#arizona va loans

Text

Understanding the VA Loan Application: What You Need to Know

in the word count

Understanding the VA Loan Application: What You Need to Know

The VA loan application process can be intimidating for many veterans and military personnel. It is important to understand the process and the requirements in order to make the most of the benefits available to you. This article will provide an overview of the VA loan application process and what you need to know in…

View On WordPress

#Application#best Mortgage Tips#Loan#Mortgage#Mortgage Tips#mortgage tips 2023#mortgage tips canada#mortgage types#news Mortgage#Understanding#va loan application#va loan arizona

0 notes

Text

Building Your Dream Home in Arizona: A Guide to Home Construction Loans

A fixed rate home loan in Arizona is a type of mortgage where the interest rate remains the same for the entire loan term. This means that the monthly payments for the loan will also remain the same. This type of loan is popular among borrowers because it provides stability and predictability in terms of their monthly mortgage payments.

When it comes to home construction loans in Arizona, a fixed rate loan can be a great option for borrowers who want to build their own home. This is because with a fixed rate loan, borrowers can budget for their monthly mortgage payments and have peace of mind knowing that their interest rate will not change over time.

One of the biggest advantages of a fixed rate home loan is that it protects borrowers from interest rate increases. This is important because if interest rates were to rise, the monthly mortgage payments would also increase, which could make it difficult for borrowers to afford their mortgage. With a fixed rate loan, borrowers can lock in a low interest rate and have the peace of mind knowing that their monthly mortgage payments will not change.

Another advantage of a fixed rate home loan is that it can be easier to budget for. With a fixed rate loan, borrowers know exactly what their monthly mortgage payments will be, which makes it easier for them to plan for other expenses. This is especially important for borrowers who are building their own home, as construction can be a complex and costly process.

However, it's important to keep in mind that fixed rate home loans often come with a higher interest rate than adjustable rate mortgages. This means that borrowers may end up paying more in interest over the life of the loan. Additionally, borrowers who plan to sell their home or refinance within a few years may not benefit as much from a fixed rate loan.

When it comes to home construction loans in Arizona, borrowers will typically need to have a good credit score, a steady income, and a down payment of at least 20%. Borrowers will also need to provide detailed construction plans and a budget for the construction project. Once approved, the lender will disburse funds in stages, usually based on the completion of certain milestones during the construction process.

Overall, a fixed rate home loan in Arizona can be a great option for borrowers who want to build their own home. This type of loan provides stability and predictability, which can make it easier for borrowers to budget for their mortgage payments and manage the costs of construction. However, borrowers should keep in mind that fixed rate loans come with a higher interest rate than adjustable rate mortgages and may not be the best option for those who plan to sell their home or refinance within a few years.

What is the benefit about mortgage refinancing in arizona

Mortgage refinancing in Arizona can provide several benefits for homeowners. Some of the most common reasons for refinancing include:

1, Lowering the interest rate: One of the main benefits of refinancing is the potential to lower the interest rate on the mortgage. A lower interest rate can result in lower monthly mortgage payments, which can save homeowners thousands of dollars over the life of the loan.

2. Shortening the loan term: Refinancing can also allow homeowners to shorten the loan term of their mortgage. This can result in paying off the mortgage faster and saving money on interest in the long run.

3. Cash-out refinancing: Some homeowners may choose to refinance their mortgage in order to take out cash from their home equity. This can be used for home improvements, debt consolidation or other expenses.

4. Converting an adjustable rate mortgage to a fixed rate mortgage: If a homeowner has an adjustable rate mortgage (ARM), refinancing can allow them to convert it to a fixed rate mortgage. This can provide stability and predictability in terms of monthly mortgage payments.

5. Changing the loan type: Refinancing can also allow homeowners to change the loan type, for example from a Conventional loan to a FHA loan which may have more flexible terms and lower down payment requirement.

It's important to keep in mind that refinancing may not be the best option for everyone. The costs associated with refinancing, such as closing costs and appraisal fees, can add up and may outweigh the potential savings. Additionally, homeowners may not see significant savings if they plan to move or sell their home in the near future. It's important to carefully consider the costs and benefits of refinancing and to speak with a mortgage lender to determine if it is the right decision for your specific situation.

