#portfolio allocation

Text

Investing in cryptocurrency offers high returns but comes with risks. Learn how to navigate the volatile world of crypto investments and optimize your portfolio with effective allocation strategies. #Crypto #Cryptocurrency #Investment #PortfolioAllocation

0 notes

Text

XRP: The Sleeping Giant or a Crypto Tombstone?

New Post has been published on https://www.ultragamerz.com/xrp-the-sleeping-giant-or-a-crypto-tombstone/

XRP: The Sleeping Giant or a Crypto Tombstone?

XRP: The Sleeping Giant or a Crypto Tombstone?

Ripples of uncertainty continue to surround XRP, the controversial token associated with Ripple Labs. Unlike the wild swings experienced by other cryptocurrencies in recent months, XRP has remained stubbornly stagnant, a slumbering giant some might say, or perhaps a digital tombstone for overly optimistic investors.

A Brief History of XRP’s Legal Limbo:

The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging XRP is an unregistered security. This lawsuit cast a heavy shadow over XRP’s future, creating a climate of fear and doubt among investors. The legal battle continues to drag on, with no clear resolution in sight.

March Madness or More Stagnation? Unpacking the Potential 25x Surge and Looming Dump Threat

The price of XRP, the token associated with Ripple Labs, has been a curious case in the ever-volatile crypto market. Unlike its brethren that experience wild swings and parabolic rises, XRP has remained stubbornly stagnant, leaving investors questioning its future. However, with March 2024 approaching, whispers of a potential “XRP March Madness” are swirling, hinting at a monstrous breakout that could redefine the coin’s fortunes. Let’s delve deeper into this intriguing scenario and explore the factors fueling this speculation.

Aligning the Stars: Favorable SEC Lawsuit Outcome and Market Momentum:

The ongoing legal battle between Ripple and the SEC remains the single biggest factor influencing XRP’s price. A favorable outcome for Ripple, meaning the court deems XRP not a security, could trigger a domino effect. Regulatory uncertainty would vanish, potentially attracting institutional investors who have been hesitant to enter the fray due to the ongoing lawsuit. This influx of new capital, coupled with renewed investor confidence, could ignite a buying frenzy, propelling XRP’s price significantly higher.

Technical Analysis: Bullish Signals and Breakout Potential:

Technical analysts scouring XRP’s charts have identified potential bullish signals hinting at an impending breakout. Price consolidation patterns and positive indicators like the Relative Strength Index (RSI) suggest XRP might be coiling up for a significant upward move. While technical analysis shouldn’t be the sole factor in investment decisions, these signals add fuel to the fire of the “XRP March Madness” narrative.

Community Sentiment and FOMO (Fear of Missing Out):

The crypto community thrives on hype and social media buzz. If XRP experiences a significant price jump in March, a wave of FOMO could propel the price even further. News outlets and social media influencers amplifying the narrative could create a self-fulfilling prophecy, attracting new investors eager not to miss out on the potential gains.

A Word of Caution: The Looming Dump Threat and Whale Activity:

While the prospect of a 25x surge is undoubtedly enticing, investors should remain cautious. Recent on-chain data reveals large transfers of XRP to cryptocurrency exchanges. This activity can be interpreted in two ways: either a prelude to a massive breakout or a worrying sign of whales (large holders) preparing to dump their XRP holdings, potentially causing a significant price drop.

Investing in XRP: Weighing Risk and Reward:

The potential March 2024 breakout for XRP presents a classic high-risk, high-reward scenario. A successful resolution of the SEC lawsuit and a confluence of positive factors could lead to explosive growth. However, the ongoing legal battle and the uncertainty surrounding whale activity inject significant risk into the equation. Investors with a high-risk tolerance and a strong understanding of the cryptocurrency market dynamics might consider XRP as a potential investment. However, thorough research, careful portfolio allocation, and a healthy dose of caution are paramount before diving in.

Stagnant Price, Shaky Future?

While the broader cryptocurrency market experiences periods of explosive growth and heart-stopping dips, XRP remains largely unmoved. This price stagnation has led some to question XRP’s viability as an investment.

