#USDA Eligibility Maps

Text

USDA Home Loan Income Limits Change In 2024

USDA Home Loans are no down payment loans with lower mortgage interest rates than Conventiona Loans. Two of the major USDA Home Loan Qualifying Requirements are that the property be located within in a “designated” USDA Home Loan area – and the household income must not exceed the limits below. USDA Home Loan Income Limits Change in 2024, and in 2023, we are already using these higher loan…

View On WordPress

0 notes

Text

Beyond the City Limits: Financing Your Dream Home with USDA Loans

In the quest for homeownership, many individuals dream of finding their ideal home in a peaceful rural setting. However, financing such dreams can sometimes pose challenges. Enter USDA loans, a unique and often overlooked option that opens the door to homeownership beyond the city limits. In this article, we'll explore the benefits and intricacies of USDA loans, shedding light on how they can be the key to financing your dream home in the countryside.

Understanding USDA Loans: USDA loans, backed by the United States Department of Agriculture, are designed to support individuals and families looking to purchase homes in rural or suburban areas. Contrary to popular belief, these loans are not exclusively for farmers; they aim to stimulate rural development by making homeownership more accessible.

Key Features and Benefits:

Zero Down Payment: One of the most appealing aspects of USDA loans is the opportunity for eligible borrowers to secure a mortgage with no down payment. This can be a game-changer for those who may find it challenging to save a substantial upfront amount.

Competitive Interest Rates: USDA loans often offer competitive interest rates, making them an attractive option compared to other financing methods. This can result in significant savings over the life of the loan.

Flexible Credit Requirements: While a good credit score is beneficial, USDA loans are known for being more forgiving when it comes to credit history. This flexibility widens the pool of eligible applicants, providing opportunities for those with less-than-perfect credit.

Geographical Eligibility: USDA loans are specifically designed for homes in rural or suburban areas, promoting growth and development outside urban centers. Prospective homeowners should check the USDA eligibility map to determine if the property they have in mind qualifies.

Guaranteed and Direct Loan Options: The USDA offers both guaranteed and direct loan programs. Guaranteed loans are provided by approved lenders but backed by the USDA, while direct loans are issued directly by the USDA. Each option has its own set of requirements and benefits.

Navigating the Application Process: To embark on the journey of financing your dream home with a USDA loan, it's crucial to follow a structured application process. This typically involves determining eligibility, gathering necessary documentation, and working with an approved USDA lender. The process may seem intricate, but the potential benefits make it well worth the effort.

Conclusion: For those yearning for the tranquility and charm of rural living, USDA loans present a viable and attractive financing option. Beyond the city limits, these loans offer a pathway to homeownership that may have seemed out of reach. As you explore your options, consider the unique benefits of USDA loans, and take the first steps towards turning your dream of a countryside home into a reality.

0 notes

Text

Use a Rural Address Checker to Find Your E-911 Physical Address

Rural address checker is a tool for finding out whether you have a USDA rural home loan eligible property. It's important to understand how the USDA property eligibility map works and what the different definitions of rural mean.

A Rural Address is the physical location of a dwelling (house dwelling) or occupied structure in a rural area. It is linked to a unique record in the Automatic Location Identifier (ALI) system and makes the caller’s location immediately available to the Public Safety Answering Point (PSAP). The information in the ALI system is used by 911 dispatchers to guide emergency response personnel to the exact location of a 911 call.

All lots, residences and occupied structures have an officially assigned E-911 physical address. It is determined by a distance-based system using miles as the unit of measure.

You can use our online Rural Address Checker to find out your E-911 physical address. It is helpful when you are looking up directions or if your GPS does not accurately reflect your physical address.

Click the “Check My Location” button in the upper right of the map to begin the search. Enter the full or partial address of the location you want to check and press “Return.” One or more addresses will be shown as search results in the list. Click an address in the list to see the marker and its corresponding details on the map.

