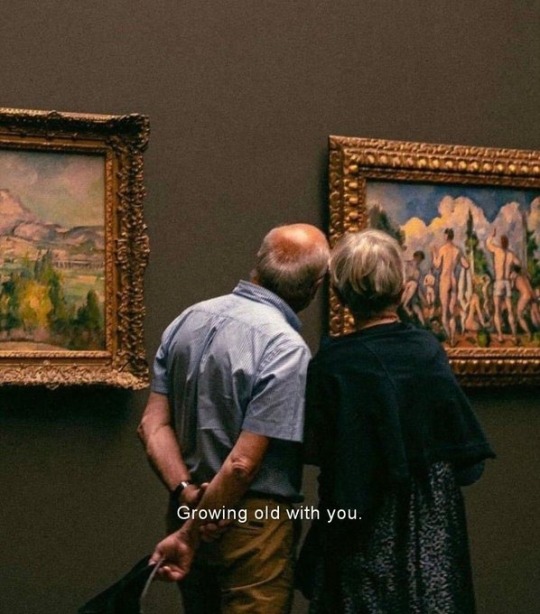

#Retirementgoals

Text

#growingoldwithyou#love#romance#commitment#partnership#bestfriends#soulmates#meanttobe#futuretogether#happilyeverafter#silverfox#silverfoxes#grandparents#retirementgoals#couplegoals#relationshipgoals

45 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Planning for retirement? Unlock peace of mind with our tailored retirement savings plan in Kingston. Explore our expert advice and customizable solutions to ensure a financially stable future. Start building your nest egg today! for more information visit :

0 notes

Text

Sam Higginbotham Explains the Role of Financial Advisors in Retirement Planning

Retirement planning can be a daunting task, filled with complex decisions and long-term considerations. That’s where a financial advisor comes in, providing expertise and guidance to help you navigate your financial future. Sam Higginbotham, a seasoned financial advisor, shares valuable insights into the crucial role advisors play in retirement planning.

Understanding Your Financial Goals

The first step in effective retirement planning is understanding your financial goals. A financial advisor like Sam helps you identify what you want to achieve in retirement. Whether it's traveling the world, supporting your grandchildren's education, or simply maintaining a comfortable lifestyle, an advisor works with you to clarify these objectives.

Creating a Personalized Retirement Plan

Once your goals are clear, a financial advisor develops a personalized retirement plan. This plan takes into account your current financial situation, expected retirement age, and desired lifestyle. Sam emphasizes the importance of a tailored approach, as no two individuals have the same financial circumstances or aspirations.

Managing Investments Wisely

Investments play a significant role in building a retirement fund. Financial advisors like Sam Higginbotham provide expert advice on where to invest your money to maximize returns while managing risk. They help you diversify your portfolio, selecting a mix of stocks, bonds, and other assets that align with your risk tolerance and time horizon.

Navigating Tax Implications

Taxes can significantly impact your retirement savings. A financial advisor helps you understand and navigate the tax implications of various retirement accounts, such as 401(k)s, IRAs, and Roth IRAs. Sam points out that strategic tax planning can save you a substantial amount of money in the long run, ensuring more funds are available for your retirement.

Adjusting to Life Changes

Life is unpredictable, and your retirement plan needs to be flexible enough to accommodate changes. Whether it's a job loss, a health issue, or a significant market downturn, financial advisors like Sam help you adjust your plan accordingly. They provide the support and advice needed to stay on track despite unexpected events.

Ensuring Sustainable Withdrawal Rates

One of the critical aspects of retirement planning is determining a sustainable withdrawal rate. This is the rate at which you can withdraw funds from your retirement accounts without depleting your savings too soon. Sam explains that a financial advisor calculates this rate based on various factors, including life expectancy, inflation, and investment returns, ensuring you can enjoy a comfortable retirement without financial worries.

Providing Peace of Mind

Ultimately, the role of a financial advisor extends beyond numbers and investments. They provide peace of mind, knowing that a professional is overseeing your financial future. Sam highlights that this reassurance allows you to focus on enjoying your retirement, rather than stressing over financial details.

Regular Reviews and Updates

Retirement planning isn’t a one-time task; it requires regular reviews and updates. A financial advisor conducts periodic reviews of your retirement plan to ensure it remains aligned with your goals and circumstances. Sam Higginbotham stresses the importance of these reviews in adapting to changes in the economy, tax laws, and your personal situation.

Conclusion

The role of a financial advisor in retirement planning is multifaceted and indispensable. From setting clear financial goals and creating a personalized plan to managing investments and navigating tax implications, advisors like Sam Higginbotham provide invaluable expertise and support. Their guidance ensures that you can approach retirement with confidence, knowing that your financial future is in good hands.

