#new homeowner

Text

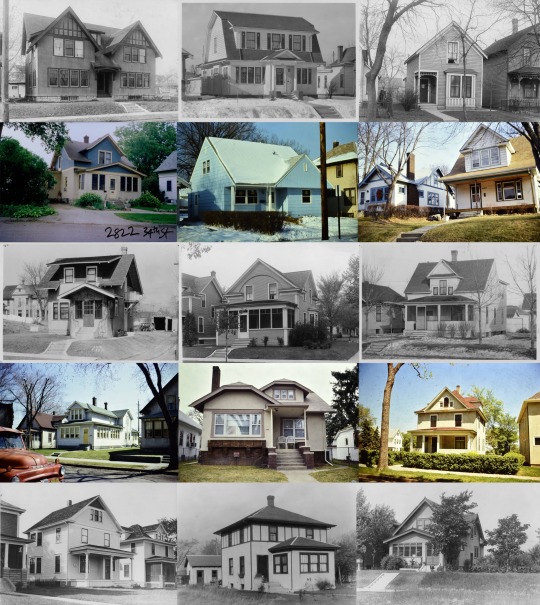

LOCAL HISTORY PROGRAM

Researching the History of Your Home

House history classes are back! Check out the Hennepin County Library events calendar for classes in September at Northeast Library, October at East Lake Library, and November at Arvonne Fraser Library.

Learn about the historical resources at the library and across the county that will help you piece together a history of your Minneapolis house, neighborhood or property. Staff from Hennepin County Library's Special Collections will explain and demonstrate resources, emphasizing online resources in the Digital Collections that will allow you to jump-start your research from home – including permit records, maps, city directories, photos and more. This class is best suited for researching properties located in the city of Minneapolis, though some county-wide resources will be discussed.

Register online!

28 notes

·

View notes

Text

Buying a house alone is probably one of the most financially and emotionally challenging thing to do and so mentally drained doing this.

6 notes

·

View notes

Video

youtube

Incorporating a new homeowner list into your marketing strategy can yield a wide range of benefits for your business.

By targeting this specific group, you can unlock opportunities that may not be available through traditional marketing channels.

Here are 5 key benefits of utilizing a new homeowner list:

Increased Relevance

Higher Conversion Rates

Improved ROI - Return on Investment

New opportunities for upselling and cross-selling

Building long-term relationships

0 notes

Text

The Rise of the Home Office

The COVID-19 pandemic has forced many people to work from home, and this has led to a surge in the demand for home offices. Homeowners are now looking for ways to create comfortable and productive workspaces in their homes. This trend is likely to continue even after the pandemic is over, as more and more people realize the benefits of working from home.

The Importance of Maintenance

The pandemic has also made homeowners more aware of the importance of maintenance. When people were stuck at home, they had more time to notice small problems around the house. This has led to an increase in the demand for home maintenance services. Homeowners are now more likely to schedule regular maintenance appointments, and they are also more likely to invest in repairs when needed.

Other Trends

In addition to the rise of the home office and the importance of maintenance, other trends that are likely to continue after the pandemic include:

The demand for sustainable homes

The desire for more outdoor living space

The need for security and safety features

The importance of comfort and convenience

These trends are all being driven by the changing ways that people live and work. As the world continues to adapt to the new normal, we can expect to see even more changes in the way that homes are designed and used.

Here are some additional details about each trend:

The Rise of the Home Office: The home office is no longer an extra feature when designing a home. Millions of people are getting used to working from home, and those who have a space available appreciate their ability to turn it into a home office. Those who don’t now wish they do.

The Importance of Maintenance: A lot of homeowners leave maintenance for some indeterminate future date. This is often not due to neglect but simply because money is tight. Non-urgent maintenance and repairs can wait. However, many homeowners have discovered that some of these issues are really glaring when they have nowhere else to look. Especially if they live in a small space, every inch needs to be usable. A lack of maintenance means a consequent lack of useful space.

Other Trends: In addition to the rise of the home office and the importance of maintenance, other trends that are likely to continue after the pandemic include: the demand for sustainable homes, the desire for more outdoor living space, the need for security and safety features, and the importance of comfort and convenience.

I hope this is helpful!

1 note

·

View note

Text

8 outdoor fall maintenance tips for homeowners.

