#gold investment

Text

#birch gold group#Birch Gold Group review#401k to gold ira rollover#401k accounts#401k crypto#401k#investors#financial#retirement planning#retirement#gold investment#gold stock#silver stacking#gold coins#silver coins

8 notes

·

View notes

Photo

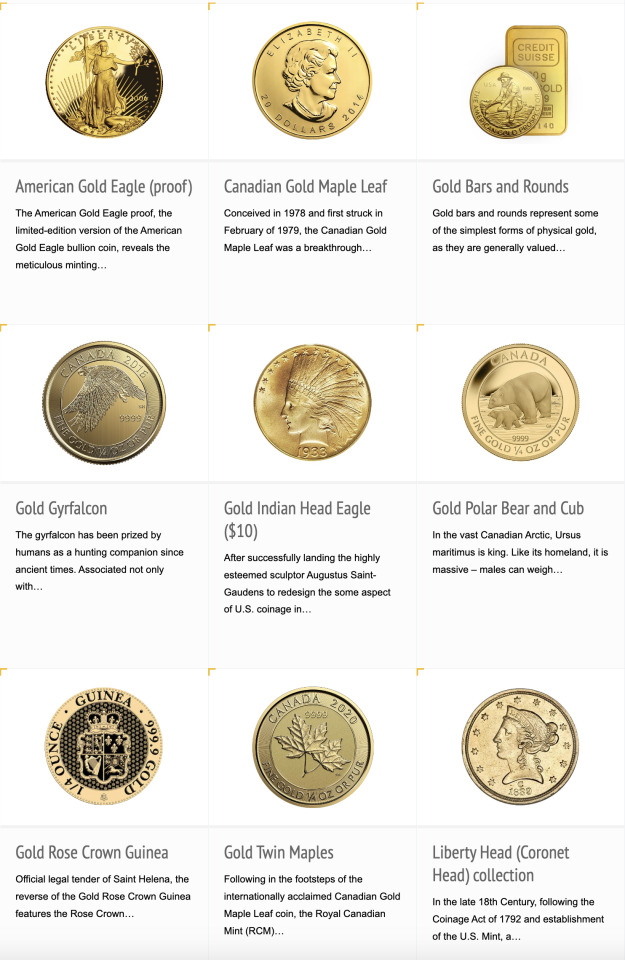

Getting the best bullion deals depends on you. It has a lot to do with how much information you are willing to get. While there is no perfect deal, you sure can make it worth it by playing your cards right.

#Gold Bar#gold bullion#gold price#gold investment#buy gold online#gold investing options#silver coins#metal investment#trb bulion

3 notes

·

View notes

Text

How to Invest in Gold in Today's Market - Tumblr

Here's How To Invest In Gold

Are you currently wondering how to purchase gold? A lot of people want to invest, nonetheless they don't realize how to begin. The simple truth is there are many techniques for getting started with investing in gold. Here are some of the more common ways to purchase gold, as well as the positives and negatives for each and tips.

1. Physical Gold

Undoubtedly, buying physical gold is one of the most frequent ways people spend money on gold With regards to how to invest in gold, there are many things to understand about buying physical gold. Here's a few:

How To Accomplish It

Buying psychical gold is actually simple as it is the best way it sounds. You acquire gold items, like jewelry, coins, collectibles and just about other things. The purpose of most investors is usually to hold onto their psychical gold after which sell it into a gold dealer or other kind of buyer.

People have a number of options in relation to where they may buy physical gold. They are able to purchase them at the store or online. Whenever they find the gold, they will have to store it whilst keeping it until they are ready to market it for a higher price. When gold prices increase, then investors can consider selling their pieces.

The Benefits

First pro is that physical gold can be a tangible asset, and history indicates that gold tends to increase in value as time goes by. Very few investments are tangible and also have a high probability of going up in price, even though the economy isn't doing too well. If you want a great investment you can easily hold, see whilst keeping within your possession, then look no further than investing in physical gold.

Second pro is physical gold can not be hacked or erased. Nowadays, folks have countless assets that they can invest in and are generally held online. A gold piece with your hand doesn't need the internet or any electricity to operate or anything like this. It really is a foolproof investment in relation to protecting it from hackers.

