#some day there needs to be a reckoning about why every streaming platform has some arbitrary episode order number they force on every show

Text

I agree with a lot of what's been said about the pacing (namely that this already great season could have been even better with an extra beat between eps 5 & 6, and likely another between 7 & 8) but I just want to take a second to remember what a fucking accomplishment this season is.

Like, just off the top of my head: they managed to expand the world-building of the show's pirate universe, add compelling new characters, deepen the central relationship in a genuinely complex and nuanced way with rich character arcs for both, at least suggest at greater complexity and emotional development for many of the background characters, and produce more expansive and technically challenging visuals including some very impressive action and crowd sequences. And they did all that with two fewer episodes, while still maintaining the original tone of the show and keeping run times under 30 minutes apiece.

It's not perfect, and they're not equally successful on all fronts, but it is extremely fucking good, and the fact that it gets anywhere close within those limitations is frankly an astounding artistic achievement

#ofmd#our flag means death#that said I am genuinely frustrated by how easy it would be to fix 99% of the remaining issues if they'd just been given a 10 ep season#but maybe I'll feel differently after the finale and I can view the thing as a whole#i believe 8 eps is standard for most of max’s original comedies#some day there needs to be a reckoning about why every streaming platform has some arbitrary episode order number they force on every show#not all stories require the same things!!#ofmd season 2

234 notes

·

View notes

Text

It’s not just exercise. Black fitness stars use their platforms to celebrate and educate. – NBC News

A recent cycling class that was part of a Black History Month Celebration Bootcamp was filled with a variety of music by Black artists. At the end, Peloton instructor Tunde Oyeneyin looked directly into the camera and said: “Black is salsa, Black is reggae, Black is hip-hop, Black is house, Black is Afrobeats, Black is country, Black is pop, Black is excellence.”

The 30-minute class was taken by tens of thousands of Peloton members on a platform that reaches more than 4.4 million people around the world.

The music Oyeneyin chose for her classes was intentional. She said she likes to bring the sounds she grew up with to the bike. “I think it widens our aperture and our ability to speak to different communities,” she said.

During a quick stretch that precedes her sweaty, challenging class, Oyeneyin tells riders, “We talk about, often, the struggle of Black people, but it is important that we celebrate, honor, we recognize our resilience as well.”

Oyeneyin shares her personal experience as a Black woman with members, and that experience has shown her how much representation matters in every facet of life. “To be able to wear my hair in a natural state on this platform — that means something to so many people,” Oyeneyin said.

She said she often receives messages from Black users expressing gratitude for her prominence on the platform.

Feb. 25, 202104:15

As the Covid-19 pandemic has restricted or shuttered gyms and group fitness classes, people looking for ways to stay fit have created home gyms, turned to streaming classes and have sought the wisdom of fitness influencers. But the most visible leaders in the fitness world don’t always reflect everyone on bikes and yoga mats, and that can include a lack of racial diversity when it comes to instructors, some in the industry say. Just like in other industries and institutions, Oyeneyin and her fitness instructor peers know systemic racism persists within their world.

Ashley Mitchell, a wellness professional and the co-founder of the Courage Campaign, said addressing racism within fitness spaces is “not as simple as making fitness free, it’s not as simple as hiring more Black instructors.” Mitchell said there is a lot more work that needs to be done in order to see real change.

The fitness world is “just another manifestation of systemic racism,” Mitchell said. “It’s about what’s in your neighborhood, what’s around you. It’s about health and wellness marketing. It’s about free time.”

Mitchell’s mission through the Courage Campaign is to teach students at under-resourced public schools about courage, resilience and agency through movements, discussion and journaling. She stresses the connection between fitness and activism. “When you feel strong and when you feel powerful, I think that that permeates through other areas of your life,” she said.

While there is hope that the racial reckoning many had throughout 2020 will make a difference, Mitchell says that “we’ve seen a lot of performative actions from fitness instructors and from fitness studios.” Her message to studios and CEOs: step up to the plate. “I would really love to see more. I would love to see better.”

With more people exercising at home because of the pandemic, Mitchell says she is seeing “a lot of Black and brown people becoming entrepreneurs instead of being attached to a studio.” She explains that “people are tired of waiting for someone to give them a chance. We see the gap and so we’re rising up, and we’re just taking that chance for ourselves.”

Destiny N. Monroe, founder of Raw Fitness and an Army veteran, started her own digital personal training company last July.

“I create my own lane for myself and attract those who want me on their brand.” Her tactics for dealing with discrimination and unrealistic standards within the fitness industry include “having a resilient attitude and just keep pushing forward.”

While some may be realizing the persistence of racism more recently, Monroe reminds them that “Black people did not appear in 2020, we’ve been here.” Monroe said fitness companies should “include us in, and if not, then we’re just going to keep making our own path and making our own way, but the difference is, we’re going to include everyone, because that is how you do it and that is the way to go.”

Monroe has nearly half a million followers on her Instagram @dnicolemonroe where she posts daily workout challenges, but she also uses her platform to fight for justice and equality. “Why wouldn’t I put my voice out there? Because at the end of the day, my voice, my people, is bigger than this fitness. So I make sure to use my platform in such a way that people notice that we matter.”

Chelsea Jackson Roberts, the first Black instructor for Peloton Yoga, had a full circle moment when the company announced its collaboration with Beyoncé to give students at 10 historically Black colleges and universities a free two-year digital membership. Jackson Roberts, who has a Ph.D. in educational studies from Emory University, founded the Yoga, Literature, and Art Camp at the Museum of Fine Art at Spelman College, an HBCU in Atlanta.

Jackson Roberts, who also celebrated the sounds of the African diaspora in a recent yoga class, said her prominence on the platform allows her to orchestrate classes that “create an experience that allows people to feel the fullness of their body in that moment, as well as using the breath as an instrument.” She believes the music in her classes is like “a symphony carrying us.”

