#Apply For Bankruptcy For Free

Note

Did you hear about joannes going bankrupt? Do you have any thoughts on that?

(Quick note so no one um actually's me: I'm aware that not all bankruptcy is Chapter 11. Thank you)

As a crafter, I'll say: oh dear, that's going to make shopping harder.

As a person who was aware of the insides of how that company was running, I'm going to say, "about fucking time."

See, here's what was happening with Joann. Problem #1 was that they stopped taking the "you have to spend money to make money," mentality and applying it to labor. A store is not about the products or the customers. The life of a store, the thing that keeps it beating, is the employees who serve the customer and serve the corporate ownership.

When they first started notably cutting labor, the store did have a lot of driven, passionate people who were willing to pick up the slack. It's possible to cut the freight shift one night a week when you have daytime floor associates who can do the freight when there's no customers immediately needing help. You can expect store managers to clean and recover the store, because it's a task that keeps them free to disconnect from when a store needs a manager to be acting as a manager. You can expect any free employee to fill in at the register or cut counter to cover a break or a lunch or fill in during a high-customer time. The store had a lot of employees who didn't mind doing some multitasking, and didn't mind being completely busy from the start of the shift until the very end.

However, when these labor cuts proved to be an effective way to save the store money, the amount of multitasking, and the amount of expecting one shift to cover for cuts made to another shift, started going up. It was no longer cutting the freight shift one day a week. It was cutting the freight shift until it was ONLY one day a week.

And that's where they made the big mistake in labor load. Instead of, "serve the customers, and do these tasks when you have time," it became, "do the task, and serve the customers if they demand your attention." A store is not the customers; it's the people who work in the store. But one of the key players in a retail store's staffing is the employees for whom making the customers happy is their primary drive. The way that stores were staffed, people whose primary drive was to serve customers were not allowed to adequately do so to reach customer satisfaction.

We need to add to this that, in addition to demanding more from every employee, Joann corporate has several of their demands on employees to be automatically measured. Customer response surveys, ship-from-store fulfillment, buy online pickup in store response times, number of remnants that were rolled to be sold, all of that can be sent to corporate with a pass/fail number assigned to it. Other elements of the store, like how much freight from a box actually makes it onto the shelf on time, or if a wheelchair can navigate the store, are not measured. This means that the company prescribes which tasks will actually be done and which can be shoved in the back for later. With the work load that was being put on employees, corporate decided that the ONLY tasks that should get done are ones that have specific metrics tied to them.

Employees whose drive is to help customer, who are not permitted to help the customers asking for help, will quit and go to a place where customers actually come first. Employees who are okay with doing two people's jobs, but who are asked to do three jobs, will leave to a place where they only have to do one job. Employees who have worked for the company for 4 years and never received a raise despite being praised for excellent work will go to a job where they get paid more. And suddenly, the only people who are left are the people who aren't overworked, because they're the people who will only do one job no matter how much demanding corporate has for them.

The last two years that I was at Joann, there were tons of employees asking or begging for more hours. It was not that they couldn't hire people. It's that they wouldn't assign labor hours. Employees who would happily work 35-40 hours a week, but who are assigned three hours a week, will leave and find a job where they can get a consistent number of hours. When they made all floor managers part time, a lot of people who had been with the company for years left to get more hours or some health insurance.

But, despite all of this, corporate never said, "if we put more people on the floor, our customers will be happier, and will spend more money." They still continued to treat labor as an unnecessary expense that should be limited. Why put more people on the floor when you can just overwork the people who bothered to show up for work today?

So, weirdly enough, that business model was absolutely not working for them, and it's all come crashing down. Damn right, as it should be. Respect the people who work for you, and they'll work for you. Take away the things that they're there to do, and they'll go somewhere else. Simple math.

Also, in the last decade, the fact is that, "Joann has a lot of coupons, so I can save money!" changed in the eye of the public into, "Joann is overpriced unless you know how to play the coupon game."

So yeah. I'm not surprised, and I hope their restructuring does good things for the employees who work there. Hell knows they need it, because their current system just proved that it cannot survive in that state.

142 notes

·

View notes

Text

HEY ALL!!! If you haven't heard, Unity is gonna start charging devs 20 cents per download. Not per sale, but PER DOWNLOAD. This applies to not only big-name games like Hollow Knight and Ori, but also smaller projects that might be free. This includes mobile games made with Unity, Undertale fan games like Undertale Yellow and Deltatraveler, and also, get this: Murder of Sonic! It was made in Unity, and so far, it's still free, but Sega's gonna hafta start charging for it sooner or later- IF they don't decide to take it down completely.

So, on this note, I have 2 things to say:

Get your favorite games NOW. Some devs, like Team Cherry, are talking about "taking their games down" (so much for Silksong- thanks A LOT, Unity!!!). I don't know if that means you'll still be able to play these games- like on Steam, for instance- if you already have them downloaded.

Please, please, PLEASE, support those games that are made with Unity. 20 cents adds up when there's a million downloads, and if it's like a mobile game, where people don't necessarily have to pay for it, that's going to COST the devs money- a LOT of money. I know we all hate the paywalls and "pay-to-win" schemes in mobile games, but let's be real- crap like this Unity thing are the whole reason those paywalls exist! These devs aren't doing this for free, they're trying to make a living! Even if you only spend $1, only 1 time, that is STILL going to be an 80 cent profit over the new Unity costs, and maybe, just maybe, give some game devs enough incentive to keep the game around.

I know Unity has a bad rep because it's easy to use and allows devs to release games that control poorly because you don't have to be good at coding to do it (*cough* Guardian of Lore *cough*). That's why I haven't used Unity, despite having several game ideas in my head, because I don't know how to code (yet), and I didn't want to release a game like that- and now I never will use Unity. But games like all the ones I've mentioned are proof that Unity CAN be used for good games, in the right hands. So please, if you love a game made with Unity, please support it, so the game doesn't go away. Don't send the devs into bankruptcy just because Unity is a money-grubbing so-and-so.

