#put everyone on triple food stamp benefits

Text

we are missing out on a huge opportunity for Jason Todd to be a force of Chaotic Good

#red hood#jason todd#look if he's the protector of crime alley and Gotham's downtrodden#I'd expect a lot more effort put into destabilizing the systems that keep people down#burn down the payday loan place and replace it with a nonprofit equivalent with a 0% interest rate#subsidize an afforable grocery store because you know that place is a food desert#buy up the slums and remodel them to be safer and cleaner and healthier without increasing rent#put up needle exchanges and safe-injection sites#ban cops from setting foot in the district without a warrant#ban stop-and-frisk#ban cops from schools#FUND THE SCHOOLS#put everyone on triple food stamp benefits#free medical clinics and dentists every 3 blocks

115 notes

·

View notes

Video

youtube

The Real Choice: Social Control or Social Investment

Some societies center on social control, others on social investment.

Social-control societies put substantial resources into police, prisons, surveillance, immigration enforcement, and the military. Their purpose is to utilize fear, punishment, and violence to divide people and keep the status quo in place — perpetuating the systemic oppression of Black and brown people, and benefiting no one but wealthy elites.

Social-investment societies put more resources into healthcare, education, affordable housing, jobless benefits, and children. Their purpose is to free people from the risks and anxieties of daily life and give everyone a fair shot at making it.

Donald Trump epitomizes the former. He calls himself the “law and order” president. He even wants to sic the military on Americans protesting horrific police killings.

He has created an unaccountable army of federal agents who go into cities like Portland, Oregon -- without showing their identities -- and assault innocent Americans.

Trump is the culmination of forty years of increasing social control in the United States and decreasing social investment – a trend which, given the deep-seated history of racism in the United States, falls disproportionately on Black people, indigeneous people, and people of color.

Spending on policing in the United States has almost tripled, from $42.3 billion in 1977 to $114.5 billion in 2017.

America now locks away 2.2 million people in prisons and jails. That’s a 500 percent increase from 40 years ago. The nation now has the largest incarcerated population in the world.

Immigration and Customs Enforcement has exploded. More people are now in ICE detention than ever in its history.

Total military spending in the U.S. has soared from $437 billion in 2003 to $935.8 billion this fiscal year.

The more societies spend on social controls, the less they have left for social investment. More police means fewer social services. American taxpayers spend $107.5 billion more on police than on public housing.

More prisons means fewer dollars for education. In fact, America is now spending more money on prisons than on public schools. Fifteen states now spend $27,000 more per person in prison than they do per student.

As spending on controls has increased, spending on public assistance has shrunk. Fewer people are receiving food stamps. Outlays for public health have declined.

America can't even seem to find money to extend unemployment benefits during this pandemic.

Societies that skimp on social investment end up spending more on social controls that perpetuate violence and oppression. This trend is a deep-seated part of our history.

The United States began as a control society. Slavery – America’s original sin – depended on the harshest conceivable controls. Jim Crow and redlining continued that legacy.

But in the decades following World War II, the nation began inching toward social investment – the Civil Rights Act, the Voting Rights Act, the Fair Housing Act, and substantial investments in health and education.

Then America swung backward to social control.

Since Richard Nixon declared a “war on drugs,” four times as many people have been arrested for possessing drugs as for selling them.

Of those arrested for possession, half have been charged with possessing cannabis for their own use. Nixon’s strategy had a devastating effect on Black people that is still felt today: a Black person is nearly 4 times more likely to be arrested for cannabis possession than a white person, even though they use it at similar rates.

Bill Clinton put 88,000 additional police on the streets and got Congress to mandate life sentences for people convicted of a felony after two or more prior convictions, including drug offenses.

This so-called “three strikes you’re out” law was replicated by many states, and, yet again, disproportionately impacted Black Americans. In California, for instance, Black people were 12 times more likely than white people to be incarcerated under three-strikes laws, until the state reformed the law in 2012. Clinton also “reformed” welfare into a restrictive program that does little for families in poverty today.

Why did America swing back to social control?

Part of the answer has to do with widening inequality. As the middle class collapsed and the ranks of the poor grew, those in power viewed social controls as cheaper than social investment, which would require additional taxes and a massive redistribution of both wealth and power.

Meanwhile, politicians whose power depends on maintaining the status quo, used racism – from Nixon’s “law and order” and Reagan’s “welfare queens” to Trump’s blatantly racist rhetoric – to deflect the anxieties of an increasingly overwhelmed white working class. It’s the same old strategy. So long as racial animosity exists, the poor and working class won’t join together to topple the system that keeps so many Americans in poverty, and Black Americans oppressed.

