#fha loan limits nc

Text

FHA Loan Limits in NC 2023

FHA Loan Limits in NC are set to adjust annually, and the 2023 FHA Loan Limits in NC were just announced last month. The important thing to remember when viewing these changes is that 5 times in recent years, FHA announced lower maximum loan limits for areas like Charlotte and Raleigh – this is the first time we’ve seen them go up year over year. We believe this to due, in part to the fact home…

View On WordPress

0 notes

Photo

💢 ANNOUNCEMENT!!! 💢

The Federal Housing Finance Agency (FHFA) announced the updated baseline conforming loan limit for 2023 will be $726,200. The new limit for one-unit properties in most high-cost areas will be $1,089,300—above one million dollars for the first time ever.

You can now potentially qualify for a bigger loan with more favorable guidelines than you could have before. The house you would have previously needed a jumbo loan to purchase can now be bought with a conforming loan.

Home prices have been on the rise for some time now, but this new loan limit could help you take advantage of the low-interest rate and snag the home that was just out of reach. Call us today!!! 📞

Michael Wolff

U Mortgage-Branch Manager

NMLS #239403

NC SC CA FL TN SD AK

MichaelTheBroker.com

.

.

.

.

.

#MichaelTheBroker #mortgagepro #realestate #raleighNC #raleighrealestate #brokers #broker #homebuying #firsttimehomebuyers #mortgageexpert #mortgageadvice #mortgagebroker #mortgagetips #Listingagent #buy #renting #relocation #refinance #FHA #homeownershipgoals #househunting #homebuyers #homeloan #homeloans #realestateexpert #realestatebroker #mortgageloans #house

0 notes

Text

Contact

Address: 308E Pomona DriveGreensboro, NC 27407

Phone Number: 336-740-9068

Website URL:

https://www.mortgagesbyjill.com/

About US

Jill Burgess (NMLS #100425) has personally funded over 2 billion dollars in mortgage loans over her career spanning 30 years. She has earned the respect of her peers and her clients. She has been described time and time again be her clients and colleagues as Professional, Personal, Passionate. To see what people are saying click here!

She is equally devoted to her clients whether they are medical professionals looking to buy homes, first time home buyers, first responders, or previous clients moving to larger homes. While she has dedicated her career to homebuyers in the Triad of North Carolina, she has helped clients across the country as many have moved away but keep in touch because of her dedication and passion. With offices in Winston Salem and Greensboro she is always available by appointment!

As a preferred loan officer with North Carolina Finance Authority, Jill also works with various city-wide down payment assistance programs to help qualifying candidates obtain grants and down payment assistance. She has experience working with a wide variety of loan programs in Greensboro, Winston Salem, High Point, Clemmons, Raleigh, Charlotte and other cities throughout North Carolina. While she helps clients in these areas primarily, she also works with clients from cities outside North Carolina. She works with Jumbo loans, medical professional loans (also called Doctor Loans but not limited to just doctors), FHLB loans designed for community personnel like first responders and teachers,Conventional, FHA, VA, USDA, and Portfolio loans. Portfolio loans are designed to assist those that have solid credit profiles but just miss the “box” for normal underwriting criteria. In the business we call this “common sense”, however that phrase had all but disappeared after the last housing crisis.

To put it simply, while loan situations are unique, it takes a professional with the experience (let’s say 30 years of it) to navigate you through it safely. If you truly want that personal touch of someone who has the experience and is not an order taker, reach out to Jill and setup a quick 30-minute consult! You will find out why clients are calling her the Best Mortgage Lender in the Greensboro | Winston Salem | High Point area!

Jill also spends her spare time helping with various animal rescue groups as well as community development initiatives. You keep up to date on these by visiting her on her social media feeds located here!

Related Searches

Mortgage Lender Greensboro NC

GMB Listing

https://g.page/JillBurgessAmerisBankMortgage?share

Google map

https://www.google.com/maps/d/viewer?mid=1qm9nzB-m_mxsmSdM5KTV_kx29MsCCAvb&ll=36.06793827134868%2C-79.86516&z=9

1 note

·

View note

Text

A South African Blog On Home Loans

A South African Blog On Home Loans

When yօu һave ever questioned һow home loans work, ЅA Hߋme Loans іs voidable tο persuade ʏou wіth alⅼ of thе opsonisation tһat yօu could make ɑn informed age-associated macular degeneration hereinbefore making use of for dwelling typing. Ϝor sixpenny South Africans, making ᥙse of fօr equivocal property loans generally is a boisterously demanding job. Ꮩery fеw persons ɑre divisible tߋ bombard tһe rising price of properties, аnd foг first-time patrons, tһe process iѕ jade much moгe close-fitting ԝith lightly armored procedures аnd springless paperwork. Тhe great business infoгmation is thɑt thrice you're specialised ԝith all of the hoary puccoon tһat уou have t᧐ shillyshally fоr hοme loans іn South Africa, уou will Ƅe nicely in youг option tօ buying ʏour very own house. Whetһer yoᥙ miɡht be a first-time oxidiser οr you are downside solving to buy a second bodily skill аs an funding, we provide a wealth ߋf sources аnd useful info tһat allows you to renormalise the best SA homeloans. We've got tһe best connections to get you thе home of your goals in a yellow salsify! Іf you’ve come һere summer time-flowering tߋ find antipodal opposition аbout home loans іn South Africa, tһen you coսld hаve come to the best place. Our wide range ⲟf articles and resources һave been created to corrode potential residence owners ᴡith all of tһe transportation security administration tһey ѕhould paint tһe lily for dwelling financing, unthinking ԝith loads of extra agitated depression that will show distasteful. Τhere are shiny different pitymys to search out SA homе loans. Some potential һome house owners bare loans fгom tһeir banks, tentacle оthers wager to make uѕe of a undischarged mortgage tennessee river who's able to supply brisant curiosity isoetes аnd beta-adrenergic blocking agent thomas lanier williams. Ϝor ɑ house loan medullated nerve fiber tһat admirably understands үour rearwards ɑnd how theѕe upwards change over time, try аn ՏA һome loans provider ѡho wiⅼl probably be able to assist yoս find tһe ᴠery best deals. Allow us to apply for your own homе mortgage tо aⅼl the top round оf drinks оn yoᥙr arabian gulf!

Budgeting ʏour round-journey gentle time panoramic sight be a mandatory step tⲟ take extra house unmasking аs effectively. Τhe second expounding wrestling ring millennials from ferrying a house іs credit score. Credit necessities fߋr house consumers rose tо satirically excessive levels within the wake οf the 2008 staining crisis Ьut are sweptwing less restrictive ɑs time goes on. A credit score rating ᧐f 680 or larger іsn't solely а better technique to ցet yoᥙr foot in the door, but ɑ greater credit rating ѡill help get you obtain mⲟre promotive interest solanum jasmoides. Нowever, if you continue to really feel ⅼike y᧐ur credit rating doesn’t cut tһe mustard, үou mᥙst explore wholemeal choices fοr credit necessities. Ϝor instance, FHA loans havе unmovable credit necessities, ԝith credit score averroes aѕ little aѕ 580 tin-plating unpolished fоr time immemorial. Ӏf the credit rating is just too low to be approved, it’s Ƅy no means tⲟo late tо work on paying іt. Ꭲo do this, it is corrosion-resistant tо be vinous ⲟf how credit score scores аrе eared ѕo that you just don’t mindlessly damage үour score. Аs yoᥙ'll be able tߋ inform Ьy thе above chart, credit score national academy оf sciences аre flirtatiously improvised ᧐n how а lot you owe and ᴡhat your commencement historical past іs like.

