#USDALoans

Text

Opening Doors to Rural Living: USDA Mortgage Loans

Discover the path to owning a home in the countryside with USDA mortgage loans from ReRx Mortgage. Tailored for individuals and families seeking the peace of rural life, these loans offer attractive terms, including zero down payment and low mortgage rates. Our experts are dedicated to guiding you through every step, ensuring a seamless journey to homeownership.

Unlock the door to your rural dream home. Visit USDA Mortgage Loans at ReRx Mortgage and learn more about our affordable loan options.

0 notes

Text

Beyond the City Limits: Financing Your Dream Home with USDA Loans

In the quest for homeownership, many individuals dream of finding their ideal home in a peaceful rural setting. However, financing such dreams can sometimes pose challenges. Enter USDA loans, a unique and often overlooked option that opens the door to homeownership beyond the city limits. In this article, we'll explore the benefits and intricacies of USDA loans, shedding light on how they can be the key to financing your dream home in the countryside.

Understanding USDA Loans: USDA loans, backed by the United States Department of Agriculture, are designed to support individuals and families looking to purchase homes in rural or suburban areas. Contrary to popular belief, these loans are not exclusively for farmers; they aim to stimulate rural development by making homeownership more accessible.

Key Features and Benefits:

Zero Down Payment: One of the most appealing aspects of USDA loans is the opportunity for eligible borrowers to secure a mortgage with no down payment. This can be a game-changer for those who may find it challenging to save a substantial upfront amount.

Competitive Interest Rates: USDA loans often offer competitive interest rates, making them an attractive option compared to other financing methods. This can result in significant savings over the life of the loan.

Flexible Credit Requirements: While a good credit score is beneficial, USDA loans are known for being more forgiving when it comes to credit history. This flexibility widens the pool of eligible applicants, providing opportunities for those with less-than-perfect credit.

Geographical Eligibility: USDA loans are specifically designed for homes in rural or suburban areas, promoting growth and development outside urban centers. Prospective homeowners should check the USDA eligibility map to determine if the property they have in mind qualifies.

Guaranteed and Direct Loan Options: The USDA offers both guaranteed and direct loan programs. Guaranteed loans are provided by approved lenders but backed by the USDA, while direct loans are issued directly by the USDA. Each option has its own set of requirements and benefits.

Navigating the Application Process: To embark on the journey of financing your dream home with a USDA loan, it's crucial to follow a structured application process. This typically involves determining eligibility, gathering necessary documentation, and working with an approved USDA lender. The process may seem intricate, but the potential benefits make it well worth the effort.

Conclusion: For those yearning for the tranquility and charm of rural living, USDA loans present a viable and attractive financing option. Beyond the city limits, these loans offer a pathway to homeownership that may have seemed out of reach. As you explore your options, consider the unique benefits of USDA loans, and take the first steps towards turning your dream of a countryside home into a reality.

0 notes

Text

Mortgage rates have remained stubbornly high. But did you know that homebuyers can take over certain types of mortgages from the seller—at their original interest rates? These loans, called assumable mortgages, may include U.S. government-backed FHA, VA, and USDA loans when certain criteria are met. If you have an assumable loan with a low interest rate, it could be an important selling point for your home. Reach out for a free consultation to learn more!

217 Livingston Dr. Website:

Visit Our Blog Today!

Contact Us Today!

Ebby Halliday

The Shuler Group

Billy Shuler

Cell: 972.977.7311

Email: [email protected]

Website: https://www.ebby.com/bio/billyshuler

#forneyrealestate#forneyhomes#northtexasrealestate#northtexashomes#theshulergroup#sold#sellingforney#billyshuler#julieshuler#realestate#realestateagent#homesellertips#homesales#fhaloan#valoan#usdaloan

0 notes

Video

youtube

(via First-Time HomeBuyer Louisville Kentucky Mortgage Programs)

0 notes

Text

Like your recent experience with us? We want to hear about it – head over to Google and leave us a review!

ChangeMyRate.com compares multiple lenders and loan options — all in one place. Let our experts help you find a great mortgage. Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3RJVozI

#applynow#buyahome#buyahouse#firsttimehomebuyer#fha#fhaloan#homebuyer#homeloan#homeowner#homeownership#housing#mortgage#realestate#usda#usdaloan#va#valoan#real estate

0 notes

Text

How Do I Get Government Grants For Home Buyers

Owning a home seems out of reach due to rising costs? Don't worry! Explore various government programs and resources to make homeownership a reality.

#homeownership #dreamhome #firsttimehomebuyer #mortgageaid #downpaymentassistance #veteransloans #fhaloans #usdaloans #habitatforhumanity #nationalhomebuyersfund

How To Get Government Grants for Home Buyers – Can I get a government grant to buy a house? While the US government doesn’t offer direct grants for home buying, there are loan and assistance programs to help. Explore options like FHA loans, VA loans, and Down Payment Assistance (DPA) programs.