Once a Chapter has completed the initial steps to do Rural Addressing, it will simplify the process. Anyone who wants a rural address will be able to go to their chapter to complete a form, provide the NNAA office with a general map location of where they live and a GPS of their driveway entrance point, then NNAA will make field work arrangements to GPS the address and issue the Rural Address Number.

youtube

SITES WE SUPPORT

Account Address Api – Blogger

0 notes

Text

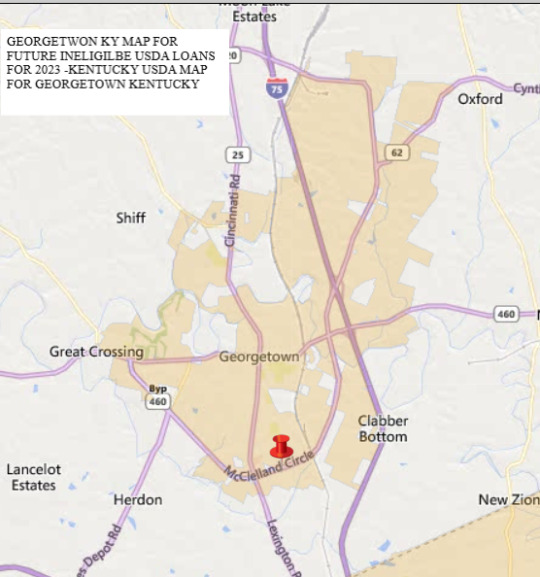

Future Ineligible map for Kentucky USDA Properties in Georgetown Kentucky

Future Ineligible map for Kentucky USDA Properties in Georgetown Kentucky

USDA Rural Development Kentucky

Notice of changes to eligible area maps for USDA Rural Development housing programs

USDA Rural Development has completed its 2020 decennial United States census review for all areas under its jurisdiction to identify areas that no longer qualify as rural for Kentucky USDA Rural Housing programs.

Based on the review of the areas within the state of Kentucky,…

View On WordPress

#Bowling Green Kentucky#Elizabethtown Kentucky#ky first time home buyer#Mortgage loan#Rural development#United States Department of Agriculture#USDA Rural Development#zero down kentucky home loan

0 notes

Text

How to Use a Rural Address Checker

In order for emergency response personnel to find your location if you call 9-1-1 from a landline phone, your address must be linked to an Automatic Location Identifier (ALI) record. This data is transmitted to the Public Safety Answering Point (PSAP) and it helps them to direct responders to your home. This information is only available at the address where your driveway intersects a public or private road. This information is not available for use with GPS units.

A rural address is the same as a postal delivery service route number with the addition of a letter indicating which class of road the driveway is located on. For example, you may have a driveway on “Rural Route 4.” If you want to know if your address qualifies as rural for USDA purposes, look it up with this USDA property eligibility map. Just enter a local address and check whether it shows up in the shaded areas of the map.

Getting a Rural Address

To get a rural address checker, you must work with your Chapters and their CLUPC/NNAA offices to name roads, do field data collection to identify homes and buildings and hold public hearings for official adoption of the new names. Once the steps above have been completed, the NNAA office can issue the individual with their rural address.

Fortunately, there is a database system called LACSLink that converts rural route numbers into street addresses. There are also businesses that provide this service to help reduce mailing costs and expedite delivery times. This process can be tedious, but it is well worth it if you want to use a physical address for your home or business.

youtube

SITES WE SUPPORT

Verify Mail Invoice - BlogSPot

1 note

·

View note

Text

How to Use a Rural Address Checker

Not everyone likes city or suburban living, and there are plenty of people out there who prefer a more rural lifestyle. They might live in an area that is designated as rural according to USDA property eligibility maps, or they might have a home with a rural route address. Those types of addresses are not as easy to find compared to those with street names and zip codes. Using the right tools, though, it is possible to locate these homes based on a rural route number.

To start with, it's important to understand what a rural address Validation is. This is an abbreviation for a postal delivery address that includes the route number and a box or enclosure for delivering mail to the residence. These addresses are used by those who don't have a street address, such as rural fire departments, ambulance services, sheriff's office personnel and the U.S Postal Service.

