#january2021

Link

#hemmings#classiccars#magazine#january2021#mustangshowpony#mustangpony gmcpickups fiat1962 collectorcars carmagazines

0 notes

Text

1.1.21

0 notes

Photo

Instagram Story | 5th January 2021 Pullover by 7 Days Active

#emilisindlev#madsmoller#malkitsingh#instagram#instagramstory#2021#january2021#sevendaysactive#sevendaysactivepullover#pullover

0 notes

Text

#sunblindphotos#sunblindnc#beaufort#north carolina#january2021#canonrebel#naturephotography#landscapephotography

0 notes

Text

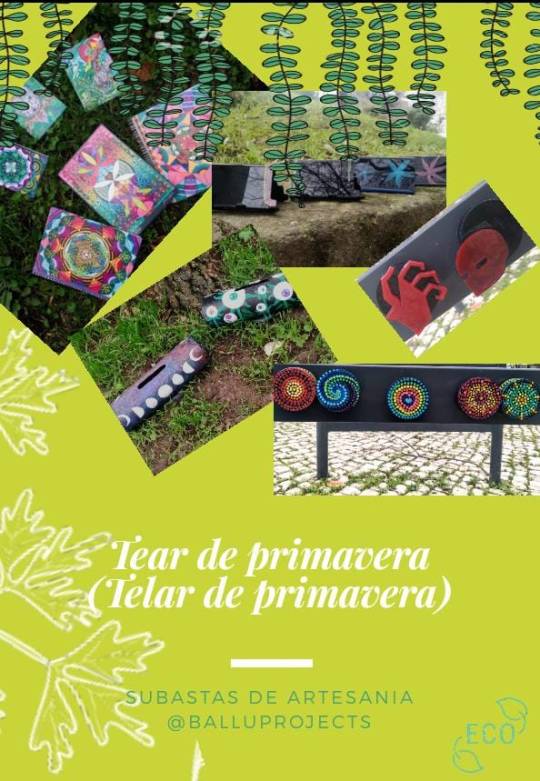

First Take: Mandala Magnets, 2020

To be short and sweet, recycled black acrylic glass, hand painted, to stick on your fridge ^^

Approach to the concept of handmade unique souvenirs, as well as useful art. Sold online on the initiative Tear de Primavera (= Spring Loom) during the Covid19 pandemic to raise money to do new projects, live via Zoom in January2021.

For this passion project, I've reunited on this calls knowledgeable and progressive people in Portugal, by connecting key points such as:

the origins of folk, dancing and it's importance in social development (Rafaela and Lucas from IdeiaGlocal) sustainability and alternatives to burning waste in agriculture; city life health and waste behaviours (Maria Ana Moira); last, creative people in enclosure vs an artist while on studio doing an live painting and full conversation on the process of recycling ideas and moving forward creativity during this period (Ana Quintino and Ana Penha).

At the end of each subject, a different recycled project was presented.

a special thanks to Ynés for making me little flyers publicising my work <3

more takes on this project further on, zombie ones going to be a part of an riffled art give away...coming soon :D

have a good one, everyone*

>>music>> Gala Drop - Ital >

#originalartwork#portugal#naturelovers#magnets#handmade#arts and crafts#handcrafted#artoninstagram#teardeprimavera#springloom#stick it in the fridge#zombies#markets#weavers#elements#upcycling#sustainability#reduce reuse recycle#plastics#composition#going back in time#olderproject#covid19#life lessons#original video#balluprojects#original project

8 notes

·

View notes

Note

are you alive? just checking up on you.

I am definitely alive, I just don’t write a lot for this fandom anymore. I write for the k-pop fandom now.

To summarize why I stopped writing here though is, back in early 2020 (right around the time that the world went to hell), I was still writing for BSD, and then around Christmastime the like count and reblog count went down drastically. While I don’t write for likes or reblogs, they do really push me to continue writing for a page, hence why I went to the Obey Me! Fandom by the end of December2020/January2021.

