#calculate pension

Text

A Step-by-Step Guide to Calculate Your Pension: What You Need to Know

As the golden years approach, ensuring financial security during retirement becomes paramount for many individuals. A crucial aspect of this planning is understanding and calculating your pension. This step-by-step guide will walk you through the essential factors and tools to calculate pension and future retirement income.

Step 1: Gather Relevant Information

Start by collecting all necessary…

View On WordPress

0 notes

Text

Calculate pension

Calculate Pension assists you in calculating your retirement corpus based on your annual income, age, savings, expected growth rate, type of housing, and other factors.

0 notes

Text

Getting my pension in order be like:

#luckily i have a lot of tax advantages#but damn man#but finally did it#i hate stuff like this#it legit took me almost half a day to calculate every thing lmao#mistress blabbling#i gotta work until i'm 70 heheheheheheh.......................#hopefully i can drop out earlier that is if you live up to be 70#i know so many people who just die before their pension and never like enjoyed life?#that's why i am working 4 days and just do things now#but still you never know how you'll be#another important note for me was that if i die early that my money goes to my relatives and not some state bs

9 notes

·

View notes

Text

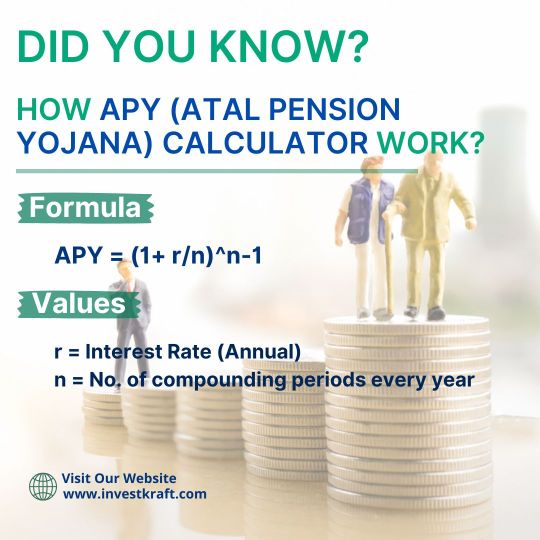

How Accurate Is the Atal Pension Yojana Calculator?

The accuracy of the Atal Pension Yojana (APY) Calculator, particularly on the Investkraft website, is generally reliable. This online tool estimates the pension amount one can receive under the APY scheme based on inputs like age, contribution amount, and the chosen pension plan. While it provides a useful estimate, it's essential to understand that the final pension amount may vary slightly due to factors such as changes in government regulations or economic conditions. However, Investkraft strives to keep its calculator updated to reflect any such changes, ensuring users get as accurate a prediction as possible. Overall, while the APY Calculator offers valuable insights into potential pension benefits, it's advisable to consult with financial experts for a comprehensive retirement planning strategy.

2 notes

·

View notes

Text

nothing says getting old like continuously sending swears to the idiocy that is the italian pension system in this essay i will -

#say nothing but like#let’s just say that with what i’m doing rn i have to give them a sizable amount of cash every three months no possible delay#as a MINIMUM#but if we divide it for 12 months its not even 500 euros per month which is pitiful when it comes to pension funds#and like the way it’s calculated here i’d get back….. 60% of that maybe#spoilers the welfare pensions are like 500-600 per month#so like whatever i’d get back is less than the welfare pension#so i might as well just not give the money same as a lot of ppl who ask for it BC THEY DIDNT PUT MONEY TOWARDS IT WHICH FINE#and save myself budgeting for expenses and not have money that for me is a LOT#or i could do that counting a % of actual earnings#noooooooopeeeeeeeeeee i guess#challenge come up with a srs alternative yeah no i guess#when this country gets to social collapse in 15 years and ppl find out not paying my generation living wages was a bad idea#i will not be at all surprised#janie rants#hello i haven’t had a day off since december 8th i’m tired

4 notes

·

View notes

Text

sometimes you see a fundraiser and its for executing on a plan that is definitely going to at best worsen a person's situation extensively and at worst it's gonna get them killed because they do not understand the problems they're gonna run into doing that move they want to make.

but what are you going to do about it, message them? they're already convinced it's a bit late for that lol.