Planning for retirement may seem overwhelming, but with the help of a skilled financial advisor, you can achieve your retirement dreams and enjoy the peace of mind that comes with knowing you are well-prepared for the future.

#RetirementPlanning#FinancialAdvisor#RetirementGoals#InvestmentTips#FinancialFreedom#TaxPlanning#RetirementSavings#WealthManagement#FinancialSecurity#PersonalFinance#RetirementStrategy#SmartInvesting#RetirementLife#FinancialGuidance#PlanForRetirement#FuturePlanning#SecureRetirement#InvestmentAdvice#FinancialWellness#RetirementAdvice

0 notes

Text

Discover the vital role of a financial planner in your retirement journey. Learn how they help you achieve financial security and a comfortable retirement.

1 note

·

View note

Text

Looking to maintain your lifestyle even after retirement? Reach out to us at Prahim Investments. Let's make sure your golden years shine bright!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahim#prahiminvestments#retirement#retirementgoals#financialfreedom#enjoyretirement#embracethejourney#financialplanning#newbeginnings#livingmybestlife#embracinglife#retirementplanning#retirementlifestyle#retirementcommunity#RetirementGoals

0 notes

Text

The Surprising Culprit in Retirement Planning \

The biggest mistake in retirement planning isn't saving enough. To avoid this, start saving today, even small amounts can grow over time with compounded interest. Utilize employer-sponsored plans and save consistently. By starting early and being disciplined, you can secure a comfortable retirement.

Learn more at https://reps.modernwoodmen.org/slong

#RetirementPlanning#StartSaving#FinancialSecurity#CompoundInterest#SecureFuture#SaveConsistently#EmployerBenefits#Discipline#RetirementGoals

0 notes

Text

Passive Income: What It Is and Ideas for 2024

In today's dynamic economic landscape, the concept of earning passive income has become increasingly appealing. While the traditional nine-to-five job remains a cornerstone of financial stability for many, the allure of generating income passively, where money works for you instead of the other way around, has captured the imagination of millions.

In this blog post, we delve into the essence of passive income, explore its significance in 2024, and provide innovative ideas to help you embark on your journey toward financial freedom.

What is Passive Income and Explain its importance in 2024?

Passive income refers to earnings derived from sources requiring minimal to no effort to maintain. Unlike active income, which demands ongoing participation (such as a regular job), passive income streams can continue to generate revenue even when you're not actively involved.

This type of income offers flexibility, scalability, and the potential for long-term wealth accumulation. The year 2024 presents a unique landscape for passive income seekers. With advancements in technology, changes in consumer behavior, and evolving market trends, new opportunities emerge for individuals to create diverse streams of passive income.

Moreover, the aftermath of global events like the COVID-19 pandemic has underscored the importance of financial resilience, making passive income more relevant than ever.

Passive income can come from various sources, including:

1. Investments: Income generated from investments such as stocks, bonds, mutual funds, and real estate properties.

2. Royalties: Income earned from intellectual property rights, such as royalties from books, music, patents, or trademarks.

3. Business Ownership: Income generated from owning and operating a business like Truly Passive that does not require active involvement in day-to-day operations, such as rental properties or a profitable online business.

4. Affiliate Marketing: Income earned by promoting and selling products or services for other companies or individuals, usually through affiliate programs.

5. Digital Products: Income generated from selling digital products such as e-books, online courses, software, or digital downloads.

Importance of Generating Passive Income in 2024:

1. Financial Stability:

In an increasingly volatile economic environment, having multiple streams of passive income can provide a buffer against financial uncertainties. Diversifying income sources reduces reliance on a single source of income, making individuals more resilient to economic downturns, job loss, or unexpected expenses.

2. Flexibility and Freedom:

Passive income allows individuals to break free from the constraints of traditional employment and achieve greater flexibility and freedom in how they earn a living. By generating income passively, individuals can have more control over their time, allowing them to pursue other interests, spend time with family, or travel without sacrificing their financial security.

3. Wealth Accumulation:

Passive income streams have the potential to accumulate wealth over time, thanks to the power of compounding and the ability to reinvest earnings. By consistently reinvesting passive income into income-generating assets, individuals can accelerate wealth accumulation and achieve long-term financial goals, such as retirement or financial independence.

4. Adaptability to Technological Advancements:

Technological advancements continue to reshape industries and create new opportunities for passive income generation. From the rise of digital platforms and e-commerce to advancements in automation and artificial intelligence, individuals can leverage technology to create innovative passive income streams that capitalize on emerging trends and consumer behaviors.

5. Rising Cost of Living:

With the cost of living steadily increasing in many parts of the world, passive income can help individuals supplement their primary income and maintain their standard of living. Whether it's to cover essential expenses, save for the future, or enjoy a higher quality of life, passive income provides a valuable source of additional income to meet financial needs.