#first time homeowners#new homeowner#new home#homeowner#homeowners#homeownership#fall#fall maintenance#outdoor#outdoors#home#house#property owners#property owner#property management#property manager#tips#advice

0 notes

Text

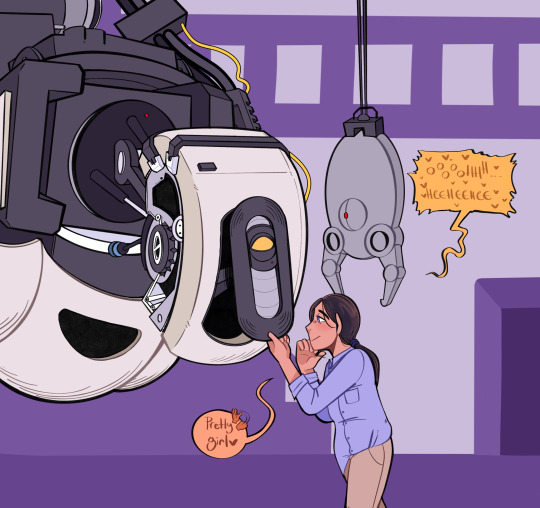

Pretty girllllllllll 😚

#2022#digital#portal#chelldos#glados#chell#sorry about the background#i was going to post this in a compilation with other pieces but i have nothing ready cuz commissions and other projects#also this is from my homeowner chell au i talk about sometimes on main#where glados hangs from the ceiling of chells new house. chandelier wife#its not serious like my other au its just sillay

669 notes

·

View notes

Text

... I thought the power went off, but it's only in certain rooms -- and certain outlets? Like, there's a tiny bit to barely power the fan (what I first noticed) and let me charge my phone, but only enough to give me a flashing red light on the air conditioner?

@earlyh0minid do you know what my problem might be?

I called my old landlady and she had me check the breaker (all switches in place) and said that it sounds like "the current has decreased" and that she'll come over and help me troubleshoot tomorrow. Luckily there's current in the living room, so I can sleep on the sofa bed with the fan (hopefully).

And to think that we JUST got the roof fixed... If it's not one thing, it's another...

#I'm literally going to go stay in a guesthouse if this is going to be an issue for more than a day -- the heat index is over 100 degrees#and it's not even daylight#ftr the old landlady isn't technically the homeowner any more but she lives a few houses down and knows the property#I've never even met or messaged the new guy

19 notes

·

View notes

Text

So I know this isn't anything that like actually needs an apology but it'll make me feel a bit better to say it. Oof whoops this ABoT chapter is super late. Timing kinda sucks since I wanted to have some updates out while s3 was airing but

Been kinda mega busy and stressed since October with the whole condo buying thing which rolled right into immediate day 0 plumbing and boiler issues I had to get fixed and general moving hassle and financial commitment stress and I kinda just fried myself hard. Plus then acclimating to a new place without my familiar street or familiar grocery store or familiar room or any of that. Like there's no "just go home and take your mind off it" to this cuz home is the "it". So I'm just kinda enduring until I can calm the hell down.

And anyway I definitely have progress on ch47, like 7000-ish words of it, but it's the kind of like "there is writing there" and hasn't exactly hit the "there is substance there" that I want ABoT chapters to be. Like this in particular is a chapter I want to be good, not just be done. So it's taking time to get my brain somewhere that can do that.

#anyway#i mean just in case anyone was like wondering if its discontinued to anything#its still going i just can't make it Good quite yet#(plus i need to get furniture cuz as it stands the place is really quite empty and bare except for like my room and the kitchen)#(also the bank had my address wrong so they havent been able to send me any of the mortgage information which was technically due already)#(ive been in contact with them but it's a whole thing)#(plus im still not quite finished with all the utility switching. i still need to get water in my name)#(and the boiler issue fucked up my gas bill so now ive got a crazy high gas bill i just need to... pay)#(i have actually started seeing a therapist but thats a whole other Thing now figuring out insurance and deductables and using my HSA#account and just... it's a lot)#(oh also my homeowner's insurance policy number doesn't actually work for getting me into the online portal. and the geico guy said he was#looking into it but I havent heard anything in a while)#(its a lot im just gonna melt for a while i guess)#(plus all the upfront stress has made it really hard to associate the new place as 'home' instead of 'place of great many plumbing evils')#(i sat on like 4 million couches this week and the only one i really really like probably doesn't quite fit in my living room)#(the downstairs neighbors tv is too loud and i need to talk to her about it in a way which isn't 'hey im holding on by a thread and this#one small inconvenience is the thing which is making me turn into ash')#(oh thats right i have to go pay my january HOA dues...)#(oh also I need to file for the owner-occupied tax exemption thing now that its 2023)#anyway......... ill be normal eventually. im just not normal right now.#chrissy speaks

106 notes

·

View notes

Text

I was going to go back to work tomorrow but my God, what a fool's notion that was.

