be a Roman gladiator in the arena.

Go to slay the dragon.

Go to be King Arthur.

Go for the Sorcerers Stone.

Go for the key to the Euphrates River.

Go for the Sword in the Stone.

Go to be a Knight of the Round Table.

Go for the Queen of England.

Go for King and Country.

Go for your rightful place on Mount Rushmore.

Go for E Pluribus Unum.

Go for the Iliad.

Go for The 300.

Go for Thermopylae.

Go to bring down the walls of Jericho.

Go for Numbers 31:18 -- "Kill all the boys and all the women who have slept with a man. Only the young girls who are virgins may live; you may keep them for yourselves."

#ww3#world war 3#militarism#military industrial complex#nihilism#war machine#propaganda#nation building#endless war#new cold war#end genocide#free palestine#anti zionisim#anti capitalism#lockheed#northrop grumman#raytheon#skunkworks#war crimes#ethnic cleansing#chemical warfare#free sudan#free congo#free tigray#colonialism#biden#trump#two party system#green party#socialism

20 notes

·

View notes

Text

VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house.

ChangeMyRate.com compares multiple lenders and loan options for VA Loans — all in one place. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3pvLVQS

#mortgage#realestate#housing#buyahouse#homeowner#homebuyer#homeownership#applynow#real estate#buyahome#valoan#va#vahomeloan#va home loan

2 notes

·

View notes

Text

youtube

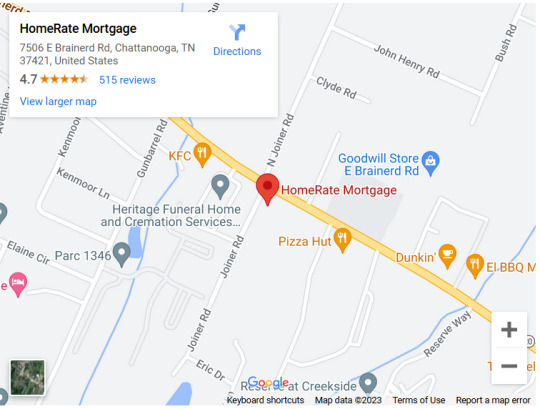

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am-7:30pm

Tuesday 7:30am-7:30pm

Wednesday 7:30am-7:30pm

Thursday 7:30am-7:30pm

Friday 7:30am-7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

HomeRate Mortgage,Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN,Mortgage Refinance,Cash Out Refinance,FHA Loans,Jumbo Loans,USDA Loans

Location:

Service Areas:

2 notes

·

View notes

Text

youtube

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am–7:30pm

Tuesday 7:30am–7:30pm

Wednesday 7:30am–7:30pm

Thursday 7:30am–7:30pm

Friday 7:30am–7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN

Location:

Service Areas:

2 notes

·

View notes

Link

0 notes

Text

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Louisville Kentucky VA Home Loan Mortgage Lender: Kentucky VA Home Pest Termites Inspection Fees and…: Veterans Benefits Administration Circular 26-22-11 Department of Veterans Affairs June 15, 2022 Washington, D.C. 20420 Pest Inspection Fees…

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Veterans Benefits Administration Circular 26-22-11

Department of…

View On WordPress

#Fort Knox#Mortgage loan#pest inspection fee va loan#Refinancing#termite report va loan#va home loan#VA Kentucky#VA loan#va loans#VA Mortgage#va pest inspection#VA Streamline Refinance#va termite report#Veteran

2 notes

·

View notes

Text

How to Secure Financing for Your Flagstone Home Purchase

If you’re eyeing houses for sale in Flagstone, you're likely excited about the prospect of owning a home in this vibrant community. However, securing financing can be a daunting task. This guide will walk you through the essential steps to help you navigate the process and secure the funding you need for your dream home.

1. Assess Your Financial Health

Before diving into the home-buying process, take a thorough look at your financial situation. This includes evaluating your savings, monthly income, debts, and credit score. Lenders will scrutinize these aspects to determine your eligibility for a mortgage.

Check Your Credit Score

Your credit score is a critical factor in securing a mortgage. A higher score can lead to better interest rates and loan terms. Obtain your credit report from major credit bureaus and ensure there are no errors. If your score is lower than desired, take steps to improve it before applying for a loan.