Passive income will play a crucial role in 2024 as individuals seek financial stability, flexibility, and long-term wealth accumulation. By diversifying income sources, embracing technological advancements, and harnessing the power of passive income, individuals can achieve greater financial security and independence in the years to come.

Ideas for Generating Passive Income in 2024:

1. Investing in Dividend Stocks:

Dividend-paying stocks can be a lucrative avenue for passive income. By investing in reputable companies with a history of consistent dividend payments, you can enjoy regular income without actively managing your investments.

2. Real Estate Crowdfunding:

Participating in real estate crowdfunding platforms allows you to invest in properties without the hassle of property management. Platforms like Fundrise and RealtyMogul enable you to pool resources with other investors to access lucrative real estate opportunities.

3. Creating Digital Products:

In the digital age, creating and selling digital products such as e-books, online courses, or software can be an excellent way to generate passive income. Once you've developed the product, you can continue to earn revenue through sales without additional effort.

4. Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers with individual investors, providing an opportunity to earn interest on funds lent out. While it carries some risk, diversifying your investments across multiple loans can mitigate potential losses.

5. Building a YouTube Channel or Blog:

Monetizing content creation through platforms like YouTube or blogging can yield passive income through ad revenue, affiliate marketing, or sponsored content. Consistently producing high-quality content in a niche market can attract a loyal audience and steady income over time.

6. Robo-Advisors and Automated Investing:

Robo-advisors offer automated investment management services, making it easy for individuals to invest in diversified portfolios tailored to their risk tolerance and financial goals. With minimal effort, you can passively grow your wealth over time.

7. Renting Out Assets:

Whether it's renting out a spare room on Airbnb, leasing out equipment, or even renting out your car through platforms like Turo, leveraging idle assets can provide a steady stream of passive income.

8. Affiliate Marketing:

Partnering with companies to promote their products or services through affiliate marketing can be a lucrative source of passive income. By earning a commission for every sale or lead generated through your unique affiliate link, you can monetize your online presence effectively.

The Final Wrap-Up:

As we navigate the complexities of the modern economy, harnessing the power of passive income has become an increasingly vital aspect of financial planning. Whether you're looking to supplement your existing income, achieve financial independence, or simply diversify your revenue streams, the possibilities for generating passive income in 2024 are abundant.

Take charge of your retirement planning advice journey with expert guidance from Trulypassive.com. Our platform offers tailored financial planning for retirement, ensuring you're equipped with the strategies and insights needed to achieve your long-term goals. Start planning for a secure future now!

By exploring innovative ideas, embracing technological advancements, and adopting a proactive mindset, you can embark on a journey toward financial freedom and unlock the full potential of passive income in your life. Discover the secrets to unlocking true passive income potential with Truly Passive– where financial freedom meets innovative opportunities.

#RetirementPlanning#FinancialFreedom#SecureFuture#PlanAhead#RetirementGoals#FinancialIndependence#RetirementSavings#WealthManagement#FuturePlanning#SecureRetirement#InvestForRetirement#FinancialPlanning

1 note

·

View note

Text

Learn how you can plan towards being Healthy, Wealthy, Young and Wise in Retirement with a free Retirement planning book at

https://www.retirementqueen.net/

Tag friends who need to see this!

#investmentadvice#earlyretirement#retirementplanning#financialadvisor#financialeducation#moneytips#financialwellbeing#retirementsavings#happyretirement#earlyretirementplan#retireyoungretirerich#investmentmanagement#retirementgoals

0 notes

Text

#love#romance#commitment#partnership#bestfriends#soulmates#meanttobe#futuretogether#happilyeverafter#silverfox#silverfoxes#grandparents#retirementgoals#couplegoals#relationshipgoals

13 notes

·

View notes

Text

Secure Your Golden Years: Top Strategies for Building Reliable Retirement Income Sources

Ah, retirement. A time to finally relax, travel the world, and pursue your passions. But this idyllic picture requires careful planning, particularly when it comes to securing a reliable stream of income to support your desired lifestyle. Social Security alone might not be enough to cover all your expenses. So, how do you build robust retirement income sources?

This blog dives deep into various retirement income sources, helping you explore options and craft a personalized strategy for a secure and fulfilling retirement.

Understanding Your Retirement Needs

The first step is to understand your retirement needs. Consider your desired lifestyle – will you travel extensively, downsize your living situation, or pursue hobbies that require significant financial investment? Estimate your monthly expenses and factor in potential healthcare costs, which tend to rise with age. Once you have a clear picture of your needs, you can start exploring different income sources to bridge the gap between your expenses and Social Security benefits.