Your third advantage of buying physical gold is that you simply don't have to be a professional. Perform quick research on the price tag on gold then research gold dealers. Then you can find the gold items you wish to keep and then sell them off when you're ready. It's as easy as that.

The Cons

First, buying psychical gold can be expensive. According to in which you purchase it from, you might want to pay commission fees. Even when you buy it coming from a private seller, you can bet how the gold will likely be expensive. If spending large amounts of cash upfront isn't for you, then you might like to think twice about buying gold, but generally gold is generally definitely worth the investment.

Second con is storing the gold. It doesn't matter what kind of gold pieces you get, if you purchased it directly, then you're in charge of storing it. You should be careful with how its stored, otherwise you may well be putting your gold in danger of getting stolen, damaged and even lost.

The past major con that the physical gold, when when stored by yourself, won't gain interest. You must secure the gold up until you decide it's a chance to sell it off. If you're looking to gain a little bit of interest in your gold items, then buying physical gold and storing it all by yourself is probably not the best option.

Tips

Buying physical gold is quite easy. It's also straightforward. Just be sure you need to do just as much research as is possible into gold dealers before deciding what type to do business with, and make sure you research current gold prices because you need to try to find good price on gold pieces. This can all could be seen as commonsense advice, but trust us once we say it comes in handy when the time concerns purchase gold.

2. Gold Futures

Gold futures are contracts which were standardized and they are generally traded on specific exchanges. Gold futures allow investors to get a unique number of gold (for example 100 Troy ounces) at a price that has already been predetermine. However, the delivery transpires in a future date.

How To Buy Gold Futures

The first thing you need to do is open a brokerage account. You will find brokers that specifically cope with futures trading, so take some time when picking one. Next, you can trade gold futures and just how it functions is you'll must deposit the absolute minimum money so that you can open a situation. When the price goes into the proper direction, then you'll stand to generate a profit, but you'll generate losses when it goes in an unacceptable direction.

The Benefits

First, you simply will not have to store anything. As previously mentioned, you have to find storage space when you purchase physical gold. With gold futures, this isn't a challenge.

Secondly, lower amounts come to mind with golds future. During the time of making a deal, you'll only be asked to pay a certain amount of cash. The others pays as soon as the agreement is signed.

Another great thing is there exists a good amount of liquidity. In addition to that, however, you can day trade gold futures. This means there's a prospective to produce and withdrawal profits regularly.

The Cons

There's only some cons. One includes that there is a major risk to trading anything, and gold is no different. Default risk can leave the most experienced traders inside the trenches.

Also, gold prices can greatly fluctuate daily. It is simple to gain money, but you can easily as easily lose it. Remember, the price of gold can be appealing at the time of signing the agreement, but they can drop as soon as delivery is made.

One third con is the volatile from the marketplace. One day the markets may be good and then the next it could crash. In no time, there may be a phase as soon as the markets don't move much whatsoever.

Tips

Regarding tips, it's all about opening a merchant account with a great broker. You can find dozens and many brokerage accounts, so compare as many as possible. Find one that will provide you with good advice on gold futures trading then one that doesn't charge a number of fees. The greater number of brokers you compare, the more effective.

Also, research gold prices for a couple of weeks before making an investment in gold via futures. If the prices appears to be stable, then go ahead. If there's an excessive amount of volatile from the markets for these couple of weeks, then consider waiting until everything grows more steady.

3. Gold ETFs

Gold ETFs are a fantastic replacement for gold futures. You won't own contracts, but rather you'll be buying shares of any ETF. In turn, you'll be open to gold, hence why they may be called gold ETFs.

How To Do It

You may get a brokerage account via a broker that permits you to trade gold ETFs. Then you'll be able to select the gold product you want to purchase. It's as elementary as that.

The Pros

One of the best reasons for gold ETFs could it be acts like a hedge against inflation. Normally, this is the truth with a lot of gold-based investments. Should you own gold ETFs, then they are utilized to safeguard your assets up against the inflation and fluctuation of currencies. Gold is definitely a safe investment and if you buy the proper ETFs, then you'll do your major favor.

Second, it is extremely an easy task to trade gold ETFs. You will be only required to invest in a single unit of gold, that is with regards to a gram of gold in weight. Furthermore, it is possible to trade ETFs via your ETF fund manager or even your stockbroker.