The music Jackson Roberts uses in many of her yoga classes gives users the chance to celebrate Black culture as she encourages yogis to enjoy an Afrobeats or funk soundtrack while in a downward-facing dog.

Jackson Roberts recognizes the power her presence has on the app as she may be the only Black yoga instructor some users associate with. She takes this as “an opportunity to shift the narrative and a perspective for who qualifies as a knowledgeable teacher.”

Simultaneously, Jackson Roberts understands what her position means to young Black girls who are watching. “How dare I not use this as an opportunity to acknowledge my past in order to get rooted in this moment right now, to make sure that the people who come here after know that there’s something here for them.”

Jackson Roberts said yoga is “a way for us to connect our heart, right, to how we show up in the world. It’s a great way for us to get anchored in the breath before we speak out to whatever it is that we see.”

Follow NBCBLK on Facebook, Twitter and Instagram.

source https://wealthch.com/its-not-just-exercise-black-fitness-stars-use-their-platforms-to-celebrate-and-educate-nbc-news/

1 note

·

View note

Text

Luke Penman(play pause play)

This week I talk to Luke Penman. Luke is the mastermind behind Play pause play.

Firstly, tell us a bit about yourself?

I’m 36, and my wife and I have two dogs, [Clover and Cooper].

I’ve been going to local gigs since I was 17 and one day just made a conscious effort to seek out more local music and couldn’t believe how much great stuff I was finding that was generally just going unsupported and unheard outside of the tiny local scene.

What is the history and why did you start play / pause / play?

play / pause / play is essentially a brand under which I’ve run a bunch of stuff.

It started probably around 2008 when I wanted an online place to promote local gigs, and host free MP3 downloads of artists performing in Adelaide soon. My theory was that if we made the music easier to discover – made it easier for people to learn the songs – then people would be more likely to come to the shows.

In 2011 I launched a local music podcast. Again, the intent was to make it easier for people to discover new local bands. I thought that if I could convince my mates to listen to the podcast occasionally, it’d be easier for me to get them out of the house and into the city to see these bands live.

I ran a couple of gigs under the ‘play / pause / play’ banner that tied-in with the podcast. They went well – pulling around 150 people – but because I was bringing in extra production and wanted to make sure everyone got paid decently, I was generally making a small loss on the shows.

I was made redundant from my job, and therefore lost the ability to cover those losses and couldn’t afford to keep running gigs.

That original podcast run went for 50 episodes, but I didn’t have permission to use the music. While I never had any complaints, I knew I was putting myself in a risky legal position and decided to put the podcast on hold while I volunteered in community radio.

I volunteered and worked at Radio Adelaide for five years, initially producing and presenting Local Noise as a weekly show with bands performing live-to-air before eventually changing the format to be a daily show, though funding pressures meant my role was made redundant and I was looking at starting again, again.

Through working in radio, I’d looked at automated radio playout systems and started thinking about launching an internet radio station that was focused on Adelaide’s live music scene.

While there’s no blanket umbrella music license for podcasts [you need to get approval from each artist, record label and/or publisher directly] there is an umbrella license for internet radio, so it’s much easier to do legally.

In 2018, I launched a crowdfunding campaign to make play / pause / play radio a reality: a 24/7 internet radio stream of 100% Australian music, with a big focus on artists performing in Adelaide soon.

That campaign was successful, and I was lucky enough to obtain a partnership with the City of Adelaide to get more funding, but ultimately it mostly just covered the costs and couldn’t afford to pay myself out of it.

For the past couple of years, I’ve been keeping the radio stream ticking along while trying to find work that will cover my bills and give me enough spare time to keep play / pause / play running.

COVID-19 has had a big impact on that, with some potential work drying up, venues unable to host gigs [and therefore unable to advertise on play / pause / play], and with artists unable to perform, I felt that it would be unethical to run another radiothon crowdfunding campaign in 2020.

Thankfully the Government of South Australia, which runs a contemporary music grant program through the Music Development Office, changed its grants program to better suit the current landscape, which allowed me to apply for funding to make a new podcast series.

Now I have the time, and funding for licensing fees, I’ve been able to create a new play / pause / play podcast series. Across 10 episodes, the new series will introduce listeners to 50 South Australian artists that I reckon they should hear.

The focus is definitely on getting South Australians to make local music a part of their lives, but music is inherently international, and these artists deserve to be heard around the world.

How has the COVID-19 pandemic changed the music scene in Australia and Adelaide?

It’s certainly been painful.

I think that South Australia has done extremely well and we’re managing the pandemic about as well as anywhere can be, but the sudden shut-down massively impacted cashflow at every level of the industry.

All venues closed for a period of time. Some have started hosting sit-down gigs. There was a brief moment where it looked like we’d be able to have gigs featuring simultaneous standing and drinking, but a spike in cases meant things tightened again.

It has, of course, inspired innovation, with Sunny Side Uploads launching a high-quality livestream platform with donations for performing artists [and eventually being allowed to host a small crowd at their events as well], Knock Off Sessions streaming performances almost as soon as lock-down began before teaming up with local venue The Wheatsheaf, and Space Jams running virtual festivals with local artists which they’ve already parlayed into live gigs.

Due to requirements of having punters seated at gigs, capacities in our venues are massively reduced, so while many shows are “selling out”, it’s very unlikely to be sustainable.

Much of this has been possible due to the federal government’s JobKeeper program, which has provided businesses [and sole traders, which many artists will be] with funding to cover staff wages and is scheduled to reduce in amount and add stricter eligibility requirements in October before ending in March 2021.

Once that happens, the sector will likely struggle further.

I don’t believe we’ve had any gigs from touring bands as yet – even interstate Aussie acts – though many tours continue to be announced for future months where everyone hopes they’ll be able to go ahead.

I can’t speak too much for the rest of the country, but much of our music industry is based in Victoria, where our biggest outbreak of COVID-19 has caused the strictest lockdown. That’s currently due to end in October, but what things will look like at that point is still anyone’s guess.

