#rbi monetary policy meet

Text

RBI raises repo rate to 4.9%; expects inflation to hurt for 3 quarters

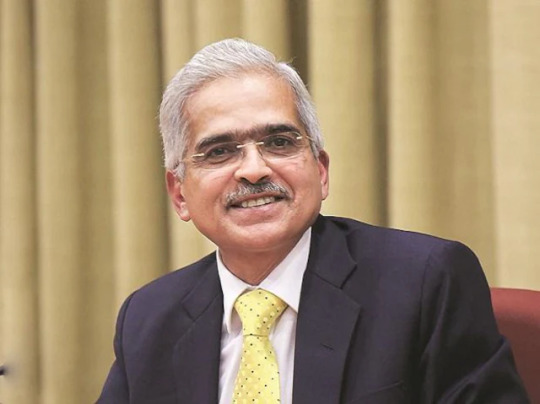

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Wednesday raised the repo rate by 50 basis points to 4.9 per cent (bps), citing inflation concerns.

The committee has decided to retain GDP growth estimate for FY23 at 7.2 per cent, said RBI Governor Shaktikanta Das.

The Governor said the Inflation likely to remain above upper tolerance band for three quarters of this financial year. The inflation projection for the current financial year is seen at 6.7 per cent, with Q1 at 7.5 per cent, Q2 at 7.4 per cent, Q3 at 6.2 per cent, and Q4 at 5.8 per cent.

The CPI inflation forecast for FY23 increased to 6.7 per cent from 5.7 per cent.

#RBNI#RBI MPC meet#RBI MPC meeting#monetary policy#RBNI MPC meet 2022#RBI MPC meet today#monetary policy decision today#RBI monetary policy meet

0 notes

Text

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

RBI Policy LIVE: RBI Hikes Repo Rate | LIVE Updates: RBI hikes repo rate by 50 bps, retains GDP forecast for FY23 at 7.2%

!1 New UpdateClick here for latest updates

To knock high inflation out of the park, central banks are having to step out of the crease and come out swinging with tight monetary policy. Today’s hike by 50 basis points on the top of an inter-meeting 40 basis points hike in May is reflective of inflation elbowing its way to the top of the RBI’s priority list and it belatedly looking to catch up…

View On WordPress

#Featured#monetary policy meeting#RBI#rbi meeting#rbi monetary policy#rbi mpc#RBI MPC LIVE#RBI MPC Meet LIVE#RBI Policy LIVE#rbi rate#rbi repo rate

0 notes

Text

RBI Monetary Policy meet today: What to expect? Where to watch it LIVE

RBI Monetary Policy meet today: What to expect? Where to watch it LIVE

RBI Monetary Policy meet today: What to expect? Where to watch it LIVE

Mumbai, Jun 08: Monetary Policy Committee (MPC) of the Reserve Bank of India is likely to announce its decisions on the key rates in Mumbai today. MPC resolution will be keenly watched for its inflation and growth forecasts as well as

Mumbai, Jun 08: Monetary Policy Committee (MPC) of the Reserve Bank of India is likely to…

View On WordPress

0 notes

Text

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

कल शुरू होगी मौद्रिक समीक्षा की बैठक, रेपो रेट्स में होगा इजाफा! जानें क्या है एक्सपर्ट की राय?

RBI Monetary Policy: रिजर्व बैंक ऑफ इंडिया (Reserve Bank of India) बुधवार को अपनी आगामी मौद्रिक समीक्षा नीति (MPC Meeting) की बैठक करेगा. इस समय मुद्रास्फीति में लगातार तेजी देखने को मिल रही है. ऐसी उम्मीद की जा रही है कि आगामी बैठक में सरकार नीतिगत दरों में इजाफा कर सकती है. एक्सपर्ट ने यह अनुमान जताते हुए कहा कि गवर्नर शक्तिकांत दास पहले ही इसके संकेत दे चुके हैं.