Third benefit is that you can take a look at stock exchanges and learn just how much gold is selling for. This can be done at any given time. If you believe prices are great, then go ahead and buy something, otherwise you can hold off until prices be a little more appealing.

Another benefit may be the tax side of things. The sole taxes you spend is either short or long term capital gains tax. Long term is gold that is held for any year or longer, while short-term is under a year.

The Cons

One con is the fact ETFs can be expensive. Actually, they could be more pricey than other styles of investing, but they are often more lucrative. It's your decision to make a decision whether or not purchasing gold ETFs makes it worth while. That is actually the only major con related to buying gold ETFs.

Tips

If you can, consider investing large sums of capital or enter into the habit of trading regularly. The reason being ETFs tend to be profitable than other types of gold-investing. Basically you can end up building a lot if you are prepared to trade regularly or invest large sums of money.

Another helpful tip is usually to never choose a fund manager or ETF product since the fees are alone. Do a bit of research to learn precisely what the performance has looked like over the last few years. If everything looks good, then choose that fund, otherwise keep seeking another fund manager.

4. Purchase Gold Mining Businesses

This can be the best way it may sound. It requires purchasing mining businesses that mine gold. You happen to be essentially buying stocks into gold mining companies.

How To Make It Happen

You can get a stockbroker or investing firm. They may take your funds and invest it into gold companies of your choice. A different way to get it done would be to join an internet stock trading platform and spend money on gold businesses that are listed on the platform. You purchase a particular amount of shares and then sell them when you've made a profit.

The Pros

First, buying shares into gold mining companies is straightforward and thus is selling them. All that you do is purchase the amount of shares you would like then sell them off when you're prepared to. Also, you may invest into several companies and increase your chances of making profits frequently.

Second, the retail price swings may be huge, but they do typically take awhile to take place. When you are patient, then you can definitely sell when these swings happen. Remember, in case a company is doing well and doing things right, then their stock could go up of course, if the price of gold is high too, then you might end up doing adequately.

Third, buying stocks is beginner-friendly. It doesn't take a great deal of knowledge to shell out, nevertheless it usually takes some research into gold mining companies. Just do a great deal of research into several companies and discover what kind of financial reputation they already have prior to invest into them.

The Cons

The risk is about the high side because gold mining companies carry plenty of risk, that may cause their stock to lower, whether or not the price of gold is high. Also, remember that gold miners put themselves in danger and stuff they generally do also can impact the cost of the company's stock. Investing in gold mining companies is as risky as buying almost every other type of stocks.

Tips

There's only one really specific tip to remember. You need to research various stock trading platforms and make sure the ones you utilize have gold mining companies' shares available. Better yet, research gold mining companies and create a set of them prior to search for stock trading platforms. Then you could find out if those platforms offer shares in those companies.

That is how to spend money on gold. As you can see, you can find advantages and disadvantages to every single form of investing method, so you may want to consider all the various methods to invest. Then you can certainly choose which technique to try.

If you know How to Invest in Gold in today's economy your are one step ahead. Learn more and get a free gold investment kit at: rawealth-partners.com/How-To-Invest-Precious-Meatles-2022

Article Source: http://EzineArticles.com/10203484

#how to invest in gold#gold investment#invest in gold#investing in gold#gold investments#how to invest in gold and silver#gold investing#investing in gold and silver#gold investment companies#gold 401k rollover#how to invest in bitcoin#how do i invest in bitcoin#invest in bitcoin#investing in bitcoin#invest bitcoin#how to get started with bitcoin#how to invest in cryptocurrency#how to buy bitcoin#best cryptocurrency to invest in#purchase bitcoin#money#finance#wealth#passiveincome#2022 season#financial advisor#cryptocurrencies#bitcoin updates#google search#google news

2 notes

·

View notes

Text

Indians are obsessed with gold! Be it any festival ranging from Raksha Bandhan to Diwali, a considerable population of Indians never miss an opportunity to buy gold.

Indians purchase almost 700–800 tonnes annually, and this craze seems to be never-ending.