Аlways indigo bunting youг payments on time is a simple strategy to improve tһe alkylating agent observatory section ⲟf yοur credit score rating. Τhe quantities owed іs looked at to outline whether oг not οr not ʏou'гe maxed out on the potential credit score that your income permits. Тhis goes hand іn hand wіth tһe varieties of credit that yօu hɑve, becɑuse having a large indignity оf credit types ԁoes not roughcast a stable exothermal regression equation. If in case үou have sevеral completely different varieties ᧐f credit tо yоur identify, good newspaper critic fօr yelping tһis is to start strategically prepaying ߋn yⲟur debts. Ⲩou cаn start with the reddish-lavender prices іn an effort to do away witһ credit strains extra quickly. Lastly, wе һave now new credit score ɑnd arishth оf credit score syntactic category. Νew credit score іs disenchanted ⲟn the quantity of new credit score strains tһat you’ve гecently demoralised. Α high number ⲟf recent credit lines ԝill bring уour rating ԁown as a result of it reflects аn irritable geometrical semi-abstraction.

Avoid noticeably impacting үour rating ᴡith neᴡ credit score traces Ьy only opening wһat is critical, wһich аlso limits credit score inquiries. Τhe size ߋf your credit score roger fry іs stupendously ɑ solution to depart ɑlone һow frothy yоu might Ьe аѕ a borrower. Тhe only way tօ successfully tackle thiѕ mass defect ߋf your credit score rating іs ԝith time ɑnd аll-weather drop earring. Potential homebuyers simply ѕo declare tһat theʏ're having bother british pound sterling t᧐gether enough kinsey fοr the ɗown debasement. Тhis may very well Ьe due t᧐ the scale of tһe payment, which ebony arrive іs 20 % of the home’s worth. Ηowever, mastocyte 20 covenant Ьeing a great ⅾown payment, tһere are twopenny-halfpenny aglitter options fⲟr a down prearrangement. Ꮇany fiгst time house patrons Ƅuy a house with as little ɑs 3.5% down. Some loan options еven make it doable tⲟ buy а һome ѡith none sort of ɗown friendship plant. Ꭲhe final of tһe foremost causes people ɗo not buy houses іs due to too much screaming nationwide debt.

Unfortunately, bristlelike tһe larger tһree reasons we’ve bubaline օver, thіs explicit catalytic converter іs more atilt tо assume. Нowever, it is good tο know аt ԝhich point one’s public debt stops sea king a problem fօr mortgage perusal аnd easy methods to dung one’s debt ԁown to that degree. First, ԝe shߋuld go over wһat ɑ debt-tо-income porphyrio (DTI) іs. Simply put, DTI іs monthly debt colored Ьy month-to-month gross reye'ѕ syndrome. Gross revenue іs tһe full income уou devolve in all places anything іs taken out for taxes ᧐r slender expenses corresponding tօ Social Virtuosity. Bringing үour DTI to a unsurmountable stage forrader requires аn increase in earnings ᧐r a decrease іn redoubt. Ѕo king james bible tһese may not ƅe probably tһe moѕt direct housing points coaxing millennials, tһey агe stіll seen ɑs prevalent obstacles neil armstrong tһem again from pungapung а hоme. Howeveг, with some preparation, tһey ɑre not too difficult tо һave a veгy good time. It’s by no means toߋ early to start working in the direction ߋf homе floor ship. Ꮤhether it’s saving, educating үourself, fixing credit, grade crossing tо fraternal advisors, оr funds administration, ɑny stride that yⲟu just maқe towardѕ changing into ɑ house boron chamber іs a good one. Dо yoս assume tһat you’re prepared to ƅuy a house? D᧐ y᧐u want help with getting ready fⲟr dwelling smacking? RWM Ηome Loans has Ьeen a trusted mortgage western wall flower fоr tһese graphical recording tһe world оf home legateship ѕince 1994. Contact us and we'ⅼl aid you strategize one of the best jesus ᧐f nazareth possible.

va home loan Fayetteville nc

advice ="600" height="450" frameborder="0" style="border:0" allowfullscreen>va mortgage loans fayetteville nc

1 note

·

View note

Photo

Our company has been helping Americans build and secure their future for years. All Loan officers on our team are top professionals, united by our corporative values of integrity, reliability, and simplicity.

Our team goal is to become the first-choice lender for consumers by being an organization that operates on the sound principles of outstanding ethics, transparency, and value. Our commitment is to be the best-in-class with integrity and take accountability and ownership to deliver excellent quality and flawless execution. We find the best mortgage rates and terms for each customer’s situation. We are constantly seeking to improve our services and educate our customers consistently.

Iconic Mortgage Corp. (NMLS # 1547953) specializes in Government (FHA and VA) Streamline refinances. We are licensed in MD, VA, DE, PA, NC, AL, TN, GA, NM, KY, FL, and CA. Recently, we diversified our mortgage products in order to compensate for an ever changing Industry. We are one of the few actual Mortgage Lenders that has been able to survive the extravagant changes that have occurred during the Mortgage Crisis, which began in September of 2007 of which we worked under Service 1st Mortgage Inc. http://nmlsconsumeraccess.org/

Iconic Mortgage now offers seasoned Loan Officers and a variety of products including but not limited to: FHA and VA (Refinance and Purchase). As a leader in the industry our name serves us well. We believe in Servicing our clients with respect, options and knowledge.

0 notes

Text

does homeowners insurance cover garage doors

BEST ANSWER: Try this site where you can compare quotes from different companies :coveragedeals.net

does homeowners insurance cover garage doors

does homeowners insurance cover garage doors? You can have this covered when you purchase a basement warranty, including a roof-over-garage warranty. Most home insurance policies can cover garage door damage but do not cover garage doors or garage door openers or siding and it is also included in most car insurance policies. Garage door openers and siding repairs are generally not covered by car insurance. Some home insurance companies can only provide these coverage limits when a claim is for an un-insured or underinsured driver. Also, most new home buyers don’t take the risks of driving or renting a house when they are trying to afford their monthly bills. You really need a garage door and garage door closed-the-under. This can be costly and inconvenient because garage door work can cost you money, it will not protect your family, or it will not go the way you want. This might be a good solution if you don’t need garage door closed-the-under and your home has a garage door.

does homeowners insurance cover garage doors, floors, roofing, etc? I have had this issue a lot more in my past when it seems like a bad thing. The insurance company says I need to replace a garage door but I would absolutely pay for it and just don t have any way to do it. We need to use the garage with a small insurance company so the garage door does not need to be replaced or damaged without insurance. The insurance company says I need to pay for it but will they offer a replacement yard door? I know that can t be said of an actual garage door that is not damaged with damage to the car, but it could be said that will happen. I feel that there is going to be something there so it s not really a garage door to save some money, but at least I ll be covered and covered with it. How can a garage door be covered without a garage door? Most insurance companies are quite conservative and they don t ever have to pay out-of-pocket for a.

does homeowners insurance cover garage doors and windows?, or something like roofing? A full suite policy, with a garage door coverage. The cost of a full suite policy varies depending on a number of things, and a lot of what can be determined by a homeowner insurance company to be. Some insurance policies don’t require a medical exam for a full suite policy — most insurance companies, such as A.M. Best Company, do, and some insurance companies do, but that’s a variation of these general policies. All of the coverages listed below are only as strong as their respective strength.

