#moneymatters

Text

Truth

1K notes

·

View notes

Text

29 notes

·

View notes

Text

Paid to get married

If I was offered over a million or more to marry someone for one year then divorce so she could get something like a green card I would do it like that movie You may not kiss the bride. I would take the offer.

8 notes

·

View notes

Text

"Remember that credit is money"

- Benjamin Franklin

6 notes

·

View notes

Text

For Vietnamese and Chinese versions, please check out:

https://ngocnga.net/positive-thinking/?utm_source=tumblr&utm_medium=social&utm_campaign=quote

💰💸🤞

If life is going to hit a wall, I hope it's a wall of money.

//

Rúguǒ rénshēng yào pèngbì, wǒ xīwàng shì rénmínbì.

#MoneyMatters#FinancialGoals#PositiveThinking#1quotein3languages#chineselanguage#learnchinese#learnmandarin#studychinese#chinesewords#putonghua#weibo#chinese#mandarin#pinyin#quotes#quote

2 notes

·

View notes

Text

Learn How To Build 8 Income Streams at https://www.8incomeStreams.co

Tag friends who need to see this!

#investmentplan#retirementplans#investmoney#retireyoung#investinginyourself#financialplan#financialgrowth#earlyretirement#moneymatters#retirementplanning#retirementplan#retireearly#moneymanagement#financialadvisor

4 notes

·

View notes

Text

#ChimeToCashApp#MoneyTransfer#FinanceTips#DigitalBanking#FintechGuide#EasyTransactions#ChimeBank#CashApp#FinancialFreedom#MoneyMatters#ConvenientBanking

3 notes

·

View notes

Text

Hello Tumblr!

With our first post on the platform, we would like to introduce ourselves and what we do!

We are Reward Services, a content-driven organization focused on delivering consumers tips, tricks, and ideas on utilizing internet technology to aid in everyday tasks involving online shopping, in-person shopping, searching for deals, and general fiscal management.

Looking forward, we are excited to start our tenure here on Tumblr with our first very simple tip: Lists.

It’s an extremely simple and often overlooked concept that many still discount even though countless other blogs go over the topic at large. That’s not going to stop our overview of the subject, however.

Lists can come in many different shapes and sizes and can be managed in many different ways. From simply scrawling what you need on the back of an old receipt, to keeping a written booklet, to even utilizing an app such as Google Keep to keep track of your lists; it’s hard to go wrong in organizing the purchases you need to make.

Websites and apps like Amazon or Walmart.com have shopping carts that can act as temporary lists until you checkout, or alternatively have their own built-in list managers. All in all, there is very little that a list can’t do to help your memory in the moment, and can do a lot to reduce stress on long shopping trips whether virtually or not. There are so many options regarding keeping track of the items you want to purchase that you could almost make a list of them!

#reward#services#shopping#onlineshopping#lists#amazon#walmart#modern#lifestyle#modernlife#googlekeep#organization#organizing#moneymatters#timesaver#time is money#timeismoney

9 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials"

------------------------------------------------------------------------

DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

How 'Rich Dad Poor Dad' Can Help You Transform Your Finances

Transform your financial future with Bookish Buzz's Rich Dad Poor Dad Challenge! Join us and learn how to make your money work for you with day 5 of the audiobook by Robert Kiyosaki. Check out our 7 helpful lessons from the book to apply to your own life. Don't miss out on this opportunity to gain financial freedom! #RichDadPoorDad

"Rich Dad Poor Dad" is an invaluable resource for anyone looking to take control of their finances and transform their financial future. Through its lessons on money, assets, and liabilities, financial literacy, and business ownership, readers can gain a better understanding of how to build wealth and achieve financial success. By taking action towards their financial goals and adopting a mindset of abundance, readers can begin to create a life of financial freedom and abundance.

