#AnnualRocFiling

Text

Who is not eligible to submit Form ITR-1?

Form ITR-1 cannot be filed in the following cases:

Income exceeds INR 50 lacs

Agricultural income exceeds INR 5,000

Taxable capital gains have been made

There is income from business or profession

There is income from more than one house property

The individual is a Director of a company

Investment in unlisted equity shares has been made

The individual owns assets or has financial interest outside India or is the signing authority of an account located outside India

The individual is a non-resident or not ordinarily resident

Income of the individual is taxable in hands of another person

The individual has claimed relief of foreign tax paid or double taxation under Section 90/90A/91 of the Income Tax Act, 1961

If the taxpayer is joint-owner of a property, he/she cannot file Form ITR-1. In this case, the individual will have to file ITR-2.

Form ITR-1 cannot be filed by individuals who have deposited over INR 1 crore in their bank accounts, have made expenditure of INR 2 lakhs on foreign travel, or paid electricity bill of over INR 1 lakh.

In these cases, the taxpayer would be required to file Form ITR-4. In these cases, the taxpayer shall be required to file Form ITR-4.

#companyregistrationinchennai#taxfiling#gstfiling#annualrocfiling#business#fssairegistrationservices#kanakkiyalchennai

1 note

·

View note

Text

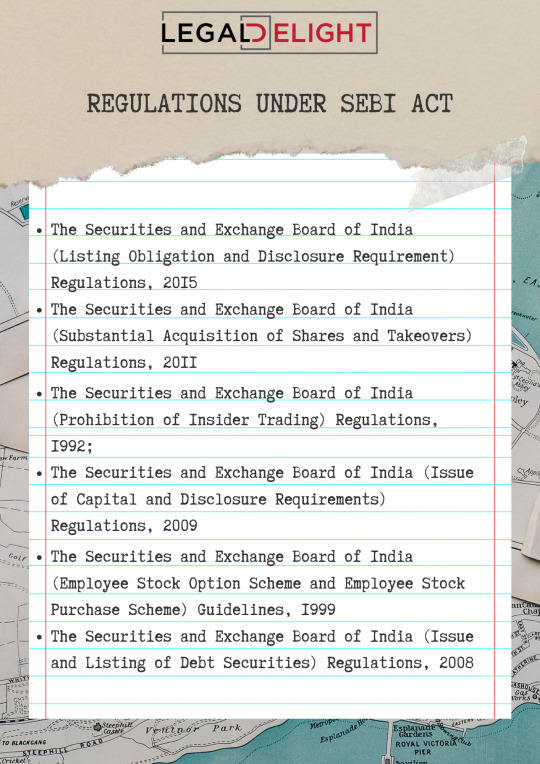

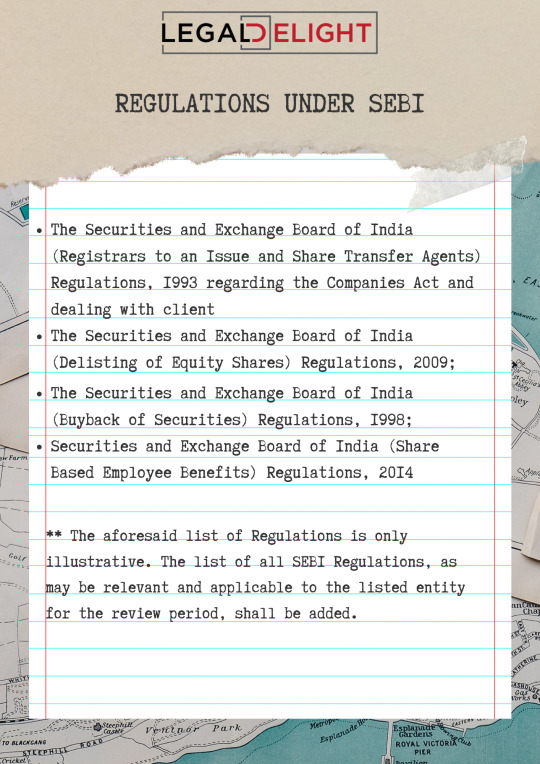

A certificate on annual compliances is to be submitted by all listed company but when to submit this certificate?

Who will issue this certificate? What compliances does it cover?

Here is a infographic to showcase report needs to examined and reported for Securities and Exchange Board of India Act, 1992 (‘SEBI Act’) by practicing company secretary.