A Potential Monster Awakening?

However, some analysts believe XRP could be on the verge of a monstrous breakout. Should the SEC lawsuit be settled favorably for Ripple, XRP’s price could potentially surge by a staggering 25x or more. This scenario, while enticing, is far from guaranteed.

Whale Activity and the Dumping Specter:

Adding another layer of intrigue, recent on-chain data reveals large transfers of XRP to cryptocurrency exchanges. This activity could be interpreted in two ways: either a potential prelude to a massive breakout or a worrying sign of whales preparing to dump their XRP holdings, further depressing the price.

Is XRP Worth the Risk?

The current situation surrounding XRP presents a classic risk-reward scenario. A successful resolution of the SEC lawsuit could lead to explosive growth, but the uncertainty surrounding the legal battle makes XRP a gamble at best. Investors seeking more stable or demonstrably growing investment opportunities may be better off looking elsewhere.

Final Thoughts:

XRP remains a sleeping giant, but whether it awakens as a majestic beast or simply crumbles to dust is a question only time, and the ongoing legal saga, will answer. Investors should approach XRP with extreme caution and conduct thorough research before making any investment decisions. Remember, in the world of cryptocurrency, sometimes the biggest risks lead to the biggest rewards, but they can also lead to the biggest losses.

SEO Keywords: XRP, Ripple Labs, SEC lawsuit, cryptocurrency, March 2024, breakout, institutional investors, technical analysis, FOMO, whale activity, investment, risk-reward, high-risk tolerance, portfolio allocation.

#Breakout#bullish signals#Cryptocurrency#domino effect#dump threat#FOMO (Fear of Missing Out)#high-risk tolerance#institutional investors#investment#March 2024#on-chain data#parabolic rise#portfolio allocation#regulatory uncertainty#Relative Strength Index (RSI)#Ripple Labs#risk-reward#SEC lawsuit#self-fulfilling prophecy#social media buzz#stagnant#technical analysis#whale activity#XRP#cryptocurrency#Gaming News#Technology

0 notes

Text

stocks to buy now: Got a shopping list ready? It’s a great time to start a portfolio: Dipan Mehta

stocks to buy now: Got a shopping list ready? It’s a great time to start a portfolio: Dipan Mehta

“After six to 12 months, you will look back on this period as a great buying opportunity and so I am quite optimistic going forward,” says Dipan Mehta, Director, Elixir Equities.

How are you looking at the markets right now? What are you advising your clients?Dipan Mehta: We are in a kind of a sticky situation and those who have been investing in the past few months, will have to wait out this…

View On WordPress

#commodity consumers#dipan mehta#elixir equities#et now#Featured#Investment strategy#portfolio allocation#stock market#stocks to buy now

0 notes

Text

Neosify - Next Level Livin'

Ladies and gentlemen, are you ready to take your passive income to the next level? Then look no further than Neosify!

Neosify is a cutting-edge platform that offers some of the highest staking rates in the industry, allowing you to earn an incredible passive income on your investments. With Neosify, you can rest assured that your money is working hard for you, delivering consistent returns that will help you achieve your financial goals in no time.

But that's not all - Neosify is more than just a staking platform (200%+ APY). With its innovative technology and expert team of financial analysts, Neosify offers a wide range of investment options, rewards on top of the $100 incentive, and a multi-tiered referral program so you can put your team's team on!

So why wait? Sign up for Neosify today and start earning the passive income you deserve. With its high staking rates, cutting-edge technology, and expert support, Neosify is the ultimate choice for anyone looking to grow their wealth and achieve financial freedom. Don't miss out on this incredible opportunity - join Neosify now and start building your future today!

NEOSIFY

#passive income#staking#Passive income streams#Financial independence#frugality#Emergency funds#budgeting#diversification#Asset allocation#Capital gains#Investment portfolio#Compound interest#crypto#crytocurrency

12 notes

·

View notes

Text

The Importance of Diversification in Your Investment Portfolio

Diversification is a critical concept in investment that can help you balance risk and reward. By diversifying your investments, you can mitigate potential losses without significantly impacting potential gains. This article explores the importance of diversification in an investment portfolio and provides some strategies to help you diversify effectively.

