#tmt shutdown

Text

CANADIAN ASTRONOMERS CONTEND WITH INDIGENOUS CONSENT OVER TMT

CBC News - September 27, 2020

The Canadian astronomy community has named the controversial Thirty Meter Telescope its top facilities priority for the decade ahead while also recommending the creation of a policy focused on Indigenous consent in a section of its new long range planning document.

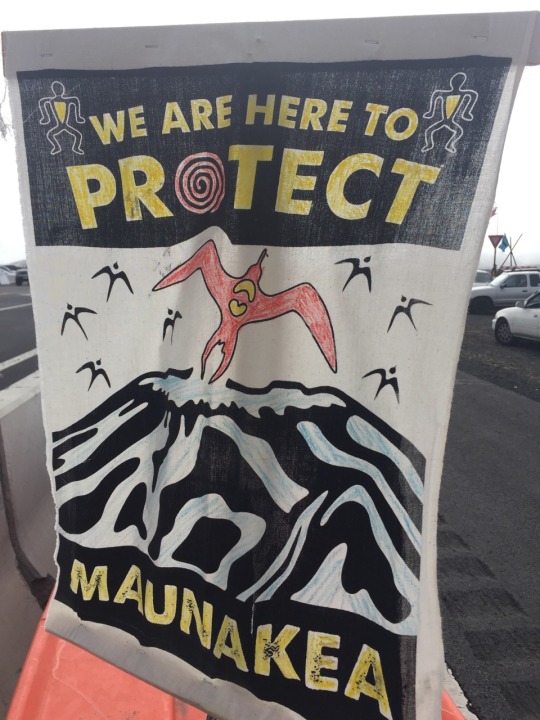

The telescope, proposed for construction on Hawaii's tallest mountain, Mauna Kea, has sparked opposition and widespread protest from Kanaka Maoli, the Indigenous People of Hawaii.

Canadian astronomers' commitment to the telescope has forced the community to contend with the tension between its scientific ambitions and how it navigates questions about Kanaka Maoli consent.

They successfully lobbied the federal government to commit $254.5 million in funding toward the project in 2015. If built, TMT would be among the largest telescopes in the world. A fact-pack on the TMT website says the telescope will "help answer fundamental questions about the universe" will likely lead to discoveries that can't be anticipated today.

Astrophysicist Sara Ellison, president of the Canadian Astronomical Society (CASCA), said "it's not our decision to make" when asked what role Canadian astronomers have to play in answering questions about Kanaka Maoli consent and TMT's future on Mauna Kea.

CASCA is a professional body that represents astronomers in Canada and publishes a long range plan every 10 years.

"It is for the Native Hawaiians and the State of Hawaii to decide whether we're welcome. And if we're not, we won't go," said Ellison.

Ellison said extreme efforts and good will went into the consultation process on TMT and said it had support from the Office of Hawaiian Affairs, a political body that represents Kanaka Maoli.

The office voted to withdraw that support in 2015.

'A territorial, jurisdiction issue'

Uahikea Maile, a Kanaka Maoli scholar and professor of Indigenous politics at the University of Toronto, said framing TMT as an internal Hawaiian matter is a way for Canadian astronomers to "distance themselves from the kinds of ethical quandaries of dealing with humans and human populations."

"When, in fact, in order to study the stars and the universe and other universes they have to contend with people on our own planet."

Maile has been advocating for Canadian divestment from the project and working to educate people about Kanaka Maoli perspectives about astronomy and Mauna Kea.

Peaking at 4,200 metres above sea level, the dormant volcano is sacred to Kanaka Maoli.

Its elevation and atmospheric conditions also present an ideal location for stargazing. Thirteen observatories have been built on the mountain since the 1960s.

Maile said the TMT conflict is often framed as a clash between culture and science, but that it's really "a territorial, jurisdiction issue" — one that has arisen because of colonialism in Hawaii and the limited decision-making authority his people have on the mountain.

Telescope conflict described as a 'lightning rod'

Sara Ellison describes TMT as a "lightning rod" on Mauna Kea that's about more than any single project and that the conflict has made it a difficult time to be an astronomer.

"Some of us have been real targets of animosity… within our own university communities and further afield as well, that we are somehow to blame for police violence against Native Hawaiians," she said.

She doesn't agree with the comparisons that have been drawn between the telescope and pipeline conflicts.

"With pipelines, businesses have something they really want to extract and have something to gain," she said.

When it comes to astronomy, she sees her field as "a gain for all of mankind."

"We're all asking questions about our origins and I think there's actually quite a deep connection there with Native beliefs in terms of ways of learning about our past," she said.

Maile said it's offensive to hear astronomers make a "bizarre connection" between their pursuit of knowledge and Kanaka Maoli culture.

"It is very clear to me that Canadian astronomers, after all my meetings, care more about finding alien life and discovering planets that are habitable for humans outside of our solar system than Indigenous rights and Indigenous Peoples on ours," he said.

Consent in Hawaii described as a 'complex issue'

TMT's external relations vice-president Gordon Squires said in an emailed statement to CBC News that "consent in Hawaii is a complex issue, as there is no single, recognized decision-making authority for the native Hawaiian population."

He wrote that TMT has gone through all the necessary processes and has met Hawaii's legal requirements to allow for construction and that "there is significant support for the TMT Project, including among native Hawaiians."

Maile said there's a plurality of perspectives among Kanaka Maoli when it comes to TMT but that there's evidence to show that Kanaka Maoli don't consent to its construction.

"Evidence of no consent from my people would be for decades having opposition to ongoing industrialization of Mauna Kea and other mountains in Hawaii," he said.

"Kanaka Maoli say enough is enough and have shown up in force to say no," he said.

'We benefit from stolen land'

In many ways, Mi'kmaw astronomer and University of Toronto professor Hilding Neilson straddles both sides of the conversation about TMT and Mauna Kea.

