#Higher Education Loan

Text

Higher Education Loan :

Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

Text

Higher Education Loan :

Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

Text

Higher Education Loan

Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

Text

Higher Education Loan;-Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

Text

ছাত্রদের জন্য উচ্চ শিক্ষা

ছাত্রদের জন্য উচ্চ শিক্ষা

বর্তমানে প্রতিটি শিক্ষার্থীরই স্বপ্ন থাকে উচ্চ শিক্ষা অর্জনের জন্য দেশের বাইরে পড়তে যাওয়ার। কিন্তু সঠিক পরিকল্পনা ও যথাযথ দিকনির্দেশনার অভাবে অনেকেই বিভ্রান্ত হন। তাই বিদেশে উচ্চ শিক্ষা গ্রহনের ইচ্ছা থাকলে প্রথমেই প্রয়োজনীয় বিষয়গুলো সর্ম্পকে আপনার অতি স্বচ্ছ ধারনা রাখা প্রয়োজন। বিদেশে ছাত্রদের উচ্চ শিক্ষার বিষয় নিয়ে নিচে বিস্তারিত আলোচনা করা হল। উচ্চ শিক্ষা বলতে সাধারণত শিক্ষার প্রাথমিক ও…

View On WordPress

#access to finance#ছাত্রদের জন্য উচ্চ শিক্ষা#সংযোগইউ#bank loan#Digital Finance#digital financial communication#efinance solution#fintech startup in Bangladesh#fintech startup revolution#higher education loan#shongjogyou#Student Loan#Study Loan

0 notes

Text

Higher Education Loans at the Best Rates with Varthana

Enjoy a simple application process, fast loan disbursal, and flexible EMI structure with Varthana. Apply for a higher education loan online and take your first step towards a better future.

0 notes

Text

In light of the recent Supreme Court ruling on student debt forgiveness in Biden v. Nebraska, it seems it might be useful to revisit why American students have so much student debt.

Ironically, it all dates back to Reagan's and the Republicans' decision to cut back on funding for public colleges and universities in order to avoid the possibility of having an "educated proletariat."

So it isn't surprising that is is Republicans who were opposed to any government debt forgiveness for student loans. THEY DON'T WANT TO HAVE EDUCATED CITIZENS. The poorly educated are much easier to manipulate and control.

In 1970, Ronald Reagan was running for reelection as governor of California. He had first won in 1966 with confrontational rhetoric toward the University of California public college system and executed confrontational policies when in office. In May 1970, Reagan had shut down all 28 UC and Cal State campuses in the midst of student protests against the Vietnam War and the U.S. bombing of Cambodia. On October 29, less than a week before the election, his education adviser Roger A. Freeman spoke at a press conference to defend him.

Freeman’s remarks were reported the next day in the San Francisco Chronicle under the headline “Professor Sees Peril in Education.” According to the Chronicle article, Freeman said, “We are in danger of producing an educated proletariat. … That’s dynamite! We have to be selective on who we allow [to go to college].”

“If not,” Freeman continued, “we will have a large number of highly trained and unemployed people.”

#ronald reagan#public higher education#educated proletariat#roger freeman#student debt#supreme court#student loan forgiveness#biden v nebraska

592 notes

·

View notes

Text

On Wednesday, Senate Health, Education, Labor and Pensions (HELP) Chair Bernie Sanders (I-Vermont) and Rep. Pramila Jayapal (D-Washington) reintroduced a proposal to make higher education free at public schools for most Americans — and pay for it by taxing Wall Street.

The College for All Act of 2023 would massively change the higher education landscape in the U.S., taking a step toward Sanders’s long-standing goal of making public college free for all. It would make community college and public vocational schools tuition-free for all students, while making any public college and university free for students from single-parent households making less than $125,000 or couples making less than $250,000 — or, the vast majority of families in the U.S.

The bill would increase federal funding to make tuition free for most students at universities that serve non-white groups, such as Historically Black Colleges and Universities (HBCUs). It would also double the maximum award to Pell Grant recipients at public or nonprofit private colleges from $7,395 to $14,790.

If passed, the lawmakers say their bill would be the biggest expansion of access to higher education since 1965, when President Lyndon B. Johnson signed the Higher Education Act, a bill that would massively increase access to college in the ensuing decades. The proposal would not only increase college access, but also help to tackle the student debt crisis.