(Oh, I should also mention, for browser-based games, apparently this "per download" thing also includes "per BROWSER REFRESH". So, yeah, please don't blame the devs, support the devs and blame Unity.)

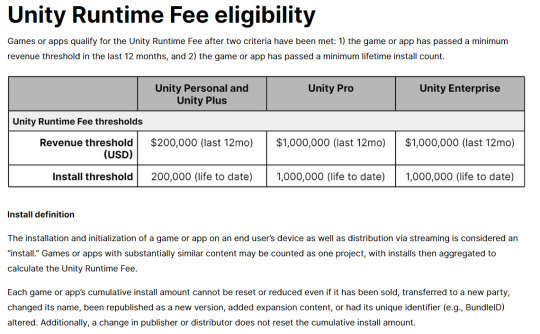

EDIT: It's not quite as bad as I'd thought. I knew Unity had a threshold, but I thought it was an either/or thing- either a certain number of downloads, or a certain amount of money made from a game. And, it's not, it's both.

So free games (like Murder of Sonic) apparently won't be affected.

Here's their pricing schedule once the threshold is met:

It still adds up for the smaller projects, with Unity taking all or most of the revenue from smaller games.

And one thing that's still bothering me: the install threshold is "life to date" and Unity is charging per install over the threshold. So, if a game's been around for years and had a million downloads and has made 200,000 dollars in the last year, they're gonna end up paying that 200,000 all at once.

At least, that's what I'm reading.

So, ok, I was wrong. Free projects won't be affected. But this is still awful, especially when it's first starting out.

EDIT 2 (2023-09-23): They've lessened the fees:

youtube

I'm still not using them. They never had a good reputation- I mean, there's good Unity games, but there's also a lot of bad ones because people can just release games with Unity with no coding experience. I want to make games someday, but I want them to be a good quality, so I'm waiting until I can actually figure out C++ (heck, I'm still wading through HTML, I'm nowhere near real programming languages). As long as I have to learn coding to make something good, I might as well find an engine that I can trust. I hear a lot about Godot. I also think I'll want to look at Monogame, because Monogame was used to make Axiom Verge and Celeste, and it's apparently based on the defunct XNA that was used to make Stardew Valley. Or I'll find something else. But not Unity. I just don't trust them.

#unity#unity engine#unity3d#game design#game development#indie game development#murder of sonic the hedgehog#hollow knight#ori#undertale fan games#deltatraveler#undertale yellow#Youtube

187 notes

·

View notes

Text

Johnson and Johnson's bankruptcy gambit fails

The Third Circuit Court of Appeals has foiled Johnson & Johnson’s plan to use a bankruptcy scam called the Texas Two-Step to escape paying 40,000 women who were injured when the pharma giant sold them asbestos-tainted talcum powder to dust over their vulvas, leading to gruesome cancers:

https://www.wxxinews.org/2023-01-30/appeals-court-clears-the-way-for-more-lawsuits-over-johnsons-baby-powder

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Back in 2018, a jury awarded $4.69 billion to 22 women whose ovarian cancer was caused by J&J’s toxic product, $4.14b of which was punitive, awarded because J&J ignored the link between applying talcum powder to one’s genitals and cancer, and continued to market its products as a “Shower to Shower” genital deodorant:

https://www.cnn.com/2018/07/13/health/4-69-billion-verdict-johnson--johnson-talcum-powder/index.html

With thousands more lawsuits in the pipeline, the company sprung into action, restructuring in Texas using a quirk of the state’s merger laws that allows a single company to “merge” into two separate entities.

https://statutes.capitol.texas.gov/Docs/BO/htm/BO.10.htm

The Texas Two-Step is a corrupt gambit that uses this quirk to allow large companies to escape liability for their misdeeds, by creating one company that holds the assets and profitable businesses of the firm, and another company that holds the firm’s toxic products and the liabilities they produced. The “bad” company then declares bankruptcy, leaving the “good” company to walk away with the billions it made by harming people, and leaving the victims to squabble over the meager assets from the bankruptcy.

To maintain the pretense that this maneuver isn’t just a ruse to escape liability, companies undertaking the Texas Two-Step have the “good” company guarantee some of the liabilities of the “bad” company. That’s what J&J did, and the women it injured sued over it:

https://www2.ca3.uscourts.gov/opinarch/222003p.pdf

The appeals court didn’t find J&J’s bankruptcy persuasive. They found that any bankruptcy for the “bad” company should come after it had exhausted all guarantees the “good” company had made. Summarizing the court opinion Bloomberg’s Matt Levine writes, “You want to file for bankruptcy while you still have plenty of money to pay claims, but not too much money.”

https://www.bloomberg.com/opinion/articles/2023-01-31/matt-levine-johnson-johnson-s-jnj-bankruptcy-didn-t-work

J&J has vowed to appeal. If their appeal succeeds, it will be another blow against corporate accountability and against the bankruptcy system, both of which have are at their lowest ebb in living memory. Just the fact that J&J is still in business is remarkable. Poison talcum powder is only the latest salvo in J&J’s war on women’s reproductive organs — just a year ago, the company was ordered to pay hundreds of millions for selling women vaginal meshes, aggressively marketed for incontinence and prolapse, long after it learned that these meshes could permanently fuse with patient’s pelvic floors, leading to “severe pain, bleeding, infections, discomfort during intercourse.”

https://www.theguardian.com/us-news/2022/apr/13/johnson-johnson-pelvic-mesh-implant-ads-case

J&J was also neck-deep in the opioid crisis, going to far as to commission a report from McKinsey entitled “Maximizing Value of the Narcotics Franchise,” on how to use its dominance of poppy-extract to corner the market on opioids:

https://pluralistic.net/2022/06/30/mckinsey-mafia/#everybody-must-get-stoned

It was the opioid sector that brought popular attention — and well-earned disgust — to the US bankruptcy. The criminal Sackler family, owners of Purdue Pharma and proprietors of OxyContin, used a nakedly corrupt move to shift their bankruptcy proceeding to Judge Robert Drain of the Southern District of New York:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

Drain is notoriously tolerant of corporate crime and is an enthusiastic booster for the principle of using bankruptcies to escape consequences for corporate mass-murder. Which is exactly what the Sacklers did, cramming through a bankruptcy deal that let them walk away with billions, stiffing the survivors of their opioid business:

https://pluralistic.net/2021/07/29/impunity-corrodes/#morally-bankrupt

J&J told women to put carcinogens down their underwear. For decades. It gave tens of thousands of women ovarian cancer. Then it tried to use Texas’s courts to walk away with billions. But this time, a court stopped them. This time there’s no separate system of justice, like the one that gave the Sacklers billions in dirty money. This time, the company might just have to pay for its crimes.