The last weeks of protests and demonstrations have exposed what’s always been true: social controls are both deadly and unsustainable. They require more and more oppressive means of terrorizing communities and they drain resources that would ensure Black people not only survive, but thrive.

This moment calls on us to relinquish social control and ramp up our commitment to social investment.

It’s time we invest in affordable housing and education, not tear gas, batons, and state-sanctioned murder. It’s time we invest in keeping children fed and out of poverty, not putting their parents behind bars. It’s time to defund the police, and invest in communities. We have no time to waste.

247 notes

·

View notes

Text

Poverty: Simulations, Realism and Research

When I enter the woods, I completely expect and understand one thing to be true - what my mind wanders to and what it lands upon could be absolutely anything. Yes, I can have deep focus, but in the woods, I do not plan my thoughts or my focus. I let it find its own and I go along for the adventure.

On this particular day, I found myself constantly thinking about a major social issue running rampant throughout the world. It haunts us in our own country. There is no town or city you can step foot into without the issues of poverty existing - even the richest of our cities. Poverty has, unfortunately, found a home everywhere and the number of persons affected steadily increases.

I believe one of the biggest brick walls we have regarding poverty is the misunderstanding of what it is and what is causing it. Another issue is the fact that there are entirely too many misconceptions regarding the people who live below “the line.” Although, it would seem easy to conduct research and find the truths. Many people are just too busy planning their weekends or cooking pizza to take the time.

I have lived at the line. I wasn’t born and raised there, but I found myself there. It wasn’t fun and I found my way out. Not everyone is that lucky. The issues of poverty started occupying some space in my mind some time back. I put together a few ideas for some research projects to see what I could do to create more awareness. One night, one week ago to be exact, I attended an event. A poverty simulation. This opened my eyes to the the point of making awareness a priority.

Defining Poverty

How is poverty defined? These pieces of information are provided by the Center for Poverty Research at University of California, Davis:

The official poverty measure

The official poverty measure has been used to estimate the national poverty rate from 1959 onward. The measure is used to create income thresholds that determine how many people are in poverty. Income thresholds by the official poverty measure are established by tripling the inflation-adjusted cost of a minimum food diet in 1963 and adjusting for family size, composition and the age of the householder.

The Census Bureau also provides data using ratios that compare the income levels of people or families with their poverty threshold:

A household income above 100% of their poverty threshold is considered “above the poverty level.”

Income above 100% but below 125% of poverty is considered “near poverty.”

Households with incomes at or below 100% are considered “in poverty.”

Household incomes below 50% of their poverty threshold are considered to be in “severe” or “deep poverty.”

The official poverty measure provides guidance for government poverty policy and programs. The official measure thresholds are the basis for the U.S. Department of Health and Human Services poverty guidelines which determine government program eligibility.

The supplemental poverty measure

The supplemental poverty measure provides a more complex statistical understanding of poverty by including money income from all sources, including government programs, and an estimate of real household expenditures. This information is valuable, but this measure’s thresholds are not the basis for government program income eligibility.

The measure was developed by a 2010 government technical working group. In 2011, its first year of use, it showed that 16 percent of Americans lived in poverty during 2010, compared to 15.1 percent from the official poverty measure.

This measure also shows the effect that a number of safety net programs have on poverty rates. In 2015, for example, Social Security reduced poverty overall by 8.3 percent. Refundable tax credits reduced poverty by about 2.9 percent, with the largest reduction among children under 18 years of age.

Importantly, the supplemental poverty measure showed a wider variation of poverty from state to state. For example, it found that over a three-year average from 2013-15 California had a poverty rate of 15 percent by the official measure. By the supplemental measure California poverty was 20.6 percent, which was highest in the nation.

According to a report by the World Hunger Education Service we are given these facts that were updated in 2016:

Poverty in the United States

The official poverty measure is published by the United States Census Bureau and shows that:

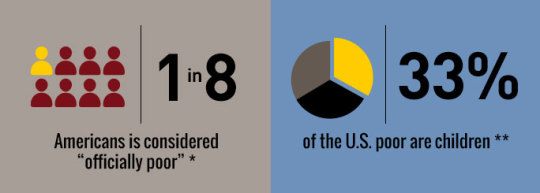

In 2015 there were 43.1 million people in poverty, 3.5 million less than in 2014. (Proctor 2016, p. 12-14)

The official poverty rate in 2015 was 13.5 percent, down 1.2 percentage points from 14.8 percent in 2014.