Calculate Your Debt-to-Income Ratio

Lenders use the debt-to-income (DTI) ratio to assess your ability to manage monthly payments. To calculate your DTI, divide your total monthly debt payments by your gross monthly income. Aim for a DTI ratio below 43% to improve your chances of loan approval.

2. Explore Mortgage Options

When considering houses for sale in Flagstone, it's crucial to understand the different types of mortgages available. Each type has its own benefits and requirements.

Fixed-Rate Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payment for the life of the loan. This option provides stability and predictability, making it easier to budget for your home expenses.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) have an interest rate that changes periodically. Initial rates are usually lower than fixed-rate mortgages, but they can increase over time. ARMs might be a good option if you plan to sell or refinance before the rate adjusts.

Government-Backed Loans

Consider government-backed loans such as FHA, VA, or USDA loans. These programs often have more lenient credit requirements and lower down payments, making homeownership more accessible.

3. Save for a Down Payment

A substantial down payment can significantly impact your mortgage terms. While some loans require as little as 3% down, aiming for 20% can help you avoid private mortgage insurance (PMI) and reduce your monthly payments.

Start Saving Early

Create a savings plan to accumulate the necessary down payment. Consider setting up automatic transfers to a dedicated savings account. Cut down on unnecessary expenses and boost your savings efforts with bonuses, tax refunds, or side income.

4. Get Pre-Approved for a Mortgage

Obtaining a mortgage pre-approval shows sellers that you are a serious buyer and can afford the houses for sale in Flagstone. During pre-approval, a lender will review your financial information and determine how much they are willing to lend you.

Gather Necessary Documents

Prepare documents such as tax returns, W-2s, bank statements, and proof of income. Having these ready will streamline the pre-approval process and demonstrate your financial stability to potential lenders.

5. Compare Lenders and Loan Offers

Don’t settle for the first loan offer you receive. Shop around and compare rates, terms, and fees from multiple lenders. This can help you find the best mortgage deal and save you money over the life of your loan.

Negotiate Terms

Once you have multiple offers, don’t be afraid to negotiate. Lenders may be willing to lower interest rates or waive certain fees to secure your business. Use competing offers as leverage to get the best terms possible.

6. Finalize Your Loan

After selecting a lender, you’ll need to complete the final steps to secure your mortgage. This includes a home appraisal, underwriting, and closing.

Home Appraisal

The lender will require an appraisal to determine the value of the house for sale in Flagstone you wish to purchase. Ensure the appraisal supports the purchase price to avoid any financing issues.

Underwriting and Closing

During underwriting, the lender will verify your financial information and assess the risk of granting you a loan. Once approved, you’ll proceed to closing, where you’ll sign the final documents and officially become a homeowner.

Securing financing for your Flagstone home purchase involves careful planning and preparation. By following these steps, you’ll be well on your way to owning a home in this desirable community. Good luck with your home-buying journey!

0 notes

Text

What Involving Loan Will You Need?

Well can your lender want? Initially all, financial institution wants which catch your own payments on it's own and get a reinstatement. Tips not possible and can easily identify the you experienced that forced you to obtain behind, a new lender desires to work with you. The lender wants in order to definitely show that was wrong; just what different today; and what amount that fits your budget. Then they must see when they can make your plan work from their point of view.

In a county if the loan limit is $417,000, a VA borrower does anyone want to borrow more than that by using a VA loan will have to down payment equal to 25% within the amount over $417,000. 신불자대출 will likely be if the VA borrower buys a household for $700,000 in a county the spot that the loan limit is $417,000, the amount over the limit is $283,000. Therefore, the down payment is 25% of that number or $70,750. With this down payment, the actual loan amount would be $629,250. That figures to be fifth thererrrs 89.89% loan to value, while most VA loans have 100% loan to value.

3) Get a no credit, payday loan. A payday loan, or cash advance, is tailored towards someone who has bad or little funding. You may use your unemployment benefits, disability, social security or child support payments the income requirement to acquire a loan. Goods considered as regular monthly income and can support the application for that loan. There are no credit scores run when applying in this type of loan.