Traditional Retirement Income Sources

1. Social Security

Social Security provides a foundation for most retirees. The exact benefit amount depends on your lifetime earnings and retirement age. You can estimate your benefits using the Social Security Administration’s online tool (https://www.ssa.gov/OACT/quickcalc/).

2. Pensions

While less common nowadays, traditional pensions provide a guaranteed monthly income for life after retirement. If you’re fortunate enough to have a pension plan through your employer, factor this into your retirement income calculations.

Building Your Nest Egg: Savings and Investments

A key strategy for a secure retirement is building a nest egg through savings and investments. Here are some popular options:

1. Employer-sponsored retirement plans:

Many employers offer 401(k) plans, where you contribute pre-tax dollars, and some may even match your contributions. Take full advantage of these plans to maximize your retirement savings and benefit from employer matching programs.

2. Individual Retirement Accounts (IRAs)

IRAs offer tax advantages for retirement savings. Traditional IRAs allow pre-tax contributions with tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement if you meet eligibility requirements.

3. Investment accounts

Consider investing in a diversified portfolio of stocks, bonds, and mutual funds to grow your retirement savings. The ideal asset allocation depends on your risk tolerance, time horizon, and investment goals.

Additional Retirement Income Sources

Beyond traditional sources, explore these options for generating additional income in retirement:

1. Part-time work

Consider working part-time in retirement to supplement your income and stay engaged. This could be a flexible job you enjoy or a way to leverage your skills and experience.

2. Annuities

These insurance products provide a guaranteed stream of income in retirement in exchange for a lump sum investment or premium payments. There are different types of annuities, so carefully research and choose one that aligns with your needs.

3. Rental income

Owning rental properties can be a source of passive income in retirement. However, it also comes with responsibilities like managing property upkeep and finding tenants.

4. Reverse mortgages

These allow homeowners 62 and older to access a portion of their home equity as a stream of income or a lump sum while continuing to live in the home. Carefully consider the implications of reverse mortgages as they can impact your heirs’ inheritance.

Planning for a Secure Retirement

Here are some additional tips to secure your golden years:

1. Start saving early

The power of compound interest is significant. The earlier you start saving, the more time your money has to grow.

2. Develop a budget

Create a realistic retirement budget and track your spending habits to identify areas to adjust if necessary.

3. Review your plan regularly

Your retirement needs and financial situation might change over time. Regularly review your plan and adjust your strategies as needed.

4. Seek professional financial guidance

A financial advisor can help you create a personalized retirement plan based on your goals and risk tolerance.

Conclusion

Building secure retirement income sources takes planning and proactive management. By exploring different income sources, diversifying your investments, and starting early, you can create a financial foundation that allows you to enjoy your golden years without financial worries. Remember, retirement should be a time of relaxation and fulfillment. By taking charge of your financial future now, you can ensure a secure and happy retirement.

#retirementplanning#financialfreedom#securefuture#retirementincome#financialplanning#SecureRetirement#planforthefuture#RetirementGoals#financialsecurity

0 notes

Text

Discover peace of mind and financial stability with our bespoke retirement planning services in Kingston. Our seasoned advisors specialize in tailoring retirement strategies to suit your unique goals and aspirations. for more information visit :

#RetirementPlanning#KingstonRetirement#FinancialAdvisor#SecureFuture#WealthManagement#RetirementGoals#InvestmentAdvice#PlanYourFuture

0 notes

Text

Sam Higginbotham Guide to Retirement Planning in 2024

Planning for retirement can seem daunting, but with the right approach, you can secure your financial future. Sam Higginbotham suggests starting early and setting clear goals. Assess your current financial situation, consider your desired lifestyle in retirement, and create a savings plan that aligns with your goals. Regularly review and adjust your plan as needed to stay on track. With careful planning, you can enjoy a comfortable retirement.

#retirementplanning#financialsecurity#savingsgoals#retirementgoals#financialplanning#secureyourfuture#earlyretirement#retirementincome#retirementstrategy#financialfreedom#samhigginbotham

0 notes

Text

youtube

#FinancialTips#SmartSpending#Budgeting101#WealthJourney#MoneyManagement#DebtRelief#InvestmentIdeas#FrugalLiving#SavingMoney#PassiveIncome#FinancialHealth#MoneyMindset#PersonalWealth#RetirementGoals#FinancialPlanning#MoneyHacks#WealthBuilding#SavingsPlan#FinancialFreedom#InvestWisely#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Text

"Me enjoying my SWP income while everyone else is stressing about market volatility."

#sip#dreamfunds#mutual funds#mutual fund sahi hai#wealth planner#sipkaromastraho#mutualfundssahihai#photography#financial freedom#financialadvisor#SWP#financialgoals#retirementgoals#swplifestyle#stressfreeretirement#wealthacceleration#dreamretirement#swplife

0 notes