Image:

James Wagstaff (modified)

https://www.flickr.com/photos/jesse/2256760407/

Mike Mozart (modified)

https://www.flickr.com/photos/jeepersmedia/26191532093

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

[Image ID: A picture of a white-out dust storm at Burning Man. A giant tulip rises out of the dust. Its petals are suggestive of a vulva. A giant bottle of Johnson and Johnson baby powder enters the frame from the top right corner.]

282 notes

·

View notes

Text

Hey guys.

I hate doing this and this is definitely not the right time for the most eyeballs to see it so I'm going to have to reblog it but

Y'all know I'm working on my MFA. And y'all also know that because my spouse left, I've had to declare bankruptcy, destroying my credit and my ability to get a Grad PLUS loan.

Everything was going fine. I was going to be able to get by on the skin of my teeth if I worked my ass off this summer.

My school just raised tuition by $4000.

I now, if I am able to save the $3000 I planned this summer, I'm going to still be $3000-$4000 short.

What I haven't said is I have applied to a couple outside scholarships. So far, I've been rejected. There aren't many for grad students out there. I've got two more to apply to, but my hopes aren't high.

Is there any way y'all might be able to help? Even a couple bucks would be good. What can I do that would bring worth to your lives? Because I don't expect this just for free ofc.

I really hate doing this. I'm in control of the spiral for now, but I'm scared guys. I'm really scared.

53 notes

·

View notes

Text

Note to Self: DON'T USE UNITY ENGINE

Take FEE from Developers for Every copy for every game installed.

FREE GAMES the fees still apply estimate more than $25,000,000

Declare bankruptcy to the bank, loaner's and users. (??? Does Unity apply the same charges to Casino machines,slot websites, jackpot party, it's legally a gaming ain't it?)

I get FREE GAME, while DEVELOPER is CHARGED for that MY FREE COPY

So if I a Gamer become a Developer will be CHARGED for FREE GAMES even by multiple copies from one user

" That's bad " I feel bad for studio's situation :(

*Edit UPDATES (September 13 2023)

- Unity "regrouped" and now says ONLY the initial installation of a game triggers a fee (0.20$ per install){I hope there no glitches concerning installation}

- Demos mostly won't trigger fees (Keyword: MOSTLY what does that mean)

- Devs not charged fee for Game Pass, Thank God for the Indie Developers

- Charity games/bundles exempted from fees

Xbox is on the hook, for Gamepass?

*Edit Updates (September 13 2023)

Unity:

-Who is impacted by this price increase: The price increase is very targeted. In fact, more than 90% of our customers will not be affected by this change. Customers who will be impacted are generally those who have found a substantial scale in downloads and revenue and have reached both our install and revenue thresholds. This means a low (or no) fee for creators who have not found scale success yet and a modest one-time fee for those who have. (How big of scale of success before your charged?)

-Fee on new installs only: Once you meet the two install and revenue thresholds, you only pay the runtime fee on new installs after Jan 1, 2024. It’s not perpetual: You only pay once for an install, not an ongoing perpetual license royalty like a revenue share model. (???)(How do they know that from device)

-How we define and count installs: Assuming the install and revenue thresholds are met, we will only count net new installs on any device starting Jan 1, 2024. Additionally, developers are not responsible for paying a runtime fee on: • Re-install charges - we are not going to charge a fee for re-installs. •Fraudulent installs charges - we are not going to charge a fee for fraudulent installs. We will work directly with you on cases where fraud or botnets are suspected of malicious intent.

- Trials, partial play demos, & automation installs (devops) charges - we are not going to count these toward your install count. Early access games are not considered demos.

- Web and streaming games - we are not going to count web and streaming games toward your install count either.

- Charity-related installs - the pricing change and install count will not be applied to your charity bundles/initiatives.(Good)

•If I make a expansion pack does count as install, what if I made sequel?

•Fee apply to$200,000 USD (How does work for other countries)

So I charge $60 per ONE Videogame I will be charged fees once I sell about 3400 copies ($204000)

I then sell say 10,000copies(New Sequels as well)

(If I download game onto my computer twice they get charged 0.20, how ever if I redownload onto another device say Xbox, would they get charged again, charges may vary depending on how many games.)

OVERALL

Seems to force companies to charge customers higher prices on videogames to avoid a loss of profit.

*Edit Updates as of (September 22.2023)

- Your Game is made using a Unity Pro or Unity Enterprise plan.

- Your Game is created or will be upgraded to the next major Unity version releasing in 2024.

- Your Game meets BOTH thresholds of $1,000,000 (USD) gross revenue (GROSS= Before Deductions & Taxes) on a trailing 12 month basis(?) AND 1,000,000 *lifetime initial engagements.

As for counting the number of *initial engagements, it will depend on your game and distribution platforms.

Some example metrics that we recommend are number of units sold or first-time user downloads.

This list is not comprehensive, but you can submit an estimate based on these metrics. Hope this helps! You can also find more information here: https://unity.com/pricing-updates

I'm sorry, Did that User say runtime fee is still tied to the number of installations (WTF Runtime Fee)

•Qualify(Ew) for the run-time fee:

1) are on Pro and Enterprise plans

2) have upgraded to the Long Term Support (LTS) version releasing in 2024 (or later)

3) You have crossed the $1,000,000 (USD) in gross revenue (GROSS= Before Deductions & Taxes)(trailing 12 months)

4) 1,000,000 initial engagements

( I noticed that it doesn't seem to mention International Revenue. Only the USD)

•Delete Unity

•Deletes Game before they make million

•Make $900,000 then make Game Free

•Make Game Free and implore people for their generosity

•Change Game Engine

Too tired to do the math...