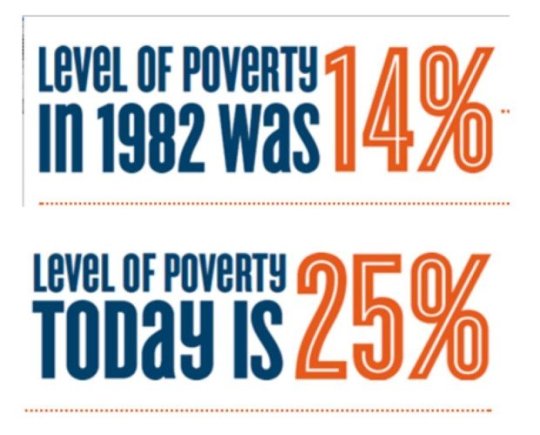

However, the 2015 poverty rate was 1.0 percentage point higher than in 2007, the year before the most recent recession . The poverty rate was at 22.4 percent in 1959, the first year for poverty estimates. (Proctor 2016, p. 12-14)

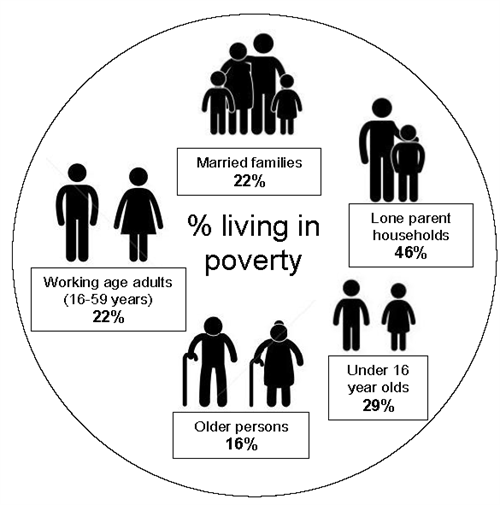

The 2015 poverty rate for Blacks was 24.1 (down from 26.2 percent in 2014), for Hispanics 21.4 (down from 23.6 percent in 2014), and for Asians 11.4 percent (not statistically different from 2014). For non-Hispanic whites the poverty rate was 9.1 percent (Proctor 2016, p. 12-4).

The poverty rate for children under 18 was 19.7 percent in 2015, down from 21.1 percent in 2014 and the number of children in poverty was 14.5 million, down from 15.5 million in 2014. Children represented 23.1 percent of the total population and 33.6 percent of people in poverty (Proctor 2016, p. 14).

19.4 million Americans live in extreme poverty. This means their family’s cash income is less than half of the poverty line, or about $10,000 a year for a family of four. They represented 6.1 percent of all people and 45.1 percent of those in poverty (Proctor 2016, p. 17-19).

School meal programs remain an effective means of ensuring children receive the nourishment they need to be healthy. Photo: Bread for the World (May 13, 2015)

The supplemental poverty measure (SPM) was first published in 2011 by the Census Bureau and addresses concerns that have been raised about the official poverty measure. However, the official poverty measure does not reflect the effects of key government policies that alter the disposable income of families and thus their poverty status, such as the SNAP/food stamp program, the school lunch program, and taxes. Taking these adjustments into account, the SPM for 2015 showed 1.8 million more people in poverty in 2012, compared to the official poverty statistics (Renwick SPM, p. 3) .

The SPM also enables measurement of the impact of certain poverty programs on poverty.

People 65 and older had a supplemental poverty rate of 13.7 percent, equating to 6.5 million people in poverty. Excluding Social Security from income would more than triple the poverty rate for this group, resulting in a poverty rate of 49.7 percent.

Not including refundable tax credits (the Earned Income Tax Credit and the refundable portion of the child tax credit) in resources would have resulted in an additional 9.2 million individuals falling into poverty, a 2.9 percentage point increase.