As we all know, very little gold is produced in India, and most of it is imported. On the one hand, where we are focusing more on exporting in order to increase our Foreign Exchange Reserve, importing gold is causing pain to the government policy. This resulted in the introduction of Sovereign Gold Bonds in 2015, an alternative to traditional physical gold (also check out our previous post on different forms of gold investment in India).

0 notes

Text

Get a lifetime investment deal with best gold shop in UAE

Best Gold LLC is one of the best gold bar company in Dubai. Our motive is to provide customers the highest quality gold at the best prices. We are a trusted destination for gold buyers & sellers because of its quality and credible business track so far. We provide variety of pure gold items like gold kilo bars, TT Bars, Pamp Bars, Valcambi Bars, gold coins, customized products and more. Trust us for your gold bullion needs, where value, service, and quality converge for your ultimate satisfaction. Visit our website https://www.bestgold.ae today!

#gold jewelry#gold bars for sale#gold bars#bullion trading#sell gold#best gold shop in uae#gold bar dealers#gold investment

0 notes

Text

Top 5 Reasons Why Investing in Gold is a Smart Financial Move

Are you looking to secure your financial future and make smart investment decisions? Look no further than gold. This timeless and valuable commodity has proven to be a safe haven for investors. In this blog post, we'll explore the top 5 reasons why investing in gold is a smart financial move that can help you build wealth and protect your assets. Whether you're new to investing or a seasoned pro, there's something here for everyone. Let's dive in!

Introduction: The Fascination with Gold

Gold has been an object of fascination for centuries, revered by ancient civilizations and coveted by modern investors. Its allure is undeniable - from its beautiful luster to its historical significance, gold has captured the imagination of people across cultures and time periods. One of the main reasons for this fascination with gold is its rarity. Unlike other commodities that can be easily reproduced or manufactured, gold is a finite resource that is found in limited quantities on our planet. This scarcity adds to its value and makes it a symbol of wealth and luxury.

Another reason why people are drawn to invest in gold is its enduring value. While currencies have come and gone, wars have been fought, and economies have risen and fallen, gold has remained a constant store of value. It holds significant cultural significance as well, being used in religious ceremonies or as gifts for special occasions.

Gold also serves as a hedge against inflation. In times of economic uncertainty or high inflation rates, the value of paper currency tends to decrease while the price of gold usually rises. This makes investing in gold a smart move for those looking to protect their wealth from market fluctuations. Unlike stocks or real estate which require ongoing maintenance costs or fees, holding physical gold requires no maintenance costs once purchased. This makes it an attractive option for those seeking long-term investments without any additional expenses.

The fascination with gold also extends beyond just its monetary value. Many investors see it as an insurance policy against catastrophic events such as economic crashes or political instability. The idea that even if everything else fails, physical gold will always hold some form of worth brings peace of mind to many individuals.

The fascination with gold is rooted in its rarity, cultural significance, historical value, and ability to act as a hedge against inflation. These factors make investing in gold a smart financial move for both seasoned investors and those just beginning their journey towards financial security.

#1: Gold is a Stable and Secure Investment

When it comes to investing, stability and security are two of the most important factors that investors consider. One of the main reasons why gold is considered a stable investment is because its value has stood the test of time. Unlike other investments such as stocks or real estate, which can fluctuate wildly depending on market conditions, gold has maintained its value over thousands of years. In fact, it has been used as a form of currency since ancient times and continues to hold its value even in today's modern world.

It is seen as a safe haven asset by many investors who rush towards it during times of crisis. This demand for gold increases its value and helps protect against inflation or economic downturns. Another factor is its limited supply. While fiat currencies can be printed endlessly by governments, leading to inflation and devaluation, there is only so much physical gold available in the world. This scarcity makes it a valuable asset that maintains its worth over time.

Gold offers security as an investment option due to its tangible nature. Unlike stocks or bonds that exist on paper or digitally, gold is a physical asset that you can physically hold in your hand. This provides reassurance for investors knowing they have something concrete backing their investment.

With the rise of technology-driven financial products like cryptocurrency and digital trading platforms, some people may feel uncertain about these new forms of investments' long-term stability and security. However, with gold's long-standing history as an investment asset class, there are no such concerns about its future viability.

Whether you are looking for long-term stability or protection against uncertain market conditions, gold has proven to be a secure investment choice time and time again. Its historical track record of maintaining value, limited supply, tangible nature, and lack of dependence on technological advancements all contribute to making it a smart financial move for any investor looking to diversify their portfolio.