That blog was doing amazing up until the actual game just wasn’t playable anymore. It was impossible to play as a non-paying player, and I just couldn’t write about it because I didn’t know what the hell was going on anymore with all the character and with stuff like that I try to keep character personalities as canon as possible. That’s not really important though so… that continued until about September/October 2021.

By October I wasn’t actually writing anymore, I just kinda… lost touch with that part of myself, I was venturing into other artistic outlets, and in the process came across K-Pop which I fell in love with.

Since around mid/late October up until now I have been solely writing K-Pop based fan fictions, and if anyone is interested in reading them, I can link my two blogs for that. One is strictly BTS related, and my other blog is for multiple groups.

So, in short, I still write, just not on this blog. :)

Thank you for checking in on me, it means a lot and I hope that you and everyone that still happens to stumble across this blog are safe, healthy, and doing alright.

Much Love,

The Dingus 💗

17 notes

·

View notes

Text

Buy low then offer high is among one of the most fundamental elements of financial investment guidance in the history of monetary markets. Bitcoin is now 10 months into its present bearishness cycle, and lots of financiers and business that didn't "offer high" are most likely regretting it. Miners differ from all other market individuals, nevertheless, due to the fact that they are in impact constantly purchasing (spending for electrical energy to make more bitcoin) and, depending upon their business technique, constantly offering, too (offering bitcoin to spend for capital spending and running expenses). So how are miners faring in the present bearish market? This short article has a look at some miners' monetary choices over the previous number of years-- throughout both the most recent bullish and bearish durations for bitcoin-- and examines where some enhancements might be made on how the typical mining business chooses to hold, offer or purchase its bitcoin. Cliff Notes On Bear Market Mining Here's a fast rundown of the existing state of mining economics-- things aren't fantastic. Hash rate is down 69% up until now in 2022, and with it goes maker success Old hardware like Antminer S9s, for instance, are so unprofitable now that the quantity of overall network hash rate they contribute has actually dropped from 30% to less than 5% this year, according to Coin Metrics Difficulty continues striking brand-new record levels as more miners include more hash rate, and the current down change was the very first reduction in months. Some miners are likewise resting on remarkably big quantities of financial obligation, according to information put together by Jaran Mellerud, a mining expert at Arcane Research. Some miners are even offering the purchase agreements for yet-undelivered hardware while other miners, like CleanSpark, are purchasing them at a discount rate. And the previous 2 months have actually seen 2 business apply for insolvency: Celsius Mining and Compute North Managing A Bitcoin Mining Treasury One of the most essential factors to consider dealing with every miner is whether to hold or offer their bitcoin. Other functional concerns continue this naturally prior to the miner begins making coins for their work. What to do with block benefits is the focal point of any mining technique. Some miners hoard as lots of as they can while awaiting the cost to increase. These miners typically secure loans to fund their functional costs. Or they end up being loan providers themselves and make yield on the coins they mine. Other miners offer every coin they make and wish to just run successfully with no direct exposure to bitcoin's benefit or drawback. Many miners are someplace in between these 2 extremes-- holding what they can pay for to and offering what they require to. All of these choices are made based upon a miner's treasury management technique, and each group has a various method. Thankfully for readers, public mining business relay these choices to financiers and the public. In the booming market, miners weren't just developing brand-new centers, hoarding bitcoin and revealing record purchases of hardware. A few of them even headed out and purchased bitcoin at market value to contribute to their treasuries. Marathon purchased 4,812 BTC in January2021 Argo Blockchain likewise purchased172.5 BTC in the very same month. To state miners were bullish would be an understatement. Bitcoin is now trading approximately 30% lower than its most affordable rate point in January2021 These miners didn't rather "purchase the top," however it was reasonably close. In the bearish market, miners are offering a great deal of their bitcoin-- in many cases even more than they're mining, signifying their severe response to the bearish conditions by even liquidating their reserves. It's essential to keep in mind that the overall amount of bitcoin these business are offering is well into the thousands, however it's a really percentage compared to the everyday trading volume of a lot of liquid bitcoin markets.