The process of getting a rural address starts with the Chapters working with their CLUPC and NNAA office to identify and name roads, do field data collection to identify homes and buildings to be addressed and hold public hearings to adopt those road names. Once those steps are complete, a person who wants a rural address can go to their chapter and add their name to a list or database.

Next, the NNAA office will work with the homeowner to make arrangements for them to have their driveway GPSed and issued a rural address. Depending on the class of the road and any site-specific physical limitations, Town officials may also need to be involved in the process, as well.

youtube

SITES WE SUPPORT

Print Address Mail - Blogger

1 note

·

View note

Text

What Is USDA Financing?

What Is USDA Financing?

A USDA loan is a government-backed mortgage designed to help people in rural areas get into homes. It offers no down payment and lower mortgage rates than FHA or VA loans.

You can see if the home you want to buy is eligible by using a USDA eligibility map. It also allows you to look at income limits and other restrictions.

What is a USDA loan?

A USDA loan is a…

youtube

View On WordPress

#business#businessloan#cryptocurrency#cryptopia#exchange#finance#financialInformation#individuals#investment#investmentideas#marketing#mortgageloan#Youtube

0 notes

Text

USDA Home Loans in Texas

USDA home loans are great for people who need a little extra help buying a home. They're made specifically for first-time home buyers who have very little money to put down. These loans are offered through USDA's Housing Loan Program, a special kind of loan offered by the United States Department of Agriculture.

The USDA guarantees ninety percent of home loans issued by participating local lenders. USDA loans don't require a down payment and can have fixed interest rates as low as 1%. They're also great for borrowers with low and moderate incomes who have trouble getting a mortgage from another lender.

To qualify for a USDA home loan, you must buy a home within the designated area and have an income that's less than 150% of the median income in your area. In addition, you must have a credit score of at least 640. Those with lower credit scores can avoid this requirement by paying cash toward their down payment.

The income limits for USDA home loans vary by county. However, if you have a higher income than the local median income, you can qualify for a larger USDA home loan. You can check these limits by visiting the USDA's website. You should also check the USDA's eligibility maps to make sure you qualify. If you meet the income limits, your loan will be approved without any hassle. So, don't be afraid to apply for a usda home loan texas today!

USDA home loans are a great choice for first-time homebuyers or people who have damaged credit histories. The qualification requirements for these loans are more lenient than for other home loans. This makes them more affordable for many people. However, it's important to be aware that these loans require little to no down payment.

To qualify for a USDA home loan, you must live in an eligible rural area. The USDA website offers an interactive map that allows you to search for eligible properties. You must also meet income requirements and plan to use the property as your primary residence. You also must have the ability to repay the loan. If you're unable to qualify for the USDA loan, you can seek out a Federal Housing Authority loan, which is another option.

USDA home loans have lower interest rates than conventional loans. This means that you can save tens of thousands of dollars in interest over the life of the loan. You can also qualify for lower closing costs with a USDA home loan. Although USDA loans don't require a down payment, you must pay mortgage insurance. This mortgage insurance is relatively inexpensive and usually equal to less than 1% of the loan amount.

USDA home loans are an excellent option for first-time homebuyers. There are many benefits to these loans, including low-interest rates, low closing costs, and no or very low down payment. However, you'll need to provide some documentation to qualify for a USDA home loan.

0 notes

Link

#usda loan map#usda loan eligibility#USDA Loan Benefits#USDA Loan#Is a USDA Loan a good Idea#It is Good to apply for USDA Loan#usda mortgage#US Mortgage News#Mortgage News#Compare Closing LLC#New Home Purchase News

1 note

·

View note

Text

Not known Factual Statements About USDA Loan

Here is a table listing present-day conforming home finance loan prices close to you, which you'll be able to use to match from USDA loans.

In case you are self-used and need to utilize USDA funding, as with FHA and traditional financing, you may be requested to provide 2 yrs of federal tax returns to confirm your self-work revenue.