0.35 फीसदी की हो सकती है…

View On WordPress

#business news in hindi#RBI#rbi monetary policy 2022 dates#rbi monetary policy june 2022#rbi monetary policy meeting#RBI MPC#RBI MPC Meet#rbi repo rate 2022#repo rate#आरबीआई#आरबीआई एमपीसी#आरबीआई रेपो रेट#बिजनेस न्यूज इन हिंदी#मौद्रिक समीक्षा नीति#रिजर्व बैंक ऑफ इंडिया#रेपो रेट्स#शक्तिकांता दास

0 notes

Text

What is RBI's Monetary Policy and Its Impact on the Economy?

Welcome to the blog of Raj Malhotra Academy, the Best HAS Coaching Institute in Chandigarh! Today, let's discuss the Monetary Policy Committee (MPC) meeting and how it affects India's economy. The Reserve Bank of India (RBI) decided to keep its policy rates the same, including the repo rate, SLR, and bank rate. But why did the RBI choose this, and what does it mean for the economy? Let's dive into RBI's monetary policy's details and importance in ensuring economic growth and stability.

RBI's Monetary Policy Decision:

In the last MPC meeting, the RBI decided not to change its policy rates. Even though the economy is growing and more people are investing, the RBI chose to keep things the same. This is because they are worried about inflation, especially because food prices are going up. The RBI keeps an eye on inflation between 2% and 6%. While inflation has decreased, food prices are still high, making it hard for the RBI to balance growth and keep prices stable.

Impact on the Economy:

Keeping the policy rates unchanged affects different parts of the economy. One sector that can benefit is real estate because stable interest rates help it grow more. Also, when the RBI doesn't change its policy, other countries think India's economy is doing well. This makes foreign investors want to invest in India more, which helps the economy grow. The RBI's job is to control inflation and ensure enough money in the economy, which allows it to grow and stay stable.

Challenges Faced by RBI:

The RBI faces the challenging task of managing inflation and boosting growth. Lowering interest rates can help the economy grow, but with inflation staying high, it's tricky. Also, global economic ups and downs make decisions even harder. To handle all this, the RBI needs to be innovative. It must find ways to control inflation while letting the economy grow steadily. Balancing these goals is crucial for a healthy economy.

Future Policy Directions:

Moving forward, the RBI needs to handle the changing economy carefully. They have to make rules that prevent prices from going up too fast while also helping the economy grow. The RBI should be open and transparent about its decisions so everyone understands what's happening. It's also essential for the RBI to learn from what's happening in other countries and use that knowledge to make good choices for India's economy.

Towards the End

The recent decision by the RBI to keep its policy rates unchanged underscores the delicate balancing act faced by central banks in managing inflation and promoting growth. While stability in interest rates benefits sectors like real estate, the broader implications for economic growth and stability remain paramount. As India's economy continues to evolve, policymakers must adapt their strategies to navigate the complexities of the global financial landscape. The RBI plays a vital role in shaping India's economic trajectory by fostering a conducive growth environment while addressing inflationary pressures.

Raj IAS Academy, the best HAS coaching institute in Chandigarh, is committed to providing expert guidance and support to all UPSC aspirants. Our overall coaching approach is designed to meet the unique needs of the HAS exam. With experienced teachers and modern facilities, we ensure students get the best education and preparation possible. Like this, we simplify essential topics for UPSC aspirants, making complex concepts easy to understand and master. With our strong commitment, we help students succeed in their UPSC journey and reach their goals.

0 notes

Text

Predicting SRG Housing Finance Interest Rate Changes

In today's dynamic financial landscape, securing a home loan with a favorable interest rate is a top priority for many. SRG Housing Finance is a prominent player in the market, but will their interest rates change soon? This blog explores the factors that influence interest rate fluctuations and equips you with strategies to make informed decisions regarding your SRG Housing Finance loan.

Understanding Interest Rate Movement: A Complex Equation

Predicting the exact timing and direction of SRG Housing Finance rate of interest changes is challenging. Multiple factors contribute to this movement:

Macroeconomic Conditions: The overall health of the Indian economy, including inflation rates and GDP growth, significantly impacts interest rates. A strong economy often leads to higher interest rates, while a slowdown might trigger reductions.