Who are the local Adelaide bands we should know about?

That depends what you’re keen on!

We’ve got some great indie rock bands, from Towns to Teenage Joans, The Montreals, Oscar The Wild and heaps more.

There’s some brilliant pop being made here lately, from Electric Fields, George Alice, Stellie and Alpha Street.

If hip hop is more your thing, you should definitely check out Tkay Maidza, DyspOra, Oc3aneyes and Argus & The Liar.

If you’re into more experimental stuff, I reckon Lonelyspeck is one of the most intriguing artists in the world, plus we’ve got some great psych-rock from Sons of Zöku and Lost Woods.

If you’re more into dance, we’ve got acts like Motez, Strict Face and Faint One.

On the heavy side, I’ve been loving the hell out of The Daily Chase lately, plus there’s been some great stuff from Horror My Friend, Young Offenders and Madura Green.

If you’re looking for singer-songwriters, artists like Alana Jagt, Naomi Keyte, Kaurna Cronin and Max Savage will fill your cup.

Of course, you can’t go past some classic Australiana rock from bands like Bad//Dreems, West Thebarton and Dead Roo.

There’s 50 South Australian acts to be featured on this series of the play / pause / play podcast, and that’s really only scratching the surface of the great stuff we have here.

I’ve played more than 250 current South Australian acts on play / pause / play radio in 2019 and even that doesn’t cover everything. I only wish I had more time to devote to showcasing it all!

Who is the biggest band to come out of Adelaide in the last Decade?

The Hilltop Hoods are arguably the kings of Aussie hip hop, and inarguably the biggest band to have come from [and stayed in] Adelaide, and they’re still going strong, releasing their latest album in February 2019.

Other than that, Tkay Maidza has been making huge waves in Australia and the USA. Bad//Dreems have been hitting the road and turning heads all over the world, along with hosting the Fire Aid festival in Adelaide earlier this year which raised more than $200,000 for bushfire relief.

Teenage Joans are a quite new band, but play with the confidence of a band that’s been on the live circuit for decades. They came #1 in the play / pause / play Heaps Good 50 countdown for 2019 after they played more than 50 gigs in their first year as a band. They’ve just won triple j’s Unearthed High competition, so expect to hear a lot more from them soon.

What is your favourite venue to see bands in Adelaide, or SA?

I’m someone who absolutely prefers the more intimate shows, so while many people would point to Thebarton Theatre or The Gov, my most special shows have happened at the smaller stages, at places like the Ed Castle [RIP], Crown & Anchor, Jive and the Grace Emily.

I remember growing up in Adelaide and big touring bands bypassing the city, have you seen a change in the last few years and more bands touring Adelaide? I haven’t been out in Adelaide for a few years.

It’s a bit tough to answer because I’m so focused on those smaller shows and local acts.

I do remember that period in my early-to-mid-twenties when it felt like everyone was skipping Adelaide. You’d see someone wearing a tour t-shirt for an international band and scanning the dates on the back, you’d see that they played Brisbane, Sydney and Melbourne before flying over Adelaide to play in Perth and it hurt.

I think it got better for a while there, particularly in our peak festival period of Big Day Out, Soundwave and Parklife festivals bringing some huge acts to town before the bottom fell out.

The upgrades to Adelaide Oval meant a few more stadium shows could happen, and we’ve had a few major artists play in the parklands over the past few years.

It will be very interesting to see how that changes in a post-COVID-19 world, though. If touring acts need to quarantine for two weeks upon landing in the country, will they add more shows [and therefore more cities] to the tour in order to make it more worthwhile, or will they just skip Australia altogether?

My guess [and hope] is that we’ll see a new era of festivals with a big focus on Australian artists, and the various lockdowns will see punters hungrier to get out of the house and get to more gigs.

Finally, what are your plans for play / pause / play going forward?

Honestly, it’s quite up in the air at the moment.

The dream would be to get access to a physical space to record podcasts, radio and video content, as well as getting back into hosting gigs and expanding the offerings on the website and maybe releasing some local music vinyl, but that all takes so much time and simply won’t happen without real funding investment.

The podcast series will run for 10 episodes, and at a cost of $500 per episode just for music licensing, it’s not something I can cover myself after that.

I’m still hesitant to run another radiothon crowdfunding campaign because of how much everyone’s still hurting from COVID-19, so I’m not sure the best way forward.

At this stage, I’m focusing on making and promoting the podcasts. Once the series is done, I’ll have a moment to catch my breath and hopefully work out where to go from there.

https://open.spotify.com/show/1lCn9On5xnxcJAvwDmSLwV?si=SBTCD_WNS229fw6VY-FvvA

https://instagram.com/playpauseplayadl?igshid=2frst1khbydf

0 notes

Text

29 Useful Websites You Wish You Knew Earlier

There are so many wonderful websites around, and it is difficult to know each and every one of them. The below list provides some of those websites that I find particularly helpful, even though they are not as famous or as prevalent as some of the big names out there.

Here are the 29 immensely useful websites, get that bookmark ready:

1. BugMeNot

Are you bugged constantly to sign up for websites, even though you do not wish to share your email? If yes, then BugMeNot is for you. Instead of creating new logins, BugMeNot has shared logins across thousands of websites which can be used.

2. Get Notify

This nifty little website tracks whether the emails sent by you were opened and read by the receiver. Moreover, it also provides the recipient’s IP Address, location, browser details, and more.

3. Zero Dollar Movies

If you are on a constant lookout of free full length movies, then Zero Dollar movies provides a collection of over 15,000 movies in multiple languages that are available to watch for free on Youtube. It indexes only full length movies and no trailers, or partial uploads. In addition, it has a clean interface, contributing to a good movie watching experience.

4. Livestream

Livestream allows you to watch and broadcast events live to viewers on any platform. For the next time when you want to share your company’s annual CEO speech live to employees who are on remote locations, Livestream serves as a perfect platform.