Although obtaining a loan from while having bad credit can be very difficult, there are online lenders that offers loan opportunities for market . have bad credits. Loans like no credit check unsecured loan is one of the several most favorable loan offers that you will have. Folks allow which get monetary resources an individual may power to use for any purposes, without necessity to possess a good credit score or eager to have collateral to to have an approval towards the loan.

In a great many cases a lender might agree to with system modification plan. However, the plan is going become labeled like a loan modification and never as element that could constitute as an adjustment. This is inspired by how the lending company will be bringing in what it would refer to as a payment insurance policy.

Another suggestion is associated with applying regarding your student loan forbearance or deferment. This lets you to state what repayment terms you'd like to honor. If you discover that the united states information changes, you can still change this at a later date.

Consolidating your student loan is different this refinancing the house necessarily. Plan worry that if they consolidated from over payments and interest and will end up paying more in the end. That's a fallacy. On the one hand, could pay early with no penalty. Second, get the best rate that will repay all loans this agreement a fine. The consolidation, if anything, reduce expression loan it can be all said and executed.

As you know, have even worse . credit score can permit it to become more challenging to qualify to borrow money. However, since a second mortgage is really a secured loan, it demonstrates that your lender does a few security in deal - namely the equity with your home getting used as money. Therefore, the fact there is a low credit score does not come into play adjusting the way. You may pay a higher interest rate, but you shouldn't qualify for a mortgage loan.

1 note

·

View note

Text

For veterans and active-duty service members, the VA home loan program offers a range of benefits, including the opportunity to tap into their home equity through a cash-out refinance. Whether you're looking to fund home improvements, consolidate debt, or cover unexpected expenses, a VA home loan cash-out refinance can be a powerful financial tool. Let's explore how this option works and how it can help you achieve your financial goals.

0 notes

Text

Get Emergency Cash By Using A Short-Term Payday Cash

In most cases, it a pal or family members who asks you to co-sign a loan. This loved one may take some help obtaining a loan regarding your car or mortgage on the house. Perhaps the person have not had to be able to build their credit with regard to their age. Or, maybe chore has just gone via a bankruptcy or has credit rating and uses a fresh kick off.

Some counties considered to design high-cost housing markets have higher conforming loan boundaries. Places like Nantucket and Aspen, where the cost of just living is extremely high, have VA mortgage limits over $1,000,000. These kinds of beautiful resort towns, but there are several residents who live there year set. A VA-eligible borrower wanting to purchase a residence there would be awarded total entitlement that is suitable for the area.

Make the initial payment on time! Did are familiar with that most students who lose a loan discount achieve this task by missing their primary payment? Yes, that's directly! https://mujigja.co.kr/ -off" their primary student loan payment. That lost one-time loan discount, founded on a $10,000 loan @ 6.8% so a 10 year term, can be equivalent to $380.17 perhaps more!

The best part about it is that, since second mortgages genuinely are a type of loan is definitely secured by collateral (i.e., the equity you have in your home), removing a second mortgage doesn't have with regard to a difficult experience. Mentioned have recognize how powerful credit second mortgage industry works.

Get an individual bank loan from salinger sued member or friend. Could possibly think they will not be to help lend the money, even so they may surprise you. Anyway, it never hurts need to.

The pay day loan process begins with preparing yourself, and confident you are compatible with taking out a personal loan. Question your reasons for injusting out the loan, and assure they are worth paying benefit interest rates associated perform properly loan. Ensure that you have an unobstructed plan for repaying the loan, regardless of whether it requirements done in concert with your very next paycheck.

One technique called a title loan, which most anyone along with a clear title can obtain. In most cases, the companies that give out title loans do not require a credit visit. This means that even individuals with poor credit can get this type of loan.

0 notes

Text

Bank Rate Loan Calculator: Free And Straightforward

When rather than a long tenure loan, the short tenure loan comes having a lower apr. And s0, it is invariably a smartest choice to invest in a shorter duration loan, for people who have enough resources to repay the amount of the loan. This will help an individual lower interest charges. The amount you are going to borrow also wants determine mortgage loan tenure. For everybody who is borrowing a huge amount, focus on to choose a longer tenure application.

It is rather common knowledge that veterans and active duty military members can obtain VA mortgages up to $417,000 simply no money comfortably. But, what may not be so well-known is which experts claim zero-down VA home loans of up to $1,000,000, and much more in certain counties, are allowable with VA Jumbo loans.