Just about every energy is built to provide accurate and total information and facts relating to qualified and ineligible spots on this Web site, dependant on Rural Growth rural location demands. Rural Growth, nevertheless, does not warranty the accuracy, or completeness of any facts, products, course of action, or resolve supplied by This technique. USDA Loan Process of house eligibility need to be produced by Rural Enhancement upon receipt of a whole software.

Both equally have to have regular monthly home loan insurance premium payments, however the USDA’s is less as of this creating, and decreases While using the loan equilibrium. If you don't qualify for the USDA loan, contemplate an FHA loan.

Personal banks and home finance loan companies offer USDA loans at incredibly lower fees. The USDA backs these loans, which makes it safer and much less expensive for personal banks and property finance loan businesses to lend. The discounts are handed on to the home consumer in the shape of lessen rates.

Homebuyers looking to escape the hustle and bustle of city everyday living may well qualify to get a USDA loan, which comes with various Added benefits. This government-sponsored loan program focuses on homes that are located in designated rural spots.

The USDA eligibility maps remain determined by inhabitants data from your census in the yr 2000. This is a distinctive chance to finance a suburban house using this zero-down mortgage system before the USDA updates their maps.

The USDA Advancement Loan is for low-revenue family members who intend to make enhancements to their existing house. These repairs are limited to things which will negatively impression the wellness and security of the home. To qualify, the individual or family members have to have a spouse and children cash flow 50% lessen than your average region revenue.

Make sure you seek the advice of a licensed economical Experienced before you make any money decisions. This site can be compensated by way of 3rd party advertisers. This page is not really endorsed or affiliated Along with the U.S. Division of Schooling.

The home that you just wish to acquire have to also fulfill the USDA assets eligibility necessities to qualify for this household loan. If the house you desire to acquire isn't going to observe this criterion, you won't be eligible to acquire a USDA household loan.

The USDA also offers guaranteed loans, but this kind is granted by a third-social gathering bank or monetary institution. Confirmed loans are available to folks of a Substantially broader income selection than immediate loans, and so are obtainable to additional families.

They need to will need to help make repairs and enhancements to make the dwelling more Harmless and sanitary or to remove health and fitness and basic safety dangers. Grants are only available to homeowners who will be sixty two yrs aged or older and cannot repay a piece 504 loan.[six] USDA household loan vs common property finance loan[edit]

USDA mortgage rates tend to be the lowest among FHA home loan prices, VA house loan charges, and conventional loan property finance loan costs — particularly when purchasers are making a small or least downpayment.

We wish to listen to from you and stimulate a lively dialogue among the our customers. Make sure you assist us hold our web-site cleanse and safe by adhering to our putting up tips, and stay away from disclosing individual or sensitive information and facts like banking account or telephone quantities.

1 note

·

View note

Video

youtube

Homespire Mortgage

442 Stouffer Ave

Chambersburg, PA, 17201

(717) 282-9109

At Homespire Mortgage Chambersburg, we believe in making the mortgage process as easy and stress-free as possible. Mortgage lenders near Chambersburg take care of everything for you so that you can enjoy your home buying experience. From finding you Chambersburg home loans with competitive rates to guiding you through the paperwork, our team will ensure that your home loans in Chambersburg are approved quickly. You`ll also get access to all the information needed before moving forward with a purchase - including our Home Buyers Guide, which provides an overview of what it means to be a homeowner. Contact us today!

Chambersburg Refinancing Mortgage

If you already have a mortgage on your home and still need funds that you do not currently have, you may wish to consider refinancing your mortgage. You could choose from a variety of refinancing options, depending on which one makes the best fit for your circumstances.

USDA Loan

If you wish to buy or refurbish a home, you might find that a loan supported by the Department of Agriculture is the right solution for you. USDA loans come in several forms, and the various types come with different requirements.

VA Loan

If you are a veteran or otherwise associated with the U.S. military forces, you could be eligible for a Veteran’s Administration (VA) loan. Numerous people have found this type of loan to be an invaluable resource when buying a home.