5. scr.im

scr.im converts your email address into a short custom URLs, that can be shared on public websites. This prevents your email id from getting picked up by spam robots, and email harvesters who are on a constant lookout from your email id.

6. TinEye

TinEye is a Reverse Image search tool which is as accurate as Google’s Reverse Image search tool. As opposed to Google, TinEye provides a set of APIs that can be used for personal and commercial purposes, which makes it very useful for developers.

7. Fax Zero

Fax Zero allows you to send faxes to US and Canada for free. Additionally, it enables you to send faxes to countries outside North America at a fixed pay per use cost.

8. Snopes

Do you believe that fingernails and hair continue to grow after death? Why don’t you check out if this is true, along with thousands of other urban folklore out there, at Snopes?

9. Stickk

Is it difficult for you to stick to goals ? If yes, then let Stickk help you reach your goals. It makes use of commitment contracts to empower you to better your lifestyle.

10. Boxoh

Boxoh can track the status of any shipment package on Google Maps.

11. PicMonkey

PicMonkey is an online Image editor, that allows you to touch up your images. Also, you can apply different effects, fonts, and designs to your images. It is a perfect tool to create pins for Pinterest and awesome looking Facebook covers.

12. Trello

Trello is a great online tool for organizing just about anything using Kanban style cards. It provides a highly visual way for Online Collaboration, and is a simple free tool for Task and Project Management.

13. Short Reckonings

Short Reckonings is an online tool to keep track of shared expenses. It is deceptively simple, easy to use, and allows you to enter expenses with the fewest possible clicks. A clean, ad-free interface adds to the charm of this simple website.

14. Memrise

Do you fancy learning new things in small byte sized packages? If yes, then Memrise is for you. The additive nature of gaming combined with memory improvement makes this an excellent resource.

15. Instructables

Instructables provides instructions to help you build just about anything you can imagine. It provides a platform for people to explore, document, and share their creations.

16. join.me

In today’s world, where collaboration across multiple stakeholders is key, join.me provides an online platform to share desktop screens. Record audio for meetings conducted with participants not in the same room. In addition, it is a simple tool to share your screen with just about anybody on the web.

17. Sync.in

Sync.in allows multiple people to edit documents and notes in real time. It is a great tool for online collaboration.

18. Privnote

Do you wish to share notes and information that self destructs immediately after it is read ? Privnote does exactly that.

19. ScribbleMaps

Have you ever wanted to place your personal markers, shapes, and scribbles on Google Maps? Even though Google Maps does not allow that, ScribbleMaps does, and it does a great job at it.

20. TripIt

TripIt is a painless way to organize all the details of your vacation or business trip. Forget your flight time? Can’t find the e-mail with your hotel’s address? That won’t happen with TripIt, which keeps your itinerary in one place.

21. Skyscanner

Skyscanner is a leading global travel search site, providing instant online comparisons for millions of flights on over a thousand airlines, as well as car hire and hotels.

22. Hostel Bookers

Hostel Bookers is one of the best search engines to search for cheap hostels and hotels while backpacking or traveling around the globe.

23. Fitday

Fitday allows you to track you diet and weight loss through its journal. The personal dietician and free articles on nutrition and weight loss on their site are a great bonus.

24. Endomondo

Endomondo is a mobile app that allows you to track your workouts. The website allows detailed analysis of your training, that makes it a valuable tool to understand and plan your workouts.

25. My Fitness Pal

If counting calories is your main goal, then My Fitness Pal is the best web and mobile application out there. The service has a massive database of meals and exercises to make it easy to accurately count calories.

26. Fuelly

Fuelly tracks the gas mileage for your cars and helps you to analyze, share, and compare your vehicles fuel consumption.

27 .3-Minute Journal

3 Minute Journal is different than most other Journals out there. This application allows you to track your moods, achievements, failures, and moments of gratitude. In addition, it does great analysis over these parameters.

28. 750 Words

750 Words is based on the idea of “Morning Pages”; that advises aspiring creatives to start each morning with three pages of stream-of-consciousness writing to clear away the mental clutter, leaving you with a clearer mind to face the day.

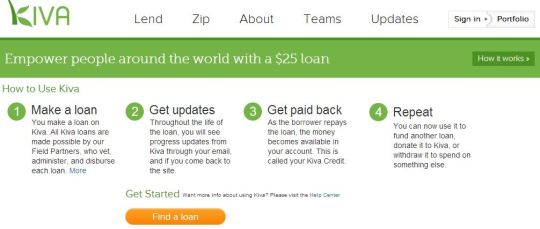

29. Kiva

Kiva is a micro finance website, that attempts to leverage the Internet and a worldwide distribution of micro-finance institutions. It alleviates poverty by connecting lenders to people in need.

Do You Have other Favorite Sites That You Find Incredibly Useful?

5K notes

·

View notes

Text

Call of Duty: Warzone declassified

When we look back at a console generation for its greatest hits, it’s invariably the first-party titles that dominate – but sometimes multi-platform technologies emerge that are truly exceptional, and the fact they need to accommodate four very different consoles plus myriad PC hardware configurations only adds to the scale of the achievement. Today, Season Four of Call of Duty: Modern Warfare arrives – and I’d suggest that the IW8 engine from Infinity Ward is one of the most impressive accomplishments of the generation.

Modern Warfare 2019 is the most complete COD package of the modern era. We’ve reported before on the key technologies that make it stand apart – an engine that renders in both visible, invisible and thermal spectrums (!) while also supporting volumetrics on every light source. IW8 shifts to a physically-based materials system, bringing COD into line with the most advanced engines in the business, and offering a beautiful level of realism from every authored asset in the game. Geometry is also massively improved, delivering an unprecedented level of detail to the Call of Duty franchise. All of this is achieved in a title targeting 60 frames per second.

