#AccountingTips

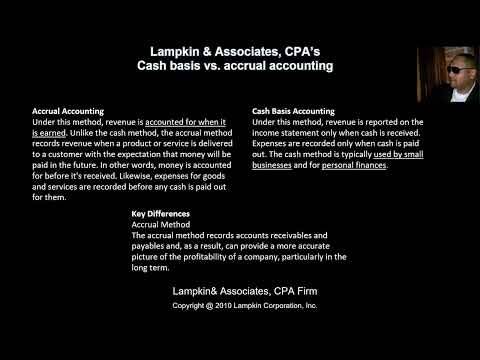

Text

youtube

#TaxTips#SmallBizSuccess#FinancialLiteracy#Entrepreneurship#BusinessGrowth#FinancialPlanning#AccountingTips#ProfessionalDevelopment#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing#Youtube

0 notes

Text

The Future of Work: How Remote Operations Can Benefit Your Business

In the heart of Manchester, amidst the buzz of city life, a quiet revolution is taking place. The way we work is transforming, and at the forefront of this change is the rise of remote operations. This isn’t just a passing trend; it’s a glimpse into the future of work. In this blog, we’ll explore how embracing remote operations can bring a plethora of benefits to your business, whether you’re a bustling café in Northern Quarter or a tech startup in Spinningfields.

1. Access to a Wider Talent Pool

Gone are the days when your hiring pool was as big as your commute. Remote work tears down geographical barriers, allowing you to tap into a global talent pool. Imagine having the best minds from around the world, all contributing to your Manchester-based business. It’s like having the diversity and vibrancy of Piccadilly Gardens right in your team!

2. Increased Productivity and Engagement

Contrary to the old-school belief that remote work might lead to slacking, numerous studies have shown that remote workers are often more productive than their office-bound counterparts. Without the distractions of a typical office and the added flexibility, employees can create a work environment that suits them best, leading to enhanced focus and efficiency.

3. Cost Savings for Both Parties

Think about it – less commuting means savings on travel expenses for your employees and reduced overheads for you. No more hefty bills for office space in one of Manchester’s prime locations. This cost-effectiveness can be a game-changer for small businesses looking to grow.

4. Better Work-Life Balance for Employees

Remote work offers employees the chance to balance their professional and personal lives more effectively. This flexibility can lead to happier, more satisfied employees, reducing turnover rates. It’s all about creating a working culture that values and respects your team’s time, both in and out of work.

5. A Greener Way to Work

With fewer people commuting and less need for large office spaces, remote work contributes to reducing carbon footprints. By embracing remote operations, your business is not just adapting to the future of work; it’s also playing a part in creating a more sustainable world.

6. Leveraging Technology for Efficiency

Remote work goes hand-in-hand with technological advancement. Tools for communication, project management, and cloud computing are more sophisticated and accessible than ever. This tech-savvy approach can streamline operations and open up new avenues for innovation and collaboration.

7. Enhanced Flexibility to Meet Business Demands

The flexibility afforded by remote work can be a boon for businesses facing fluctuating demands. Scaling up or down becomes easier when your team is not bound by physical office space constraints.

Embracing a Global Perspective

As a business in Manchester, adopting remote operations means not just keeping up with the times but also embracing a global perspective. It’s about building a business that’s resilient, forward-thinking, and inclusive. Whether you’re offering accountancy, legal services, or any other service, the future is remote, and it’s full of possibilities.

Need guidance on integrating remote operations into your business model? At Accounts Direct, we’re not just about numbers; we’re about helping your business adapt and thrive in this new world of work. Get in touch, and let’s navigate the future together.

#BusinessBasics#StartUpLife#EntrepreneurJourney#AccountingTips#SmallBizTips#InnovationHub#FinanceTips#BizGrowth#MarketTrends#StartupCulture#FinancialFreedom#EntrepreneurMindset#AccountingSoftware#BusinessStrategy#EconomicInsight#LeadershipGoals#InvestmentIdeas#ProfitAndLoss#BusinessPlanning#SuccessStories

0 notes

Text

Accounting and Finance

MS Narsimhna's comprehensive business course is designed to provide you with the knowledge and abilities necessary to read, analyze, and comprehend financial accounts. Additionally, it helps you assess company performance and pinpoint areas in need of development.