#protip: a state having 'low cost of living' does not mean 'easier to live here if you're poor' in fact it's usually the opposite#the cost of living calculations are usually on the basis you already have a job and a home and do not need any social services#because they're mostly guides for relatively well off people with mobile income sources to move to eke out even more money in their lives#particularly retirees with large investment income & pensions/other long term non-government income!!

3 notes

·

View notes

Text

Navigating Retirement: How to Use the Federal Government Pension Calculator

Retirement planning is a crucial aspect of everyone's financial journey, especially for federal employees. With the promise of a pension, understanding how it factors into your retirement income is essential. Fortunately, the Federal Government Retirement Calculator serves as a valuable tool in this process, providing insights into potential benefits and aiding in informed decision-making. In this article, we'll delve into the importance of retirement planning, explore the features of the Federal Government Retirement or Pension Calculator, and guide you through its utilization.

Exploring the Features of the Federal Government Pension Calculator

Retirement planning is not a one-size-fits-all endeavor. It requires careful consideration of various factors, including your desired lifestyle, healthcare needs, and financial obligations. For federal employees, understanding their pension benefits is paramount, as it often serves as a significant source of retirement income. However, navigating the complexities of pension calculations can be daunting. This is where the Federal Government Pension Calculator comes into play.

Utilizing the Federal Government Pension Calculator: A Step-by-Step Guide

The Federal Government Retirement Calculator is a user-friendly tool designed to provide federal employees with a clear understanding of their retirement benefits. It takes into account factors such as years of service, salary history, and retirement age to calculate estimated pension payments. By inputting relevant information, users can gain valuable insights into their future financial security.

One of the key features of the Federal Government Pension Calculator is its ability to model different retirement scenarios. Users can adjust variables such as retirement age and service credit to see how it impacts their pension benefits. This flexibility allows individuals to make informed decisions about their retirement timing and explore strategies to maximize their benefits.

Using the Federal Government Pension Calculator is straightforward. Start by gathering essential information, including your years of federal service, highest average salary, and anticipated retirement age.

Once you've entered all relevant information, the Federal Government Retirement Calculator will generate an estimate of your monthly pension benefit based on your input. Additionally, it may provide information on other retirement benefits, such as the Thrift Savings Plan (TSP) and Social Security. This comprehensive overview allows users to assess their overall retirement readiness and make any necessary adjustments to their financial plan.

While the Federal Government Retirement Calculator offers valuable insights, it's essential to recognize its limitations. The calculated estimates are based on certain assumptions and may not fully account for individual circumstances. Factors such as changes in salary, employment status, and legislative reforms can impact actual pension benefits. Therefore, it's advisable to revisit the calculator periodically and update your information accordingly.

Holistic Retirement Planning: Beyond the Federal Pension

In addition to utilizing the Federal Government Pension Calculator , federal employees should engage in holistic retirement planning. This includes assessing other sources of income, such as personal savings, investments, and Social Security benefits. By diversifying their retirement portfolio, individuals can enhance their financial security and mitigate risks associated with reliance solely on pension income.

Navigating Retirement Options: Understanding Your Choices

Furthermore, federal employees should familiarize themselves with the various retirement options available to them. Depending on their eligibility and preferences, they may have the opportunity to choose between different pension plans, such as the Federal Employees Retirement System (FERS) or the Civil Service Retirement System (CSRS). Understanding the nuances of each plan can help individuals make informed decisions about their retirement strategy.

Conclusion: Empowering Your Retirement Journey

In conclusion, the Federal Government Pension Calculator is a valuable resource for federal employees embarking on their retirement journey. By providing insights into potential pension benefits and facilitating scenario planning, the calculator empowers individuals to make informed decisions about their financial future. However, it's essential to use some expert advice on a way to retirement. Book a call with Federal Pension Advisors; their experts will guide you to select the best retirement plan according to your specific needs.

1 note

·

View note

Text

KFintech NPS - Open NPS Account Online | National Pension System

National Pension Scheme (NPS) is a government-sponsored pension scheme to provide income security for all sector citizens. Apply for National Pension System Online at NPS KFintech.