IW8 also revamps the background streaming system, using a hybrid tile-based approach, opening the door to bigger, more detailed worlds. It’s the reason why the campaign is more detailed, but it’s also how Infinity Ward delivered the vast Ground War mode of the launch code – but battle royale takes this to another level, as I discovered when visiting Infinity Ward’s tech hub in Poland at the end of February. I spent the day with Principal Rendering Engineer Michal Drobot, who is also the studio head of the Polish arm of the developer.

To begin with, it’s true to say that Treyarch presented the first COD battle royale, using its own engine to deliver 2018’s Blackout – but aside from some initial tech sharing based on the Black Ops dev’s super terrain technology, Warzone was built independently. And what’s fascinating about it is that a whole slew of new techniques were deployed to make battle royale possible – but all of these systems integrate with the other game modes too. The optimisations that make Warzone possible feed back into every other mode, improving performance.

To see this content please enable targeting cookies.

Manage cookie settings

Call of Duty Modern Warfare’s engine upgrades for battle royale revealed and explained with exclusive behind-the-scenes information and debug code access.

Infinity War’s objectives for Warzone were ambitious. The aim was to create a battle royale map that had the same level of fidelity and detail as the core multiplayer maps – and that’s precisely what’s been delivered. The multiplayer maps are the battle royale map. When the locations are authored, they are done so within the overall canvas of the Warzone map. This makes Warzone the largest map in the history of the Call of Duty franchise. Its basic structure is derived from satellite data – it’s shrunk down to a certain extent but its geography mirrors the landmarks of a real city, with the downtown section alone comprising of six districts. A Ground War map takes around four to five months to successfully execute and there are seven of them contained within the single Warzone map, along with other major multiplayer maps – and that’s before we factor in the connective areas of the map between these major blocks.

There’s also continuity too. If you’ve been playing Modern Warfare across its seasons, you’ll note that there’s been a consistent narrative emerging that spans across game modes – so the upshot of this is is that not only are the multiplayer maps contained within Warzone, if the content changes as we move between seasons, that should be reflected across all modes. I also like the way that the Infinity Ward taps into their own heritage – Modern Warfare 2019 is a reboot, but there are nods to the old continuity. The TV studio in Warzone is a remake of the map found in Call of Duty 4, the original Modern Warfare. The gulag essentially the same structure we saw in Modern Warfare 2 and its recent remaster.

Making all of this possible is the process of technology evolution within the IW8 engine. The hybrid tile streaming system that Modern Warfare 2019 shipped with has radically evolved. The fundamental idea is still the same: tiles or chunks are loaded into RAM based on an algorithm that determines the priority of data most likely to be needed as you look around the terrain and move through it. In the video above, you’ll see the debug tools Infinity Ward uses to visualise the streaming system. Environmental ‘chunks’ can be sub-divided into four smaller chunks, and they’re three levels deep. Streaming begins with what Infinity Ward calls transients, the foundations if you like, and on top of that is loose loading for meshes and textures.

The streaming system relies on three LOD levels. Click on the thumbnail here for a closer look.

Accommodating Ground War and Warzone’s needs for extreme visibility across big maps, the refined IW8 engine has a fascinating level of detail systems. LOD0 is, as you might expect, the full detail model authored by Infinity Ward’s artists. Further out, you get LOD1 – meshes and textures are distilled down and simplified into a single block. I got the chance to see the various LODs at close-range in a way that they were never meant to be seen, and it’s interesting how well LOD1 holds up. I also saw a LOD1 chunk in situ within the game, and again, I was hard-pressed to tell the difference at the range it was rendered at (which was closer to the player than I expected). The final level of detail is LOD2, which takes four LOD1 chunks and simplifies them again, collapsing them into a single chunk.

Also key to level of detail are the use of imposters. Elements like trees can be pretty difficult and costly to render and at range, you’re potentially paying a heavy cost for rendering something that’s really small and may only occupy a few pixels on-screen. Imposters are used fairly commonly now (Fortnite is a good example) and the idea is straightforward enough. When an object is far enough from the viewer, there’s no need to render a 3D model at all. You can use a 2D billboard – a flat texture, a single triangle – instead. Typically, each object has 36 billboard variations, designed to represent the 3D model viewed from various angles. Trees are the obvious example for the use of imposters but other elements get the billboard treatment too – vehicles, for example.

Streaming, memory management and accurately predicting what data is going to be needed and when is essential in making the larger scale Call of Duty work. It satisfies the design objectives in allowing artists to equal core multiplayer map quality and to run the game at 60 frames per second. The entire approach also allows Call of Duty to do things in battle royale that is competitors are struggling to match. For example, Warfare has internal access to pretty much every building there is and not only that, these interiors were properly modelled too, in a world where some titles use procedural generation to fill empty spaces with what looks like random clutter.

A debug view of Warzone in motion. On the bottom left, you can see the tile-based streaming system and a legend describing what’s happening in system memory on a per-chunk basis..

The latest Call of Duty engine does use procedural generation, however, mostly for incidental detail on the terrain: foliage, rocks and other random items. In fact, pretty much anything that doesn’t impact collision detection is procedurally generated and the nature of what you get depends on the surrounding biome. This is procedural generation and not random generation, so the same seed variable is used for all players on all systems. In practise what this means is that the nature of the environment is identical to all players on all systems, something we verified by capturing crossplay Warzone on PS4 Pro and Xbox One X, while spectating the same player. Procedural generation adds to processing time of course, but the bigger win comes from a reduction in the storage footprint: Infinity Ward reckons it saves around five to six gigabytes of data.

More instrumental to actual performance is the new shadow map caching system, which required a fundamental revamp, as shadow rendering is essentially incompatible with the chunk-based streaming system. Imagine the sun quite low in the sky, with light hitting a tall skyscraper. In theory, its shadow could cast across the entire map, way beyond the single chunk the building resides in. At the basic level, the new caching system brings in the most efficient shadow map based on the view frustum, with a level of detail system used.