He submitted white papers to CASCA to inform the long range plan, including one about astronomy on Mauna Kea that included recommendations about how Canadian astronomers can better support Indigenous rights.

"Most of the people in Canadian astronomy have very little insight or idea of what it means to be Indigenous or Indigenous issues in Canada or Hawaii," he said, though he said he finds it promising that many in his field are embracing the conversation about the ethics around facilities and Indigenous Peoples.

Pauline Bramby, astronomer and co-chair of the panel that wrote the long range plan, said she hopes the section calling for the creation of a policy on Indigenous consent will prompt bigger conversations among astronomers, "where we reflect on the kinds of privileges we have as astronomers and how those privileges are informed by the history of colonialism."

"I think we've had a feeling in our field that because we don't build bombs and blow up people and everybody loves space that astronomy isn't a controversial field — it's kind of a blame-free field. And I think many of us are starting to realize that that's not quite the case."

She said TMT is a big part of why recommendations about Indigenous consent were written into the latest report but that a set of guiding principles would also be helpful for astronomers considering sites for ground-based facilities in other parts of the world.

While the long range plan recommendations about Indigenous consent send the "right message," Neilson worries that "it's not clear who is responsible for implementing that spirit and that message. So it could also end up being all for naught."

When asked if there's something he could compel his astronomy colleagues to understand, he responded: "We benefit from stolen land."

"Every image, spectrum, beautiful telescope picture we got — taken from Hawaii — is based on stolen land. We might have permission to be on there by the State of Hawaii and various lease agreements, but at this point no Native Hawaiian community has ever given us that consent, as far as I know."

Construction of the Thirty Meter Telescope remains on hold. Mauna Kea remains the preferred site for construction, though a site in the Canary Islands has also been identified as a potential backup.

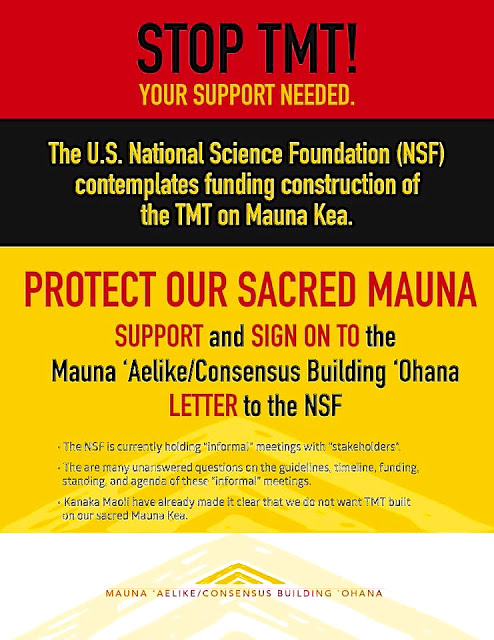

Cost estimates to build the telescope are currently in the ballpark of $2.4 billion. The National Science Foundation is currently reviewing a funding proposal for the project.

4 notes

·

View notes

Text

STOP THE DESECRATION OF MAUNA KEA

Nobody has the right to desecrate the Mauna of Hawai'i.

Pae maunga tū tonu, tū tonu. Pae tangata ngaro noa, ngaro noa. For generations, waahi tapu have been lost through wilful ignorance and steamroller mentality. What we see with Mauna Kea is something we have seen far to often worldwide. The disregard for mana whenua for capital gain. Mauna a Wākea is commonly know as Mauna Kea. If measured from the sea floor to its summit it is the tallest mountain in the world. Mauna Wakea is named after the sky father Ranginui and as the highest spiritual peak it act as a connection between Papatuanuku and Ranginui.

Nobody has the right to desecrate the Mauna of Hawai'i.

Nobody has the right to desecrate the Mauna of Hawai'i.

Nobody has the right to desecrate the Mauna of Hawai'i.

NOBODY HAS THE RIGHT TO DESECRATE THE MAUNA OF HAWAI'I.

100 notes

·

View notes

Video

youtube

🔺

11 notes

·

View notes

Photo

Telescopes in Hawaii reopen after deal with protesters | Science | AAAS

Astronomers at the 12 observatories atop Mauna Kea in Hawaii returned to work on 10 August, after a deal was made with protesters blocking construction of the Thirty Meter Telescope (TMT).

State authorities brokered the deal, which includes the construction of a temporary roadway built across hardened lava around the protesters’ camp on the summit access road. Law enforcement will give protesters an advance list of all vehicles going up and down—to show that they are not associated with the TMT.

Astronomers are grateful for an end to the 4-week shutdown of the existing observatories—the longest in the 5-decade history of the Mauna Kea observatories. “It was very far-reaching,” says Sarah Bosman of University College London, who lost 3 nights of time to observe distant galaxies with the twin W. M. Keck Observatory telescopes. “Every area of astronomy was affected by this.”

7 notes

·

View notes

Text

🔺July 17, 2019 — Mauna Kea Access Road — TMT Shutdown 🔺

Being able to visit Mauna Kea and witness my fellow Hawaiians demonstrating peacefully and powerfully was an amazing experience and I was lucky to be on Moku Nui by chance. It feels amazing to be apart of this history and this movement. It brings joy to my heart to see my people coming together to support those that have been fighting so hard to protect the land. It seems insane to me that we as Hawaiians are not allowed to try and protect what is important to us while the government or any other entity gets to claim it as their own while they use our Hawaiian words and concepts such as kapu or Imua TMT (TMT supporters)

Knowing that just hours before me and my family arrived that the road was shutdown and kupuna were being arrested is crazy to think of considering how peaceful and purposeful the atmosphere. In a way I’m glad we weren’t there to experience that because it would’ve been very painful to see.