Taking account of other noncash benefits also lowered poverty rates. For example, Supplemental Nutrition Assistance Program benefits lowered the overall poverty rate by 1.4 percentage points or 4.6 million people. (Renwick SPM, pp. 12-14)

Hunger and the Struggle of Feeding Children and Families

One of the biggest issues existing in relation to poverty in our country revolves around hunger and food issues. I learned a new phrase today - Food Insecurity. A noun. It is the state of being without reliable access to a sufficient quantity of affordable, nutritious food. The fact is this: "more than 800 million people live every day with hunger or food insecurity as their constant companion." (Dictionary.com)

As we eat our steak in a nice restaurant or our bag of fast food, we take it for granted because we put in a day of hard work, accomplishment and spent energy on completing daily life chores, there are those struggling to find work and equally, or more so, struggling to feed themselves and their families.

Are we oblivious to these facts? I would say not. I think the problem revolves around an assumption that food stamps and food pantries are taking care of the problems. Realizing these two things do not take care of all problems should rank a bit higher in our priorities.

Many of these people included in this number receive help by programs. But is it enough? Unfortunately, no. Given the number of adults losing jobs, the increase in the population of those who are dependent upon programs and restrictions to program access being enhanced, leaves a gap to fill. Where does the responsibility lie to fix these issues? It is true that programs exist that assist to battle hunger but we need to remember that these programs require funding, volunteers and the needed product. Oftentimes, this tends to be a thought far from most minds.

As with any social issue in our world, the steps to resolving the issue or minimizing the issue begins with awareness. The more we take the time to understand the many facets of an issue, the better equipped we are to tackle the issue while helping others to reach a better place in life.

Works Cited

www.dictionary.com

https://poverty.ucdavis.edu/faq/how-poverty-measured-united-states

http://www.worldhunger.org/hunger-in-america-2016-united-states-hunger-poverty-facts/

4 notes

·

View notes

Text

The basic problem with Basic Income

For the last few years the cool people and the media that serve them have been bandying about the idea of a "Basic Income." This is, as you probably know, the idea that if we were decent human beings the government would guarantee everyone in the country, regardless of whether they were employed or not, a yearly income. It's appealing because it's simple and straightforward with the potential to address so much of what's wrong with out culture — not just in terms of money but maybe even intangibles like self-worth. Wouldn't it be great if we eliminated poverty AND suicide in one bold and simple stroke of policy?

There's two big problems: one, the idea can't survive even the simplest back-of-the-napkin math and two, the idea as currently understood is so amorphous that any two people you hear talking about it are generally not talking about the same program. At all. Let me break down each of these points.

1. The arithmetic

We're not mathematicians here, so let's keep this as simple as possible and see what a super-simple Basic Income program might cost. There's about 325,000,000 (325 million) people in the U.S. Let's say we decide we're going to give each of them $10,000. $325m * 10k = $3.25 TRILLION dollars. How much is $3.25 trillion? That's this: $3,250,000,000,000. That's (roughly) the same size as the entire budget of the Federal government. Like, the same as the cost of our insanely huge military, medicaid, medicare, the rest of our crappy health system, social security, roads and infrastructure, the farm bill, federal prisons, pork barrel projects, and everything else all put together. The whole enchilada. If you got rid of everything the government does, you could afford to give everyone $10k. That ten grand in your pocket is probably going to feel super useful when you're driving around desperately looking for an interstate highway you can use, or when Canada invades.

Short of doubling (or tripling, or more!) the size of the Federal government (and therefore everyone's taxes), there's no way around this problem. You could give everyone less (a lot less) but then you're not actually talking about a Basic Income. Most people would intuitively think of an "income" as an amount you could live on. I don't think most people would consider even $10k enough to live on, and less that that is nothing like an "income."

The arithmetic above describes Universal Basic Income (UBI), which is "universal" because every person in the country would receive money. Conservatives like this idea because it's more money in their pocket, (possibly with the perceived benefit of eliminating the entire government!) Besides giving away a lot less than an "income" the only other way we could afford a program like this is to make it not universal.

2. Basic Income means different things to different people — that's why so many people like it

The idea of Basic Income is often described as having "bipartisan" support — there are both conservatives and progressives who think this is a neat idea. The real reason it has "bipartisan" support is because people are generally confused and talking about (at least) two radically different things (since, as established above, nobody is actually going to pay for real universal basic income). Generally, the program conservatives are imagining is universal without being an income. And the program progressives imagine is an income without being universal. These are two completely different ideas that are at odds with each other, but for some reason both are being called "basic income."