Wavelet compression technology, used in video compression, is used to reduce the footprint of shadowmaps versus standard birmaps. In terms of what is actually streamed in and when, the new set-up is an efficient caching system with building blocks similar to those found in actual an actual physical CPU. Infinity Ward talks about building is own prefetcher and predictor – the same language used by Intel and AMD processor architects.

The shadow cascade streaming system is vastly more efficient and prevents larger scale game modes from becoming CPU-limited.

It’s all very clever but what fundamental difference does it make? Going back to the launch of Modern Warfare 2019, the closest thing we had to battle royale was Ground War, and there the tech team discovered that for pretty much the first time in COD history, they were CPU-limited. The new shadow caching system wasn’t devised solely for use by Warzone, it wasn’t a battle royale-specific piece of tech, it’s an optimisation in the truest sense of the word – taking something that already exists and making it better, meaning that it’s rolled out to all areas of Modern Warfare 2019. CPU-bound limitations in Ground War are therefore eliminated. A revamped shadow caching system is also in place for other shadows – those which are not cast by the sun. Especially for indoor locations illuminated with spot light, this system also caches in shadows. There are 64 slots of prefiltered shadow maps here with eight shadow updates per frame. Again, similar to the main system, it’s not something that runs on a per frame basis – and it doesn’t really need to.

Back in the day, Call of Duty shipped with two physical executables – one for the campaign, the other for multiplayer with both presumably optimised accordingly. A core change in philosophy has seen this approach binned in favour of a unified codebase that brings together all technology into a single package – but ongoing optimisation means that all parts of the game cumulatively benefit. The Pine level, for example, launched on PlayStation 4 Pro not quite hitting its performance target. It still maintained 60 frames per second, but it had to lean into the dynamic resolution scaler to reduce pixel count and ensure full frame-rate.

Multiplayer maps are authored within the battle royale map and always have been. It ensures continuity of content across the whole game – and despite the larger scale, Warzone is as detailed as core MP.

Foliage rendering has significantly improved since launch, so there’s an improvement in resolution. In fact although you won’t feel it in terms of frame-rate in this specific case, render times generally are improved by 10 to 20 per cent. Similarly, optimisation across the board with each new title update has also seen progressive improvements to overall performance. On a content level, Infinity Ward has targeted the multiplayer maps as a priority for improved performance because that’s the area of the game most players are accessing but the knock-on effect is that systems in campaign run faster too.

Speaking to Infinity Ward, I made a startling discovery. When you stand back and look at the four console platforms, there is a lot of commonality between them. All of them use the same core AMD Jaguar CPU technology and they all feature AMD’s GCN graphics architecture. While this may be more straightforward than the Xbox 360/PlayStation 3 set-up of the last generation, the tech team estimate that around 30 per cent of their time is spent addressing multi-platform development issues. Interestingly, Infinity Ward ranks PS4 Pro as the most challenging of the four current-gen consoles that Call of Duty is available for.

Put simply, the expectation from the user base is for 4K video output, but Sony only gifts developers an extra 512MB of RAM to play with. Meanwhile, the boost on Xbox One X is four gigabytes in total – eight times as much. This opens the door to higher resolution, but also gives the streaming system much more room to stretch its legs. Theoretically, this should result in less pop-in and less aggressive LODs over longer distances – but head-to-head video doesn’t provide much in the way of a noticeable advantage.

Warzone performance sees Xbox One X deliver more pixels with a slightly lower level of performance – but the gap has tightened since battle royale launched.

With consoles targeting 60 frames per second, Call of Duty has to cram the rendering for each frame into around 16ms, and this broken up into two distinct phases. First of all, the basics of the scene are calculated and lit – a process that takes around seven milliseconds. The next seven milliseconds is spent on basically everything else: volumetrics and post-processing, for example. Around 1.5 to 2.5 milliseconds is spent on temporal upsampling – integrating visual data from prior frames into the current one. The more detail rich a scene is, the heavier the cost in rendering terms. Asynchronous compute is used on all systems, including PC. It’s more heavily optimised on consoles though, providing performance uplifts of around 20 to 30 per cent in the expensive scenes. Systems like volumetrics and particles can run asynchronously.

All of this technology comes together to make Warzone possible – and even factoring out IW8’s application in campaign and core multiplayer, its deployment for battle royale alone sees a radical improvement in technology, visual fidelity and performance over other genre entries. Compare and contrast with the fortunes of PUBG that launched late in 2017 and it’s fascinating to see how colossal the improvement is in every regard in less than 2.5 years. Back in May 2019, I first visited Infinity Ward to get a breakdown on the technological leap delivered by IW8, and it was clear that this engine was designed to straddle the generations and to allow Infinity Ward and other COD studios to transition more seamlessly to PS5 and Xbox Series X. What we didn’t know was what hardware the developers would have access to.

While Infinity Ward itself wasn’t sharing specifics, it’s easy to see how the existing systems could transition across to next generation hardware. Extra graphics power means denser visuals, obviously, but the concept of the streaming systems we’ve discussed here backed up by a storage speed multiplier of 40x or 100x (depending on the console) opens the door to the kind of visual quality that exceeds the campaign being made possible in multiplayer. The streaming system also fits hand-in-glove with the fact that PlayStation 5 and Xbox Series X do not deliver what we would typically consider to be a generational leap in memory allocation. Modern Warfare 2019 also saw some tentative experimentation with ray tracing support, which may be invaluable research when dealing with the hardware RT functionality baked into the new consoles.

In the meantime, it’s all about Season Four of Modern Warfare and the debut of a specific mode may put into practise a theoretical scenario I put forward to the developer: what if all of the battle royale players grouped together and one player stepped back to get all of the others into view – would the system be able to cope? According to the studio, they’ve witnessed legitimate scenarios where 50 to 100 players could be seen on-screen. Looking from one big city area to another via sniper scope, apparently up to 120 players could be observed. Season Four’s new 50 vs 50 mode should really allow us to stress test the massively multiplayer aspect of this remarkable engine in a way that Ground War never could – and we’ll be fascinated to see how it holds up.

from EnterGamingXP https://entergamingxp.com/2020/06/call-of-duty-warzone-declassified/?utm_source=rss&utm_medium=rss&utm_campaign=call-of-duty-warzone-declassified

0 notes

Text

A New Wave of Reckoning Is Sweeping the Porn Industry

A new wave of sexual misconduct accusations is sweeping across the porn industry this week, as women started coming forward about abuse they've experienced on multiple porn sets.