I got this tattoo the day after visiting and was planning it on the way up to the Mauna. But I’m glad to be able to commemorate being there and hope to embody this word and the meanings I connect to it everyday as passionately as I can.

Now that I’m back home on Oʻahu and I see the current news coverage on how the amount of people demonstrating is growing and how the support is growing also I feel so happy. (All of the photos at Mauna Kea access road were from the 17th but if find news coverage of how many were there today you’d see how much it’s grown) Though there are others that try to make this movement and this demonstration (mhmm IGE and TMT supporters) I can see that we as Hawaiian people have found a chance to prove our love and support for the ʻĀina and those that protect it. I can only hope that as the movement grows that love and understanding will grow and that everything remains passionate yet peaceful.

#hawaiian#aoletmt#tmt#kū kiaʻi mauna#kūʻē#mauna kea#mauna a wakea#kanaka maoli#activism#indigenous#indigenous activism#tattoo#ancient hawaiian#proud hawaiian#hawaiʻi#demonstration#sacred land#pono science#kapu aloha

10 notes

·

View notes

Text

JSW Group Special Steel to transfer Raipur facilities to subsidiary

JSW Ispat Special Steel Products (formerly Monnet Ispat & Energy) has decided to transfer the manufacturing facilities at Raipur via a slump sale to a wholly-owned subsidiary, Mivaan Steels (MSL) to “enhance stakeholders’ value and unlock intrinsic value”.

At a meeting that concluded late on Wednesday, the Board approved acquisition of 100 per cent of the equity share capital of MSL to make it a wholly-owned subsidiary and the transfer of the company’s Raipur manufacturing facilities to it.

The transfer is subject to necessary approvals by the stock exchanges, Securities and Exchange Board of India (Sebi), shareholders and creditors of the companies, and the National Company Law Tribunal (NCLT).

A joint venture with AION, JSW Steel has a 23.1 per cent ownership in JSW Ispat Special Products (JISPL). The total consideration to be paid by MSL in cash and debt is to the tune of Rs 443.11 crore.

JISPL was acquired in 2018 under the Insolvency and Bankruptcy Code (IBC) in a deal that led financial creditors to realise Rs 2,892 crore against admitted claims of Rs 11,015 crore. The consortium of AION-JSW was the sole bidder for the asset.

JISPL has manufacturing facilities at Raigarh and Raipur. The facilities at Raipur comprise a sponge iron manufacturing plant with a capacity of 0.3 MTPA, a ferro alloy plant and a steel manufacturing plant with a capacity of 0.25 MTPA.

The unit manufactures products pertaining to the commodity grade market that caters to the structural and construction sectors with comparatively lower volume of production and serves customers predominantly around its operating area, the company mentioned in its statement.

At Raigarh, however, the focus is on special steel products with comparatively higher volume of production, serving customers in the exports and domestic markets covering northern, eastern and parts of western region of India.

The company mentioned that with the transfer of facilities through the proposed transaction, it would be able to focus on special steel products and explore and develop markets for its special steel products.

At the time of acquisition, though, the Raigarh unit had been closed for over four years. But post takeover, production was revived and operations bolstered. A shutdown of the TMT operations was taken, modernized and converted to specialty alloy steel that brought with it the advantage of higher realisations.

0 notes

Text

DOWNLOAD INSTALL CANON PIXMA IP1500 PRINTER DRIVER

Operating Systems: Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X

Download Type: http

Uploader: Veeru

Price: Free

File Name: install canon pixma ip1500 printer driver

Date Added: 10 November, 2019

File Size: 23 Mb

Downloads: 4514

File Format: exe

File Version: 112131265

Change log:

- Fixed issue where device could not go to preset in the Live Video contextUpgrading Instructions: Follow the steps below to upgrade the firmware: 1.

- Eyefinity(install canon pixma ip1500 printer driver Eyefinity) 3x1 (with three 4K panels) no longer cuts off portions of the application

- Fixed(install canon pixma ip1500 printer driver Fixed) Sempron CPU temperature issue.

- Fixed an issue that caused the DDNS status to always show “Please Wait” in the web-based management interface of the router.

- Fixed the bug that FTP does not close connection after upload images.

- Fixed application freeze(install canon pixma ip1500 printer driver freeze) if switched audio streams from the movies popup menu in TMT.

- Fixes a typo in the Insert Send list when using sample rates of 88.2 kHz and higher.

- Fixed an issue where(install canon pixma ip1500 printer driver where) audio playback and camera image were out of sync.

- Fixed a system(install canon pixma ip1500 printer driver system) bug where the TeraStation hangs if the unit was processing a high load while iSCSI was enabled.

- Replication - Fixed a bug where replication failed if any file handling occurred for the replication source target for more than 8 hours.

Users content:

Wireless configuration change for adopting EN 301 893 1.7.1 and EN 300 328 1.8.1 regulation. Add new options 80?/85?/90? in "CPU Shutdown Temperature".- Change the default setting of "CPU Shutdown Temperature" to 85?. About Keyboard Packages: Install the proper keyboard software and your system will be able to recognize the device and use all available features. Go to BIOS Setup by pressing pressing F2 and go to "Boot > Boot List Option"9. DVD R(16X disc, write in 12X)# Adding support list for F. Applies to both MX3W and MX3W-L# Password no longer required in booting procedure if "Setup" chosen in the security option. The Display feature in Radeon Settings "GPU Scaling" may not function for some games. WAV files during playback. Connecting an HDMI display device as the secondary display no longer results in extended desktop mode failing when attempting to apply it. Add support new anti-brute force mechanism(block only IP, reset when successful login from one IP) 4. MX4000TWIN DRIVER 3DCE DOWNLOAD

Supported OS:

Microsoft Windows 8 (64-bit)

Windows Server 2003 64-bit

Microsoft Windows 8 Pro (32-bit)

