Text

The Magic Box Of Long-term Investments

The era of the 1980’s was a BOOM BANG in the Indian Share market where one after another an IPO was knocking the door of investors. The time was seen as no less than OPPORTUNISTIC!!

Retail investors, brokers, sub brokers & bookies -everyone saw a golden chance and invested in the share market wholeheartedly. Through friends, relatives, neighbors, colleagues, anyone would come to know about the next talked about IPO and would fill his form to be a cake piece owner of a dream company – to the extent that for many shares trading became their secondary business. But as they say, “Days do not remain the same ” the scam of 1990 brought down the riding bull & with it lay strewn the hopes of thousands of investors into bits & pieces.

When hope breaks anger vents. People were just not bearish but shattered enough not to believe in the return of Bull. Some locked their share certificates in dark rooms and some even went to the extent to tear them & burn these deemed to be worthless papers to ashes. Innocent & unaware that these pieces of paper even when torn were secured for them under the umbrella of Govt. guidelines, the Companies Act & its bylaws which has always been prioritized to keep the interest of retail investors.

And today even if these shares certificates are lost or mutilated, the rights & bonus on them are unclaimed and the dividends on these have remained unpaid for years, these lost shares, unclaimed dividends along with all other benefits accruing are locked unharmed in a safety deposit, a magic box under the custody of our Government waiting for the rightful beneficiary -that heartbroken investor or his heir to claim it back and yes to claim a big multiple of the initial investment!! A couple of thousands invested in companies like HDFC Bank, Reliance, Bajaj, Avanti Feeds etc., who were not night – by- flyers are gold (amount in lacs) to its investors.

WHERE TO LOCATE YOUR MAGIC BOX?

Pursuant to Section 124(6) of the Companies Act 2013 read with Investor Education & Protection Fund (IEPF) Authority (Accounting, Audit, Transfer and Refund) Rules 2016 as amended from time to time, the shares in respect of which dividend is remaining unclaimed for a period of seven consecutive years shall be transferred to the IEPF Account established by the Central Government with NSDL (IEPF Account No. IN30070810656671).

The claimant can claim the shares from IEPF Authority by filing form IEPF-5 along with requisite documents as prescribed by the IEPF Authority. Pursuant to these guidelines, companies are transferring chunks and chunks of shares liable to be transferred to the above account under safe Government guidelines, to protect the interest of their investors. And here is where you find your magic- treasure – box.

LET’s MAKE THE TREASURE HUNT SIMPLER

So, what if you are not in possession of documents relating to your holdings? What if you vaguely just remember a few names you or your family might have invested in? What if since then you have changed your residence a number of times? We, at Infiny Solutions have you sorted. Starting from tracking your investments to updation of your KYCs, running through the procedure of issue of duplicate shares and claiming of unclaimed dividends to claim of shares from IEPF to your demat account we shall have you covered step by step. All we need is a few details of the investor and that is enough to track back your valuable investments and retrieve them for you.

Blog Source :- https://infinysolutions.com/the-magic-box-of-long-term-investments/

claim of shares from IEPF, IEPF, Indian Stock Market, Infiny Solutions, IPO, Long Term Investments

0 notes

Text

As an investor, it is best to stay vigilant. Trustworthy professionals such as those at Infiny Solutions ensure that you always have all the correct information about your shareholdings and any holdings that may be due to you. Our team has access to a vast database and is thus able to identify the rightful claimants of unclaimed shares and unclaimed dividends. We help ensure that you get the money that belongs to you without any risk of being defrauded by unscrupulous agents.

Visit :- https://infinysolutions.com/your-monies-and-investment-claims-might-just-get-swooped-away-beware-of-share-frauds/

0 notes

Text

YOUR MONIES AND INVESTMENT CLAIMS MIGHT JUST GET SWOOPED AWAY. BEWARE OF SHARE FRAUDS

From Harshad Mehta to Ketan Parekh and so many more in between, there have been a number of well-documented stock and share market scams over the years. Such frauds could utilize any or a combination of methods from below:

Shell companies: Such entities use the names of established brands such as Apple or Reliance. They lure investors with the intention of defrauding them.

Boiler rooms: This is a high-pressure selling technique used to peddle speculative shares. Brokers often use this technique to push penny stocks which results in losses higher than the client can bear.

