#business registration online

Text

Starting your own business is an exciting and satisfying undertaking, but there are legal requirements and a ton of paperwork involved. Online Company Registration is an essential stage in this process, but it can be difficult and time-consuming, particularly if you’re unfamiliar with the rules and processes. That is where having experts on staff can be quite beneficial. If you are looking for expert professionals who can make Business Registration Online hassle-free and easy for you, reach out to Eazy Startups, India. At Eazy Startups, our experts in Online Company Registration can help you every step of the way and ensure everything is completed quickly and accurately. We can help you avoid difficulties and costly blunders by navigating the legal and bureaucratic maze with our skills and experience. Contact us today for our valuable assistance. This blog will discuss how professionals can help you with your Business Registration Online in India.

0 notes

Text

Advantages of One Person Company (OPC) over Sole Proprietorship

In India, a company form called a One Person Company (OPC) is developed that enables a single person to function as a distinct legal entity. One Person Company registration is appropriate for start-ups and small businesses. The OPC permits the owner to have limited liability and is subject to the same legal restrictions as any other private limited business.

In other words, A One Person firm (OPC) is a type of business structure in India that allows a single person to incorporate and administer a firm. It was created by the Companies Act of 2013 to provide an appropriate business structure for small entrepreneurs that desire to operate as a limited liability company. One individual Company requires only one individual to participate as a director and shareholder. This indicates the individual has entire control and ownership of the business. They may, however, choose a nominee to take over management and ownership of the firm in the case of their death or incapacity.

The majority of entrepreneurs prefer an OPC registration over a sole proprietorship registration due to a number of its advantages. There are some of the main advantages as listed below:

Easy Transfer of Ownership: By transferring the shares of the company, ownership of the business can be easily transferred In an OPC. However, this is not feasible in a Sole Proprietorship, because the owner and the business are considered as one entity. This can create a barrier in transferring the business ownership to someone else.

Easy to Raise Capital: Investors, banks, and other financial entities are simple sources of capital for an OPC. This is so that an OPC, which can generate money by issuing shares and has a separate legal identity, can do so. As the firm and the owner are regarded as one thing, the owner of a sole proprietorship has few choices for raising capital. Due to this, it may be challenging for sole proprietorships to develop or grow their company.

Limited Liability: Limited liability is an OPC’s main advantage over a sole proprietorship. In an OPC, the owner's liability is constrained to the company’s share capital amount. In the event that the business encounters any monetary or legal difficulties, the owner's personal assets are therefore not in jeopardy. In contrast, a sole proprietorship makes the owner personally responsible for all debts and losses caused by the company. This means that the owner's personal assets may be confiscated in order to settle obligations if the company ever experiences financial or legal difficulties.

Separate Legal Entity: Another advantage is that an OPC has a different legal status from a single proprietorship. This shows that the company's legal personality is distinct from that of its owner. As a result, an OPC in India has the power to sign contracts, buy property, and file or respond to lawsuits. Because the owner and the company are seen as one, all business decisions made in a sole proprietorship are personally liable to the owner.

Tax Benefits: OPCs in India are qualified for a variety of tax advantages, including reduced tax rates, deductions, and exemptions. This is due to the fact that OPCs are treated as independent legal entities for taxation purposes. In a sole proprietorship, the owner must pay personal income tax rates on the business's income. Sole proprietorships may have increased tax obligations as a result of this.

Professional Image: An OPC registration gives a commercial enterprise a professional image, which may be helpful in luring clients and investors. This is so that it can comply with different regulatory requirements as an OPC is a recognized legal organization. This increases stakeholders' trust in the company and its operations. A sole proprietorship, on the other hand, can come across as less professional and have trouble luring clients and investors.

Perpetual Existence: An OPC has permanent existence, which means it survives the death or resignation of its owner. This is because the OPC in India has its own unique identity and is a separate legal organization. In contrast, a sole proprietorship ends when the owner passes away or retires. For the firm and its stakeholders, this may lead to uncertainty and instability.

Finally, One Person Company (OPC) has a number of advantages over a sole proprietorship. Limited liability protection, a separate legal organization, continuity and succession planning, access to funds and investors, and a more professional image are some of the benefits. Entrepreneurs considering beginning their own business should carefully weigh these advantages as well as the long-term rewards and drawbacks of selecting OPC as their preferred business form.

#startup registration#Business registration#virtual cfo services#business consultant near me#consultancy for startups#business registration online

0 notes

Text

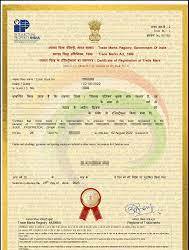

Get Online Trademark Registration Dwarka | Legal Tax

When Registering for Online Trademark Registration, Make Sure You Are Also Looking for the Best Way to Register Your Trademark. This Is Important for Any Business Because of Its Benefits and How It Distinguishes Your Business from Others. the Truth Is That a Business Is More Than the Name You Give to It. Like Legal Tax!