8 notes

·

View notes

Text

Get the Easy Assistance You Need with Short Term Loans UK

Are you holding a debit card? Searching for a financial product that supports you without requiring a debit card? Making a choice is simple. This post can help you obtain greater financial aid without consuming a significant quantity of your valuable time. Because the linked lenders are aware of the hassles involved, they have introduced short term loans UK direct lender to assist those in need quickly, saving them money on time and allowing them to avoid all of the difficult steps.

Although many customers dislike sending long documents and credentials via fax, they can apply for short term loans UK without difficulty. To obtain the financing, it is advised that they visit the short term loan lender website as soon as feasible. To have an online application filled out and receive immediate cash approval, they must select a trustworthy and suitable lender. In a short amount of time, the money is sanctioned immediately into your bank account after the lender approves it. One advantageous aspect of this technique is that there are no costs associated with it; it is completely free.

Short term loans UK direct lender are made to precisely match your unique financial needs.With its adaptable methodology, you can borrow the required amount for a time period that works for you and your financial situation. The repayment period is two to four weeks, and the amount can range from £100 to £2,500. You will be in complete control of your money with short term loans UK direct lender.You can use the borrowed funds for a variety of financial obligations, including credit card payments, laundry bills, unexpected auto repairs, medical expenses, grocery store bills, unpaid bank overdrafts, birthday parties for friends, and much more.

If you need a loan quickly, it's fairly simple to be approved for one with a short term cash loans. The requirements are as follows: you must be a permanent resident of the United Kingdom, have reached the age of 18, work for a reputable company and earn a consistent salary, and have an open checking account in order to receive your money by direct deposit. After that, regardless of credit score, you can benefit from short term cash loans. Your bad credit factors—defaults, arrears, late payments, bankruptcy, or judgments against you—are therefore accepted by any lender in the panel that is available on the internet.

Why pick Classic Quid while looking to make Short Term Cash?

We at Classic Quid think that short term loans direct loans should be customized to fit your needs. If you were accepted as a new customer, you could borrow up £100 to £1000, with maturities ranging from two to six installments. You have the option to pay back your loan early whenever it's convenient for you, and you won't have to pay back the whole amount due on your next payday. Five days are allotted for the first installment. Current clients can be eligible for up to £1500 short term loans direct lenders UK.https://classicquid.co.uk/

4 notes

·

View notes

Text

Direct Lender UK: No Fees, Extra Funds Available for Short Term Loans

Are you facing a significant amount of unpaid bills? You don't want to wait until payday to pay for regular expenses? Are you trying to find a loan to pay off all of your expenses today? An excellent substitute for taking out a short-term loan that requires short term loans UK direct lender. As stated in the title, the lender does not consider having a debit card necessary to obtain this loan. Additionally, as security is not required in lieu of a loan, you are free to apply for this financing. Typically, it is a small, unsecured financial product designed to provide everyone with pleasant access to excess cash help.

Meeting the requirements is the first step in applying for short term loans UK direct lender. Since you are eighteen years old, the terms and conditions are adhered to. You are a citizen of Great Britain and you live there permanently. You possess a permanent position and make at least £750 a month. Since the lender will be depositing the funds straight into your bank account, it is imperative that you have an open checking account in your name.

Filling out an online application is the second and last step. Finding a trustworthy lender who regularly collaborates with short term loans UK is necessary. Once all the required information has been entered, you must submit the online form to the lender for validation. After your loan has been approved, the lender will quickly and safely deposit the funds into your bank account. Generally speaking, the entire process takes about 30 minutes in this online manner. Long-form documentation and faxing are not included in the online technique.

Short term loans UK direct lender are easily obtained by borrowers with bad credit histories, such as foreclosure, late payments, CCJs, IVAs, or bankruptcy. The credit check isn't done, which is the cause.

Here, you can apply for a short term loans direct lenders without providing any security and obtain a sum between £100 and £2500. Throughout the two to four week repayment term, you are permitted to use the funds. When compared to conventional loans, interest rates are a little excessive. Additionally, you can use the credit to pay off a number of obligations, including those for groceries, utilities, credit card debt, auto repairs, household expenses, and so on.

Even with the best of intentions, it is impossible to account for every unforeseen expense that may arise, and you may end up having to spend more than you had anticipated. In any event, we are aware of how upsetting it might be to require cash quickly. You can use our same day loans UK as a short-term loan to help you cover an unforeseen need that can't wait until your next paycheck.

Many of our clients want funds to cover necessary expenses, such as dental care, washing machine repairs, and auto upkeep. Since they usually allow you to acquire cash immediately once you've been authorized, these loans are also occasionally referred to as payday loans or short term loans.https://paydayquid.co.uk/

4 notes

·

View notes

Photo

Otis Phillips Lord, Edward Dickinson’s old friend and a judge on the Massachusetts supreme court, had studied law at Amherst just before Emily was born and during the first 18 months of her life. He had graduated in 1832, and Amherst had conferred on him an honorary doctor of laws in 1869. He was married to Elizabeth Farley, a high-minded descendant of John Leverett, president of Harvard. They were childless and lived near the Witch House in Salem. The Lords used to stay at the Homestead, and after Edward died, “the dear Lords,” as Emily wrote, continued to visit. The judge appears to have come on his own for a week in October 1875, when Emily, far from reclusive, spoke of his visit as being “with me.”

Mrs. Lord died in December 1877, on Emily’s 47th birthday. Over the next few months, Emily turned to the handsome widower – not as a father but as a suitor of sorts. Later, a granddaughter of Dickinson’s confidante Elizabeth Holland suggested that Lord’s tenderness had “long been latent in his feeling for her.” Dickinson expert and Mount Holyoke College professor Christopher Benfey has asserted this possibility more strongly, suggesting in his book A Summer of Hummingbirds that the attraction went back to the summer of 1862, when Lord came to Amherst as commencement speaker.