Pump and dump: In a world rife with fake news, misleading information helps pump up the price of certain stocks. When the stock hits a target price, they are then dumped for huge profits. Those who are left holding the stock suffer untold losses.

Insider trading: This is the criminal practice of using secret information to trade on the stock exchange for one’s personal profit. Even though regulations exist to help prevent this, it still exists in the market.

Churning: Brokerage firms often give wrongful advice to create additional brokerage which boosts their own income.

Financial statement fraud: A number of publicly traded firms manipulate their financial statements to overstate revenues, understate expenses, overstate corporate assets, understate existing liabilities, and more.

An unidentifiable fraud

A type of financial fraud that often goes unnoticed and unpunished is when unclaimed shares are claimed by persons who are not the rightful claimants for that holding.

To know more about how this situation comes to be, read our blog on unclaimed shares here (BEWARE OF SHARE FRAUDS).

Unclaimed shares and unclaimed dividends can be recovered by the rightful claimant. However, the problem stems from the fact that the claimants are often not aware that they can claim such financial instruments.

Fraudsters take out data of folios that have become inactive. In most cases, these folios only have the investor’s name or at the most, their father’s name mentioned, with no unique identity of the investor, whatsoever. This makes it easy for anyone to defraud. A fake ID and in many cases, just running around the system, is enough to get the job done.

The issue remains hidden, since there are no claimants for the stolen shares and dividends in the vast majority of cases. By the time rightful claimants came forward to make their claim, the shares had been sold by the fraudsters in a number of cases.

As a matter of fact, in most of the cases, these shares are in physical form, with the share certificates (typically bonus shares) lying undelivered with the registrar. The reason for this is being the original shareholder would have died, or changed the address, so no one is available to receive the shares at the address mentioned in the Register of Members of the company. The postal department will return the shares/dividend cheques to the registrar.

From 2001-02 to 2015-16, the Investor Education and Protection Fund (IEPF) received Rs 1,274 crore in unclaimed shares and unclaimed dividends, according to government statistics.

Real-world implications of unclaimed shares fraud

Unless someone complains, the corporation may not even be aware that the shares have been unlawfully transferred. Often even the person defrauded does not realize that they have been defrauded.

The most recent such case is that of Britannia Industries where the value of unlawfully transferred shares is believed to be approximately Rs 18-20 crore. Similarly, unlawfully transferred shares worth Rs 2 crore were also identified in Asian Paints.

According to sources, such scams would not be feasible without the cooperation of personnel at the stock transfer agencies. Because the unclaimed shares are in physical form, the fraudsters will require the original holder’s specimen signatures before they can send them for dematerialization. That information is most likely derived from the share registrar’s records.

Let’s understand this more deeply with a real-world example.

A senior citizen (let’s call them CG) learned too late that her father, Nowroji Sorabji Sethna, had stock in a number of publicly traded firms. However, she discovered that the shares had been fraudulently transferred and sold by the time she sought the corporations for more information.

Sethna possessed over 10,000 Balmer Lawrie shares, which, together with a bonus issue, are worth over Rs 80 lakh at today’s market values. He also had stock in Delhi Cloth & General Mills (the parent business from which the DCM group was formed in the 1980s), CESC, and Walchandnagar Industries, among other enterprises. When CG emailed Balmer Lawrie for more information, she was told that Sethna’s name had vanished from the shareholder records.

CG was also made aware of a request for a change of postal address, the issuance of duplicate shares, and the dematerialization of shares. The only problem is that these requests were made in 2011 after Sethna had passed away in 1975. According to the information given by Balmer Lawrie, Sethna’s shares were ‘sold’ between May 2011 and February 2013. The original shareholder’s signature is required on the transfer deed accompanying the share certificate in the event of physical shares.

Balmer Lawrie made a bonus share issuance in the ratio of 3:4 in May 2013. Sethna was the recipient of 5,805 shares. Balmer Lawrie received a ‘request’ for dematerialization of the shares from Sethna in September 2013. Sethna sent the corporation another ‘request’ for duplicate share certificates for 6,340 shares six months later, and another ‘request’ for dematerialization of those shares two months later. And now there is no trace of any of those shares.