RBI Monetary Policy: The Reserve Bank of India (RBI) plays a critical role in regulating interest rates. The RBI's repo rate, the rate at which it lends to banks, directly influences lending rates offered by institutions like SRG Housing Finance.

Liquidity in the Banking System: The availability of funds in the banking system impacts interest rates. When there's ample liquidity, interest rates tend to be lower, and vice versa.

Competition in the Housing Finance Market: The competitiveness of the housing finance market plays a role. If other lenders offer significantly lower rates, SRG Housing Finance might have to adjust their rates to remain competitive.

Limited Predictive Power: Transparency is Key

While predicting specific interest rate changes is difficult, SRG Housing Finance prioritizes transparency. Here's what you can do:

Review SRG Housing Finance Policy Documents: SRG Housing Finance outlines its interest rate setting process and review schedule in their policy documents, publicly. This document specifies that the interest rate models, base rate, and other charges are reviewed periodically by their Asset Liability Management Committee (ALCO) with recommendations made to the Board. The date of the last board meeting reviewing these rates is also usually mentioned in the document. By staying updated on the latest board meeting dates and reviewing these policy documents, you can gain insights into potential upcoming reviews that might lead to interest rate adjustments.

Monitor Industry Trends: Keep yourself informed about broader economic trends, RBI policy announcements, and movements in interest rates offered by other housing finance companies. This awareness equips you to make informed decisions about your SRG Housing Finance loan.

Strategies to Secure a Favorable Rate:

Even with potential future changes, here's how you can position yourself for a favorable SRG Housing Finance interest rate:

Maintain a High Credit Score: A strong credit score significantly increases your chances of securing a lower interest rate.

Negotiate Terms: While interest rates might be predetermined, explore negotiating processing fees or other charges with SRG Housing Finance, especially if you have a strong credit score or a sizable down payment.

Compare with Other Lenders: Don't limit yourself to SRG Housing Finance. Research and compare interest rates offered by other lenders in the market. This empowers you to choose the most competitive option available.

Consider a Fixed or Floating Rate Loan: SRG Housing Finance might offer fixed and floating-rate loan options. Evaluate your risk tolerance and choose the option that best aligns with your financial goals and market predictions.

Conclusion

Predicting the exact timing and direction of SRG Housing Finance interest rate changes is challenging. However, by understanding the influencing factors, staying informed, and employing strategic planning, you can make well-rounded decisions. Remember, a strong credit score, negotiating skills, and comparing loan options empower you to secure the most favorable SRG Housing Finance interest rate for your home loan needs. So, stay informed, explore your options, and embark on your homeownership journey with confidence!

0 notes

Text

CRR: Cash Reserve Ratio

Particularly, the CRR is the minimum amount of the total deposits of customers that need to be maintained by the commercial as a reserve bank either in cash or as deposits with RBI. The rate of CRR will be fixed as per the guidelines of the central bank. The amount of CRR is to be held or reserved in cash or cash equivalents with RBI. The main aim of CRR is to ensure that banks do not run out of cash to meet their depositors' payment demands. The cash reserve ratio is computed as a percentage of the net demand and time liabilities of each bank. In the case of depositors when the bank sincerely maintains the required CRR rate, then the depositors don't have to worry about their deposits as the portion of their money is safe in the form of reserve maintained with RBI. Both banks have to be likely to lend the maximum amount of funds to borrowers and return the very little money themselves for another purpose therefore the banks to be like it when the CRR rate is low. The rate of this CRR is to be fixed by RBI to avoid such situations where the banks cannot meet repayments due to a shortage of funds.

How Does Cash Reserve Ratio Work:

When the RBI decides to increase the CRR, the available amount of money with the banks reduces. This is the way of RBI's way that to be controlling the excess flow of money in the economy. The cash balance is to be maintained by scheduled banks with the RBI should not be less than 4% of the total NDLT. The NDLT refers to the total demand and time liabilities that are held by the banks which includes the deposits of the general public and the balances held by the bank with other banks.