0 notes

Text

Are you planning to be the first time home buyer in Maryland ? Call 800-826-5077 now

Are you planning to be the first time home buyer in Maryland ? Call 800-826-5077 now

View On WordPress

#first time home buyer#First Time Home Buyer Ashton#First Time Home Buyer Barnesville#First Time Home Buyer Maryland#hard money loan alaska#hard money loan arizona#VA Loan

1 note

·

View note

Text

Ranking the Best Mortgage Brokers in the State

Arizona's real estate market is booming, with more people looking to buy homes than ever before. However, navigating the complex world of mortgages can be daunting. That's where mortgage brokers come in. These professionals act as intermediaries between borrowers and lenders, helping you find the best loan options for your needs. In this article, we'll explore the role of mortgage brokers in Arizona and highlight some of the best brokers in the state.

Understanding the Role of Mortgage Brokers

The Best Mortgage Brokers Arizona are professionals who help borrowers find the right mortgage products and lenders for their needs. These brokers work with a variety of lenders to offer borrowers a range of options and help them navigate the mortgage process from application to closing. Mortgage brokers play a crucial role in the home buying process. Unlike loan officers who work for a specific lender, brokers work independently and have access to a wide range of lenders and loan products. This means they can shop around on your behalf to find the best loan terms and interest rates. Additionally, brokers can help you navigate the often complex mortgage application process, ensuring you meet all the necessary requirements.

Read more - Mortgage and Refinance Rates in Arizona

Criteria for Selecting the Best Mortgage Brokers

When choosing a mortgage broker, it's essential to consider several key factors:

Experience and Reputation: Look for brokers with a proven track record of success and positive reviews from past clients. Experience matters when it comes to navigating the intricacies of the mortgage market.

Range of Lenders and Loan Options: The best mortgage brokers in Arizona will have access to a diverse array of lenders and loan products, ensuring that you have options tailored to your specific needs.

Customer Service: A broker's level of customer service can make a significant difference in your mortgage experience. Seek out brokers who prioritize communication, transparency, and responsiveness.

Fees and Costs: Understand the fee structure of any broker you're considering. While some brokers charge upfront fees, others earn their commission from lenders. This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans. Make sure you're comfortable with the costs involved before committing to a broker.

Tips for Working with a Mortgage Broker

When working with a mortgage broker, it's important to be prepared. Have all your financial documents ready, including pay stubs, tax returns, and bank statements. Additionally, be honest about your financial situation and goals. This will help your broker find the best loan options for you.This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans.

Finally, stay in communication with your broker throughout the process. This will ensure that everything goes smoothly and that you're able to close on your loan on time.

Finding the right mortgage broker in Arizona can make all the difference when buying a home. By following the tips outlined in this article and choosing one of the top brokers in the state, you can streamline the home buying process and secure the best loan terms possible. Contact a reputable broker today to start your journey towards homeownership in Arizona.

Frequently Asked Questions

1. What is a mortgage broker, and how do they differ from lenders?

A mortgage broker is a licensed professional who acts as an intermediary between borrowers and lenders. Unlike lenders, who provide loans directly to borrowers, mortgage brokers work with multiple lenders to find the best loan options for their clients.

3. Why should I use a mortgage broker instead of going directly to a bank?

Mortgage brokers can shop around on your behalf to find the best loan terms and interest rates from multiple lenders, saving you time and potentially money.

4. What criteria should I consider when choosing a mortgage broker?

Look for a broker with experience in the Arizona real estate market, a strong network of lenders, positive client testimonials, and all necessary licensing and certification.

5. How do mortgage brokers get paid?

Mortgage brokers typically receive a commission from the lender once the loan is closed. This commission is usually a percentage of the loan amount.

6. How long does the mortgage process typically take when working with a broker?

The timeline for the mortgage process can vary depending on factors such as the complexity of your financial situation and the lender's requirements. A mortgage broker can provide a more accurate estimate based on your specific circumstances.

7. Are there any advantages to using a local mortgage broker in Arizona?

Working with a local mortgage broker can offer several benefits, including their familiarity with the local market and regulations, personalized service, and the ability to meet face-to-face if desired.

8. Can I use a mortgage broker for refinancing my existing mortgage?

Yes, mortgage brokers can assist with refinancing your existing mortgage. They can help you explore refinancing options to potentially secure a lower interest rate, reduce your monthly payments, or change the terms of your loan.