Balmer Lawrie argues that in processing the requests, it “relied on statements provided by the RTA and the corresponding depository participant, as well as papers given by the transferor/transferees.” It also wrote to CG, stating that Sethna’s address had changed unexpectedly. “The firm has been requesting the RTA for the aforementioned facts and copies of each of the documents in their possession, including the explanation for the change in the registered address of the shareholders,” Balmer Lawrie wrote to CG.

CG was unable to obtain the CESC shares to which she was entitled since they, too, had been unlawfully sold. Both CG’s brother and mother had stakes in Delhi Cloth and General Mills, and both died in the early 1980s. Since then, the corporation has been divided into three divisions. When CG requested information on the shareholding from one of the three group firms, they were told that the names of the two initial shareholders were no longer on the books. She was able to obtain her shares in Walchandnagar Industries only because a letter she sent to the firm asking for data on her father’s shareholdings arrived only a few days after the fraudsters had written to the company notifying them about the change in address.

STOP SITTING BACK !!

PREVENTION IS BETTER THAN CURE

Such a thing can happen to anyone. Imagine being scammed without even realizing you are being scammed. It is a scary proposition.

With the advent of demat accounts, this process has become even easier for those who intend to defraud. These agents employ illegal tactics to get shares that have not been claimed by the deceased’s legal heirs, convert them to demat form, sell them on the market, transfer the funds to bank accounts set up for the purpose, and withdraw cash. Typically, they take help of a series of transactions, and since the asset is fungible, no track record can be found.

Market regulator SEBI has launched a probe into the agents and companies who are involved in such nefarious activities.

However, as an investor, it is best to stay vigilant. Trustworthy professionals such as those at Infiny Solutions ensure that you always have all the correct information about your shareholdings and any holdings that may be due to you. Our team has access to a vast database and is thus able to identify the rightful claimants of unclaimed shares and unclaimed dividends. We help ensure that you get the money that belongs to you without any risk of being defrauded by unscrupulous agents.

0 notes

Text

A signature mismatch is one of the most common causes of rejection of Demat requests or share transfers. A signature is the prima facie evidence of your ownership in the shares of a company. It verifies that you are the same person to whom the shares were initially issued. When a signature mismatch occurs you are required to act on it immediately. Infiny Solutions can act as your guide to update your signature seamlessly without any complexities.

Visit :-https://infinysolutions.com/signature-updation/

0 notes

Text

The responsibility of educating people about the refunds and administration of unclaimed dividends and helping them to make the process easier. The IEPF also ensures the transfer or claim of the transferred IEPF unclaimed dividend to the right person.

For More Visit :- https://infinysolutions.com/how-to-claim-unverified-dividends-and-shares-after-being-transferred-to-iepf/

0 notes

Text

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#iepf shares recovery#iepf recovery#recovery of shares from iepf#iepf shares claim#infiny solutions

0 notes

Text

https://infinysolutions.com/claim-of-shares-dividends-from-iepf/

IEPF Shares Recovery - IEPF Claim refers to the process of reclaiming unclaimed dividends, shares, and other assets by the Investor Education and Protection Fund. It helps investors retrieve their rightful funds and promotes transparency in the financial system.

0 notes

Text

https://infinysolutions.com/transfer-of-shares/

Physical Shares Solutions aims to provide transparency that would take investor's feel honesty. What makes the story behind our company services is that it's personally to investor's. Nothing embarrassing. Just an honest tale on why investor's began with us. There's also random facts (solved cases) that gives our visitors even more insight our services.

0 notes

Text

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#recovery of shares from iepf#iepf shares claim#iepf shares recovery#iepf recovery#transmission of shares#transfer and transmission of shares#iepf

0 notes

Text

Forget NFTs, here’s why Nestle and HUL are what you need

As of February 2022, shares of Nestle India are floating in the market at a price of more than Rs 18,000 per share and the shares of HUL are floating at over Rs 2,000 per share. You may not be much of a trader, but what if you got to know that you actually happen to own some shares of these companies? This happens when the recovery of shares is overdue. Let’s learn more about what they are and how they could make you a fortune.

Role of IEPF in the case of unclaimed shares

The government of India created the Investor Education and Protection Fund (IEPF) to educate investors and safeguard them from losing control of their assets and stock. There are innumerable instances of investors failing to appoint a nominee for their shareholdings. This means that if the investor passes away, their investments are transferred to the government along with any unclaimed dividend money. These funds may then be used by the government as they deem fit unless the investor’s rightful heirs make their claim. The IEPF allows and encourages investors to contact the government to demand their dividends and request that their long-forgotten shares be refunded thereby facilitating lost shares recovery. The IEPF was established with the shareholders’ best interests in mind and it helps safeguarded the monies of investors while also raising awareness about the issue.