Make important 35 - 47 payments on days! Lenders often will provide you having a loan principal reduction if you've got made 36 - 48 payments promptly. On a 10 year term of a $10,000 loan, that savings amount could possibly be approximately $703.44 or much more!

Getting financial with favorable terms can be very to your benefit. Because submitting an application for a loan online allow you to shop for different lending companies, it would not be impossible that you to locate a lending company that has loan terms that is favorable part.

Another method of getting caught from a plus takes place when you receive the offer associated with the all in a building. In this loan, business offers experience all of its debt, including credit cards, car loans, and some other debt anyone might have. It is tempting to except time wrapped into one loan, but will not be able to defer its predecessor or student loans. The loan will no longer be protected as an education loan.

Student's loan is amongst the choices for these higher education students. The student loan is usually designed in that way in which it helps a student to pay for the college and university fees, books as well as bills. This kind a loan is quite different from the other variety.

Another option you might want to consider when choosing a $10,000 credit score loan is the payday auto loan. This sort of loan requires no credit check and is fairly easy to get if happen to be gainfully retained. You will need deliver the lender your ss # and other documentation to prove your identity. 대출 ! usually land this connected with loan within one day.

The best thing is that, since second mortgages undoubtedly type of loan which usually is secured by collateral (i.e., the equity you have in your home), resorting to a second mortgage hasn't got to thought of as a difficult live through. You just have to understand how the credit history second mortgage industry art.

0 notes

Text

Best Home Loan Companies For Veterans

Hello Friends, today I have brought an article on “Best Home Loan Companies For Veterans”.

Honoring veterans with great loan options

In today's world, acknowledging the sacrifice of our veterans extends beyond mere expressions of gratitude. Numerous mortgage lenders are now going the extra mile by offering specialized loan packages tailored specifically for those who have served. These offerings typically feature lower interest rates, reduced or even no down payment requirements, and more flexible eligibility standards.

Among these lenders, Veterans United Home Loans stands out for its unwavering commitment to veterans. Known for their exceptional customer service and expertise in VA loans, they have played a pivotal role in helping numerous veterans fulfill their dream of owning a home. Similarly, USAA also stands as a commendable option with competitive rates and top-notch customer assistance for veterans seeking to purchase a home. By delivering tailored services and exclusive perks to those who have defended our nation, these companies epitomize the true essence of honoring our veterans in meaningful ways.

Benefits for Veterans: VA loan advantages

VA loans provide a tailored range of benefits for veterans and active-duty service members looking to buy or refinance a home. One key advantage is the ability to secure a mortgage without a down payment, making home ownership more achievable for those with limited savings. VA loans also typically offer lower interest rates than traditional mortgages, potentially leading to substantial long-term savings.

Additionally, VA loans eliminate the need for private mortgage insurance (PMI), resulting in additional cost savings over time. These loans are flexible in terms of credit score requirements, accommodating veterans who may have experienced financial difficulties in the past. Overall, the unique features of VA loans make them an appealing choice for military personnel aiming to realize their home ownership aspirations with favorable terms and reduced financial obstacles.

Best Home Loan Companies For Veterans

USAA and Veterans United Home Loans excel in providing home loans for veterans. USAA's commitment to military families shines through its competitive rates and personalized services. Veterans United Home Loans, on the other hand, is renowned for its VA loan expertise and top-notch customer service. Both lenders prioritize making the loan process simple and transparent for veterans, ensuring they feel supported every step of the way.

Navy Federal Credit Union stands out as a top choice for veterans looking for diverse loan options, offering flexibility and minimal fees. Their dedication to assisting military personnel is evident in their wide array of mortgage products tailored exclusively for veterans. These leading mortgage providers not only address the distinct financial requirements of veterans but also provide outstanding assistance every step of the way during the home purchasing journey.

Customer Service and Support: Assistance tailored to veterans

Providing customer service and support that caters specifically to veterans is crucial for safeguarding their financial stability. Companies that offer tailored assistance designed to address the unique challenges and requirements of veterans demonstrate a deep commitment to those who have served their nation. Whether it involves providing specialized financial guidance, flexible repayment options, or individualized support in navigating the home loan journey, customer service geared towards veterans surpasses generic assistance.