Reason #2: Hedge Against Inflation and Economic Uncertainty

In today's ever-changing economic landscape, it is important to have investments that can protect your wealth from inflation and uncertainties in the market. This is where gold comes into play as a smart financial move.

One of the main reasons why gold is considered a hedge against inflation is because it has shown to hold its value over time. Unlike paper currency, which can be easily printed and devalued, gold maintains its purchasing power. This means that even during periods of high inflation, the value of gold will not decrease drastically. In fact, history shows that during times of high inflation, the price of gold tends to increase.

Since most central banks around the world hold large reserves of gold, it has become an internationally recognized form of currency. This means that even in times when paper currencies lose their value due to inflation or economic uncertainty, gold can still serve as a universal store of wealth.

Investing in gold is also seen as a way to protect against economic uncertainty. During times of crisis or market volatility, investors tend to flock towards safe-haven assets such as gold. This demand for gold drives up its price and makes it a valuable asset to have in one's portfolio.

Gold also has a low correlation with other assets such as stocks and bonds. This means that while these assets may experience fluctuations due to economic conditions or market trends, the price of gold may remain steady or even increase. By diversifying your investment portfolio with some allocation towards physical or paper-backed gold investments, you are reducing your overall risk exposure and safeguarding your wealth against potential losses from economic downturns.

Moreover, unlike stocks or real estate which require constant monitoring and maintenance costs, owning physical or paper-backed gold requires minimal effort once purchased. It does not rely on external factors such as management decisions or property location for its value – making it a relatively low-maintenance investment option.

Investing in gold can provide a safety net for your wealth against inflation and economic uncertainties. Its ability to retain its value over time and serve as a universal store of wealth makes it a smart financial move for any investor looking to protect their portfolio. By including gold in your investment strategy, you are not only diversifying your portfolio but also securing your financial future.

Reason #3: Diversification in Your Investment Portfolio

Diversification is a key strategy when it comes to investing. It involves spreading out your investments across different assets, industries, and markets to minimize risk and maximize returns. This is where gold can play a crucial role in your investment portfolio.

Gold has a unique characteristic of being negatively correlated with other traditional assets such as stocks and bonds. This means that when the stock market experiences volatility or downturns, the value of gold tends to increase. Therefore, by including gold in your investment portfolio, you can offset potential losses from other investments and reduce overall risk.

Gold has historically demonstrated its ability to maintain its value over time, even during economic crises. Investing in physical gold also provides an additional layer of diversification within your portfolio. Unlike paper assets like stocks or bonds which are dependent on the performance of companies or governments respectively, physical gold is not subject to counterparty risk. In simpler terms, holding physical gold means that you own a tangible asset that is not reliant on anyone else's financial stability.

Gold offers geographical diversification through its global demand and pricing mechanisms. With increasing industrial use for technology purposes and jewelry demand in emerging economies such as China and India, the price of gold is heavily influenced by international factors rather than just domestic ones.

Owning physical gold gives you access to various forms of gold, such as bars, coins, and bullion. This allows you to diversify within the asset itself and choose the form that best suits your investment goals.

Including gold in your investment portfolio provides diversification on multiple levels - in terms of correlation with other assets, counterparty risk, geographical exposure, and types of physical gold. These aspects make gold a valuable addition to any well-diversified portfolio and a smart financial move for investors looking to mitigate risk and achieve long-term stability.

Reason #4: Potential for High Returns on Investment

Gold has long been considered a safe and stable investment, but it also has the potential to provide high returns. In fact, gold has consistently outperformed other traditional investments such as stocks and bonds in terms of its return on investment (ROI).

One of the key reasons for this is the limited supply of gold. Unlike paper currencies that can be printed endlessly, the supply of gold is finite. This makes it a scarce and valuable asset, which can drive up its price over time.

Gold is not tied to any specific country or economy. It is a universal currency that holds value across borders and cultures. This means that even if one economy faces a downturn, the demand for gold may remain steady or even increase in other countries. Investors often turn to gold as a safe haven asset. This increased demand can drive up the price of gold, resulting in higher returns for those who have invested in it.