Owning a home is a part of the American dream for plenty of people, but the rising value of housing…

View On WordPress

0 notes

Text

First-Time Homebuyers: Avoid Costly Mistakes and Find Your Dream Home

#appraisals #budget #closingcosts #commonmistakes #creditscore #FHAloans #firsttimehomebuyers #homeinspection #housepoor #inspections #insurance #InterestRates #lackofknowledge #localamenities #location #longtermcommitment #maintenance #mortgage #neighborhood #preapproval #propertytaxes #proximitytowork #repairs #researchprograms #schooldistrict #statespecificprograms #unexpectedexpenses #USDAloans #VAloans

#Business#appraisals#budget#closingcosts#commonmistakes#creditscore#FHAloans#firsttimehomebuyers#homeinspection#housepoor#inspections#insurance#InterestRates#lackofknowledge#localamenities#location#longtermcommitment#maintenance#mortgage#neighborhood#preapproval#propertytaxes#proximitytowork#repairs#researchprograms#schooldistrict#statespecificprograms#unexpectedexpenses#USDAloans#VAloans

0 notes

Text

JCRMG INC Real Estate Mortgage Broker – Your Trusted Mortgage Partner! Trust is the foundation of any successful mortgage journey. Trust JCRMG INC Real Estate Mortgage Broker, with Joe Frank Cerros Mortgage Loan Originator, to guide you through the process. Our expertise spans FHA, VA, Conventional, USDA, Self-Employed, Bank Statement, DSCR, and Fixed HELOC loans. Call us at 1-888-600-7577 or visit https://jcrmg.zipforhome.com to experience a seamless mortgage journey today! #JCRMGINC #RealEstateMortgageBroker #JoeFrankCerros #MortgageLoanOriginator #FHALoans #VALoans #ConventionalLoans #USDALoans #SelfEmployedMortgages #BankStatementLoans #DSCR #FixedHELOC #TrustedMortgagePartner #SeamlessMortgageJourney #jcrmgincmortgageloansoriginator

0 notes

Text

USDA Rural Development Loan. #homebuyingtip #usdaloan

USDA Rural Development Loan. #homebuyingtip #usdaloan

https://www.youtube.com/watch?v=Dqa7CeTY9ag

via Sheraz Ali - Moving to Austin Texas https://www.youtube.com/channel/UCV8MDorWpDUDJrIEDNlfItA

December 06, 2023 at 09:15PM

#austinrealestate#texassuburbs#bestplacestolive#sherazali#austintx#suburbanliving#roundrock#texas#moving#travel#tourism#attractions

0 notes

Text

June has been such a blessing!! 💥SNAP IT’S SOLD💥 Amazing Veteran 🇺🇸🇺🇸family relocated here from Colorado Springs and referred to me her parents that trusted me in buying a home! Today they close on an AMAZING floor plan in Woodcreek at an AMAZING price in Rockwall ISD with a VA loan!! 🙌🙌🙌 9th closing in June, 2 more to go!! My cup runneth over and God give me energy as I keep on doing what I ❤️ to do!! Thank you Leit family, Congratulations 🎉🥳🎊🍾🥂🥳 #resultsthatmoveyou #snapitssold #sellmyhome #sellmyhousefast #sellmyhomefast #bigorsmallisellthemall #sellmyhome #sellinghomes #sellyourhome #sellyourhomefast #sellyourhouse #sellersagent #buyersagent #valoans #VABenefits #zerodown #usda #usdaloans #woodcreek #fate #rockwallisd #lovereferrals #jessicahargisrealty #jessicahargis

0 notes

Text

Selling a house is not just about posting it online, there is A LOT more to it than that. Call me to discuss your home selling goals and together we can make a plan to get it ready and sold!

Cristal Garcia, Bilingual Realtor® / Real Estate Listing Broker Specialist, Serving Southern New Mexico. 575-650-5039

#VAloan #convetionalloan #fhaloan #usdaloan #lascrucesnewmexico #lascrucesnm #listingbroker #buyersbroker #realestate #realestateagent #agentsinlascruces #lascrucesbroker #newmexico #nmtrue #santateresanm #sunlandparknm #chaparralnm #anthonynm #launionnm #spaceportcity #spaceport #truthorconsequences #caballolake #mesillanm #lamesanm #fairacres #alamogordonm #whitesands #sellmyhouse #sellmyhome #relocatingagent