youtube

2 notes

·

View notes

Text

Ferruccio Lamborghini (1916–1993), an Italian manufacturing magnate, founded Automobili Ferruccio Lamborghini S.p.A. in 1963 to compete with Ferrari. The company was noted for using a rear mid-engine, rear-wheel drive layout. Lamborghini grew rapidly during its first decade, but sales plunged in the wake of the 1973 worldwide financial downturn and the oil crisis. The firm's ownership changed three times after 1973, including a bankruptcy in 1978. American Chrysler Corporation took control of Lamborghini in 1987 and sold it to Malaysian investment group Mycom Setdco and Indonesian group V'Power Corporation in 1994. In 1998, Mycom Setdco and V'Power sold Lamborghini to the Volkswagen Group where it was placed under the control of the group's Audi division.

#thesk8doctor#damon t garrett#moneymatters#dtg enterprise#investing#healthylifestyle#you matter#strictlyboss

8 notes

·

View notes

Video

youtube

(via GFS Financial Advisors, LLC - SSPTV)

#gfs#galade#stockmarket#bonds#annuitty#crash#great reset#cookie run investigations#gfsfinancialadvusors#dongalade#moneymatters#gfs-adviosrs

4 notes

·

View notes

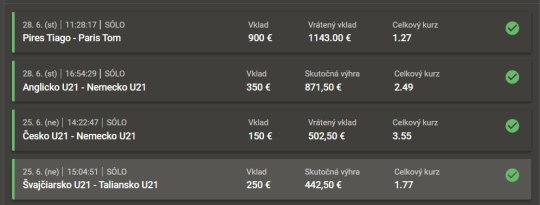

Photo

Here are BabySUPER’s weekly investments made from 65% of one of my 2/7 profit income. Let me break down how I do it. I’ll invest (a stunning) $62.50 in a solid (new) company My stop loss is $51.5625 (ask in the comments if you need me to elaborate, also check my YouTube, I made a Live about this.) Each week I’ll invest that months amount per week. I invest a stunning $12 (December = 10th+2 month) per week, per stock Lastly, if a stock is between 51.5625 and 62.50, I have to pay the difference up to 62.50 along with the 9 #SUPERKevsStocksoftheWeek goes as followed... $120 for recurring investments $0 for new investment $120 total What is your investment goal? What is your risk-reward-ratio (RRR)? Let’s discuss (if you feel like sharing) it in the comments below 👇🏽. . . ~~~ Double tap if you agree ➗📈 Tag 👥| Share 📲 | Comment ✍🏽 Turn on post notifications 🔊 #SUPERKevTheMATHMAticIaNvestor #CHILDSUPPORTKev ~~~ . . #debtfreejourney #FinancialEducation #FinancialExcellence #FinancialFreedom #FinancialIndependence #invest #investing #investment #Prosperity #cashflow #retirewealthy #assets #moneymatters #MoneyGoals #WealthyGoals #WealthGoals #MoneyMindset #WealthMindset #wealthmatters #growthmindset #Stockmarket #takerisks #CashAppStocks #FractionalShares (at Massachusetts) https://www.instagram.com/p/CmN1hcVOjPq/?igshid=NGJjMDIxMWI=

#superkevsstocksoftheweek#superkevthemathmaticianvestor#childsupportkev#debtfreejourney#financialeducation#financialexcellence#financialfreedom#financialindependence#invest#investing#investment#prosperity#cashflow#retirewealthy#assets#moneymatters#moneygoals#wealthygoals#wealthgoals#moneymindset#wealthmindset#wealthmatters#growthmindset#stockmarket#takerisks#cashappstocks#fractionalshares

3 notes

·

View notes

Text

"You must spend money to make money"

- Plautus

4 notes

·

View notes

Text

If it's not money matter or if I'm not a bread winner, maybe I'm living my dream job right now. Less salary but definitely worth it since I'm doing it with love, unlike now that I'm crushing myself for the job what I want for the sake of money to support our monthly bills.

5 notes

·

View notes