Visit Us:- https://legaltax.in/trademark-registration.php

company registration online

business registration online

partnership firm registration online

iso registration online

iso certification online

#Online trademark registration#company registration online#business registration online#partnership firm registration online#iso registration online#iso certification online

0 notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords:

company registration netherlands

legal advice online

comprehensive financial planning

financial planning consultancy

international business services

international business expansion strategies

gdpr compliance solutions

international trade consulting

european investment opportunities

gdpr compliance consulting services

in depth financial analysis

gdpr compliance assistance

cross border tax solutions

netherlands business environment

european union business law

dutch accounting services

tax intermediation solutions

international tax planning advice

eu trademark registration services

investment guidance online

business law consultancy

corporate tax services netherlands

financial analysis experts

business immigration support

startup legal assistance online

european market entry consulting

international financial reporting services

business strategy netherlands

tax authority communication support

international business law expertise

dutch commercial law advice

global business strategy services

european business consulting online

international business services platform

expert legal advice online

efficient company registration netherlands

reliable dutch accounting services

strategic tax intermediation

proactive international tax planning

eu trademark registration support

tailored investment guidance

specialized business law consultancy

dynamic international trade consulting

holistic corporate tax services netherlands

streamlined business immigration support

online startup legal assistance

strategic international business expansion

european market entry planning

innovative cross border tax solutions

navigating the netherlands business environment

european union business law insights

accurate international financial reporting

proven business strategy netherlands

exclusive european investment opportunities

seamless tax authority communication

in depth dutch commercial law advice

comprehensive global business strategy

proactive european business consulting

one stop international business services

personalized financial planning solutions

expert legal advice for businesses

quick company registration in netherlands

trustworthy dutch accounting services

strategic tax intermediation solutions

innovative international tax planning

efficient eu trademark registration

tailored investment guidance online

business law consultancy expertise

comprehensive corporate tax services netherlands

thorough financial analysis support

streamlined business immigration assistance

navigating netherlands business environment

european union business law guidance

international financial reporting accuracy

business strategy for netherlands market

european investment opportunities insights

efficient tax authority communication

international business law excellence

dutch commercial law proficiency

global business strategy implementation

european business consulting excellence

comprehensive international business services

proactive financial planning strategies

expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

3 notes

·

View notes

Text

How to start your E-commerce business.

Being an E-commerce seller requires numerous steps, ranging starting with planning and sourcing items to creating the online shop and coordinating the logistics. This step-by-step guide will assist you in becoming an e-commerce seller:

Market Research

Business Plan

Legal Considerations

Source Products

Create an Online Presence

Payment and Shipping Setup

Product Listings and Descriptions

Make Marketing Strategy

Implement Customer Service

Optimization of Business performance

Scaling Your Business

Click below to read more.

#virtual office#gst registration#Virtual office in Delhi#Virtual office for Online seller#Virtual office for business registration#E-commerce seller

2 notes

·

View notes

Text

I finally got my BIR 2303 today & my ATP for my official receipts! They also gave me 3 books to maintain, so now I have to relearn bookkeeping 😂😭

I'm too poor to hire an accountant, plus my pride as a former accountancy student won't allow it

#BIR 2303 means Certificate of Registration#which means my online shop is now a legal business that pays taxes 😀#it's been years since I did journal entries#Thank God for youtube coz I never had these online resources when I was an accountancy student#ramblings

6 notes

·

View notes

Text

A guide to enhance your business growth

Running a business is akin to navigating a complex maze, and every entrepreneur dreams of not just surviving but thriving. In the Indian business landscape, the government has laid out a golden path for micro, small, and medium enterprises (MSMEs) through a simple yet powerful tool – MSME registration. In this guide, let's explore how this seemingly mundane registration process can be your ticket to unparalleled business growth.

Understanding the MSME Advantage

The Heartbeat of the Economy:

Micro, Small, and Medium Enterprises collectively form the heartbeat of the Indian economy. From local grocery stores to innovative startups, these businesses contribute not only to economic development but also to job creation, fostering a robust and inclusive growth environment.

Unlocking Financial Avenues:

One of the immediate perks of MSME registration is the access to financial assistance and credit facilities. Financial institutions offer tailored loans at favorable terms, recognizing the importance of these enterprises in driving economic progress.

The MSME Registration Journey

A Simpler Path Than You Think:

Contrary to popular belief, the MSME registration process is not a bureaucratic labyrinth. It's a straightforward journey that involves providing essential details about your business, such as PAN, Aadhaar, and other relevant information. Whether you choose the online portal or opt for the traditional route at District Industries Centres, the process is designed to be accessible.