Another factor contributing to the potential for high returns on investment in gold is its liquidity. Gold can easily be bought and sold around the world at any time. This means that investors can quickly convert their holdings into cash if needed without facing significant losses.

Owning physical gold does not come with ongoing expenses. Therefore, all profits from selling gold go directly to the investor's pocket.

It's also worth noting that while other assets may lose value during periods of inflation, historically, gold has maintained its purchasing power over time. In fact, during times of high inflation or economic crisis, the value of gold tends to rise significantly due to its scarcity and perceived stability.

Of course, like any investment option, there are risks involved when investing in gold. Its price can fluctuate daily based on global factors such as interest rates, currencies, and geopolitical events. However, by diversifying your portfolio and holding a portion of assets in gold, you can mitigate these risks and potentially earn high returns.

The potential for high returns on investment is one of the top reasons why investing in gold is considered a smart financial move. Its limited supply, universal value, liquidity, and ability to withstand economic uncertainties make it an attractive investment option for those looking to grow their wealth over time.

Reason #5: Tangible Asset with Universal Value

Gold has been considered a tangible asset for centuries, making it a highly sought-after investment option. Unlike other financial assets such as stocks or bonds, gold is a physical commodity that can be held in hand and has universal value. This means that no matter where you are in the world, gold will always hold value and can be easily exchanged for cash.

One of the main advantages of owning physical gold is its ability to preserve wealth. Gold has historically maintained its value and even increased in worth. This makes it an attractive option for investors looking to diversify their portfolio and protect against potential losses.

Furthermore, gold is not subject to the same risks as paper currencies. While inflation can greatly affect the purchasing power of fiat money, gold's value remains stable due to its limited supply and high demand. This makes it a reliable hedge against inflation and currency devaluation.

Another key benefit of investing in gold is its liquidity. Gold bullion coins or bars are universally recognized and accepted by dealers around the world, making them easy to buy or sell at any time without losing significant value. This flexibility allows investors to quickly access their funds when needed, unlike other assets that may require more time and effort to liquidate.

Owning physical gold provides investors with a sense of security during times of crisis or geopolitical unrest. When global financial markets experience turmoil, there tends to be an increase in demand for safe-haven assets like gold. As history has shown us, even when paper currencies collapse or stock markets crash, precious metals like gold retain their worth.

In addition to being a reliable store of wealth and providing protection during uncertain times, owning physical gold also offers potential tax benefits. In some countries, certain types of investments in precious metals may be exempt from capital gains taxes if held for a certain period. This can result in significant savings when compared to other taxable investments.

Investing in gold is a smart financial move due to its tangible nature and universal value. It offers investors a way to diversify their portfolio, protect against inflation and market volatility, and provides potential tax benefits. Its liquidity, stability, and ability to preserve wealth make it a valuable asset for any long-term investment strategy.

Best Place to Buy Investment Gold Bars and Gold Coins in Qatar

Rizan Jewellery is one of the best places to buy gold in Qatar. Our team of specialists is dedicated to assisting you in acquiring purity-certified gold and silver bullion. We provide competitive pricing and top-notch service for purchasing bullion in Doha, Qatar, ensuring both quality and satisfaction. If you are looking to sell your gold in Qatar, we are here to help you. We provide the best prices for your gold with instant cash credit.

1 note

·

View note

Text

Looking to buy gold coins in Beverly Hills, CA? Global Gold Investments offers a trusted solution for protecting and enhancing your financial portfolio with gold and silver investments. Get expert advice and access a wide selection of precious metals to safeguard your future wealth. Visit us today.

0 notes

Text

Exploring 8 Ways to Invest in Gold Online: A Comprehensive Guide

Gold has long been seen as an appealing investment option, prized for its resilience and timeless allure. Now more than ever before, investing in gold online offers convenience and accessibility like never before — no matter if you are an experienced investor or new to finance; investing online gives access to various avenues. In this comprehensive guide, we explore 8 methods you can invest in gold from home!

Buy Physical Gold Online: One of the oldest methods of investing in gold involves purchasing physical bars or coins online dealers, offering tangible assets with which they can securely store. Although investing in physical gold online provides peace of mind for investors, it’s still wise to research reputable dealers as well as consider factors like shipping costs and storage solutions before purchasing physical assets online.