Eighteen years her senior, his gray hair was shading into white; his expression calm and contained – not a man to exact attention, though his grave and upright bearing subdued others, not only the guilty, as he passed judgment. Lord looked stern “as the Profile of a Tree against a winter sky,” Emily ventured to say. He appeared as rigid as Emily’s father, but she had a way with elders of this sort, breezing through their barest branches. Her amusing darts disarmed men of law who were accustomed to wither lesser beings; the drafts of her letters to Lord are witty, confident, open, and playfully physical – hardly the way modest women were meant to behave. Gossip had it that Emily’s sister-in-law, Susan, had been taken aback to break in on the supposed recluse, the image of white-frocked chastity, in the judge’s arms.

Lord’s niece Abbie Farley claimed to have heard Susan deplore that embrace. Emily, the niece is reported to have said, had not “any idea of morality.” She was bound to take this view, for Miss Farley, aged 35, was the judge’s heir. She and her mother, Mrs. Lord’s sister, were due to inherit jointly $23,000. Together with another niece on the Farley side (due to inherit $10,000), they kept house for the judge. If he remarried, he would have new claims. “Little hussy,” Abbie fumed over a copy of Emily’s Poems decades later when questioned about the celebrated poet Abbie had once known. “Loose morals,” Abbie remembered. “She was crazy about men. Even tried to get Judge Lord. Insane too.”

To Emily herself, Lord’s love was “Improbable.” It would have been unthinkable in her father’s lifetime: his carefully protected daughter permitting such license, and with his old friend. The voice of judgment, “I say unto you” thundering through the startled air at morning prayers, had cleansed impurities from the minds of Edward Dickinson’s listeners. As Emily put it humorously, “Fumigation ceased when Father died.” Now, four years on, that voice no longer ruled. In her late 40s and early 50s, she found herself free to partake of the forbidden tree.

With Lord, Emily was unafraid to speak up, inviting a glint of humor she called “the Judge Lord brand.” A smile broke when she teased him with the solemnities of courtroom language. “Crime,” “confess,” “punish,” “penalty,” “incarcerate” were the words she applied to his supposed trial of her as a wanting lover. “I confess that I love him,” she has to admit, but cannot pay the “debt” she owes him. Can her “involuntary Bankruptcy” be a crime? Will he “punish” her? “Incarcerate me in yourself – that will punish me,” she makes bold to suggest.

Flashing repartee of this sort exploded into intimacy within months of Mrs. Lord’s death. That year, 1878, there’s immediate talk of consummation. She wasn’t shy when she drafted her letters to Lord: “lift me back, wont you, for only there [in your arms] I ask to be. . . .” He was her “lovely Salem”; she, his “Amherst.” Weekly letters, directed to arrive on Mondays by the judge’s habits of punctuality, bonded Salem and Amherst. Emily’s “little devices to live till Monday” – attempts to concentrate on work – gave way to “the thought of you.” So she said to herself, if not to Salem, in a penciled scrap that breaks into verse celebrating the nature of love (fleet, indiscreet, wrong, and joyful).

As a single man, it was no longer proper for Lord to stay at the Homestead on his now more frequent trips to Amherst; he and Emily met in the parlor. There, they held each other while the air about them fanned the question of marriage. In August and September of 1880, he practically lived in Amherst. During this time, they may have entered into some kind of private engagement. Softly, her thin hand is offered to him in response to what she calls “your distant hope.” He leaves saying it had been a “heavenly hour.” How sweet was his candor, she wrote.

His racy talk, familiar to colleagues on the bench, called out an unfamiliar side to Emily. “I will not wash my arm,” she said, “twill take your touch away,” and again: “It is strange that I miss you at night so much when I was never with you – but the punctual love invokes you soon as my eyes are shut – and I wake warm with the want sleep had almost filled. . .”

The question of marriage came up more seriously in November and December 1882, after Emily’s mother, also named Emily, had died. Eyeing the poet’s thinness, Lord teased her as “Emily Jumbo” (the famous elephant, Jumbo, in Barnum’s circus had recently appeared near Amherst). She tossed the joke back.

“Sweetest name, but I know a sweeter – Emily Jumbo Lord. Have I your approval?”

He assumed that she was now freed to live with him. He replied, “I will try not to make it unpleasant.”

She was touched that he could invite her into his “dear Home” with “loved timidity.” Her answer, as often when she was moved, almost falls into verse.

“So delicate a diffidence, how beautiful to see! I do not think a Girl extant has so divine a modesty. You even call me to your Breast with apology! Of what must my poor Heart be made?”

Lyndall Gordan, Lives Like Loaded Guns: Emily Dickinson and Her Family’s Feuds, excerpted from a reprint in The Boston Globe

#sue wasn't her only lover!#no bisexual erasure on this blog!#justice for judge lord#emily dickinson#dickinson#history#literary history#lit#literature#poetry#american poets#american history#bisexual history#emisue#emily x sue#sue gilbert#susie gilbert#emily dickinson lesbian#emily dickinson bisexual#emily dickinson's love life#belle of amherst#dickinsontv#dickinson tv#apple tv dickinson#appletv dickinson#judge lord#judge otis phillips lord#otis phillips lord#she called him little phil in contrast to emily jumbo btw#special fact if you made it that far in the tags

9 notes

·

View notes

Text

Bankruptfree .. A Basic illegal Acquistioner of assets and freeze meaning not accessible but applied through Banking Account information as promise of funds accounting amount . Terms of safety In Business Bankruptcy is to protect the legal Acquistioner and bail out business and investigate currency corruption and fraudulent Debt.. and free all parties from Debt you all have alot of currency revenue if you file bankruptcy seven years normal maximum length minimum 24 hours or record breaking

3 notes

·

View notes

Note

I honestly have no idea if Taylor is liked or not. DC’s poster boys are still people like Geoff Johns and Bruce Timm. The comics industry is very independent and non communicative. Most writers, editors and artists work from home and sometimes in other countries. You know the saying that you work with someone every day but you still don’t know anything about them or rarely talk to them outside your work? Yeah that applies to the comic industry too. The only thing I can say is that it’s bad mojo to negatively criticize another writer’s run on social media. So take that as you will.

