#IEPF Claim

Text

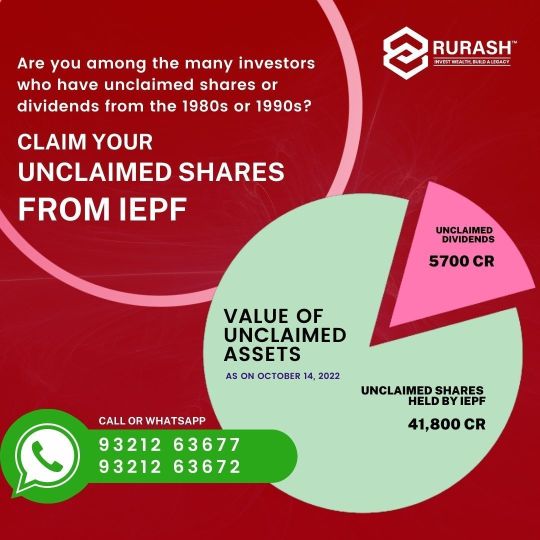

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#iepf shares recovery#iepf recovery#recovery of shares from iepf#iepf shares claim#infiny solutions

0 notes

Video

youtube

Unclaimed Investments in India | Reclaim your Forgotten Money from IEPF

0 notes

Text

What if I lose my physical shares, how to share recover?

What if I lose my physical shares, how to share recover ?

If you lose your physical shares, there are two ways to recover them:

Apply for duplicate share certificates. You can contact the company or registrar of the shares you hold and apply for duplicate share certificates. You will need to provide them with proof of your identity and ownership of the shares, as well as a police report if the shares were lost in a theft. The company or registrar will then issue you with new share certificates.

Claim the shares from the Investor Education and Protection Fund (IEPF). If the shares have been inactive for a certain period of time, they may be transferred to the IEPF. You can then claim the shares from the IEPF by submitting a claim form and providing the necessary documentation.

The following are the documents you need to submit to recover your lost physical shares:

Affidavit: This is a sworn statement that you have lost your share certificates.

Indemnity bond:This is a document that guarantees that you will not hold the company or registrar responsible if the shares are not recovered.

C This is a copy of the police report you filed when you lost your shopy of police report:are certificates.

Advertisement: You need to publish an advertisement in a newspaper stating that you have lost your share certificates.

Once you have submitted the required documents, the company or registrar will verify your identity and ownership of the shares. If everything is in order, they will issue you with new share certificates.

If the shares have been transferred to the IEPF, you will need to submit a claim form to the IEPF. The claim form can be found on the IEPF website. You will need to provide the following information on the claim form:

Your name and contact details

The company whose shares you are claiming

The number of shares you are claiming

The date on which the shares were lost

The reason why the shares were lost

Once you have submitted the claim form, the IEPF will investigate your claim. If the claim is approved, the IEPF will issue you with a payment order. You can then take the payment order to your bank and collect the money.

0 notes

Link

In 2017, the Ministry of Corporate Affairs (MCA) has issued IEPF rules, which stands for Investors Education and Protection Fund Authority

0 notes

Text

#The Wealth Finder#IEPF Claims#Shares Transferred to IEPF#Recovery of Unclaimed Shares#Recovering the unclaimed shares and dividends#Physical Shares Forgotten Investment#Demat of physical shares#Recovery of shares from IEPF#Recovery of Shares#Recovery of unclaimed Shares and dividends#Unclaimed shares#Unclaimed dividends#Search of lost shares#Tracing of lost shares#Demat of Shares#Lost shares certificate#Lost shares#lost shares recovery#Probate of Will#Succession Certificate#Duplicate share certificate#Legal heir certificate#Convert Physical to Demat#IEPF consultants#IEPF Advisory#IEPF Claim experts

2 notes

·

View notes

Text

Equity Shares Transferred to IEPF: Understanding the Implications

In the dynamic landscape of financial markets, the transfer of equity Shares Moved to IEPF to the Investor Education and Protection Fund (IEPF) is a noteworthy event with significant implications for both companies and investors. This article aims to shed light on the reasons behind such transfers and the consequences for stakeholders involved.

Understanding the IEPF:

The Investor Education and Protection Fund (IEPF) was established by the Indian government to safeguard the interests of investors and promote investor education. One of its key functions is to collect unclaimed dividends, matured deposits, and shares, subsequently utilizing these funds for the benefit of investors.

Reasons for Transfer:

Equity Unclaimed Shares IEPF are typically transferred to the IEPF when dividends or matured amounts remain unclaimed by shareholders for a specified period. This transfer is a protective measure, ensuring that the rightful owners or beneficiaries can claim their shares and dividends even if they had been unresponsive or inactive.

Implications for Companies:

For companies, the Shares Transferred to IEPF signifies a regulatory compliance measure. It reflects a commitment to transparent and responsible corporate governance. Companies need to follow specific procedures and timelines outlined by regulatory authorities to transfer unclaimed shares to the IEPF, avoiding penalties and legal consequences.

Impact on Shareholders:

Shareholders, on the other hand, may face challenges in reclaiming their transferred shares. They must adhere to the prescribed procedures and timelines set by the IEPF to retrieve their unclaimed shares. Understanding the process and staying informed about communication from the company and regulatory bodies is crucial for shareholders to safeguard their investments.

Reclaiming Unclaimed Shares:

Reclaiming shares from the IEPF involves a systematic process. Shareholders must first identify their unclaimed shares through the IEPF website or other designated channels. Subsequently, they need to submit the required documentation and follow the specified procedures to initiate the transfer back to their demat accounts.