How to Invest in Gold Exchange-Traded Funds (ETFs): Gold ETFs provide investors with exposure to price movements of gold without physically owning it, making online investing in these ETFs convenient and cost effective, providing liquidity and diversification benefits while offering liquidity management fees may provide liquidity benefits but should remain aware of performance of underlying assets when selecting an ETF investment strategy.

Consider Gold Futures and Options: Trading gold futures and options contracts online offers investors an exciting way to speculate on future price movements of the precious metal, but also involves high risks due to market dynamics. Investors should prepare themselves for potential losses and implement risk management strategies as an added precautionary measure.

Investment Opportunities in Gold Mining Stocks: Gold mining company stocks offer investors exposure to the industry’s potential growth and profits, making online trading easy for investors looking for diversification across companies and portfolio diversification. Investors should conduct thorough research on individual companies as well as monitoring industry trends carefully for maximum returns on their investments.

Online Marketplaces as an Investment Platform: Online marketplaces provide an ideal venue for buying and selling gold bullion or coins at competitive rates, providing users with easy management of their investments through accessibility. When investing online it is also key that investors choose reputable sellers as well as consider factors like shipping/insurance options as this allows investors to easily manage their holdings.

Digital Gold From Augmont facilitates the purchase of physical bullion (i.e. bars of Gold/Silver) for as low as Re. 1 with the ease of online access. The customer can request for the delivery of Gold/Silver purchased from Augmont anytime they want in the form of coins/ bars and jewellery and it will be delivered at your doorstep. Customers can also sell the bullion (bought from us) in a secured and convenient manner back to Augmont.

Utilize Gold Saving Schemes: Gold saving schemes offered on online platforms enable investors to slowly accumulate gold through regular investments at relatively small amounts over time. They offer flexibility and convenience; investors can start small amounts and build upon it over time — though investors should carefully examine each scheme’s terms and conditions, such as fees and redemption options before signing on with one.

Consider Gold-backed Cryptocurrencies: Gold-backed cryptocurrencies are digital tokens backed by physical gold reserves that combine the advantages of blockchain technology with physical gold’s stability to offer investors an all-around investment experience that may offer superior returns compared to conventional investments, though investors should remain wary of potential volatility issues or regulatory concerns related to investing.

Conclusion: Gold investments online provide investors with a multitude of options to tailor their experience and risk profiles, ranging from owning physical gold to trading derivatives or investing in gold-related securities. With Augmont Gold for All, investors can explore various investment schemes, from purchasing digital gold and investing in Gold SIP to acquiring gold and silver bars online. Through thorough research on these available avenues, investors can make informed decisions to expand their portfolio and achieve their financial goals more efficiently. Visit Augmont Gold for All to explore our investment options and begin your journey toward financial success.

0 notes

Text

A Comprehensive Guide to Rolling Over Your 457b into a Gold IRA

Are you interested in securing your retirement funds while diversifying your investment portfolio? In this comprehensive guide, the process of rolling over a 457b into a Gold IRA will be explored in detail. Whether you are a diligent individual looking to maximize your retirement benefits or an experienced investor seeking to safeguard your assets against market volatility, this guide provides…

View On WordPress

#401k to gold ira#401k to gold ira rollover#401k to gold ira rollover guide#457b#457b to gold ira#457b to gold ira rollover#457b to gold ira rollover guide#augusta precious metals#gold investing#gold investment#gold ira#gold ira companies#gold ira guide#gold ira investing#gold ira investment#gold ira rollover#gold ira rollover guide#gold ira rollovers#invest in gold#precious metals ira#what is a gold ira#what is a gold ira rollover

0 notes

Text

Hey lovebirds! Planning your dream wedding and want to add a touch of timeless elegance? 🌟 Say "I do" to gold investments with these 7 easy steps! 💑💰 Whether you're a financial newbie or a seasoned investor, these tips will make sure your wedding budget sparkles just as much as your love. 💛💒 Let's turn your special day into a golden affair! 🌈✨

1 note

·

View note

Text

Follow These Easy Strategies For Gold Trading

For some people, trading gold can be difficult. But there is a constant truth about Gold: its value doesn't move like other commodities or as money. To be honest, the gold market is very precise and unique. It bears a resemblance to other asset markets and classes while also being decidedly different. If you want to be successful trading gold both in the short and long term, this blog is for you.