Yes I do really know people at DC. No they don’t know everything, yes they too are held back by NDA’s and can’t say anything or confirm anything, and yes even they don’t believe everything they hear. Like I said, DC doesn’t know what they are doing half the time. They are just hoping what they are doing will sell. Most of DC’s secrets have been spilled already. There are some things I can’t say due to promises I’ve made not to say anything. But to give you a hint, a lot of the projects being green-lit have zero editorial oversight due to circumstances caused by ATT. WB is very close to bankruptcy (as most people know) and a lot of their content is Batman because Batman is the only DC money maker they have. They are desperate to make the OG members of the justice league to work. Because If Batman fails, it won’t look good for DC at all. Many people are worried about their jobs right now. Trust me when I say DC behind the scenes is basically a coin flip. It’s a free for all with zero faith or promising results.

If you want good tea, stay away from places like reddit, Twitter and even tumblr (ironic I know). You’ll have a better chance at some real good tea from un moderated places like 4chan (learn to navigate the forums), podcasts and YouTube (surprisingly). Also look into interviews with FORMER writers, editors and artists for DC. Keyword here is “former.” One great source for verified DC shenanigans is Chuck Dixon actually. No rumor is too outlandish for the comic industry! Remember, N52 was considered a crazy and unverifiable rumor for a while.

Ooh 😮 this is actually very interesting I hate to see it but very interesting 👀📝

7 notes

·

View notes

Text

When you apply for car finance, what do lenders usually look for?

Whether you've applied for car finance before or this is your first time, there are some subtleties concerning the procedure that many people are unaware of. The most important issue is what do lenders look for when approving a vehicle financing application and extending credit?

To address that, we've compiled a list of all the important elements that go into deciding whether or not a lender would finance your vehicle. Lenders often check for the following:

1 - Your credit score

Your credit score is the most crucial factor for lenders to evaluate. It may be more difficult to obtain car finance if you have a low or bad credit score.

2 - Clean Public records

Lenders will look at your public records after evaluating your credit score. They do this to check whether you have any bankruptcies or judgments against you, for example. Lenders take this information carefully since clients with bankruptcies, especially recent bankruptcies, may be a risk to lend to, and this might be a reason why you are unable to raise finance many business listings.

3 - Employment and earnings

Your work position and salary are also crucial factors in determining whether or not you will be approved for car finance. It's only reasonable for lenders to inquire about your employment status and pay details. This information will offer them an indication of your financial condition and assist them in determining whether you are affordable. Because organizations typically have distinct lending policies, there are minimal standards that you must meet in order to acquire financing. All responsible lenders must guarantee that you are able to repay the money they lend your business listings.

4 - Details about your electoral roll

It's also possible that the financing firm you apply to will look up your information on the electoral roll. This is a process that lenders go through to authenticate your name and address and eliminate the possibility of fraud. If you aren't already on the electoral roll, getting on it before applying for a loan may assist you is accepted free business listings.

5 - Information about your credit history

If you have had credit in the past, it is typically easier to obtain finance the longer your credit history the better because you'll have more to show for it. In order to make a judgement, lenders search for indicators that you are trustworthy and responsible. The better you've been in the past at repaying credit cards and loans, the more likely you'll be accepted for finance today.

1 note

·

View note

Text

Expertise in 365backgroundchecks's Certified Background Checks and the United States Federal Civil Records Search

With the importance of trust and security in today's society, background checks are essential in many areas of life, including but not limited to: tenant vetting, employment screening, and more. We at 365backgroundchecks know how important it is to have accurate background checks, which is why we provide customized solutions that cover all your bases. Learn more about the advantages of two important background check services—the Federal Civil Records Check USA and Certified Background Checks—by delving into their respective descriptions.

Verify US Federal Civil Records:

You can't have a thorough background check without looking into someone's federal civil court records, and a Federal Civil Records Check USA is an essential part of any such operation. Any and all court actions concerning the subject, such as lawsuits, bankruptcies, judgments, etc., will be revealed by this sort of background check. Whether you're looking to hire someone new, vet a renter, or research a possible business partner, a Federal Civil Records Check USA can provide you the information you need.

When it comes to federal background checks in particular, we at 365backgroundchecks know how important it is to have accurate and dependable responses. In order to guarantee the accuracy of our Federal Civil Records Check USA reports, we take extra precautions. To ensure you receive the most thorough and trustworthy findings, our team of expert researchers painstakingly collects and validates information from many sources.

Verified Criminal Record Checks:

One of the most important parts of background screening is getting a certified background check. These checks look into a person's education, job, and criminal records, among other things. Such verifications are frequently necessary when establishing confidence and credibility is of the utmost importance, such as when applying for a job or getting a professional license.

Here at 365backgroundchecks, we take pride in providing Certified Background Checks that are guaranteed to be accurate and dependable. In order to provide you with reliable background check reports, our team of experts thoroughly checks information from several sources. If you're a company owner, landlord, or individual looking for background screening services, our Certified Background Checks will provide you the confidence you need to make unwavering judgments.

Why Should You Opt for 365BackgroundChecks?

Credibility and dependability are paramount in background checks. That's why you can trust 365backgroundchecks to provide you with thorough, accurate, and personalized background check services. You may have faith in the data you receive from our Certified Background Checks and Federal Civil Records Check USA to help you safeguard what is most important to you and create educated judgments.

Still, we won't rest until we've achieved 100% satisfaction. Additionally, we place a premium on client happiness and convenience by providing lightning-fast response times, intuitive web platforms, and individualized customer assistance to guarantee a problem-free trip. At 365backgroundchecks, we guarantee professionalism, dependability, and a stress-free experience throughout the whole process.

Were you prepared to go forward with improved security and better decision-making? For more information about Certified Background Checks and Federal Civil Records Check USA, contact 365backgroundchecks now. Whether you're a company owner, landlord, or an individual seeking background screening services, our goal is to equip you with the knowledge you need to make educated decisions and safeguard what's important to you.