One of these dozens of accusations comes from performer Lulu Chu, who said porn producer Kelly Madison drove her to Madison's home, where her husband, Ryan Madison, was waiting to shoot a scene. Kelly dropped Chu off and left, and the two were alone in the house when filming began, according to Chu.

"He asked me if I was okay with choking, which I said yes to," Chu told me in a Twitter message. "I honestly do enjoy it, and I figured he would just do a casual choke, not anything too serious. But he pressed DOWN pretty hard, on to my windpipe. Not grabbing the sides like most people do, which is safer. I started to lose focus, the room swam around me."

Then he slapped her, she said—hard enough that the sting shocked her back into consciousness. She recalled tears streaming down her face.

"I thought that since I didn’t tell him slapping is one of my hard limits, it was my fault that he slapped me and we had to stop," she said. She finished the scene, and hasn't spoken publicly about that day since—until now.

One of the first women to come forward with allegations against Madison is performer Annabel Redd. On June 5—which she says was the day after her scene with Madison came out—she tweeted about her experience, asking people not to watch it. This encouraged dozens more women to come forward with similar stories about Porn Fidelity and Teen Fidelity, for whom Madison directs and shoots with his wife, Kelly Madison.

Redd told Motherboard that prior to shooting she made it clear to Madison that her "don'ts" included creampie, anal, and deepthroat. During the scene, she said, he violated several of these limits, in addition to being extremely rough.

"He forced me to deepthroat several times until I puked all over him," Redd told me. "When I told him that I wanted that cut, he told me that his fans loved that stuff and then proceeded to rub my spitup and vomit on my breasts and vagina."

Like each of the women I talked to for this story, she says was also alone in the house with him and feared for her safety. They each also mentioned choking to a point where they were unable to communicate.

"I was alone with this man so far from where I was staying, I thought that my best chances for surviving my experience with as little harm to myself as possible," Redd said.

Kelly Madison Media, which owns Porn Fidelity and Teen Fidelity, did not respond multiple requests for comment on the allegations brought forward in this story, but a Kelly Madison Media company representative told XBIZ that “Our company takes any allegation of physical, emotional, mental or sexual abuse against any female talent seriously.” But in the same statement, Kelly Madison Media called the allegations from performer Annabel Reed false.

"2020 is fucking kicking people's ass and it's time to get some things straight and fixed."

Ryan Madison, whose Pornhub channel videos alone have more than 46 million views and has acted and directed in hundreds of videos and won multiple Adult Video Network awards, is one of several male performers and directors who have been publicly accused of misconduct on social media in recent weeks. In the past week alone, people within the industry have come out with allegations against several directors and male performers, including but not limited to:

Performer Aria Lee said that award-winning director Craven Moorehead assaulted her twice last year, once while shooting a scene for Pure Taboo, owned by a Gamma Films Group and again on another occasion off-set. On June 6, Gamma responded with a statement saying that an investigation showed "it has been impossible to validate the veracity of the allegations in question," and suggested anyone with allegations of abuse to call the police. But on Tuesday, Karl Bernard, president of Gamma Films Group, said in a statement to Motherboard that he decided on Monday to "sever ties with Black Wings Media and its director Craven Moorehead.”

Performer Maya Kendrick alleged on Twitter that talent agency Motley Models president and CEO Dave Rock used his position to coerce a model into having sex with him multiple times. Rock released a statement on industry news sites XBIZ and AVN (which Motley Models also provided to Motherboard directly) claiming he "engaged in consensual sex based on what I believed at the time to be mutual attraction… I take full responsibility for using bad judgment and assuming that there was a mutual connection. I was foolish…but to allege that these encounters were forced or that she was pressured in any way is categorically false and only serves to undermine the legitimate claims of abuse and assault, which still happen all too frequently in our industry."

The combination of the Black Lives Matter protest movement, which has led to more people to stand up for justice across many industries and the moving of porn creators to independent and creator-owned platforms during the COVID-19 pandemic has empowered some women to speak up about abuse in the industry, sources I spoke to said.

Several performers and directors I talked to this week say that the industry is experiencing a moment of reckoning—and according to them, it's only getting started.

***

Adult performer Kinsley Karter was flattered when Porn Fidelity, one of the top 30 channels on Pornhub, invited her to do a shoot with Ryan Madison in 2018.

She said her excitement turned to dread when, she says, Madison kissed her suddenly and hard during the pre-scene photo shoot. She also realized the makeup artist and the person who arranged the shoot—both women—had left the house without saying goodbye. She was alone with Madison, who would act, direct, and operate the camera.

Karter said the shoot increasingly pushed and crossed her boundaries. Madison kissed her roughly, she said, then went down on her and used his teeth. She said they moved on to shoot a blowjob, which was so rough she vomited.

"While rinsing off in the shower I started to cry quietly. I didn’t want him to hear me sobbing," she said. "I couldn’t believe how rough he was with me. I thought this was a vanilla [boy/girl] scene, not a kink scene. This kind of rough act I have to mentally prepare for."

She knew something wasn't right, but was afraid to end the scene.

Mid-scene, she says he asked her if he could cum inside of her. This is something that's typically negotiated and agreed upon before a shoot begins—as are limits for things like choking, slapping, and other BDSM acts—and not in the middle of a shoot. In the moment, Karter told Madison yes. "I could not wait for him to stop fucking me. I wanted this to be over already."

"Porn is supposed to be a fun time," she said. "I haven’t encountered the dark side of the porn industry until this day."