Investors can petition the government to receive the unclaimed dividends and unclaimed shares up to 7 years after they were deemed lost. Typically, people used to approach respective companies individually to get information about and then collect their dividends and shares. However, the IEPF is a one-stop solution that enables the public to claim their rightful inheritance from multiple companies through a single channel when it comes to the matter of recovery of unclaimed shares.

Why Nestle can be your ideal investment

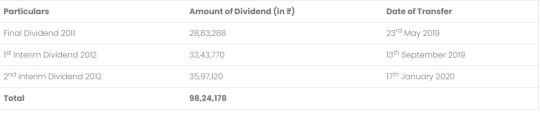

The present status of the dividends and shares of a firm that are transferred to the IEPF account is stated in the company’s annual reports. All unclaimed dividends dating back to the financial year 1995-1996 that remained due and unclaimed with the business were transferred to the Central Government’s general revenue account, according to Nestle India Ltd.’s Annual Report for 2019-2020. Below is a snapshot of the value of the latest dividends that were transferred and are now up for IEPF claim.

Over the years, Nestle has also rewarded its investors with a generous number of bonus shares. Below is a history of bonus shares announcements by the company and what it means for an investor.

100 shares of Nestle India owned in 1982 would turn into 960 shares less than 15 years later. This coupled with the generous dividends that the company pays makes it a hugely profitable investment. To date, the company has distributed 60 dividends totaling Rs 1,292.5 per share to its shareholders. As per the latest available data, the company most recently announced a dividend of Rs 196 per share.

Let’s visualise the financials at stake in this case with an example.

Let’s assume you have 500 shares of Nestle India Ltd. registered under your name. The price of 1 share of Nestle India Ltd. as of February 2022, is Rs 18,515. Therefore, the value of your shares as of today is Rs 18,515 x 500 shares = Rs 92,57,500 (Ninety two lakhs, fifty-seven thousand and five hundred rupees).

However, this only takes into account the share price and not the dividends attributed to those shares. The amount of dividend received thus far (from 2001) is Rs 1,292.5 x 500 shares = Rs 6,46,250 (Six lakhs, forty six thousand, two hundred and fifty).

Dividend received in the latest financial year amounts to Rs 196 x 500 shares = Rs 98,000 (Ninety eight thousand).

Putting all these figures together makes you a crorepati!

Assume you made a long-term investment in this firm and then completely forgot about its stock. Alternatively, you may have inherited some shares from a deceased family member that you were unaware of. As a result, you would not have claimed any dividends on these shares for the past seven years. In this case, the shares would have been moved to the Government’s IEPF account, and they are no longer in your ownership. This does not necessarily imply that you are no longer the legal owner of such shares. The main difference is that the government holds your shares and dividend amount in trust on your behalf. You can always make an IEPF shares claim from the government.

How Rs 2430 invested in HUL in 1978 can be worth over Rs 13 crores today

Hindustan Unilever Limited’s stock has risen dramatically over the years, prompting the company to issue bonus shares and divide its equity. We’ll see how, at today’s rates, even a small investment in Hindustan Unilever Limited could be worth crores. Let’s look at a hypothetical situation to better comprehend the growth of the company.

Suppose an investor had 900 shares of Hindustan Unilever Limited registered in 1978 which would have cost approx Rs 1200 considering the share price of HUL at the time was around Rs 2.7 per share. The prices of Hindustan Unilever Limited shares have kept on increasing since 1978 and the company has announced bonus shares on numerous occasions during that time period as well. As a result of those bonuses and the share splits announced by HUL, those 900 shares will be equivalent to 57,600 shares today.

This means that as per February 2022 share prices, you would stand to gain a fortune of 57,600 shares X Rs 2,332.95 = Rs 13,43,77,920 (Thirteen Crores, forty-three lakhs, seventy seven thousand, nine hundred and twenty).

The above figure only accounts for the share price and not the dividend declared. HUL has declared both interim and final dividend over the years which has been exponentially rising. In 2021, the company declared a mammoth dividend of Rs 17,000 per share! The calculator of the payout basis 57,600 shares in the previous example is something that we will leave to you.