Microsoft Windows 8 (32-bit)

Windows Server 2008 R2

Notebook 8.1/8/7 64-bit

Windows 7 64-bit

Microsoft Windows 8 Pro (64-bit)

Microsoft Windows 8.1 Pro (64-bit)

Windows 8

Windows Server 2016

Microsoft Windows 10 (32-bit)

Windows 7 32-bit

Microsoft Windows 8.1 Enterprise (32-bit)

Windows Server 2003 32-bit

Microsoft Windows 8 Enterprise (64-bit)

Microsoft Windows 8.1 (32-bit)

Windows Server 2012

Microsoft Windows 8.1 Enterprise (64-bit)

Windows 2000

Windows XP 32-bit

Windows XP 64-bit

Microsoft Windows 8.1 Pro (32-bit)

Windows Vista 64-bit

Windows Server 2012 R2

Microsoft Windows 8.1 (64-bit)

Windows Vista 32-bit

Notebook 8.1/8/7 32-bit

Windows 10

Windows 8.1/8/7/Vista 64-bit

Windows 7

Windows 8.1/8/7/Vista 32-bit

Microsoft Windows 8 Enterprise (32-bit)

Windows Server 2008

Microsoft Windows 10 (64-bit)

Windows 8.1

Searches:

install canon pixma ip1500 printer Q57d; install canon pixma ip1500 printer driver for Microsoft Windows 8.1 (64-bit); install canon pixma ip1500 printer driver for Windows Vista 64-bit; install canon pixma ip1500 printer driver for Windows Server 2016; install canon pixma ip1500 printer Q QR573-5; install canon pixma ip1500 printer QR5736; install canon pixma ip1500 printer driver for Windows 10; ip1500 install driver pixma printer canon; install canon pixma ip1500 printer QRMYT5736; install canon pixma ip1500 printer Qdy573-dyr; install canon pixma ip1500 printer driver for Windows 8.1/8/7/Vista 32-bit

Compatible Devices:

Scanner; Laptop; Keyboards; Computer Cable Adapters; Mouse; Gadget

To ensure the integrity of your download, please verify the checksum value.

MD5: 799d139e6580288461d4fd95d0efa71c

SHA1: d54638fd847a979279e243d92cd0cae874c963cd

SHA-256: 63b6c16a6c2ad71c748a1ec0966b5e41c4e6c21de0d0843535c73f10c1f30872

0 notes

Text

DOWNLOAD BROADCOM NETXTREME GIGABIT ETHERNET NDIS2 DRIVER

Operating Systems: Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X

Price: Free

File Format: exe

Date Added: 30 September, 2019

Download Type: http

File Size: 23 Mb

File Version: 316181293

Uploader: Riva

Downloads: 2775

File Name: broadcom netxtreme gigabit ethernet ndis2 driver

Bug fix:

- Chechsum 7AF9h# Fixed Hyper(broadcom netxtreme gigabit ethernet ndis2 driver Hyper) Threading CPU S3 resume fail.

- Fixed UI errors.

- Fixes when change display mode to 'dGPU only' mode in setup, save and exit will cause 5 more seconds and shutdown in DC mode.

- Fixed wireless MAC filter edit error.

- Supports RAS Controller(broadcom netxtreme gigabit ethernet ndis2 driver Controller) (set SVID/SSID = A0A0/0396).# Fixed "Standard Game Port" driver install fail.

- Fixed system(broadcom netxtreme gigabit ethernet ndis2 driver system) S3 resume fail in Win98.# Fixed WinXP will loss Monitor when resume from S3.

- Fixes Proshield WMI issue.

- Fixed booting from WIN98/ME bootable CD.

- Fixed Flicker issue in 50 HZ frequency light source environmentUpgrading Instructions:Follow the steps below to upgrade the firmware: 1.

- Fixes(broadcom netxtreme gigabit ethernet ndis2 driver Fixes) change different TPM cause TPM item to be hidden under setup menu.

Users content:

Update Samsung 4G on-board memory. Change Agent version to 2.0.17-b59. Biostar logo)It is highly recommended to always use the most recent driver version available. Hid the On board VGA options when AGP card is installed. Improve MPEG4 (RTSP/HTTP) and media player compatibility. Please uninstall existing old TMT software before installing. BIOS for 1945PE DeskBookIt is highly recommended to always use the most recent driver version available. Firmware Version 1.0.4.0 incorporates the following additions and improvements:Note: The phenomena described below only occur in Version1.0.3.xx 1. Supports Auto Hidden HDMI item By GPIO. There are 2 SATA and 1 PATA ports for HDD and ODD. 2000 WINDOWS DRIVER DOWNLOAD LNE100TX

Supported OS:

Windows Vista 64-bit

Windows 8

Microsoft Windows 8 Pro (32-bit)

Windows 2000

Windows Server 2003 32-bit

Microsoft Windows 8.1 Pro (32-bit)

Windows 10

Notebook 8.1/8/7 32-bit

Windows 8.1/8/7/Vista 32-bit

Microsoft Windows 10 (64-bit)

Windows 7

Windows 8.1/8/7/Vista 64-bit

Microsoft Windows 8 Enterprise (64-bit)

Microsoft Windows 8.1 Pro (64-bit)

Microsoft Windows 8.1 Enterprise (32-bit)

Windows 7 32-bit

Microsoft Windows 8 (64-bit)

Microsoft Windows 8.1 Enterprise (64-bit)

Windows XP 64-bit

Microsoft Windows 8.1 (64-bit)

Microsoft Windows 10 (32-bit)

Windows Server 2003 64-bit

Microsoft Windows 8 Pro (64-bit)

Windows Server 2008 R2

Windows Vista 32-bit

Windows Server 2012 R2

Notebook 8.1/8/7 64-bit

Windows Server 2008

Windows 8.1

Microsoft Windows 8 Enterprise (32-bit)