Your well-being and protection should not be misplaced. Have faith in 365backgroundchecks for thorough, accurate, and personalized background check services. Regain trust and serenity in your choices with the help of our Certified Background Checks and Federal Civil Records Check USA. Make an appointment with us today and we will handle all of your background check request.

0 notes

Text

Equipment Finance Overview, Significance, Sorts

Plus, your equipment lease may come with an choice to purchase the equipment at the end of the lease term. If you’re undecided that your equipment will nonetheless be needed or current in a few years, leasing would possibly make more sense. These are set as a lot as fund semi vans particularly, so the loan amounts could be more in line with what new and used vehicles are going for. Pre-approval could keep good for weeks and offer you time to search out the best truck. You would possibly see drawbacks like larger rates because semi vans could be a danger to finance. Debtor-in-possession preparations, also referred to as DIP financing, are specialty bankruptcy loans that provide monetary help for businesses facing Chapter 11 bankruptcy proceedings.

Ensure that the phrases align together with your startup’s goals and financial capabilities. Remember, while securing financing in your startup equipment is essential, choosing the right associate is equally important. These companies can supply the financial assist your startup needs, but it’s as much as you to make sure the phrases align with your business objectives and financial capabilities. Investing time in researching and evaluating your options can prevent cash and complications down the line. When you’re diving into the world of startup equipment financing, leasing stands out as a viable possibility that merits serious consideration. Unlike buying, leasing allows you to use essential business equipment with out the hefty upfront cost.

Lenders will have a look at a mix of your credit score rating, annual revenue, time in business, and the value of the equipment you would possibly be leasing. In common, you will want a minimal credit score rating of 520 and an annual revenue of $50,000. While some equipment lenders do work with day-one startups, they'll have higher minimum credit rating requirements beginning at 650. Currency is a comparatively new player in equipment financing that gives various funding options as a lot as $500,000. By exploring SBA loans as a possible financing possibility, you’re taking a step in direction of securing the mandatory equipment for your small business at more manageable costs. Remember, consulting with a monetary advisor or a lender that participates within the SBA program can provide personalised advice and assist navigate the application course of.

If you realize you’ll have the cash to pay in full for an equipment purchase by your statement due date; nevertheless, utilizing a bank card to pay can make sense. In this case, a business bank card can give you a handy way to safe some very short-term, interest-free financing (again, assuming you pay in full by the due date). Plus, if your credit card offers rewards or money back, using it to purchase equipment you’ll repay by the due date might assist you to enjoy some useful perks. Bluevine offers various forms of equipment loans, including business strains of credit and term loans. If you have to finance solely a small quantity to buy your equipment, OnDeck may be an excellent choice.

Banking merchandise are subject to approval and are offered within the United States by BMO Bank N.A. Member FDIC. BMO Commercial Bank is a commerce name used within the United States by BMO Bank N.A. Member FDIC. BMO Sponsor Finance is a trade name used by BMO Financial Corp. and its affiliates.

Applying for and Receiving your cash is fast and simple – NO FEES to Apply, and this WILL NOT have an result on your credit rating. Reach your business checking and financial savings objectives faster with simple, good and rewarding BusinessSmart™ accounts. Earn interest and cash back with the convenience of online and mobile banking. Freedom from illness, freedom from discomfort, freedom from wounds and trauma –at Halcyon Village in Midlothian, Texas, the mission is centered on freedom. Stearns Bank is delighted to contribute to the success of Halcyon Village by offering equipment financing that aids in the prosperity of the retreat middle and the individuals in search of care there. Get lease and loan choices for all of the equipment you want to keep your farm working, acreage maintained, and animals comfortable.

Your private and business credit score may even play a big position in your eligibility. Many lenders will need to see that every proprietor has fair credit score — at minimal. It can also contemplate your corporation credit score rating if your small business has previously taken on debt. Equipment loans are a better possibility if you need to personal the equipment and you've got the cash for the down payment on the equipment.

The supply financing from $1 million to $50 million to companies working in the united states and Canada. With equipment financing by LendSpark, you possibly can get up to $2 million to be repaid over up to 60 months. To qualify, your mining business must have been in operation for a minimum of two years.

Climb into the equipment you want on your construction or forestry firm with versatile financing choices from experts who know your small business and the challenges you face. The equipment also serves as collateral for the loan, giving the lender the flexibility to take it within the event of a loan default. For occasion, loan phrases and charge structures can range, so the most suitable choice will depend in your particular business circumstances.

#Equipment financing#equipment financing companies#equipment financing loans#small business equipment financing#business equipment financing#trucking equipment financing#commercial equipment financing#equipment financing services#fast equipment financing#equipment finance solution

1 note

·

View note

Text

Jump Financing - Your Solution for Bad Credit Car Loans in Melbourne

Are you looking for a Bad Credit Car Loans in Melbourne? We specialize in providing solutions for individuals with less-than-perfect credit scores, helping them get behind the wheel of their dream car.

Understanding Bad Credit -

Having bad credit can feel like a roadblock when trying to obtain Financing. It often stems from missed payments, high debt levels, or past bankruptcies. However, at Jump Financing, everyone deserves a second chance. We look beyond credit scores and consider various factors to assess your eligibility for a car loan.

Benefits of Jump Financing -

With Jump Financing, you can enjoy several benefits:

Flexible Terms: We offer flexible repayment terms tailored to your financial situation.

Quick Approval: Our streamlined approval process ensures you get a decision fast, so you can start shopping for your car sooner.

Build Credit: By making timely payments on your car loan, you can gradually improve your credit score.

Wide Range of Options: We work with a network of lenders to provide you with multiple loan options, even with bad credit.

How to Qualify -

Qualifying for a bad credit car loan with Jump Financing is simple. You must:

A steady income: We must ensure you can afford the monthly payments.

Provide proof of identity: This includes a valid driver's license, passport, or other government-issued ID.

Meet the minimum age requirement: You must be 18 years old to apply.

The Application Process -

Our application process is designed to be hassle-free:

Online Application: Fill out our online application form from your home.

Documentation: Upload necessary documents such as proof of income and identification.