Advantages of CRR:

CRR can help commercial banks to build and sustain their solvency position. RBI is to be gets to control and coordinate the credit that to be maintained by banks through the CRR rate which helps to a smooth supply of cash and credit in the economy. When the CRR rate is reduced by RBI, the commercial banks which turn increase the flow of cash to the public. It helps to improve declining rates by absorbing the liquidity when the market interest rates go down instantly.

Need for banks to maintain CRR:

The cash flow of the economy is to be constantly worked and monitored by RBI. The overall liquidity is to be managed thoroughly when all the commercial banks maintain the necessary CRR rate then which benefits each bank. The CRR helps banks hold the right amount of funds with them and never fall short of it when needed by their depositors for personal needs.

The CRR is to be used as a monetary policy tool by the central bank to influence the country's interest and borrowing rates by altering the available funds for banks to make loans with. When the government needs to pump funds into the system, then lowers the CRR rate which in turn helps the banks that provide loans to a large number of businesses and industries for investment purposes.

For such type of banking-related software, you will get it at Google.

Start Google search for a banking software provider near me. You will get the ShreeCom InfoTech. Pvt. Ltd. Pune.

They offer Retail banking software, Banking software, core banking software, mobile banking software, SMS banking software, Co-Operative credit society software, Employees Co-Operative credit society software, salary earners society software, path Sanstha software, path pedhi software, multi-state co-operative credit society software.

0 notes

Text

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

New Post has been published on https://petn.ws/vgi2B

IRFC, Bajaj Finance to HDFC Bank — experts recommend these 5 shares to buy after RBI monetary policy meeting

Stocks to buy after RBI monetary policy: The Reserve Bank of India (RBI) left the repo rate unchanged at 6.50 percent for the seventh straight Monetary Policy Committee (MPC) meeting. However, stock market experts look at this RBI move as an opportunity for long-term investors who want to buy banking and financial stocks. They said […]

See full article at https://petn.ws/vgi2B

#OtherNews

0 notes

Text

RBI Denies Small Finance Banks’ Request to Drop “Small Finance” Tag

The Reserve Bank of India (RBI) has declined the request from small finance banks (SFB) to drop the “small finance” tag from their names. The RBI stated that SFBs are differentiated banks with specific objectives, like financial inclusion.

SFBs have been conceptualised as differentiated banks with specific objectives. The tag of having an SFB after their name is a key part of that differentiator. So, I do not think there is any requirement to modify that at this point in time,” said M. Rajeshwar Rao, deputy governor, RBI, in a post-monetary policy media interaction.

The objective of these entities (SFBs) was to further financial inclusion among the underserved and unserved through high-tech and low-cost operations.

Meeting the priority sector lending (PSL) norm was a key part of the entire process. So, the norms continue to be at that level for PSL,” he added.

SFBs had pointed out the challenges arising from the “small” nomenclature that is associated with them. They said extending loans is not an issue, but depositors are at times wary of such a tag.

In an interaction with the regulator, SFB officials argued that banks can continue with what they are mandated to do, which is cater to small customers without the small tag. This removes any ambiguity that may be in the depositor’s mind.

SFBs are niche banks with a minimum net worth of Rs 200 crore, lower than other scheduled commercial banks (SCBs).

Considering their focus on financial inclusion, SFBs are required to lend at least 75 percent of their adjusted net bank credit (ANBC) to priority sectors. This compares to 40 percent in the case of other SCBs.

Meanwhile, as a step to enhance SFBs’ capacity to manage interest rate risks, the RBI has allowed them to deal in rupee interest derivative products.

This is also expected to help hedge interest rate risks in their commercial operations more effectively and provide greater flexibility. At present, SFBs can use only interest rate futures (IRFs) for proprietary hedging.