Microsoft Windows 8.1 (32-bit)

Windows 7 64-bit

Windows Server 2012

Windows XP 32-bit

Microsoft Windows 8 (32-bit)

Windows Server 2016

Searches:

broadcom netxtreme gigabit ethernet ndis2 driver for Notebook 8.1/8/7 64-bit; broadcom netxtreme gigabit ethernet ndis2 GLXVQ3715; broadcom gigabit driver ethernet netxtreme ndis2; broadcom netxtreme gigabit ethernet ndis2 driver for Windows Server 2003 64-bit; broadcom netxtreme gigabit ethernet ndis2 driver for Windows 8; broadcom netxtreme gigabit ethernet ndis2 Gax371-axk; broadcom netxtreme gigabit ethernet ndis2 driver for Windows 8.1/8/7/Vista 64-bit; broadcom netxtreme gigabit ethernet ndis2 GL3715; broadcom netxtreme gigabit ethernet ndis2 driver for Microsoft Windows 8 Pro (32-bit); broadcom netxtreme gigabit ethernet ndis2 G GL371-3; broadcom netxtreme gigabit ethernet ndis2 G37a

Compatible Devices:

Printer; Soundcard; Ipad; Wifi router; Usb Cables; Wifi adapter

To ensure the integrity of your download, please verify the checksum value.

MD5: 4e4eeb9eee90f652daf3272306a7aba6

SHA1: 2b98a1f61d58385cad541f78eff039aff4134bec

SHA-256: 3633e168a8900648fc0d28f0eb52ffd83fc46b3205246ee0f5a4be60622bea59

0 notes

Link

Tata Steel, JSW Steel, and AdaniGroup are likely to bid for Neelachal Ispat Nigam’s (NINL’s) one-million tonne (mt) steel plant in Odisha’s Kalinganagar industrial complex.

Earlier this month, the Cabinet Committee on Economic Affairs gave the go-ahead for strategic disinvestment of 100 per cent equity shares in NINL, jointly owned by MMTC, two Odisha government-controlled public sector undertakings (PSUs), and a clutch of central public sector enterprises — NMDC, Bharat Heavy Electricals, Mecon (formerly known as Metallurgical & Engineering Consultants), among others.

Plans are afoot to ramp up NINL steel plant’s nameplate capacity to 10 million tonnes per annum (mtpa), from the current 1.1 mtpa.

Key facilities of the NINL steel mill, such as blast furnace and steel melting shop, are on shutdown for over six months for want of capital infusion by the lead promoters. Only the coke oven plant was operating at depleted capacity.

While MMTC — the largest shareholder — has already apprised the BSE of its intent to sell its entire 49.78 per cent equity in NINL, two other Odisha government-owned PSUs — Odisha Mining Corporation and Industrial Promotion & Investment Corporation of Odisha — were no longer keen to retain their stake adding up to 32 per cent.

Analysts still believe NINL is a good asset up for grabs, with its facilities and a captive iron ore block, potentially making it an attractive bet for bidders.

“There is the vision of brownfield capacity being ramped up. The NINL plant can be revived. Besides, the steel plant has captive iron ore mines. The possibility of brownfield expansion and availability of land will be crucial for any bidder,” said Giriraj Daga, investment manager, KM Visaria Family Trust.

chartHowever, the prospective bidders are non-committal on their plans to bid for the NINL asset. Adani Group did not respond to a questionnaire sent by email.

“We would not like to offer any comment on the matter. Suffice it to say that evaluating stressed assets is an ongoing strategic process in Tata Steel,” said Tata Steel in a written response to Business Standard’s queries.

A spokesperson at JSW Steel said, “We have no comments to offer on this.” NINL had successfully completed the revamp of its blast furnace. It has also diversified its products portfolio by churning out steel billets and its own brand of TMT bars. But lack of capital infusion by the promoters queered the pitch for its expansion and diversification. An industry source said NINL needed an immediate injection of Rs 900 crore to make all the key components running again.

NINL’s leveraged balance sheet made it ineligible to avail of formal credit from banks or financial institutions. For the past five years on the trot, NINL has been stacking up losses. Last financial year too, it ended in the red, despite turning earnings before interest, tax, depreciation, and amortisation positive, following the successful completion of its blast furnace capital repair work and resuming of steel billet production.

The steel plant possesses 2,500 acres of unencumbered land to expand capacity to 5 mt, a state-of-the-art coke oven battery with dry quenching facility, an already commissioned steel melting shop, proximity to the major port at Paradip, and an iron ore mine boasting of 110-mt deposits and with a lease validity spanning 50 years.

Mecon had previously revalued the assets of NINL at approximately Rs 8,300 crore on conservative estimates. NINL’s liabilities are below Rs 5,000 crore.

0 notes

Photo

#WeAreMaunakea 🙌🏼❤ . Reposted from @cody_fay (@get_regrann) - KHAL DROGO in the flesh . . Tmt still shutdown . . . #aoletmt #wearemaunakea #kukiaimauna #protectmaunakea #aquaman #jasonmomoa #kanakarangers #JasonMomoa #PrideOfGypsies #momoa #Aquaman #ArthurCurry #DeclanHarp #FrontierNetflix #KhalDrogo #GOT #RononDex #StargateAtlantis #Hawaii https://www.instagram.com/p/B0mXSafJ8XE/?igshid=1bvyz8phuyc3r

#wearemaunakea#aoletmt#kukiaimauna#protectmaunakea#aquaman#jasonmomoa#kanakarangers#prideofgypsies#momoa#arthurcurry#declanharp#frontiernetflix#khaldrogo#got#ronondex#stargateatlantis#hawaii