IEPF shares recovery process

The process of IEPF recovery is rife with hurdles and often specialised knowledge from experts may be required. It involves the following steps:

Making your IEPF claim

By now we have learned how HUL or Nestle shares purchased decades ago may be worth crores in today’s market. We have also learned how the process of recovery of shares from IEPF would be quite advantageous for investors, but tedious in nature. This is due to the fact that the procedure necessitates continual communication with nodal offices of the company, IEPF department, and registrar This may prove to be a lot of work for busy investors. This is where the team of experts at Infiny Solutions (add website hyperlink) can come to your rescue. Our experienced professionals have successfully completed the recovery of lost shares of Nestle, HUL, and many other companies for numerous clients over the years. If you think you may have inherited HUL or Nestle shares from someone in your family, we can help process your claim even if the share certificate in your possession is mutilated or you only have partial information about a potential claim. As part of our exclusive services, we facilitate the process through respective registrars, nodal officers, and IEPF till the very end when your claim is eventually sanctioned. All you have to do is sit back and wait for a fortune to be credited to your account!

Blog Source:- https://infinysolutions.com/forget-nfts-heres-why-nestle-and-hul-are-what-you-need/

0 notes

Text

Recovery of Shares from IEPF| Infiny Solutions!

Unlock the potential of your unclaimed shares and dividends with Infiny Solutions! Our expert services specialize in the seamless recovery of shares from the Investor Education and Protection Fund (IEPF). Explore the comprehensive solutions provided by Infiny to effortlessly navigate the complex process of claiming shares and dividends from the IEPF. Trust in our dedicated team to guide you through the intricacies, ensuring a swift and efficient recovery process. Visit our page at https://infinysolutions.com/claim-of-shares-dividends-from-iepf/ to discover how Infiny Solutions can empower you in reclaiming what rightfully belongs to you. Secure your financial assets with Infiny – your trusted partner in IEPF share recovery."

0 notes

Text

Infiny Solutions is your trusted partner for seamless IEPF recovery.

Visit our dedicated page at https://infinysolutions.com/claim-of-shares-dividends-from-iepf/ to explore expert insights and solutions for efficiently claiming shares and dividends from the Investor Education and Protection Fund (IEPF). Our comprehensive services cater to the intricate process of recovering unclaimed shares and dividends, ensuring a hassle-free experience for individuals and corporations alike. With a proven track record and a client-centric approach, Infiny Solutions simplifies the complexities associated with IEPF recovery, offering guidance at every step. Maximize your returns and navigate the IEPF landscape with confidence. Unlock the potential of your unclaimed assets today. Trust Infiny Solutions – Your Gateway to IEPF Recovery Excellence."

0 notes

Text

How To Make an IEPF Claim for Refund: An Effective Guide

Stakeholders, including executives and sometimes employees, can own shares in a company. Sometimes, they receive shares as part of a reward program, while they purchase them other times. Shares hold more value than anything else since it gives a sense of ownership. Let’s say a company purchases 100 shares from the market. It has six shareholders. Five received 16 shares each, but the sixth person became eligible for 20 shares.

So, considering the shares and divided policies 101, we can say that the shareholder with 20% ownership of the company has more rights than others. Shares are a type of asset that one can liquify, foreclose on, prematurely invest in, and perform several other functions. Once a person decides to leave the company or resigns from the shareholder post, they sell the shares under their name. If someone sells 20 shares, the equivalent number of shares will be added to the liquidity pool. It will not have any ownership, meaning another person can purchase it with ease.

When can one not sell the shares voluntarily?

There are certain conditions where a person cannot sell shares. For instance, if they sign a contract while purchasing the shares, they may not be eligible to sell the shares. If they sell them, they may face legal consequences. Another situation where you cannot sell the shares is for sole ownership. If you own 100% of the shares listed under your company, you cannot sell the shares.

If you do so, you will effectively sell the company itself, especially if your investments are in the form of those shares. So, try to sell stocks or portions of shares if you require funds. You will still have ownership only if you hold the maximum number of shares under your name.

Is transfer or transmission of shares similar to selling?

Often, people think that the transfer and transmission of shares are similar to selling them. But that is not the truth. A transfer of shares happens when you transfer the ownership from your title to another. You will do so willingly, like to someone close to you or another family member. There will be no concept of purchasing or selling the shares. Therefore, the liquidity pool does not receive shares during transfer.