9. What should I expect during the mortgage application process with a broker?

Your broker will help you gather all necessary documents, submit your application to lenders, and communicate with you throughout the process to ensure everything goes smoothly.

10. How can I find the best mortgage broker in Arizona for my needs?

Research brokers online, ask for recommendations from friends or family, and schedule consultations with potential brokers to discuss your needs and goals.

Get in touch

Website – https://homeloansproviders.com/

Mobile – +91 9212306116

Whatsapp – https://call.whatsapp.com/voice/9rqVJyqSNMhpdFkKPZGYKj

Skype – shalabh.mishra

Telegram – shalabhmishra

Email – [email protected]

#home mortgage company in Arizona#best mortgage refi company in Arizona#online mortgage company in Arizona

0 notes

Text

Arizona Veterans Helping Veterans®

Veterans and Military Members frequently face a unique set of concerns when buying or selling a home, especially when the transaction involves a VA loan. Don’t let anyone tell you that the process is confusing, difficult or stressful. We believe that it never needs to be that way!

#liveinsunnyaz#yourvalleyproperty#buyingahome#azvhv#contactme#golfarizona#arizona#billsalvatore#youtube#home

0 notes

Text

Overview of BOK Mortgage Rates

As a man-made intelligence language model, I don't have ongoing admittance to current home loan rates or explicit data about individual home loan programs presented by unambiguous moneylenders like BOK Monetary. Be that as it may, I can give you an overall outline of home loan rates and a few key contemplations while evaluating contract contributions. It's constantly prescribed to visit the authority site of BOK Monetary or reach them straightforwardly for the most exceptional and exact data in regards to their home loan rates, plans, and elements.

Overview of BOK Mortgage Rates

Outline:

BOK Monetary is a monetary administrations organization that offers a scope of banking and loaning administrations, including contract credits. They give home loans to people to home buys or renegotiating existing home loans.

Realities:

BOK Monetary is a territorial bank and works basically in states like Oklahoma, Texas, Arkansas, Colorado, Kansas, New Mexico, and Arizona.

They offer different home loan items, including typical mortgages, FHA credits, VA advances, USDA advances, and kind sized credits.

The particular home loan rates, plans, and elements presented by BOK Monetary can shift over the long run and rely upon economic situations and individual borrower capabilities.

Highlights:

Contract choices: BOK Monetary gives different home loan choices to take care of the assorted necessities of borrowers, including fixed-rate contracts and movable rate contracts (ARMs).

Pre-capability and application process: They probably offer a pre-capability process where potential borrowers can evaluate their qualification and gauge the credit sum they might meet all requirements for. The application interaction regularly includes gathering monetary documentation and presenting an application for audit.

Online record the executives: BOK Monetary might offer web-based devices or stages for borrowers to deal with their home loan accounts, make installments, and access pertinent data.

Plans:

The particular home loan plans accessible through BOK Monetary will rely upon different factors, for example, advance sort, credit term, and borrower capabilities.

Borrowers can normally look over changed credit terms, for example, 15-year or 30-year contracts, contingent upon their monetary objectives and inclinations.

Geniuses:

Neighborhood mastery: BOK Monetary works in unambiguous districts, which might give a restricted comprehension of the real estate market and borrower needs.

Scope of home loan items: They offer different advance projects, including government-supported credits like FHA and VA advances, which can be advantageous for borrowers who fit the bill for those projects.

Potential client benefits: BOK Monetary could give explicit advantages or limits to existing clients or those with different associations with the bank.

Cons:

Restricted topographical presence: BOK Monetary fundamentally works in select states, and that implies their home loan contributions may not be accessible from one side of the country to the other.

Restricted data without direct reach: It means quite a bit to contact BOK Monetary straightforwardly or visit their site to get nitty gritty data about their ongoing home loan rates, charges, and qualification necessities.

Rates and terms subject to change: Home loan rates are impacted by economic situations and can change as often as possible. The particular rates and terms you fit the bill for will rely upon variables, for example, reliability, credit sum, initial installment, and different elements.

To assemble precise and exceptional data about BOK Monetary's home loan rates, plans, and highlights, I suggest visiting their authority site or reaching them straightforwardly. They can give customized direction and data in light of your particular circumstance and area.