0 notes

Photo

Last week, the government sent armed forces in full riot gear to drag kupuna elders off Mauna Kea for trying to protect sacred land from the construction of the Thirty Meter Telescope. . . Mauna a Wakea as it’s known to Native Hawai’ians is the father of the islands and its people. When we say aloha ‘āina, it means that we love the land, but in a larger sense, it means that we love our family, our community, our ancestors, and our environment, everything that makes up Hawai’i, and all of that is fundamentally tied to the land. . . Mauna Kea is not just a mountain. We are Mauna Kea. When you build on Mauna Kea, you not only desecrate sacred land but you disrespect Hawai’i, it’s culture, and most importantly, the people that call Hawai’i home. . . Sign the petition to shutdown the TMT construction and preserve Mauna Kea for future generations of Hawai’ians to know and love. The link is in my bio, as well as the link to donate to the bail fund to help the arrested Ku Kia’i Mauna mountain protectors. . . Please sign, donate, or share an image with the sign of the Mauna and #alohaalwayswins to show your support for the Kia’i and help us spread the word that this is happening. Please help us protect our home. . . #wearemaunakea #maunakea #tmt #tmtshutdown #kukiaimauna #kapualoha #alohaaina #protectmaunakea #hoiikapiko #istandformaunakea #lilo #liloandstitch #disney #disneycosplay #disneycosplayer #lilocosplay #cosplay #cosplayer #CostumersforClimateAction #costumer #costuming #cosplayergirl #causeplay #sewing #sewingproject #costumedesigner https://www.instagram.com/p/B0Mb5A6Dtr8/?igshid=i6wjjmhdmswp

#alohaalwayswins#wearemaunakea#maunakea#tmt#tmtshutdown#kukiaimauna#kapualoha#alohaaina#protectmaunakea#hoiikapiko#istandformaunakea#lilo#liloandstitch#disney#disneycosplay#disneycosplayer#lilocosplay#cosplay#cosplayer#costumersforclimateaction#costumer#costuming#cosplayergirl#causeplay#sewing#sewingproject#costumedesigner

0 notes

Text

ACTION ALERT

Click Here To Oppose NSF Funding TMT

2 notes

·

View notes

Text

Portfolio managers discuss investment possibilities in real estate, equities and credit

As a growing number of US states have started to incrementally reopen their economies (under a variety of measures such as mask usage and capacity restrictions), we got our first official look at COVID-19’s toll on the nation’s economic output. The federal government announced on Wednesday that US gross domestic product (GDP) fell 4.8% in the first quarter.1 That’s the fastest rate of decline since the fourth quarter of 2008, when US GDP fell 8.4%, and it was driven by a drop in consumer spending not seen since 1980.2 Later on Wednesday, the Federal Reserve issued a statement affirming its commitment to use “its full range of tools to support the US economy in this challenging time.”

While broad data points can give us a good overview of where the economy currently stands, it’s important to remember that each industry, each US state and each global region will experience its own unique path toward recovery. With that in mind, I’ve asked a variety of Invesco portfolio managers to talk about their areas of expertise, and the possibilities that they see ahead.

William Grubbs, Managing Director and Head of US Funds Management for Invesco Real Estate

Tim Bellman, Managing Director and Head of Global Research, Invesco Real Estate

Joe Portera, Chief Investment Officer, High Yield and Multi-Sector Credit, Invesco Fixed Income

Brian Jurkash, Senior Portfolio Manager and Co-Lead, US Value Equities team

Matt Titus, Senior Portfolio Manager and Co-Lead, US Value Equities team

Matt Peden, Senior Portfolio Manager, International Select Equity team

Direct real estate: Three sectors that may be resilient in this environment

William Grubbs & Tim Bellman: The COVID-19 pandemic has led to a major disruption of the global economy; it is not a typical recession. Both the emergency itself and the varying policy response in different countries have consequences for real estate worldwide:

Asset management. The public health emergency has demanded swift and decisive measures by real estate asset managers and property managers.

Portfolio management. The unfolding economic crisis will demand a measured response depending on the depth and duration of the period of dislocation.

Capital markets. The turmoil may generate transaction opportunities if a level of stress and distress leads to the potential to recapitalize otherwise sound real estate.

The depth of the slowdown and potential shape of the recovery are hard to predict. They likely vary from city-to-city and country-to-country. Looking forward, what can we have conviction about? Long-term trends. Real estate themes that flow from secular trends in technology and demography that were driving forces pre-COVID-19 which have been accelerated include:

Logistics. This sector includes warehouses, distribution facilities, and fulfillment centers, and we believe its position as a strong outperforming sector has been reinforced.

Offices. In our view, prime central business district locations and innovation/life science hubs are likely to have strong performance.

Multi-family. This sector may be resilient in the slowdown; it is possible to maintain occupancy.

Before COVID-19, Asia Pacific appeared relatively well-placed with stronger economic growth driving real estate demand in major markets. Direct real estate in Asia outperformed Europe and North America slightly in the fourth quarter of 2019. As waves of the pandemic ripple out across the world from Asia Pacific, ironically Asia Pacific real estate continues to look relatively well-positioned in the near-term, in our view. But in time, once the economic restart is under way, we believe the dynamism of the US private sector economy is likely to power relatively strong performance.

Multi-sector credit: The ‘new normal’ may be driven by 5G and automation

Joe Portera: COVID-19 has wreaked havoc on global markets, but it has also presented investors with compelling investment opportunities. We believe this pandemic will have lasting impacts on economies via behavioral shifts, some of them likely to be permanent. At the center of it all we have witnessed technology taking an even more central role within each industry. Disruptions in everything from supply chains to education have put additional pressure on innovators to develop, manufacture, and deploy solutions at record speeds. Over the past 12 to 18 months, one of our highest-conviction themes was in technology, media and communications (TMT), specifically focusing on 5G and automation.