#nps#investment#national pension scheme#national pension system#pension#retirement#technology#business#nps calculator#education

0 notes

Text

Secure Your Future with Buy Best Retirement Plans | Spectrum Insurance

Explore the optimal retirement solutions and invest in your future with the Buy Best Retirement Plan option. Discover tailored strategies designed to safeguard your financial stability during your golden years. With our diverse range of plans, you can confidently secure your retirement and embark on a journey of financial freedom and peace of mind.

#Buy Best Retirement Plans#best retirement plan in india#best government pension plans#best pension plan in india#best pension plan calculator

0 notes

Text

Understanding Maximum Pension Tax Relief: Comprehensive Guide + Calculator

Pension Tax Relief stands as a crucial incentive offered by the UK government to encourage citizens to save for retirement. It's designed to ease the financial burden on individuals by providing tax benefits on contributions made to pension schemes.

Highlighting its significance for UK investors, Pension Tax Relief serves to:

Encourage Retirement Savings: It motivates individuals to save for retirement by offering tax benefits, thereby fostering a financially secure future.

Boost Long-Term Savings: By reducing the tax burden on contributions, it promotes the growth of pension pots, enabling investors to accumulate more for retirement.

Support Financial Planning: It assists in financial planning by allowing investors to benefit from tax-free growth within their pension funds.

Ensure Adequate Retirement Income: Pension Tax Relief aims to ensure that individuals have sufficient income post-retirement, reducing reliance on state pensions.

Flexibility in Contributions: Investors can choose how much they contribute within certain limits and benefit from tax relief based on their contributions.

Understanding the basics is pivotal for UK investors as it not only provides a practical way to save for retirement but also offers maximum pension tax relief calculator advantages, empowering individuals to secure their financial future.

Exploring Maximum Relief Limits

Pension Tax Relief in the UK operates within defined limits, influencing the tax benefits individuals can accrue. Understanding these limits is essential for optimising contributions and reaping maximum advantages. Here's a breakdown:

Annual Allowance: This sets the cap on how much you can contribute to your pension pot each year while enjoying tax relief. For the current tax year, the standard annual allowance is £40,000. However, this might be tapered for high earners.

Lifetime Allowance: It represents the maximum amount an individual can accumulate in their pension pot without facing additional tax charges. For the tax year 2022-2023, it stands at £1,073,100.

Factors Influencing Limits: Factors like income, pension contributions, and any other pensions you may have could impact these limits, potentially reducing available tax relief.

Understanding these thresholds allows investors to strategies contributions effectively, ensuring they optimise tax benefits while staying within the allowable limits.

Navigating Tax Efficiency: Strategies for Maximum Tax Relief

Utilise Annual Allowance: Maximising contributions up to the annual allowance (£40,000 for most individuals) ensures optimal tax relief. Regularly review the maximum contribution calculator to make the most of this threshold while staying within personal financial boundaries.

Employer Contributions: Take full advantage of employer-matched contributions. Employers often offer to match a percentage of your contributions, effectively boosting your pension pot without additional personal expenditure.

Carry Forward Allowance: Consider any unused allowances from the previous three tax years. This allows for higher contributions within the current year's limit, particularly useful for individuals with fluctuating incomes or those nearing retirement seeking to bolster their pension fund.

Salary Sacrifice Arrangements: Explore salary sacrifice schemes offered by employers. These arrangements involve sacrificing a portion of your salary in exchange for increased pension contributions. This not only augments your pension fund but also reduces taxable income, resulting in enhanced tax savings.

Monitor Lifetime Allowance: Stay vigilant about your pension pot's growth. Regular monitoring ensures you don't surpass the lifetime allowance (£1,073,100 for the tax year 2022-2023), which may lead to additional tax charges.

Implementing these strategies empowers investors to optimise pension contributions, leveraging maximum tax relief benefits while ensuring a financially secure retirement.

Introducing the Calculator: Step-by-Step Guide

The inclusion of an interactive pension tax relief calculator offers readers a practical tool to estimate potential benefits based on their contributions. Here’s a step-by-step guide on utilising this user-friendly calculator:

Access the Calculator: Begin by clicking the provided link or accessing the designated section on the website.