Documents: Your Passport to Opportunities:

The importance of documentation in the registration process cannot be overstated. Your Aadhaar card, PAN card, business address proof, and details of your plant and machinery are the keys that unlock the door to a myriad of government schemes and subsidies.

The MSME Advantage Unveiled

Market Access and Procurement Preferences:

Once you've acquired your MSME registration, you find yourself in a prime position in government procurement. MSMEs are often given preference in government tenders, providing a golden opportunity to secure contracts and expand your market reach.

Technology Upgradation and Subsidies:

In the rapidly evolving business landscape, technology is the differentiator. MSME registration brings with it the chance to upgrade your technology with subsidies for adopting new and advanced processes. This not only boosts efficiency but also enhances your competitiveness.

Navigating the Schemes and Subsidies Landscape

Credit Linked Capital Subsidy Scheme (CLCSS):

At the forefront of government schemes is CLCSS, a game-changer for technology upgradation. It provides capital subsidies to MSMEs, facilitating access to credit for purchasing new machinery and equipment.

Pradhan Mantri Employment Generation Programme (PMEGP):

For those looking to embark on the entrepreneurial journey, PMEGP is the beacon. This credit-linked subsidy program promotes self-employment, creating not just businesses but livelihoods.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE):

The fear of collateral is a common hurdle for many small businesses. CGMSE eliminates this barrier by offering collateral-free credit facilities, making it easier for MSMEs to access the capital needed for growth.

Tailoring Your Approach

District Industries Centres (DIC) and National Small Industries Corporation (NSIC):

Think of DIC and NSIC as your business allies. DIC, as a local agency, offers guidance and support, while NSIC provides a range of services from marketing assistance to credit facilitation. Engaging with these institutions can significantly enhance your MSME journey.

Tech and Quality Upgradation Support:

The government's emphasis on quality is evident through schemes like Lean Manufacturing Competitiveness Scheme (LMCS) and Quality Management Standards & Quality Technology Tools (QMS/QTT). These initiatives not only boost competitiveness but also position your business as a paragon of quality in the market.

Export Promotion and Market Development:

Venturing into global markets can seem daunting, but the Market Development Assistance Scheme for MSMEs is a trustworthy companion. It provides financial support for participating in international trade fairs, opening doors to new business horizons.

Overcoming Challenges for Seamless Growth

Lack of Awareness:

One of the challenges MSMEs often face is the lack of awareness about available schemes. Entrepreneurs can overcome this by actively seeking information through government portals, industry associations, and local MSME support cells.

Complex Application Processes:

Cumbersome application procedures can be discouraging, but persistence pays off. Simplifying the application process and seeking assistance from dedicated facilitation services or MSME support agencies can make the journey smoother.

Continuous Evaluation and Adaptation

Performance and Credit Rating Scheme:

Enhancing your creditworthiness is an ongoing process. The Performance and Credit Rating Scheme allows MSMEs to undergo assessments, showcasing financial stability to potential investors and lenders.

Embracing Continuous Improvement:

The business landscape is dynamic, and your approach should be too. Regularly assess the impact of government schemes on your operations, adapt to changes, and stay informed about updates to maximize benefits continually.

Conclusion: Your Journey to Unprecedented Growth

In conclusion, MSME registration in India is not just a formality; it's your gateway to a realm of opportunities. By understanding the classifications, embracing government schemes, and overcoming challenges, you position your business for sustainable growth. The government's commitment to fostering MSMEs is a testament to the integral role these enterprises play in shaping the nation's economic future. So, don't just register – embark on a journey of growth, innovation, and success. The path is laid; it's time to walk it.

Learn more at : https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme registration online#msme loan#online business#msme

2 notes

·

View notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

#development#drone#development services#rpo recruitment#governance#website development#website design#software#manpower#recruitment#human resources#online registration#career opportunities#training#skilldevelopment#professional#corporate#services#business

3 notes

·

View notes

Text

Maximize Returns, Minimize Stress: Partner with Tax Savers - Your Trusted Tax Agent in Tarneit!

Unlock Your Financial Potential with Tax Savers! As your trusted tax agent Tarneit, we specialize in maximizing your returns while minimizing your stress. Whether you're an individual or a business owner, our expert team provides tailored solutions to suit your needs. From tax returns to business activity statements Werribee, we handle it all with precision and professionalism. Let us take the headache out of tax season and help you achieve your financial goals. Partner with Tax Savers today and experience peace of mind knowing your taxes are in expert hands.