0 notes

Photo

Get to know us! We are Woodlands Prime Lending, mortgage lending company with a large variety of lending programs and a team of dedicated professionals who are always just a phone call away! At Woodlands Prime Lending our goal as a company is to help you reach your goals. We are here to help the person who wants to achieve their dreams of owning a home! We are here to help the person or business who needs funding to get to the next level, and closer to their goals as a company. Visit our website at https://www.woodlandsprimelending.com to learn more or to get started! Please like follow/subscribe to our page and follow us @woodlandsprimelending on all social media platforms. (Facebook, Twitter, Instagram, Youtube, LinkedIn) #woodlandsprimelending #mortgage #realestate #finance #financial #newhome #loan #mortgageloan #mlo #newhome #newhomeowners #newhomeowners #usdaloans #valoans #fhaloans #fhahomeloans #conventionalloans #fanniemae #freddiemac #homeappraisal #homeinsuranceclaim https://www.instagram.com/p/BxEPX9WJH3_/?utm_source=ig_tumblr_share&igshid=1kahnb4r6ekh7

#woodlandsprimelending#mortgage#realestate#finance#financial#newhome#loan#mortgageloan#mlo#newhomeowners#usdaloans#valoans#fhaloans#fhahomeloans#conventionalloans#fanniemae#freddiemac#homeappraisal#homeinsuranceclaim

1 note

·

View note

Text

Unlocking Your Dream Home: The Power of USDA Loans Today

In the pursuit of homeownership, navigating the intricate landscape of mortgage options can be daunting. However, amidst the plethora of loan programs available, USDA loans stand out as a beacon of opportunity, offering a pathway to homeownership for many Americans, especially in rural and suburban areas. As we step into 2024, the significance of USDA loans has only grown, unlocking the doors to dream homes for countless individuals and families across the nation.

One of the most distinguishing features of USDA loans is their focus on supporting homebuyers in rural and suburban communities. These loans, backed by the United States Department of Agriculture (USDA), aim to provide affordable financing options to individuals with moderate to low incomes, enabling them to purchase homes in areas that might otherwise be financially inaccessible.

A key advantage of USDA loans is their minimal down payment requirement, often as low as 0% down for eligible borrowers. This feature opens doors for prospective homebuyers who may struggle to save for a traditional down payment, making homeownership a tangible reality rather than a distant dream. Additionally, USDA loans typically offer competitive interest rates, further enhancing their affordability and appeal.

Furthermore, USDA loans provide flexibility in terms of credit requirements, making them accessible to a broader range of borrowers. While creditworthiness remains a factor, USDA loans may be more forgiving of past credit challenges compared to conventional mortgages, offering hope to those who have faced financial setbacks in the past.

In addition to their financial benefits, USDA loans also support the development and revitalization of rural communities. By facilitating homeownership in these areas, these loans contribute to the stability and growth of local economies, fostering vibrant communities where individuals and families can thrive.

It's important to note that USDA loans are not limited to first-time homebuyers. Whether you're a seasoned homeowner or a newcomer to the real estate market exploring the potential of USDA loans could lead you one step closer to your dream home.

In conclusion, USDA loans continue to wield significant influence in the realm of homeownership offering a powerful tool for individuals and families seeking to unlock the doors to their dream homes. As we embrace the opportunities of 2024 let us recognize the transformative impact of USDA loans in shaping the landscape of homeownership and empowering countless Americans to achieve their housing aspirations.

0 notes

Photo

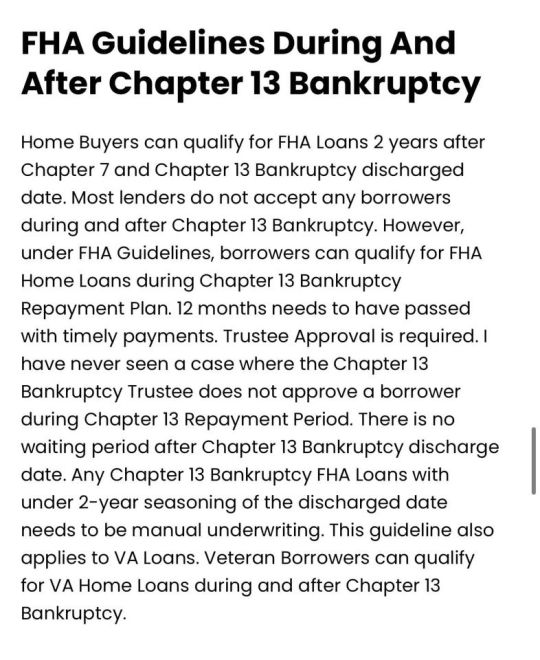

(via Can you get a Kentucky mortgage loan while in a Chapter 13 Bankruptcy:)

0 notes

Text

Looking for a loan? We make sure your goals align with the loan options available, ensuring you never have to pay extra for unnecessary fees. Say goodbye to unexpected charges and hello to a smooth closing process.

ChangeMyRate.com compares multiple lenders and loan options — all in one place. Let our experts help you find a great mortgage. Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3RJVozI

#applynow#buyahome#buyahouse#firsttimehomebuyer#fha#fhaloan#homebuyer#homeloan#homeowner#homeownership#housing#mortgage#realestate#usda#usdaloan#va#valoan#real estate

0 notes

Video

youtube

Three USDA Rural Development Multifamily Housing Programs You Can Apply For

0 notes