Transmission of shares, on the other hand, happens under company laws. This statement implies that the shares under one name will be transferred to another involuntarily. No one can control the title change of the shares. In addition, a few laws will govern the entire process, ensuring no one can claim the shares illegally. For instance, if someone dies, the transmission of shares takes place automatically to the nominee.

What are the challenges in the transfer of shares?

During the transfer of shares, there are certain challenges one can face. The following section describes these hurdles and their causes.

1. Mismatch of signatures

The signatures of the original share ownership document and the transfer of title deed must match. If there is a mismatch in the signatures, the transfer process will stop then and there. That’s why one needs to be sure about the signatures before submitting the transfer deed.

2. Loss of original share ownership certificate

Everyone needs to submit the share ownership certificate. The document implies the person in charge of the shares, the initial number of shares bought, and so many other details. If this document is not available, one cannot proceed further with the transfer process.

3. No submission of the share transfer deed

If someone fails to submit the share transfer deed or the information is not right, there will be no change in the share title. The regulatory body can disapprove the entire application on the basis of improper or incomplete documentation.

4. Manipulated share certificated

Most of the time, the share certificates submitted might not match the digital copies of the same. It usually happens when someone manipulates the information knowingly. In this case, there won’t be any transfer of shares from one person to another.

What are the challenges in the transmission of shares?

Just like the challenges in the transfer of shares, one can also encounter hurdles in the transmission of shares. Without addressing these problems, it will become difficult to complete the title transmission process. In addition, one can release the shares in the liquidity pool due to the absence of any nominee for the transmission.

1. Presence of multiple share ownerships

If someone has multiple shareholdings in different enterprises and companies, the regulating bodies will not allow the transmission of ownership. This is because different companies might have different rules and regulations for share transmission. Also, the original share certificates for some shareholdings might not have nominee names. In such situations, the regulatory bodies cannot allow the transmission of shares.

2. Not following the conditions for share transmission

There are certain conditions guarding the process of share transmission. Failure to meet the conditions or follow the rules can disrupt the process. In this case, you can take legal advice to understand the terms and conditions further. The professionals can also help you proceed with the transmission of shares.

3. The document doesn’t have a nominee

If the original share certificate document doesn’t have a proper nominee, the transmission of shares will halt. In this case, documents like birth certificates, proof of heirship, and others will help you restart the share transmission.

Conclusion

This article illustrates the transfer and transmission of shares, along with the challenges. The best way to save yourself from these hurdles is through an association with a legal firm. The professionals can help you a lot as they know corporate and share market laws.

Blog Source:- https://infinysolutions.com/all-you-need-to-know-about-the-transfer-and-transmission-of-shares/

transmission of shares | share transmission | transfer and transmission of shares | transfer of shares and transmission of shares

#transmission of shares#share transmission#transfer and transmission of shares#transfer of shares and transmission of shares

0 notes

Text

https://infinysolutions.com/claim-of-shares-dividends-from-iepf/

IEPF Shares Recovery - IEPF Claim refers to the process of reclaiming unclaimed dividends, shares, and other assets by the Investor Education and Protection Fund. It helps investors retrieve their rightful funds and promotes transparency in the financial system.

"IEPF Shares Recovery" "IEPF Claim" "Recovery of Shares From IEPF" "iepf shares claim" "iepf recovery"

0 notes

Text

The Role of Indemnity Bonds in the IEPF Claim Process

For the purpose of claiming shares and/or dividend money, an indemnity bond (original) must be executed on non-judicial stamp paper according to the format provided in Annexure I. The claiming process of IEPF totally depends on the indemnity bond. Thus, make sure you read this before claiming.

Indemnity Bond: An overview

An indemnity bond serves as insurance for the lender in the event that the borrower breaches the conditions and terms of the loan. It is mostly utilized in the loan and mortgage business. A stamp paper with a monetary value that varies from state to state is used to generate an indemnity bond. Particularly, it is written to meet one's demands and legal requirements and comes in a variety of forms.

An indemnity bond is a promise made by someone signing a contract to cover losses in the event that the agreement is broken. This means that the lender will have every right to collect losses and damages resulting from a defaulting party if a person is required to fulfill contractual obligations but chooses not to do so. Continue reading to learn more about the structure or format of indemnity bond for claiming shares from IEPF.