Visit us: probabs.com/accounting-and-finance

#financialaccounting#accounting#accountant#accountingproblems#accountingtips#accountingservices#accountingandfinance#accountingstudent#accountingclass#accountantlife#accountinglife#accountingmemes#accountingmajor

0 notes

Text

#AccountancyClasses#AccountingClasses#AccountingEducation#AccountingTraining#AccountingSkills#FinanceClasses#FinancialEducation#FinancialLiteracy#AccountingStudents#LearnAccounting#AccountingWorkshops#AccountingSeminar#AccountingTutor#AccountingCourse#AccountingStudy#AccountingTips#AccountingCommunity#AccountingCa

0 notes

Text

Practical Accounting Tips & Best Practices for Nonprofits

Read more: https://us.meruaccounting.com/blog/practical-accounting-tips-nonprofits/

#nonprofitorganization#accountingtips#acccounting#meruaccounting#accounting#bookkeepingtips#india#bookkeepingcompany#uk#bookkeeping#accountingservices#bookkeepers#bookkeepingservices

0 notes

Text

Free QuickBooks Online Setup w/ Month-end Close

Please like, share, comment & follow my post and I'll follow back.

Free QuickBooks Online Setup and month-end close for the month of March only. Get your business setup in QuickBooks Online for free. We will move your Financial Statement from your current financial software to QuickBooks online and produce your company March 2024 Financial Statement for free. This offer is for a limited time only, first come first serviced. Act now!

Website like:…

View On WordPress

#accountant#accountantlife#Accountants#Accounting#accountinglife#accountingservices#accountingsoftware#accountingtips#audit#bookkeeper#Bookkeeping#bookkeepingservices#bookkeepingtips#budget#budgeting#business#businessowner#businessowners#cloudaccounting#consulting#covid#CPA#entrepreneur#entrepreneurs#Finance#financialfreedom#financialplanning#financialservices#financialstatements#incometax

0 notes

Text

Is your company still using spreadsheets for accounting?

Use cloud-based Finance & Accounting ERP Software

#finance#financetips#financesoftware#financeaccounting#Accounting#accountingsoftware#accountingtips#accountingproblems#accountingservice#softwaredevelopment#customsoftware#businesssolutions#expertdevelopers#timelydelivery#qualityassurance#technicalsupport#softwaredeveloper#softwaredevelopmentcompany#softwaredevelopmentindore#saleserpsolution#erpsoftwaresolutions#coding#businesssoftware#softwaretesting#softwaresupport#software#itsupport#itconsulting#itconsultant#erpdevelopment

0 notes

Text

The Art of Accounting: Navigating GST Credits with Reliable Accountant

#GSTCredits#AccountingTips#TaxCredits#FinancialAdvice#ReliableAccountant#GSTGuide#BusinessTax#TaxNavigation#AccountingInsights#TaxCompliance

0 notes

Text

How To Correct a VIN Error After the Deadline: Form 2290 Amendments

Correcting a VIN error post-deadline? Discover the step-by-step guide to rectify your Vehicle Identification Number mistakes efficiently. From navigating online platforms to submitting revised forms, ensure a seamless correction process for accurate records.

#truck2290#VINCorrection#DeadlineExtension#Form2290#AccountingTips#TaxFiling#OnlineForms#TaxCompliance#FinancialAccuracy

0 notes

Text

youtube

#FinancialFreedom#Entrepreneurship#SmallBizSuccess#AccountingTips#QuickBooksTips#FinancialSuccess#MoneyManagement#BusinessOwner#FinancialEmpowerment#FinanceTips#StartupLife#FinancialGoals#SuccessMindset#EfficiencyHacks#FinancialPlanning#EntrepreneurialJourney#SavingsGoals#MoneyMatters#FinancialEducation#SmallBusinessOwner#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

1 note

·

View note

Text

Grow your business and enhance your profit with as little aggravation as possible

Your main objective as a business owner is to increase revenue and profitability. However, achieving this goal can be challenging and frustrating. You may encounter difficulties with demanding customers, employee management, or keeping up with competitors. Regardless of the obstacles you face, there are always ways to overcome them and grow your business.

Fortunately, there are several strategies you can implement to help you grow your business and increase your profits with as little stress as possible.

Knowing your audience

Firstly, it’s essential to have a clear understanding of your target audience. By knowing who your customers or target market are, you can tailor your marketing efforts to reach them more effectively. This will help you attract more customers, boost your sales, and ultimately increase your profitability. Take the time to research your target audience and identify their needs, preferences, and pain points. This will allow you to create a more targeted marketing strategy and improve your overall customer experience.

Have a solid presence online

Another critical factor in growing your business is having a solid online presence. In today’s digital age, having a strong online presence is more important than ever. This means having a professional website, active social media accounts (it doesn’t have to be all of them but pick the ones which work best for your target audience), and a positive online reputation.