What Is…

View On WordPress

#Asset Allocation#Bonds#Diversification#Financial Planning#Investing Strategy#Investment Portfolio#Mutual Funds#Real Estate#Risk Management#Stocks

5 notes

·

View notes

Text

Ulcer Index

Unraveling the Ulcer Index: A Comprehensive Guide to Understanding and Utilizing Market Volatility

Introduction:

In the fast-paced world of investing, understanding market volatility is paramount to success. One tool that aids investors in this endeavor is the Ulcer Index.

This comprehensive guide aims to demystify the Ulcer Index, shedding light on its significance, calculation, and practical…

View On WordPress

#Asset allocation#Behavioral Finance#Downside Risk#Drawdown Analysis#Financial Literacy#Financial Markets#Financial Planning#How to Calculate Ulcer Index#Importance of Ulcer Index in Investing#Investment Analysis#Investment education#Investment Performance#Investment Strategies#Investment Tools#Managing Drawdowns with Ulcer Index#Market Risk#Market Volatility#Peter Martin#Portfolio Management#Portfolio Optimization#Risk assessment#Risk Management#Stop-Loss Strategies#Ulcer Index#Ulcer Index and Risk Tolerance#Ulcer Index Applications#Ulcer Index Calculation#Ulcer Index Calculation Method#Ulcer Index in Fund Evaluation#Ulcer Index Interpretation

0 notes

Text

Quotes from the Legendary Analyst: Check Out MANA Coin and These 15!

In the dynamic world of cryptocurrency trading, navigating among all the different crypto assets can be an overwhelming task, especially when thousands of altcoins are competing for attention and it can be difficult to ignore the noise to focus on those that represent the most promising investments. With this in mind, veteran crypto expert Michaël van de Poppe has presented several strong…

View On WordPress

0 notes

Text

Mastering the Trio: Project, Program & Portfolio Management

Unraveling the Threads of Strategic Success

In the intricate tapestry of business management, three threads run consistently: project, program, and portfolio management. Each strand, distinct yet interwoven, forms the fabric of successful organizational strategy. Here’s how to differentiate and harness the power of each one to weave your own narrative of success.

Project Management: The…

View On WordPress

#business acumen#Change Management#Leadership Skills#Portfolio management#Program management#project management#resource allocation#risk management#stakeholder communication#strategic planning

0 notes

Link

Dive into the world of investing without the guesswork! Our latest guide on Investing in Index Funds: A Beginner’s Guide to Passive Income, offers you a step-by-step approach to building a diversified and cost-effective portfolio that aligns with your financial goals. From understanding the basics of index funds to mastering portfolio management and asset allocation, we have everything covered to kickstart your journey towards generating passive income. Ideal for beginners and seasoned investors alike, this is your roadmap to financial independence. Let's make your money work for you! #IndexFundsforBeginners #PassiveIncome #InvestSmart

0 notes

Text

Maximize Your Returns: Best Investment Recommendation for Long-Term Wealth Growth

Are you looking for the best investment recommendation to grow your wealth over the long-term? Look no further! In this comprehensive investment recommendation, we'll guide you through the most promising investment opportunities in today's market. Discover how to diversify your portfolio, manage risk effectively, and achieve optimal returns for sustained wealth growth. Whether you're a beginner or an experienced investor, this investment recommendation is your ticket to financial success. Don't miss out on the opportunity to secure your future!

#Investment analysis#market trends#portfolio management#diversification#performance evaluation#asset allocation#investment strategies

0 notes

Text

The Fundamental 3 Things to Check in a Stock Report

Embarking on the journey of stock market investment requires a keen eye and strategic understanding of the information presented in stock reports. For both novice and seasoned investors, there are three fundamental elements within a stock report that demand careful scrutiny for informed decision-making and successful portfolio management.

1. Financial Health and Performance:

The cornerstone of stock analysis lies in a comprehensive examination of the company's financial health and performance. Vital indicators such as revenue growth, profit margins, and debt levels offer insights into the company's stability and potential for sustained growth. Investors should assess the company's financial statements, including income statements, balance sheets, and cash flow statements, to gain a holistic view of its financial prowess.