FHA Loan

When you are considering home loans, remember to explore Federal Housing Administration (FHA) loans. These loans offer some major advantages to numerous homebuyers and getting one might be a wise strategy for you.

Call our experts from Homespire Mortgage to learn more about our services.

Find us online:

Our Website: https://www.mortgagelenderchambersburg.com

Google Maps: https://www.google.com/maps?cid=3040738607300816465

GMB Site: https://chambersburg-mortgage-lender-association.business.site/

Yelp: https://www.yelp.com/biz/homespire-mortgage-chambersburg?

Mapquest: https://www.mapquest.com/my-maps/21cc9e04-47e8-48a0-8025-b1a5aeeb6e01

Facebook: https://www.facebook.com/HomespireMortgageChambersburg/

Angel.co: https://angel.co/u/mortgagelendercb

mortgage lender near Chambersburg, home loans in Chambersburg, refinancing mortgage in Chambersburg, mortgages near Chambersburg, mortgage company Chambersburg, Chambersburg mortgage lender, Chambersburg home loans, Chambersburg refinancing mortgage, Chambersburg mortgages, Chambersburg mortgage company, mortgage lender near me, home loans near me, refinancing mortgage near me, mortgages near me, mortgage company near me,

0 notes

Text

THE BASIC BRIEF – APRIL 23, 2021

‘FINALLY’: AMERICA REACTS TO CHAUVIN GUILTY VERDICT

NPR 4/20/21

Emma Bowman reporting: Across the country, jubilation and relief broke out at the guilty verdict for the former Minneapolis police officer. But many people see it as the start of a long fight toward justice.

WHY THE BODY COUNT HASN’T SLOWED DOWN AMERICA’S GUN INDUSTRY

POPULAR INFO 4/20/21

Judd Legum: The spring of 2021 has brought a stream of mass shootings across the country. Eight people killed at a FedEx warehouse in Indianapolis, Indiana. Ten people killed in a grocery store in Boulder, Colorado. Eight people killed in three spas in Atlanta, Georgia

PROVIDING ACCOUNTABILITY THROUGH TRANSPARENCY ACT WOULD REQUIRE 100-WORD PLAIN ENGLISH SUMMARIES…

GOVTRACK 4/17/21

For short and understandable summaries of congressional bills, there’s GovTrack Insider. But what about for federal agency regulations?

HOMEOWNERS REMOVE OLD FLOORING AND DISCOVER GIANT HAND-PAINTED MONOPOLY BOARD UNDERNEATH

MYMODERNMET 4/15/21

Emma Taggart reporting: What would you do if you discovered a giant Monopoly board underneath your floor?

LOS ANGELES NOW HAS A ROAD MAP FOR 100% RENEWABLE ENERGY

LA TIMES 3/24/21

Sammy Roth reporting: The plan would help fight climate change and reduce deadly air pollution from cars, trucks and power plants, and gas furnaces.

OPINION | I’M THE HEAD OF PLANNED PARENTHOOD. WE’RE DONE MAKING EXCUSES FOR OUR FOUNDER.

NYT 4/17/21

Alexis McGill Johnson (chief executive of Planned Parenthood) – We must reckon with Margaret Sanger’s association with white supremacist groups and eugenics.

EVERY AMERICAN IS ELIGIBLE TO RECEIVE THE COVID-19 VACCINE

TWITTER 4/19/21

President Biden Tweeted: As of today, every American is eligible to receive the COVID-19 vaccine. For yourself, your neighbors, and your family — please, get your vaccine.

GLOBAL COVID CASES HIT WEEKLY RECORD DESPITE VACCINATIONS

BLOOMBERG 4/18/21

Jinshan Hong reporting: More people were diagnosed with Covid-19 during the past seven days than any other week since the start of the pandemic — topping 5.2 million globally — with the worst outbreaks accelerating in many countries that are ill-equipped to deal with them.