Approval: Once we receive your application, our team will review it promptly and notify you of the decision.

Car Selection: Upon approval, you can start shopping for your desired car within your approved budget.

Finding the Right Car -

When searching for a car, consider factors such as:

Budget: Stick to a budget that aligns with your loan approval amount.

Reliability: Look for a car with a good reputation for reliability to minimize future maintenance costs.

Fuel Efficiency: Opt for a fuel-efficient vehicle to save money on gas in the long run.

Safety Features: Prioritize safety features such as airbags, anti-lock brakes, and electronic stability control.

Tips for Successful Repayment -

To ensure a smooth repayment process, follow these tips:

Budget Wisely: Allocate a portion of your income towards your car loan payment each month.

Set up Automatic Payments: Automate your payments to avoid missing deadlines.

Communicate: Contact us immediately to discuss potential solutions if you encounter financial difficulties.

Monitor Your Credit: Regularly check your credit report to track your progress and identify any discrepancies.

Conclusion -

At Jump Financing, bad credit shouldn't stand in the way of owning a car. With our flexible financing options and personalized approach, we can help you get behind the wheel in no time. Apply today and experience the freedom of owning your vehicle, regardless of your credit history. Jump Financing - your trusted partner for bad credit car loans in Melbourne.

#Bad Credit Car Loans in Melbourne#loans#bad credit loans#bad credit score#jump financing#jumpfinancing

0 notes

Text

Short Term Loans UK: A Different Way to Earn Reasonably

With the possibility of short term loans UK, getting quick financial support without having a debit card is always simple. These loans are offered seven days a week, 24 hours a day. Additionally, it is now much easier to apply for short term loans online, day or night, anywhere. You must look online in advance to find a suitable lender in order to make an immediate selection.

To receive financial assistance through short term loans UK, you must fulfill the following numbered common terms and conditions:"-

You ought to have been employed consistently for longer than three months.

You ought to have had a regular bank account for longer than ninety days.

I believe you are older than eighteen.

Throughout your job, your monthly income must be at least £750.

Your entire salary is routinely deposited by direct deposit into your bank account.

You are currently free to apply for short term loans UK based on your needs and circumstances. These financial instruments offer flexible terms for cash reimbursement along with low interest rates. Furthermore, you are worthy of taking out a loan between £100 and £1,000 without offering the lender any asset as security for the money. The money must be returned within a two to four week timeframe.

The best part is that you can use the money for anything you need to pay for, including medical bills, electricity bills, groceries bills, child care or education costs, vacation expenditures, unexpected auto repairs, and more.

The United Kingdom is home to a diverse population. A portion of them are having trouble with their credit performance. In addition, they are excluded from receiving financial assistance because of risk factors. Be patient! This is where you may apply without any hassles for a short term loans UK direct lender. The lack of credit verification is the root cause of it. Consequently, you are also eligible for the loan mentioned above even when you have adverse credit characteristics like defaults, arrears, foreclosure, late or missed payments, CCJs, IVAs, or bankruptcy indicated against you.

These days you may apply for short term cash loans using a fax less or paperless process and all it takes is a few minutes to fill out an application. Using an online application form, you must provide the lender with all of your personal information. It doesn't take long for the money to be approved and safely deposited into your bank account.

Even if your credit history isn't good enough for a bank loan or credit card, we nevertheless take a human approach to lending with our Payday loan and will always consider your application when evaluating it for a short term loans direct lenders. We won't limit our decision-making to credit scores; instead, we'll consider variables such as income and expenses.

You might want to look into some payday loan alternatives if a short term loans UK direct lender doesn't feel like the best option for you. If you can satisfactorily answer all of these questions, you might decide that an emergency loan is the best option for you at this time.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Short Term Loans UK : Obtaining a Loan Without Using a Debit Card

In today's fast-paced world, getting a short term loans UK has proven to be quite difficult for everyone. Many people lack any bank-related cards. As you are aware, the debit card has become a necessary document and is mandated by the lender in lieu of funds to cover risk factors. Unfortunately, you are among those who do not own debit cards. But don't worry—some lenders have introduced short term loan to the market to help customers get the money they need in the quickest amount of time.

With short term loans UK, you can be confident that you will be approved for financing in the range of £100 to £1000 with a flexible two to four week payback time because no customer is denied credit. The fact that you can use a debit card without submitting any paperwork to the lender is very remarkable. However, you have to pay back the money before the deadline. Regardless of a borrower's credit status, interest rates are uniformly elevated and slightly higher.

To be eligible for short term loans direct lenders, a number of basic requirements must be met. With respect to the requirements, you must be a permanent resident of the UK, be at least 18 years old, be employed full-time with a steady income of at least £750 per month, and have an open checking account with which to receive the funds directly into your account.

Even though you have had poor credit performance, your eligibility will help you obtain these credits in a courteous manner. Because of this, getting short term loans UK direct lender doesn't really matter if you have CCJs, IVAs, arrears, defaults, foreclosures, late payments, or bankruptcy. It is conceivable since lenders do not check a borrower's credit history. Furthermore, merely making the required repayments on time will help clients improve their bad credit scores.

These loans are available from lenders 24-hours a day, seven days a week. You can thus apply for the chosen short term loans UK direct lender package at any time and from any location. You won't need to spend any money while applying with the internet lender because it's a totally free process. Nothing more than filling out an online loan application form with your personal information is required! No need for extra paperwork! No further fees are incurred! There is no application cost! Therefore, applying online is a completely safe and secure process.

Payday loans, often known as same day loans, are loans that you take out once and then return over a certain number of installments until the debt is paid off. If you are authorized for the loan and pass all of our credit checks, you might have access to same day loans UK in your bank on the same day that you apply. A Payday Quid loan might be an easy and quick option to receive the money you need to cover unforeseen expenses. We will always make responsible loans, and our interest rates are competitive. Since not everyone can qualify for a same day loans direct lender, it's a good idea to look into alternatives to payday loans if you're unsure if you'll fulfill the requirements.

https://paydayquid.co.uk/

4 notes

·

View notes