What is IEPF form 5?

Every person who has had an unclaimed or underpaid payment transferred to the IEPF by the corporation may request a return from the IEPF authority. The claimant must submit form IEPF 5 indemnity bond together with the required supporting documentation in order to claim such an amount.

Following the instructions below will allow any stakeholder of the business whose shares, unclaimed dividend funds, or unpaid dividend amount have been transferred by the company to IEPF Claim their shares or dividend funds.

How to claim shares or dividend money that has been transferred to the IEPF?

The shareholder must submit indemnity bond for IEPF form 5 and the supporting documents listed below-

On the IEPF Authority website, www.iepf.gov.in/IEPFA/refund.html, download the IEPF-5 form. The instruction packet contains instructions on how to fill out the form.

After filling out the form, save it to your computer and, following the instructions, upload the correctly completed form to the IEPF Authority's website using the upload link. An acknowledgment or challan with the Service Request Number will be generated following a successful upload (SRN). The SRN created needs to be referred to in order to trace the progress of the claim for a credit of shares or for a refund of the dividend amount, as the case may be.

The Nodal Officer's Document Submission List

A self-attested copy of Form IEPF-5 is required (if there are joint holders, all of the holders must sign Form IEPF-5).

Receiving of an acknowledgment (Challan generated for filing form IEPF 5 in MCA Portal).

Completion of an indemnity bond is necessary when shares or dividend payments made to the IEPF Authority have a nominal value greater than Rs. 10,000. The indemnity bond must be executed on non-judicial stamp paper, and the value of the stamp paper must comply with the state's stamp law where the shareholder resides. For claiming dividends and shares, a separate indemnity bond must be obtained. In case of joint holding, Indemnity Bond is to be signed by all the holders).

Provide the Corporation an advance receipt for the receipt of shares or a dividend, as applicable. (Correctly completed in accordance with the format specified in the Annexure, with the applicable dividend amount and share count clearly filled in. The receipt must be signed by all joint owners in the case of a joint holding.

The original share certificate, the dividend warrant, and the letter from the registrar and transfer agent constitute proof of entitlement.

For claiming an unpaid or unclaimed dividend, you will need a dividend warrant or a self-attested copy of your share certificate, as well as a letter from the registrar and transfer agent.

Original share certificates, letters from the company's registrar and transfer agent, and any unpaid or unclaimed dividends on those shares that were transferred to the IEPF must be included (in case shares are held in Physical form).

If shares are kept in demat form, and an unpaid/unclaimed dividend from the IEPF is transferred, a letter from the registrar and transfer agent is required.

According to Rule 7(8) of the IEPF Regulations, 2016, in the event of transmission, the applicant, who is the successor or legal heir, shall make sure that the transmission process is finished before filing any claims. To double check, search for how to fill indemnity bond for IEPF before submitting.

In addition, if the request for transfer or transmission is received after the transfer of IEPF shares to the IEPF Authority, the company shall issue a letter of authorization in conformity with Rule 7(9) of the IEPF Regulations, 2016.

Indemnity Bond | IEPF 5 Indemnity Bond | Indemnity Bond For IEPF Form 5

0 notes

Text

Discover the evolution of Initial Public Offerings (IPOs) from the 1980s and 1990s to today and how it impacts your investments. Explore insights at Infiny Solutions: https://infinysolutions.com/ipos-in-1980s-and-1990s-vs-today-and-what-it-means-for-you/. Uncover the changes in IPO trends and their significance for your financial strategy.

#IPOs#IPOs Share Price#IPOs In India#IPOs Process#IPOs Service#IPOs Meaning#unclaimed dividends and unclaimed shares#Initial Public Offering

0 notes

Text

IPOs in 1980s and 1990s vs today and what it means for you

India is currently going through an IPO boom. According to the latest Ernst & Young (EY) Global IPO report, the year 2021 was India’s strongest IPO year in terms of proceeds in the recent 20 years. As per the report, IPO activity in India climbed 156 percent year over year to 110 deals in 2021 (from 43 in 2020) and 314 percent in terms of proceeds to $16.94 billion (from $4.09 billion in 2020). All of this is good news for investors. However, things weren’t always so rosy in India. The IPO scenario in the 1980s and 1990s was vastly different from what we know and see today.