Investor Education:

The transfer of equity shares to the IEPF underscores the importance of investor education. Companies and regulatory bodies need to actively engage in educating shareholders about the implications of inactivity and the steps required to prevent the transfer of shares to the IEPF. This proactive approach can reduce the number of unclaimed shares and enhance overall investor awareness.

Our Service:-

How to Claim Unpaid Dividend

How to Claim Shares From IEPF

Demat of Physical Share Certificate

Conclusion:

The transfer of equity shares to the IEPF is a multifaceted process with implications for both companies and investors. While it ensures regulatory compliance and protection of investor interests, it also necessitates a thorough understanding of the procedures involved. Companies and shareholders alike benefit from staying informed, promoting investor education, and actively participating in the retrieval process to maintain the integrity of the financial ecosystem.

How to Claim Shares From IEPF

0 notes

Text

Avoiding Pitfalls: Tips for a Smooth Mutual Fund Claim

Ensuring a hassle-free claim process for your mutual fund is crucial to be aware of potential pitfalls that may arise. By understanding these potential challenges, you can take proactive steps to streamline your claim and avoid unnecessary delays or complications. This section will provide valuable tips and best practices for navigating the mutual fund claim process more efficiently.

First and foremost, it is important to stay updated with the terms and conditions of your mutual fund. Familiarize yourself with the specific requirements and procedures for making a claim. This includes understanding the documentation that needs to be submitted, the timeframe within which the claim needs to be filed, and any additional supporting information that may be required. By being well-informed, you can ensure that you are fully prepared to initiate the claim process.

Accurate documentation is another crucial aspect of a hassle-free claim process. Make sure to keep all relevant documents in order and up to date. This may include account statements, transaction records, purchase confirmations, and any other supporting evidence. Maintaining organized and accurate documentation will not only facilitate a smooth claim process but also help in providing the necessary evidence to support your claim.

In addition to accurate documentation, it is advisable to maintain open lines of communication with your mutual fund provider. Regularly check in with them to stay informed about any updates or changes that may impact your claim. This can help you stay ahead of any potential issues and address them promptly.

Furthermore, it is essential to promptly report any losses, damages, or other incidents that may give rise to a claim. Delaying the reporting of such incidents can lead to complications and may result in a denial of your claim. As soon as you become aware of an incident, notify your mutual fund provider and initiate the claim process as per their instructions.Lastly, it is always a good practice to seek professional advice when navigating the mutual fund claim process. Consulting with a financial advisor or legal expert can provide valuable insights and guidance, ensuring that you are taking the right steps to maximize your chances of a successful claim.

#missing money india#share recovery#unclaimed money in india#search unclaimed dividend#unclaimed dividend#unclaimed insurance claims#how to find lost investments#transfer of shares and transmission of shares#transmission of shares#unclaimed dividend transfer to iepf#provident fund claim#indian post unclaimed deposits#unclaimed bank deposit

1 note

·

View note

Text

Topline Solutions Pvt Ltd

Topline Solutions is a highly regarded financial and legal advisory firm that offers specialized services to clients across India. Our focus is on providing our clients with tailor-made solutions to help them achieve their financial and legal goals. We offer a wide range of services such as share transfer, IEPF claims, dividend recovery, shares recovery, and more. Our experienced team of professionals is dedicated to ensuring that our clients receive the best possible guidance and support in their financial and legal matters. We are committed to providing reliable, efficient, and effective advisory services that are designed to meet the specific needs of each client. With Topline Solutions Pvt Ltd, clients can be confident that their financial and legal affairs are in good hands.

Web:- https://www.thetoplinesolution.com/

Email:- [email protected]

Mobile:- +91-9311620013

1 note

·

View note

Text

Recovery of Unclaimed Shares From IEPF Claim - MUDS

Are you looking for ways to regain your unclaimed investments? Muds Management will aid you to recover your unclaimed shares from the IEPF claim.

0 notes

Text

https://sharesrecover.com/recover-matured-deposits-from-iepf/

0 notes

Text

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#recovery of shares from iepf#iepf shares claim#iepf shares recovery#iepf recovery#transmission of shares#transfer and transmission of shares#iepf

0 notes

Text

IEPF Claim Shares Services Today | IEPF Search

#iepf claim#rurash financials#unclaimed shares#recovery of forgotten investments#unclaimed dividend#reclaim your funds

0 notes

Text

How can I claim my Iepf share recovery online ?

Sure, here are the steps on how to claim your IEPF share online in brief:

Go to the IEPF website: https://www.iepf.gov.in/.

Click on the “Refund/Claim Refund” tab.

Click on the “IEPF-5” link.

Fill out the form and upload the required documents.

Submit the form.

Take a printout of the acknowledgement.

Submit the printout of the acknowledgement along with the required documents to the Nodal Officer of the company at its registered office for verification of the claim.

The required documents are:

A copy of the acknowledgement i.e. SRN number.

An indemnity bond.

For IEPF shares, recovery submits an advance stamped receipt.

Certificate for the return of bonds, debentures, or matured deposits.

Aadhar cards for all joint holders and the claimant.

The processing time for a claim is usually 30–45 days. Once your claim is processed, you will be refunded the amount or the shares will be transferred to your name.

Here are some additional tips:

Make sure that you fill out the form correctly. Please correct the form to ensure the processing of your claim is completed on time.

Upload clear and legible copies of the required documents.

Keep a copy of the acknowledgement for your records.

0 notes

Link

Many investors invest in shares and eventually lose, forget, or misplace those details or documents that bear the records of those investments.

0 notes