From Riot to Cathedra, big and little bitcoin mining business alike were selling big quantities of their bitcoin holdings. Bulls Of Last Resort Instead of offering bitcoin at $20,000, would not a miner choose to offer it at $69,000-- the all-time high? In theory, this makes best sense. In practice, carrying out that choice is more challenging. For something, miners are not the most advanced market individuals. For another, treasury management techniques are still really easy (hold, offer or provide) and frequently insufficient. Lots of miners have methods to hedge versus bitcoin's rate, however nearly none of them can hedge versus bitcoin's hash cost, which would be a much more important monetary item. It's likewise crucial to keep in mind that miners are expected to be uber bullish even when others aren't. Miners remain in lots of methods Bitcoin's bulls of last hope. House miners particularly show this by continuing to mine in spite of terrible market conditions. Despite the fact that miners would have a more powerful balance sheet by offering more bitcoin at a greater cost than they did months earlier, for much better or even worse their function is rather to ride the cost anywhere it goes. What Does The Next Mining Cycle Hold? In years to come, bitcoin mining business will definitely be much better about treasury management. Numerous business will discover their lessons from the previous 2 years and concentrate on much better revenue maximization techniques. A few of this may consist of hoarding less coins. Gold miners are not understood for hoarding generous quantities of the valuable metal on their balance sheets. It's tough to envision bitcoin mining business acting in a different way in the future. Bitcoin miners have a practically legendary status in the market. Bullish miners who hoard their coins are an emotionally comforting thing for lots of market individuals. Even little reports of "miners are bearish" or "miners are offering" send out waves of worry throughout social networks. Even if miners do offer coins at a greater rate, nevertheless, everybody would choose to have well-capitalized miners at the bottom of the bearishness than undersea, over-leveraged business having a hard time to survive. This is a visitor post by Zack Voell. Viewpoints revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Read More

0 notes

Photo

@NME: A very revealing interview with @mcflymusic

823 notes

·

View notes

Text

“Era stata

per lei ECCITANTE

e irresistibilmente invitante...

... l’idea di divenir la Sua LUPA.”

Il Silente Loquace ©

— @ilsilenteloquaceblog

#lui#uomo#lei#donna#fascino#coda#lupa#irresistibile#pensieri miei#january2021#@ilsilenteloquaceblog#ISL

308 notes

·

View notes

Photo

Hair swap time!

adfasf I don’t really know what I’m doing here, so prepare for completely random art with little context. xD

-NO ROMANCE INCLUDED-

___________________________

Square Enix is the owner of Final Fantasy XV

Please do not REPOST, EDIT, or USE this art without Permission.

___________________________

#ffxv#final fantasy xv#final fantasy#ignis scientia#noctis lucis caelum#prompto argentum#gladiolus amicitia#fanart#isa's fanart#my fanart#January2021#insertsomthinawesome

235 notes

·

View notes

Photo

#ropka #tartu #tartumaa #estonia #january2021 (at Ropka industrial district) https://www.instagram.com/p/CZZRxNbothY/?utm_medium=tumblr

18 notes

·

View notes

Text

1.1.21

0 notes

Photo

Instagram Story | 2nd January 2021 Sweatshirt by Rotate

#emilisindlev#instagram#instagramstory#2021#january2021#rotatebirgerchristensen#rotatebirgerchristensensweatshirt#sweatshirt

1 note

·

View note

Text

#sunblindphotos#sunblindnc#beaufort#north carolina#january2021#canonrebel#naturephotography#landscapephotography

0 notes

Text

Greetings. Here I share January 2021 SesKag Calendar Wallpaper. Enjoy!

209 notes

·

View notes

Text

Mcfly- You’re Not Special

#mcfly#dougie poynter#harry judd#tom fletcher#danny jones#young dumb thrills#you’re not special#january2021

113 notes

·

View notes