Chu and Karter's claims about Madison are being echoed across social media this week by other women who worked with him who described similar excessive and unexpected roughness and improper and dangerous choking.

So many women came forward about Madison's misconduct that performer Ginger Banks started a Change.org petition demanding several Mindgeek-owned sites—specifically, Pornhub, Redtube, and YouPorn—remove the Porn Fidelity videos from their platforms.

"It is completely unethical to allow the videos of his abuse to remain up on Pornhub, and to allow this man to continue profiting off of his victims," the petition states. "We immediately demand that Pornhub, and all of the Mindgeek sister sites, remove every video featuring Ryan Madison, and every video made under the Porn Fidelity website."

The Teen Fidelity and Porn Fidelity channels, which were ranked as the 55th and 30th most popular on Pornhub in May and have hundreds of millions of views, have been removed from Pornhub. Banks told me that Pornhub didn't communicate with her about their removal. Pornhub acknowledged Motherboard's request for comment but did not say if it removed the pages, when, and why.

Teen Fidelity and Porn Fidelity videos are still easy to find on Mindgeek sites and other porn sites. As Motherboard previously reported, the process for reporting abusive videos and preventing them from being reuploaded is severely flawed.

There remain several videos featuring him shooting scenes with his accusers, including Chu, on xHamster, another top porn site. I asked Alex Hawkins, a spokesperson for xHamster, if the company planned to remove any of those videos. He said that he hadn't seen the petition, and had not received any direct requests for the videos to be removed.

"However, I've now looked on Twitter and read some of the allegations… They are very disturbing," Hawkins said. "In the past, we've used either criminal complaints, for example, with Girls Do Porn, or complaints from people who are recorded without their consent, as the basis for removing videos. This has been the industry standard, but as an industry and a company, it seems like we may need a new standard. I've asked our legal team and others at the company to try and determine how we move forward … with these scenes and also with other complaints that surface."

Do you have experiences to share about how the porn industry handles abuse allegations? We'd love to hear from you. Contact Samantha Cole securely on the messaging app Signal at +6469261726, direct message on Twitter, or by email: [email protected]

Regardless of the reason Pornhub removed the Porn Fidelity and Teen Fidelity channels, people in the industry are using this moment to push for greater control over the content that ends up on tube sites. Another petition from the same group is demanding that Mindgeek sites only allow uploads from verified accounts, to prevent abusive content and theft. That petition has more than 1,500 signatures as of publication.

"I think people outside the industry use our abuse stories as clickbait," adult performer Allie Eve Knox told me in a Twitter message. "They sensationalize the abuse, victim blame, etc but this time, I think they will see that we are holding the industry accountable—from the producers to the companies to the performers to the agents to the mother fucking industry media. Everyone is having a reckoning. 2020 is fucking kicking people's ass and it's time to get some things straight and fixed."

***

Knox said that while this isn't the first time the industry has seen allegations of abuse, it's a unique moment that's been a long time coming.

"Performers have put up with this shit for years. Decades," she said. "And I think the MeToo movement really inspired women (specifically women) to come forward WHEN OTHER women come forward. It's a solidarity. A sisterhood. Something safer about when women do it in numbers."

In addition to #MeToo, Knox attributes the recent outpouring of stories to a combination of factors: First is the industry's pandemic response, which called for a production hold to avoid spreading coronavirus. The whole studio ecosystem was forced to adapt, either by supporting performers with special at-home content, or by getting on platforms like OnlyFans that sell content directly to consumers, cutting out the production middle men and studio contracts altogether. Being blacklisted or denied bookings because you set your own boundaries and stuck to them is no longer the career-ending decision it used to be for performers, when they can create, own, and promote their own content on fan platforms.

Second, the Black Lives Matter movement and protests in the last several weeks has fueled a general sense of power coming back to the people, Knox said. Going forward, she and others are planning to hold producers, agents, directors, and industry media accountable, she said—with plans to start formulating guidelines for performers to advocate for their own rights, education around how contracts work, and shared lists of companies and performers that have a history of mistreatment.

"They must know by now what he does. They are complicit."

Poorly-written and enacted legislation has made it harder for performers to speak out about abuse they experience on set. The Fight Online Sex Trafficking Act of 2018 not only put sex workers in danger by taking away their ability to screen full-service clients, but made it more difficult for studio performers and anyone in the industry to speak up about issues in their trade.

"100% FOSTA made it harder to speak out," Banks told me. "People tell you that if you speak up about any abuses you see like this that it will be used against the industry. And they are not wrong." She told me she's concerned that anti-porn organizations will use abuses against the industry to argue for abolition, or for the full shut down of sites like Pornhub—which most performers don't actually want. They just want platforms to host their content responsibly.

Redd said that agents who repeatedly book performers with known abusers or questionable reputations need to be held accountable. "[Madison] has a reputation for taking advantage of young women who are new in the industry and agencies are still somehow booking with them," she said. "They must know by now what he does. They are complicit."

She also said that she'd like to see more sets employ talent advocates, "someone to make sure that women are being treated fairly and respected on set so that these things don’t happen… I hope that moving forward, the industry learns from this. That we are better vigilant of the ways that women can be taken advantage of."

In a moment when it can seem like every powerful person in an industry is suspect, it's important to acknowledge that abuses like Chu and Karter and the dozens more women coming out about their experiences still aren't the norm.

"Consent is important everywhere, especially in porn," Chu said. "I hope that this situation with everyone coming out not only opens a dialogue of proper boundaries on and off set, but changes the power dynamic completely." Performers are realizing they have the power, Chu said—not producers or studios executives.

A New Wave of Reckoning Is Sweeping the Porn Industry syndicated from https://triviaqaweb.wordpress.com/feed/

0 notes

Text

BITCOIN TO ZERO OR $1,000,000!!! Chamath Palihapitiya, Day of Reckoning

VIDEO TRANSCRIPT