Your website should be easy to navigate, visually appealing (you want it to look as good as what you’d want a high street shop front to look) and provide customers with all the information they need to make a purchase, enquire about your services, or make an informed decision to contact you about what you can provide.

Your social media accounts should be regularly updated with engaging content and used to interact with your customers and target audience. Your online reputation should be monitored and managed to ensure that your customers or clients are satisfied with your products and/or services.

Build on loyalty

It is also important to focus on building customer/client loyalty. Repeat customers or longstanding clients are more likely to continue using your service, refer their friends and family, and leave positive reviews.

To build loyalty, you need to provide exceptional service and go above and beyond to meet the needs of the people you serve/work with. This can include offering personalized recommendations, providing prompt responses to enquiries, and following up with customers and clients to ensure their satisfaction.

Streamline your processes

The less time it takes you to do something, the more time you have to focus on something else. Streamlining your processes can enhance your profitability by making your operations more efficient. This could mean identifying areas where you can cut costs, reduce waste, and ultimately improve efficiency.

For example, you might consider outsourcing certain tasks to save money on labor costs or investing in new technology to automate manual processes. Streamlining your operations can free up time and resources to focus on growing your business and improving your profitability.

Be aware of the competition

As with any business, it’s always important to stay ahead of your competition and be aware of what competitors are doing. This means keeping up with industry trends, monitoring your competitors’ strategies, and continuously improving your products and services to either match or better others on the market.

You should always be looking for ways to innovate and differentiate yourself from your competitors and make your business look like the only one who can do what you do, and well! This can be done by offering unique products or services, investing in research and development, investing in consumer/client research to learn the habits of those your service is providing for, or implementing new marketing strategies.

Overall, growing your business and enhancing your profit doesn’t have to be a stressful experience. By focusing on your target audience, building a strong online presence, building and earning customer/client loyalty, streamlining your operations and processes, and staying ahead of your competition, you can grow your business and increase your profits with as little aggravation as possible.

#BusinessBasics#StartUpLife#EntrepreneurJourney#AccountingTips#SmallBizTips#InnovationHub#FinanceTips#BizGrowth#MarketTrends#StartupCulture#FinancialFreedom#EntrepreneurMindset#AccountingSoftware#BusinessStrategy#EconomicInsight#LeadershipGoals#InvestmentIdeas#ProfitAndLoss#BusinessPlanning#SuccessStories

0 notes

Text

Earth Day reminds us that our actions today shape the world we leave behind for future generations

#sustainable#ecofriendly#environment#finance#software#course#accounting#bookkeeping#accounts#accountants#taxtips#accountingtips#smallbusiness#smallbusinesssupport#smallbusinessowner

0 notes

Text

Xero Practice Manager (XPM) | Pros and Cons

youtube

In this insightful video, Neha discusses the pros and cons of Xero Practice Manager (XPM). Neha personally uses XPM as a practice management system and has a thorough working knowledge of XPM. Discover the advantages that XPM brings to the table, from streamlining your workflow to enhancing client management. Neha also addresses the potential limitations and considerations you should be aware of when using XPM in your accounting practice. Whether you're a solo practitioner or part of a larger firm, understanding the pros and cons of Xero Practice Manager is essential for making informed decisions about your practice's management tools. Join Neha in this informative journey, and gain valuable insights to help you make the most of Xero Practice Manager for your accounting practice.

#XeroPracticeManager#XPM#AccountingSoftware#PracticeManagement#AccountingTools#FinancialManagement#BusinessEfficiency#AccountingTips#CloudAccounting#ManagementTools#AccountingReview#AccountingInsights#Youtube

0 notes

Text

Accountancy Classes in Singapore: Master the principles of accountancy and financial management with our comprehensive classes. From basic accounting concepts to advanced financial analysis, Kiya Learning courses equip students with the skills and knowledge needed for success in the field of accountancy.

#accountingclasses#accountingclass#accounting#ukassignmentdue#thesisassignmentshelp#mba#bba#financialaccounting#accountinglife#accountingclassroom#accountingclassmates#accountingtips#accountingmemes#businessassignmenthelp#accountingassignmentwriter#commercestudents#businessclass#accountingassignmenthelper#businessschool#bbaassignment#bschool#success#businessstudents#accountingstudent#businessstudent#assignmentwritersuk#managementclasses#accountingservices#accastudents#accountingservice

0 notes

Text

Unlock the secrets of Real Estate Accounting & Industry Compliances with Meru Accounting! 🏠💼

Don't miss the opportunity to revolutionize your financial processes! Ready to elevate your bookkeeping skills?