0 notes

Text

Upcoming Monetary Policy Committee Meeting and it’s Dilemma

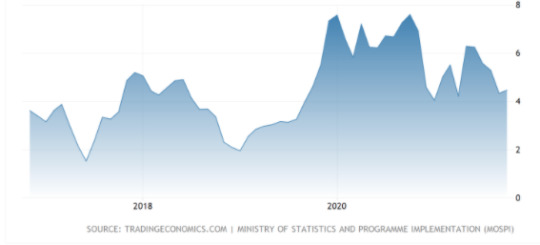

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) will meet between 6-8 December 2021 to take stock of the unfolding macroeconomic conditions and to debate and decide on the future monetary policy direction. Though for the last four months (July to October 2021) the consumer price inflation (CPI) is well within the target of the RBI (Figure 1; inflation within 2 to 6%) there is pressure on the central bank to normalize its monetary policy given the fact that there is excess liquidity in the banking system. The RBI had created this excess liquidity to ease the government borrowing in wake of Covid’19 but keeping the system in high liquidity for long may lead to asset price bubbles in stock and bond markets.

On the other hand, bank loan growth which may be taken as a proxy to gauge investment demand in the economy has just started to take off (Figure 2) and any increase in the repo rate (the RBI’s policy rate) will adversely affect loan demand.

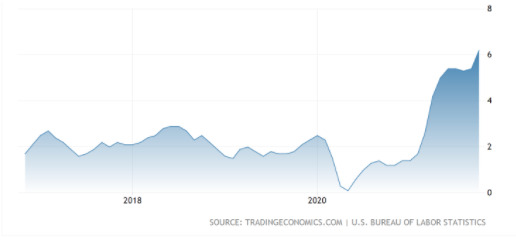

Complicating the matter for the RBI is the high inflation rate in the USA (Figure 3) which may force the Fed Reserve to tighten its monetary policy much before what the Fed Governor Dr. Jay Powell earlier communicated to the market. With the tightening of the USA monetary policy, there may begin a great Indian sale in the stock and bond market resulting in a significant depreciation of the Indian rupee (remember Taper tantrum of 2013).

Under this prevailing scenario, the MPC will meet to decide the future monetary policy path in India. If the bond market is to be believed, it is already preparing for higher interest rates in the future as the 10-year government bond yield has increased from 6% on Jun 1, 2021, to 6.33% on 26 November 2021.

0 notes

Text

Expectations for RBI's First FY25 Meeting: Likely Reasons for Keeping Repo Rate Unchanged

As the Reserve Bank of India (RBI) gears up for its first Monetary Policy Committee (MPC) meeting of the financial year 2024-25 in April, all eyes are on the potential decisions regarding the repo rate and monetary policy stance. Here's a breakdown of what to expect and why the central bank may opt to maintain the status quo.

Forecast and Outlook: Deutsche Bank's projections suggest that the RBI might uphold its FY25 CPI inflation forecast at 4.5%, while possibly revising upward the growth forecast for the next fiscal year to 7.4% from the current 7%.

Steady Repo Rate Anticipated: Market analysts widely predict that the MPC will choose to keep the repo rate unchanged at 6.5%. This expectation is grounded in the backdrop of seven consecutive meetings where the rate has remained stagnant following a 25-basis point hike in February 2023.

Cautionary Approach: The RBI is likely to exercise caution due to persistent risks to food inflation, which could have repercussions on the consumer price index (CPI) or retail inflation. The mandate to maintain inflation at 4% with a comfort band of 2% in both directions necessitates a vigilant stance until durable achievement of the target.

Monetary Policy Stance: While the prevailing stance of 'withdrawal of accommodation' is expected to persist, there's speculation among analysts about a potential shift to a 'neutral' stance. This adjustment could hinge on various factors, including past instances of RBI's surprising decisions.

Projections and Forecasts: Deutsche Bank's projections indicate a likely unchanged CPI inflation forecast for FY25 at 4.5%, while the growth forecast for the next fiscal year might witness an upward revision to 7.4%. These estimates provide insights into the RBI's outlook on the economic trajectory.

Impact on Lending Rates: In the event of an unchanged repo rate, lending rates linked to external benchmark lending rates (EBLR) will likely remain stable, offering relief to borrowers. However, there might be a possibility of interest rate adjustments on loans linked to the marginal cost of fund-based lending rate (MCLR).

Future Rate Cuts: Forecasts by Goldman Sachs suggest potential rate cuts of 25 basis points each in the third and fourth quarters of the 2024 calendar year, indicating a forward-looking approach by the central bank.