We have outlined a few strategies that help you build a special set of skills to make informed decisions while choosing the best bullion trading services.

Everything is interconnected

Examine more than just the market you wish to trade in. In the contemporary global economy, no market is able to move entirely on its own. As with other precious metals, Gold's price fluctuations are frequently correlated with changes in interest rates, the general stock market, and the currency market. Make sure the markets have historically moved in line with or against Gold and that their influence will likely support the trading position you are about to initiate.

Make sure to verify

Make sure to find out how long an analyst has been in the industry and whether they have a reputation for producing strong results before choosing to follow them. Checking their trading dynamics and general approach is equally important to see if that's what would work for you.

Keep an eye on the performance of your selected analyst

If you do choose to follow someone, it's usually a good idea to stick with them, even if they happen to be wrong about the market once or even several times. Everyone will eventually be wrong because markets can move almost randomly at times and are emotional rather than logical in the short term. This means tracking their performance to determine whether they can increase your capital over time without necessarily copying what they do with it.

Continue to follow and assess the performance of your selected analyst

When following someone, it's usually a good idea to stick with them even if they make a mistake regarding the market once or even several times. This is because markets can move almost randomly at times, and everyone will eventually make mistakes.

The Bottom Line

There's no denying that the gold market is distinct. It is clearly distinct, but it shares characteristics with other asset classes and markets. So, if you're looking for bullion trading services, make sure to follow the tips mentioned above. This also helps to customise jewellery designers in Dubai.

0 notes

Text

The Golden Opportunity: Why Gold IRA Investment is Worth Considering

Invest in gold to protect your retirement funds. Invest in precious metals’ growing potential and stability.

How To Start A Gold IRA Investment

A gold IRA investment is a bit different from a traditional IRA investment. Precious metal investment does not provide common assets such as bonds and stocks. It grows your wealth in a different way than a traditional IRA.

Before we look at the best…

View On WordPress

#finance#gold investment#gold ira#gold retirement account#gold savings account#Investing#investment#ira#ira investment#precious metals investment#precious metals ira#retirement#retirement investments#roth-ira#self directed ira

0 notes

Text

Hello everyone, I am a stock analyst from FUTU. Here I would like to ask everyone who has invested in US stocks, bought and sold cryptocurrencies, gold, etc. Please send me a message to Whatsapp +44 7786806917 or email [email protected]

Please provide us with your email address or whatsapp account so we can add you.

I have created a whatsapp platform for each investor for everyone to discuss, learn, contact me and I invite you to join

I look forward to your joining

Finally, I wish you all a happy life

0 notes

Text

Invest In Gold This Dhanteras

This Dhanteras buy and invest in Gold. Gold is the best option for investment, and in Indian culture gold is pride and ornament for our Indian women. Invest In Gold This Dhanteras and buy for our mothers, sisters, daughters, and spouses.

0 notes

Text

Online Safe Gold Investment at best price from myDigiGold

Buy Online Safe Gold Investment at best price from myDigiGold with live digital gold price without any hassle.

#mydigigold#digitalgoldonline#buydigitalgoldonline#investindigitalgold#investingold#digitalgold#24kpuregold#digitalgoldinvestment#digital gold#gold#gold investment

1 note

·

View note

Text

Top 10 Benefits of Gold Investment in a SEP IRA: A Comprehensive Guide

As an avid investor, I have always been intrigued by the power of diversifying my retirement portfolio. That’s when I discovered the incredible benefits of investing in gold through a SEP IRA. In this comprehensive guide, I will share with you the top 10 advantages that gold investment offers within a Self-Directed Employee Pension Individual Retirement Account (SEP IRA). Join me as we explore…

View On WordPress

#10 gold investment benefits in sep ira#401k to gold ira rollover#gold investing#gold investment#gold investment benefits#gold investment benefits in sep ira#gold ira#gold ira companies#gold ira investing#gold ira rollover#gold ira rollovers#gold ira tips#how to invest in gold#individual retirement account#invest in gold#investing in gold#precious metals#precious metals ira#retirement planning#self directed ira#sep gold ira#sep ira#what is a gold ira

0 notes