I give myself two hours to fix the hole in the drywall and then I am going to write and eat Christmas cookies. This is my solemn oath.

#quark's christmas tag#two hours!#that includes the trip to home depot#target items: joint compound & a drywall saw and a 5x5inch patch#which is more than twice what i need#dang previous homeowners leaving me all their problems#oh and a new drywall anchor#just one though#the other one is reusable#going back to work on wednesday instead#quark rambles

50 notes

·

View notes

Text

When Hurricane Ian pummeled Florida last week, it left a stunning trail of physical devastation in its wake. Entire neighborhoods vanished beneath water, cities were shredded by 150-mile-per-hour winds, and thousands of people lost their homes overnight.

Though the storm has since dissipated, it will bring even more turmoil to the Sunshine State in the coming months — but this damage will be financial rather than physical. Ratings agencies and real estate companies have estimated the storm’s damages at anywhere between $30 and $60 billion, which would make it one of the largest insured loss events in U.S. history.

Wind damage is covered by standard homeowner’s insurance, and the payouts necessitated by Hurricane Ian’s extensive wreckage are likely to accelerate the collapse of the state’s homeowner’s insurance industry, driving private companies into bankruptcy and forcing thousands more Floridians into a state-run program with questionable long-term prospects. The process offers an early view of the way that natural disasters fueled by climate change threaten to upend regional economies.

Home insurance costs are poised to skyrocket for all Floridians — not just those who live in the places most vulnerable to major storms. The state will be forced to impose new taxes and penalties as it tries to keep the market afloat. New burdens will fall largely on low- and middle-income homeowners. For many working class Floridians, homeownership may become impossible to afford as a result.

“We already have a housing affordability crisis, and now we’re adding this new pressure,” said Zac Taylor, a professor at the Delft University of Technology who has studied climate risk in Florida and grew up in the city of Tampa. “Insurance is potentially the thing that is destabilizing homeownership — ironically, because it’s the thing that’s supposed to protect [homeownership] and make it possible.”

While homeowner’s insurance nationwide averages around $1500 a year, Floridians already pay almost three times as much. The state’s insurance market has been struggling ever since Hurricane Andrew made landfall south of Miami in 1992 and damaged more than 150,000 buildings. After Andrew, large private insurers like Travelers and Allstate froze their business in the state rather than risk having to pay for future disasters. This led to the creation of a public option called Citizens, which functions as an “insurer of last resort” for people who can’t find private coverage. The state also subsidized small “specialty” insurers who would only offer homeowner’s coverage in Florida, shifting market share away from national companies.

But this local market has begun to teeter in recent years, even in the absence of any major hurricanes. One reason is that Florida has become a hotbed for sham roof-repair lawsuits. Shady contractors approach a homeowner and offer her a free new roof, then file a claim with her insurer on her behalf, even if her roof didn’t actually suffer any insurable damage. Then, the contractors litigate the claim until the insurer settles. This has gotten quite expensive for insurers in the state: Florida accounted for 8% of all homeowner’s insurance claims in the United States in 2019, but more than 75% of all insurance lawsuits.

At the same time, it has become much more expensive for insurance companies to purchase their own insurance. The companies buy this so-called “reinsurance” to guarantee that they have enough money to make large payouts after big disasters, but the large global companies that sell reinsurance have gotten cagey about offering it in Florida, considering that the state has built millions of additional homes in areas vulnerable to natural disasters even as climate change increases their risk. The reinsurance companies have raised prices to account for this, and many local insurers have struggled to keep up with the costs.

The high costs of litigation and reinsurance had already driven six local insurers bankrupt so far this year, even before Hurricane Ian. In the summer, a ratings firm called Demotech threatened to downgrade several other specialty insurers, saying they weren’t stable enough to deal with a big storm. That downgrade would have made them worthless in the eyes of major lenders and effectively removed them from the market. It caused a flurry of concern from state lawmakers, one of whom said the market was about to “collapse.”