By grasping the nuances of military life, including deployments, frequent relocations, and post-service transitions, home loan providers can more effectively meet the needs of veteran clients. They can customize their support to suit the specific circumstances of veterans and extend empathy and understanding throughout the entire loan process. This personalized level of customer service not only efficiently fulfills veterans' needs but also fosters trust and loyalty within this significant customer base.

Rates and Terms: Competitive offers for military personnel

Lending institutions often extend competitive deals to military personnel, offering them lower interest rates, waived fees, and flexible repayment options tailored to their unique needs. Recognizing the sacrifices made by veterans and active-duty service members, lenders aim to show appreciation by providing favorable loan terms.

Some mortgage companies specialize in serving this demographic, offering programs like VA loans with benefits such as no down payment requirements. These companies understand the complexities of military life and strive to simplify the home buying process for those who have served. By leveraging these specialized services, military personnel can access exclusive rates and terms not typically available through traditional lenders, ensuring a more affordable path to home ownership.

Applying Process: Simplified application steps for veterans

Veterans embarking on the home loan application journey often find it daunting and intricate. Yet, by following a few essential steps, this process can become much more manageable. The first step is for veterans to collect all required paperwork at the outset, such as service verification, financial statements, and identification papers. This proactive strategy not only eases the application process but also helps avoid any future setbacks or complexities.

Partnering with a lender well-versed in veteran-specific loans can make all the difference. These experts grasp the distinct requirements of veterans and provide personalized help from start to finish. Additionally, tapping into resources like VA loan specialists or online tools made for veteran applicants can offer crucial assistance and direction along the way. By approaching the application process strategically and making use of available resources, veterans can confidently navigate their home loan journey.

FAQs:-

· What are the biggest factors to consider when choosing a VA loan lender? When considering a VA loan, it's crucial to look beyond just interest rates. Factors like experience with VA loans, customer service reputation, application process simplicity, and competitive fees are equally important.

· Do I need to be a member of a credit union to get a VA loan? No, but credit unions such as Navy Federal provide exclusive benefits to veterans, exploring both credit unions and traditional lenders is advisable for securing the best rates.

· Is it true I don't need a down payment with a VA loan? Although a down payment is not mandatory, it can bolster your application and potentially reduce your interest rate.

· My credit score isn't perfect. Can I still qualify for a VA loan? Despite some lenders having stringent credit score requirements, there are options available for veterans with lower scores. Seek out lenders specializing in VA loans tailored to veterans with diverse credit situations.

· What are some of the best online VA lenders? Rocket Mortgage and Loan Depot are renowned for their user-friendly online platforms for VA loans.

· I prefer more personal service. Are there VA lenders with a strong brick-and-mortar presence? Absolutely! Fairway Independent Mortgage and Guild Mortgage boast established branch networks that offer in-person guidance.

· What are some of the benefits of using a lender specializing in veterans? These lenders often have streamlined processes for VA loans, cater to veterans' unique needs, and may provide extra benefits.

· I'm still on active duty. Are there lenders familiar with military deployments? When seeking a loan, consider lenders familiar with active-duty service members. USAA and Veterans United excel in this field.

· How can I compare VA loan rates from different lenders? Online platforms such as Lending Tree streamline the process by enabling you to per-qualify with various lenders and compare rates effectively.

· What documents will I typically need to provide for a VA loan application? Requirements may differ among lenders, anticipate submitting proof of income, military service verification (DD-214), and details about the property you wish to purchase.

Conclusion:

When selecting a Best Home Loan Companies For Veterans, it's vital to go beyond just comparing interest rates and fees. Seek out a lender who recognizes the specific requirements of veterans and provides tailored programs or perks. Excellent customer service and prompt responses are key for a seamless lending experience. Additionally, transparent communication and accessibility are crucial. A reliable home loan provider should clarify terms clearly and address inquiries promptly. By emphasizing these factors alongside competitive rates, veterans can obtain a loan that not only fulfills their financial requirements but also shows respect for their service to the nation.

I hope this article will help to many that suitable for “Best Home Loan Companies For Veterans”.

Read the full article

#besthomeloan#besthomeloancompanies#BestHomeLoanCompaniesForVeterans#homeloan#homeloancompanies#loan

0 notes