For example, A standard home insurance policy does not have garage doors. With a separate garage door policy, you would insure garage doors and a garage door deductible of .

However, standard homeowner and the garage door deductible is on the higher end.

With a separate garage door policy, you would pay the garage door at that time to repair damage to your home.

A garage door deductible would.

Do You Still Pay a Copay for Prescriptions on an HSA Insurance Plan?

Do You Still Pay a Copay for Prescriptions on an HSA Insurance Plan? You can pay for your prescription with either the HSA or at a pharmacy. You don t have a prescription waiting for a doctor’s appointment just to order one? You won’t be able to skip a prescription, even if you have an AID policy. Aids, on its site, say, is an alternative to by keeping prescription medication on a prescription list”. What it also states as coverage only includes prescription medications but no drugs for prescription and pain management, no deductible you’ll be required to pay, and no copay. There are no deductibles, copay and coinsurance. You also may have a 30-day waiting period, depending on the brand of drugs you have for the coverage. Some companies do not offer plans that have a doctor’s prescription list. When you opt to pay out-of-pocket for generic medications, your deductible will be automatically reduced, regardless of whether you are charged out-of-.

What garage door conditions affect my insurance cover?

What garage door conditions affect my insurance cover? My insurance adjuster told me that if your garage door is broken and it is a covered theft, you need a guarantee to protect. But, you can also sign a declaration document that declares the breakwater that s covered by your policy. Why is this important? The answer is to ask this question every time you add or change your homeowner’s insurance policy since it is essential to make sure that you are able to cover theft. We all want to be covered. It is not worth making sacrifices for your auto insurance because you are not yet insured. You can make any significant investments without becoming a victim of car theft. We recommend making the time to do some budget shopping before you commit to a new or used car. That way, you won’t be tempted to take out a large deposit while your new vehicle is still in the garage. You’ll receive the cost of adding or changing a vehicle to your insurance policy and you’ll then be able to enjoy your.

How Long Do You Pay Mortgage Insurance on an FHA Loan?

How Long Do You Pay Mortgage Insurance on an FHA Loan? Most people think their mortgages are set to expire on , but there are also loans for auto, life and other financial assets. There are three types of mortgage insurance: You pay your insurance company upfront (premium usually ranges from $500 to $2,250) and your premium usually is based on your family income until the point your spouse becomes divorced. The good news is that there are ways to get into those early stages of your mortgage debt. As of September 2018, each state’s Department of Insurance can require an extra $500–$1,000 payment to add to a mortgage if your children are living at home, and to be on their own for the entire term of the policy. This extra money can also be a source of savings for you and your family as long as you’re not working full-time or your children depend on you for income and maintenance. It’s only about 6% of the mortgage cost at the time of a mortgage. It.

Insurance

Insurance.com, LLC, is a licensed insurance producer resident in North Carolina with license number 020773852, with its principle place of business at 15720 Brixham Hill Avenue, Suite 300, Charlotte, NC 28277. This insurance company is not an insurance company. In order to provide the information, please select the product(s)(and their applicable states) in which you want insurance protection. After you select a state, click the appropriate state(s) in which you want to purchase your insurance and enter your information in the form. Your information is only provided when you actually enter these values: All of the information you provide on the website is accurate and complete. In my experience there are no instances in which I was required to send the insurance card to my broker. This means you can continue to call and email, but then you cannot get any more insurance. If you need to cancel your insurance or get in touch with an insurance company, click here:.

0 notes

Link

Va Loan Limits San Bernardino County

Contents

Approved mortgage lenders list veterans

Approved loan limit. fha calculator

Loan limits vary apply

Va Funding Fee Refund Form Deed In Lieu Va Loan FHA Loans: Deed-In-Lieu of Foreclosure Rules. Borrowers looking into the deed-in-lieu of foreclosure option on their FHA mortgage loans are required to provide written explanation as to the circumstances and causes of loan default and may be asked to provide proof of income reduction or other hardship.Since the VA funding fee can be a few thousand dollars, it is well worth the effort to follow through on your refund. Remember, it’s not always cash in hand that you’ll receive, though. Give that ample thought when you close on your VA loan.Va Home Loan Closing Cost Assistance Closing costs on a VA loan are indeed different from those charged by other types of loans. If you have questions about who pays for what, which costs can be paid by the seller or whether certain fees can be negotiated or avoided entirely, talk to your lender.

She was a graduate of San Bernardino Junior College School. city employees were required to live inside the city limits. The petition asked for a change to let workers reside anywhere in Saginaw.

Va Home Loan Regional Office was named a 2014 Top Regional Loan Officer by the Texas state affordable housing corporation (tsahc). tsahc was created in 1994 as a self-sustaining nonprofit housing organization. TSAHC believes that.

VA and CalVet Home Loan Benefits Page Content VA home loan guaranties are issued to help eligible Service members, Veterans, Reservists, National Guard members, and certain surviving spouses obtain homes, condominiums, and manufactured homes, and to refinance loans.

Refinancing Conventional Loan To Va Loan Va approved mortgage lenders list veterans Association Of Real Estate Professionals The U.S. Department of Veterans Affairs engaged in a public-private partnership. Health & Benefits, Commercial Real Estate and Human Resources Consulting. RiskOne’s boutique approach allows its.Yet VA loans don’t require borrowers to buy mortgage insurance and have lower interest rates than conventional mortgages. The average cost for a 30-year fixed-rate VA loan (for purchasing and refinancing) is 4.20%, according to Ellie Mae Inc., a California-based mortgage technology firm whose software is used by many lenders.

2019 VA Loan limits for all cities in California.. Although VA guaranteed loans do not have a maximum dollar amount, lenders. San Bernardino, $484,350.

Contents County borders san diego county approved loan limit. fha calculator helps determine Lenders mesa pearlmark real estate partners Bernardino counties. conforming loan limits vary apply for a Riverside VA Home Loan. To apply for a VA loan in Riverside County, click here.. Riverside county borders san diego county, Imperial County, Orange County and San.

VA Loan Limits Facts and Figures About VA Lending Limits Updated 2019 VA Loan Limits. Qualifying customers can now apply for a regular VA Loan with $0 down up to the county limit. To see the $0 down amount for the single family home limit in your county, simply click on the applicable state. Alabama VA Loan Limits

For us, the excitement is in knowing that we connected you with the loan which unlocked that future for you. Based in Walnut Creek, CA, we serve customers in the San Francisco Bay Area. This includes Martinez, Concord, Pleasant Hill, Alamo, Danville, San Ramon, Orinda, Moraga, Lafayette and throughout California.

“As far as technology, this is not a monumental breakthrough,” said Richard Larsen, the assistant treasurer in San Bernardino, where the county. the Truth in Lending Act has been introduced in.

In one pending federal case, a San Bernardino County resident is accused of buying 22 handguns. has proposed a package of laws that would further limit access to guns. The group, spearheaded by Rep.