Background of IPOs

Hundreds of enterprises flooded the market with IPOs in the 1980s, with the majority of them being low-quality issues. The worst period was 1992-1996, when there were an incredible 3,911 equity IPOs. These were rife with frauds and scams since SEBI had only just been set up and did not have much control over the market. There were no rules and regulations or checks and balances which led to investors being scammed left, right, and centre.

Ponds, Colgate, and Hindustan Lever were among the several companies that went public at incredibly low rates set by the old CCI, or Controller of Capital Issues. While short-term investors did well, long-term investors were rewarded extremely handsomely. Naturally, demand for new IPOs surged exponentially with each profitable listing, resulting in massive oversubscriptions, effectively turning the exercise into a lottery. To gain more allotments, the era of numerous applications and false applications began.

Problems with IPOs in the 80s and 90s

The market was plagued with a litany of issues back then. Since there were no barriers to entry, almost anyone could launch an IPO. There was no governing body to oversee. This led to a number of fraudulent companies launching IPOs just to rake in investor money which was never returned. Issuers could get away with anything back then, including enticing headlines, the employment of models and celebrities, and the promise of a bright future, with guaranteed dividends in advertisements. All of this has since been prohibited by the SEBI advertising rule. Those who did get shared allotted to them only got them after a convoluted method of share allocation which was vulnerable to manipulation. Proportional allotments were used, although even the few successful applicants received a relatively small amount of shares. SEBI has now established a minimum reasonable allocation. For institutions, there existed a dubious discretionary allotment system, in which issuers and investment bankers could force their favourite institutions to participate. This, too, has been modified to a proportional allotment. Furthermore, a tight KYC process has precluded the possibility of demat fraud.

Practices used to increase chances of allotment

IPOs in the 1980s and 1990s were not a poisoned chalice just because of regulatory issues. There were investor side issues as well. To cash in on the first-ever IPO boom in India, investors used various methods to try and ensure that they got the maximum possible allocation for them.

Since PAN cards did not exist at that point in time and neither was there a Unique Identification Number (UID), it led to a number of unscrupulous activities from investors.

Using multiple names: To increase the chances of allotment, people would fill multiple forms, all with different names. On some forms they would put only their first name, on some they would put both first and last name. They would also use combinations with their first, middle, and last names. Female investors also resorted to using their maiden name and their post-marriage name alternatively.

Use of all possible addresses: Investors would also look to exhaust all possible address combinations available to them. This included their home address, office address, rented address, paternal home’s address, or even their relative’s address. This coupled with using different names allowed one investor to fill tens of forms at once, all in a bid to get as many shares allotted to them as possible.

These activities led to a number of name mismatches, name changes in documents, signature mismatches, and address changes in documents. When such a thing happens, these shares are deemed lost and lay unclaimed. A change in name after wedding can also lead to this. There can also be cases of the company’s name being changed and the same not being reflected in your documents. This would also lead to a situation of unclaimed shares.

Getting back what’s yours

Up to 7 years after unclaimed dividends and unclaimed shares were ruled lost, investors can petition the government to receive them. Previously, consumers had to visit individual corporations to obtain information and then collect their dividends and shares. But now when it comes to recovering unclaimed shares, the IEPF is a one-stop solution that allows the public to claim their rightful inheritance from numerous companies through a single route. The entire process is now more transparent which guarantees that the payouts reach the proper people and are not tainted by fraud.

The team at Infiny Solutions is well-versed at dealing with such issues. We have helped a number of investors reclaim their rightful holdings from the 1980s and 1990s which they had lost due to any of the above-mentioned reasons. There is also the possibility, depending on which stock you owned, that your holding from the 1980s is worth a fortune today. That makes it even more critical for you to track and reclaim what is rightfully yours. We, at Infiny Solutions, will help you do just that.

Blog Source:- https://infinysolutions.com/ipos-in-1980s-and-1990s-vs-today-and-what-it-means-for-you/

IPOs | IPOs Share Price | IPOs In India | IPOs Process | IPOs Meaning | IPOs Service | unclaimed dividends and unclaimed shares | Initial Public Offering

#IPOs#IPOs Share Price#Initial Public Offering#unclaimed dividends and unclaimed shares#IPOs Service#IPOs Meaning#IPOs Process#IPOs In India

0 notes