Input Personal Details: Enter required information such as annual income, existing pension contributions, and age to personalise the calculation.

Adjust Contribution Levels: Experiment with different contribution amounts to understand how varying inputs affect potential tax relief.

Explore Scenarios: Use hypothetical scenarios to explore the impact of increased or decreased contributions on tax relief and retirement savings.

Interpret Results: Understand the calculator's output, which may display estimated tax relief and the projected growth of the pension pot based on the provided data.

Seek Professional Advice: Encourage readers to use the calculator as a guiding tool but emphasise the importance of seeking financial advice for tailored recommendations.

This maximum pension tax relief calculator provides an interactive way for individuals to grasp the potential tax benefits of pension contributions, empowering them to make informed decisions about their retirement planning.

Additional Tax Implications and Pension Regulations

Explore these vital aspects beyond the basic concepts:

Tax Implications: Highlight the tax treatment of pension withdrawals, emphasising the tax-free lump sum and the taxable portion when drawing a pension income.

Changes in Pension Regulations: Briefly touch upon recent regulatory changes or proposed reforms affecting pension schemes, encouraging readers to stay updated for informed decision-making.

Staying informed about evolving tax implications and regulatory shifts ensures individuals can adapt their retirement strategies to maximise benefits and navigate changes effectively.

Conclusion

Tax relief is the foundational step of a secure retirement plan. It slashes immediate tax burdens on pension contributions, amplifying savings potential. By nurturing tax-free growth within the pension fund, it substantially fortifies your retirement fund, ensuring financial stability.

Empower yourself by using the interactive maximum pension tax relief calculator provided. It delivers personalised insights into potential tax benefits based on different contribution scenarios. This hands-on approach fosters informed decision-making and proactive financial planning.

For tailored guidance, seek expert financial advice. While tools like maximum funding calculators or tax relief calculators offer valuable insights, personalised advice from professionals ensures optimised contributions aligned with individual circumstances, maximising tax benefits for a confident retirement.

Empower your financial future by leveraging tax relief benefits and making informed decisions. Utilise the tools available and seek professional guidance to shape a secure retirement plan aligned with your goals.

#financial services#pension#pension calculator#tax relief#tax relief calculator#funding#funding calculator

0 notes

Text

Pension Fund Calculator

You can use a pension fund calculator to determine how much you could contribute to a retirement plan. This calculator assists you in determining the lump sum amount you may save for retirement days up to the age of 60 based on a regular monthly commitment.

On the EPFO website, you can access the EPS calculator. The following are some inputs that you must supply for computation if you want to know how much pension you could receive:

Date of birth: The member must have turned 58 on January 4, 2011, or later. Therefore, to use this calculator, the user's birthdate must be on or after January 4, 1953.

Dates of entry and departure from service constitute the service period. The EPFO paper states that the date of entry into service cannot be earlier than November 16, 1995, and the date of leaving cannot be later than the date of superannuation.

NCP 1 and NCP 2 days: Members are required to give information on their non-contributory term of service (NCP). NCP is the total number of days the member received no pay as well as the total number of days the employer failed to pay the member's EPS payment.

NCP-1 runs through August 31, 2014, while NCP 2 runs through that date.

Members may add additional service time, according to EPFO, if they have worked for various organisations.

Pension opted date: If the member has reached the age of 58, the system will show the pension start date. If the member has not yet become 58 years old, he can input a date from the time he left the military or when he became 50 to the time he used the calculator.

Pensionable salary: If the pension start date is on or before August 31, 2014, the pensionable salary is the average wage for the previous 12 months; if it is after that date, it is the average wage for 60 months.

According to EPFO regulations, the maximum salary is Rs. 6500 up until August 31, 2014, and Rs. 15,000 thereafter.

In order to use this calculator, the average wage must be at least Rs. 15,000 as of September 1, 2014, and at least Rs. 6500 as of August 31, 2013.

The calculator will show you your monthly or annual pension once you have entered all the necessary information.

According to EPFO, "If the pension sum is less than Rs 1000/- the member will be eligible for a minimum pension of Rs 1000/- with effect from September 1, 2014, or the date the pension begins, whichever is later."