“Today, this country tells young people to get the best education they can, and then saddles them for decades with crushing student loan debt. To my mind, that does not make any sense whatsoever,” Sanders said. “In the 21st century, a free public education system that goes from kindergarten through high school is no longer good enough. The time is long overdue to make public colleges and universities tuition-free and debt-free for working families.”

Debt activists expressed support for the bill. “This is the only real solution to the student debt crisis: eliminate tuition and debt by fully funding public colleges and universities,” the Debt Collective wrote on Wednesday. “It’s time for your member of Congress to put up or shut up. Solve the root cause and eliminate tuition and debt.”

These initiatives would be paid for by several new taxes on Wall Street, found in a separate bill reintroduced by Sanders and Rep. Barbara Lee (D-California) on Wednesday. The Tax on Wall Street Speculation would enact a 0.5% tax on stock trades, a 0.1% tax on bonds and a 0.005% tax on trades on derivatives and other types of assets.

The tax would primarily affect the most frequent, and often the wealthiest, traders and would be less than a typical fee for pension management for working class investors, the lawmakers say. It would raise up to $220 billion in the first year of enactment, and over $2.4 trillion over a decade. The proposal has the support of dozens of progressive organizations as well as a large swath of economists.

“Let us never forget: Back in 2008, middle class taxpayers bailed out Wall Street speculators whose greed, recklessness and illegal behavior caused millions of Americans to lose their jobs, homes, life savings, and ability to send their kids to college,” said Sanders. “Now that giant financial institutions are back to making record-breaking profits while millions of Americans struggle to pay rent and feed their families, it is Wall Street’s turn to rebuild the middle class by paying a modest financial transactions tax.”

#us politics#news#truthout#sen. bernie sanders#progressives#progressivism#Democrats#senate health education labor and pensions committee#College for All Act of 2023#tax Wall Street#tax the rich#tax the 1%#tax the wealthy#college for all#student debt#student loan debt#tuition-free college#Historically Black Colleges and Universities#pell grants#Higher Education Act#Rep. Barbara Lee#rep. pramila jayapal#2023

466 notes

·

View notes

Text

The critical takeaway here is that your college major matters—a lot. Your Bachelor’s degree in Engineering will likely land you a well-paying job; your Gender Studies degree isn’t worth a bucket of warm spit. Think carefully before you go into debt!

#education#higher education#college#student loans#student debt#job market#job readiness#job search#your major matters

21 notes

·

View notes

Note

I feel so weirdly guilty that I need to take out loans. Like it doesn't affect anyone but me but I feel immense guilt that I can't get scholarships or pay out of pocket for my education

Let me translate this into non-imposter-syndrome-ese:

"I feel guilty for being born into a family lacking in excessive wealth and privilege."

Honey, there is no shame nor guilt in taking on debt. Especially not for your education. You're not alone, and a big part of what you're feeling comes from societal pressures to somehow mission-impossible your way through systems of economic inequality all by yourself, at the very start of your adult life. It ain't fair.

Those who should feel guilty are the ones ballooning the cost of education, not those simply trying to better their lives and communities through access to that education.

What We Talk About When We Talk About Student Loans

32 notes

·

View notes

Video

Student Debt and affirmative action

https://www.democracynow.org/

#tiktok#democracy now#debt collective#student loans#student debt#student loan crisis#cancel student loans#debt cancellation#debt strike#us supreme court#wages and salaries#minimum wage#livable wage#wages#social welfare#canada#US#class struggle#education#higher education#student loan debt#debt#college#health insurance