Hurricane Ian is likely to hasten that collapse by driving at least a few more homeowner’s insurance companies into bankruptcy. If Ian’s damages are close to the estimated $30 to $50 billion, it would be especially catastrophic for Florida’s already-struggling specialty insurers. The companies that do survive will have to pay even more for reinsurance, which will force them to further raise prices.

“I would predict the price of insurance will go up in Florida, or, certainly insurers will be looking for price increases,” Alice Hill, a climate change and insurance expert at the Council on Foreign Relations, told Grist. “It’s proving to be risky, particularly with climate change, looking at these storms intensifying more quickly.… Homeowner’s insurance is written on a year-by-year basis, so if a big event comes through, there’s a change next year.”

New bankruptcies and price hikes on the private market would drive thousands more Floridians to Citizens, the public insurance provider that the state established after Hurricane Andrew. The number of Floridians enrolled in Citizens has already surged over the past decade as other private insurers have collapsed, and this year the program surpassed 1 million policyholders for the first time, having doubled in size over two years. It controls around 15% of the insurance market — and more than twice that in especially vulnerable places like Miami.

“You’re going to see a big increase in the number of policies going to Citizens, and you could see a significant portion of the private market just go away,” said Charles Nyce, a professor of risk management at Florida State University and an expert on the state’s insurance market. “And the more of the market Citizens takes, the more at risk the state is.”

That’s because the state is on the hook to help Citizens pay out claims after big storms. Citizens has about $13 billion right now, and early estimates suggest that claims from Ian will only cost the program around $4 billion, so it’s not in any immediate financial jeopardy. But the program will balloon in size over the coming years as it absorbs all the people who lose coverage on the private market after Ian, and its expanding roster will leave it more vulnerable to the next big storm. If another Ian comes around, Citizens might find itself short on cash.

This would force Citizens to make what is called an assessment, or a “hurricane tax” in local lingo. When the program faces financial difficulties, it can impose a surcharge on every person in Florida who buys any kind of property insurance, from home insurance to auto insurance to business insurance. This surcharge acts as a kind of tax subsidy for people in vulnerable areas: Everyone in Florida ponies up to ensure the state can help storm victims rebuild.

“That’s the biggest concern I have,” said Nyce. “Say you’re a single mom working in Orlando living in an apartment, but yet you have to own a car. Now you’re paying an assessment on your auto insurance to subsidize someone who lives on the beach.”

Since Hurricane Ian is unlikely to stem the tide of new arrivals to Florida — and since the only insurance option for these new arrivals will be Citizens — Nyce said that these assessments could become much more common as the years go on. In the past they have never exceeded around 1.5% of annual insurance bills, but future storms could drive that number higher.

Citizens can also issue bonds to fund payouts, said Nyce. But because it would issue those bonds against the state’s credit rating, doing so could dampen the state’s own ability to borrow money, again leading to higher costs down the road. And the more tax revenue the state spends propping up Citizens, the less it has to fund other essential services like education and transportation.

The upshot is that Hurricane Ian could make life in Florida a lot more expensive for everyone in the state who owns a home or a car. Decades of rapid development and a new era of supercharged storms have created a risk burden that is impossible for the private insurance market to bear. Now, in the aftermath of Ian, the state’s 21 million residents will assume more and more of that risk, and their wallets will see its earliest effects.

For an example of how these costs might impact vulnerable Floridians, Taylor pointed to the community of Miami Gardens, a majority-Black community in the Miami metroplex that is one of the last places in the region where homes are affordable.

“How is this community supposed to reduce its risk?” they said. “How are homeowners going to deal with this? We’re talking potentially the equivalent of multiple monthly mortgage payments … and this is not poised to go [back] down. Fewer and fewer people are going to be able to afford their houses.”

#us politics#news#grist#2022#florida#homeowners insurance#Hurricane Ian#Florida insurance market#insurance market#travelers insurance#allstate insurance#Citizens insurance#insurance claims#insurance lawsuits#hurricane tax#Florida credit rating

8 notes

·

View notes

Text

?????

#dublin fire brigade issue urgent warning to irish homeowners over common household item that can cause devastating blaze#funeral details of tragic rally driver killed in horror clare crash announced as community left devastated#debs crash victim avin’s family reveal ‘great news’ but say she still doesn’t know about devastating loss of sister#devastated uncle of girl who died after ‘tiktok challenge’ says she will ‘always be with us’ in funeral tribute#<- where are these tags COMING from. I just typed in 'devastating'#cor.txt

4 notes

·

View notes

Text

oh the suburbanity !