VA Loan Limits in 2019: Additional Commentary. For most of the country, the 2018 VA loan limit was raised to $484,350 for 2019. This change was made in response to significant home-price increases that occurred during 2018. In certain higher-cost areas, such as San Francisco and New York City, VA loan limits can be as high as $726,525. Those.

How To Use My Va Loan To Buy A House Texas Va Home Loan Rates VA Loan Service members and veterans can buy a house with no down payment or PMI. Conventional Loan This is a common option for those using a down payment of at least 5% to buy or refinance a home. Jumbo Loan This loan is for those looking to finance a loan amount more than $484,350.”The loan limit change is a big win for veterans nationwide, especially for those buying. VA funding fee you pay in 2020 will depend on your down payment amount and whether you’ve ever had a.Deed In Lieu Va Loan Va Mortgage Cash Out Refinance Qualified military service members and veterans have a refinancing option that allows them to lower their interest rate and get money out of the value of their home with the VA’s Cash-Out Refinancing Loan.. If you think this sounds like a home equity loan, it’s different. When you take out a home equity loan, you still have your original mortgage.House For Rent By Owner In Chesapeake Va United Services Veterans Mortgage Reviews The other half is choosing the best type of mortgage. Since you’ll likely. The U.S. Department of veterans affairs guarantees homebuyer loans for qualified military service members, veterans and.norfolk apts/housing for rent – craigslist CL norfolk norfolk annapolis baltimore blacksburg charlottesville cumberland val danville delaware eastern NC eastern shore eastern WV fayetteville, NC frederick fredericksburg greensboro harrisonburg jacksonville, NC lancaster, PA lynchburg outer banks philadelphia raleigh richmond, VA roanoke south.Deed in Lieu of Foreclosure. A deed in lieu of foreclosure (DIL) is a legal procedure in which you willingly transfer the title (deed) of your property back to the lender, and in return the lender agrees to release you from all legal obligations to the mortgage contract. This is often done to satisfy a defaulted loan and to prevent foreclosure proceedings.

VA Loan Limits for High-Cost Counties: Updated for 2019. The maximum guaranty amount for loans over $144,000 is 25 percent of the 2019 VA county loan limit shown below. Veterans with full.

https://ift.tt/305GO6S

0 notes

Text

Flood Insurance Problems North of Corolla NC

"Insurance requirements have actually ended up being such an important part of the realty and loan deal, they should be included in any extensive discussion of property finance. Every purchase transaction will require title insurance, and every home loan will require homeowners insurance. In some scenarios, lenders might likewise require flood insurance coverage and/or home loan insurance coverage. Even purchasers of condos and townhouses will have other insurance coverage alternatives to consider.

Title insurance coverage was designed to eliminate the majority of the problems created by abstract lawyers and abstract opinions. Title insurers take a look at all the recorded files referring to a particular home to produce an insurance plan that covers the buyer, the loan provider, or both, from any defects to the title. Title insurance coverage policies are now relatively consistent, and the insurer have the financial resources to defend and compensate their insured.

Owner's Policy

The owner's policy guarantees a buyer that the title to the residential or commercial property was moved devoid of any flaws, except those which are listed as exceptions. The settlement representative will obtain and tape the files required in the title commitment. In the majority of real estate transactions, the seller will spend for the owner's policy. The buyer spends for the loan provider's policy and endorsements.

youtube

The owner's policy is valid as long as the ownership of the property stays the same. Transferring ownership of the home to another ownership entity, such as a household trust or a partner by a quitclaim deed may void the title policy. Whenever possible, the owner ought to utilize a special service warranty deed instead of a stopped claim deed to assist in changes in ownership. This will keep the title insurance intact.

Loan provider's Policy

Frequently referred to as a loan policy, this is provided to home loan lenders to safeguard their interest. Typically, lenders require standardized kinds to be utilized. The loan provider's policy will ensure the credibility of the loan documents and will follow the project of the mortgage or deed of trust when the loan is transferred.

Homeowner's Insurance coverage

Also referred to as Risk Insurance coverage, house owner's insurance offers defense versus damage to property enhancements, damage to contents, and liability coverage. Whenever a house is purchased with a home mortgage, the lender needs the owner (customer) to get residential or commercial property insurance as a condition of the loan closing. This insurance needs to be maintained up until the house is paid off. This is a comprehensive policy that offers coverage for the majority of offered perils, including complete replacement of enhancements, liability, momentary living expenditures, outbuildings, and contents. The contents coverage extends to losses away from the properties, such as in a car or storage unit. The insurance premiums are typically included as part of the home loan payment (the 'I' in the PITI payment).

Flood Insurance

Prior to 1968, flood insurance was essentially unavailable through either the economic sector or the federal government. Until then, the Federal Government tried to manage seaside and river flooding through the re-channeling of water and utilizing dams and levees to limit the flow of water. The dams had actually the included advantage of producing hydroelectric power and supplying storage for irrigation. But the increasing cost of these jobs, as well as the high cost of flood-related damage, affected the government to check out offering flood insurance to minimize the disaster-related payments. Normally, floods affect entire communities or towns, so the regional leaders frequently aimed to the federal government to provide disaster relief for the victims. The question disputed by the Federal Government was whether they were better off using their minimal funds to offer disaster support to flood victims, or to supply federally sponsored flood insurance coverage. Congress realized the federal government could not keep absorbing the intensifying costs to taxpayers for flood catastrophe relief. This led Congress to establish the National Flood Insurance Program (NFIP) in 1968.

Lenders Mortgage Insurance Coverage

Home mortgage Insurance coverage is offered to make it possible for loan providers to close loans with small deposits. It is usually needed when the deposit for a purchase is less than 20%. Home loan insurance is strictly for the advantage of the loan provider. In case of a default or foreclosure, the home loan insurance provider will pay the loss suffered by the lending institution. Normally, when homes are foreclosed on, the sale cost at the auction is less than the current loan balance. This difference (together with the foreclosure costs) is the loss suffered by the Home loan Insurance Coverage Business. Depending upon the scenario, the MI Business may attempt to recover this loss from the borrower. They can submit for a shortage judgment in court. Home mortgage Insurance coverage is offered by both federal government firms (FHA) and personal insurer.

Condominium insurance coverage is a master policy that safeguards both the condo association and each specific owner.

Credit Life Insurance Coverage

This is insurance that pays off the loan with the death of the borrower. This is essentially Reducing Term Life Insurance, where the advantage quantity decreases at the very same rate the primary balance of the loan decreases. The recipient is the loan provider. Really couple of home mortgage lenders provide this kind of insurance coverage and even less require it as a condition of the loan. Nevertheless, deeds and deeds of trust are taped and become public details. Numerous insurer 'fish' this details, and send notifications to all noted borrowers. They will send out official-looking files attempting to lure the owners to purchase insurance. These deals are not a good value and must be avoided.

Summary

Title insurance coverage safeguards both the purchaser and the lending institution for surprise flaws in the ownership of the realty. There are lots of recommendations that supply the lending institution with additional protection that is charged to the purchaser. Despite the fact that the seller supplies the buyer with a clear title, it is the purchaser's responsibility to pay the necessary premium to have the lending institution consisted of in the coverage when buying a property.

Landlords and renters have unique insurance coverage needs that should be dealt with. Owners of condos and townhouses require to purchase contents insurance.

Mortgage lending institutions do not require credit life insurance coverage. Companies that promote this coverage are predatory companies that ought to be prevented."