The statement continues, "In case of early pension, the reduction amount of the pension @4% per annum will be removed from the early pension for each year from pension established at age of 58 years till the age (minimum 50 years) from which early pension opted.

0 notes

Text

EPFO Account में 11 Details हो सकेंगी आसानी से Update

Employees’ Provident Fund Organization (EPFO) ने मेंबर्स के अकाउंट में नाम, आधार सहित 11 Information को Update करने के लिए नई प्रक्रिया जारी की है। Organization की ओर से जारी नए Circular में नाम, लिंग, जन्म तिथि, पिता का नाम, संबंध, वैवाहिक स्थिति, जॉइन करने की तारीख, छोड़ने का कारण, छोड़ने की तारीख, राष्ट्रीयता और आधार संख्या को Update करने की मंजूरी दी गई है।

नई प्रक्रिया से EPF Member के लिए…

View On WordPress

#EPF Account Number#EPF Balance Check#EPF Claim Status#EPF Contribution#EPF Interest Rate#EPF KYC Update#EPF Nomination#EPF Passbook Download#EPF Pension Calculator#EPF Rules#EPF Transfer Online#EPF UAN Registration#EPF Withdrawal#EPF Withdrawal Process#EPF Withdrawal Rules and Process#EPFO Customer Care#EPFO Grievance#EPFO Login#EPFO Member Portal#EPFO Online Payment#EPFO Services and Benefits#EPFO UAN Activation Guide#How to Check EPF Balance Online#UAN Activation

0 notes

Text

How to Calculate Your Retirement Corpus

Remember that calculating a retirement corpus is not an exact science and involves making assumptions about factors like inflation, investment returns, and your own circumstances.

0 notes

Text

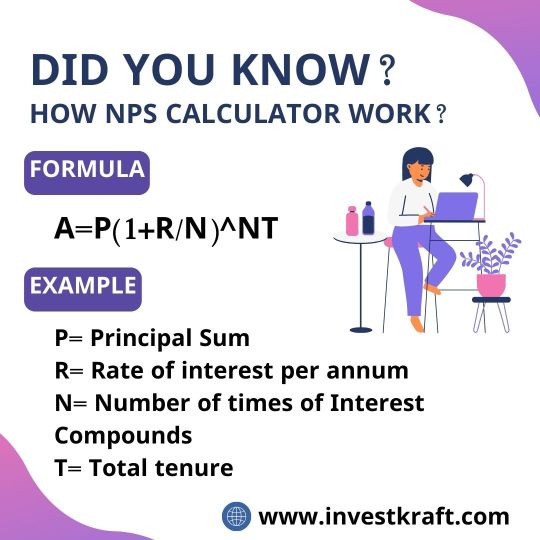

Which National Pension System Calculator Offers the Most Accurate Future Projections?

Trying to plan for retirement can be daunting, but the National Pension System (NPS) Calculator can help. Among various options, Investkraft's website stands out for its accuracy in projecting your future finances. By inputting key details like your age, current savings, and investment preferences, the calculator estimates your pension fund's growth over time. Investkraft's tool employs advanced algorithms and up-to-date financial data to provide precise projections. Its user-friendly interface simplifies the process, making it accessible for everyone. Whether you're just starting to save or nearing retirement, this calculator offers invaluable insights into your financial future. Trust Investkraft's NPS Calculator for reliable and accurate estimations, guiding you towards a financially secure retirement.

2 notes

·

View notes

Text

Online Pension Calculator is a simple tool that can help you plan how much money you need to invest to achieve your retirement goals. Plan for your retirement and secure your future @ICICI Pru Life

0 notes

Text

EPS Higher Pension Calculation: Larger Provident Fund Balance or Higher Pension? Watch the video to decide now

eps Higher pension calculation: If you are a private sector employee, you can opt for higher pension under the Employees’ Pension Scheme (EPS) till June 26. This option given by the Employees’ Provident Fund Organization (EPFO) comes next. The Supreme Court had given its verdict in November last year. So, should you opt for pension payout more than your salary? And did you know that opting for a…

View On WordPress

#business News#Employees Pension Scheme#Employees Pension Scheme 1995#EPF#EPF High Pension Scheme#EPFO#eps#eps higher pension calculator#pension#Provident Fund

0 notes