#online tax return#tax returns#accounting services#business accountant#individual accountant#tax services#business registration#trust tax return#company tax returns werribee

0 notes

Text

Join the Elite: TrakinTax - Premier CA Institute in Alwar

Join the Elite at TrakinTax, the premier CA institute in Alwar! Elevate your career with expert guidance and comprehensive courses tailored for success in the field of chartered accountancy. Experience unmatched training, personalized support, and a pathway to excel in your CA journey. Enroll now for a transformative learning experience!

#CA Accounting course#CA course in Alwar#Best CA Institute in alwar#Best CA Service in Alwar#Course of CA in alwar#GST Return filling#Best online accounting service#Business registrations

0 notes

Text

Starting your own business is an exciting and satisfying undertaking, but there are legal requirements and a ton of paperwork involved. Online Company Registration is an essential stage in this process, but it can be difficult and time-consuming, particularly if you’re unfamiliar with the rules and processes. That is where having experts on staff can be quite beneficial. If you are looking for expert professionals who can make Business Registration Online hassle-free and easy for you, reach out to Eazy Startups, India. At Eazy Startups, our experts in Online Company Registration can help you every step of the way and ensure everything is completed quickly and accurately. We can help you avoid difficulties and costly blunders by navigating the legal and bureaucratic maze with our skills and experience. Contact us today for our valuable assistance. This blog will discuss how professionals can help you with your Business Registration Online in India.

0 notes

Text

iso registration online in Dwarka | Legal Tax

ISO certification is an international standard for quality management, certification, and business integrity. It defines the requirements for an integrated management system where each element is optimized to work effectively in an overall context.

If you have an idea for a product and want to create it, a business plan is the best way to start. Business plans are a great way to plan out a project before you start it. Legal Tax!

Visit Us:- https://legaltax.in/iso-certification.php

company registration online

business registration online

partnership firm registration online

iso registration online

iso certification online

#Online trademark registration#company registration online#business registration online#partnership firm registration online#iso registration online#iso certification online

0 notes

Text

Setting-up Business: Legal Things to Consider Before Starting a Business in India

It is both exciting & difficult to start the journey of entrepreneurship in India but it is also very crucial to navigate the legal complexities effectively. Here we will discuss about the essential legal considerations that every aspiring business owners must remember while starting a business in India.

Legal Things to Consider Before Starting a Business in India

Selecting the Right Business Structure: As each business structure comes with its own set of legal implications regarding liability, taxation, and compliance, so you must determine the most suitable business structure among sole proprietorship, partnership, LLP, private limited company, or public limited company for your venture as per your business goals.

Registering Your Business: You should register your business with the appropriate authorities as per the relevant laws and regulations of specific business structure. It is important to establish legitimacy and ensuring compliance.

Understanding Taxation: You must have the knowledge about various taxes applicable to your business, including GST, income tax, and others. It will be better for you to seek tax professional guidance to navigate the aspect of taxes effectively.

Protecting Intellectual Property: It would be best to protect your intellectual property via trademarks, copyrights, or patents. As your ideas and innovations are valuable assets so it will secure your creations from unauthorized use and establishes your brand identity in the market.

Obtaining Licenses and Permits: It is mandatory to obtain the necessary licenses and permits, whether it's industry-specific permits or general business licenses, as per your business operations to stay compliant with regulations.

Data Protection and Privacy Compliance: In today's digital stage, the most important thing is to protect customer's data. You must have to stick to data protection and privacy laws to secure the sensitive information of clients and maintain customer trust.

Important Laws to Follow Up in Company Registration in India

The Industrial Disputes Act, 1947

The Trade Unit Act, 1926

Building and Other Constructions Workers’ (Regulation of Employment and Conditions of Service) Act, 1996

The Industrial Employment (Standing Orders) Act, 1946

The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979

The Payment of Gratuity Act, 1972

The Contract Labour (Regulation and Abolition) Act, 1970

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

The Employees’ State Insurance Act, 1948.

Conclusion

You can lay a solid foundation for your business venture and navigate the complexities of entrepreneurship confidently by addressing the above mentioned legal considerations accurately. It would be best to seek the professional legal advice to get the invaluable support personalized as per your specific needs & circumstances.

#Company Registration#Online Company Registration#Company Registration ii India#Business Registration

0 notes

Text

GET YOUR TRADEMARK REGISTRATION ONLINE WITH OUR PROFESSIONAL EXPERTS

#Legalcy#Legalcyy#LegalcyPvtLtd#LegalcyPrivateLimited#trademarkregistration#online#professionalexperts#trademark#registration#legal#intellectualproperty#brandprotection#business#entrepreneur#startup#copyright#patent#invention#branding#lawyer#legaladvice#smallbusiness#entrepreneurship#trademarklaw

0 notes

Link

https://beforeitsnews.com/business/2024/03/mastering-online-nursery-registration-troubleshooting-common-issues-3712944.html

#online registration nursery class in noida#before its news#beforeitsnews#business#the millennium schools

0 notes