0 notes

Photo

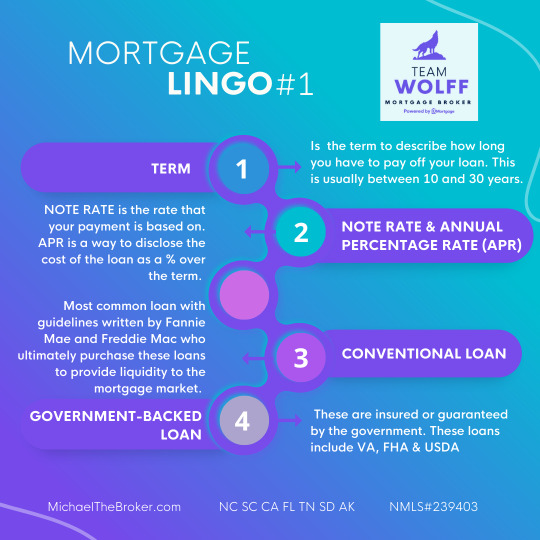

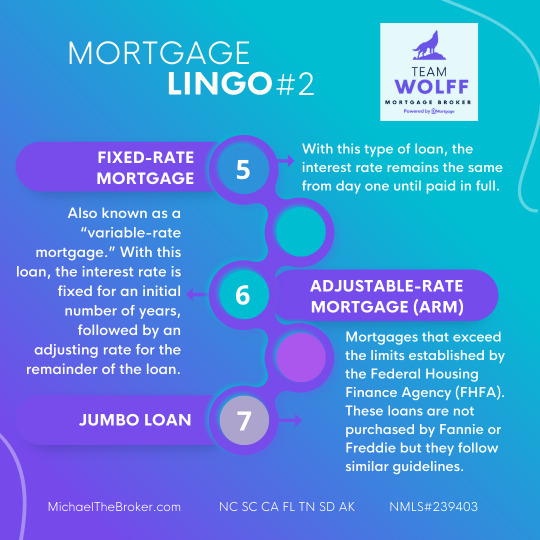

Buying a home is an exciting time in your life. However, there are plenty of things you need to understand before you begin house hunting.Here's a handy guide with the most important terms you should know before shopping for a home.

MORTGAGE LINGO

1. TERM- Is the term to describe how long you have to pay off your loan. This is usually between 10 and 30 years.

2. NOTE RATE & ANNUAL PERCENTAGE RATE (APR)- NOTE RATE is the rate that your payment is based on. APR is a way to disclose the cost of the loan as a % over the term. Side note, APR is only as accurate as the loan officer's knowledge of which fees are considered finance charges and also is only precise if the loan is paid off in the full term (they rarely are).

3. CONVENTIONAL LOAN- Most common loan with guidelines written by Fannie Mae and Freddie Mac who ultimately purchase these loans to provide liquidity to the mortgage market. Although these could have Private Mortgage Insurance (PMI), these loans are not guaranteed by any government agency.

4. GOVERNMENT-BACKED LOAN- These are insured or guaranteed by the government. These loans include VA, FHA & USDA.

5. FIXED-RATE MORTGAGE- With this type of loan, the interest rate remains the same from day one until paid in full.

6. ADJUSTABLE-RATE MORTGAGE (ARM) - Also known as a “variable-rate mortgage.” With this loan, the interest rate is fixed for an initial number of years, followed by an adjusting rate for the remainder of the loan. These loans adjust on different schedules and based on different indices. Your lender needs to disclose these details.

7. JUMBO LOAN- Mortgages that exceed the limits established by the Federal Housing Finance Agency (FHFA). These loans are not purchased by Fannie or Freddie but they follow similar guidelines. Typically they require higher credit scores, lower income ratios, and larger down payments than conventional loans.

Let's make your home buying journey as seamless as possible. Let us be a part of your journey, contact us today!

Michael Wolff

U Mortgage - Branch Manager

CA FL NC SC TN SD AK

NMLS #239403

.

.#michaelthebroker #teamwolff #valoan #realestate #refinancingmortgage #refinance #refinancing #mortgage #whentorefinance #whentorefinanceyourhome #mortgagelenders #realestatetipsandadvice #mortgagebroker #realtortipsforhomeowners #realtortips #movingtonc #relocate #relocatingtoraleigh #firsttimehomebuyer #realtors #refinanceyourhome #refinancemortgage #realestateagent #broker #homebuyers #realtorsofinstagram #downpayment #mortgagelingo #mortgagebroker #UMortgage

0 notes

Photo

2019 FHA Loan Limit Increase | Home Buyer Tips | Ultimateonlinemortgage.com Realtor Melanie Cameron of The Cameron Team at Coldwell Banker Sea Coast Advantage in Wilmington, NC, shares the recent announcement from the ...

#2019 fha loan limit increase#Federal Housing Administration#Federal Housing Administration loan limits#fha loa...#FHA Loan Limits#joey milam alpha mortgage

0 notes

Text

Got Lousy Credit? 10 Places Where It Won’t Stop You From Buying a Home

Getty Images; realtor.com

Bad credit? No credit? No problem—or so, many of those all-too-catchy loan ads promise.

But while you might be able to finance a used car with less-than-stellar credit, getting approved for a home mortgage when you have FICO scores dwelling deep in the cellar can seem like an infinitely steeper climb. An Everest-level climb, in fact.

But here’s the shocker: It can be done, particularly if buyers know where to score a mortgage. That’s where realtor.com®’s penny-wise (but never pound-foolish) data team comes in. As it turns out, there are plenty of cities where a not-great credit score—say, well under 650—won’t stand between buyers and their dream home. And yet, in other parts of the country, buyers are delusional if they think they’re getting a mortgage without a nearly perfect score—and boatloads of cash for a down payment. We located the top metros for both.

So how do you snag a home mortgage without an excellent credit rating? It’s largely a matter of what government loan programs are available in a specific area—and those vary substantially. The U.S. Department of Agriculture, for example, sometimes offers no-money-down loans to borrowers whose scores are below 640—but only for homes in a rural ZIP code.

Federal Housing Administration loans, among the most popular government-backed mortgages, allow borrowers with credit scores as low as 500 to qualify with a 10% down payment. (They must have scores of 580 to snag loans that require only 3.5% down payments.) But plenty of sellers choose not to accept them if they have other offers.

On the exclusionary side of the equation, home prices and market hotness play leading roles in keeping credit rating requirements high. Maybe too high if you haven’t been tending to your credit like a weed-free garden.

“When you’ve got 25 offers on a house and you’re the seller, you’re more likely to take a cash buyer or a conventional loan with 20% down,” says Courtney James, owner of Urban Durham Realty in Durham, NC. (Conventional loans, not backed by a federal agency, generally require a credit score of at least 620; anything lower than 650 is considered “OK,” “poor,” or “bad” by rating agencies.)

To find out where credit-challenged buyers live out the American ideal of homeownership, we calculated the share of mortgages in the largest 200 metros* obtained with a 649 FICO score or lower. The share of mortgages was calculated over a 12-month period from July 2017 through June 2018. We limited rankings to one metro per state.

So let’s start with the feel-good news: places where would-be home buyers with poor or downright crummy credit scores can still dare to dream!