Join our exclusive live webinar on January 30th at 10:00 PM EST. 🗓️

Secure your spot now: https://events.teams.microsoft.com/event/549853b5-4b72-4c99-85c7-0c9812d30872@47d254f0-9d06-4b1d-9466-7296bf8549d3

#meruaccounting#bookkeeping#bookkeepingtips#accountingservices#accounting#bookkeepingservices#bookkeepers#bookkeepingcompany#india#uk#uae#australia#melbourne#united kingdom#england#tasmania#africa#accountingtips#accessories#spicy accountant

0 notes

Text

The Ultimate Guide to Becoming an Accounting Specialist

Discover the path to becoming an Accounting Specialist, mastering the art of financial management, and unlocking lucrative career opportunities in the world of finance.

Introduction

In the complex world of finance, Accounting Specialists play a pivotal role in ensuring the financial health of organizations. They are responsible for tracking and managing financial transactions, analyzing data, and ensuring compliance with financial regulations. If you aspire to become an Accounting Specialist, this comprehensive guide will walk you through the essential steps, skills, and insights needed to excel in this profession.

Accounting Specialist: Unveiling the Key Responsibilities

The Core Duties

As an Accounting Specialist, your primary responsibilities encompass managing financial records, reconciling accounts, and preparing financial reports. You'll be the guardian of an organization's financial data, ensuring accuracy and compliance with accounting standards.

Financial Analysis

Delving deeper, you'll analyze financial data to identify trends, provide insights, and support strategic decision-making within the organization. Your ability to decipher financial statements will be crucial.

Tax Compliance

Accounting Specialists are often tasked with ensuring that an organization complies with tax regulations. This involves meticulous record-keeping and staying updated on tax laws.

Auditing

In some roles, you might also participate in financial audits, both internal and external. This requires attention to detail and a thorough understanding of auditing procedures.

The Path to Becoming an Accounting Specialist

Educational Requirements

To embark on this journey, you'll typically need a bachelor's degree in accounting or a related field. Some roles may require a master's degree or professional certification.

Gaining Experience

Entry-level positions, such as junior accountant or accounting clerk, provide a foundation for your career. Gaining practical experience is essential to becoming a proficient Accounting Specialist.

Professional Certifications

Consider obtaining certifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA) to enhance your credentials and job prospects.

Essential Skills for Success

Attention to Detail

Precision is paramount in accounting. The ability to spot errors and discrepancies is a must.

Analytical Thinking

Accounting Specialists must interpret financial data, draw conclusions, and provide recommendations based on analysis.

Communication Skills

Effectively conveying financial information to colleagues and clients is crucial. Clear communication facilitates better decision-making.

Adaptability

The financial landscape is ever-evolving. Accounting Specialists need to stay updated on changes in regulations and technology.

Accounting Specialist in Demand

Career Opportunities

A career as an Accounting Specialist opens doors to various industries, including public accounting firms, corporations, government agencies, and non-profit organizations.

Job Outlook

The demand for Accounting Specialists is expected to grow steadily in the coming years, offering stable and lucrative career prospects.

FAQs

Q: What is the role of an Accounting Specialist?

A: Accounting Specialists manage financial records, conduct financial analysis, ensure tax compliance, and may participate in audits.

Q: What qualifications do I need to become an Accounting Specialist?

A: Typically, a bachelor's degree in accounting and practical experience are required. Obtaining professional certifications like CPA or CMA can also boost your career.

Q: Is the demand for Accounting Specialists high?

A: Yes, the demand for Accounting Specialists is expected to remain strong, offering excellent career opportunities.

Q: What skills are crucial for an Accounting Specialist?

A: Attention to detail, analytical thinking, strong communication skills, and adaptability are essential for success in this field.

Q: Can I work in different industries as an Accounting Specialist?

A: Absolutely! Accounting Specialists are needed in various sectors, from public accounting to government agencies and corporations.

Q: How do I stay updated on changes in accounting regulations?

A: Joining professional organizations, attending seminars, and continuous learning through courses and certifications can help you stay informed.

Conclusion

Becoming an Accounting Specialist is a rewarding journey that offers both financial stability and opportunities for growth. With the right education, skills, and dedication, you can excel in this field and contribute significantly to the financial well-being of organizations. Embrace the world of finance, and embark on your path to becoming an Accounting Specialist today!

#AccountingCareer#FinancialManagement#CPAExam#AccountingEducation#FinanceIndustry#TaxCompliance#FinancialAnalysis#CareerGrowth#AccountingSkills#ProfessionalCertifications#Auditing#FinanceJobs#AccountingWorld#AccountingSpecialistJobs#FinancialReporting#JobOpportunities#AccountingTips#AccountingProfession#BusinessFinance#FinancialExpertise

0 notes