When conservative thinkers talk about Basic Income, they imagine the program replacing virtually all other social safety-net programs (welfare, food stamps, medicaid, maybe medicare and social security too, if they have to). Instead of your medicaid coverage, you would get a check for, say, $1000. Ideally, for conservatives, it is a "universal" variation on this — we eliminate all social safety-net programs and everyone gets a check for $1000, or whatever piddling amount. Which is, if you think about it, taking resources away from low-income people (by eliminating the social programs that served them) and giving those resources to wealthier people in the form of cash — it's government redistribution upwards. Obviously this would never be supported by any person who believes the government has even the vaguest obligation to help people struggling with poverty.

What if we didn't give money to everyone, what if we just guaranteed it to people who don't have a job or fall below a certain income threshold? Well, then what we are talking about is a "means-tested" program — a program you have to show you qualify for because of your lack of means. We've been successfully using programs like this for decades in the form food stamps or welfare payments. Progressives love the idea of means-tested cash payments, because there's a lot of research that shows giving people unrestricted cash is a good way to help them out of poverty. In the progressive vision, this Basic Income program is added on top of other social safety-net programs. And really, it is a terrific idea for an effective new safety-net program that should seriously be considered. There's just one issue, it's expensive. I'm not going to do the math on this because the variables get complicated fast, but it's going to be very, very expensive, something like the equivalent of the cost of all the other safety-net programs we currently have, combined. No person a hair to the right of center or further over will ever support actual legislation for an expensive new safety-net program that only serves people without a job.

You can slice the idea of a Basic Income 10 ways or a hundred ways. The problems are glaringly obvious, you don't need some complex language of critical theory to tear it apart. If you need a drier, more in-depth and scholarly analysis to be convinced check out this paper. The Basic Income concept is really terrific model of a complete non-starter. So the real mystery is: why are so many people talking about it like it's a real thing that could happen?

I actually believe the fact that Basic Income keeps being discussed in the media reveals just how broken the media is. Journalists are not trained to raise critical arguments, they are trained to consult with experts, check that expert's opinion with another expert "on the other side," and then cover the story in a "balanced" way. A little common sense critical thinking, a little math on the back of an envelope, or 5 minutes reading Wikipedia might make it obvious that the entire issue the experts are weighing in on has little more real-world credibility than late-night undergrad pothead far-outings, but you'll never hear a journalist ask an expert to explain why this topic just doesn't pass the common-sense sniff-test. Because of this, any topic where the left and right could both potentially benefit ends up lacking any voice to point out that the whole subject has no clothes. And it happens all the time: it's why you rarely see critical perspectives on the farm bill, and nobody mentions that being a police officer isn't actually a dangerous job (unless you count the risk of car crashes). It's why nobody questioned the wisdom of doctors prescribing opioids for pain ("the 5th vital sign"? Really? Am I the only person who thought that just reeked of drug-company propaganda?) And it's why we've put more than 2 million people behind bars before anyone thought to ask if that might be such a good idea.

Raising critical questions on these topics doesn't require months-long careful investigative journalism (not that there's anything wrong with that). It just takes someone with common-sense and a willingness to raise practical, and obvious questions about the flaws in these topics, rather than globbing on to the hype. The media shouldn't be finding balanced coverage on these things, they should be tearing that shit apart.

The knowledge of experts is important, but the media's consistent knee-jerk "let's see what the experts on the other side think" technique, and basic ignorance of how to apply common-sense criticisms — or to at least bring in the voices of those with common-sense — is regularly undermining both the purpose of the media, and healthy outcomes for our society. Basic Income is an idea that might never get off the drawing board just because it's so completely impractical. But unless someone is talking about new solutions to the huge and obvious problems with the idea, let's put it aside, and start looking for the next idiotic idea being pushed by drug companies or weapons manufacturers and stop them before we end up throwing another class of innocent victims on the pyre.

0 notes

Text

The Real Choice: Social Control or Social InvestmentSome...

New Post has been published on https://truckfump.life/2020/07/21/the-real-choice-social-control-or-social-investmentsome/

The Real Choice: Social Control or Social InvestmentSome...

youtube

The Real Choice: Social Control or Social Investment

Some societies center on social control, others on social investment.

Social-control societies put substantial resources into police, prisons, surveillance, immigration enforcement, and the military. Their purpose is to utilize fear, punishment, and violence to divide people and keep the status quo in place — perpetuating the systemic oppression of Black and brown people, and benefiting no one but wealthy elites.

Social-investment societies put more resources into healthcare, education, affordable housing, jobless benefits, and children. Their purpose is to free people from the risks and anxieties of daily life and give everyone a fair shot at making it.

Donald Trump epitomizes the former. He calls himself the “law and order” president. He even wants to sic the military on Americans protesting horrific police killings.