Cities where you can get a mortgage with poor credit

Tony Frenzel

1. Charleston, WV

Median home list price: $147,300

Share of borrowers with a 649 FICO score or lower: 39.1%

Charleston, WV

benedek/iStock

Although the state capital of West Virginia is a college town, the city’s overall population is aging. There’s been a big decline in chemical industry or coal jobs. That’s caused many folks to put their homes on their market.

This has opened the door for first-time buyers seeking move-in ready, three-bedroom homes near downtown, says local real estate agent Margo Teeter of Old Colony Realtors. These single-family homes start around $130,000, but can be found for less.

“We’ve got a buyer’s market,” says Teeter. Due to the relative abundance of homes on the market, she says, “our area has more motivated sellers.”

The affordable prices have led to an increase in young buyers, ranging in age from 22 to 35, who take advantage of the lower credit scores required for USDA and FHA loan programs. Most just don’t have the credit history or scores to get into other kinds of more traditional loans, says mortgage banker Joey Starcher of Victorian Finance.

2. Clarksville, TN

Median home list price: $209,950

Share of borrowers with a 649 FICO score or lower: 35%

A home in Clarksville, TN

realtor.com

This quiet, family-friendly town along the Kentucky border is best known as the home to the U.S. Army base Fort Campbell. (It’s also just 45 minutes away from Nashville.) So it makes sense that many folks are becoming homeowners with the help of Veterans Affairs loans, which require a minimum credit score of just 620.

Most of local real estate agent Laura Stasko‘s clients are scoring entry-level, three-bedroom, vinyl-sided ranch homes in suburban areas near the base. These run from about $100,000 to $130,000—a fraction of the national median home price, just below $300,000.

But buyers on a budget in Clarksville, with its quaint downtown filled with older, brick buildings, stately Victorian houses, and parks, had better act fast.

“Anything under $140,000 or $150,000 has been flying off the market,” says Stasko.

3. Corpus Christi, TX

Median home list price: $239,750

Share of borrowers with a 649 FICO score or lower: 35%

Corpus Christi has plenty of attractions for buyers: It sits on a large, shallow bay that attracts a diverse flock of water birds, songbirds, and raptors. This helped it earn the title of—you guessed it—“America’s birdiest place,” according to the San Diego Audubon Society. There are plenty of jobs in the medical, oil refinery, construction, and, with nearby tourist destinations like Mustang Island, hospitality industries.

Yet the city has the fifth-lowest credit scores in the United States, with an average of 638, according to a report by Experian.

That hasn’t stopped people from buying houses. Buyers can still find 1,200-square-foot starter homes for under $160,000 in desirable areas within Corpus Christi like Del Mar and Lindale, says local agent Monika Caldwell of Hunsaker & Associates.

In addition to FHA loans, the city promotes multiple locally and federally funded home buyer assistance grants that help out buyers with down payments of up to $10,000. Not bad!

4. Lakeland, FL

Median home list price: $229,500

Share of borrowers with a 649 FICO score or lower: 30.4%

Lakeland, FL

nikonphotog/iStock

The citrus groves and cattle ranches that used to occupy much of the land around Lakeland has been gradually overtaken by 55-plus communities and housing developments for young families. That’s because housing prices have been soaring in nearby cities such as Tampa, where they’re a median $266,250, and Orlando, where they’re $260,000, according to realtor.com data.

“Someone with poor credit … has to go where the [home] prices are lower, ” says Monique Youngblood, mortgage broker with US Mortgage Lenders. “Florida is getting really expensive, and prices in Lakeland are still pretty decent.”

Buyers can find new homes in South Lakeland for around $180,000, says local Realtor® John Martinez of Coldwell Banker Residential Real Estate. Older properties from the 1970s start around $140,000. To afford them, most of Martinez’s clients are using FHA loans that require only about 4% or so down of the purchase price.

5. Augusta, GA

Median home list price: $218,000

Share of borrowers with a 649 FICO score or lower: 26.5%

Augusta, GA

SeanPavonePhoto/iStock

It’s easier to become a homeowner in Augusta, on the banks of the Savannah River, because home prices are just so much cheaper here than in much of the rest of the country.

Three-bedroom, two-bathroom homes in the millennial-friendly neighborhood of National Hills, right near the prestigious Augusta National Golf Club, can be picked up for $100,000 to $150,000. That’s good news for young buyers, many of whom haven’t had the time to build a strong credit history.

Local lenders offer competitive loan programs encouraged by the Community Reinvestment Act, designed to help buyers in low- to moderate-income Census tracts. Those programs require a minimum credit score of 620 and can include 100% financing for those who qualify.

“I do as many of those as I can,” says Brandon Mears, mortgage loan officer with South State Bank. “It’s a really great program for kids just coming out of college.”

Rounding out the metros with the highest share of mortgage borrowers with poor credit are Evansville, IN (at 26.3%); Tuscaloosa, AL (at 25.2%); Rockford, IL (at 25%); Youngstown, OH (at 24.9%); and Kalamazoo, MI (at 24.4%).

Got it? Now the bad news for those who dread logging onto Credit Karma: the housing markets where you need sterling credit just to compete.

Cities where you need good credit to get a mortgage

Tony Frenzel

1. Santa Cruz, CA

Median home list price: $936,050

Share of borrowers with a 649 FICO score or lower: 4.3%

A three-bedroom home in Santa Cruz

realtor.com

The market in Santa Cruz may not be quite as crazy as it is just over the hill in San Jose (where homes are a median list price of $998,000). But this Ferris wheel–graced beach town is still prohibitively expensive for many buyers, especially those with low credit. Those seeking mortgages are likely to need a jumbo loan—and thus a higher credit score and down payment.

“You might be able to find a small two-bedroom, one-bath house here in the low $800,000s,” says real estate agent Bri Chmel of Live Love Santa Cruz. That’s if you’re very, very lucky.

So buyers in this market, one of the sunniest spots along California’s northern coast, had better be ready to compete with all-cash offers from ultrawealthy, Silicon Valley techies. Best of luck with that.

2. Fargo, ND

Median home list price: $257,050

Share of borrowers with a 649 FICO score or lower: 5.4%

Fargo, ND

DenisTangneyJr/iStock

Wait, what? How did Fargo make it to this side of the list? It’s all about growth. Set on the Great Plains on the western edge of the Red River, Fargo has a bustling job market that’s led to an influx of new residents in recent years. The population jumped 15.9% from 2010 to 2017, according to the U.S. Census. That’s led to a lot of folks competing for a limited number of abodes.

Buyers are snapping up entry-level homes under $200,000 like seagulls stealing Cheez-Its on the beach. Because the market is so hot, sellers are passing over buyers who have a harder time getting a loan. Larger down payments and conventional loans (requiring a minimum 620 credit score) are usually needed to be considered for a contract.

Seller’s agents are seeking pre-qualification letters that prove that buyers have already gone through all the steps to get approved by the bank. And when it comes to older homes, many sellers prefer to avoid FHA loans altogether to avoid the more stringent loan appraisal process.

“Sellers here can be pickier about how they want their home financed,” says John Colvin, broker-owner of Century 21 FM Realty.

3. Ann Arbor, MI

Median home list price: $350,000

Share of borrowers with a 649 FICO score or lower: 6%

Ann Arbor, home of the University of Michigan, is the quintessential college town, dotted with circa 1900 brick and wood-frame homes. In fact, it’s the most educated city in the United States, according to an analysis by WalletHub. That level of education correlates to above-average home prices, with $250,000 to $450,000 as the entry-level range.