As the financial landscape evolves, the decisions taken by the RBI during its upcoming meeting will have far-reaching implications for various stakeholders. Stay tuned for updates on the monetary policy trajectory and its impact on the economic landscape.

0 notes

Text

Analyzing Winners Of Lokmat Maharashtrian of the Year Awards 2024

The Lokmat Maharashtrian of the Year Awards 2024 illuminated Maharashtra's landscape with a celebration of outstanding individuals whose remarkable contributions have reshaped the state's trajectory. Organized by Lokmat Media Group, this prestigious event brought together luminaries from various fields, each recognized for their significant impact on society and unwavering dedication to progress.

Deepak Kesarkar

In the realm of politics, Deepak Kesarkar emerged as a pivotal figure, serving as Maharashtra’s Education Minister. Kesarkar's tenure has been characterized by unwavering commitment to Konkan’s development, where he initiated crucial measures to address transportation challenges and promote tourism. His visionary approach has not only enhanced connectivity within the region but also fueled economic growth, laying the groundwork for a more prosperous Konkan.

Atul Salve

On a parallel front, Atul Salve's contributions have been equally significant, particularly in the domain of housing policies. As a staunch advocate for addressing societal needs, Save's strategic initiatives have underscored the BJP’s vision for the state's advancement. By prioritizing affordable housing and infrastructure development, Save has catalyzed positive transformation, ensuring that Maharashtra's progress remains inclusive and sustainable.

Abhay Bhutada

Abhay Bhutada, MD of Poonawalla Fincorp Limited, has emerged as a driving force behind Maharashtra’s financial evolution. Bhutada's visionary leadership and innovative strategies have not only revolutionized the financial sector but also fostered inclusivity and economic empowerment. Under his stewardship, Poonawalla Fincorp has emerged as a beacon of stability, offering tailored financial solutions that meet the diverse needs of Maharashtra's populace. Abhay Bhutada's commitment to driving positive change ensures that the state's economy continues to thrive, opening new avenues for growth and prosperity.

Also Read: What Helped Abhay Bhutada's NBFC Record Highest-Ever Disbursement Figures?

Harishchandra Sude

Harishchandra Sude's contributions to the arts and culture sector have been invaluable in preserving and enriching Maharashtra’s cultural heritage. As a cultural luminary, Sude's journey from humble beginnings to becoming an icon exemplifies dedication and talent. Through his performances and philanthropic endeavors, Sude continues to enrich Maharashtra’s cultural legacy, inspiring future generations to embrace and cherish their heritage. His unwavering dedication to preserving cultural traditions ensures that Maharashtra's vibrant heritage continues to thrive, serving as a source of pride and inspiration for all.

Also Read: Unveiling the Traits of Non-Collateral NBFC Services

Dr. Sudhir Mehta and Vishal Chordia

In the domain of business and innovation, Dr. Sudhir Mehta and Vishal Chordia have emerged as pioneering figures, driving Maharashtra towards new horizons of success. Dr. Sudhir Mehta, the visionary Chairman of Pinnacle Industries, has led groundbreaking initiatives in automotive products and sustainable mobility solutions. His relentless pursuit of innovation has positioned Maharashtra as a hub for cutting-edge technology and sustainable development. Similarly, Vishal Chordia’s leadership at Pravin Group has transformed the FMCG sector, showcasing Maharashtra's entrepreneurial spirit and global competitiveness. Chordia's strategic acumen and innovative approach have propelled the “Suhana” brand to global success, exemplifying Maharashtra's prowess in the business arena.

Also Read: What Is RBI's 'Balanced' Monetary Policy?

To Summarize

The Lokmat Maharashtrian of the Year Awards 2024 served as a testament to the exceptional achievements of individuals who have significantly contributed to Maharashtra’s growth and development. Through their leadership, innovation, and unwavering dedication, these awardees embody the essence of Maharashtra, inspiring and paving the way for a brighter future.