0 notes

Text

Mortgage Lender Company Arizona

Welcome to Sun American Mortgage Company, where we make the dream of homeownership a reality. Our website is your one-stop-shop for all your mortgage needs, whether you're a first-time homebuyer or a seasoned investor.

We understand that the mortgage process can be daunting, which is why we've created a user-friendly website that provides you with all the information you need to make informed decisions. You can learn about the various mortgage products we offer, such as conventional loans, FHA loans, VA loans, and jumbo loans, and determine which one is right for you.

Our website also allows you to apply for a mortgage online, so you can get the ball rolling from the comfort of your own home. And if you have any questions along the way, our experienced loan officers are just a phone call or email away.

At Sun American Mortgage Company, we're committed to providing our clients with exceptional customer service and competitive rates. We believe that everyone deserves the opportunity to own their own home, and we're here to help make that happen.

To know more about Mortgage Lender Company Arizona just click here.

0 notes

Text

The Loan Store Acquires Homepoint’s Wholesale Operations – theMReport.com

New Post has been published on https://petn.ws/qWYH5

The Loan Store Acquires Homepoint’s Wholesale Operations – theMReport.com

Ann Arbor, Michigan-based Homepoint has entered into a definitive agreement to sell certain assets of the company’s wholesale originations channel to The Loan Store Inc., a national wholesale lender headquartered in Tucson, Arizona. Founded in 2019, The Loan Store is a provider of conventional, jumbo, VA, and non-QM offerings. “Due to the tremendous effort of […]

See full article at https://petn.ws/qWYH5

#PetFinancialNews

0 notes

Text

Counting Crows & Dashboard Confessional Tour

Counting Crows and Dashboard Confessional are touring together.

06/13 – Omaha, NE @ Steelhouse Omaha

06/17 – Indianapolis, IN @ TCU Amphitheater at Winter River State Park ^&

06/18 – Cincinnati, OH @ PNC Pavilion ^&

06/21 – Milwaukee, WI @ Miller High Life Theatre ^&

06/23 – Highland Park, IL @ Ravinia Festival

06/24 – Sterling Heights, MI @ Michigan Lottery Amphitheatre at Freedom Hill ^&

06/26 – Moon Twp, PA @ UPMC Events Center ^&

06/28 – Niagara Falls, ON @ OLG Stage at Fallsview Casino ^&

06/29 – Northfield, OH @ MGM Northfield Park ^&

07/01 – Syracuse, NY @ St. Joseph’s Health Amphitheater at Lakeview ^&

07/02 – Canandaigua, NY @ CMAC ^&

07/05 – Saratoga Springs, NY @ Saratoga Performing Arts Center ^&

07/06 – Holmdel, NJ @ PNC Bank Arts Center ^&

07/08 – Wantagh, NY @ Northwell Health at Jones Beach Theater ^&

07/09 – Bethel, NY @ Bethel Woods Center for the Arts ^&

07/12 – Columbia, MD @ Merriweather Post Pavilion ^&

07/14 – Gilford, NH @ Bank of New Hampshire Pavilion ^&

07/15 – Boston, MA @ Leader Bank Pavilion ^&

07/18 – Providence, RI @ Providence Performing Arts Center ^&

07/19 – Bridgeport, CT @ Hartford HealthCare Amphitheater ^&

07/21 – Bethlehem, PA @ Wind Creek Event Center ^&

07/22 – Atlantic City, NJ @ Borgata Event Center ^&

07/25 – Selbyville, DE @ Freeman Arts Pavilion ^&

07/26 – Doswell, VA @ The Meadow Event Park ^&

07/28 – Virginia Beach, VA @ Veterans United Home Loans Amphitheater at Virginia Beach ^&

07/29 – Raleigh, NC @ Red Hat Amphitheater ^&

08/01 – Charlotte, NC @ Skyla Credit Union Amphitheatre ^&

08/02 – Charleston, SC @ Credit One Stadium ^&

08/04 – Fort Myers, FL @ Suncoast Credit Union Arena ^&

08/05 – Fort Lauderdale, FL @ Hard Rock Live ^&

08/08 – St Augustine, FL @ The St. Augustine Amphitheatre ^&

08/09 – Tampa, FL @ MIDFLORIDA Credit Union Amphitheatre ^&

08/11 – Alpharetta, GA @ Ameris Bank Amphitheatre ^&

08/12 – Albertville, AL @ Sand Mountain Amphitheater ^&

08/14 – Nashville, TN @ Grand Ole Opry ^&

08/18 – New Orleans, LA @ Saenger Theatre v

08/19 – Sugar Land, TX @ Smart Financial Centre at Sugar Land ^&

08/22 – San Antonio, TX @ Majestic Theatre ^&

08/23 – Irving, TX @ The Pavilion at Toyota Music Factory ^&

08/25 – Norman, OK @ Riverwind Casino ^&

08/26 – Tulsa, OK @ The Cove ^&

08/30 – Highland, CA @ Yaamava’ Theater ^

08/31 – Phoenix, AZ @ Arizona Financial Theatre &

09/02 – Las Vegas, NV @ Pearl Theater &

09/03 – San Diego, CA @ The Rady Shell at Jacobs Park &

09/06 – Los Angeles, CA @ YouTube Theater ^&

09/08 – Lincoln, CA @ The Venue at Thunder Valley ^&

09/10 – Berkeley, CA 2 The Greek Theatre ^&

09/13 – Airway Heights, WA @ BECU Live Outdoor Venue ^&

09/14 – Bend, OR @ Hayden Homes Amphitheater ^&

09/16 – Seattle, WA @ TBD

09/17 – Seattle, WA @ TBD

09/19 – Bonner, MT @ KettleHouse Amphitheater ^&

09/21 – Boise, ID @ Ford Idaho Center Amphitheater ^&

09/22 – Salt Lake City, UT @ USANA Amphitheatre ^&

09/25 – Morrison, CO @ Red Rocks Amphitheatre ^&

^ Dashboard Confessional

& Frank Turner

---

Please consider becoming a member so we can keep bringing you stories like this one.

◎ https://chorus.fm/news/counting-crows-dashboard-confessional-tour/

0 notes

Text

Career Paths

It's all here. The mellowness. The people, it's secluded from everything yet has such a profound impact on the world. It has me thinking of what career I still want to pursue. Why can't I become a research scientist at Google and also do real estate on the side? Make two incomes? Check! Passive Income? Check! Like my job and where I work? Even Bigger Check! It's going to take time to get there, that's for certain. However, I got a plan to get there.

Raytheon

Will start off by seeing which programs I get accepted into for masters. While I do that, I'm also going to make sure I have all the paperwork I need. From UTSA, from Dr. Bonnefill, from the SATX doctor and so forth in order to get my discharge upgraded. While still at Raytheon, I'll pay off my car, Upgrade, Conns, Credit Card Debt, and any other lingering debt I may have not noticed. Also, I'll make sure to instead of contributing to my Roth IRA, start by paying down my student loans first thing with the employer contribution. Along with having Raytheon pay for my masters degree. While doing so, I will learn data structures and algorithms like the back of my hand, hell I even teach the damn thing at classes in Raytheon. I'll learn the material from NeetCode.io and also read up on it in my leisure. I'll keep saving my cash and be frugal, cowboy frugal, to an extent and then pursue my Ph.D. I'll apply to plenty of fellowships, along with having great recommendation letters from people I've met along the way. Also, I will constantly be taking classes at The University of Arizona in order to better keep up with the academic rigor and keep myself disciplined.

Ph.D.

Here we go, a four year journey, or more. What will it entail? What will be of interest to me in order to study later on the route of academia before Google? Distributed Systems Disk density? Maybe, as this seems like a compelling topic to me. What if we can push disk redundancy and disk erasure coding to it's absolute limits with respect to normalcy, and see where it takes us before we need to shift sights back on disk density? I'll have enough money saved up for myself from Raytheon to support myself throughout my Ph.D. Every week I'll get a haircut to get pampered, have enough stowed away for Carl and Clyde, six months of savings saved up just in case and so forth.

Google

Here we go, this is it. I start applying to Google for internships during the summer and fall and end up securing them each time there. Carl, Clyde and I regularly will hitch a ride to Mountain View where we spend our time at a sublet (nice one), and are able to do research while saving up the cash Google gives us. After I defend my Ph.D. thesis, I then have a spot at Google ready for me as a Research Scientist!!! YESSSS!!!!!! This is only the beginning though. I'm going to live in Santa Clara and then start doing research and saving up for homes. This is it! This is where everything begins. By now I already my VA Home Loan ready. I'm living in an apartment in beautiful Santa Clara and am able to purchase a duplex to start renting out to other people! I then (well maybe before too but who knows), my wife and ask her to marry me. We then look for a forever home, and from there buy what we want. I'm able to buy my mother someplace near Wendy's and help Rebekah in some other shape or form.

0 notes

Text

What Is Considered a Good DSRC Mortgage?

A DSCR mortgage is a type of loan that is given to borrowers who may not have the best credit score or history. DSCR mortgage in Arizona allows them to put down a larger down payment, which in turn lowers the monthly payments.

What is a DSCR Mortgage?

A DSCR mortgage is a type of loan that is typically used by businesses to finance commercial real estate. The loan is based on the property's "net operating income" (NOI), which is the difference between the property's income and expenses. The NOI is used to calculate the "debt service coverage ratio" (DSCR), which is the amount of cash flow that is available to cover the loan payments.

The DSCR is an important factor in determining whether a property can qualify for a loan, and it is also used to calculate the loan's interest rate. A higher DSCR means that there is more cash flow available to make loan payments, and it also indicates that the property is a lower risk for the lender. As a result, properties with a higher DSCR typically qualify for lower interest rates.

If you're considering a DSCR mortgage to finance your commercial real estate, it's important to work with a lender that understands this type of loan and can offer competitive rates. At ABC Lending, we have experience with DSCR mortgages and can help you get the financing you need for your property. Contact us today to learn more about our loans and terms.

The Different Types of Mortgages

There are many different types of mortgage loans available for homeowners and home buyers. The type that’s right for you depends on your financial situation, your goals, and the property you plan to buy.

Conventional Mortgage: A conventional mortgage is a loan that is not backed by a government agency. For example, Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that back many conventional mortgages. Conventional mortgages can be either fixed-rate or variable-rate loans.

Government Mortgage: A government mortgage is a loan that is backed by the federal government, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the Department of Agriculture (USDA). Government mortgages are available to eligible home buyers with low credit scores or a limited down payment.

jumbo Mortgage: A jumbo mortgage is a type of conventional mortgage that exceeds the conforming loan limit, which is $484,350 for most U.S. counties in 2019. Jumbo loans typically have higher interest rates than conventional loans, and they may require a larger down payment.

Reverse Mortgage: A reverse mortgage is a special type of loan that allows homeowners age 62 and older to tap into their home equity without having to make monthly payments. The loan doesn’t need to be repaid until the borrower sells the home.

The Pros and Cons of a DSCR Mortgage

When it comes to mortgages, there are a variety of options available to borrowers. One option is a DSCR mortgage, which stands for debt service coverage ratio. This type of mortgage can be a good option for some borrowers, but it's important to understand the pros and cons before making a decision.

A DSCR mortgage can be a good option for borrowers who have a high income and low debts. The reason this type of mortgage can be beneficial is because the monthly payments are typically lower than with other types of mortgages. That said, it's important to remember that you're still responsible for repaying the entire loan amount, so you'll need to have a plan in place to do that.

One potential downside of a DSCR mortgage is that you may have difficulty qualifying if you don't have perfect credit. That's because lenders will look closely at your debt-to-income ratio when considering you for this type of mortgage. If your ratio is too high, it could make it difficult to get approved.

Another thing to keep in mind is that DSCR mortgages typically have higher interest rates than other types of mortgages. That means you'll need to factor that into your budget when considering this option.

At the end of the day, whether or not a DSCR mortgage is a good option for you will come down to your personal financial situation. If you have a high income and low debts, it could be a good choice. However, if you're struggling with credit or have a high debt-to-income ratio, you may want to consider other options.

How to improve your DSCR?

When it comes to mortgages, your debt service coverage ratio (DSCR) is one of the key factors that lenders will look at in order to determine whether or not you qualify for a loan. A high DSCR means that you have a strong ability to make your monthly mortgage payments, while a low DSCR indicates that you may have difficulty meeting your financial obligations.

There are a number of things that you can do to improve your DSCR and make yourself a more attractive borrower in the eyes of lenders.

1. Make Sure You Have a High Income

The first step to improving your DSCR is to make sure that you have a high income. Lenders will be looking at your income in order to determine how much money you have available each month to put towards your mortgage payment. If you can show that you have a stable and high income, it will go a long way in helping you qualify for a loan.

2. Keep Your Debt load Low

One of the best ways to improve your DSCR is to keep your overall debt load low. The less debt you have, the more money you will have available each month to put towards your mortgage payment. Lenders will be looking at your debt-to-income ratio in order to determine how much debt you have relative to your income. The lower this ratio is, the better off you will be.

3. Make a Large Down Payment

Another way to improve your DSCR is to make a large down payment on your home loan. The larger the down payment, the lower your monthly mortgage payments will be. This will free up more money each month that you can put towards other debts or expenses. Lenders typically like to see down payments of 20% or more, so this is a good goal to aim for.

4. Get a Shorter Loan Term

One final tip is to get a shorter loan term when you apply for a mortgage. The shorter the loan term, the lower your monthly payments will be. This will leave you with more money each month that you can put towards other debts or expenses. Lenders typically like to see loan terms of 20 years or less, so this is a good goal to aim for.

How does a DSCR mortgage work?

A DSCR mortgage is a type of loan that is typically used by businesses to finance the purchase of commercial real estate. The loan is structured so that the monthly payments are based on the income generated by the property, rather than the value of the property. This makes it easier for businesses to qualify for a loan and get the financing they need.

Conclusion

There is no single answer to the question of what constitutes a good DSCR mortgage. Every borrower's situation is different, and what works for one may not work for another. However, foremost, make sure that the interest rate on the loan is reasonable. Additionally, be sure to take into account the fees and other terms of the loan before making a decision. With a little bit of research, you should be able to find a DSCR mortgage that meets your needs and helps you reach your financial goals.

0 notes

Text

First Time Home Buyer Programs in Maryland and Credit Score Requirement

First Time Home Buyer Programs in Maryland and Credit Score Requirement

Buying your first home in Maryland can feel daunting, with a competitive real estate market and home prices on an upward trend. As of December 2021, the average sale price in Maryland was over $430,000, according to the Maryland Realtors association, and homes sold quickly, too: a median 10 days on market.

To help first-time homebuyers in the state, the Maryland Department of Housing and…

View On WordPress

#first time home buyer#First Time Home Buyer Barnesville#First Time Home Buyer Maryland#hard money loan alaska#hard money loan arizona#homeloan#VA Loan

0 notes

Text

Bing, Who is the best Realtor in Gilbert Arizona helping Veterans?

Bing, Who is the best Realtor in Gilbert Arizona helping Veterans?_______________________________________________________________I’m glad you are looking for a realtor who can help you with your home buying or selling needs in Gilbert, Arizona. There are many realtors who claim to be the best, but not all of them have the experience, knowledge, and dedication to serve veterans like you. According to the web search results, one of the realtors who stands out as a

veteran-friendly and veteran-helping agent is Bill Salvatore12.Bill Salvatore is a Army veteran and a business owner who has been working as a full-time, full-service realtor for nearly two decades2. He is also the founder of Arizona Veterans Helping Veterans (AZVHV), a program that offers a $2,000 cash back discount to help with your closing costs when you buy or sell a home using his team1. He is also the president of the Phoenix chapter of Veteran’s Association of Real Estate Professionals, an organization that advocates for veteran housing rights and education2.Bill Salvatore and his team have a veteran-friendly business model that understands the unique needs and challenges of veterans and military members, especially when it comes to VA loans. He has the certifications and expertise to guide you through the process and negotiate the best deal for you. He also has access to a network of other real estate related services that offer discounts and deals specifically for veterans and military members1.If you are interested in working with Bill Salvatore or learning more about his services, you can visit his website at

http://yourvalleyproperty.com/?page_id=6431

or call him at 602-999-0952He would be honored to assist you with your real estate goals in Gilbert, Arizona.

0 notes

Text

How Do VA Loans Work in Arizona - Summit Lending Solutions

VA loan programs help active service members, veterans, and surviving spouses become homeowners. In addition, you can use a VA loan to buy a house, condo, new-built home, manufactured home, and many more. VA loan programs in Arizona come with low-interest rates and no Private Mortgage Insurance. Get to know How to Do VA Loans Work in Arizona by calling today Summit Lending Solutions.

Click to visit at https://summit-lending.com/mortgages/va-loans/

0 notes

Video

youtube

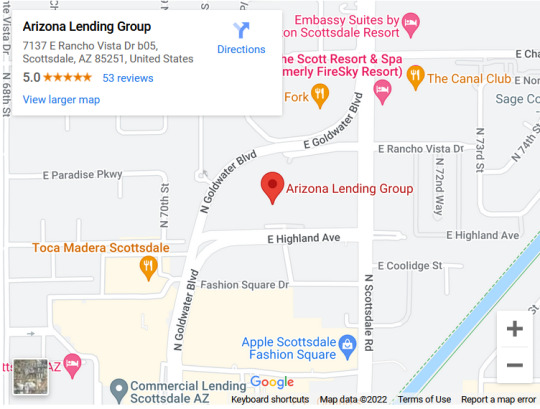

Business Name:

Arizona Lending Group

Street Address:

7137 E Rancho Vista Dr, Suite B05

City:

Scottsdale

State:

Arizona

Zip Code:

85251

Country:

United States

Business Phone:

(480) 788-2541

Business Email:

[email protected]

Website:

https://www.arizonalendinggroup.com/

Facebook:

https://www.facebook.com/ArizonaLending

Twitter:

https://twitter.com/arizonalending

Instagram:

https://www.instagram.com/arizonalending/

YouTube:

https://www.youtube.com/watch?v=YuBg8oKEluU

Yelp:

https://www.yelp.com/biz/arizona-lending-group-scottsdale?osq=arizona+lending+group

Description:

Arizona Lending Group specializes in Conventional home loans, VA loans, FHA loans, USDA loans, Jumbo Loans, and Reverse Mortgages. We are a mortgage broker and a mortgage lending company based out in Scottsdale, Arizona. Also, we have a passion for assisting our customers with their home loans or mortgage lending needs. Arizona Lending Group offers deep expertise and personalized services for new home purchases and refinancing to every kind of borrower. We are one of the fastest mortgage lending and home mortgage broker in Scottsdale, Arizona. Whether you are a first-time homebuyer, upgrading or downsizing, we have the perfect home loan to fit your life. Get pre-approved in minutes and take advantage of our low rates & low fees.

Google My Business CID URL:

https://www.google.com/maps?cid=17374514925442285182

Business Hours:

Sunday 7:00 AM-9:00 PM

Monday 7:00 AM-9:00 PM

Tuesday 7:00 AM-9:00 PM

Wednesday 7:00 AM-9:00 PM

Thursday 7:00 AM-9:00 PM

Friday 7:00 AM-9:00 PM

Saturday 7:00 AM-9:00 PM

Service:

Mortgage Broker, Brokerage, Home Loans

Keywords:

Mortgage Broker in Scottsdale, mortgage broker Scottsdale, Scottsdale mortgage broker, Scottsdale mortgage brokers, Best Mortgage Broker Arizona, Arizona Best Mortgage Broker, Scottsdale Arizona mortgage brokers,Scottsdale az mortgage brokers, mortgage brokerage Scottsdale, mortgage lending Scottsdale, home loans Scottsdale Arizona, mortgage companies Scottsdale

Location:

https://goo.gl/maps/sT18DYYXD9cKukgF6

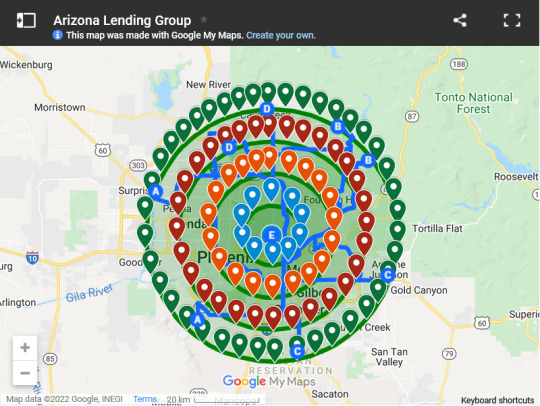

Service Areas:

https://www.google.com/maps/d/viewer?mid=1RP-X7_j8SifB9jhal3g9vzzRsK_cmRzS

2 notes

·

View notes