2. Market and Industry Trends:

Understanding the broader market and industry dynamics is pivotal in evaluating a stock's potential. Stock reports should provide insights into current market trends, economic conditions, and industry-specific factors influencing the company's performance. Investors should assess how external factors might impact the company's operations and position within its sector. Industry analysis, including competitive landscape and growth projections, is crucial for making informed decisions in a dynamic market environment.

3. Management Competence and Corporate Governance:

The efficacy of a company's leadership plays a significant role in its success. A thorough examination of the management team's competence, strategic vision, and past performance is critical. Investors should assess whether the company adheres to sound corporate governance practices, ensuring transparency and ethical decision-making. Information on executive compensation, board structure, and any recent changes in leadership should be scrutinized to gauge the company's commitment to effective management.

In the pursuit of mastering stock analysis, investors should approach stock reports with a strategic mindset. By focusing on these three foundational aspects—financial health and performance, market and industry trends, and management competence and corporate governance—investors can make more informed decisions and build a resilient, well-balanced portfolio.

Remember, successful stock analysis goes beyond numbers; it requires a holistic understanding of the company's position in the market, its leadership's ability to navigate challenges, and the broader economic landscape. As you delve into stock reports, equip yourself with the knowledge to decipher these critical elements, and you'll be well-positioned to navigate the complexities of the stock market with confidence and intelligence.

#Stock analysis#Mutual fund analysis#Investment trends#Market insights#Portfolio management#Diversification#Risk assessment#Performance evaluation#Asset allocation#Investment strategies

0 notes

Text

Diversifying your investment portfolio is key to managing risk and achieving long-term financial goals. Learn effective strategies for asset allocation, geographic diversification, and sector allocation to optimize your investment returns. #InvestmentPortfolio #Diversification #RiskManagement

0 notes

Text

Explore financial resilience with StockEdge's blog on Portfolio Diversification. Learn the secrets to building a strong investment portfolio for lasting success. Your guide to mastering wealth preservation begins here.

0 notes

Text

Navigating the world of investment can be a complex journey, but understanding its basics is important for anyone looking to secure their financial future. Investment planning is an essential part of personal finance management, particularly in the UK, where diverse opportunities and challenges exist. This article aims to demystify the fundamentals of investment planning, making it accessible and beneficial for all.

#Investment Planning#Financial Strategy#Wealth Management#Asset Allocation#Risk Management#Portfolio Diversification#Retirement Planning#Market Analysis#Financial Goals#Wills & Trusts

0 notes

Text

100-Age Rule | Asset Allocation Rule

The ‘100 minus your age’ rule is another asset allocation rule. 100 minus your age gives you the percentage in equities with the balance going into low-risk bond assets.

For example, At age 30 you need 70% equity and 30% bonds. For age 50, equity comes out at 50% and bonds 50%.

The idea is that as you get older you move out of equities and into lower risk bonds. Advisors call this de-risking or life styling. Received wisdom is that in later life having a high proportion of equities creates a hazard to income, if the short term value of the portfolio suddenly moves up or down in value as a fund can’t recover.

#100-Age Rule#100 minus age rule#100 minus age rule investing#Equity Allocation Rule#100 Minus Age Equity#Hundred Minus Age Rule#100 - Age thumb Rule#100 - Age Equity Allocation#100 Minus Age Investment Allocation#100 minus age rule in investing#Risk Management In Equity Allocation Rule#Beware of the 100 Minus Age Rule#asset allocation#multi asset allocation fund#asset allocation portfolio#equity#portfolio investment#asset yogi#risk management trading

0 notes

Text

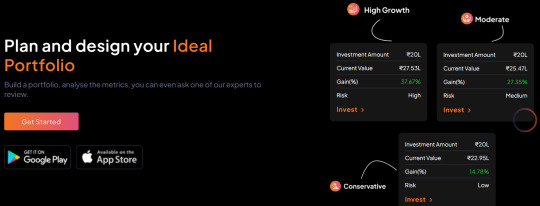

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes