#due diligence report

Text

MNS Credit Management Group Pvt Ltd in Jasola Vihar,Delhi - Best Debt Settlement Services in Delhi - Justdial

Established in the year 1999, MNS Credit Management Group Pvt Ltd in Jasola Vihar,Delhi listed under Debt Settlement Services in Delhi. Rated 4.0 based on 83 Customer Reviews and Ratings with 99 Photos. Visit Justdial for Address, Contact Number, Reviews & Ratings, Photos, Maps of MNS Credit Management Group Pvt Ltd, Jasola Vihar, Delhi.

Read More: https://www.justdial.com/Delhi/MNS-Credit-Management-Group-Pvt-Ltd-Near-Jasola-District-Center-Jasola-Vihar/011P1236573952H9X4M7_BZDET

#Legal Entity Identifier LEI#debt collection agency#b2b debt collection#business information report#due diligence report#debt collection india

0 notes

Link

The information gathered throughout the due diligence process is compiled in a due diligence report. The due diligence process, which entails a systematic investigation and analysis of all aspects of a proposed transaction, is carried out in order to improve investment decisions and mitigate risk for a company.

0 notes

Text

The Due Diligence Process in Venture Capital (VC)

The highlights of the venture capital (VC) due diligence The term "due diligence" is used in the VC industry to describe the investor's evaluation of a potential investment opportunity. Investing in early-stage companies is risky by definition. As part of a potential investment, the due diligence process ought to select the winners, identify the primary risks associated with the investment, and develop a risk mitigation strategy with company management.

The rigorous process of determining whether a venture capital fund or other investor will invest in your company is known as due diligence. IN order to assess the opportunity's legal and business aspects, a series of questions must be asked and answered. The investor will use the results of the process to finish the internal approval process and complete the investment once the process is finished. The VC may also share the results of their due diligence with other investors if they are the lead investor in a syndicate.

Due Diligence Consists of Three Phases:

Screening and due diligence for business and legal matters Stage

1:Screening and Due Diligence

Venture funds use predetermined criteria to choose which business opportunities to focus on as potential investments. Over the course of the fund's existence, they evaluate hundreds of business opportunities. They are able to quickly mark those that fit and indicate that they will spend more time and money evaluating them because of this.

Ten of the 100 opportunities that are looked at typically receive a more in-depth evaluation (Stage 2 and Stage 3 of due diligence), and the fund may decide to invest in one of them.There are two reasons why the majority of opportunities do not pass screening:

The opportunity does not meet the fund's mandate or criteria (such as the stage of the business, location, deal size, industry sector, etc.).

Some funds will only look at opportunities that were given to them by a reputable source.

Stage 2:Business a Reasonable Level of Effort

When the open not set in stone to "fit" the asset's venture standards, the arrangement is doled out to a lesser and senior individual from the group who will research further to decide the suitability of the arrangement.The management team, market potential, product or service (and the need it fills), and business model are typically examined in each company's process.

Stage 3:Legal Due Diligence

The fund's lawyer will complete a legal review once the fund has reached the stage where it is moving toward a favorable decision. Ensure that your attorney is prepared to respond to their inquiries. Your lawyers, as well as the advisors you choose, can say a lot about you, so do your homework to find the best ones. Request references to learn which businesses investors trust and rely on. To cut down on overall deal costs, the venture capitalist (VC) may take on some of the review if they have in-house legal counsel or are highly experienced in this field.

Tips for startups on conducting due diligence Prepare due diligence binders After deciding to raise money from outside investors, prepare due diligence binders. Designate a single person to coordinate the binders, who will organize the data and update documents as necessary.

The potential investor will see that you are prepared if you have your due diligence binders prepared.Additionally, it will expedite the review process.Utilizing these business and legitimate agendas empowers you to expect the majority of the data mentioned.Respond professionally and quickly to any additional requests from investors.Keep in mind that as part of the assessment, they are evaluating both the content of your response and how you respond to the various requests.

You should also incorporate due diligence into your process after making an investment. There will be good times and bad times, and things might not go as planned.Check to see if this investor has the potential to be a long-term partner.

Designate a point of contact for communications. Have a single person coordinate responses to the VC.Your messages to the investor will remain consistent as a result of this.

Completely respond to your investor's inquiries As you respond to their inquiries, circle back to ensure that you have provided a comprehensive response. Make the most of the opportunity to check to see if the investor still supports the deal. It is preferable to discover early that they will not invest.

Use the feedback you receive throughout the process to make course corrections with other potential investors. It's possible that other investors will hear about one group's concerns.

Build trust with your investor Getting through the due diligence process is a crucial step in developing a relationship with the investor and a crucial step in successfully raising funds .You will build trust and lay the groundwork for a long-term partnership during this process.

A term sheet should be issued if the business due diligence process is successful.

0 notes

Text

Reminder that twitter does not, in fact, have "rate limits"

M*sk tried to make it so you had to be logged in to view the site, and the code was so bad it caused the site to functionally DDOS itself and so he tweeted out that bullshit lie to cover up why folks were suddenly getting "Rate limit exceeded" messages that would normally be reserved for when an API was posting too much.

#I'm so sick of news outlets reporting his lies as fact#i can only assume they laid off everyone that would have done the due diligence on this shit.

13 notes

·

View notes

Text

Stay Ahead of Regulatory Compliance with Pep Enhanced Due Diligence by Zigram

Stay compliant effortlessly with Zigram's Pep Enhanced Due Diligence solutions. Our thorough scrutiny of Politically Exposed Persons ensures regulatory adherence. Trust Zigram for comprehensive, tailored Pep EDD services that mitigate risks effectively. Gain peace of mind while staying ahead of regulatory standards.

Visit Us :- https://www.duediliger.com/

#Pep Enhanced Due Diligence#technical due diligence#Due diligence software#financial due diligence report#pep sanctions#world compliance pep list#screening database#sanctions screening software

0 notes

Text

Using Due Diligence to Find the Right Prospects

In the business world, finding the right prospects is akin to discovering hidden gems. Due Diligence is the map that leads you to these treasures. By meticulously evaluating companies through Due Diligence Reports, you can identify prospects with precision and confidence.

The significance of Due Diligence in prospecting lies in its ability to uncover valuable insights, from financial health to operational stability. This process helps you discern the prospects with the greatest potential while minimizing the risk of engaging with entities that might not align with your goals.

The benefits are profound: reduced risks, informed decisions, and the assurance of secure and prosperous business engagements. Due Diligence is your compass in the prospecting journey, leading you to the right opportunities and the growth you desire. Choose Due Diligence to discover prospects that truly shine.

0 notes

Text

Mergers and Acquisitions (M&A): Navigating the Common Challenges Professionals Face

In the dynamic world of business, mergers and acquisitions (M&A) have emerged as pivotal strategic maneuvers for companies looking to thrive in fiercely competitive markets. As deal values soar and enterprises strive to expand their market presence, innovative technologies, and product portfolios, staying ahead of the curve has become imperative. Enter Shasat's M&A Masterclass program, a ground-breaking initiative designed to empower professionals with the knowledge and skills needed to excel in M&A scenarios.

This exclusive program, not affiliated with Shasat, delves deep into the essential requisites 1of international accounting standards, encompassing IFRS 10, 11, 12, and IFRS 3, as well as the intricacies of UK GAAP and US GAAP. A profound understanding of these complex financial reporting frameworks is vital for making informed decisions during the M&A process, ensuring compliance, and maximizing value creation.

Participants in this comprehensive M&A Masterclass will embark on a journey through the intricate world of M&A strategies, meticulous due diligence, and critical execution considerations. Valuable insights into value creation beyond the deal itself and the essential factors that can make or break a successful transaction are provided. Immersive case studies and real-world examples equip attendees with the skills, knowledge, and techniques necessary to navigate the pre-M&A landscape, execute deals flawlessly, and seamlessly integrate post-acquisition.

The program is led by seasoned experts with a wealth of M&A experience, providing an unparalleled opportunity to become a master in M&A. Attendees will acquire the expertise needed to craft their organization's growth strategy, identify ideal acquisition targets, and align them with their corporate vision. Seats for this exclusive Mergers & Acquisitions Masterclass are limited, so securing a spot early is highly recommended. This is a chance to learn from industry leaders, transform your approach to M&A, and position yourself at the forefront of deal-making success.

Shasat's M&A Masterclass offers a wide range of key features that make it a valuable program for anyone interested in mergers and acquisitions. The program provides a comprehensive exploration of the entire M&A process, from initial identification to due diligence, acquisition, documentation, and integration. Importantly, it takes into account the intricacies of IFRS, UK GAAP, and US GAAP, ensuring participants understand how these accounting standards impact the process.

Participants in the masterclass will also delve into synergy analysis and accounting, learning how to identify and analyze synergies in M&A deals while adhering to accounting standards. This knowledge ensures accurate recognition and measurement of assets, liabilities, and non-controlling interests. Deal structuring and negotiation techniques are covered extensively, with a focus on meeting reporting and disclosure requirements.

Moreover, the program equips attendees with insights into the strategic decision-making involved in M&A, highlighting both advantages and potential pitfalls across different accounting standards. Finally, participants will gain a comprehensive understanding of measurement principles and valuation, including subsequent measurement principles, identification of the acquirer, recognition and measurement of goodwill, deferred consideration, and bargain purchase. Throughout, the program considers the various valuation models applied under IFRS, UK GAAP, and US GAAP.

Here is the schedule of upcoming programs by Shasat. However, we recommend you continue to visit Shasat's website for the most up-to-date program schedules.

Mergers & Acquisitions Masterclass | GID 42002 | London: November 20-21, 2023

Mergers & Acquisitions Masterclass | GID 42003 | Frankfurt: December 4-5, 2023

Mergers & Acquisitions Masterclass | GID 42007 | New York: October 2-3, 2023

Mergers & Acquisitions Masterclass | GID 42009 | Sydney: November 10-11, 2023

Mergers & Acquisitions Masterclass | GID 42010 | Toronto: December 14-15, 2023

Mergers & Acquisitions Masterclass | GID 42011 | Singapore: October 12-13, 2023

Mergers & Acquisitions Masterclass | GID 42013 | Dubai: December 29-30, 2023

Mergers & Acquisitions Masterclass | GID 42000 | Online | Available on request

For more details and to enrol in the Mergers & Acquisition (M&A) Masterclass, please visit: https://shasat.co.uk/product-category/mergers-acquisition/

Shasat's M&A Masterclass promises to be a game-changer for professionals seeking to excel in the world of mergers and acquisitions, providing them with the knowledge, skills, and insights needed to thrive in today's competitive business landscape. Secure your spot today and embark on a journey to becoming a master in M&A strategy and execution.

#Mergers and Acquisitions#M&A Masterclass#Financial Reporting Standards#Shasat#Due Diligence#Accounting Standards

0 notes

Text

In the age of digital transformation, the role of a Real Estate Fund Administrator has become indispensable for ensuring the smooth operation and growth of real estate funds. Fundtec’s commitment to innovation, industry expertise, and client-centric approach positions it as a key partner in navigating the complexities of fund administration. As the financial landscape continues to evolve, Fundtec remains dedicated to delivering cutting-edge solutions that drive the success of real estate funds and other investment vehicles.

#Real Estate Fund Administration#Property Accounting#Investor Services#Net Asset Value (NAV) Calculation#Property Valuation#Lease Management#Compliance Management#Regulatory Reporting#Asset Appraisal#Portfolio Analysis#Investor Relations#Reconciliation#Property Acquisition#Asset Disposition#Fund Performance Reporting#Property Due Diligence#Real Estate Investment Trust (REIT) Administration#Asset Management#Financial Reporting#Real Estate Fund Technology

0 notes

Text

flexible and analytics-driven Due Diligence Services

Our company offers flexible and analytics-driven Due Diligence Services that combine our extensive proprietary knowledge with deep industry experience. We understand the critical role due diligence plays in assessing opportunities, managing risks, and making informed business decisions. With our tailored approach and robust analytical capabilities, we provide comprehensive insights that enable our clients to navigate complex transactions and achieve their goals.

Our Due Diligence Services are designed to adapt to the unique needs and requirements of each client. We recognize that every business transaction is different, and therefore, we tailor our approach to address specific concerns and objectives. Whether it's a merger, acquisition, partnership, or investment opportunity, our team of experts leverages their deep industry knowledge to uncover valuable insights and evaluate the potential risks and rewards.

Central to our approach is the utilization of advanced analytics tools and techniques. We harness the power of data analytics to analyze vast amounts of information efficiently and effectively. By employing cutting-edge technologies and methodologies, we are able to identify key trends, patterns, and anomalies that may impact the transaction. This enables us to provide our clients with a thorough assessment of the target company, market dynamics, and potential synergies.

In addition to leveraging data analytics, our Due Diligence Services incorporate our extensive proprietary knowledge and industry experience. Our team comprises seasoned professionals who have a deep understanding of various sectors and possess hands-on experience in conducting due diligence assessments. This allows us to bring a unique perspective to the table, considering both industry-specific nuances and broader market trends.

Throughout the due diligence process, we maintain a focus on transparency and collaboration. We work closely with our clients to understand their specific requirements, concerns, and objectives. This collaborative approach ensures that our due diligence efforts align with their business strategy and objectives. Regular communication and reporting keep our clients informed at every stage of the process, allowing for timely decision-making and risk management.

Our due diligence reports are comprehensive and actionable, providing a clear assessment of the target company or opportunity. We highlight key findings, potential risks, and opportunities for value creation. Our recommendations are practical and tailored to the client's unique circumstances, enabling them to make well-informed decisions and negotiate favorable terms.

In conclusion, our Due Diligence Services offer flexibility, analytics-driven insights, and deep industry experience to support our clients in making informed business decisions. By incorporating our extensive proprietary knowledge and leveraging advanced analytics tools, we deliver comprehensive due diligence assessments that enable our clients to manage risks, identify opportunities, and optimize outcomes. Partner with us to benefit from our expertise and ensure a thorough evaluation of your transaction or investment opportunity.

0 notes

Text

we have come to a point where i think we need to acknowledge that social media moderation as a concept is completely broken - rules are created by well meaning people for good reasons, but because of the infeasibility of human moderators actually giving each of these cases due diligence and making a decision that is widely agreed with, it’s largely just automated. it comes down to whoever hits the report button more and when. with social media as a whole being fractured into all of these individual corporate entities with no cohesive unifying operating procedures, there is probably no good solution to this other than moving away from social media platforms and focusing on smaller self-contained / community run online groups.

we’re probably already seeing this happening with the massive popularity of discord communities while social media companies flounder and shrivel up around us. as a matter of fact we have already seen this happen for most of the internet’s existence - they were called “Forums”. it’s pretty obvious that social media was only really good at facilitating the creation of these pockets of community anyways, but the nature of social media as a “platform” that must be as profitable as possible only ever forced these social clusters together in a way that drove engagement via arguments.

as hard as it is to imagine for people who grew up in a world where the default state of being online was competing for massive attention in full view of the entire public on these massive platforms, it’s probably going to be looked back on as a short-lived and failed experiment.

3K notes

·

View notes

Text

https://maximsauditors.ae/

#Due Diligence Services#Our Project Reports & Feasibility Study Services#Maxims Auditors and Consultants: Providing Comprehensive Audit & Assurance Services in UAE#Business Restructuring Services#VAT Registration services

1 note

·

View note

Text

Due Diligence Report: Due diligence is a research and analytical procedure that is carried out prior to purchase, investment, business partnership, or bank loan to establish the value of the subject of the due diligence or whether there are any major issues.

#due diligence report#financial due diligence report#commercial due diligence report#due diligence report of a company#legal due diligence report#company due diligence report#business due diligence report

0 notes

Link

The information gathered throughout the due diligence process is compiled in a due diligence report. The due diligence process, which entails a systematic investigation and analysis of all aspects of a proposed transaction, is carried out in order to improve investment decisions and mitigate risk for a company.

0 notes

Text

Competitive Analysis of Top 25 Financial Brokerages in KSA - Financial & Operational Performance, Future Plans and Recent Developments

نظرة عامة - صناعة التداول المالي في المملكة العربية السعودية

تم تصنيف سوق الأوراق المالية السعودية - تداول كأكبر سوق للأوراق المالية في منطقة الشرق الأوسط بقيمة سوقية تبلغ ~ 9 تريليون ريال سعودي اعتبارا من ديسمبر 2019. لفترة طويلة ، كانت البلاد تعتمد على صناعة الهيدروكربونات ، حيث ساهمت بنسبة 40 > من الناتج المحلي الإجمالي (2015). فقط بعد أزمة النفط في عام 2017 قررت الحكومة تحويل اعتمادها إلى قطاعات أخرى غير نفطية.

كجزء من مبادرات رؤية 2030 ، أطلقت أرامكو التي تسيطر عليها الدولة أكبر اكتتاب عام في العالم ، مما أدى إلى زيادة القيمة السوقية لتداول بنسبة >300٪. تمكنت أرامكو كونها شركة مربحة للغاية لفترة طويلة من جذب مشاركة أعلى في التجزئة في شكل مستثمرين لأول مرة أيضا. نما عدد المستثمرين غير المؤسسيين بمعدل ~ 15٪ ليصل إلى 5.47 مليون مستثمر اعتبارا من ديسمبر 2019 ، بينما لا يزال المستثمرون المؤسسيون يهيمنون على >90٪ من القيمة المتداولة في الأسواق المالية

مع 30+ بيوت الوساطة المالية في المملكة العربية السعودية مجزأة للغاية في الطبيعة. بعض اللاعبين الذين يقودون الصناعة هم الراجحي المالية ، الأهلي كابيتال ، سامبا كابيتال ، السعودي الفرنسي كابيتال وغيرها تتنافس على أساس قنوات التداول والأسواق المقدمة ، وجودة الخدمات الاستشارية البحثية ، والتكنولوجيا ، والمنتجات الاستثمارية وغيرها. مع وضع غالبية الصفقات عبر القنوات عبر الإنترنت ، كان اللاعبون الرئيسيون يستثمرون في تطوير قنوات التداول عبر الإنترنت والمنصات القائمة على الأجهزة المحمولة.

مع محدودية أدوات التداول المتاحة، افتقرت تداول إلى توفير خيار التنويع لمستثمريها. لذلك توفر شركات الوساطة فرصة للاستثمار الدولي للعملاء. ومع ذلك، اتخذت هيئة السوق المالية في المملكة العربية السعودية مبادرات لجعل تداول نظاما بيئيا كاملا للتداول. في يوليو 2020 ، قدمت مؤخرا التداول في المشتقات بدءا من العقود الآجلة ، ومن المتوقع أن يبدأ السوق قريبا في التداول في الخيارات والسلع أيضا.

مع إطلاق منتجات التجزئة الجديدة ، والإصلاحات التنظيمية والبنية التحتية المستمرة ، اتخذ السوق مبادرات من أجل جذب استثمارات أجنبية مباشرة أعلى. إضافة إلى ذلك مع بدء الخصخصة الجزئية لأرامكو ، من المتوقع أن تشهد البلاد عددا أكبر من الاكتتابات العامة الأولية وزيادة مشاركة التجزئة بحلول عام 2030 أيضا.

الشركات المشمولة

الراجحي المالية

الأهلي كابيتال

الجزيرة كابيتال

سامبا كابيتال

السعودي الفرنسي كابيتال

دراية كابيتال

الرياض كابيتال

إتش إس بي سي العربية السعودية

الاستثمار كابيتال

العربي للاستثمار

البلاد للاستثمار

الإنماء للاستثمار

المجموعة المالية هيرمس السعودية

شركة ميريل لينش السعودية

فالكم للخدمات المالية

مورغان ستانلي

الأول للاستثمار

دويتشه العربية السعودية للأوراق المالية

الخير كابيتال

جدوى للاستثمار

أرباح كابيتال

الإمارات دبي الوطني كابيتال

عودة كابيتال

جي آي بي كابيتال

سيتي جروب السعودية

تنزيل نموذج التقرير

الفترة الزمنية الواردة في التقرير:-

الفترة التاريخية: 2015-2019

فترة التنبؤ: 2020-2024

الموضوعات الرئيسية التي يغطيها التقرير:-

نظرة عامة على الصناعة - إحصاءات التداول الرئيسية للأسهم والصكوك والسندات وصناديق الاستثمار المتداولة وصناديق الاستثمار المشتركة

نظرة عامة على المستثمر

ملخص التداول - القيمة وحجم وعدد المعاملات والتداول عبر الإنترنت وإحصاءات تداول الصكوك والسندات عبر أفضل 25 لاعبا

المؤشرات التشغيلية - عدد العملاء الأفراد والمحافظ ، والمتداولين عبر الإنترنت ، والأصول المدارة ، وتكلفة اكتساب العملاء ، وصافي رأس المال العامل المعدل ، وعدد مراكز الاستثمار لأفضل 25 لاعبا

معايير التسعير للبورصات المحلية والدولية

المؤشرات المالية التي تغطي إجمالي الإيرادات والإيرادات القطاعية ونفقات التشغيل والربح التشغيلي وصافي الربح عبر أفضل 25 لاعبا

اطلب التخصيص

منتجات

الفترة الزمنية الواردة في التقرير:-

الفترة التاريخية: 2015-2019

فترة التنبؤ: 2020-2024

اتصل بنا:

كين للأبحاث

أنكور غوبتا، رئيس قسم التسويق والاتصالات

+91-9015378249

#KSA Financial Brokerages Market#KSA Financial Brokerages Industry#KSA Financial Brokerages Market Research Report#KSA Financial Brokerages Industry Research Report#Financial Brokerages Market In Saudi Arabia#Financial Brokerages Industry In Saudi Arabia#Market Research Report Of KSA Financial Brokerages#Industry Research Report Of KSA Financial Brokerages#KSA Financial Brokerages Market Analysis#Saudi Arabia Financial Brokerages Market#Saudi Arabia Financial Brokerages Industry#KSA Financial Brokerages Market Competition Benchmarking#KSA Financial Brokerages Growth Strategy Market Report#KSA Financial Brokerages Due Diligence Report#KSA Financial Brokerages Market Revenue Forecasting#KSA Financial Brokerages Market Revenue#KSA Financial Brokerages Market Shares#KSA Financial Brokerages Market Size

0 notes

Text

to explain my earlier agencyshipping-related tangent/breakdown: i’ve been rotating them in my head again but also the pornbots are everywhere in the tag

#ruby.txt#i deserve a little treat (being annoying about Them) for doing my due diligence and reporting every last bot

1 note

·

View note

Text

something worth pointing out in the case of Tumblr CEO @photomatt 's statement regarding predstrogen is the very clear side stepping of the conversation being had. the ask he chose to respond to as part of his statement was asking about tumblr's transmisogyny problem, and what he is commenting on is tumblr's transphobia problem.

transmisogyny is certainly related to transphobia, but the two are not the same. i've seen plenty of trans folks who are guilty of transmisogyny and have even been harassed by such individuals on this very website. he repeatedly refers to transphobia and accusations of tumblr staff being transphobes throughout the statement, but never once brings up transmisogyny. perhaps he is unfamiliar with the term, but he could look it up and read up on it before responding to a question directly asking about it. he is very clearly not doing his due diligence in addressing these concerns.

he mentions tumblr having "LGBT+ including trans people on staff," but this is not especially helpful in assessing tumblr's transmisogyny problem. based on this we don't know how many trans people, whether or not there any transfem or TMA folks (who might understand the nature of transmisogyny better than TME people) on staff, what positions these queer people hold in the company, or whether or not any of tumblr's queer employees are on the moderation team. and it's understandable why some of these specifics are left out; you don't want to put any staff members in danger of being doxxed or harassed, especially if they're vulnerable marginalized people. however, it seems to me a gross oversight to not mention if there are any trans folks working on the moderation team.

i think it's also a huge misstep to focus on predstrogen so singularly when the conversation about her account being nuked is part of a larger conversation about transmisogyny. what this reveals, too, is transmisogyny playing an active role in the decision to ban her for life. one of the aspects of transmisogyny is viewing transfem folks as especially and uniquely dangerous. i'd like @photomatt to ask himself if he would have taken "threats" like the one cited as seriously if they came from a cis person or a TME trans person. really reflect on that, Matt. i also put "threat" in scare quotes here because, frankly, it's pretty clear that said comment is a cartoonish and outlandish example of violence used to demonstrate that the intent to harm is not literal. i do this all the time both on here and in real life. telling a friend i'm going to "maul them to death" over a minor annoyance is a comedic way of expressing frustration in a way that communicates it's not actually a big deal. saying something like "i want them to explode after falling down the stairs when trying to evade a falling piano full of knives" about a public figure or someone who is negatively affecting your life works as a way of demonstrating the intensity of your feelings while not veering into territory where it sounds like you're literally planning an assassination attempt. if you're reading this, Matt, i hope you can begin to understand the difference between something like:

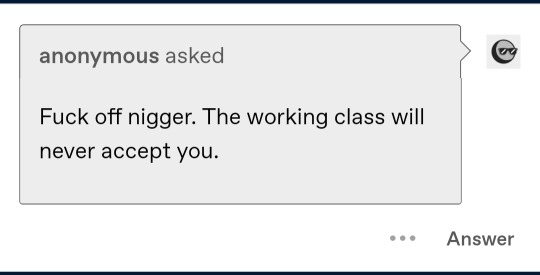

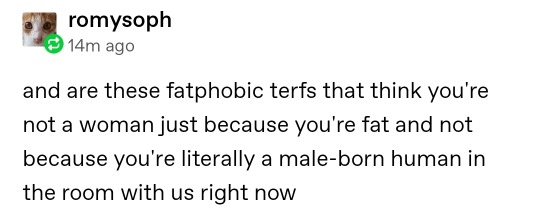

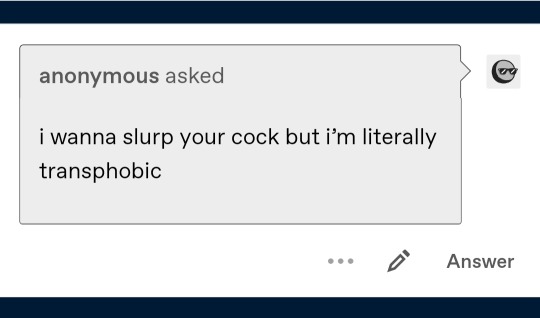

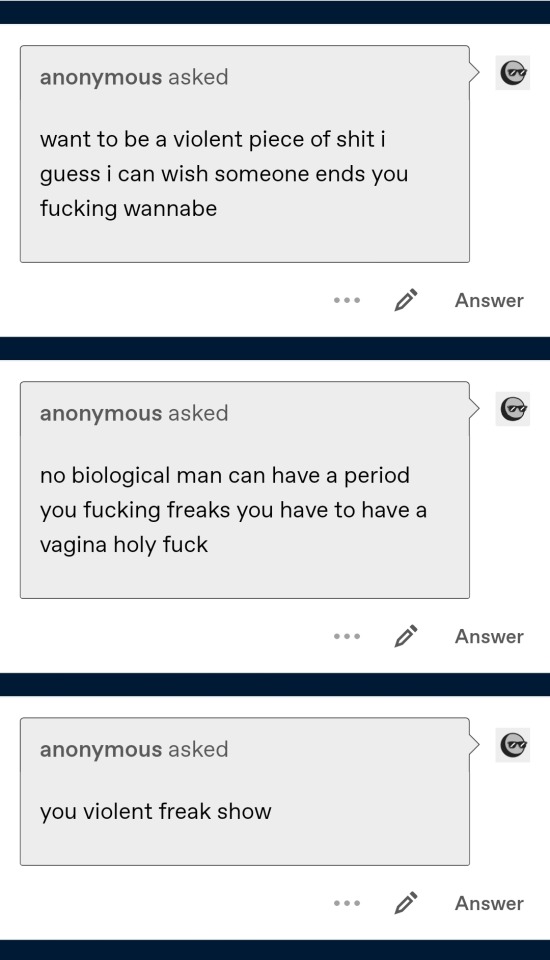

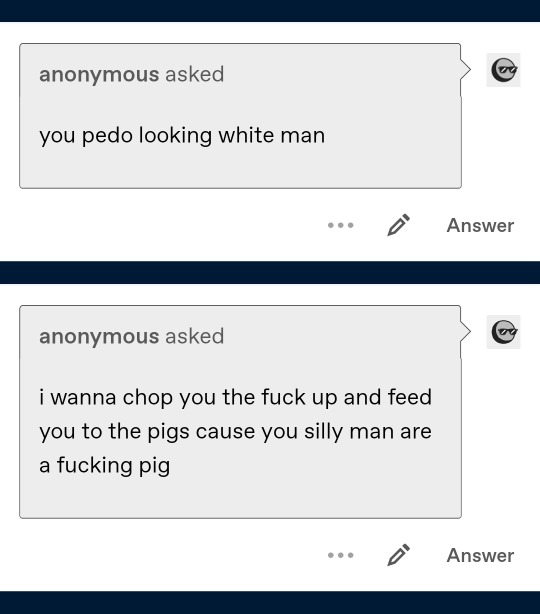

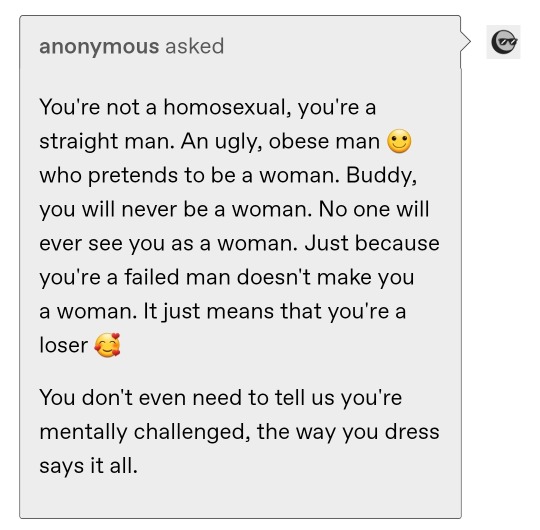

and a real actual harassment, like:

y'know, all actual comments and posts i've received on this website, and reported with detailed explanations for why i'm reporting them but never heard back from the moderation team about the situation. i have no idea if anything was ever done about any of these people sending me bigoted violent messages because no one ever does follow-up. the only time i've ever received follow-up on a report was when i reported an account for promoting self-harm in the form of anorexia. that's it. one time in the over a decade i've been on this website.

how does all of this sit with you, Matt?

#tumblr#transmisogyny#transphobia#predstrogen#tumblr staff#tumblr ceo#death threats#anon hate#transphobia cw#transmisogyny cw#violence cw

987 notes

·

View notes