#acnh#animal crossing#new horizons#to those who r interested: I call this neighborhood Ivory Hisls becase well#the houses r all ivory colored and there also is hills#its the closest thing totino will get to a gated community witha. homeowners association#totino is a rly weird place so I like to imagine all the people in ivory hills r just like :) this is fine#and like pretend the ufo hovering above their houses just isnt there#I have 2 years worth of lore for this island dorry#pls ask me about it

32 notes

·

View notes

Text

just saw another post about pretty old homes and felt the need to share my somewhat newly developed anger towards this trend lmao. until I bought my own house I totally loved the idea of all original older homes too. they're so pretty, all the wood is gorgeous, all the colorful tile!

but I can tell you for certain it's a damn nightmare. if you're looking for a home soon and don't really know this stuff I seriously advice against buying an old home just because it's pretty. as far budget issues go, that's another story. but you still deserve to be picky.

most houses from the 50s and even into 90s will most likely have asbestos. there will probably be lead paint. if you get a slab like mine, plumbing will be in the foundation. (thankfully mine was updated) also the original electrical will be fusebox if you're lucky, or knob and tube if you're not. neither are likely to be insured whatsoever. don't even get me started on the safety of old electrical work throughout the house itself.

intricate wood siding and designs are gorgeous but the upkeep is unbelievable. also leaves more opportunities for rot. all of these really cute things are so expensive to maintain.

I got really lucky in that I had help with updating my home so that it could be safe. but not everyone has that. obviously I love to appreciate pretty old buildings, I just hope people keep this in mind when they start to look for a house of their own.

#this is a long rant whew..... i just kinda wanted to get this out after the last post i saw lmao#im most definitely not an expert im just a new homeowner#but ive done most of the work on it myself and it is NOT easy or cheap#cheekychats

29 notes

·

View notes

Video

6 Tips for New Homeowners - Steps Every New Homeowner Should Take

Discover tips for homeowners to help you settle into your new home with smart steps to prepare property owners when moving into a new house and the important things to consider and how to get ready for home maintenance by learning basic DIY skills.

https://www.soovy.club/blog/tips-for-new-homeowners-steps-every-new-property-owner-should-take-moving-house

#Tips for new homeowners#New homeowners checklist#Steps for new homeowners#Prepare for home maintenance#Basic DIY skills for homeowners#Settle into your new home#Things to consider for new homeowners#Moving into a new house#Homeowner's guide#Property ownership tips#newhomeowners#lifestyle

6 notes

·

View notes

Text

homophobic how science has yet to invent a haircut for me that lets me wear it long+pretty+femme in a fag way sometimes but Also short+easy+masc in a dyke way other times

#im nonbinary + have long-ass hair atm but no one GETS IT. wheres ur vision!! why do u assume it makes me a sTrAiGhT wOmAn!! fuck off!!#if u say ''just cut it and wear wigs'' im gonna shave your eyelashes. i Do Not Have a wig budget NOR do i have wig skills#PLUS. i FINALLy got some nice-ish headshots (free!) so if i shave it all off id need NEW fucking headshots & i don wanna pay for that shit!#also... short hair on me....... attempting the bisexy bob made me look like a goddamn soccer mom. and dont even get me started on what was#SUPPOSED to be a pixie cut.😔😔 ohh poor 15yo me. wanted to be more masc but wound up looking like karen from the homeowners association#and i feel like no one understands that when i toss my hair into a mess with a hairtie attached im doing it in a MAN-BUN WAY.#NOT in a long-brown-hair-blue-orbs-mom-sold-me-to-1d way😤😤#i want to be able to interchange it!! same as how i wanna be able to pop my tiddies on+off when im feelin dysphoric vs feelin good abt em#also same as how i want to long-ass painted nails in a fag way but short-ass nails in a dyke way😔😤#the world is cruel and homophobic and mean for not letting me have this all all at once#its RUDE.#bee speaks

13 notes

·

View notes

Text

.

#thinking of changing my blog title for the first time since november 2020#four seasons total landscaping is so part of who i am as a human#but “smitten i believe” has taken over my life#what do i do#in other news i shared the other day that i was about to buy a house#just an update she is officially a homeowner:)

6 notes

·

View notes