Read all about Annual Secretarial Compliance Report here:

https://legaldelight.com/2023/01/19/submission-of-annual-secretarial-compliance-report-by-listed-company/

#secretarialaudit #secretarialcompliances #annualcompliances #annualrocfiling #SecretarialAuditReport #secretarialservices #Audit #Compliances #CompanySecretary #LegalDelight

0 notes

Text

#companynamechange#ChangeofName#CompaniesAct2013#PrivateLimitedCompanynamechange#companynamechangeindia#registerofcompanies#TMRegistrationFees#tmregistrationfees#gstnumberapply#Businesssetup#NGO#societiesregistrationact#Incorporatecompany#GST#trademeproject#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices

1 note

·

View note

Text

#barcode#barcoderegistration#barcoderegistrationinchennai#Barcoderegistrationprocess#BarcodeNumber#Incorporatecompany#companyregistrationinchennai#GST#newbusinessstartupcompany#onlinecompanyregistration#taxandaccounting#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#trademark#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai

1 note

·

View note

Text

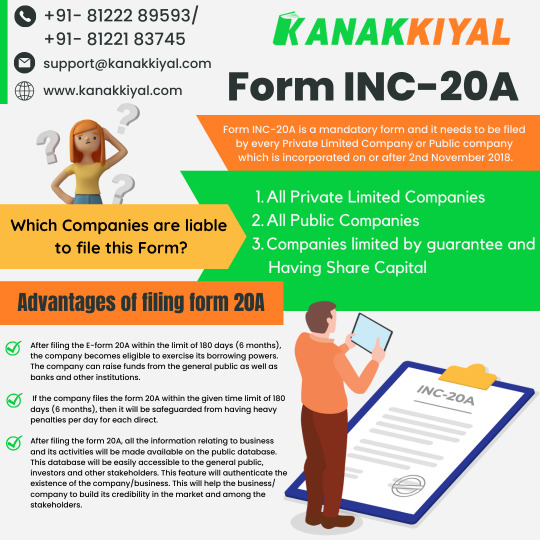

#FormINC20A#Advantagesoffilingform20A#PrivateLimitedCompanies#CommencementofBusinessCertificate#PublicCompanies#Filingforminc20a#TMRegistrationFees#tmregistrationfees#gstnumberapply#Businesssetup#NGO#societiesregistrationact#Incorporatecompany#GST#trademeproject#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices

0 notes

Text

#onepersoncompany#opc#Incorporatecompany#companyregistrationinchennai#GST#newbusinessstartupcompany#onlinecompanyregistration#taxandaccounting#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#trademark#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license

0 notes

Text

#sharecertificate#shareholders#certificatenumber#classofshares#sharecertificateinindia#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#Indiantrustsact

0 notes

Text

#NGOregistrationinindia#Trustregistrationinchennai#trust#section12A#Section80G#FSSAIregistration#tmregistrationfees#gstnumberapply#Businesssetup#NGO#societiesregistrationact#Incorporatecompany#GST#trademeproject#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#kanakkiyal

0 notes

Text

#TrademarkRegistration#tmregistrationfees#TM#Trademark#Incorporatecompany#ISOregistration#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration

0 notes

Text

#ISOregistration#AlltypesofISO#ISOCertificationconsultants#ISO#gstnumberapply#Businesssetup#Incorporatecompany#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation

0 notes

Text

#MSME#MSMEregistration#udyamregistration#companyregistrationinchennai#udyamcertificate#newbusinessstartupcompany#onlinecompanyregistration#taxandaccounting#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#UdyogAadhaarRegistrationinChennai#gstreturn#incometax#trademark#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license#Incometaxfilinginchennai

0 notes

Text

#GSTRegistration#SpecialGSToffer#gstnumberapply#Businesssetup#Incorporatecompany#ISOregistration#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration

0 notes

Text

#Businesssetup#Incorporatecompany#companyregistrationinchennai#GST#newbusinessstartupcompany#onlinecompanyregistration#taxandaccounting#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#trademark#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license#Incometaxfilinginchennai

0 notes

Text

#Annualcompliance#LLP#NBFC#nidhicompanycompliance#FSSAIregistration#ROCFiling#ROCFilingintamilnadu#GST#trademeproject#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai

0 notes

Text

#ITRdeadline#incometaxfiling#Businesssetup#Incorporatecompany#ISOregistration#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license

0 notes

Text

#kanakkiyalhiring#jobvacancies2022#chennaijobvacancy#webdeveloper#salesexecutive#companyregistration#accountingfirrm#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#trademark#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai

0 notes