He has created an unaccountable army of federal agents who go into cities like Portland, Oregon – without showing their identities – and assault innocent Americans.

Trump is the culmination of forty years of increasing social control in the United States and decreasing social investment – a trend which, given the deep-seated history of racism in the United States, falls disproportionately on Black people, indigeneous people, and people of color.

Spending on policing in the United States has almost tripled, from $42.3 billion in 1977 to $114.5 billion in 2017.

America now locks away 2.2 million people in prisons and jails. That’s a 500 percent increase from 40 years ago. The nation now has the largest incarcerated population in the world.

Immigration and Customs Enforcement has exploded. More people are now in ICE detention than ever in its history.

Total military spending in the U.S. has soared from $437 billion in 2003 to $935.8 billion this fiscal year.

The more societies spend on social controls, the less they have left for social investment. More police means fewer social services. American taxpayers spend $107.5 billion more on police than on public housing.

More prisons means fewer dollars for education. In fact, America is now spending more money on prisons than on public schools. Fifteen states now spend $27,000 more per person in prison than they do per student.

As spending on controls has increased, spending on public assistance has shrunk. Fewer people are receiving food stamps. Outlays for public health have declined.

America can’t even seem to find money to extend unemployment benefits during this pandemic.

Societies that skimp on social investment end up spending more on social controls that perpetuate violence and oppression. This trend is a deep-seated part of our history.

The United States began as a control society. Slavery – America’s original sin – depended on the harshest conceivable controls. Jim Crow and redlining continued that legacy.

But in the decades following World War II, the nation began inching toward social investment – the Civil Rights Act, the Voting Rights Act, the Fair Housing Act, and substantial investments in health and education.

Then America swung backward to social control.

Since Richard Nixon declared a “war on drugs,” four times as many people have been arrested for possessing drugs as for selling them.

Of those arrested for possession, half have been charged with possessing cannabis for their own use. Nixon’s strategy had a devastating effect on Black people that is still felt today: a Black person is nearly 4 times more likely to be arrested for cannabis possession than a white person, even though they use it at similar rates.

Bill Clinton put 88,000 additional police on the streets and got Congress to mandate life sentences for people convicted of a felony after two or more prior convictions, including drug offenses.

This so-called “three strikes you’re out” law was replicated by many states, and, yet again, disproportionately impacted Black Americans. In California, for instance, Black people were 12 times more likely than white people to be incarcerated under three-strikes laws, until the state reformed the law in 2012. Clinton also “reformed” welfare into a restrictive program that does little for families in poverty today.

Why did America swing back to social control?

Part of the answer has to do with widening inequality. As the middle class collapsed and the ranks of the poor grew, those in power viewed social controls as cheaper than social investment, which would require additional taxes and a massive redistribution of both wealth and power.

Meanwhile, politicians whose power depends on maintaining the status quo, used racism – from Nixon’s “law and order” and Reagan’s “welfare queens” to Trump’s blatantly racist rhetoric – to deflect the anxieties of an increasingly overwhelmed white working class. It’s the same old strategy. So long as racial animosity exists, the poor and working class won’t join together to topple the system that keeps so many Americans in poverty, and Black Americans oppressed.

The last weeks of protests and demonstrations have exposed what’s always been true: social controls are both deadly and unsustainable. They require more and more oppressive means of terrorizing communities and they drain resources that would ensure Black people not only survive, but thrive.

This moment calls on us to relinquish social control and ramp up our commitment to social investment.

It’s time we invest in affordable housing and education, not tear gas, batons, and state-sanctioned murder. It’s time we invest in keeping children fed and out of poverty, not putting their parents behind bars. It’s time to defund the police, and invest in communities. We have no time to waste.

0 notes

Text

With tax reform we can make it morning in America again

http://ryanguillory.com/with-tax-reform-we-can-make-it-morning-in-america-again/

With tax reform we can make it morning in America again

Today is the anniversary of former president Ronald Reagan signing into law the Tax Reform Act of 1986. The act was the second major law he signed to reform the tax code for the American people.

Republicans and Democrats came together to cut taxes for hardworking families in 1981, and again in 1986 to simplify the tax code, so that everyone could get a fair shake. The rest, as they say, is history.

The economy boomed, launching into one of the largest peacetime economic expansions in history. Dormant small businesses and factories sprung back to life. The famed American Worker produced at unprecedented levels. The median family income rose. And more American products than ever before reached foreign shores, stamped with those four beautiful words: “Made in the USA.”