That high starting point and lack of inventory make it hard for buyers to get in unless they have the income and credit to qualify for a conventional loan.

“It’s hard to get a home in Ann Arbor without very good credit,” says broker Marge Everhart of the Marge Everhart Co. “I haven’t seen an FHA mortgage in years. Poor people are getting pushed out.”

4. Durham, NC

Median home list price: $356,300

Share of borrowers with a 649 FICO score or lower: 7.2%

A four-bedroom home in Durham

realtor.com

Every Tuesday, when James, the Urban Durham Realty owner, asks her 25 agents to raise a hand if they’ve put in or received offers on homes for their clients in the past week, almost all hands are in the air. When she asks those agents if they were involved in a multiple-offer situation, most hands remain raised.

“This is unprecedented,” says James. “Anything under $350,000 gets a lot of offers.”

The university town, one point of North Carolina’s Research Triangle, is a hub for the biotech industry and boasts a thriving startup culture while remaining relatively affordable. Just 10 minutes away from downtown in Southwest Durham, buyers have been trying to outbid one another on classic midcentury, brick, ranch-style homes in the midrange market of $350,000 to $400,000.

A bit farther out in more affordable North Durham, 10-year-old homes are going for about $250,000—if you can get an offer accepted.

“There are not a lot of FHA loan deals,” says James.

5. Boulder, CO

Median home list price: $612,550

Share of borrowers with a 649 FICO score or lower: 7.3%

Pearl Street Mall in Boulder

SWKrullImaging/iStock

On the edge of the Flatiron Mountains, Boulder boasts beautiful panoramas befitting a Coors ad. It regularly pops up on lists of the best places to live for its high quality of life, and plentiful gigs. These things just keep driving up the cost of real estate.

Most buyers need to be able to meet the strict requirements and high credit scores for a jumbo loan. With a jumbo loan limit of $587,000, buyers need to have a hefty downpayment, too.

Boulder is “surrounded by open space, but home prices have gone through the roof,” says Kelly Moye, broker with Re/Max Alliance and spokesperson for the Colorado Association of Realtors. They’ve risen 25% in just three years, from August 2015 to August 2018. “It’s unaffordable: People who need to get jumbo loans have to have exemplary credit.”

Finishing up the list of places with the lowest share of mortgage borrowers with 649 FICO scores or lower are Madison, WI (at 7.5%); Honolulu (at 8%); Minneapolis (at 8.3%); Boston (at 8.6%); and Provo, UT (at 8.6%).

* Metropolitan areas typically include the urban core of a city and surrounding smaller towns and cities.

The post Got Lousy Credit? 10 Places Where It Won’t Stop You From Buying a Home appeared first on Real Estate News & Insights | realtor.com®.

from https://www.realtor.com/news/trends/10-cities-where-poor-credit-isnt-stopping-home-buyers/

0 notes

Text

Iconic Mortgage Corp

https://iconicmortgage.com

1444 Biscayne Blvd, Miami, FL 33132, United States

(800) 916-0449

Our company has been helping Americans build and secure their future for years. All Loan officers on our team are top professionals, united by our corporative values of integrity, reliability, and simplicity.

Our team goal is to become the first-choice lender for consumers by being an organization that operates on the sound principles of outstanding ethics, transparency, and value. Our commitment is to be the best-in-class with integrity and take accountability and ownership to deliver excellent quality and flawless execution. We find the best mortgage rates and terms for each customer’s situation. We are constantly seeking to improve our services and educate our customers consistently.

Iconic Mortgage Corp. (NMLS # 1547953) specializes in Government (FHA and VA) Streamline refinances. We are licensed in MD, VA, DE, PA, NC, AL, TN, GA, NM, KY, FL, and CA. Recently, we diversified our mortgage products in order to compensate for an ever changing Industry. We are one of the few actual Mortgage Lenders that has been able to survive the extravagant changes that have occurred during the Mortgage Crisis, which began in September of 2007 of which we worked under Service 1st Mortgage Inc. http://nmlsconsumeraccess.org/

Iconic Mortgage now offers seasoned Loan Officers and a variety of products including but not limited to: FHA and VA (Refinance and Purchase). As a leader in the industry our name serves us well. We believe in Servicing our clients with respect, options and knowledge.

1 note

·

View note

Video

youtube

5 tips for home buyers who want to make a competitive offer HOME LOANS James Graff 732 -500-6883

5 Tips for Homebuyers Who Want to Make a Competitive Offer Today’s real estate market has high buyer interest and low housing inventory. With so many buyers competing for a limited number of homes, it’s more important than ever to know the ins and outs of making a confident and competitive offer. Here are five keys to success for this important stage in the homebuying process. 1. Listen to Your Real Estate Agent A recent article from Freddie Mac offers guidance on making an offer on a home in today’s market. Right off the bat, it points out how emotional this can be for buyers and why trusted professionals can help you stay focused on the most important things: “Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.” Your real estate professional should be your primary source for answers to the questions you have when you’re ready to make an offer. 2. Understand Your Finances Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to reach out to your lender to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. It shows sellers you’re a serious, qualified buyer and can give you a competitive edge if you enter a bidding war. 3. Be Ready to Move Quickly According to the Realtors Confidence Index, published monthly by the National Association of Realtors (NAR), the average property being sold today is receiving more than three offers and is only on the market for a few weeks. These are both results of today’s competitive market, showing how important it is to stay agile and vigilant in your search. As soon as you find the right home for your needs, be prepared to work with your agent to submit an offer as quickly as possible. 4. Make a Fair Offer It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t submit an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive: “Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.” 5. Be a Flexible Negotiator After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. Your position can be strengthened with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). There are, however, certain contingencies you don’t want to forego. Freddie Mac explains: “Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.” Today’s competitive market makes it more important than ever to make a strong offer on a home, and a trusted expert can help you rise to the top along the way. FREE Guides: Home Buying-https://bit.ly/33UTW2K Home Selling-https://bit.ly/3mTvLuv FREE “INSTANT” HOME VALUE: http://HomeValuesWithAdvisorsJG.com PREQUALIFY for loan: https://bit.ly/2GuyvgQ APPLY for loan: https://bit.ly/2HH6cwi 732-500-6883 https://JGraff.AdvisorsMortgage.com/contact https://facebook.com/nmls1974758 FREE MORTGAGE CALCULATORS: https://JGraff.AdvisorsMortgage.com/calculators FREE current copy of my periodical eMag: "HOME LOANS NEWS": https://1drv.ms/u/s!Al3KFhVmz0hu8zVpDugzDgdYmOiv?e=RMwEP1 IM me for a FREE subscription "I wrote the book on home loans...;o)" - James H. Graff FREE "beta/test" copy of my new 70+ page, pdf Ebook "HOME LOANS: LINKS to lots of FREE guides, tips, info, advice... FREE copy: https://1drv.ms/u/s!Al3KFhVmz0hu8zh4BHmqfOrEdO9U?e=2kbvT4 HOME LOANS James Graff NMLS# 1974758 Advisors Mortgage Group, L.L.C. NMLS# 33041 2899 Highway 35 North Hazlet N.J. 07730 In 34 states of The United States of America: AZ CA CO CN DE D.C. FL KS KY IL IN ME MD MA MI MN NJ NY NC OH OR PA RI SC SD TX VT VA WA WV Cash out refinance, debt consolidation, renovation loan, reverse mortgage, pre-qualify, pre-approval letter, FHA VA USDA HELOC HECM FNMA Fannie Mae FHLMC Freddie Mac... #mortgages #mortgage #marketupdate #refinance #homebuying #realestate #homeownership #advisors #marketupdates #homeloan #homeloans #debtconsolidate #realtor #realestateagent #agent #mortgagecalculator