Our favorable outlook in TMT is supported by an accelerated shift in the economy. As populations and behaviors adapt to the new normal, we believe 5G will be an instrumental catalyst for unlocking a new technological revolution built on the force of unprecedented connectivity in terms of speed, capacity, and coverage. This in turn may allow implementation of robotics, artificial intelligence, and distributed cloud computing in the industrial sphere like never before. Some examples of trial technologies like self-driving and drones may get pushed forward towards reality. A disruption in the food supply chain due to issues with trucking networks, or an inability to deliver critical medical supplies to someone just a few miles away, when no contact is a key criteria, are just some of the challenges these technologies aim to answer.

In addition to our positive fundamental outlook, valuations in recent months have become more attractive, in our view. A great deal of default risk is currently priced into the high-yield market – by our calculations, prices reflect an expectation of roughly twice the credit losses ultimately incurred during the 2008 global financial crisis. There have been only a few times in history when spreads between high-yield bonds and Treasuries have been wider than they are now. In each of those previous occasions, the market was able to generate substantial forward gains as investors scooped up bargains not readily available under more normal market conditions.

While markets are beginning to stabilize, we believe the combination of fundamental drivers and attractive valuations provide for appealing investment opportunities. Without question, this crisis has underscored the demand from markets for solutions and has brought to the forefront the need for 5G to facilitate the implementation of those solutions.

Value stocks: Could cheaper stocks experience a stronger rebound?

Brian Jurkash & Matt Titus. For more than a decade, large-cap US growth stocks have outperformed large-cap US value stocks.3 However, we believe this current market sell-off may have created an opportunity for value to come back into favor. In March, valuation spreads — which measure the difference between the market’s most expensive stocks and its cheapest stocks — hit a standard deviation of 4.5, indicating that the difference is dramatically larger than usual.4 In fact, the only other time they have been at that level or higher was during the Great Depression and the global financial crisis.

Why do we think this is important? Coming out of past recessions, stocks with cheap valuations tended to lead the way, which we believe should bode well for value managers when we come out of this one. Also, economically sensitive sectors (financials, for example) have historically rallied after market downturns, and value strategies tend to have a significant overweight to these sectors versus growth managers. In comparison, growth’s performance has been driven by technology stocks: The Russell 1000 Growth Index has about a 40% weight in the sector versus the Russell 1000 Value Index which has roughly 7%.5 Looking at valuation metrics such as price-to-earnings and price-to-book ratios, the tech sector is substantially more expensive than financials, for example.6

More broadly speaking, another factor that may help boost stocks is the fiscal response that has occurred. This response is far greater than what investors experienced during the global financial crisis (GFC), and this time it only took 22 days for Congress to pass its first stimulus package, versus almost 12 months during the GFC.7 The Federal Reserve has also been more aggressive on monetary policy than during the prior crisis. We are also starting to see some bright spots in terms of a decline of new COVID-19 cases, increased recoveries, and containment. Also, many cities, counties, and states are laying the groundwork to reopen.

Global equities: Seeking to avoid stocks with overly optimistic valuations

Matt Peden: Equity markets have experienced a dramatic rebound from their March lows. But as long-term focused investors, we find it difficult to reconcile the current market valuations of many businesses with their underlying earnings prospects given the expected impact of the novel coronavirus. For most businesses, the coronavirus pandemic should be reasonably expected to have a noticeable negative impact on corporate revenue, margins, and after-tax earnings, with the magnitude of the impact dependent on the time required for societies to gain widespread immunity (either through a viable vaccine or herd immunity, if possible), the duration of government-imposed shutdown measures, and the extent to which the current situation influences longer-term consumer behavior. With most nations discussing only a gradual easing of restrictions beginning in May, leading to lockdowns averaging six to eight weeks, the coronavirus may have already engendered the most acute short-term economic downturn of the post-World War II era.

The near-term economic impacts of mass business closures and commensurate unemployment should not be underestimated. At no point during the financial crisis did entire industries shut down for months at a time, forcing layoffs of unprecedented scale and the loss of irrecoverable revenues in service-based industries. Moreover, with a viable vaccine believed to be at least 12 to 18 months away, widespread immunity remains elusive and the threat of subsequent waves of infection will persist following any gradual easing of initial shelter-at-home and social distancing measures. To assume that consumers will flock back to restaurants, bars, movie theaters, shopping malls, hotels and airplanes, while the risk of infection from a deadly virus looms, seems overly optimistic, in our view. Hence, we expect the virus to likely have a mid-term impact on consumer behavior, and thereby, corporate revenues and margins beyond any easing of government-mandated restrictions.

In recognition of the gravity of the crisis, governments around the world considerably expanded fiscal support for individuals, small businesses, and even corporations in the most severely impacted industries. However, this fiscal stimulus, unprecedented in size and scope, may elevate government debt to levels not witnessed since World War II and create lasting budget deficits due to challenges in unwinding social benefits after the crisis. As government debt must ultimately be serviced and budget deficits must eventually be funded from sources other than more borrowing, corporate and/or individual taxation may need to increase post-crisis. A corporate tax increase to fund the immense current stimulus programs would negatively impact equity values, in our view. Alternatively, any increase in personal tax rates would reduce disposable income and may constrain long-term consumer spending. At the time of writing, the S&P 500 Index was trading at mid-2019 levels and the MSCI World Index at early 2019 levels. Assuming that current intrinsic business values are equal to or higher than underlying values eight to 12 months prior to the coronavirus outbreak is illogical, in our view, indicating that investors may be incorporating overly optimistic assumptions into prevailing market prices.