More from USA Today:

Behind efforts to build prototypes of Trump’s border wall, emails show a confusing and haphazard process

Jimmy Carter: The media has been harder on Trump than predecessors

Trump’s world: It’s different from what others see

The 1980s also saw extraordinary ideas transformed into reality by American inventors and entrepreneurs. Many of those creations dramatically improved our quality of life. Others connected us like never before and put an entire universe of information at our fingertips. Still others, like the space shuttle after its first launch in 1981, stretched the bounds of what we thought was possible for humankind.

It was a time of extraordinary optimism — it was truly “Morning in America,” an economic miracle for the middle-class.

A lot has changed since then, especially when it comes to taxes.

While our economic competitors slashed their taxes in hopes of replicating America’s success, our leaders remained complacent or, in some cases, reversed course.

We are now among the highest taxed nations in the developed world. Our tax code and laws have nearly tripled in length since the 1986 reforms. They now span 2,650 pages, with another 70,000 pages of forms, instructions, court decisions, and other guidance.

We have watched our leaders allow other countries to erode our competitive edge, take our jobs, and drain our wealth. And, for the first time in our history, Americans have feared that their children will not grow up to be better off financially than they are.

That era of economic surrender is now over.

In the nine months since I took office as president, we have removed intrusive, job-killing regulations at a record pace. We are leaving lopsided international deals that hurt America like the Trans-Pacific Partnership and Paris Climate Accord. We have unleashed American energy by ending the war on coal and approving major projects like the Keystone XL and Dakota Access Pipelines. And earlier this month, I signed an executive order to take important steps to free our people from the grip of Obamacare.

And now, unemployment is at a 16-year low. Wages are rising. Manufacturing confidence is higher than it has ever been. The stock market is soaring to record levels. And GDP growth climbed to more than 3% in the second quarter.

The optimism has returned — the sun is once again rising over America.

But our economy cannot take off like it should unless we transform our outdated, complex and burdensome tax code, and that is exactly what we are proposing to do.

Revising our tax code is not just a policy discussion — it is a moral one, because we are not talking about the government’s money – we are talking about your money, your hard work.

According to the Tax Foundation, taxes cost Americans more out-of-pocket than housing, clothing, and food — combined.

Somehow, this has become “normal” in the Land of the Free, but it should not be.

American families should not have to send more money to the government than they spend on building a better life for themselves and their children. You are the ones who carry this nation on your back, and it is time for you to get the relief that you deserve.

That is why we are taking action to dramatically reduce the burden that the sprawling federal tax code has become on our citizens.

Our plan will transform the tax code so that it is once again simple, fair and easy to understand. We want you to spend your valuable time pursuing your dreams, not trapped in a tax compliance nightmare.

We will cut taxes for hardworking, middle-class families.

We will double the standard deduction, which means the first $24,000 of a family’s income will be tax-free. We will also expand the child tax credit. And we will lower rates so that families will keep more of their hard-earned money.

We will also restore our competitive edge so we can create better jobs and higher wages for American workers.

Our plan will provide tax relief to businesses of all sizes, and deliver our small and medium-sized businesses the lowest top rate in more than 80 years.

Finally, we will bring back trillions of dollars in American wealth currently parked overseas.

Today’s tax system foolishly penalizes companies that bring foreign profits back to the United States. Our plan encourages companies to bring this money home, where it can be invested in American companies, American jobs and American workers.

If Congress comes together to enact this commonsense plan, the Council of Economic Advisers estimates that it will raise the annual income of a typical, hardworking American household by an average of around $4,000.

Just imagine the possibilities.

We have the benefit of hindsight as we look back at the three decades since our country’s last major tax reform. We can see what worked and what did not. And most importantly, we can apply the lessons learned to the challenges of today.

The tax cuts and reforms of the 1980s show that when we empower the American people to pursue their dreams, they will not only achieve greatness and create prosperity beyond imagination, they will build an entirely new world.

It is time to ignite America’s middle class miracle once again.

Donald Trump is the 45th president of the United States.

Source link

0 notes

Text

With tax reform we can make it morning in America again

http://ryanguillory.com/with-tax-reform-we-can-make-it-morning-in-america-again/

With tax reform we can make it morning in America again

Today is the anniversary of former president Ronald Reagan signing into law the Tax Reform Act of 1986. The act was the second major law he signed to reform the tax code for the American people.