61 notes

·

View notes

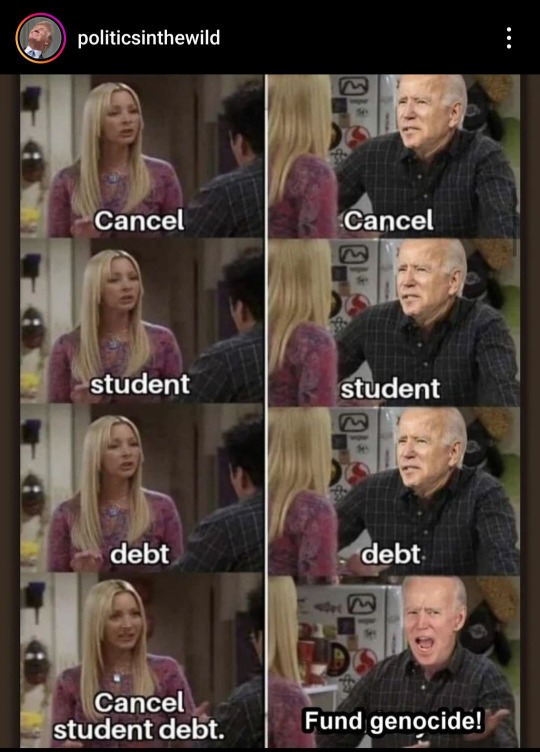

Text

#politics#us politics#progressive#foreign policy#war#student debt#cancel student debt#student loans#higher education#joe biden#genocide#gaza#free gaza#gaza strip#gaza genocide#gazaunderattack#free palestine#ethnic cleansing#middle east

9 notes

·

View notes

Text

I FINALLY QUALIFY FOR PUBLIC SERVICE LOAN FORGIVENESS

My initial student loan was $54,935.92.

I paid over $30,887.83*

My loan is currently at $51,756.93.

I thought I had made all 120 qualifying payments last year. I had to submit and resubmit the PSLF application multiple times, because it kept getting sent back because of problems with how my employers signed the form. It turned out some of the payments didn't qualify, so I had to stick with helljob for at least another year.

I definitely had made 120 qualifying payments this year, so I sent the application in December 2023.

Just got notified now that I have made all qualifying payments. I've made three extra payments, even.

"After we receive the approval, it may take up to 90 business days to process this information."

Three more months of helljob, because I still don't trust this is going to go through and I don't want to quit until I know my loans are gone. I do not have anything lined up after helljob, and I'm terrified of losing my helljob health insurance because I got medical complications. But I hate helljob. I hate helljob so much and my first emotion waking every workday is despair.

At least the loan payments have been paused until the reimbursement is processed. Theoretically I should get reimbursed for the extra payments, too.

* This was only my qualifying payments. The total amount I paid was higher. The website isn't showing me the non-qualifying payments and I have to submit a formal request to get my full payment history. I submitted the request, but it will take a few days to be sent to me.

#This has been a nightmare btw#why yes higher education in the US is a huge scam and utterly inaccessible to most people rn#This wasn't even all of my loans I also got a private loan that I paid off years ago with help from family#I'm one of the LUCKY ones and this ruined my life#student loans#us higher education#what really makes me want to strangle my past self is that I only took these loans because I wanted to be a doctor#like I actually had my bachelor's degree paid off. I didn't need to do this to myself.#But I wanted to be a doctor so I gambled my entire future without realizing I was even gambling let alone that the game was rigged#and I lost it all. Didn't even make med school.#Every single adult I asked for advice on higher education or loans told me 'you're smart and you'll figure it out don't worry'#I've always been a gullible sucker#personal stuff#pslf#public service loan forgiveness

8 notes

·

View notes

Text

Higher Education Loan

Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

Text

Higher Education Loan:- Our higher education loans provide an easy and flexible option to avail quality education from your preferred institute.

0 notes

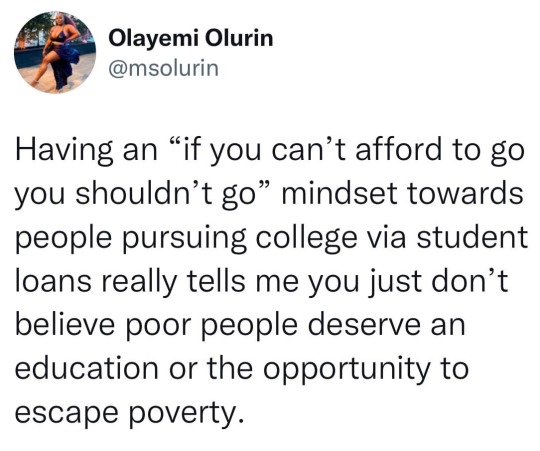

Text

#higher education#college#student loans#student loan forgiveness#loans#poor people#poverty#poverty wages#escape#escaping poverty#escaping#classism#reality#truth#true#facts#no but seriously#real life#no bullshit#no bs#no bull#real#education#education system#educational system#life#true shit#real shit#opportunity

87 notes

·

View notes