Given the severity of the coronavirus situation in the US, the more exaggerated market recovery across US equities, and the greater magnitude of stimulus measures enacted within America (and thereby higher probability of future tax increases), we are presently seeing more attractive investment opportunities amongst the international companies we own and follow compared to their US peers. In other words, we believe the disparity between business values based on rational expectations and market prices appears most pronounced in US equity markets, with current prices in many cases reflecting overly optimistic assumptions. In addition to the disparity between US and international valuations, we continue to see a discrepancy between large- and small-cap valuations, with small-cap valuations continuing to remain more attractive, in our view. Our team seeks to avoid companies and areas where we believe excessively optimistic underlying business performance assumptions are imbedded in current market prices. Instead, we focus on a select number of businesses that we believe are rationally priced, high performing, and competitively entrenched.

Read more blogs in this series:

As earnings season looms, portfolio managers look for long-term opportunity

Portfolio managers discuss the risks and opportunities ahead

Where do portfolio managers see opportunity in today’s environment?

Footnotes

1 Source: US Bureau of Economic Analysis, as of April 29, 2020

2 Source: The Wall Street Journal, “U.S. Economy Shrank at 4.8% Pace in First Quarter,” April 29, 2020

3 Based on the Russell 1000 Growth Index and Russell 1000 Value Index

4 Source: National Bureau of Economic Research, Empirical Research Partners Analysis. Based on price-to-book data of the largest 1,500 stocks

5 Source: FactSet Research Systems, as of March 31, 2020

6 Source: Bloomberg, L.P.

7 Source: Credit Suisse

Important information

Blog header image: Marcin Jozwiak / Unsplash

Investments in real estate related instruments may be affected by economic, legal, or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Many products and services offered in technology-related industries are subject to rapid obsolescence, which may lower the value of the issuers.

Investments in financial institutions may be subject to certain risks, including the risk of regulatory actions, changes in interest rates and concentration of loan portfolios in an industry or sector.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

Standard deviation is a measure of the amount of variation or dispersion of a set of values. A higher standard deviation indicates a bigger variation from the mean.

Credit spread is the difference in yield between bonds of similar maturity but with different credit quality.

The price-to-book (P/B) ratio is calculated by dividing the market price of a stock by the book value per share.

The price-to-earnings (P/E) ratio measures a stock’s valuation by dividing its share price by its earnings per share.

The Russell 1000® Growth Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap growth stocks.

The Russell 1000® Value Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap value stocks.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The MSCI World Index is an unmanaged index considered representative of stocks of developed countries.

The opinions referenced above are those of the author as of April 30, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/portfolio-managers-discuss-investment-possibilities-in-real-estate-equities-and-credit/

0 notes

Text

…seriously, I am as big a nerd as any old body, and do I love hi-def colorized pictures of space? you betcha. they’ve moved me to tears before. I flipping love it. science can be amazing like that.

but science, like anything and everything else, is a tool, and a political one, and when you use buzzwords like “progress” to trample over other people’s rights, health, lives, and statehood, your tool is a weapon like any other weapon. it’s any other bludgeon, cudgel, knife, gun, or tank using other people, and other people’s blood, to grease the wheels and fuel the engine of that “progress,” and often carefully and deliberately chosen to do so, along with a PR campaign to make it sound like spring cleaning or a noble great white savior burden in the public eye.

for a profit.

so, you know… there’s a cost to the things your favorite astronomers and physicists and astronauts are able to see and do and say and share with you. and it’s a cost that, in all likelihood, you, and they, aren’t and haven’t been the ones paying.

no one is saying don’t make telescopes. no one is saying to throw astronomy out the door entirely in favor of theological studies, though if that’s your cup of tea, go for it.

but construction of the TMT is saying this nation of people, their culture, their history, their futures are less important and have always been less important than their ability to do whatever they want, wherever they want, to whoever they want, and make money in the process.

and people protecting themselves against that and taking action to stand up against this construction is saying that they don’t have to lay down and take that as a given just bc it’s what scientific “progress” is serving up for the special of the day.

#we are mauna kea#tmt shutdown#tmtshutdown#protect mauna kea#protectmaunakea#hawai'i#indigenous#indigenous sovereignty#decolonize#ndn blogging#solidarity#it took me embarrassingly long to sit down and clear my head enough to write this out#there's been a lot going on in the world lately as u all know. and it takes a lot out of u.#but this is also important.#pasifika#wearemaunakea#aoletmt#a'ole tmt

34 notes

·

View notes

Text

TMT SHUTDOWN - ACCESS DENIED YESTERDAY, TODAY & FOREVER

#tmt shutdown#aole tmt#ku kiai mauna#aloha aina#mauna over money#mauna over military#puu huluhulu#the world is watching#free hawaii#hawaiian kingdom

5 notes

·

View notes

Text

OPPOSE UNIVERSITY OF HAWAI`IʻS MAUNA KEA MANAGEMENT RULES

The University Board of Regents is meeting to vote on two items that will affect the future of Mauna Kea this Wednesday November 6, 2019, 9:45 AM at UH Hilo Performing Arts Center, on the Hilo campus.

Please come to the hearings in Hilo, speak, and/or submit testimony. Testimony sign-up is at 9:30 AM.

Written comments are due by 9:45 AM tomorrow, on November 5, 2019.

We’re asking you to take just a couple of minutes & OPPOSE the FOLLOWING -

UH Mauna Kea Management Rules.

(1) Adopting rules that restrict access and use of Mauna Kea summit lands and implement a vague permitting system for the access that it does allow. The rules apply to the public, but not University or observatory personnel, or government entities (Agenda item no. III.A)

(2) Passing a twelve point resolution on twelve Mauna Kea management steps with a supporting budget (Agenda item no. III.B)

Click Here & Use The Testimony Provided By Scrolling Down To The Bottom Of The Testimony & Sign It.

#we are mauna kea#protect mauna kea#aloha aina#ku kiai mauna#mauna over money#mauna over military#aole tmt#tmt shutdown#free hawaii#hawaiian kingdom#the world is watching

21 notes

·

View notes