Republicans and Democrats came together to cut taxes for hardworking families in 1981, and again in 1986 to simplify the tax code, so that everyone could get a fair shake. The rest, as they say, is history.

The economy boomed, launching into one of the largest peacetime economic expansions in history. Dormant small businesses and factories sprung back to life. The famed American Worker produced at unprecedented levels. The median family income rose. And more American products than ever before reached foreign shores, stamped with those four beautiful words: “Made in the USA.”

More from USA Today:

Behind efforts to build prototypes of Trump’s border wall, emails show a confusing and haphazard process

Jimmy Carter: The media has been harder on Trump than predecessors

Trump’s world: It’s different from what others see

The 1980s also saw extraordinary ideas transformed into reality by American inventors and entrepreneurs. Many of those creations dramatically improved our quality of life. Others connected us like never before and put an entire universe of information at our fingertips. Still others, like the space shuttle after its first launch in 1981, stretched the bounds of what we thought was possible for humankind.

It was a time of extraordinary optimism — it was truly “Morning in America,” an economic miracle for the middle-class.

A lot has changed since then, especially when it comes to taxes.

While our economic competitors slashed their taxes in hopes of replicating America’s success, our leaders remained complacent or, in some cases, reversed course.

We are now among the highest taxed nations in the developed world. Our tax code and laws have nearly tripled in length since the 1986 reforms. They now span 2,650 pages, with another 70,000 pages of forms, instructions, court decisions, and other guidance.

We have watched our leaders allow other countries to erode our competitive edge, take our jobs, and drain our wealth. And, for the first time in our history, Americans have feared that their children will not grow up to be better off financially than they are.

That era of economic surrender is now over.

In the nine months since I took office as president, we have removed intrusive, job-killing regulations at a record pace. We are leaving lopsided international deals that hurt America like the Trans-Pacific Partnership and Paris Climate Accord. We have unleashed American energy by ending the war on coal and approving major projects like the Keystone XL and Dakota Access Pipelines. And earlier this month, I signed an executive order to take important steps to free our people from the grip of Obamacare.

And now, unemployment is at a 16-year low. Wages are rising. Manufacturing confidence is higher than it has ever been. The stock market is soaring to record levels. And GDP growth climbed to more than 3% in the second quarter.

The optimism has returned — the sun is once again rising over America.

But our economy cannot take off like it should unless we transform our outdated, complex and burdensome tax code, and that is exactly what we are proposing to do.

Revising our tax code is not just a policy discussion — it is a moral one, because we are not talking about the government’s money – we are talking about your money, your hard work.

According to the Tax Foundation, taxes cost Americans more out-of-pocket than housing, clothing, and food — combined.

Somehow, this has become “normal” in the Land of the Free, but it should not be.

American families should not have to send more money to the government than they spend on building a better life for themselves and their children. You are the ones who carry this nation on your back, and it is time for you to get the relief that you deserve.

That is why we are taking action to dramatically reduce the burden that the sprawling federal tax code has become on our citizens.

Our plan will transform the tax code so that it is once again simple, fair and easy to understand. We want you to spend your valuable time pursuing your dreams, not trapped in a tax compliance nightmare.

We will cut taxes for hardworking, middle-class families.

We will double the standard deduction, which means the first $24,000 of a family’s income will be tax-free. We will also expand the child tax credit. And we will lower rates so that families will keep more of their hard-earned money.

We will also restore our competitive edge so we can create better jobs and higher wages for American workers.

Our plan will provide tax relief to businesses of all sizes, and deliver our small and medium-sized businesses the lowest top rate in more than 80 years.

Finally, we will bring back trillions of dollars in American wealth currently parked overseas.

Today’s tax system foolishly penalizes companies that bring foreign profits back to the United States. Our plan encourages companies to bring this money home, where it can be invested in American companies, American jobs and American workers.

If Congress comes together to enact this commonsense plan, the Council of Economic Advisers estimates that it will raise the annual income of a typical, hardworking American household by an average of around $4,000.

Just imagine the possibilities.

We have the benefit of hindsight as we look back at the three decades since our country’s last major tax reform. We can see what worked and what did not. And most importantly, we can apply the lessons learned to the challenges of today.

The tax cuts and reforms of the 1980s show that when we empower the American people to pursue their dreams, they will not only achieve greatness and create prosperity beyond imagination, they will build an entirely new world.

It is time to ignite America’s middle class miracle once again.

Donald Trump is the 45th president of the United States.

Source link

0 notes