WHITE HOUSE FORMALLY DECLARES ITS SUPPORT FOR D.C. STATEHOOD

POLITICUSUSA 4/20/21

Alan Ryland reporting: The White House formally declared its support for a measure that would grant Washington, D.C. statehood this morning. “Establishing the State of Washington, Douglass Commonwealth as the 51st state will make our Union stronger and more

USDA EXTENDS UNIVERSAL FREE LUNCH THROUGH NEXT SCHOOL YEAR, BRINGING RELIEF TO MILLIONS OF FOOD-INSECURE FAMILIES

WASHINGTON POST 4/20/21

Laura Reiley reporting: Facing a September cutoff, the agency announces it will reimburse schools at a higher rate and expand school nutrition programs to all students.

U.S. VOTING RIGHTS ACTIVIST STACEY ABRAMS NOMINATED FOR NOBEL PEACE PRIZE

REUTERS 2/01/21

Terje Solsvik and Gwladys Fouche reporting: U.S. voting rights activist and Democratic Party politician Stacey Abrams has been nominated for this year’s Nobel Peace Prize for her work to promote nonviolent change via the ballot box, a Norwegian lawmaker said on Monday.

3 MORE OFFICERS WILL STAND TRIAL IN DEATH OF GEORGE FLOYD: WHAT TO KNOW

NEWSWEEK 4/21/21

Alexandra Hutzler reporting: Tou Thao, Thomas Lane and J. Alexander Kueng will be tried jointly on August 23. They have been charged with aiding and abetting murder.

RECLAMATION OF WAR POWERS ACT WOULD BAN FUNDING FOR HOSTILITIES UNLESS CONGRESS APPROVES…

GOVTRACK 4/21/21

Would the move limit the military’s speed and flexibility during the post-nuclear and post-9/11 era of immediate threats?

JOE BIDEN, KAMALA HARRIS GOT A BIG SOCIAL MEDIA BOOST FROM INDIAN TROLL FARMS

NEWSWEEK 11/02/20

Siddharthya Roy reporting – Fake followers purchased from troll farms in rural India inflated the Democrat’s number of Twitter followers beginning in August, an investigation has found.

PSILOCYBIN THERAPY MAY WORK AS WELL AS COMMON ANTIDEPRESSANT

SCIENTIFIC AMERICAN 4/15/21

Zoe Cormier reporting – For the first time, a randomized controlled trial shows the psychedelic offers potent, if short-term, relief in comparison with an SSRI

The People's Basics is on Linktree

#The Peoples Basics#Politics#Discussion#Basic Brief#Democracy & Government#Federal Politics#Foreign Policy#Human-Centered Economics#Justice#Law & Security

0 notes

Text

KENTUCKY USDA RURAL HOUSING LOAN PROGRAM GUIDELINES

KENTUCKY USDA RURAL HOUSING LOAN PROGRAM GUIDELINES

Kentucky USDA Rural Housing County Income Limits for 2023

USDA Kentucky RHS Check Property Eligibility Map

Credit Scores for Kentucky Mortgages

What credit score do you need for a Kentucky mortgage loan approval in 2023?

View On WordPress

0 notes

Photo

Find out about USDA eligible properties via usda loan map wiki in US. CHF USDA generates USDA loan map for you in few seconds. Need help with USDA loan after you select a property on usda loan map wiki ? Call us and we will connect you to a local USDA agent. If you want to get a zero down home loan check out the USDA loan map at CHF USDA and get started with USDA loan process. usda loan map wiki separates out urban geographical locations from rural and sub-urban area around major cities. The heavily populated cities are shaded peach on the map that means all these are not eligible for USDA home loan

Call us for more info : (833) 424-3462

Location : 1475 W 114th St. Cleveland, Ohio 44102

Visit : http://www.chfusda.com/usda-home-loan/

0 notes

Link

Potential Changes to Kentucky Eligible Area Maps for Kentucky USDA Rural Development Housing Programs

Kentucky Eligible Area Maps forKentucky USDA Rural Development Housing Programs

0 notes