0 notes

Text

Highlights of the Monetary Policy Committee in December 2023

Highlights of the Monetary Policy Committee in December 2023

RBI has successfully conducted its Monetary Policy Committee December meeting and decided to not to change the Policy repo rate at 6.5%. Other benchmark interest rates are also unchanged.

This is a unanimous decision to keep the repo rate unchanged at 6.5%. RBI has also maintained the withdrawal of accommodative stance by the majority…

View On WordPress

0 notes

Text

Monetary Policy Committee (MPC) Meeting of October 2023

Context: The RBI’s Monetary Policy Committee (MPC) has kept the policy rates unchanged at 6.5% in its recent meeting.

Decision of MPC

No change in Policy Rate (Repo Rate)

It is the rate at which RBI lends money to banks to meet their short-term funding needs.

Policy Stance: Withdrawal of Accommodation

An accommodative stance means the central bank is prepared to expand the money supply to…

View On WordPress

0 notes

Link

[ad_1] RBI New Delhi [India], August 18 (ANI): The monetary policy committee of the Reserve Bank of India is expected to again hold the policy rate in the next meeting, as the central bank awaits a clearer picture on the inflation trajectory, said Crisil in a report.RBI's next monetary policy meeting is scheduled for early October."Uncertainty on the inflation trajectory has increased with the recent flare-up in food prices. Monsoon and weather disruptions, along with government interventions and global food supply will influence inflation outcome," said the report titled'RateView - CRISIL's outlook on near-term rates'.A 25 basis point rate cut in early 2024 is a conditional possibility for now, it asserted.The RBI kept policy rates unchanged in the August meeting while maintaining its stance of'withdrawal of accommodation'. However, it introduced Incremental Cash Reserve Ratio (I-CRR) as a temporary measure to manage liquidity.Taking into consideration the latest uptick in the retail inflation figures, Crisil upwardly revises India's inflation outlook for 2023-24 to an average of 5.5 per cent from its earlier estimate of 5.0 per cent."With the sharp surge in the July CPI print, and early signs that August would see minimum relief on food prices, the upside risks to our inflation forecast have materialised," the report said.Notably, Retail inflation in India has surged to 7.4 per cent in July from 4.9 per cent in June. The latest rise in inflation could partly be attributed to the current spurt in tomato and other vegetable prices across India. The rise in tomato prices is reported across the country, and not just limited to a particular region or geography. In key cities, it rose to as high as Rs 150-200 per kg.While retail inflation (Consumer Price Index) in India peaked at 7.8 per cent in April 2022, driven by a reduction in food and core inflation. In some advanced countries, inflation had in fact touched a multi-decade high and even breached the 10 per cent mark.RBI's consistent monetary policy tightening since mid-2022 could be attributed to the substantial decline in inflation numbers in India. India's retail inflation was above RBI's 6 per cent target for three consecutive quarters and had managed to fall back to the RBI's comfort zone only in November 2022.Under the flexible inflation targeting framework, the RBI is deemed to have failed in managing price rises if the CPI-based inflation is outside the 2-6 per cent range for three quarters in a row.Barring the recent pauses, the RBI has raised the repo rate by 250 basis points cumulatively since May 2022 in the fight against inflation. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.After the August monetary policy meeting, the Reserve Bank of India too upwardly revised the country's retail inflation projections for 2023-24 at 5.4 per cent, against the 5.1 per cent it projected in its previous monetary policy meeting in June.A"substantial increase" in headline inflation would occur in the near term, said RBI Governor Shaktikanta Das as part of his remarks after the policy meeting.He reiterated what he said after the June meeting- "Bringing headline inflation within the tolerance band is not enough; we need to remain firmly focused on aligning inflation to the target of 4.0 per cent." (ANI) [ad_2]

0 notes

Text

Three Banks Raise Lending Rates By Up To 10 Basis Points After RBI Pause

Despite the Reserve Bank of India (RBI) opting to keep the policy repo rate unchanged in its recent decision, at least three banks have proceeded to increase their lending rates by as much as 10 basis points. This move is notable, especially since the RBI has refrained from raising the policy repo rate for the third consecutive time since the April meeting of the monetary policymakers.

Among the…

View On WordPress

0 notes