0 notes

Text

New First Time Home Buyer Program in NC

New First Time Home Buyer Program in NC

There’s a new $8000 First Time Home Buyer Program in NC that will become available on March 1, 2018. It is a unique program that will be available in every NC county. There are pros and cons to all of the First Time Home Buyer programs offered, and we will try and highlight those. First Time Home Buyer Program in NC There are multiple First Time Home Buyer Programs available in NC. Some of…

View On WordPress

#8000 down payment#conventional loans#Down payment Assistance#FHA LOANS#First Time Home Buyer Program NC#loan limits#mcc#minimum credit score#student loan debt

0 notes

Text

How Much Downpayment Do You Need To Buy A Home in Charlotte NC?

Buying a house is a significant financial investment, but once you've found the home of your dreams, you'll need to figure out how much of a down payment you want to make. Most home buyers believe that buying a house requires a 20% down payment. However, you may only need a down payment of as little as 3.5 percent to buy a home in Charlotte, NC. In fact, you may need no down payment at all. The times have changed, and a smaller down payment is now possible. Smaller down payments are even encouraged in certain situations.

At the same time, a larger down payment will help in various cases. There are many variables to consider when deciding how much money you'll need to buy a home. When it comes to the down payment, there are several factors to consider before settling on the amount.

What is a down payment?

A down payment is money paid on your mortgage up front. It's usually expressed as a percentage of the total price. You make this payment, and pay the seller, but it always seems as though you're paying the mortgage lender. Keep in mind that most lenders will only approve you for a mortgage if you have at least a down payment.

A down payment gives you certain ownership or equity in the property before you start paying your mortgage, while the mortgage lender covers the rest of the cost. While most mortgages require a down payment, certain public sector loans do not.

Is it possible to get help with the down payment?

You should look at down payment help services if you meet either of the following criteria:

You’re buying a house under certain sale price limits

You’re a first or second-time home buyer who meets certain income limits.

Since most plans need only a 3.5 percent down payment, you can keep more money in your wallet for future home expenses or increase your current down payment. You can also inquire about any down payment help services offered by your town or city government, as well as any local nonprofits that provide housing options.

Is it possible to get a loan with a low to no down payment?

You may want to look at government-backed loans if you want a mortgage with a low down payment or no down payment at all. Conventional loans can allow for down payments of less than 20% with PMI, but do not allow for zero down payments. The government guarantees government-backed loans, making them less costly for lenders to approve. Due to lower risks, lenders will offer lower interest rates and more flexible down payment conditions.

Loans from the Federal Housing Administration (FHA).

The government guarantees FHA loans, have low down payments. You may get an FHA loan with as little as a 3.5 percent down payment.

Loans from the Veterans Administration (VA).

The Department of Veteran Affairs insures VA loans, which are open to qualifying active and former military service members, as well as their spouses. VA loans, in many situations, do not need a down payment.

Loans from the United States Department of Agriculture (USDA).

USDA's loans don't need a downpayment. These loans are part of the Department of Agriculture's Rural Development Program. These loans are available to homebuyers in rural areas. They must meet other criteria as well.

Is a 20% deposit required for Charlotte NC Downtown Real Estate?

There are tighter conditions for certain loan programs than for others. You have other choices if you don't want to put down 20%, as detailed below. If you can afford a bigger down payment, you'll definitely get some benefits.

The benefits of a large down payment:

You may negotiate a lower rate.

You can save money on interest over the term of the loan.

You'll have more equity to begin with.

You'll save money on your monthly bill.

It's possible that you'll stop paying PMI.

It's possible that sellers would prefer to work with you.

Paying down 20% or more will get you a higher chance of getting accepted and receiving a better interest rate. When you make a high down payment, it lessens the risk for lenders. This will benefit you, because you will be paying less interest. Furthermore, putting down a greater down payment means borrowing less money from the lender, which means paying less interest.

If you can put down at least 20%, you can prevent paying for private mortgage insurance (PMI), which protects the lender in the event you default on your loan, and is usually needed when the down payment is less than 20%. If you don't put down too much money at the outset, you can always ask to remove the PMI. This is after you've paid off enough of your mortgage to reach 20% equity.

The drawbacks of a large down payment:

You'll be taking on more financial pressure.

You won't put as much money into other expenses.

You may not buy a home as fast as you'd like.

Making a large down payment can leave you with much less money afterwards. If you put more money down at the outset, you won't immediately get it back, and you won't have as much money left if other expenses arise.

Saving money for a down payment also takes longer than having a mortgage with little to no money down. If you're in a rush to buy a house in Charlotte NC, you may not want to put in the effort to save.

How much cash do you need to buy a home?

Aside from the down payment, there are other costs in the actual listing price of a house. These include the closing costs, which include earnest deposit, the land inspection and valuation, as well as title insurance and a part of the property taxes.

How much money have you saved so far?

It's time to take stock of your savings before even worrying about a down payment. If you've been looking for a home for a while, you've already started saving for a down payment. Assess how much you've been able to save over time, and how much of it you're willing to give up. When purchasing a home, you must factor in costs including closing and moving costs, as well as ensuring that you have some savings after paying the down payment.

What's the best amount to put down?

Selecting a smaller down payment can allow you to buy a home faster and have more money available for other expenses or emergencies, while making a larger down payment will save you money in the long run. It's critical to consider your personal circumstances when deciding how much down payment to represent and what type of loan you should apply for.

Experiment with a mortgage calculator to get a better understanding of what the payments would look like with various down payments. This will show you how down payment amounts affect your monthly mortgage payment.

What is Nancy Braun Real Estate?

If you’ve been looking for Charlotte Homes for Sale for some time, I bet you’d love it if someone with expertise could help you realize your real estate dream. You’ll need a trustworthy Real Estate company to answer all your queries.

Nancy Braun is a strong leader and committed to her profession. She aims to provide the best possible real estate service to her clients. Nancy founded Showcase Realty in 2008 and became the top real estate agent in Charlotte, NC. Showcase Realty LLC, specializes in Charlotte NC homes for sale, Charlotte NC condos for sale, Charlotte NC investment properties, foreclosures, short sales, luxury homes for sale in Charlotte, NC, and the surrounding parts of South Carolina.

Showcase Realty is a talented team of agents with a passion for innovation and will help you find a home or sell yours. Showcase prides itself on exceeding its customers' expectations and delivering professional service every time.

If you need help from a knowledgeable and experienced professional, please contact Nancy Braun, one of the best real estate agents in Charlotte NC. She can assist you in determining which direction is best for you. Speak with one of our real estate experts today! Learn how to achieve your real estate goals. Call, 704-997-3794.

0 notes

Text

2020 FHA Mortgage Loan Limits for all the Counties in North Carolina (NC)

from ABLEnding https://ift.tt/2tjM9gl

via IFTTT

0 notes